Transcontinental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

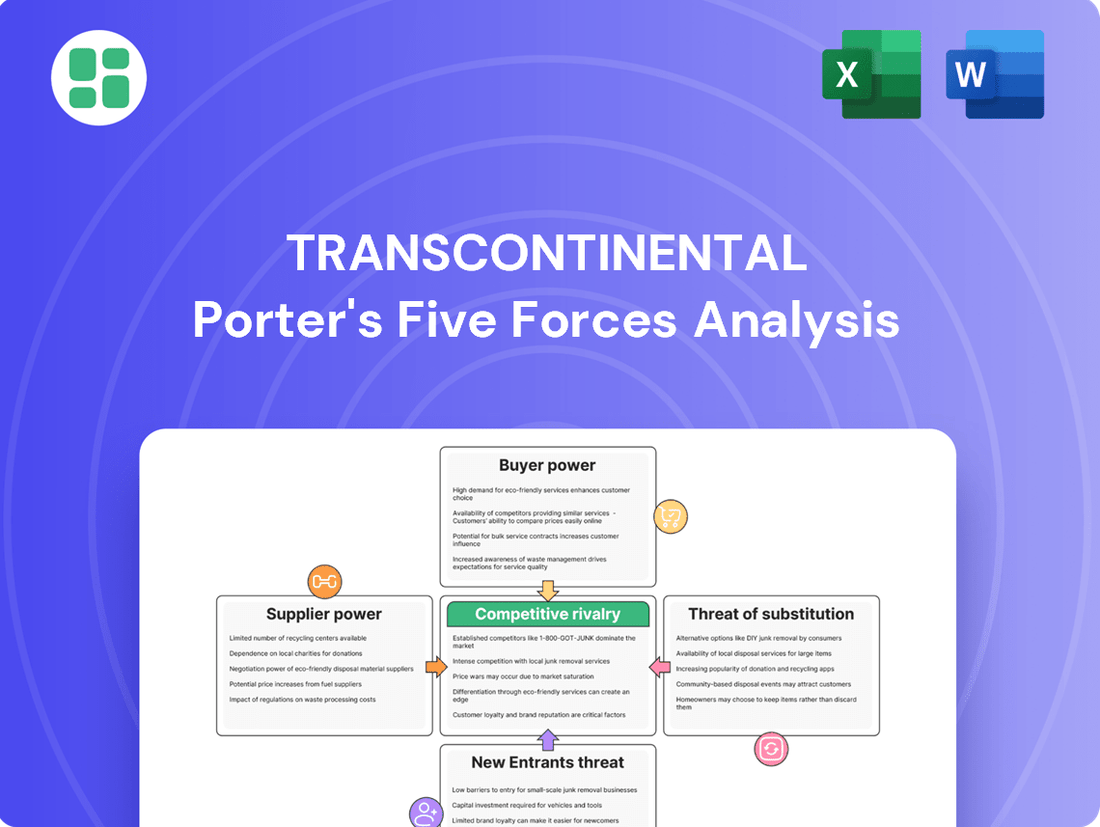

Transcontinental's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the threat of new entrants. Understanding these dynamics is crucial for any business operating in or investing in this sector.

The complete Porter's Five Forces Analysis for Transcontinental provides a deep dive into each of these pressures, offering critical insights into market profitability and strategic positioning.

Ready to gain a comprehensive understanding of Transcontinental's competitive environment? Unlock the full analysis to uncover actionable intelligence and make more informed strategic decisions.

Suppliers Bargaining Power

TC Transcontinental's reliance on a limited number of suppliers for critical materials like resins, paper, and specialized inks grants those suppliers considerable bargaining power. For instance, if only a few companies produce the specific resins needed for their flexible packaging operations, they can dictate higher prices or stricter terms. This concentration means TC Transcontinental has less room to negotiate, directly impacting its cost of goods sold.

The bargaining power of suppliers for TC Transcontinental is significantly influenced by the availability of substitute inputs. For example, in its packaging segment, the presence of various plastic resins, recycled content options, and emerging biodegradable or plant-based materials can dilute the leverage of any single resin supplier. Similarly, the printing division can mitigate supplier power by sourcing different paper grades and pulp from a wider array of producers.

TC Transcontinental's position as a major player in the North American flexible packaging market and Canada's largest printer means it's a significant customer for many suppliers. This scale likely grants TC Transcontinental some leverage in negotiations, as a substantial portion of a supplier's business could depend on their relationship with the company. For instance, in 2023, TC Transcontinental reported revenues of CAD 3.1 billion, indicating the considerable volume of materials and services they procure.

Cost of Switching Suppliers

The costs associated with switching suppliers can significantly bolster the bargaining power of those suppliers. For TC Transcontinental, these costs might include retooling machinery to accommodate new materials, the expense and time involved in qualifying new vendors, or the potential disruption to ongoing supply chains. High switching costs make TC Transcontinental less inclined to seek alternative suppliers, even if current terms become less favorable.

This is especially true for specialized printing equipment or custom-designed packaging materials where the investment in new setups or supplier relationships is substantial. For instance, if TC Transcontinental relies on a specific ink formulation or a unique paper stock that requires specialized printing presses, changing suppliers would necessitate significant capital expenditure and operational adjustments.

- High Switching Costs: Expenses like retooling machinery, vendor qualification, and supply chain disruption empower suppliers.

- Reluctance to Change: Elevated switching costs make TC Transcontinental hesitant to switch suppliers, even with unfavorable terms.

- Specialized Inputs: Custom packaging materials and specialized printing equipment often carry high switching costs, increasing supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into a company's operations, such as a packaging or printing firm's customers producing their own packaging, can significantly boost supplier bargaining power. This is because suppliers could potentially capture more of the value chain.

For many raw material suppliers in the packaging and printing sectors, this threat is typically low. The substantial capital required for manufacturing facilities and the need for different operational expertise present significant barriers to entry for these suppliers. For example, a paper pulp supplier would need to invest heavily in printing presses and finishing equipment to directly serve end-consumers.

However, the dynamic shifts for suppliers of highly specialized components or services. If a supplier offers a unique ink formulation or a proprietary printing technology, they might possess the capability and incentive to move into direct production for the end market, thereby increasing their leverage. For instance, a specialist in advanced security printing might consider offering direct services to high-value clients if the market signals are strong enough.

- Forward Integration Threat: Suppliers can increase their bargaining power by threatening to produce the final product themselves.

- Barriers for Raw Material Suppliers: High capital investment and differing core competencies generally limit this threat for basic material providers in packaging and printing.

- Specialized Component Impact: The threat is more pronounced when suppliers offer unique or highly specialized inputs, making direct market entry more feasible.

TC Transcontinental's bargaining power with suppliers is influenced by the concentration of suppliers for key inputs like resins and specialized inks. For instance, a limited number of producers for specific flexible packaging resins can dictate terms. This concentration means TC Transcontinental has less negotiation room, directly impacting its cost of goods sold.

The availability of substitutes for raw materials, such as various plastic resins or recycled content in packaging, can dilute supplier leverage. Similarly, the printing division can source different paper grades from multiple producers. TC Transcontinental's significant market presence, evidenced by its CAD 3.1 billion in revenue in 2023, also provides some negotiation strength as a major customer.

High switching costs for TC Transcontinental, including retooling machinery or qualifying new vendors, empower suppliers. This reluctance to change is particularly pronounced for specialized inputs like custom inks or unique paper stocks, where changing suppliers involves substantial capital expenditure and operational adjustments.

The threat of supplier forward integration, where suppliers might produce the final product themselves, is generally low for raw material providers due to high capital barriers. However, suppliers of specialized components or proprietary technologies face a more significant threat, potentially increasing their leverage.

| Factor | Impact on TC Transcontinental | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power | Limited number of producers for specialized packaging resins. |

| Availability of Substitutes | Decreases supplier bargaining power | Various plastic resins, recycled content, and biodegradable options for packaging. |

| TC Transcontinental's Scale | Increases TC Transcontinental's bargaining power | CAD 3.1 billion in revenue (2023) indicates significant procurement volume. |

| Switching Costs | Increases supplier bargaining power | Retooling machinery, vendor qualification, potential supply chain disruption. |

| Threat of Forward Integration | Low for raw materials, higher for specialized inputs | High capital investment for printing facilities limits raw material suppliers; specialized tech suppliers may integrate. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Transcontinental's unique position in the printing and packaging industry.

Quickly identify and mitigate competitive threats across the entire value chain, transforming potential market disruptions into manageable challenges.

Customers Bargaining Power

TC Transcontinental interacts with a diverse clientele across its printing, packaging, and media segments. In areas like flexible packaging, where major food and beverage corporations are key clients, or in printing services for large retail chains, the concentration of a few significant customers amplifies their bargaining power. These substantial clients leverage their large order volumes to negotiate for reduced pricing, enhanced service levels, and tailored product offerings.

TC Transcontinental's customer price sensitivity significantly impacts its profitability, particularly in the competitive commercial printing sector where clients often prioritize cost. This sensitivity can lead to downward pressure on pricing and, consequently, thinner profit margins for the company.

However, in segments like specialized packaging, where TC Transcontinental offers unique or value-added solutions, customers may exhibit lower price sensitivity. This is because the perceived benefits, such as enhanced product protection or branding, can outweigh a slightly higher cost, allowing for better margin retention.

Customers wield significant bargaining power when a wide array of substitute packaging, printing, or educational materials are readily available from competing suppliers. This ease of switching suppliers directly impacts a company's ability to dictate terms and pricing.

The printing industry, for example, sees its customers' bargaining power amplified by the growing prevalence of digital media. In 2024, the global digital advertising market was projected to reach over $600 billion, offering a direct substitute for traditional print advertising and compelling print companies to remain competitive on price and service.

Cost of Switching Suppliers for Customers

The ease and cost for customers to switch from TC Transcontinental to a competitor significantly shape their bargaining power. When switching costs are minimal, such as for straightforward print jobs where a customer can easily find another provider for similar services, their leverage increases. This means TC Transcontinental needs to remain competitive on price and service for these offerings.

Conversely, for more specialized or integrated solutions, like complex flexible packaging tailored to specific product needs or comprehensive publishing services that involve established workflows and client relationships, the cost of switching can be considerably higher. These higher switching costs, often involving retooling, retraining, or establishing new supplier relationships, tend to reduce customer bargaining power.

In 2023, the print and packaging industry saw ongoing consolidation, with companies like WestRock acquiring the packaging division of Smurfit Kappa, creating a larger entity that could potentially increase switching costs for some customers due to scale and integration. For TC Transcontinental, maintaining strong customer relationships and demonstrating unique value propositions in these complex service areas is crucial to mitigating the impact of potential customer switching.

Key factors influencing customer switching costs for TC Transcontinental include:

- Setup and integration costs: The expense and effort required to onboard a new supplier for specialized packaging or printing processes.

- Learning curve: Time and resources needed for a customer's team to adapt to a new supplier's systems and product specifications.

- Contractual obligations: Existing long-term agreements that may include penalties for early termination.

- Brand and product integrity: The risk associated with maintaining the quality and consistency of branded products when changing packaging or print suppliers.

Threat of Backward Integration by Customers

The threat of backward integration by customers represents a significant lever in their bargaining power. If TC Transcontinental's clients possess the capacity to manufacture their own packaging, print their own marketing collateral, or even create their educational content internally, their reliance on TC decreases, thereby amplifying their negotiation strength.

For TC Transcontinental, this threat is generally considered low across most of its customer base. The specialized nature of printing, packaging production, and digital content development often necessitates substantial investment in sophisticated equipment, technical expertise, and achieving economies of scale that many individual customers cannot readily replicate. For instance, the capital expenditure for advanced printing presses or specialized packaging machinery can run into millions of dollars.

However, very large, diversified corporations might evaluate the feasibility of in-sourcing certain simpler or high-volume packaging or printing requirements. This strategic consideration is driven by potential cost savings and greater control over their supply chain. For example, a major food manufacturer might explore producing its own basic retail packaging if the volume justifies the investment in dedicated production lines.

- Customer Capability: Customers can increase bargaining power if they can produce TC's offerings (packaging, print, content) in-house.

- TC's Advantage: Specialized equipment, expertise, and scale required for TC's operations generally make backward integration difficult for most customers.

- Large Corporation Exception: Major corporations with significant volume may consider in-sourcing simpler packaging or printing needs.

Customers of TC Transcontinental possess significant bargaining power, particularly when they are concentrated, price-sensitive, or face low switching costs. Large clients in sectors like flexible packaging or commercial printing can leverage their volume to demand better pricing and services, directly impacting TC Transcontinental's profit margins. The availability of numerous substitutes, such as digital media replacing print, further empowers customers by making it easier to switch suppliers, forcing TC Transcontinental to remain highly competitive.

The threat of backward integration, where customers produce TC's offerings in-house, is generally low due to the specialized nature and high capital investment required for printing and packaging. However, very large corporations with substantial volumes might consider in-sourcing simpler needs, thereby increasing their leverage. For instance, in 2024, the printing industry continues to feel pressure from digital alternatives, with global digital ad spending projected to exceed $600 billion, underscoring the need for print providers to offer compelling value beyond just price.

Same Document Delivered

Transcontinental Porter's Five Forces Analysis

This preview showcases the complete Transcontinental Porter's Five Forces Analysis, identical to the document you will receive instantly upon purchase. You are viewing the final, professionally formatted report, ensuring no hidden placeholders or missing sections. This comprehensive analysis is ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

TC Transcontinental navigates a varied competitive arena. In North America's flexible packaging sector, it faces formidable rivals such as Amcor and Berry Global, both significant global entities. This suggests a market where scale and established presence are crucial for success.

The Canadian printing industry presents a similarly crowded landscape. It's populated by a broad spectrum of companies, ranging from substantial national operators to numerous smaller, specialized firms. This diversity in player size and focus intensifies competition across various printing segments.

The growth rate of the industries TC Transcontinental operates within directly influences competitive rivalry. For instance, the Canadian commercial printing market is anticipated to experience steady growth between 2025 and 2029, which can attract new entrants and intensify competition among existing players.

Similarly, the North American flexible packaging market's projected growth presents both opportunities and a heightened risk of increased competition as more companies vie for market share in this expanding sector.

Competitors in the packaging and printing industries actively pursue differentiation. For instance, in 2024, many packaging firms are focusing on sustainable materials like compostable bioplastics and recycled content, with a significant portion of consumers indicating a willingness to pay more for eco-friendly options. This innovation in materials, alongside smart packaging solutions that offer track-and-trace capabilities, can effectively set companies apart and lessen the pressure for direct price competition.

Switching costs for customers can also temper rivalry. In the printing sector, for example, companies that offer specialized printing techniques, such as advanced finishing or unique material applications, create higher switching costs. Furthermore, integrated service offerings that include in-store marketing support or supply chain management solutions can lock in clients, reducing the likelihood of them easily moving to a competitor based solely on price.

Exit Barriers

High exit barriers, such as specialized assets and significant employee severance costs, can trap companies in an industry, even when profits are scarce. This can lead to intensified competition as firms are reluctant to leave. For TC Transcontinental, while they have divested some operations, the remaining business segments likely still possess certain specialized assets that contribute to exit barriers.

TC Transcontinental has actively managed its portfolio. For instance, in 2023, the company completed the sale of its U.S. industrial packaging operations, a move aimed at focusing on its core printing and digital transformation activities. This strategic divestiture highlights an effort to reduce exposure to segments with potentially higher exit barriers or lower strategic fit.

- Specialized Assets: Industries with highly specific machinery or facilities, like large-scale printing presses, create significant costs if a company decides to exit, as these assets may have limited resale value outside the industry.

- Employee Severance and Contractual Obligations: High costs associated with laying off a large workforce or breaking long-term contracts with suppliers or customers can deter companies from exiting.

- Government or Regulatory Constraints: In some industries, regulatory approvals or environmental cleanup costs can act as significant barriers to exiting.

- Strategic Divestitures: TC Transcontinental's sale of its U.S. industrial packaging business in 2023 for approximately CAD 240 million demonstrates a strategy to manage its portfolio and potentially reduce exposure to certain exit barriers.

Diversity of Competitors

TC Transcontinental operates in a landscape marked by a broad spectrum of competitors, ranging from multinational packaging behemoths to niche regional printers and digital educational content creators. This heterogeneity in strategic approaches, geographical origins, and core objectives fosters an environment of unpredictable competitive dynamics.

For instance, global packaging leaders often leverage economies of scale and extensive distribution networks, while smaller, specialized printers might compete on agility and customized solutions. In the educational publishing sector, TC Transcontinental contends with established academic publishers and agile digital learning platforms, each vying for market share with distinct value propositions and cost structures.

- Diverse Competitor Landscape: TC Transcontinental faces competition from global packaging giants, regional printers, and specialized educational content providers.

- Varied Strategic Priorities: Competitors exhibit different strategic aims, cost structures, and market approaches, influencing their competitive behavior.

- Unpredictable Market Dynamics: The diversity of players leads to a less predictable competitive environment, requiring adaptability from TC Transcontinental.

- Impact on Strategy: Understanding these varied competitive forces is crucial for developing effective market strategies and maintaining a competitive edge.

TC Transcontinental faces intense rivalry from large global players in flexible packaging, such as Amcor and Berry Global, who benefit from scale and established networks. In the diverse Canadian printing market, competition spans from large national firms to smaller, specialized businesses, creating pressure across different segments. The anticipated steady growth in the Canadian commercial printing market between 2025 and 2029 is likely to attract new entrants, further intensifying competition.

| Key Competitors | Industry Segment | Competitive Factor |

| Amcor | Flexible Packaging (North America) | Global Scale, Distribution Network |

| Berry Global | Flexible Packaging (North America) | Global Scale, Product Diversification |

| Various Canadian Printers | Printing (Canada) | Specialization, Agility, Price |

SSubstitutes Threaten

The threat of substitutes for flexible packaging is moderate. Alternatives include rigid plastics, glass, metal cans, and paperboard cartons. These traditional formats often provide enhanced barrier properties or perceived durability, which can appeal to certain consumer segments or product requirements.

However, flexible packaging holds a strong competitive edge due to its significant advantages in weight reduction, leading to lower transportation costs. For instance, a study by the Flexible Packaging Association in 2024 highlighted that flexible packaging can be up to 10 times lighter than rigid alternatives, directly impacting shipping expenses, a crucial factor in the booming e-commerce sector.

Furthermore, the material efficiency and lower production costs associated with flexible packaging make it a more economical choice for many manufacturers. This cost-effectiveness, combined with its space-saving attributes during transport and storage, continues to drive its adoption across various industries, mitigating the threat from substitutes in many applications.

Digital media and online platforms present a substantial threat to traditional printing services, particularly impacting sectors like advertising, newspapers, and magazines. This shift is evident in the Canadian printing industry, which experienced a notable revenue decline as advertising budgets increasingly migrated online. For instance, digital advertising spending in Canada was projected to reach over $8.6 billion in 2024, a significant portion of the overall advertising market.

Despite the overall pressure from digital alternatives, certain segments of the printing industry continue to thrive. Specialized printing services, such as labels, flexible packaging, and in-store marketing materials, are still in high demand. This resilience is driven by the unique needs of consumer goods packaging and retail environments, where tangible print materials remain essential for branding and consumer engagement.

The threat of substitutes in educational publishing is significant, with options like open educational resources (OER), digital learning platforms, and online courses directly challenging traditional textbook models. For instance, in 2024, the adoption of OER continues to grow, with many institutions leveraging these free or low-cost materials to reduce student expenses.

The ongoing digital transformation within the Canadian education sector further amplifies this threat. Increased integration of technology in classrooms and the widespread availability of free digital textbooks provide compelling alternatives to paid print or digital publications. This trend is likely to accelerate as more educators and institutions embrace cost-effective and accessible digital solutions.

Relative Price and Performance of Substitutes

The appeal of substitute products hinges on their price-performance ratio. For instance, while digital media often presents a lower cost structure compared to traditional print, the latter still offers a unique tactile experience and a distinct brand presence that digital formats struggle to replicate. This trade-off directly influences consumer and business choices.

In the packaging sector, the landscape of substitutes is dynamic. Eco-friendly alternatives are gaining traction, but their widespread adoption is still moderated by their current cost and how well they perform against established materials. As of 2024, the cost premium for some sustainable packaging options can range from 10% to 30% over conventional plastics, depending on the specific material and application.

- Price-Performance Trade-off: The attractiveness of substitutes is directly tied to how much performance they offer for their price.

- Digital vs. Print: Digital alternatives are cheaper but lack the tangible quality and brand impact of print.

- Packaging Evolution: Sustainable packaging substitutes are emerging, but their cost-effectiveness and performance are still developing.

- 2024 Data Point: Sustainable packaging can be 10-30% more expensive than traditional options currently.

Customer Propensity to Substitute

Customer willingness to switch to alternatives is a key determinant of the threat of substitutes. This willingness is shaped by several factors, including the perceived benefits of substitutes, switching costs, and the availability of information about alternatives. For instance, a significant portion of consumers are actively seeking out plant-based food options, demonstrating a clear propensity to substitute traditional meat products. In 2024, the global plant-based food market is projected to reach over $74 billion, highlighting this trend.

Convenience, environmental concerns, and technological literacy also play a crucial role in customer propensity to substitute. For example, the growing demand for sustainable packaging is a powerful driver for adopting eco-friendly alternatives, with 60% of consumers in a recent survey stating they would pay more for sustainable packaging. Similarly, in the education sector, the increasing digital fluency of students and teachers is fostering the widespread use of digital learning tools, with the global e-learning market expected to grow substantially in the coming years.

- Consumer Demand for Sustainability: A 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, directly influencing their openness to substitute products.

- Technological Adoption Rates: In 2024, the adoption rate of smart home devices, a substitute for traditional home management systems, continues to climb, with an estimated 40% of households in developed countries owning at least one such device.

- Shifting Preferences in Transportation: The increasing cost and environmental impact of traditional gasoline-powered vehicles are driving a greater propensity for consumers to consider electric vehicles (EVs) as substitutes. By the end of 2024, EV sales are anticipated to represent over 15% of the total global car market.

The threat of substitutes for traditional print media, like newspapers and magazines, remains significant due to the rise of digital platforms. These digital alternatives offer immediate access to information and often at a lower cost, impacting revenue streams for print publications. For instance, by mid-2024, digital advertising spending in Canada was projected to surpass $8.6 billion, diverting funds that might have previously supported print advertising.

While specialized printing sectors such as labels and flexible packaging demonstrate resilience, the broader print industry faces ongoing pressure. The unique tactile and branding advantages of print are still valued, but the cost-effectiveness and convenience of digital substitutes continue to erode market share. This dynamic is evident as consumers increasingly opt for digital news sources over physical subscriptions.

The educational publishing sector is also heavily influenced by substitutes like Open Educational Resources (OER) and online courses, which offer more affordable or free alternatives to traditional textbooks. By 2024, the adoption of OER was growing, driven by institutional efforts to reduce student costs, directly challenging the established textbook market.

Entrants Threaten

The flexible packaging and printing sectors demand significant upfront capital. Companies need to invest heavily in advanced machinery for processes like extrusion, printing, and lamination, alongside establishing robust distribution networks. For instance, a state-of-the-art flexible packaging plant can easily cost tens of millions of dollars to set up.

Established players like TC Transcontinental leverage significant economies of scale. In 2023, TC Transcontinental reported total revenue of CAD 3.1 billion, indicating a substantial operational footprint. This scale allows them to negotiate better prices for raw materials, optimize manufacturing processes, and build extensive distribution networks, resulting in lower per-unit costs that are difficult for newcomers to replicate.

For TC Transcontinental, a significant barrier to new entrants lies in securing access to established distribution channels. Building and maintaining relationships with major clients across diverse sectors like packaging, retail, and education requires substantial time and investment. Newcomers often struggle to penetrate these established networks, which are crucial for reaching end consumers and generating consistent revenue.

Brand Loyalty and Differentiation

Building strong brand loyalty and differentiating its offerings are significant deterrents for new entrants in TC Transcontinental's core printing and packaging markets. Establishing brand recognition and fostering customer loyalty requires substantial time and financial resources, particularly in mature industries where established players already hold considerable sway. For instance, TC Transcontinental's long-standing reputation as a reliable and innovative leader in its various segments presents a formidable hurdle for any newcomer attempting to gain a foothold and market share.

TC Transcontinental's commitment to innovation and sustainability also acts as a competitive advantage. By consistently investing in new technologies and eco-friendly solutions, the company not only appeals to a growing segment of environmentally conscious consumers and businesses but also raises the bar for operational efficiency and product quality. This focus on forward-thinking practices makes it more challenging for new entrants to compete on equal footing without similar investments.

- Brand Recognition: TC Transcontinental has cultivated a strong brand presence built over decades, making it difficult for new, unknown entities to attract customers.

- Customer Loyalty Programs: Established relationships and loyalty programs with existing clients create switching costs for businesses considering new suppliers.

- Investment in Differentiation: The company's continuous investment in specialized printing techniques and sustainable packaging solutions sets it apart, requiring significant capital for competitors to match.

- Market Maturity: In mature markets, brand loyalty is often deeply entrenched, meaning new entrants must offer a substantially superior value proposition or a significantly lower price point to disrupt the status quo.

Regulatory and Environmental Hurdles

The packaging and printing sectors face significant regulatory and environmental challenges that act as a barrier to new entrants. These industries are heavily regulated, particularly concerning waste management, emissions, and the adoption of sustainable practices. For instance, in 2024, many regions intensified scrutiny on single-use plastics, pushing companies to invest in biodegradable or recyclable materials, a significant upfront cost for newcomers.

Navigating these complex environmental laws requires substantial investment in compliant technologies and processes. New players must also contend with the global push towards a circular economy, demanding innovative approaches to material sourcing and end-of-life product management. The evolving standards for sustainable packaging, such as those mandated by the EU's Packaging and Packaging Waste Regulation, mean that any new entrant must not only meet current requirements but also anticipate future regulatory shifts, adding to the capital expenditure and operational complexity.

- Environmental Regulations: Packaging and printing industries face stringent rules on waste disposal and sustainable material use, increasing compliance costs for new entrants.

- Technological Investment: Meeting these regulations often necessitates investing in advanced, eco-friendly technologies, which can be a significant financial barrier for startups.

- Sustainable Packaging Shift: The growing demand for sustainable packaging materials and practices requires new companies to adapt quickly to evolving industry standards, adding to initial setup costs.

The threat of new entrants for TC Transcontinental is moderately low due to substantial capital requirements for advanced machinery and distribution networks. For example, establishing a modern flexible packaging facility can easily cost tens of millions of dollars. This high initial investment acts as a significant deterrent for potential newcomers looking to enter the competitive printing and packaging sectors.

Economies of scale achieved by established players like TC Transcontinental, which reported CAD 3.1 billion in revenue in 2023, create a cost advantage that is difficult for new entrants to match. This scale allows for better raw material pricing and optimized production, making it challenging for startups to compete on price. Furthermore, securing access to established distribution channels and building customer loyalty requires considerable time and investment, presenting another hurdle.

TC Transcontinental's commitment to innovation and sustainability, including investments in eco-friendly solutions, raises the operational bar. New entrants must also navigate stringent environmental regulations, such as those intensified in 2024 concerning single-use plastics, which necessitate significant investment in compliant technologies and sustainable materials. This regulatory landscape, coupled with the need to meet evolving circular economy standards, adds to the complexity and cost for new businesses.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of advanced machinery and establishing distribution networks. | Significant financial barrier; a modern plant can cost tens of millions. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to compete on price against established players like TC Transcontinental (2023 revenue: CAD 3.1 billion). |

| Distribution Channels & Customer Loyalty | Established relationships and brand recognition create switching costs. | Newcomers find it difficult to penetrate existing networks and build trust. |

| Regulatory & Environmental Compliance | Strict rules on waste, emissions, and sustainable practices. | Requires investment in compliant technologies and adapting to evolving standards (e.g., EU Packaging and Packaging Waste Regulation). |

Porter's Five Forces Analysis Data Sources

Our transcontinental Porter's Five Forces analysis leverages a robust data ecosystem, including global financial databases, international trade statistics, and reports from leading market research firms to capture diverse competitive landscapes.