Transcontinental PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

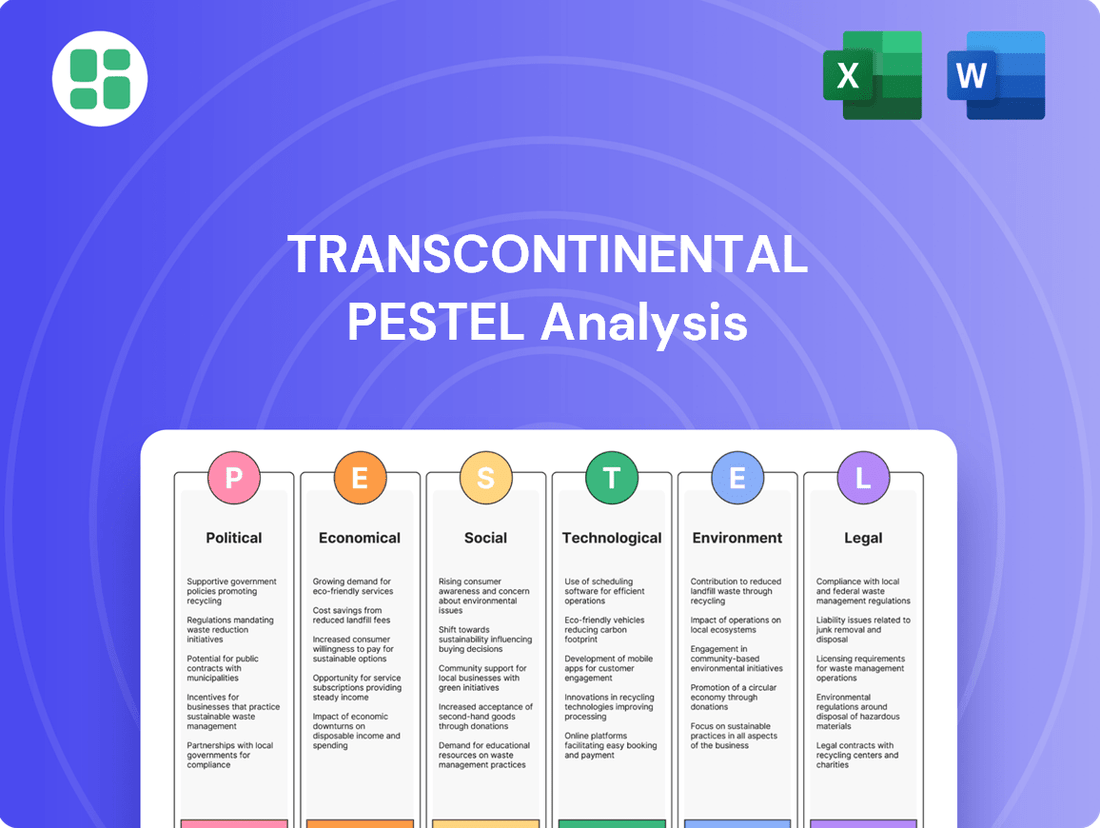

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Transcontinental's trajectory. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Gain a significant competitive advantage – download the full report now.

Political factors

Governments across North America are tightening rules on packaging, especially regarding single-use plastics and how easily materials can be recycled. For instance, Canada's proposed plastics ban, which aims to phase out certain problematic single-use plastics by the end of 2025, directly impacts packaging producers.

These evolving regulations, such as the Extended Producer Responsibility (EPR) schemes gaining traction in several US states like California and New York, can spur innovation in eco-friendly materials. However, they also necessitate significant investment in new technologies and process changes for companies like TC Transcontinental to ensure compliance, potentially affecting their operational costs.

Trade policies and agreements significantly shape TC Transcontinental's operational landscape. For instance, the United States-Mexico-Canada Agreement (USMCA) directly impacts the flow of packaging materials, printed goods, and educational resources across these North American borders. As of early 2024, the USMCA continues to facilitate trade, though ongoing discussions around specific regulations and potential adjustments to rules of origin remain a point of attention for businesses relying on these cross-border supply chains.

Fluctuations in tariffs or shifts in trade relations can introduce volatility into TC Transcontinental's business model. For example, a sudden imposition of tariffs on imported paper pulp or ink in late 2024 could directly increase raw material costs, impacting the profitability of its printing divisions. Conversely, favorable trade agreements could enhance market access for its specialized packaging solutions in emerging markets, potentially boosting revenue streams.

Governmental educational policies significantly shape the market for educational publishing materials. Curriculum changes, such as the ongoing integration of digital learning tools and updated learning standards across Canadian provinces, directly influence the demand for new textbooks and supplementary resources. TC Transcontinental's educational publishing division must remain agile to adapt to these evolving mandates and fluctuating budget allocations from both provincial and federal governments, which can impact sales volumes and product development priorities for the 2024-2025 academic year.

Labor Laws and Employment Policies

Changes in labor laws and employment policies across Canada and the United States directly influence TC Transcontinental's operational expenses and how it manages its workforce. For instance, in 2024, several US states and Canadian provinces saw adjustments to their minimum wage rates, affecting the cost of labor for TC Transcontinental's printing and packaging facilities. Adhering to the diverse provincial and state labor standards, which can vary significantly in areas like overtime pay and benefits, is a critical compliance challenge for the company’s operations spanning multiple jurisdictions.

The evolving landscape of employment regulations, including those related to worker classification and workplace safety, also presents ongoing considerations. For example, discussions around gig worker status and potential new mandates for employee benefits in 2025 could necessitate strategic adjustments in how TC Transcontinental structures its workforce, particularly in its distribution and logistics segments. The company must remain agile to adapt to these shifts, ensuring compliance while maintaining competitive operational costs.

- Minimum Wage Adjustments: In 2024, minimum wage increases in states like California and provinces such as Ontario directly impacted TC Transcontinental's labor costs in those regions.

- Worker Classification Scrutiny: Ongoing regulatory reviews in both countries regarding the classification of contract versus employee labor could affect TC Transcontinental's flexible workforce models.

- Workplace Safety Regulations: Stricter enforcement or updates to occupational health and safety standards in 2024-2025 may require additional investments in training and equipment for TC Transcontinental's manufacturing sites.

Political Stability and Geopolitical Risks

The political stability of Canada and the United States remains a significant factor for businesses. In 2024, both nations are expected to maintain generally stable political environments, though upcoming elections in both countries could introduce some policy uncertainty. For instance, the 2024 US presidential election cycle will be closely watched for its potential impact on trade agreements and regulatory frameworks that affect cross-border operations.

Broader geopolitical risks, such as ongoing international conflicts and trade disputes, can indirectly impact the North American business landscape. Supply chain disruptions stemming from events in other regions, like the Red Sea shipping crisis in early 2024, highlight the interconnectedness of global politics and economic stability. These events can lead to increased logistics costs and potential material shortages, affecting operational efficiency.

Key considerations include:

- US Election Impact: The outcome of the 2024 US presidential election could lead to shifts in fiscal policy, trade relations, and regulatory oversight, influencing investor sentiment and business investment decisions.

- Canadian Policy Continuity: While Canada generally enjoys political stability, upcoming provincial elections and federal policy reviews can introduce localized or sector-specific risks for businesses operating within its borders.

- Global Supply Chain Vulnerabilities: Geopolitical tensions in various parts of the world continue to pose risks to the stability and cost-effectiveness of international supply chains, a critical concern for many transcontinental businesses.

- Energy Security and Policy: Political decisions regarding energy production, pipelines, and international energy markets can significantly affect operational costs and strategic planning for industries reliant on energy resources.

Government regulations on packaging, particularly concerning single-use plastics and recyclability, are becoming stricter across North America, impacting companies like TC Transcontinental. For example, Canada's proposed ban on certain plastics by the end of 2025 directly influences packaging material choices.

Extended Producer Responsibility (EPR) schemes, implemented in US states such as California and New York, are driving demand for eco-friendly materials but also require significant investment in new technologies for compliance, potentially increasing operational costs for TC Transcontinental.

Trade agreements like the USMCA continue to facilitate cross-border commerce for packaging and printed goods, though ongoing discussions about regulations and rules of origin remain a focus for businesses in 2024.

Shifts in trade policies, such as potential tariffs on raw materials like paper pulp or ink in late 2024, could directly increase TC Transcontinental's production costs, while favorable agreements may open new markets for its specialized packaging solutions.

What is included in the product

This Transcontinental PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling identification of opportunities and mitigation of threats within the Transcontinental's operating landscape.

Provides a concise and actionable overview of external factors, enabling quicker strategic decision-making and reducing the burden of sifting through extensive data.

Economic factors

Rising inflation presents a significant challenge for TC Transcontinental, directly impacting its operational costs. For instance, the cost of paper, a key input for its printing and packaging segments, has seen volatility. In 2024, global paper prices experienced upward pressure due to supply chain disruptions and increased demand, potentially squeezing TC Transcontinental's profit margins if these costs cannot be fully passed on to customers.

Furthermore, the prevailing interest rate environment in key operating regions, such as Canada and the United States, influences TC Transcontinental's financial strategy. As of mid-2024, central banks have maintained relatively higher interest rates to combat inflation. This makes borrowing for new capital investments or refinancing existing debt more expensive, potentially slowing down expansion initiatives or increasing the burden of debt servicing for the company.

TC Transcontinental, a major player in packaging and printing, faces significant challenges from the fluctuating prices of essential raw materials like plastic resins and paper pulp. These price swings are driven by global supply and demand dynamics, directly impacting the company's production costs and its ability to set competitive prices for its products.

For instance, the price of polyethylene, a key plastic resin, saw considerable volatility in 2024, with spot prices experiencing upward pressure due to supply chain disruptions and strong demand in various sectors. Similarly, the cost of paper pulp, crucial for TC Transcontinental's printing segment, has been influenced by factors such as energy costs and global shipping rates, with reports indicating a 5-10% increase in pulp prices in early 2025 compared to the previous year.

Consumer spending is a critical driver for TC Transcontinental, directly affecting demand across its diverse segments. For instance, a slowdown in consumer spending, as seen during periods of economic uncertainty, can reduce demand for printed marketing materials and packaging solutions. In 2024, global consumer spending is projected to grow, but inflation and interest rate hikes may temper discretionary purchases, impacting sectors like advertising and retail packaging.

Shifts in consumer habits also play a significant role. A growing preference for digital media over print, for example, could decrease the need for traditional advertising services. Conversely, increased demand for sustainable packaging solutions presents an opportunity for TC Transcontinental to leverage its expertise. The company's 2024 first-quarter results showed revenue growth, partly driven by its packaging segment, indicating a positive response to evolving consumer preferences in that area.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations, particularly between the Canadian Dollar (CAD) and the US Dollar (USD), directly affect TC Transcontinental's financial performance given its operations in both countries. A strengthening Canadian Dollar can reduce the reported profitability of its US-based earnings when translated back into CAD. Conversely, a weaker CAD can make its exports to the US more competitive but increase the cost of imported materials.

For instance, during the first quarter of fiscal 2024, TC Transcontinental noted that foreign exchange had a negative impact on its results. The average CAD/USD exchange rate for the quarter was approximately 1.35, compared to 1.34 in the prior year's first quarter, indicating a slight appreciation of the USD against the CAD. This shift can influence the company's reported revenue and profit margins from its US segments.

- Impact on Earnings: A stronger CAD reduces the value of USD-denominated profits when converted, negatively impacting reported earnings.

- Export Competitiveness: A weaker CAD makes TC Transcontinental's products cheaper for US buyers, potentially boosting export sales.

- Import Costs: Conversely, a stronger CAD lowers the cost of raw materials or equipment purchased from the US.

- Fiscal Year 2024 Q1 FX Impact: The company reported foreign exchange as a headwind in its Q1 2024 results, highlighting the ongoing sensitivity to these rate movements.

Labor Market Conditions and Wage Pressures

TC Transcontinental, like many businesses operating in North America, faces the challenge of a persistently tight labor market. This scarcity of available workers, particularly those with specialized skills needed in printing and packaging, is driving up wage demands. For instance, in the United States, the unemployment rate hovered around 3.9% in early 2024, a figure that historically signals a tight labor environment. This directly translates to increased labor costs for the company.

These escalating wage pressures can significantly impact TC Transcontinental's manufacturing efficiency. Higher labor expenses, coupled with the ongoing need to attract and retain skilled employees across its diverse printing, packaging, and publishing operations, create a challenging cost structure. The ability to maintain competitive pricing while absorbing these increased operational costs is a key concern for the company's profitability.

- North American unemployment rates remained low in early 2024, indicating a tight labor market.

- Increased wage demands directly contribute to higher operational costs for TC Transcontinental.

- Attracting and retaining skilled labor is crucial for efficiency in printing and packaging divisions.

Economic factors significantly influence TC Transcontinental's profitability and strategic decisions. Rising inflation, particularly in raw material costs like paper pulp and plastic resins, directly impacts operational expenses. For example, paper pulp prices saw an estimated 5-10% increase in early 2025 compared to the prior year, squeezing margins if not passed on.

Interest rates in key markets like Canada and the US remained elevated in mid-2024, making borrowing for capital expenditures more costly and potentially slowing expansion plans. Consumer spending, a key driver, is projected for growth in 2024, but inflation and interest rate hikes could temper discretionary purchases, affecting demand for printed marketing and packaging.

Currency fluctuations, especially between CAD and USD, impact reported earnings. A stronger CAD in Q1 2024, with the average rate around 1.35 CAD/USD, negatively affected the translation of USD-denominated profits. Furthermore, a tight labor market in North America, with US unemployment around 3.9% in early 2024, drives up wage demands, increasing labor costs for the company.

| Economic Factor | Impact on TC Transcontinental | Relevant Data (2024-2025) |

|---|---|---|

| Inflation | Increased raw material and operational costs | Paper pulp prices up 5-10% in early 2025 |

| Interest Rates | Higher borrowing costs, potential investment slowdown | Rates elevated mid-2024 in Canada/US |

| Consumer Spending | Affects demand for packaging and print | Projected growth in 2024, but tempered by inflation |

| Currency Exchange Rates | Impacts translation of foreign earnings | CAD/USD average ~1.35 in Q1 2024 |

| Labor Market | Increased wage demands and labor costs | US unemployment ~3.9% in early 2024 |

Full Version Awaits

Transcontinental PESTLE Analysis

The preview shown here is the exact Transcontinental PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting transcontinental operations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, giving you immediate access to valuable strategic insights.

Sociological factors

Consumers increasingly favor packaging that is both eco-friendly and recyclable, a trend that significantly impacts companies like TC Transcontinental. This shift in preference isn't just a niche movement; a 2024 survey indicated that over 70% of consumers are willing to pay more for products with sustainable packaging.

As a major player in flexible packaging, TC Transcontinental is compelled to adapt by developing and promoting sustainable material innovations. Failing to do so risks alienating a growing segment of their customer base and falling behind competitors who are actively investing in greener solutions.

Educational demographics are changing, with a rise in lifelong learning and a demand for more flexible, digital-first content. For instance, in 2024, online learning platforms saw continued growth, with many institutions reporting increased enrollment in hybrid and fully online programs. This shift directly impacts how educational materials are consumed, pushing publishers like TC Transcontinental to innovate beyond traditional print.

The adoption of digital learning platforms is accelerating, influencing how students engage with educational content. By 2025, it's projected that a significant percentage of higher education courses will incorporate digital components, from interactive e-books to AI-powered tutoring. TC Transcontinental's educational publishing division must therefore adapt its offerings to cater to these evolving learning styles, potentially through multimedia integration and personalized learning pathways.

The digital transformation of media consumption is profoundly reshaping how audiences engage with news and advertising. This shift directly influences the demand for traditional print media, impacting sectors like commercial printing services. For instance, global digital ad spending was projected to reach over $600 billion in 2024, a stark contrast to the declining revenues in print advertising.

TC Transcontinental's printing division faces a critical imperative to adapt by diversifying its service portfolio. Embracing digital printing technologies is no longer optional but essential for staying competitive and meeting evolving market needs. This strategic pivot allows them to cater to clients requiring shorter runs, variable data printing, and on-demand production, services that align with the fragmented and immediate nature of digital content delivery.

Workforce Demographics and Talent Attraction

TC Transcontinental faces a critical challenge with its workforce demographics, particularly in its traditional manufacturing and printing operations. Many of these sectors are experiencing an aging workforce, meaning a significant portion of experienced employees are nearing retirement. This trend, combined with the increasing demand for new digital skills across all industries, creates a substantial hurdle in attracting and retaining the talent needed for future growth. For instance, in 2024, the printing industry, a core area for TC Transcontinental, continued to see a decline in younger workers entering the field, with many roles requiring updated digital proficiency that older generations may not possess.

To address this, TC Transcontinental must proactively invest in comprehensive training and development programs. These initiatives are essential to upskill existing employees and equip new hires with the necessary digital competencies. Furthermore, the company needs to cultivate attractive work environments that appeal to a diverse talent pool, emphasizing innovation, sustainability, and career advancement opportunities. By doing so, TC Transcontinental can better secure a skilled and motivated workforce capable of navigating the evolving demands of the printing and packaging sectors.

- Aging Workforce: Many traditional manufacturing and printing roles are held by older workers, leading to potential knowledge gaps as they retire.

- Digital Skills Gap: There's a growing need for employees proficient in digital technologies, from advanced printing software to data analytics, which isn't always met by the existing workforce.

- Talent Attraction: Competing for skilled labor in a tight job market requires TC Transcontinental to offer competitive compensation, benefits, and a positive company culture.

- Retention Strategies: Implementing effective retention programs, including clear career paths and continuous learning opportunities, is vital to keep valuable employees.

Social Awareness and Corporate Social Responsibility (CSR)

Public and investor expectations for corporate social responsibility are rising, impacting how TC Transcontinental is perceived and interacts with its stakeholders. This includes a closer look at ethical sourcing, fair labor practices, and how the company engages with the communities where it operates. For instance, in 2023, sustainability reporting frameworks like the Global Reporting Initiative (GRI) continue to guide companies like TC Transcontinental in disclosing their environmental, social, and governance (ESG) performance, with investors increasingly using this data to inform their decisions.

Demonstrating robust CSR initiatives is no longer just a good practice; it's becoming a critical differentiator. Companies that actively showcase their commitment to social good can build stronger brand loyalty and attract socially conscious investors. TC Transcontinental's efforts in areas such as reducing its environmental footprint and supporting local initiatives are key components of this evolving landscape.

- Growing Investor Demand for ESG: A significant portion of global assets under management are now influenced by ESG criteria, with many institutional investors actively seeking companies with strong social and governance performance.

- Consumer Preference for Ethical Brands: Surveys consistently show that consumers are more likely to purchase from brands that demonstrate a commitment to social and environmental responsibility.

- Supply Chain Transparency: There's increasing pressure on companies to ensure ethical labor practices and responsible sourcing throughout their entire supply chains, a challenge that impacts global operations like those of TC Transcontinental.

Societal attitudes towards sustainability are profoundly influencing consumer behavior and corporate responsibility. Consumers are increasingly prioritizing eco-friendly products and packaging, with a 2024 report indicating that over 70% of consumers are willing to pay a premium for sustainable options. This trend directly impacts TC Transcontinental's packaging division, necessitating innovation in recyclable and biodegradable materials to meet market demand and maintain brand loyalty.

Technological factors

TC Transcontinental is keenly focused on innovations in flexible packaging, particularly in areas like active and intelligent packaging. These advancements, including improved barrier films and the development of sustainable materials such as compostable and biodegradable plastics, are vital for staying ahead in a market increasingly driven by environmental concerns and consumer preferences for eco-friendly options.

TC Transcontinental's integration of Industry 4.0 technologies, including advanced automation and data analytics in its printing and packaging operations, is a key technological driver. For instance, in 2024, the company continued to invest in smart factory initiatives, aiming to boost productivity by an estimated 15% across key facilities through enhanced robotics and AI-driven process optimization. This focus on automation directly addresses cost reduction and quality improvement, critical for maintaining competitiveness in the global market.

The publishing industry is undergoing a significant digital transformation. E-learning platforms are becoming increasingly sophisticated, offering personalized learning experiences. Interactive digital content, including videos and simulations, is enhancing engagement. For TC Transcontinental, this means opportunities in its educational publishing segment to adapt and innovate.

Augmented reality (AR) in textbooks is a growing trend, allowing for immersive learning. Adaptive learning technologies, which tailor content to individual student needs, are also gaining traction. TC Transcontinental's investment in these technological advancements is crucial for staying competitive and driving future growth in the educational market, especially as the global e-learning market is projected to reach $400 billion by 2026.

Data Analytics and AI for Operational Optimization

TC Transcontinental is increasingly leveraging advanced data analytics and artificial intelligence (AI) to refine its operational efficiency. These technologies are crucial for optimizing complex supply chains, allowing for better inventory management and logistics planning. For instance, predictive maintenance, powered by AI, can anticipate equipment failures, reducing downtime and associated costs.

The company's adoption of these tools extends to production scheduling, ensuring smoother workflows and maximizing output. Furthermore, AI-driven customer analytics provides invaluable insights into consumer preferences and purchasing patterns across TC Transcontinental's diverse business segments, from packaging to printing and media.

In 2024, the global market for AI in supply chain management was projected to reach over $10 billion, highlighting the significant investment and adoption trend. TC Transcontinental's commitment to these technological advancements positions it to gain a competitive edge through enhanced decision-making and resource allocation.

- Supply Chain Optimization: AI algorithms can analyze vast datasets to identify inefficiencies, reroute shipments dynamically, and improve demand forecasting, leading to reduced transportation costs and faster delivery times.

- Predictive Maintenance: By monitoring sensor data from machinery, AI can predict potential breakdowns, enabling proactive maintenance scheduling and minimizing unplanned operational interruptions.

- Production Scheduling Enhancement: Machine learning models can optimize production sequences based on order volume, material availability, and machine capacity, thereby increasing throughput and reducing waste.

- Customer Behavior Insights: Advanced analytics help segment customers, personalize marketing efforts, and anticipate future purchasing trends, fostering stronger customer relationships and driving sales growth.

Cybersecurity and Data Protection

TC Transcontinental's increasing reliance on digital platforms for everything from manufacturing processes to customer interactions makes cybersecurity paramount. A significant breach could disrupt operations, compromise sensitive customer data, and damage the company's reputation, impacting its ability to secure new business. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial and operational risks involved.

Ensuring the integrity and protection of its vast digital assets, including proprietary manufacturing techniques and customer information, is non-negotiable for maintaining business continuity and fostering trust. This involves continuous investment in advanced security protocols and employee training to mitigate evolving cyber threats.

- Cyber threats pose a significant operational and financial risk to TC Transcontinental's digital infrastructure.

- Protecting customer data and intellectual property is crucial for maintaining business continuity and stakeholder trust.

- The global average cost of a data breach in 2023 was $4.45 million, underscoring the financial implications of inadequate cybersecurity.

Technological advancements are reshaping TC Transcontinental's core operations, from packaging innovation to digital publishing. The company is actively integrating Industry 4.0, including AI and automation, to boost efficiency and competitiveness. Investments in areas like smart packaging and AR in education are strategic responses to evolving market demands.

The company's focus on data analytics and AI is key for optimizing supply chains and production, with AI in supply chain management projected to exceed $10 billion in 2024. Cybersecurity remains a critical technological factor, given the substantial risks and costs associated with data breaches, which averaged $4.45 million in 2023.

| Technology Area | 2024/2025 Focus | Impact/Projection |

|---|---|---|

| Flexible Packaging Innovation | Active & Intelligent Packaging, Sustainable Materials | Meeting eco-friendly demands, enhancing product shelf-life |

| Industry 4.0 Integration | Automation, AI in Operations | Estimated 15% productivity increase in key facilities (2024) |

| Digital Publishing | E-learning platforms, AR, Adaptive Learning | Capitalizing on a projected $400 billion global e-learning market by 2026 |

| Data Analytics & AI | Supply Chain Optimization, Predictive Maintenance | AI in Supply Chain Management market > $10 billion (2024 projection) |

| Cybersecurity | Advanced Security Protocols, Employee Training | Mitigating data breach costs (avg. $4.45 million in 2023) |

Legal factors

TC Transcontinental’s flexible packaging segment operates under a stringent regulatory environment, demanding strict adherence to food safety standards like those set by the FDA in the United States and Health Canada. Failure to comply with these regulations, which govern everything from raw material sourcing to the final packaging product, can result in severe consequences.

Non-compliance can lead to substantial financial penalties, costly product recalls, and significant damage to the company's reputation. For instance, in 2023, the FDA reported over 1,000 food recalls, highlighting the critical importance of robust safety protocols across the supply chain. TC Transcontinental’s investment in quality control and regulatory expertise is therefore essential for maintaining market access and consumer trust.

Intellectual property laws, particularly copyright, are foundational to TC Transcontinental's educational publishing segment. These laws safeguard the company's original content, ensuring its exclusive right to reproduce and distribute it, which is vital for revenue. For instance, in 2023, the global intellectual property market was valued in the trillions, underscoring the economic significance of these protections.

Licensing agreements are also critical, allowing TC Transcontinental to legally use third-party content or grant rights to its own intellectual property. Navigating these agreements requires strict adherence to legal frameworks governing usage, duration, and territory. The digital publishing landscape, in particular, presents complex challenges in managing these licenses effectively.

Respecting intellectual property rights is paramount for maintaining legal standing and avoiding costly disputes. TC Transcontinental's commitment to this principle underpins its reputation and operational integrity. Failure to do so can result in significant financial penalties and damage to brand image, as seen in numerous high-profile copyright infringement cases across the publishing industry.

TC Transcontinental operates under a stringent framework of environmental laws governing emissions, waste management, water consumption, and the handling of chemicals in its production facilities. These regulations are crucial for minimizing the company's ecological footprint.

The company's commitment to sustainability is evident in its ongoing efforts to reduce greenhouse gas emissions. For instance, in fiscal year 2023, TC Transcontinental reported a 3.1% decrease in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2022 baseline, reaching 117.4 kg CO2e per $1,000 revenue.

Anticipating future environmental requirements, TC Transcontinental may need to allocate substantial capital towards upgrading compliance technologies and adopting more sustainable operational practices. Such investments are vital for long-term regulatory adherence and to meet evolving stakeholder expectations regarding environmental stewardship.

Labor and Employment Laws

TC Transcontinental must navigate a complex web of labor and employment laws across Canada and the United States. This includes strict adherence to regulations concerning minimum wages, working hours, workplace safety standards, and collective bargaining agreements. For instance, in 2024, Canadian federal minimum wage adjustments and varying provincial labor standards necessitate ongoing compliance efforts.

Managing legal risks tied to employment practices is paramount. This involves ensuring fair hiring, equitable treatment, and proper termination procedures to avoid costly litigation. Companies often invest in robust HR policies and training to mitigate these employment-related legal exposures.

- Compliance Burden: Adhering to diverse federal, state, and provincial labor laws in both Canada and the US presents a significant compliance challenge.

- Wage and Hour Laws: Staying updated on minimum wage rates, overtime rules, and pay equity legislation is crucial for avoiding penalties. For example, many Canadian provinces saw minimum wage increases in late 2023 and early 2024.

- Health and Safety Regulations: Strict adherence to occupational health and safety standards is mandatory, with significant fines for non-compliance.

- Union Relations: Managing relationships with labor unions, including collective bargaining and grievance procedures, is a key legal consideration.

Competition and Antitrust Laws

TC Transcontinental, as a significant player in its various markets, must diligently adhere to competition and antitrust regulations. These laws are designed to prevent monopolistic practices and ensure a level playing field for all businesses. Failure to comply can result in substantial fines and operational restrictions.

The company's market leadership in certain segments, particularly in printing and packaging solutions in North America, places it under increased scrutiny. Regulatory bodies actively monitor for any actions that could stifle competition or unfairly disadvantage rivals. For instance, in 2023, the global printing market saw continued consolidation, emphasizing the ongoing need for companies like TC Transcontinental to demonstrate competitive compliance.

- Antitrust Compliance: TC Transcontinental must ensure its pricing strategies, distribution agreements, and potential mergers and acquisitions do not violate antitrust laws.

- Market Dominance Scrutiny: Regulatory bodies may investigate if TC Transcontinental's market share in specific areas is being used to limit competition.

- Impact on Growth: Challenges to market dominance or acquisition plans due to antitrust concerns could significantly hinder TC Transcontinental's strategic expansion and growth initiatives.

TC Transcontinental faces a complex legal landscape, requiring strict adherence to diverse regulations across its operating segments. This includes stringent food safety laws in its packaging division, intellectual property rights in publishing, and environmental mandates governing its manufacturing processes. Navigating these legal frameworks is crucial for maintaining operational integrity and market access.

The company must also comply with labor and employment laws, ensuring fair practices and safe working conditions, while also adhering to competition and antitrust regulations to prevent market manipulation. These legal obligations represent significant compliance burdens and potential risks if not managed effectively.

For instance, in fiscal year 2023, TC Transcontinental reported a 3.1% decrease in Scope 1 and 2 greenhouse gas emissions intensity, demonstrating proactive engagement with environmental legal requirements. Furthermore, the company's commitment to intellectual property is underscored by the global intellectual property market's valuation in the trillions in 2023, highlighting the economic importance of these legal protections.

In 2024, ongoing adjustments to minimum wage laws in Canada and the US necessitate continuous monitoring and compliance efforts in labor relations. These legal factors collectively shape TC Transcontinental's strategic decisions and operational execution.

Environmental factors

Global pressure for environmental responsibility is significantly boosting the market for sustainable packaging. Consumers and regulators alike are pushing for materials that can be recycled, composted, or are derived from post-consumer waste. This trend directly impacts companies like TC Transcontinental, making their capacity for eco-friendly packaging innovation a key differentiator.

TC Transcontinental's investment in sustainable solutions, such as their 2023 commitment to increase the use of recycled content in their packaging products, positions them to meet these evolving demands. For instance, their North American packaging segment reported a 5% increase in the use of post-consumer recycled (PCR) resin in 2023, a figure expected to grow as their sustainability initiatives mature. This focus is not just about compliance; it's about capturing market share in an increasingly eco-conscious marketplace.

TC Transcontinental's manufacturing, particularly in printing and packaging, inherently involves substantial energy use, directly impacting its carbon footprint. In 2023, the company reported its Scope 1 and Scope 2 greenhouse gas emissions were 161,000 tonnes of CO2 equivalent, a slight decrease from 165,000 tonnes in 2022.

Growing regulatory and consumer demand for emission reductions, especially concerning Scope 1 and 2 emissions, will push TC Transcontinental to further invest in energy efficiency and explore renewable energy procurement. For instance, their sustainability report highlights ongoing projects to optimize energy usage in their printing facilities, aiming for a 10% reduction in energy intensity by 2025.

Companies like Transcontinental are feeling the heat from stricter environmental rules and public demand to cut down on waste and embrace a circular economy. This means looking closely at how materials are used, finding ways to keep waste out of landfills, and backing recycling efforts for their products.

For instance, in 2024, the European Union's Ecodesign for Sustainable Products Regulation is pushing manufacturers to design products that are more durable, repairable, and recyclable, directly impacting how companies like Transcontinental must approach their material sourcing and end-of-life product management.

Water Usage and Pollution Control

TC Transcontinental's printing and packaging operations rely on water, making responsible usage and pollution control critical environmental considerations. Wastewater discharge from these processes must meet stringent quality standards. For instance, in 2023, the company reported ongoing efforts to reduce water intensity in its manufacturing sites, aiming for a 15% reduction by 2025 compared to a 2019 baseline.

Compliance with evolving water quality regulations is paramount to avoid penalties and maintain operational continuity. TC Transcontinental is investing in advanced wastewater treatment technologies across its facilities to minimize the environmental impact of its discharges.

- Water Consumption Reduction: Implementing water-efficient technologies and process optimization to lower overall water usage.

- Wastewater Treatment: Enhancing treatment systems to ensure discharged water meets or exceeds regulatory standards for pollutants.

- Regulatory Compliance: Adhering to local and international water quality laws and permits.

- Pollution Prevention: Proactively identifying and mitigating potential sources of water contamination within operations.

Climate Change Impacts and Resilience

Climate change presents significant physical risks to TC Transcontinental's operations. Extreme weather events, like floods and severe storms, can directly impact manufacturing facilities, distribution centers, and transportation routes, leading to supply chain disruptions and increased operational costs. For instance, the increasing frequency of severe weather events globally in 2024 has already demonstrated the vulnerability of logistics networks.

To address these environmental factors, TC Transcontinental must proactively assess and enhance the resilience of its infrastructure and supply chains. This involves identifying critical assets and routes most susceptible to climate-related impacts and implementing mitigation strategies.

- Supply Chain Vulnerability: TC Transcontinental's extensive network of printing plants and distribution facilities are exposed to potential disruptions from extreme weather.

- Infrastructure Resilience: Investing in climate-resilient infrastructure, such as flood defenses for facilities in at-risk areas, is crucial.

- Operational Continuity: Developing robust business continuity plans that account for climate-related disruptions is essential for maintaining service levels.

- Mitigation Strategies: Exploring diversified sourcing and transportation options can reduce reliance on single points of failure vulnerable to climate events.

TC Transcontinental faces increasing pressure to reduce its environmental footprint, particularly concerning greenhouse gas emissions and waste management. The company's 2023 emissions were reported at 161,000 tonnes of CO2 equivalent, a slight decrease from the previous year, indicating ongoing efforts to improve energy efficiency in its printing and packaging operations.

The demand for sustainable packaging is a significant driver, pushing TC Transcontinental to increase its use of recycled content. In 2023, their North American packaging segment saw a 5% rise in post-consumer recycled resin usage, a trend expected to accelerate with further investment in eco-friendly solutions.

Water usage and quality are also critical environmental factors. TC Transcontinental aims to reduce its water intensity by 15% by 2025 compared to a 2019 baseline, investing in advanced wastewater treatment to meet stringent discharge standards.

Climate change poses physical risks, with extreme weather events threatening supply chains and operations. TC Transcontinental is focusing on enhancing infrastructure resilience and developing business continuity plans to mitigate these impacts.

| Environmental Factor | TC Transcontinental's 2023 Data/Initiatives | Outlook/Impact |

|---|---|---|

| Greenhouse Gas Emissions (Scope 1 & 2) | 161,000 tonnes CO2 equivalent (slight decrease from 2022) | Continued pressure to reduce emissions; investment in energy efficiency and renewables expected. |

| Sustainable Packaging | Commitment to increase recycled content; 5% increase in PCR resin usage in North America (2023) | Growing market demand; innovation in eco-friendly materials is a competitive advantage. |

| Water Intensity Reduction | Target of 15% reduction by 2025 (vs. 2019 baseline) | Investment in water-efficient technologies and advanced wastewater treatment is crucial for compliance. |

| Climate Change Resilience | Focus on infrastructure resilience and business continuity planning | Mitigation of physical risks from extreme weather events is essential for operational stability. |

PESTLE Analysis Data Sources

Our Transcontinental PESTLE Analysis draws from a comprehensive blend of global economic indicators, international trade agreements, and cross-border regulatory updates. We integrate data from leading financial institutions, intergovernmental organizations, and reputable market research firms to provide a holistic view of the macro-environment.