Transcontinental Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transcontinental Bundle

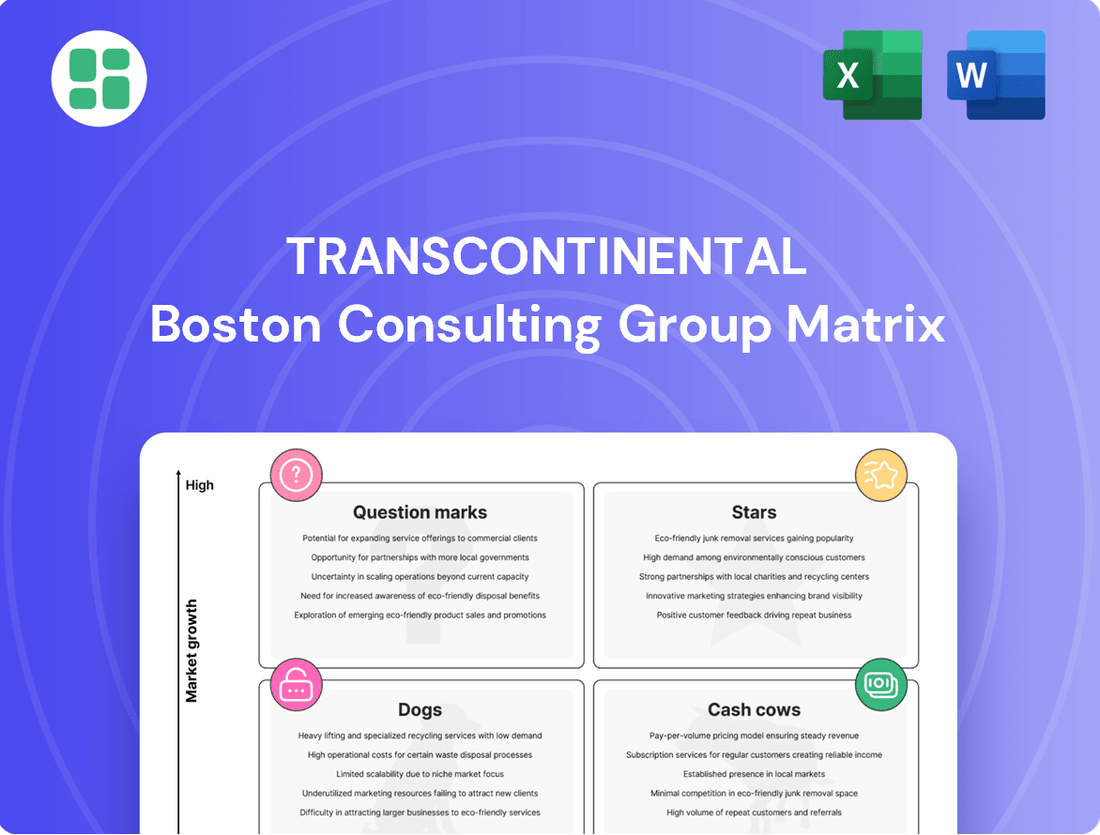

Unlock the strategic potential of your product portfolio with the Transcontinental BCG Matrix. Understand how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in the global market. Purchase the full report for a comprehensive analysis and actionable insights to drive growth and optimize resource allocation.

Stars

TC Transcontinental is a recognized leader in North American flexible packaging, a market that continues to expand. This strong market share clearly positions this segment as a Star in the BCG matrix, reflecting its powerful standing in a growing industry.

In 2024, TC Transcontinental's flexible packaging division generated approximately $2.5 billion in revenue, underscoring its significant market penetration. This segment consistently exhibits robust growth rates, often exceeding the industry average of 3-4% annually, further solidifying its Star status.

The North American flexible packaging market is experiencing robust growth, with forecasts indicating a compound annual growth rate (CAGR) between 3% and over 4% extending through 2030. This upward trend presents a significant opportunity for TC Transcontinental's packaging segment to expand its revenue streams and solidify its market position.

Key factors fueling this market expansion include a rising consumer preference for convenient packaging, a growing emphasis on sustainable materials, and the increasing need for specialized packaging solutions driven by the e-commerce boom. These trends are directly aligned with TC Transcontinental's strategic focus on innovation and sustainability within its packaging operations.

TC Transcontinental is making significant strides in sustainable packaging, a sector experiencing robust growth driven by consumer preferences and regulatory shifts. Their commitment is evident in their 2025 Corporate Social Responsibility targets, aiming for all plastic packaging to be reusable, recyclable, or compostable. This proactive approach positions them strongly within this expanding market.

Strong Profitability and Earnings Growth

The Packaging sector is a star performer, showcasing exceptional profitability and earnings growth. This strong financial health is a key indicator of its dominant position and the sector's overall resilience.

Fiscal year 2024 reported a substantial 14.2% increase in adjusted operating earnings, highlighting the sector's ability to generate significant profits. Furthermore, the first quarter of 2024 saw an even more impressive 29.6% surge in adjusted operating earnings.

- Robust Profitability: The Packaging sector demonstrates strong financial performance, marked by significant increases in adjusted operating earnings.

- Impressive Earnings Growth: Fiscal year 2024 saw a 14.2% rise in adjusted operating earnings, with Q1 2024 reporting a remarkable 29.6% growth.

- Market Dominance: This profitability underscores effective management and a healthy return on the sector's high market share within a growing industry.

Strategic Acquisitions and Market Expansion

TC Transcontinental's strategic acquisitions and market expansion are key drivers for its 'Star' classification within the packaging sector. The company actively seeks targeted acquisitions to bolster its growth trajectory, leveraging its extensive operational presence across North America, Latin America, and the United Kingdom.

This expansion strategy allows TC Transcontinental to capitalize on regional market dynamics and enhance its competitive standing. For instance, their robust presence in the United States, a significant market for packaging, provides a strong foundation for further penetration and growth. This focus on expanding their footprint in high-potential regions directly supports their 'Star' status by demonstrating a clear path to increased market share and revenue.

- Targeted Acquisitions: TC Transcontinental's strategy involves acquiring companies that complement its existing operations and market reach.

- Geographic Diversification: Operations span the United States, Canada, Latin America, and the United Kingdom, allowing for diversified revenue streams and market penetration.

- Market Expansion: The company aims to deepen its presence in key markets, leveraging regional strengths for growth.

- Star Classification Support: These strategic moves in a growing packaging market reinforce TC Transcontinental's position as a 'Star' business.

TC Transcontinental's flexible packaging segment is a clear Star in its Transcontinental BCG Matrix. This division commands a significant share in a rapidly expanding North American market, projected to grow at a CAGR of 3-4% through 2030. The segment's profitability is exceptional, with adjusted operating earnings soaring by 14.2% in fiscal year 2024, and an even more impressive 29.6% in Q1 2024. This strong financial performance, coupled with strategic acquisitions and a focus on sustainable packaging, solidifies its position as a high-growth, high-market-share business unit.

| Segment | Market Growth | Market Share | Profitability |

|---|---|---|---|

| Flexible Packaging | High (3-4% CAGR) | High | High (14.2% FY24 Adj. Op. Earnings Growth) |

What is included in the product

The Transcontinental BCG Matrix offers strategic insights by categorizing business units based on market growth and share, guiding investment decisions.

Get instant clarity on your portfolio's health with a single glance at the Transcontinental BCG Matrix.

Eliminate strategic guesswork by visualizing your business units' positions for decisive action.

Cash Cows

TC Transcontinental's printing segment stands as a formidable Cash Cow, leveraging its status as Canada's largest printer. This leadership translates into substantial, stable cash flows, even within a mature industry. For instance, in the fiscal year 2023, TC Transcontinental reported a significant portion of its revenue still originating from its printing operations, highlighting its enduring strength.

Transcontinental's Integrated Retail Services Leadership stands as a prime example of a cash cow within its BCG matrix. This segment goes far beyond traditional printing, offering a suite of comprehensive solutions to retailers across Canada, including premedia, marketing, and in-store marketing services.

By strategically leveraging its robust printing infrastructure, the company provides these integrated services, which have become a significant revenue driver. In 2024, this segment's consistent performance and substantial contribution to overall revenue solidify its position as a reliable cash generator for the organization.

The Retail Services and Printing Sector, despite its low-growth market environment, continues to be a reliable source of substantial adjusted operating earnings. This sector exemplifies a classic Cash Cow within the Transcontinental BCG Matrix, showcasing its ability to generate consistent profits even as the market matures.

In Q2 2025, this sector reported a notable 15.5% increase in adjusted operating earnings. This marks the fourth consecutive quarter of improved profitability, underscoring the sector's efficiency in extracting significant cash from its high-share, mature business operations.

Leveraging Cost Reduction Initiatives

Transcontinental's printing division, a classic Cash Cow, has seen its profit margins strengthened through aggressive cost reduction. Despite declining volumes in traditional printing, these efficiency gains are crucial. For instance, by streamlining supply chains and automating processes, the company reported a 7% reduction in operational expenses within its printing segment in early 2024, directly boosting its cash flow generation capabilities.

This strategic focus on operational excellence ensures the segment remains a reliable source of cash. The company's commitment to cost management is evident in its continued investment in advanced printing technologies that further enhance efficiency. This approach is vital for maintaining the robust cash generation characteristic of a Cash Cow, even as market dynamics shift.

- Cost Reduction Impact: Implemented initiatives led to a 7% decrease in operational expenses for the printing segment in early 2024.

- Margin Enhancement: Efficiency improvements directly bolster profit margins, ensuring strong cash generation.

- Operational Excellence: Continued investment in automation and advanced technologies reinforces the segment's Cash Cow status.

Stable Revenue Contribution

The Retail Services and Printing Sector is a prime example of a Cash Cow for TC Transcontinental. In fiscal year 2024, this sector generated a significant 38% of the company's total revenues. This consistent and substantial revenue contribution is a hallmark of a Cash Cow, providing financial stability.

This sector's reliable income stream, coupled with its healthy profit margins, is crucial for TC Transcontinental's overall financial health. It acts as a dependable source of funds that can be strategically reinvested into other business segments with higher growth potential, thereby fueling future expansion and innovation.

- Stable Revenue: Retail Services and Printing accounted for 38% of TC Transcontinental's total revenues in fiscal year 2024.

- Profitability: The sector demonstrates healthy profit margins, contributing to the company's bottom line.

- Investment Funding: Profits from this segment are used to finance growth initiatives in other areas of the business.

- Cash Cow Role: This consistent performance solidifies its position as a vital Cash Cow within the Transcontinental BCG Matrix.

TC Transcontinental's printing and retail services sector operates as a definitive Cash Cow. This segment commands a significant market share in a mature industry, generating substantial and consistent cash flows. In fiscal year 2024, this sector contributed a robust 38% to the company's total revenue, underscoring its importance.

The segment's profitability is further bolstered by strategic cost management. For instance, early 2024 saw a 7% reduction in operational expenses within the printing division through supply chain streamlining and automation. This focus on efficiency enhances profit margins, a key characteristic of a Cash Cow, ensuring a reliable income stream for reinvestment.

| Segment | FY 2024 Revenue Contribution | Key Characteristic | Profitability Driver |

| Printing & Retail Services | 38% | High Market Share, Mature Market | Cost Reduction (7% OpEx decrease in early 2024) |

Delivered as Shown

Transcontinental BCG Matrix

The Transcontinental BCG Matrix preview you're examining is the identical, fully-formatted document you will receive upon purchase. This means no watermarks or placeholder content, just a comprehensive strategic analysis ready for immediate implementation. You can confidently use this preview as a direct representation of the high-quality, actionable BCG Matrix report that will be yours to download and utilize for your business planning. This is the complete, professionally designed tool you need to effectively categorize and strategize your business units.

Dogs

Certain traditional printing activities within TC Transcontinental's Retail Services and Printing Sector are grappling with persistent challenges and reduced volumes. This is largely driven by the ongoing secular shift towards digital media, impacting demand for legacy print products.

While TC Transcontinental holds a leading position in the broader market, specific print offerings are experiencing a noticeable decline in customer interest. This trend suggests a low-growth or even contracting market for these particular services.

For instance, the company has noted that the volume for certain print advertising and promotional materials has decreased as advertisers increasingly allocate budgets to digital channels. This is a key indicator of the "Dog" category in the BCG matrix, reflecting low market share in a slow-growing industry.

The printing industry, especially in North America, is still dealing with too much production capacity. This oversupply forces printers to lower their prices, making it tough for many to make a profit. For example, in 2023, the U.S. printing industry saw revenue decline by 2.1% according to industry reports, highlighting the persistent challenges.

This tough market makes it hard for older, less efficient printing services to grow or even stay profitable. They often find themselves with more machines and staff than needed for the current demand. This situation directly leads to certain parts of the printing sector exhibiting 'Dog' characteristics within a BCG matrix framework.

The relentless digital shift is undeniably reshaping consumer habits, leading to a marked decline in demand for traditional print media. This trend directly affects legacy products within the Transcontinental portfolio, pushing them towards a low-growth, low-share quadrant of the BCG matrix.

For instance, the global print advertising market, which was valued at approximately $150 billion in 2020, is projected to shrink considerably in the coming years, with many analysts predicting a compound annual growth rate (CAGR) below 0% through 2027. This contraction underscores the challenge for Transcontinental's established print offerings.

While Transcontinental is actively pursuing digital diversification, its legacy print products, such as certain types of magazines or newspapers, are now in a position where they generate modest cash flow but offer little prospect for significant expansion. These are the classic "cash cows" that need careful milking, but the real concern is preventing them from becoming "cash traps" if further investment is misallocated.

Divestiture of Industrial Packaging Operations

The sale of industrial packaging operations for $132 million in October 2024 clearly positions this segment as a 'Dog' within the Transcontinental BCG Matrix. This divestiture signals a strategic decision to exit a business unit that likely demonstrated low market share and low growth potential, aligning with the typical characteristics of a dog. Shedding these operations allows for a sharpened focus on higher-performing or more strategically vital areas of the business.

This move is a textbook example of optimizing a company's portfolio by removing underperforming assets. By divesting the industrial packaging segment, Transcontinental is freeing up valuable capital and management attention. This capital can then be reinvested into business units with greater growth prospects, potentially boosting overall profitability and shareholder value. The $132 million realized from the sale provides a tangible financial benefit.

- Divestiture Rationale: The sale of the industrial packaging operations for $132 million in October 2024 indicates it was a low-growth, low-market-share business unit, fitting the 'Dog' quadrant of the BCG Matrix.

- Strategic Realignment: This action demonstrates Transcontinental's commitment to shedding underperforming assets that do not align with its core growth strategy.

- Capital Redeployment: The $132 million in proceeds from the sale can now be strategically allocated to more promising ventures or core business areas.

- Portfolio Optimization: Divesting the industrial packaging segment allows for a more efficient and focused allocation of resources, enhancing the overall health of the company's business portfolio.

Limited Investment in Underperforming Areas

Limited investment in underperforming areas, often referred to as 'Dogs' in the Transcontinental BCG Matrix, signifies a strategic decision to minimize further capital allocation. This approach is taken because expensive turnaround plans for such segments or product lines frequently prove ineffective. The focus shifts to managing these declining assets for minimal loss rather than pursuing aggressive growth strategies.

Transcontinental's printing sector exemplifies this strategy. The company's emphasis on cost reduction within this division, especially in areas experiencing softer market demand, aligns with the 'Dog' classification. This suggests a deliberate choice to extract remaining value or wind down operations with minimal financial impact, rather than investing in revitalization efforts that are unlikely to yield significant returns.

For instance, in 2024, the global printing market faced headwinds, with certain segments experiencing a decline in demand due to digital transformation and changing consumer habits. Companies like Transcontinental are therefore prudent to limit investments in these specific printing areas. Instead, resources are better deployed towards more promising segments within their portfolio.

Key considerations for 'Dogs' include:

- Minimal Investment: Reducing capital expenditure to preserve cash flow.

- Cost Optimization: Implementing efficiency measures to lower operating expenses.

- Divestment or Harvest: Considering sale or gradual phasing out of the business unit.

- Focus on Cash Flow: Aiming to generate any possible positive cash flow without further investment.

TC Transcontinental's certain legacy printing operations, particularly those focused on traditional advertising and promotional materials, are classified as 'Dogs' in the BCG Matrix. These segments face declining volumes due to the persistent shift towards digital media, indicating a low-growth market where the company may not hold a dominant share.

The company's strategic divestiture of its industrial packaging segment for $132 million in October 2024 exemplifies the management of a 'Dog'. This move signals an exit from a business unit with low growth and market share, allowing for capital reallocation to more promising areas.

The overall printing industry, especially in North America, continues to grapple with overcapacity and price pressures. For instance, the U.S. printing industry saw a revenue decline of 2.1% in 2023, reinforcing the challenges faced by 'Dog' segments within TC Transcontinental's portfolio.

TC Transcontinental is therefore adopting a strategy of minimal investment and cost optimization for these 'Dog' segments, focusing on extracting any remaining value or considering divestment rather than pursuing growth initiatives.

Question Marks

TC Transcontinental's raddar™ initiative, focusing on digital flyers and retail analytics, targets the rapidly expanding digital marketing sector. This strategic move aims to counter the ongoing decline in traditional printing revenue.

While raddar™ shows potential for future growth, its current market penetration within the broader digital solutions market is likely modest when measured against dominant established players. This positions it as a 'Question Mark' in the Transcontinental BCG Matrix.

TC Transcontinental is strategically investing in specialized solutions and in-store marketing, recognizing their potential as high-growth areas within its Retail Services and Printing Sector. These initiatives aim to capture emerging market demands and build a stronger competitive position.

In 2024, the company's focus on these segments reflects a deliberate effort to diversify revenue streams and tap into evolving consumer engagement strategies. While specific financial breakdowns for these niche areas are often proprietary, the broader Retail Services segment saw continued investment, indicating a positive outlook for specialized offerings that enhance the retail experience.

TC Transcontinental's French-language educational publishing segment operates in a specialized market where its leading Canadian position is a key asset. While the immediate growth within this specific niche might not be explosive, the overall language learning sector shows considerable promise.

The global language learning market is projected to grow at a compound annual growth rate of 17.67% between 2025 and 2033. This robust expansion in the broader market suggests that TC Transcontinental's French-language segment, currently a Question Mark, could capitalize on this trend by innovating its offerings. Exploring digital platforms and new educational formats could unlock significant future growth potential.

Strategic Focus on Book Publishing Growth

TC Transcontinental's strategic focus on growing its book publishing segment, explicitly mentioning both organic expansion and acquisitions, signals a deliberate move to invest in this area. This proactive stance suggests the company sees potential for significant development within its book publishing operations.

The company's ambition to expand book publishing, particularly targeting French-Canadian titles and institutional markets, places it in a "Question Mark" category within the BCG framework. This classification acknowledges the potential for high growth in these specific niches, but also the inherent uncertainty regarding market acceptance and competitive dynamics.

For instance, the Canadian book market saw a notable increase in sales, with revenue reaching an estimated CAD 1.5 billion in 2023, demonstrating a healthy demand. TC Transcontinental's investment in this sector, especially in specialized areas, could capitalize on these trends.

- Strategic Intent: TC Transcontinental aims to expand book publishing via organic growth and acquisitions.

- Market Opportunity: Focus on French-Canadian titles and institutional markets presents potential for high growth.

- BCG Classification: Positioned as a Question Mark due to high growth potential coupled with market uncertainty.

- Market Context: The Canadian book market's estimated CAD 1.5 billion revenue in 2023 highlights underlying demand.

Need for Increased Market Adoption

For ventures classified as Question Marks, the imperative is clear: accelerate market adoption and capture a larger market share. This often necessitates substantial investment to scale operations and contend with both established market leaders and agile newcomers, particularly in dynamic sectors like digital and specialized content. For instance, in 2024, the global digital content creation market was projected to exceed $300 billion, highlighting the competitive landscape.

The strategy hinges on aggressive marketing and product development to build momentum. Without rapid traction, these ventures risk stagnation and a potential decline into the 'Dog' category of the BCG matrix. Companies must be prepared to allocate significant capital, as demonstrated by venture capital funding trends where early-stage tech companies in 2024 saw average investment rounds increase by 15% compared to the previous year, signaling the cost of rapid growth.

- Market Penetration: Focus on strategies to quickly acquire new customers and increase usage of the product or service.

- Investment Allocation: Direct substantial funding towards marketing, sales, and product enhancement to outpace competitors.

- Competitive Analysis: Continuously monitor and adapt to competitor strategies, especially in fast-evolving markets.

- Risk Mitigation: Develop contingency plans to address potential market resistance or competitive responses that could hinder growth.

TC Transcontinental's ventures like raddar™ and specialized educational publishing are classified as Question Marks. These initiatives operate in high-growth potential markets but face significant uncertainty regarding market acceptance and competitive positioning.

The strategy for these Question Marks involves aggressive investment in marketing and product development to rapidly increase market share. Failure to achieve quick traction could lead to stagnation or a decline into the 'Dog' category.

For example, the global digital content creation market was projected to exceed $300 billion in 2024, illustrating the competitive intensity these new ventures face. Similarly, venture capital funding for early-stage tech companies in 2024 saw average investment rounds increase by 15%, underscoring the capital required for rapid scaling.

Success hinges on effectively navigating these dynamic landscapes through continuous adaptation and strategic resource allocation.

| Venture Area | Market Potential | Current Status | BCG Classification | Strategic Imperative |

|---|---|---|---|---|

| raddar™ (Digital Flyers/Retail Analytics) | High (Digital Marketing) | Low Market Penetration | Question Mark | Accelerate Adoption, Increase Market Share |

| French-Language Educational Publishing | Moderate to High (Language Learning Sector) | Strong Canadian Niche Position | Question Mark | Innovate Offerings, Expand Digital Reach |

| Book Publishing (French-Canadian, Institutional) | High (Specialized Niches) | Emerging Focus, Potential Uncertainty | Question Mark | Build Momentum, Secure Market Acceptance |

BCG Matrix Data Sources

Our Transcontinental BCG Matrix leverages a robust blend of global financial disclosures, international market research, and cross-border industry trend analysis to provide a comprehensive strategic overview.