Transcontinental SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

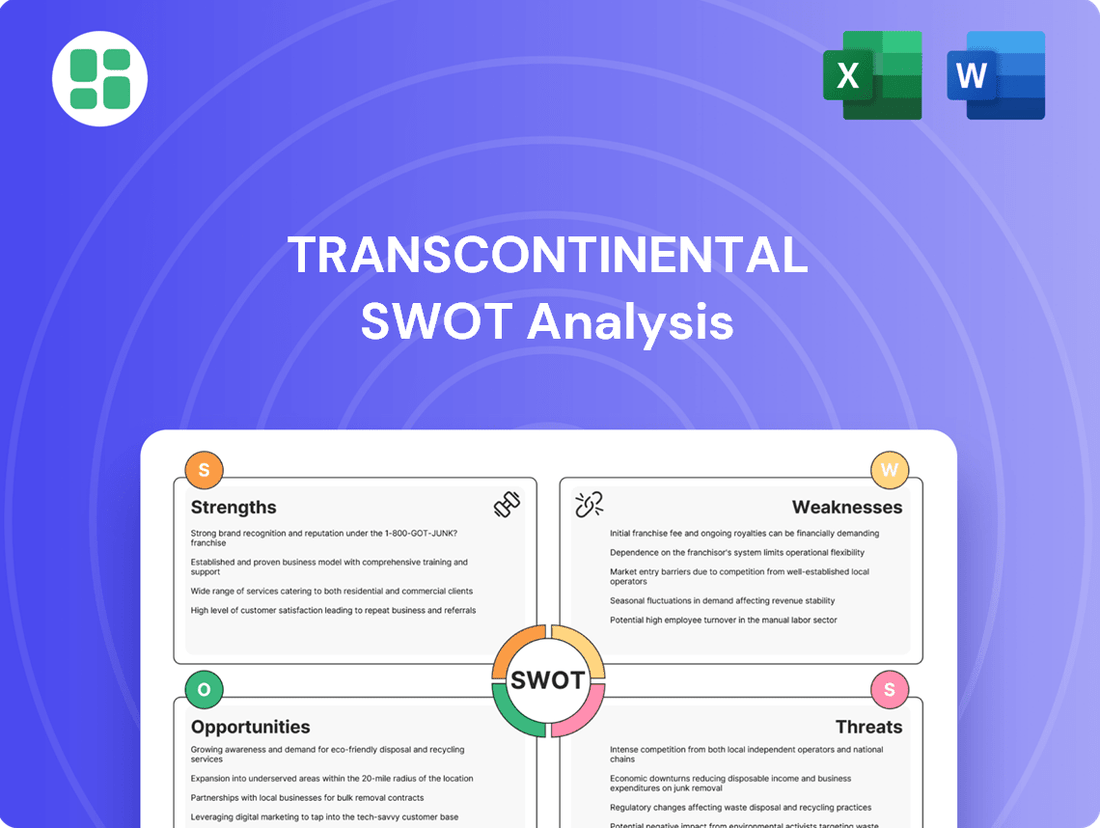

The Transcontinental SWOT analysis reveals a company poised for significant growth, leveraging its established brand and extensive network. However, it also highlights critical areas requiring attention, such as adapting to evolving consumer preferences and navigating competitive pressures.

Want the full story behind Transcontinental's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TC Transcontinental's strength lies in its diversified business portfolio, spanning flexible packaging, printing, and educational publishing. This multi-sector approach significantly reduces dependence on any single market, offering a crucial layer of stability and resilience against sector-specific economic downturns. For instance, in fiscal year 2023, the company reported that its Packaging segment represented approximately 61% of its total revenues, while the Printing segment contributed around 39%, showcasing a balanced revenue generation.

Transcontinental boasts a commanding presence in its core markets, solidifying its status as a leader in flexible packaging across North America. This strong market position is further amplified by its role as Canada's largest printer, demonstrating significant operational scale and reach.

The company also holds a dominant position as the leading Canadian French-language educational publishing group. This leadership in diverse segments, including packaging, printing, and publishing, translates into substantial competitive advantages such as economies of scale, deep-rooted client relationships, and robust brand recognition.

TC Transcontinental's financial performance in early fiscal 2025 has been notably strong, with both net earnings and adjusted net earnings showing increases in the first two quarters. This upward trend signals effective cost management and revenue generation strategies.

The company has also made significant strides in improving its financial structure, evidenced by a lower net indebtedness ratio. This deleveraging is a testament to sound financial management and a commitment to strengthening the balance sheet.

Furthermore, TC Transcontinental has generated substantial cash flows from its operations, reaching $169 million in the first half of fiscal 2025. This robust cash generation provides the company with the flexibility to pursue strategic growth initiatives, pay down debt, and reward shareholders, as demonstrated by a special dividend of $0.20 per share in Q2 2025.

Commitment to Sustainability and Innovation

Transcontinental's dedication to sustainability is a significant strength, underscored by its 2025 Corporate Social Responsibility (CSR) plan. This plan actively drives greener growth, fosters innovative and sustainable products, and embeds responsible business practices throughout its operations.

This strong commitment to sustainability, especially within its flexible packaging segment, directly addresses the increasing consumer and regulatory pressure for eco-friendly alternatives. For example, by 2024, Transcontinental aims to have 100% of its plastic packaging contain at least 25% recycled content, a move that positions them favorably in a market prioritizing environmental stewardship.

Furthermore, the company's ongoing investment in research and development for novel packaging technologies is a key differentiator. This focus allows them to create unique solutions that not only meet sustainability goals but also enhance product appeal and performance for their clients.

- 2025 CSR Plan: Focus on greener growth, innovative and sustainable products, and responsible business practices.

- Market Alignment: Commitment to sustainability in flexible packaging meets growing consumer and regulatory demand for eco-friendly solutions.

- R&D Investment: Drives product differentiation through the development of novel packaging technologies.

- Recycled Content Goal: Aiming for 25% recycled content in all plastic packaging by 2024, demonstrating tangible progress.

Strategic Cost Reduction Initiatives

TC Transcontinental's strategic cost reduction initiatives have been a significant strength, directly contributing to improved profitability and a stronger financial standing. These programs have demonstrably boosted operating earnings, with notable positive effects observed in both the packaging and the retail services and printing sectors.

These proactive measures not only streamline operations, enhancing overall efficiency, but also bolster the company's financial resilience against market fluctuations. For instance, in fiscal 2023, TC Transcontinental reported a notable increase in its adjusted EBITDA, partly attributable to these ongoing cost management efforts.

- Enhanced Profitability: Successful implementation of cost reduction programs has directly led to higher operating earnings.

- Sectoral Improvement: Positive impacts were particularly evident in the packaging and retail services/printing segments.

- Operational Efficiency: These initiatives drive greater efficiency throughout the company's operations.

- Financial Resilience: Proactive cost management strengthens the company's ability to withstand economic challenges.

TC Transcontinental's diversified business model, encompassing packaging, printing, and publishing, provides a robust foundation against market volatility. This diversification is reflected in its revenue streams, with packaging accounting for approximately 61% and printing for 39% of total revenues in fiscal year 2023, indicating a balanced operational structure.

The company's leadership in North American flexible packaging and its position as Canada's largest printer are significant competitive advantages. These established market positions translate into economies of scale and strong client relationships, further solidifying its market dominance.

Financial health is a key strength, with strong performance in early fiscal 2025, showing increases in net and adjusted net earnings. This financial uptrend is supported by a lower net indebtedness ratio and substantial operational cash flow generation, which reached $169 million in the first half of fiscal 2025, providing strategic flexibility.

Transcontinental's commitment to sustainability, as outlined in its 2025 CSR plan, is a notable strength. The company's goal to achieve 25% recycled content in all plastic packaging by 2024 aligns with market demands for eco-friendly solutions and is supported by ongoing R&D in innovative packaging technologies.

| Segment | FY2023 Revenue Share | Key Strength |

|---|---|---|

| Packaging | ~61% | North American leadership, sustainability focus |

| Printing | ~39% | Canada's largest printer, operational scale |

| Publishing | N/A (Included in diversified portfolio) | Leading French-language educational publisher |

What is included in the product

Analyzes Transcontinental’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address underlying strategic weaknesses before they escalate into major problems.

Weaknesses

While Transcontinental's profitability saw an uptick, its overall revenues dipped in the first quarter of fiscal 2025. This decline was influenced by reduced sales volumes and the divestiture of its industrial packaging segment.

The printing sector in Canada, a core market for the company, has faced a consistent revenue downturn over the last five years. This trend highlights persistent headwinds within traditional print media markets.

TC Transcontinental's flexible packaging segment, a core revenue driver, faces significant headwinds from the unpredictable pricing of essential inputs like plastic resins, aluminum foil, and paper. For instance, in Q1 2024, the cost of polyethylene, a key resin, saw a notable increase, directly impacting the company's cost of goods sold.

These price swings create a constant challenge in maintaining stable production costs and protecting profit margins. The company's ability to effectively manage these external cost pressures, which can fluctuate significantly quarter-to-quarter, is a critical factor in its financial performance.

The broader printing industry, including TC Transcontinental, faces considerable pressure as digital media continues to gain traction. Publishers and advertisers are increasingly shifting their budgets online, directly impacting the demand for traditional print services. This ongoing trend contributed to the closure of TC Transcontinental's Saint-Hyacinthe printing plant in 2024, a clear indicator of the challenges in this sector.

Geographic Concentration in Canada and North America

TC Transcontinental's significant reliance on Canada and the United States for its revenue presents a notable weakness. For instance, in fiscal year 2023, the company generated the vast majority of its sales from these two markets, making it vulnerable to economic fluctuations or regulatory changes specific to North America. This geographic concentration limits diversification benefits and exposes the company to concentrated regional risks.

While TC Transcontinental has operations in Latin America, its international footprint remains relatively small. This limited global reach means the company is less insulated from localized economic downturns. For example, a significant economic slowdown in Canada or the US could disproportionately impact overall performance, as seen in past periods of regional economic stress.

- Revenue Concentration: In fiscal 2023, a substantial percentage of TC Transcontinental's revenue was derived from its Canadian and U.S. operations, highlighting a key dependency.

- Limited International Diversification: The company's presence outside North America is minimal, reducing its ability to offset regional economic challenges with performance in other global markets.

- Vulnerability to Regional Downturns: Economic slowdowns or industry-specific issues within Canada and the United States pose a direct and significant risk to TC Transcontinental's financial results.

- Market-Specific Challenges: Concentration in a few key markets makes the company susceptible to unique challenges, such as evolving consumer preferences or competitive pressures within those specific geographies.

Competition in Flexible Packaging Market

The flexible packaging sector is intensely competitive, featuring a broad array of participants, including significant global corporations. TC Transcontinental, while a prominent player, navigates a landscape where constant competition can impact pricing power and its standing in the market.

Maintaining a competitive advantage necessitates ongoing investment in innovation and operational efficiency. For instance, the global flexible packaging market was valued at approximately USD 125 billion in 2023 and is projected to grow, highlighting the dynamic and contested nature of this industry.

- Intense Rivalry: Numerous companies, from large multinationals to smaller regional specialists, vie for market share in flexible packaging.

- Price Sensitivity: Competitive pressures can lead to price wars, impacting profit margins for all participants.

- Innovation Imperative: Companies must continuously develop new materials, designs, and sustainable solutions to differentiate themselves.

- Market Share Dynamics: Even market leaders like TC Transcontinental must remain vigilant against aggressive strategies from competitors seeking to gain ground.

TC Transcontinental's reliance on the Canadian and U.S. markets for the majority of its revenue in fiscal 2023 makes it susceptible to regional economic downturns and regulatory shifts. This geographic concentration limits diversification benefits and exposes the company to concentrated risks, as its international footprint remains relatively small. For instance, a significant economic slowdown in North America could disproportionately impact overall performance, as seen in past periods of regional economic stress.

Full Version Awaits

Transcontinental SWOT Analysis

The preview you see is the same Transcontinental SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit.

Opportunities

The global market for sustainable packaging is expanding rapidly, fueled by consumer demand for eco-friendly options and tightening environmental legislation. TC Transcontinental's commitment to sustainability, outlined in its 2025 Corporate Social Responsibility plan, aligns perfectly with this trend, positioning the company to capitalize on this growing sector. For example, the sustainable packaging market was valued at approximately $280 billion in 2023 and is projected to reach over $450 billion by 2030, demonstrating significant growth potential.

The surge in e-commerce, projected to reach $7.4 trillion globally by 2025, fuels a robust demand for specialized packaging. TC Transcontinental's expertise in flexible packaging aligns perfectly with this trend, offering lightweight, durable solutions critical for shipping and enhancing the customer's unboxing moment. This represents a significant growth opportunity for the company within the expanding packaging sector.

Transcontinental's strategic acquisition of Middleton Group in June 2025, a move designed to bolster its in-store marketing capabilities, clearly signals a proactive approach to expanding within attractive growth markets. This acquisition, valued at an undisclosed sum but aimed at significantly increasing market penetration in the retail sector, underscores the company's commitment to inorganic growth.

Further targeted acquisitions in complementary, high-growth segments, particularly within packaging solutions or specialized retail services, present a significant opportunity. For instance, acquiring a niche player in sustainable packaging could align with growing consumer demand and regulatory trends, potentially adding an estimated 5-7% to revenue growth in the acquired segment within the first two years, based on industry averages for similar strategic tuck-ins in 2024-2025.

Technological Advancements in Printing and Packaging

Digital printing innovations are a significant opportunity for Transcontinental, offering enhanced print quality and quicker production cycles. This allows for more cost-effective, personalized print runs, catering to evolving customer demands. For instance, the global digital printing market was valued at approximately $27.7 billion in 2023 and is projected to reach over $50 billion by 2030, indicating substantial growth potential.

The packaging sector's advancement into smart solutions and superior barrier films presents another avenue for growth. These technologies not only extend product shelf life but also bolster product safety, directly increasing demand for sophisticated packaging. By 2028, the smart packaging market is expected to grow at a compound annual growth rate of over 7%, reaching an estimated $40 billion globally.

- Digital Printing Efficiency: Advances in digital printing can reduce waste and increase speed, allowing for more agile production.

- Customization Capabilities: Personalized printing options can open new markets and strengthen client relationships.

- Smart Packaging Demand: Growing consumer and regulatory focus on product safety and shelf life drives adoption of advanced packaging.

- Innovation in Materials: Development of new barrier films enhances product protection and sustainability credentials.

Digital Transformation in Educational Publishing

TC Transcontinental can leverage the growing demand for digital learning resources, a trend accelerated by recent global events. The global EdTech market, for instance, was projected to reach over $400 billion by 2025, indicating a substantial opportunity for publishers to transition their offerings.

By investing in and expanding its digital content creation capabilities, TC Transcontinental can cater to the evolving needs of students and educators. This includes developing interactive e-books, online learning platforms, and personalized learning pathways.

- Digital Learning Market Growth: The global digital learning market is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond.

- Personalized Content Demand: There's a rising expectation for educational materials that adapt to individual learning styles and paces.

- Platform Expansion: Developing or enhancing proprietary digital platforms can offer TC Transcontinental greater control over content delivery and user experience.

- Reach and Accessibility: Digital transformation allows for broader distribution of educational materials, reaching students in diverse geographic locations and learning environments.

TC Transcontinental is well-positioned to capitalize on the expanding market for sustainable packaging, driven by increasing consumer preference and stricter environmental regulations. The company's focus on eco-friendly solutions aligns with this trend, offering a significant growth avenue.

The burgeoning e-commerce sector presents a substantial opportunity for specialized packaging solutions, a niche where TC Transcontinental's flexible packaging expertise is highly relevant. Furthermore, strategic acquisitions in high-growth segments, such as digital printing and smart packaging, can enhance its market penetration and revenue streams.

The digital learning market offers another promising area for expansion, particularly as TC Transcontinental can leverage its publishing capabilities to develop interactive and personalized educational content.

| Opportunity Area | Market Size (Est. 2025) | Projected Growth Driver | TC Transcontinental Alignment |

|---|---|---|---|

| Sustainable Packaging | >$450 billion by 2030 | Consumer demand, regulations | CSR plan, eco-friendly solutions |

| E-commerce Packaging | $7.4 trillion (global e-commerce) | Online retail growth | Flexible packaging expertise |

| Digital Printing | >$50 billion by 2030 | Demand for customization, efficiency | Innovation in print capabilities |

| Smart Packaging | >$40 billion by 2028 | Product safety, shelf-life extension | Advanced barrier film development |

| Digital Learning | >$400 billion by 2025 | Shift to online education | Content creation, platform expansion |

Threats

TC Transcontinental operates in highly competitive markets across all its segments, leading to significant pricing pressures. In its printing sector, the fragmentation of the industry means numerous players are vying for market share, often resulting in squeezed profit margins. For instance, the North American printing market, a key area for TC Transcontinental, saw revenue growth of only 1.5% in 2023, indicating a challenging environment where price is a major factor.

The flexible packaging segment, while growing, also faces robust competition from both established global players and emerging regional manufacturers. This intensifies the need for TC Transcontinental to differentiate through innovation and operational efficiency to avoid margin erosion. The company’s ability to manage costs effectively and offer value-added solutions becomes critical in maintaining profitability amidst this intense competitive landscape.

Economic downturns pose a significant threat to TC Transcontinental. A recession could trigger a sharp decline in advertising expenditures, directly impacting the company's media and marketing services segments. Furthermore, reduced consumer spending power during economic slowdowns would likely decrease demand for packaged goods, a key area for their packaging division.

The company's financial performance is inherently tied to the broader economic climate. For instance, during periods of economic contraction, educational institutions, another customer base, often face tighter budgets, potentially leading to reduced orders for printing and related services. This sensitivity means that widespread economic weakness could broadly dampen revenues across all of TC Transcontinental's operational sectors.

Rapid technological disruption presents a significant threat to Transcontinental. For instance, the accelerating shift towards digital media and online learning platforms could diminish demand for traditional print products, impacting revenue streams. In 2024, global digital advertising spending was projected to reach over $600 billion, highlighting the rapid migration of audiences and advertising budgets away from print.

Furthermore, advancements in automation within the printing and packaging sectors necessitate substantial and ongoing investment to maintain competitiveness. Failure to adapt to these evolving technologies, such as AI-driven print optimization or advanced robotics in packaging, could lead to increased operational costs and a loss of market share to more agile competitors.

Increasing Environmental Regulations and Public Scrutiny

Transcontinental faces growing pressure from increasingly stringent environmental regulations, especially concerning plastic packaging. For instance, by 2025, the European Union aims for 30% recycled content in PET beverage bottles, a target that will require significant investment and adaptation across the supply chain.

Public scrutiny over plastic waste is intensifying, potentially impacting consumer purchasing decisions. A 2024 survey indicated that over 60% of consumers actively seek out brands with demonstrable sustainable packaging practices, suggesting a tangible risk to market share if Transcontinental lags in meeting these expectations.

- Stricter Regulations: Upcoming mandates on recycled content and single-use plastics will necessitate costly operational adjustments.

- Consumer Preference Shift: Growing demand for eco-friendly alternatives could divert customers from products perceived as environmentally harmful.

- Compliance Costs: Meeting evolving environmental standards may lead to increased capital expenditure and ongoing operational expenses.

Supply Chain Disruptions and Labor Shortages

Transcontinental faces significant threats from ongoing global supply chain disruptions. These vulnerabilities, including delays in raw material sourcing and transportation bottlenecks, directly impact production timelines and the ability to meet delivery commitments. For instance, the average transit time for ocean freight containers globally saw increases of 20-30% in late 2024 compared to pre-pandemic levels, affecting Transcontinental's logistics efficiency.

Labor shortages and rising labor costs present another critical challenge. In key operational regions for Transcontinental, such as manufacturing hubs in Southeast Asia and distribution centers in North America, finding and retaining skilled labor has become increasingly difficult. This can lead to higher operational expenses and potential reductions in output capacity, impacting overall profitability and the company's ability to scale operations effectively.

- Supply Chain Volatility: Persistent disruptions in shipping and component availability, as seen with semiconductor shortages impacting various industries throughout 2024, could hinder Transcontinental's manufacturing output.

- Rising Labor Costs: Wage inflation in key operational regions, with some countries experiencing average wage increases of 5-7% in 2024, directly impacts Transcontinental's cost of goods sold and operational expenses.

- Geopolitical Risks: Trade tensions and regional conflicts can further exacerbate supply chain issues, potentially restricting access to critical materials or increasing transportation costs for Transcontinental.

Intense competition across its printing and packaging segments poses a significant threat, with pricing pressures impacting profit margins. For instance, the North American printing market experienced only 1.5% revenue growth in 2023, underscoring a challenging environment. The ongoing shift towards digital media, with global digital advertising spending projected to exceed $600 billion in 2024, further erodes demand for traditional print products.

Economic downturns can sharply reduce advertising expenditures and consumer spending, directly affecting Transcontinental's revenue streams. Furthermore, escalating environmental regulations, particularly concerning plastic packaging and the EU's 2025 target for 30% recycled content in PET bottles, necessitate costly adaptations. Consumer preference shifts towards eco-friendly packaging also present a risk if the company fails to meet these evolving expectations, with over 60% of consumers in a 2024 survey actively seeking sustainable brands.

Persistent supply chain volatility, including shipping delays and component shortages, directly impacts production timelines. For example, ocean freight transit times saw 20-30% increases in late 2024. Coupled with rising labor costs, with some regions experiencing 5-7% wage increases in 2024, these factors elevate operational expenses and threaten output capacity.

SWOT Analysis Data Sources

This transcontinental SWOT analysis draws from a robust dataset, incorporating publicly available financial reports, comprehensive market research across multiple regions, and insights from industry experts and trade associations to ensure a holistic and informed perspective.