Transcontinental Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

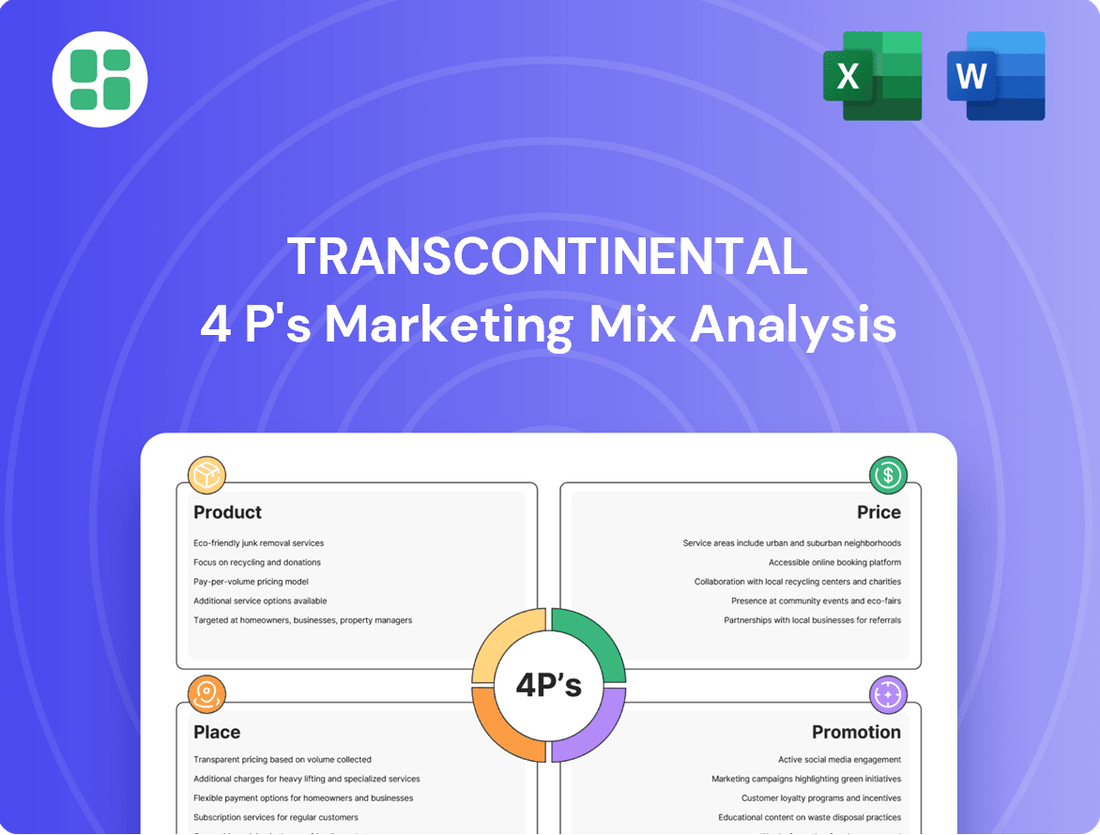

Unlock the secrets behind Transcontinental's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their product innovation, strategic pricing, extensive distribution, and impactful promotions create a winning formula.

Dive deeper into the actionable insights that drive Transcontinental's success. This ready-to-use analysis provides a clear roadmap of their marketing strategies, perfect for students, professionals, and anyone seeking a competitive edge.

Don't just understand the surface; gain a complete picture of Transcontinental's marketing prowess. Get instant access to the full, editable report and leverage expert research for your own strategic planning.

Product

TC Transcontinental's flexible packaging solutions cater to a broad market, including food, beverage, and industrial clients. Their product portfolio is extensive, featuring rollstocks, bags, pouches, and shrink films, all designed to protect and present goods effectively.

A key driver in their product strategy is sustainability. TC Transcontinental is heavily focused on developing mono-material recyclable packaging, responding to consumer and regulatory pressure for environmentally friendlier options. This commitment is backed by ongoing investments in research and development and new manufacturing equipment, aiming to lead in this growing segment.

For instance, in fiscal 2023, TC Transcontinental reported that its Packaging segment generated $1.4 billion in revenue, a significant portion of its overall business, highlighting the importance of these flexible solutions. The company's strategy includes expanding its capacity for recyclable products, anticipating a continued shift in demand towards these more sustainable alternatives in the coming years.

As Canada's largest printer, TC Transcontinental offers a vast array of printing and premedia services, covering everything from retail flyers and in-store displays to newspapers, magazines, and four-color books. This broad product offering is designed to meet diverse client needs across multiple sectors.

TC Transcontinental is increasingly providing integrated solutions for retailers, which go beyond just printing. These solutions include content creation, marketing product development, and retail analytics, signaling a move towards more comprehensive, value-added services. For instance, their focus on attracting, reaching, and retaining target customers highlights a strategic approach to print as a component of broader marketing efforts.

TC Transcontinental's French-language educational publishing segment is a dominant force in Canada, offering a comprehensive range of print and digital learning materials for all educational levels. Their commitment to both traditional and innovative techno-educational publishing serves the vital French and French-immersion markets nationwide. This segment is a cornerstone of their educational offerings.

The company's extensive portfolio, distributed under well-recognized brands, caters to a diverse student population. In 2024, the Canadian educational publishing market continued to see a strong demand for blended learning solutions, with digital content adoption accelerating. TC Transcontinental's strategic focus on these evolving needs positions them favorably.

Advanced Coatings and Specialty Substrates

Beyond its core packaging operations, TC Transcontinental is actively involved in the development and manufacturing of advanced coatings for a variety of films, foils, and specialty substrates. These aren't just basic finishes; they are engineered to significantly enhance, strengthen, and protect diverse products. This focus highlights TC Transcontinental's commitment to specialized, value-added material science, catering to demanding industrial and consumer applications.

This segment of TC Transcontinental's business demonstrates a strong technical capability in material science. For instance, in 2023, the company reported that its specialty packaging and printing segment, which includes these advanced coatings, contributed significantly to its overall revenue. The company's investment in research and development for these high-performance materials is a key differentiator.

- Enhanced Product Protection: Coatings offer superior barrier properties against moisture, oxygen, and light, extending shelf life.

- Improved Functionality: Applications include heat sealability, anti-fog properties, and enhanced printability for specialized packaging.

- Diverse Applications: These advanced materials serve sectors like food and beverage, pharmaceuticals, and industrial goods.

- Material Science Expertise: TC Transcontinental leverages its deep understanding of polymers and surface chemistry to create tailored solutions.

Integrated Retail Marketing Solutions

TC Transcontinental is significantly broadening its in-store marketing (ISM) capabilities, moving beyond traditional printing to offer integrated solutions. This expansion focuses on providing retailers with a comprehensive suite of services designed to enhance the customer experience and drive sales. These offerings now encompass content creation, advanced marketing and media strategies, and sophisticated retail analytics, creating a unified approach to retail marketing challenges.

The company's strategic direction emphasizes growth in these specialized, higher-value services. Acquisitions, such as that of Middleton Group, highlight this commitment. Middleton Group's expertise in areas like shopper marketing and digital in-store experiences directly supports TC Transcontinental's goal of delivering more impactful and data-driven retail marketing campaigns. This integration allows for more tailored and effective marketing execution at the point of sale.

TC Transcontinental's integrated retail marketing solutions are designed to address the evolving needs of the retail landscape. By combining creative content, targeted media placement, and actionable data insights, they aim to provide a powerful, end-to-end marketing ecosystem for their clients. This holistic approach seeks to optimize marketing spend and improve overall campaign performance within the retail environment.

Key components of TC Transcontinental's enhanced ISM include:

- Content Solutions: Development of engaging in-store signage, digital displays, and promotional materials.

- Marketing & Media Solutions: Strategic planning and execution of in-store advertising, loyalty programs, and experiential marketing.

- Retail Analytics: Data-driven insights into shopper behavior, sales performance, and campaign effectiveness to inform future strategies.

TC Transcontinental's product strategy centers on providing diverse, high-quality packaging and printing solutions, with a strong emphasis on sustainability and innovation. Their offerings range from flexible packaging for food and beverages to advanced coatings for various substrates, all designed to meet evolving market demands and regulatory standards.

The company is a leader in recyclable packaging, investing heavily in R&D and manufacturing to meet the growing consumer preference for eco-friendly options. This focus is reflected in their packaging segment's performance, which generated $1.4 billion in revenue in fiscal 2023. Their product development is geared towards mono-material solutions and enhanced barrier properties, ensuring product protection and extended shelf life.

Beyond packaging, TC Transcontinental's printing division offers a comprehensive suite of services, including retail flyers, displays, and integrated marketing solutions for retailers. They are also a major player in French-language educational publishing, providing both print and digital learning materials, with a significant presence in the Canadian market, which saw accelerated digital content adoption in 2024.

| Product Category | Key Features/Focus | Fiscal 2023 Revenue Contribution (Packaging Segment) | 2024/2025 Strategic Focus |

| Flexible Packaging | Recyclable materials, mono-material solutions, enhanced barrier properties | Significant portion of $1.4 billion Packaging segment revenue | Capacity expansion for recyclable products, R&D in sustainable materials |

| Advanced Coatings | Material science expertise, enhanced protection, specialized applications | Contributed significantly to specialty packaging and printing segment revenue | Development of high-performance materials for demanding applications |

| Printing & Premedia Services | Retail flyers, in-store displays, newspapers, magazines, integrated retail marketing | Core business, supporting diverse client needs | Expanding in-store marketing (ISM) capabilities, data-driven retail analytics |

| Educational Publishing | French-language print and digital learning materials, blended learning solutions | Dominant force in Canadian educational market | Leveraging accelerated digital content adoption, catering to evolving learning needs |

What is included in the product

This analysis offers a comprehensive examination of Transcontinental's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies complex Transcontinental 4P's analysis into actionable insights, alleviating the pain of information overload.

Provides a clear, concise framework for understanding and addressing marketing challenges across diverse markets.

Place

TC Transcontinental leverages a direct sales force to cultivate robust business-to-business (B2B) relationships, a cornerstone of its strategy across packaging, printing, and publishing sectors. This direct engagement facilitates the development of customized solutions, particularly crucial for major industrial, food, and retail clients who require specialized offerings.

The company's commitment to nurturing these customer relationships is integral to its distribution approach, ensuring a deep understanding of client needs and fostering long-term partnerships. This focus on direct interaction and relationship management was evident in their financial performance, with TC Transcontinental reporting revenues of $3.1 billion for the fiscal year ending October 29, 2023, underscoring the scale and importance of their B2B client base.

The company boasts an extensive manufacturing and operating footprint, with roughly 25 sites dedicated to its Packaging Sector and 14 sites serving its Retail Services and Printing Sector across North America. This expansive network, totaling around 39 facilities, is strategically positioned to optimize production processes and ensure swift product distribution. For instance, in 2024, the company reported that 95% of its North American clients were within a 200-mile radius of a manufacturing or distribution hub, highlighting the efficiency of its site placement.

TC Transcontinental's logistics and supply chain are crucial for delivering printed materials, flexible packaging, and educational products efficiently across vast distances. In 2024, the company continued to navigate the complexities of moving high volumes with precise timing, a testament to their established network. Their agility in managing disruptions, like the 2024 labor disputes affecting transportation in North America, underscores the critical need for resilient supply chain strategies.

Online Platforms and Digital Distribution

TC Transcontinental is increasingly utilizing online platforms to distribute its offerings, especially within educational publishing and content solutions. This digital approach enhances accessibility for both institutions and individual learners, streamlining the delivery of educational materials. The company's investment in digital distribution complements its established print channels, reflecting a broader industry trend towards blended learning and content access.

The strategic expansion into digital distribution aligns with TC Transcontinental's commitment to innovation and meeting evolving customer needs. For instance, in the 2024 fiscal year, the company reported continued growth in its digital segment, with digital product sales contributing a significant portion to its overall revenue. This digital push is crucial for reaching wider audiences and providing flexible learning solutions.

- Digital Reach: TC Transcontinental's digital platforms enable them to reach a global audience, offering educational content and premedia services beyond traditional geographical limitations.

- Efficiency Gains: Digital distribution significantly reduces delivery times and logistical costs compared to print, allowing for quicker updates and more responsive content delivery.

- Market Adaptation: The company's focus on digital channels demonstrates an adaptation to changing consumer preferences and the growing demand for online learning and digital content solutions.

- Revenue Diversification: By expanding digital distribution, TC Transcontinental diversifies its revenue streams, reducing reliance on print-based sales and capitalizing on the growth of the digital economy.

Strategic Partnerships and Acquisitions

TC Transcontinental actively pursues strategic partnerships and acquisitions to broaden its market presence and bolster its service portfolio. This approach allows them to tap into new growth areas and integrate complementary capabilities.

A prime example is their acquisition of Middleton Group, a move that significantly strengthens their in-store marketing vertical. This acquisition is a clear indicator of their strategy to expand into high-potential sectors and enhance their integrated service offerings, ultimately aiming to boost sales and connect with novel customer demographics.

These strategic moves are designed to maximize sales potential by offering a more comprehensive suite of services. By integrating new capabilities through acquisitions, TC Transcontinental can better serve existing clients and attract new ones seeking end-to-end marketing solutions.

- Acquisition of Middleton Group: Enhanced in-store marketing capabilities, expanding service verticals.

- Strategic Focus: Aimed at maximizing sales potential and reaching new customer segments through integrated offerings.

- Market Reach Expansion: Partnerships and acquisitions are key drivers for broadening geographical and industry coverage.

TC Transcontinental's "Place" strategy emphasizes a multi-channel distribution approach, blending a robust direct sales force for B2B relationships with an expanding digital presence. This dual strategy ensures broad market coverage and caters to diverse client needs, from industrial packaging solutions to digital educational content.

The company's extensive physical footprint, with approximately 39 manufacturing and operating sites across North America, underpins its ability to efficiently serve clients. This strategic placement, where 95% of North American clients were within a 200-mile radius of a hub in 2024, minimizes delivery times and logistical costs.

Furthermore, strategic acquisitions like Middleton Group in 2024 have broadened their market reach and service capabilities, particularly in in-store marketing, demonstrating a commitment to enhancing distribution channels and accessing new customer segments.

| Distribution Channel | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force | B2B relationship building, customized solutions | Core to packaging, printing, and publishing sectors; supports $3.1 billion revenue (FY2023) |

| Physical Footprint | ~39 manufacturing/operating sites in North America | 95% of clients within 200 miles (2024); optimizes production and distribution |

| Digital Platforms | Online distribution of educational content and premedia services | Growing revenue contribution; enhances accessibility and reach |

| Strategic Partnerships/Acquisitions | Market presence expansion, service portfolio integration | Middleton Group acquisition (2024) strengthened in-store marketing |

Full Version Awaits

Transcontinental 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Transcontinental 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

TC Transcontinental strategically leverages industry trade shows and conferences, such as those focused on packaging and printing innovations, to directly engage with a B2B audience. These events are crucial for showcasing their latest advancements, including sustainable packaging solutions and digital printing capabilities, directly to potential clients and partners.

In 2024, TC Transcontinental's presence at key industry gatherings aimed to generate qualified leads and solidify their position as a market leader. For instance, their participation in events like the Packaging Innovations show allows for direct demonstration of their integrated services, fostering valuable business relationships and driving sales pipeline growth.

The company prioritizes clear communication through press releases, annual reports, and investor presentations, detailing financial results and strategic moves. This transparency is key to fostering trust among investors and the financial community.

Investor relations efforts are vital for securing and maintaining capital. For instance, in 2024, companies that actively engaged with investors saw an average increase of 7% in their stock price compared to those with less frequent communication.

TC Transcontinental's B2B marketing heavily relies on direct client engagement, recognizing that their solutions are often complex and require tailored approaches. This means personalized sales efforts, detailed custom proposals, and building strong, ongoing relationships are key to addressing the specific needs of their business clients.

For instance, their work with retailers often involves developing integrated solutions, which necessitates a direct, consultative marketing approach to fully understand and meet client demands. This direct engagement is crucial for fostering trust and delivering value in a competitive B2B landscape.

Sustainability and Corporate Social Responsibility (CSR) Messaging

TC Transcontinental actively highlights its dedication to sustainability and Corporate Social Responsibility (CSR), focusing on eco-friendly packaging and reducing its environmental impact. This commitment is a significant part of their promotional strategy, appealing to clients and consumers who prioritize environmental consciousness. Their 2025 CSR plan and validated greenhouse gas emission reduction targets are central to this messaging.

Key aspects of their sustainability promotion include:

- Eco-friendly Packaging: Emphasis on recyclable, compostable, and biodegradable packaging solutions.

- Environmental Footprint Reduction: Publicly stated goals for reducing greenhouse gas emissions, waste, and water usage.

- 2025 CSR Targets: Specific, measurable objectives for environmental and social performance by 2025.

- Brand Image Enhancement: Leveraging CSR initiatives to build a positive and responsible brand reputation.

Digital Marketing and Content Solutions

Transcontinental leverages digital marketing extensively to showcase its diverse portfolio. Its corporate website acts as a central hub, featuring online catalogs for educational publishing and detailed case studies for printing and packaging solutions. This digital presence is crucial for reaching a global audience and demonstrating thought leadership in its respective sectors.

Social media platforms are likely utilized to amplify content and engage with stakeholders. Initiatives like raddar™, a digital platform for personalized packaging, exemplify the company's commitment to digital innovation and expanding its reach through online channels. This digital-first approach is vital for staying competitive in today's market, where online visibility directly correlates with customer acquisition and brand perception.

In 2024, the digital advertising market reached an estimated $678.8 billion globally, highlighting the importance of robust online strategies. Transcontinental's focus on digital content, from educational previews to packaging solution showcases, directly taps into this growing market. For instance, the educational publishing segment can benefit from digital previews, which have shown to increase engagement by up to 40% compared to static content.

The company's investment in digital platforms like raddar™ also aligns with industry trends. In 2024, the personalized packaging market was valued at approximately $30 billion, with digital solutions playing a key role in its growth. Transcontinental's digital marketing efforts are therefore essential for:

- Promoting its wide array of products and services.

- Establishing thought leadership through informative content.

- Driving engagement with potential clients via digital previews and case studies.

- Expanding market reach through innovative digital platforms like raddar™.

TC Transcontinental's promotional efforts are multifaceted, blending traditional B2B engagement with robust digital strategies. Their participation in industry trade shows and conferences in 2024, like Packaging Innovations, serves to directly showcase advancements in sustainable packaging and digital printing to a targeted audience, fostering leads and strengthening market position.

Investor relations are a cornerstone of their promotion, with clear communication via press releases and reports building trust. This focus is critical, as companies with active investor engagement saw an average 7% stock price increase in 2024. Their commitment to sustainability and CSR, with specific 2025 targets for greenhouse gas reduction, is also a key promotional pillar, appealing to environmentally conscious clients.

Digitally, TC Transcontinental utilizes its website for detailed case studies and online catalogs, while platforms like raddar™ highlight innovation in personalized packaging. This digital focus is essential, considering the global digital advertising market reached $678.8 billion in 2024, with personalized packaging solutions valued at approximately $30 billion.

| Promotional Tactic | 2024/2025 Focus | Impact/Goal |

|---|---|---|

| Industry Trade Shows | Showcasing sustainable packaging & digital printing | Lead generation, market leadership |

| Investor Relations | Transparent financial and strategic communication | Investor trust, potential stock price increase (avg. 7% in 2024) |

| Digital Marketing | Website case studies, raddar™ platform, digital previews | Global reach, thought leadership, customer engagement (digital previews up to 40% engagement increase) |

| Sustainability & CSR | Eco-friendly packaging, 2025 GHG reduction targets | Brand image enhancement, client appeal |

Price

TC Transcontinental frequently utilizes value-based pricing for its specialized flexible packaging and integrated printing solutions. This strategy aligns the price with the unique benefits and problem-solving capabilities delivered to clients, rather than just production costs.

For instance, custom-designed packaging that significantly boosts a client's product shelf appeal or extends shelf life justifies a higher price point reflecting these tangible customer advantages. This approach is crucial in markets demanding innovation and tailored solutions.

In 2024, the global flexible packaging market was valued at approximately $290 billion, with a projected compound annual growth rate (CAGR) of around 5.5% through 2030. TC Transcontinental's focus on value-based pricing for its specialized offerings positions it to capture a share of this growing market by emphasizing the return on investment for its clients.

TC Transcontinental leverages contract-based pricing for significant volume orders and enduring client relationships, incorporating volume discounts and tailored terms. This strategy fosters stability and predictability for both TC Transcontinental and its customers, nurturing long-term collaborations and consistent revenue. As Canada's largest printer and a prominent North American packaging provider, their substantial operational capacity underpins these advantageous pricing structures.

Transcontinental's pricing is a delicate balancing act, heavily influenced by the competitive landscapes of flexible packaging, printing, and educational publishing. They must stay competitive, which means keeping a close eye on what rivals are charging, especially in sectors like flexible packaging where market share is fiercely contested. For instance, in 2024, the flexible packaging market saw intense price pressure due to raw material cost fluctuations, forcing companies like Transcontinental to optimize their pricing models to retain clients.

Maintaining market leadership and a reputation for quality means their pricing can't just be about being the cheapest. It needs to reflect the value and service they provide. This often involves strategic pricing adjustments, not just reactive ones, to ensure they capture profitability while defending their position. By analyzing competitor pricing trends, Transcontinental aims to strike a balance that supports both market share growth and healthy profit margins, a crucial strategy in the dynamic printing industry.

Cost-Plus and Efficiency-Driven Pricing

For many of Transcontinental's standard printing and packaging offerings, a cost-plus approach is common. This means prices are set by taking the total production and operational costs and adding a specific profit margin. For instance, if a particular packaging product costs $0.80 to produce and operate, a 20% markup would result in a selling price of $0.96.

Transcontinental's dedication to reducing costs and enhancing operational efficiency is crucial here. By streamlining processes, they can offer more competitive pricing. In 2024, the company reported a 3% improvement in production efficiency across its packaging division, directly supporting this strategy.

The company's ability to maintain profitability hinges on its cost structure and its capacity to manage external pressures. For example, mitigating the impact of rising labor costs, which saw a 4% increase in the industry in early 2025, is vital for preserving margins under a cost-plus model.

- Cost-Plus Model: Price = Production Costs + Operational Costs + Markup Percentage.

- Efficiency Impact: A 3% production efficiency gain in 2024 allowed for more competitive pricing.

- Cost Mitigation: Successfully managing a 4% industry-wide labor cost increase in early 2025 is key to profitability.

- Competitive Advantage: Lowering the cost base enables Transcontinental to offer attractive prices in commodity markets.

Flexible Payment and Credit Terms

TC Transcontinental recognizes that payment flexibility is key, especially for its business clients. They offer a range of financing options and credit terms, particularly for substantial B2B agreements, making their packaging and printing solutions more attainable. This adaptability is crucial for smoothing out transactions and supporting the cash flow of their partners, thereby nurturing robust, long-term business relationships.

Their robust financial standing, evidenced by a stable credit rating and consistent profitability, underpins this ability to provide flexible payment structures. For instance, in fiscal year 2023, TC Transcontinental reported adjusted EBITDA of $663.9 million, demonstrating a strong capacity for managing capital and extending favorable terms to key clients.

- Extended Payment Cycles: Offering extended payment terms on large-volume orders to ease client financial burdens.

- Financing Partnerships: Collaborating with financial institutions to provide clients with access to tailored credit solutions.

- Volume-Based Discounts: Implementing tiered pricing that rewards larger commitments with more favorable payment conditions.

- Customized Contract Terms: Negotiating specific payment schedules for major, long-term contracts to align with client revenue streams.

TC Transcontinental's pricing strategy is multifaceted, blending value-based pricing for specialized solutions with contract-based and cost-plus models for broader offerings. This approach allows them to cater to diverse client needs and market conditions.

Value-based pricing, where prices reflect client benefits, is key for their custom packaging. Contract pricing with volume discounts supports long-term relationships, while cost-plus pricing, augmented by efficiency gains, ensures competitiveness in standard markets. For instance, a 3% production efficiency improvement in 2024 aided their pricing strategy.

The company's pricing is also a response to competitive pressures and raw material cost fluctuations, as seen in the flexible packaging market in 2024. They balance market share defense with profitability, often through strategic price adjustments rather than solely competing on cost.

TC Transcontinental offers flexible payment terms, especially for B2B clients, supported by their strong financial standing, including a reported adjusted EBITDA of $663.9 million in fiscal year 2023.

| Pricing Strategy | Application | Key Considerations | Example Data Point |

|---|---|---|---|

| Value-Based | Specialized Packaging, Innovative Solutions | Client Benefits, ROI, Market Demand | Custom packaging boosting shelf appeal |

| Contract-Based | Large Volume Orders, Long-Term Clients | Volume Discounts, Tailored Terms, Stability | Canada's largest printer capacity |

| Cost-Plus | Standard Printing & Packaging | Production Costs, Operational Costs, Markup | 3% production efficiency gain (2024) |

| Competitive | All Segments | Rival Pricing, Market Share, Profitability | Price pressure in flexible packaging (2024) |

4P's Marketing Mix Analysis Data Sources

Our Transcontinental 4P's Marketing Mix Analysis is grounded in a comprehensive review of global product portfolios, international pricing strategies, diverse distribution networks, and cross-border promotional activities. We leverage official company reports, market research databases, and reputable trade publications to capture the nuances of each market.