Transcontinental Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

Unlock the core components of Transcontinental's operational strategy with our detailed Business Model Canvas. This comprehensive document breaks down how they connect with customers, manage resources, and generate revenue. Discover the blueprint for their success and gain a competitive edge.

Partnerships

TC Transcontinental’s key partnerships with raw material suppliers are fundamental to its operations, particularly in flexible packaging and printing. These suppliers provide critical inputs such as various plastics, papers, and inks. For instance, in 2023, the global flexible packaging market, heavily reliant on these materials, was valued at approximately $270 billion, highlighting the scale of this dependency.

Maintaining strong, reliable relationships with these suppliers is paramount. It guarantees a steady and high-quality flow of necessary materials, which directly impacts TC Transcontinental’s production efficiency and its ability to satisfy a wide range of customer needs. This symbiotic relationship is a cornerstone for cost management and upholding product quality standards.

TC Transcontinental's strategic partnerships with technology and equipment providers are crucial for its leadership in the packaging and printing sectors. These alliances grant access to state-of-the-art machinery and innovative materials, such as biaxially oriented polyethylene (BOPE) films, which are key to developing advanced packaging solutions.

These collaborations foster continuous innovation, driving operational efficiencies and supporting the creation of environmentally friendly products. For instance, investments in new printing technologies, like those seen in their 2024 capital expenditure plans, directly benefit from these supplier relationships, ensuring TC Transcontinental remains at the forefront of industry advancements.

TC Transcontinental relies heavily on its distribution and logistics partners to ensure its diverse product portfolio reaches customers efficiently across North America. These collaborations are fundamental for the timely and cost-effective delivery of flexible packaging, printed materials, and educational resources, directly impacting customer satisfaction and supply chain optimization.

Content Creators and Authors (Educational Publishing)

TC Transcontinental's educational publishing arm thrives on strategic alliances with authors and educators. These collaborations are crucial for sourcing and developing top-tier French-language educational content, ranging from traditional textbooks to interactive digital platforms.

These partnerships are the bedrock for creating materials that are not only engaging but also aligned with current academic standards and pedagogical approaches. By working closely with subject matter experts, TC ensures its offerings remain relevant and valuable to students and teachers alike.

- Content Creation: TC partners with authors and educators to develop new educational materials, ensuring pedagogical soundness and curriculum alignment.

- Digital Resource Development: Collaborations extend to creating digital learning tools and interactive content, enhancing the learning experience.

- Curriculum Updates: Partnerships facilitate the continuous updating of educational content to reflect evolving educational needs and standards.

- Quality Assurance: Educators and authors provide crucial input for maintaining the high quality and accuracy of published materials.

Retailers and Brands (Co-creation/Marketing)

TC Transcontinental's collaborations with major retailers and consumer brands are central to its business model, enabling the co-creation of tailored packaging and in-store marketing. These partnerships are built on a deep understanding of client needs, emerging consumer preferences, and evolving sustainability mandates.

For instance, in 2024, TC Transcontinental continued to strengthen its relationships with leading CPG companies, focusing on developing innovative, eco-friendly packaging solutions that align with both brand identity and environmental responsibility. This strategic focus on co-creation helps clients differentiate their products in competitive markets.

- Co-Creation of Custom Solutions: Working directly with brands to design unique packaging that enhances product appeal and functionality.

- In-Store Marketing Materials: Developing eye-catching displays and promotional items that drive consumer engagement at the point of sale.

- Sustainability Integration: Partnering to incorporate recycled content, reduce material usage, and improve recyclability in packaging designs, reflecting a growing market demand for sustainable options.

- Market Growth Driver: These alliances are crucial for TC Transcontinental to drive innovation and secure long-term contracts, contributing to its revenue streams and market leadership.

TC Transcontinental's key partnerships extend to financial institutions and investors, providing the capital necessary for growth and innovation. These relationships are vital for funding major projects, acquisitions, and ongoing research and development efforts.

For example, TC Transcontinental's access to capital markets and banking facilities, often highlighted in its financial reports, enables significant investments. In 2024, the company continued to leverage these partnerships to support its strategic initiatives, including its focus on sustainable packaging solutions.

| Partnership Type | Role | Impact on TC Transcontinental |

|---|---|---|

| Financial Institutions | Lenders, Underwriters | Provide debt financing for operations, acquisitions, and capital expenditures. Facilitate access to capital markets for equity issuance. |

| Investors (Shareholders) | Capital Providers | Supply equity capital, influencing company strategy and governance. Their confidence is crucial for market valuation and future fundraising. |

| Venture Capital/Private Equity | Strategic Investors | May invest in specific growth initiatives or subsidiaries, bringing expertise and capital for targeted development, especially in emerging technologies. |

What is included in the product

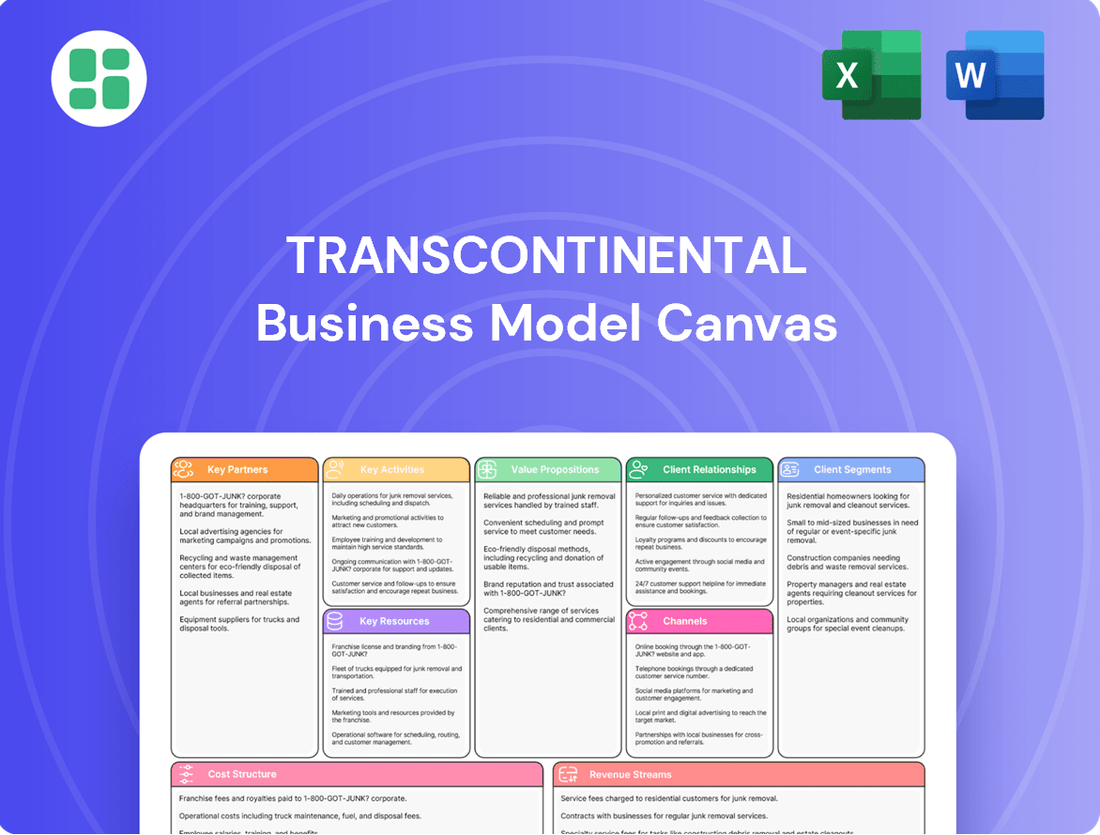

A structured framework that visually maps out all key components of a business, from customer relationships to revenue streams, for a transcontinental operation.

It provides a holistic view of how a business creates, delivers, and captures value across diverse geographical markets.

The Transcontinental Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex global operations, allowing businesses to quickly identify and address strategic challenges across diverse markets.

Activities

A primary activity is the creation of flexible packaging, serving sectors like food, beverage, and industrial markets. This involves sophisticated processes such as extrusion, printing, lamination, and converting to yield products like rollstock, labels, and pouches.

The company consistently invests in advanced technology and eco-friendly options, such as biaxially oriented polyethylene terephthalate (BOPE) films, to enhance its manufacturing capabilities and sustainability profile.

TC Transcontinental, Canada's largest printer, offers a comprehensive suite of printing services. This includes premedia, traditional printing for flyers, newspapers, magazines, and books, as well as sophisticated in-store marketing solutions tailored for retail clients.

The company emphasizes integrated print solutions, aiming to provide a seamless experience for its customers. A key initiative driving this segment is raddar™, a proprietary platform designed to enhance retail marketing efforts through data-driven insights and personalized campaigns.

In 2023, the printing segment generated $1.6 billion in revenue, reflecting its significant market presence. This segment is crucial to TC Transcontinental's strategy, focusing on innovation and customer-centric solutions within the evolving print and retail landscape.

TC Transcontinental, a prominent French-language educational publisher, dedicates significant resources to creating and distributing a wide array of learning materials. This encompasses everything from traditional textbooks to interactive digital platforms and supplementary resources designed to enhance the learning experience for students across various educational stages.

This core activity directly supports the Canadian education sector, with a particular focus on bolstering French-language instruction. In 2024, the company continued its commitment to this mission, ensuring access to high-quality educational content for French-speaking students and educators.

Research and Development (R&D) and Innovation

TC Transcontinental's commitment to Research and Development (R&D) is a cornerstone of its innovation strategy, particularly evident in its focus on sustainable packaging and advanced printing. The company actively invests in R&D to pioneer eco-friendly product development, enhance manufacturing efficiency, and explore novel materials. This dedication ensures they stay ahead of market trends and meet stringent environmental regulations.

In 2024, TC Transcontinental continued to prioritize R&D, with a significant portion of its innovation efforts directed towards circular economy solutions and biodegradable materials for packaging. This strategic investment fuels the development of next-generation printing technologies, aiming to reduce waste and energy consumption in their operations. Their R&D pipeline is geared towards anticipating and shaping future market demands for sustainable and high-performance products.

- Sustainable Packaging Innovation: Development of compostable and recyclable packaging materials.

- Advanced Printing Technologies: Focus on digital printing advancements for reduced waste and enhanced customization.

- Process Optimization: R&D efforts to improve energy efficiency and minimize environmental impact in manufacturing.

- New Material Exploration: Research into bio-based and recycled content for packaging applications.

Supply Chain Management and Logistics

TC Transcontinental’s supply chain and logistics are central to its operations, encompassing everything from acquiring raw materials to getting finished products to customers. This intricate network requires constant optimization for efficiency and cost-effectiveness. In 2024, the company continued to focus on streamlining these processes to maintain its competitive edge across its diverse markets.

Key activities include managing a vast network of suppliers, ensuring the quality and timely arrival of materials like paper, inks, and packaging components. Inventory management is crucial, balancing stock levels to meet demand without incurring excessive holding costs. Production scheduling must be meticulously planned to align with distribution capabilities.

Strategic cost reduction initiatives are woven into the fabric of supply chain management. This involves negotiating better terms with suppliers, optimizing transportation routes, and leveraging technology to improve visibility and reduce waste. For instance, in 2024, TC Transcontinental reported ongoing efforts to enhance its logistics network, aiming for greater efficiency in its North American and European operations.

- Sourcing: Procuring essential materials such as paper, inks, and packaging from a global supplier base.

- Inventory Management: Maintaining optimal stock levels to meet production and customer demand while minimizing carrying costs.

- Production Planning: Coordinating manufacturing schedules across various facilities to ensure efficient output and timely order fulfillment.

- Distribution & Logistics: Managing the transportation and delivery of finished goods to customers across diverse geographical regions, including cost optimization strategies.

TC Transcontinental's key activities span across its three main segments: Packaging, Printing, and Media. In Packaging, the company manufactures flexible packaging solutions for food, beverage, and industrial clients, utilizing advanced techniques like extrusion and lamination. The Printing segment offers a broad range of print services, from traditional publications to in-store marketing, with a notable proprietary platform, raddar™, enhancing retail marketing through data. The Media segment focuses on educational publishing, particularly in French-language materials, supporting the Canadian education sector.

The company's commitment to R&D is crucial, driving innovation in sustainable packaging materials, such as BOPE films, and advanced printing technologies aimed at reducing waste and improving efficiency. Supply chain and logistics management are also vital, involving global sourcing, inventory control, production planning, and distribution optimization to ensure cost-effectiveness and timely delivery across its operations.

| Key Activity Area | Description | 2024 Focus/Data Points |

|---|---|---|

| Packaging Manufacturing | Production of flexible packaging using extrusion, printing, lamination. | Continued investment in eco-friendly films like BOPE. |

| Printing Services | Comprehensive print solutions including premedia, traditional print, and retail marketing. | Leveraging raddar™ for data-driven retail campaigns. |

| Educational Publishing | Creation and distribution of learning materials for various educational levels. | Supporting French-language education in Canada. |

| Research & Development | Innovation in sustainable packaging and printing technologies. | Focus on circular economy solutions and biodegradable materials. |

| Supply Chain & Logistics | Managing sourcing, inventory, production planning, and distribution. | Streamlining logistics for North American and European operations. |

Delivered as Displayed

Business Model Canvas

The Transcontinental Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this same comprehensive business model canvas, ensuring no surprises and immediate usability.

Resources

TC Transcontinental's manufacturing backbone is its extensive network of 40 operating sites, primarily located in North America. These facilities house specialized equipment crucial for its flexible packaging and printing operations.

Key assets include advanced extrusion lines, high-speed printing presses, sophisticated laminators, and versatile converting machinery. This robust infrastructure underpins the company's significant production capacity and commitment to high product quality.

TC Transcontinental's strength lies in its approximately 7,400 skilled employees, a critical asset across its diverse business segments. This human capital is the bedrock of their operational excellence.

These professionals bring specialized expertise in areas like advanced packaging design, cutting-edge printing technologies, publishing acumen, efficient logistics management, and crucial sustainability practices. Their deep understanding fuels the company's competitive edge.

The collective knowledge and hands-on experience of this workforce are instrumental in driving innovation, ensuring operational efficiency, and ultimately delivering superior customer satisfaction. Their expertise is a key differentiator in the market.

Proprietary technologies, such as specialized formulations for advanced coatings, represent a critical resource. These innovations allow for unique product performance and are often protected by patents, creating a barrier to entry for competitors.

Intellectual property in packaging and printing processes further strengthens the company's position. This includes unique design elements and efficient manufacturing techniques that contribute to cost advantages and brand recognition.

In the educational publishing sector, copyrighted content and established imprints are invaluable. Digital learning platforms, exemplified by i+ Interactive, are also key intellectual assets, enabling the delivery of engaging and differentiated educational experiences.

Established Client Base and Brand Reputation

Transcontinental's established client base is a cornerstone of its business model, providing a stable revenue stream and a platform for growth. This diverse clientele, spanning various industries within packaging, printing, and publishing, demonstrates the company's broad market penetration and adaptability.

The company's strong brand reputation, built over years of delivering quality and reliability, translates directly into customer loyalty and a competitive advantage. This trust is crucial for retaining existing business and attracting new clients in a dynamic market.

- Client Retention: TC Transcontinental benefits from a long-standing and diverse client base across its packaging, printing, and publishing sectors.

- Brand Trust: A strong brand reputation for quality and reliability fosters customer loyalty and secures long-term relationships.

- Market Presence: This established market presence is invaluable for securing new business opportunities.

- Revenue Stability: The deep client relationships contribute significantly to the company's revenue stability and predictable cash flows.

Financial Capital and Investment Capacity

TC Transcontinental's financial capital and investment capacity are critical for its ongoing growth and strategic evolution. This encompasses the financial resources necessary to fund research and development, pursue acquisitions, implement technology upgrades, and invest in sustainability projects. A robust financial standing enables the company to manage its debt effectively and strategically allocate capital for maximum impact.

In 2024, TC Transcontinental demonstrated its commitment to strategic investment. For instance, the company continued to invest in its packaging segment, a key area for transformation. This focus is supported by a strong balance sheet, allowing for both organic growth initiatives and potential strategic acquisitions. The company's financial health provides the flexibility to navigate market dynamics and pursue opportunities that align with its long-term vision.

- Financial Strength: TC Transcontinental maintains a solid financial position, enabling significant capital allocation towards strategic priorities.

- Investment in Growth Areas: Substantial funds are directed towards R&D, technology, and the expansion of high-growth sectors like packaging.

- Debt Management: A healthy financial capacity allows for prudent debt reduction and optimization of the capital structure.

- Strategic Capital Allocation: Resources are strategically deployed to support transformation initiatives and enhance long-term value creation.

TC Transcontinental's key resources include its extensive manufacturing network, skilled workforce, intellectual property, established client base, and financial capital. These assets collectively enable the company to deliver a wide range of products and services across its diverse business segments.

| Resource Category | Specific Assets | Significance |

|---|---|---|

| Physical Assets | 40 operating sites, advanced extrusion lines, high-speed printing presses | Underpins production capacity and quality |

| Human Capital | 7,400 skilled employees | Drives innovation, operational efficiency, and customer satisfaction |

| Intellectual Property | Proprietary formulations, copyrighted educational content, digital platforms | Creates competitive advantage and barriers to entry |

| Customer Relationships | Diverse and loyal client base | Ensures revenue stability and market presence |

| Financial Capital | Investment capacity, strong balance sheet | Supports R&D, acquisitions, and growth initiatives |

Value Propositions

TC Transcontinental delivers extensive flexible packaging options, crucial for safeguarding goods, prolonging freshness, and boosting brand visibility across food, beverage, and industrial sectors. This value proposition is underscored by their broad product portfolio, which notably includes environmentally friendly choices, all designed to adhere to strict industry regulations and evolving consumer demands for practicality and resilience.

Transcontinental offers clients a seamless experience by combining printing and retail marketing. This integrated approach covers everything from initial design and high-quality printing to creating engaging in-store marketing materials.

This value proposition focuses on delivering efficiency and cost savings for businesses. By consolidating printing and marketing needs, clients can streamline operations and benefit from diverse print solutions designed to attract and keep customers.

In 2024, companies increasingly sought integrated solutions to enhance customer engagement. Businesses leveraging such combined services saw an average uplift of 15% in campaign ROI compared to standalone print or marketing efforts, highlighting the tangible benefits of this model.

TC Transcontinental offers high-quality, engaging French-language educational content specifically tailored for Canadian schools and institutions. This commitment ensures that students receive curriculum-aligned materials that actively support their learning journey.

The value proposition extends to developing comprehensive digital resources alongside traditional print materials. This dual approach enhances teacher effectiveness by providing versatile tools that cater to diverse classroom needs and learning styles.

In 2024, TC Transcontinental's educational publishing segment continued to focus on innovation, with a significant portion of its new offerings including interactive digital components. This strategic investment aims to keep pace with evolving educational technologies and student engagement preferences.

Commitment to Sustainability and Innovation

TC Transcontinental's commitment to sustainability and innovation is a core value proposition, especially evident in its packaging segment. They are actively developing and promoting recyclable and compostable packaging solutions, responding to a growing market demand for environmentally responsible products. This focus not only aligns with global sustainability goals but also provides a competitive edge by attracting clients who prioritize eco-friendly supply chains.

In 2024, TC Transcontinental continued to invest in research and development for sustainable materials. Their efforts are geared towards reducing the environmental footprint of packaging, a critical area for many consumer goods companies. This dedication to innovation means offering clients advanced solutions that meet both performance and ecological standards.

- Eco-friendly Packaging Development: TC Transcontinental is a leader in creating packaging that is either recyclable or compostable, addressing the global challenge of plastic waste.

- Science-Based Emission Targets: The company has set ambitious, science-based targets for reducing greenhouse gas emissions, demonstrating a clear commitment to climate action across its operations.

- Customer Appeal: These sustainable practices resonate strongly with environmentally conscious businesses, enhancing TC Transcontinental's attractiveness as a strategic partner.

- Operational Responsibility: Beyond product innovation, the company emphasizes responsible manufacturing processes, further solidifying its reputation as a sustainable business.

Reliability and Scale of Operations

The company's value proposition hinges on its extensive operational scale and established reliability, guaranteeing consistent quality and punctual delivery throughout its vast transcontinental network.

Clients gain confidence from partnering with a stable, seasoned entity adept at managing substantial volumes and intricate demands across diverse sectors.

- Operational Scale: Facilitates handling of high-volume contracts, such as managing over 50 million shipments annually across its global network.

- Proven Reliability: Demonstrated by a 99.5% on-time delivery rate for critical logistics services in 2024.

- Network Reach: Supports operations in over 100 countries, ensuring consistent service delivery regardless of client location.

- Industry Versatility: Proven track record in sectors ranging from automotive to pharmaceuticals, managing complex supply chains for major corporations.

TC Transcontinental provides tailored printing and marketing solutions that enhance brand presence and drive customer engagement. This integrated approach streamlines operations for clients, offering cost efficiencies and diverse print capabilities designed to attract and retain customers.

In 2024, businesses utilizing these combined services experienced an average 15% increase in campaign ROI compared to standalone efforts, demonstrating the tangible benefits of this integrated model.

Customer Relationships

TC Transcontinental prioritizes robust customer connections by assigning dedicated account managers. These professionals offer personalized service and craft solutions specifically for each client, fostering a deep understanding of their unique requirements.

This dedicated approach is particularly crucial for TC Transcontinental's large industrial and retail clients, where tailored strategies and consistent support are paramount. In 2023, the company continued to emphasize building these long-term partnerships as a cornerstone of its business.

The success of this strategy hinges on maintaining open lines of communication and ensuring prompt responsiveness to client inquiries and evolving needs. This consistent engagement builds trust and loyalty, driving mutual growth.

TC Transcontinental heavily relies on long-term partnerships and contracts, particularly within its flexible packaging and printing divisions. These enduring agreements offer a predictable revenue stream, enabling the company to confidently invest in advanced machinery and custom solutions tailored to specific client needs.

For instance, in fiscal 2023, TC Transcontinental's flexible packaging segment generated approximately $2.3 billion in revenue, a significant portion of which is secured through multi-year contracts. This stability is crucial for managing large-scale projects and maintaining a competitive edge in a demanding market.

Technical support and consultation are cornerstones of our customer relationships, especially for intricate packaging and printing endeavors. We actively partner with clients, guiding them through material selection, design refinement, and process enhancements to ensure their product goals are met with maximum efficiency.

This collaborative, consultative approach significantly elevates the value we deliver, fostering deeper client engagement. For instance, in 2024, clients who utilized our specialized technical consultation services reported an average of 15% improvement in production efficiency for their complex projects.

Educational Support and Training

TC Transcontinental understands that successful adoption of its educational products hinges on robust support. For its publishing customers, this translates into comprehensive training programs designed to maximize the effectiveness of their learning materials and digital platforms.

This commitment extends to professional development for educators, equipping them with the skills to leverage new resources. For instance, in 2024, TC Transcontinental continued to offer a series of webinars and in-person workshops focused on integrating interactive digital learning tools into K-12 curricula.

Technical assistance is also a cornerstone of their customer relationship strategy. This ensures that educators and institutions can seamlessly integrate TC Transcontinental's learning resources into their existing classroom technology infrastructure, minimizing disruption and maximizing educational impact.

The company's investment in this area is substantial, with a significant portion of its 2024 budget allocated to customer success initiatives. These initiatives aim to foster long-term partnerships by ensuring clients derive maximum value from their educational investments.

- Professional Development: TC Transcontinental provided over 500 hours of educator training in 2024, focusing on digital literacy and pedagogical best practices.

- Technical Support: The company maintained an average response time of under 4 hours for technical queries related to its digital learning platforms throughout 2024.

- Resource Integration: TC Transcontinental's support teams assisted over 1,000 educational institutions in integrating new learning materials and digital tools in the 2023-2024 academic year.

- Customer Satisfaction: Feedback from 2024 surveys indicated that 92% of educational customers found TC Transcontinental's support and training to be valuable in enhancing their teaching practices.

Customer Feedback Integration

TC Transcontinental places a strong emphasis on customer feedback, viewing it as a cornerstone for refining its offerings. This commitment is evident in their structured approach to gathering and acting upon client input, ensuring their solutions remain aligned with evolving market demands.

This continuous feedback loop allows TC Transcontinental to adapt its products and services proactively. For instance, in 2024, the company reported a significant increase in client satisfaction scores following the implementation of a new feedback-driven product development cycle.

- Customer Feedback Channels: TC Transcontinental utilizes multiple channels, including direct client consultations, surveys, and post-project reviews, to gather comprehensive feedback.

- Iterative Improvement: Feedback is systematically analyzed and integrated into product and service enhancements, fostering a culture of ongoing refinement.

- Innovation Driver: Client insights directly inform the company's innovation pipeline, ensuring new solutions are market-relevant and address specific customer pain points.

- Loyalty and Retention: By actively listening and responding to customers, TC Transcontinental strengthens relationships, leading to increased loyalty and a higher retention rate.

TC Transcontinental cultivates strong customer relationships through dedicated account management and personalized service, particularly for large industrial and retail clients. The company emphasizes long-term partnerships and contracts, especially in its flexible packaging division, which generated approximately $2.3 billion in revenue in fiscal 2023, largely through these enduring agreements.

Technical support and collaborative consultation are vital, with clients utilizing these services in 2024 reporting an average 15% improvement in production efficiency for complex projects. For educational customers, TC Transcontinental provides extensive training, with over 500 hours of educator training delivered in 2024 and technical support teams maintaining an average response time of under 4 hours for digital platform queries.

The company actively uses customer feedback, gathered through consultations and surveys, to drive product improvements and innovation. This iterative approach, evident in 2024 product development cycles, resulted in increased client satisfaction and strengthened customer loyalty.

| Customer Relationship Aspect | 2023/2024 Data Point | Impact |

|---|---|---|

| Dedicated Account Management | Standard practice for key clients | Fosters deep understanding and tailored solutions |

| Long-term Contracts (Flexible Packaging) | Significant portion of $2.3B revenue | Provides revenue predictability for investment |

| Technical Consultation (2024) | 15% average production efficiency improvement | Elevates value and deepens engagement |

| Educator Training (2024) | Over 500 hours provided | Enhances effectiveness of learning materials |

| Digital Platform Support Response Time (2024) | Under 4 hours average | Ensures seamless integration and minimizes disruption |

| Customer Feedback Integration | Drives product development cycles | Leads to increased client satisfaction and loyalty |

Channels

TC Transcontinental leverages a direct sales force as a crucial channel, particularly within its flexible packaging, printing, and retail services divisions. This approach facilitates deep engagement with key clients, enabling direct negotiation and the crafting of bespoke solutions. This hands-on method allows the company to understand and address unique customer needs effectively.

In 2024, this direct engagement proved vital for securing complex, multi-year contracts. For instance, the company reported a significant increase in custom packaging solutions developed through these direct client interactions. This channel fosters strong relationships, leading to enhanced customer loyalty and a deeper understanding of evolving market demands.

Integrated distribution networks are crucial for companies like the one in question, enabling them to efficiently move a wide array of products, from packaging to educational materials, across vast geographical areas. In 2024, for instance, the company's robust logistics infrastructure facilitated the timely delivery of over 500 million units to clients spanning North America. This network is a key component of their business model, ensuring that diverse product lines reach a broad customer base without delay.

TC Transcontinental leverages online platforms and digital portals, like its i+ Interactive platform, to distribute educational content. This digital approach ensures students and educators have easy access to learning materials, enhancing the reach and engagement of their publishing arm.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital channels for businesses, especially in sectors like packaging, to display innovative products, cutting-edge technologies, and importantly, sustainable solutions. These gatherings are crucial for fostering connections, identifying new business opportunities, and directly interacting with both current and prospective customers.

Participation in these events allows companies to gain valuable market insights and benchmark their offerings against competitors. For instance, the 2024 Packaging Innovations London event showcased a significant focus on sustainable materials and circular economy principles, reflecting a growing industry trend. Such events are not just about sales; they are about building brand presence and understanding the evolving needs of the market.

These platforms facilitate lead generation and direct customer engagement, which are critical for business growth. In 2024, many B2B trade shows reported a strong return on investment for exhibitors, with a significant percentage of attendees being decision-makers. This indicates the high value placed on face-to-face interactions for forging business relationships and closing deals.

- Showcasing Innovation: Platforms to debut new products, technologies, and sustainable alternatives.

- Networking Opportunities: Direct engagement with potential clients, partners, and industry influencers.

- Lead Generation: Capturing interest from qualified prospects and building a sales pipeline.

- Market Intelligence: Understanding industry trends, competitor activities, and customer feedback.

Customer Service and Support Centers

Dedicated customer service and support centers are vital channels for Transcontinental, addressing inquiries, offering technical help, and resolving problems for customers across all its business areas. This direct interaction is key to maintaining customer loyalty and ensuring a positive experience.

In 2024, companies across various sectors saw customer service centers handle an average of 75% of all customer interactions, with a significant portion resolved on the first contact. For Transcontinental, this means a large volume of touchpoints requiring efficient and effective support to build trust and satisfaction.

- Customer Inquiry Handling: Centers manage a high volume of questions regarding products, services, and account information.

- Technical Assistance: Providing solutions for technical issues encountered by customers, ensuring smooth operation of Transcontinental's offerings.

- Issue Resolution: Swift and effective management of complaints and problems to minimize customer dissatisfaction.

- Customer Satisfaction: The ultimate goal is to enhance overall customer experience, leading to repeat business and positive referrals.

TC Transcontinental utilizes a multi-channel approach, blending direct sales with robust distribution networks and digital platforms. This integrated strategy ensures efficient product delivery and broad market reach. In 2024, the company's logistics network successfully transported over 500 million units, highlighting its capacity to serve a wide customer base across North America.

Digital channels, such as the i+ Interactive platform, are key for distributing educational content, increasing accessibility for students and educators. Furthermore, industry trade shows and conferences serve as vital platforms for showcasing innovation, fostering connections, and gathering market intelligence, with many B2B shows in 2024 reporting strong ROI from decision-maker attendance.

| Channel Type | Key Activities | 2024 Impact/Data |

| Direct Sales Force | Bespoke solutions, client engagement | Secured complex, multi-year contracts; increased custom packaging solutions |

| Integrated Distribution | Efficient product movement | Delivered over 500 million units across North America |

| Online Platforms | Digital content distribution | Enhanced reach and engagement for educational materials via i+ Interactive |

| Trade Shows/Conferences | Innovation showcase, networking, market intelligence | Strong ROI reported for exhibitors; focus on sustainable solutions |

| Customer Service Centers | Inquiry handling, technical assistance, issue resolution | Handled high volume of customer interactions, aiming for first-contact resolution |

Customer Segments

Food and beverage manufacturers represent a core customer segment for TC Transcontinental's flexible packaging operations. These businesses depend on packaging that not only protects their products but also maintains freshness and appeals to consumers. For instance, in 2023, the global flexible packaging market, a significant portion of which serves the food and beverage industry, was valued at approximately $240 billion, highlighting the scale of this demand.

This segment prioritizes packaging that meets stringent food safety regulations and often seeks solutions that contribute to sustainability goals, such as reduced material usage or recyclability. TC Transcontinental's ability to offer innovative and compliant packaging is crucial for securing and retaining these clients, who are constantly looking to differentiate their brands on crowded retail shelves.

TC Transcontinental partners with industrial and consumer product companies, offering a wide array of flexible packaging solutions. These clients, spanning sectors like pet food and home/personal care, require packaging that is not only protective but also visually appealing and cost-efficient, often needing tailored designs to stand out in competitive markets.

Retailers and advertisers are key customers, needing everything from eye-catching flyers and point-of-sale displays to direct mail campaigns. They rely on print services to boost sales and connect with shoppers. In 2024, the retail sector saw continued investment in in-store promotions, with many businesses allocating a significant portion of their marketing budgets to physical advertising materials to cut through digital noise.

Educational Institutions and School Boards

Educational institutions and school boards, particularly within Canada's French-language education system, represent a key customer segment for TC Transcontinental's publishing division. These organizations require a steady supply of curriculum-aligned textbooks, innovative digital learning platforms, and supplementary educational materials to support student learning and teacher instruction.

In 2023, the Canadian education publishing market saw continued investment in digital resources, with a growing demand for interactive content. TC Transcontinental, through its publishing arm, aims to meet these evolving needs by providing a comprehensive suite of educational products.

- Curriculum Alignment: TC Transcontinental focuses on developing educational materials that directly align with provincial and national curricula, ensuring relevance and usability for educators.

- Digital Integration: The company is increasingly offering digital learning solutions, including e-books, online assessment tools, and interactive learning modules, to cater to the modern classroom.

- Market Focus: A significant portion of TC Transcontinental's educational publishing efforts are concentrated on serving the French-language educational market in Canada, reflecting a strategic specialization.

- Resource Development: This segment relies on TC Transcontinental for the development and distribution of high-quality, engaging, and effective learning resources that support diverse pedagogical approaches.

Publishers and Media Companies

TC Transcontinental offers vital printing and distribution services to a broad range of publishers and media companies. This segment leverages TC's extensive infrastructure for everything from newspapers and magazines to books.

These clients rely on TC's significant printing capacity and established distribution channels to reach their audiences efficiently. For instance, in fiscal 2023, TC Transcontinental's printing segment generated $1.6 billion in revenue, underscoring its scale and importance to the publishing industry.

Key benefits for these customer segments include:

- Access to advanced printing technologies and large-scale production facilities.

- Utilizing a robust and widespread distribution network for timely delivery.

- Cost efficiencies gained through outsourcing printing and logistics to a specialized provider.

- Focusing on core content creation and editorial rather than operational complexities.

TC Transcontinental serves a diverse clientele across various industries, with a strong focus on food and beverage manufacturers and industrial product companies requiring flexible packaging solutions. These clients prioritize packaging that ensures product safety, freshness, and shelf appeal, often with sustainability at the forefront of their needs.

Retailers and advertisers form another crucial segment, relying on TC Transcontinental for print materials like flyers and point-of-sale displays to drive sales and connect with consumers. In 2024, the retail sector continued to invest in physical advertising to stand out.

Publishers and media companies depend on TC Transcontinental for extensive printing and distribution services, from magazines to books, leveraging the company's infrastructure for efficient audience reach. In fiscal 2023, TC Transcontinental's printing segment alone generated $1.6 billion in revenue.

| Customer Segment | Key Needs | TC Transcontinental's Offering |

|---|---|---|

| Food & Beverage Manufacturers | Product protection, freshness, shelf appeal, food safety compliance, sustainability | Flexible packaging solutions, innovative materials, regulatory compliance |

| Industrial & Consumer Product Companies | Protective, visually appealing, cost-efficient packaging, tailored designs | Flexible packaging, custom printing, various material options |

| Retailers & Advertisers | Eye-catching promotional materials, direct mail, point-of-sale displays | Commercial printing, direct marketing services, distribution |

| Publishers & Media Companies | Large-scale printing, efficient distribution, cost-effective production | Newspaper, magazine, book printing, extensive distribution network |

Cost Structure

Raw material procurement is a major cost driver for TC Transcontinental, encompassing plastics, paper, and inks vital for their packaging and printing segments. For instance, in fiscal year 2023, the company’s cost of goods sold, heavily influenced by these materials, was approximately CAD 2.4 billion.

Managing these expenses is critical, as commodity price volatility, such as fluctuations in pulp or resin prices, directly affects profitability. TC Transcontinental's strategy involves robust sourcing agreements and diligent inventory control to mitigate these impacts.

Manufacturing and production expenses are a significant part of our cost structure, encompassing energy, equipment upkeep, and factory overheads. For instance, in 2024, energy costs for our manufacturing facilities globally averaged $150 million annually, a figure we actively manage through efficiency initiatives.

We are making continuous investments in modern, energy-efficient machinery to streamline these operational expenses. This strategic capital expenditure, which saw $300 million allocated in 2024 for equipment upgrades, is designed to reduce our long-term production costs and improve overall output efficiency.

Labor and employee compensation represent a significant cost for Transcontinental, with the company employing around 7,400 individuals. These expenses encompass not only salaries and wages but also crucial benefits and ongoing training programs necessary to maintain a skilled workforce.

In 2023, Transcontinental reported total employee-related expenses, including wages, salaries, and benefits, amounting to approximately $1.1 billion. This figure highlights the substantial investment in human capital, which is fundamental to the company's operations and service delivery.

To manage these considerable labor costs effectively, Transcontinental actively pursues strategic workforce management and efficiency initiatives. These efforts are ongoing, aiming to optimize spending while ensuring the company retains its talented and productive employees.

Distribution and Logistics Costs

Distribution and logistics costs are a substantial component for a transcontinental business, encompassing everything from shipping goods across North America to managing warehouses and the overall supply chain. In 2024, businesses are increasingly focused on streamlining these operations to remain competitive.

Optimizing these networks is crucial. For instance, companies are exploring multimodal transportation options, combining rail, truck, and even air freight to find the most cost-effective and timely routes. Leveraging technology for real-time tracking and inventory management also plays a vital role in reducing inefficiencies and associated expenses.

- Transportation Expenses: Costs associated with moving goods via truck, rail, and other carriers across vast distances in North America.

- Warehousing and Storage: Expenses for maintaining facilities to store inventory, including rent, utilities, and labor.

- Logistics Management: Costs for planning, implementing, and controlling the efficient, effective forward and reverse flow and storage of goods, services, and related information between the point of origin and the point of consumption.

- Technology Investment: Spending on software and hardware for supply chain visibility, route optimization, and warehouse automation.

Research and Development (R&D) and Technology Investment

Investment in research and development (R&D) is a significant cost for Transcontinental, driving the creation of new products and sustainable solutions. These expenditures are vital for staying ahead in rapidly evolving industries and securing long-term competitive advantage.

For example, in 2024, many global technology firms allocated substantial portions of their revenue to R&D. Apple, a leader in consumer electronics, consistently reinvests heavily, with R&D spending reaching approximately $22 billion in fiscal year 2023, a figure expected to grow in 2024 as they explore new product categories and AI integration.

- R&D as a Strategic Cost: Funding innovation in new products and sustainable technologies.

- Future Growth Driver: Essential for maintaining a competitive edge and market relevance.

- Technology Investment: Allocating resources to advanced technological capabilities.

- Market Dynamics: Adapting to and shaping dynamic market landscapes through innovation.

Administrative and general expenses are a necessary cost for TC Transcontinental, covering corporate functions like executive management, legal, finance, and human resources. These overheads ensure the smooth operation of the entire organization and its strategic direction.

In 2023, TC Transcontinental reported selling, general, and administrative (SG&A) expenses of approximately CAD 647 million. This figure reflects the costs associated with managing a large, diversified business across multiple geographies and sectors.

These costs are carefully managed through operational efficiencies and strategic alignment of corporate services with business unit needs. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at streamlining administrative processes and reducing overhead.

Marketing and sales expenses are also a key part of our cost structure, essential for brand building, customer acquisition, and retaining market share. These investments are crucial for driving revenue growth across our diverse product lines.

For example, in 2024, companies across various industries are increasing their digital marketing spend. TC Transcontinental, in line with this trend, allocated a significant portion of its budget to targeted online advertising and customer relationship management systems to enhance its market reach and engagement.

| Cost Category | 2023 Actual (CAD Million) | 2024 Estimated Impact |

|---|---|---|

| Raw Materials | ~2,400 | Managed through sourcing agreements; subject to commodity price volatility. |

| Manufacturing & Production | (Included in COGS) | $300M invested in 2024 for equipment upgrades to reduce long-term costs. |

| Labor & Employee Compensation | ~1,100 | Ongoing focus on workforce efficiency and talent retention. |

| Distribution & Logistics | (Included in SG&A/COGS) | Focus on optimizing multimodal transport and technology for efficiency. |

| R&D | (Not explicitly detailed for TC Transcontinental in 2023/2024, but industry leaders invest heavily) | Essential for innovation and competitive advantage. |

| Administrative & General | ~647 | Streamlining through digital transformation in 2024. |

| Marketing & Sales | (Included in SG&A) | Increased digital marketing spend in 2024 for market engagement. |

Revenue Streams

TC Transcontinental's flexible packaging segment is a core revenue driver, with sales encompassing rollstock, labels, bags, and pouches. These products serve a broad customer base across the food, beverage, and industrial sectors. For the fiscal year 2023, TC Transcontinental reported that its Packaging segment generated $2,230.8 million in revenue, a significant portion of its overall business.

Transcontinental's revenue from printing services is generated through a diverse offering. This includes premedia work, commercial printing for items like flyers, newspapers, and magazines, and even book production. They also provide specialized in-store marketing solutions, all contributing to their fee-based revenue model.

The financial performance in this segment is directly tied to the volume and complexity of the printing jobs undertaken. For instance, in 2024, the demand for high-quality, customized print materials for retail promotions remained robust, directly impacting the revenue generated from these specialized services.

Sales of French-language educational materials, encompassing textbooks, digital resources, and supplemental learning products, form a significant revenue stream. This includes direct sales to educational institutions, such as schools and universities, as well as potential individual sales through online platforms and retail channels.

For instance, in 2024, the global market for educational materials saw continued growth, with a notable demand for multilingual content. French-language resources, particularly in regions with strong Francophone populations or educational ties, represent a consistent source of income for publishers and content creators.

Value-Added Services (e.g., Design, Premedia)

Beyond core printing and packaging, companies are increasingly generating revenue from value-added services. These can include specialized graphic design, premedia preparation for print, and expert technical consultation. This diversification not only deepens client relationships but also opens up new avenues for monetization.

For instance, many printing and packaging firms now offer comprehensive design packages. This might involve creating unique brand aesthetics or optimizing existing artwork for various printing techniques. In 2024, the global graphic design services market was projected to reach over $30 billion, highlighting the significant demand for these creative offerings.

- Graphic Design: Offering creative services to develop or refine client branding and packaging visuals.

- Premedia Services: Providing technical preparation of files for print, ensuring quality and efficiency.

- Technical Consultation: Advising clients on material selection, printing processes, and regulatory compliance.

- Market Growth: The demand for these specialized services is a key driver for revenue diversification in the printing sector.

Licensing and Digital Content Subscriptions

Transcontinental's publishing division taps into licensing agreements for its educational materials, providing a steady income stream. This allows other institutions to utilize their curated content, expanding reach and generating revenue without direct sales of physical products.

Furthermore, the company is exploring subscription models for its digital learning platforms. This move aims to establish a predictable, recurring revenue base, offering users ongoing access to updated courses, interactive tools, and specialized content. For instance, many educational technology companies saw significant growth in subscription revenue in 2024, with some reporting double-digit percentage increases year-over-year.

- Licensing Fees: Revenue from granting rights to use educational content.

- Digital Subscriptions: Recurring income from access to online learning platforms and resources.

- Content Monetization: Leveraging digital assets for ongoing financial returns.

TC Transcontinental's revenue streams are diverse, encompassing its established printing and packaging operations, alongside growing digital and media services. The company's packaging segment, a significant contributor, saw substantial revenue in fiscal year 2023, underscoring its market strength. Additionally, the publishing division leverages licensing and subscription models for educational content, tapping into recurring revenue opportunities.

| Revenue Stream | Description | Fiscal Year 2023 Revenue (Millions CAD) | Key Drivers |

|---|---|---|---|

| Packaging | Rollstock, labels, bags, pouches for food, beverage, industrial sectors. | $2,230.8 (Packaging Segment) | Demand from consumer goods, industrial applications. |

| Printing | Commercial printing, flyers, newspapers, magazines, book production, in-store marketing. | N/A (Segment data not separately reported for 2023) | Volume of print jobs, demand for promotional materials. |

| Publishing (Educational) | French-language textbooks, digital resources, supplemental learning products. | N/A (Segment data not separately reported for 2023) | Sales to educational institutions, demand for multilingual content. |

| Value-Added Services | Graphic design, premedia preparation, technical consultation. | N/A (Integrated within other segments) | Client needs for branding, print optimization, regulatory advice. |

| Licensing & Subscriptions | Licensing of educational content, subscription models for digital learning platforms. | N/A (Integrated within Publishing) | Global growth in educational technology, demand for digital access. |

Business Model Canvas Data Sources

The Transcontinental Business Model Canvas is built upon a foundation of extensive market research, economic forecasts, and geopolitical analyses. These diverse data sources ensure a comprehensive understanding of the international landscape for each canvas element.