Superior Industries International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

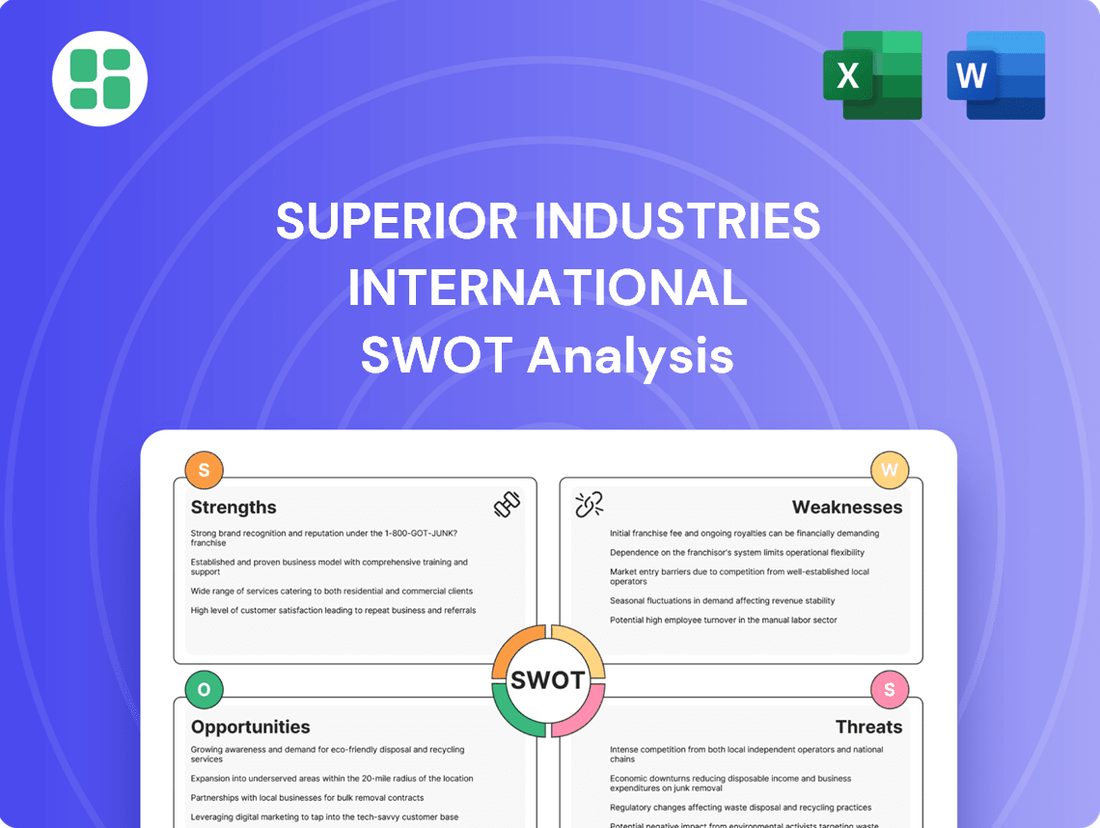

Superior Industries International's SWOT analysis reveals a company with strong manufacturing capabilities and a solid brand reputation in the automotive aftermarket. However, it also highlights potential vulnerabilities related to supply chain disruptions and increasing competition.

Want the full story behind Superior Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Superior Industries is a top-tier global supplier of aluminum wheels to major original equipment manufacturers (OEMs), serving both light vehicles and commercial trucks. This leading position highlights their manufacturing expertise and strong relationships within the automotive sector.

The company also boasts a significant footprint in the European aftermarket, leveraging well-established brands like ATS, RIAL, ALUTEC, and ANZIO. This dual market strategy diversifies revenue and strengthens their overall market standing.

For instance, in the first quarter of 2024, Superior Industries reported a 7.7% increase in net sales to $145.3 million, driven by strong OEM demand, underscoring the power of this dual market approach.

Superior Industries International boasts advanced design and manufacturing capabilities, particularly in aluminum wheel production. They leverage cutting-edge lightweighting and finishing technologies, enabling close collaboration with automotive clients to create innovative, high-quality products.

Superior Industries boasts a strategically positioned global manufacturing network, with key facilities in North America (Mexico) and Europe (Poland). This 'local-for-local' approach allows for efficient production and reduced shipping costs by serving regional markets directly.

The consolidation of European operations into Poland is a significant advantage, streamlining production and leveraging lower labor costs. This move enhances their ability to respond quickly to European market needs and improves overall operational efficiency.

Benefit from Tariff Dynamics

Superior Industries International is well-positioned to benefit from shifting global tariff landscapes. The company's manufacturing presence in Mexico and Poland provides a distinct advantage, especially with tariffs impacting wheel imports from China and Morocco into key markets like the U.S. and Europe. This has created a significant tailwind, driving substantial quoting activity and new business opportunities as original equipment manufacturers (OEMs) prioritize regional sourcing to meet compliance and cost objectives.

This strategic advantage is translating into tangible results. In fiscal year 2024, Superior experienced what management described as unprecedented quoting activity, directly linked to these tariff dynamics. The company secured notable new business wins, underscoring the market's demand for localized production solutions.

- Tariff Advantage: Capitalizes on tariffs on Chinese and Moroccan wheel imports into U.S. and Europe.

- Regional Strength: Leverages localized production in Mexico and Poland.

- Market Demand: OEMs seek regional suppliers for compliance and cost-effectiveness.

- Business Growth: Experienced unprecedented quoting activity and secured significant new business wins in FY2024.

Successful Operational Transformation

Superior Industries International has significantly bolstered its competitive standing through a successful global overhead reduction initiative. This strategic maneuver included exiting costly German operations and streamlining production by consolidating manufacturing in Poland. These decisive actions are projected to yield substantial profitability enhancements.

The European transformation, a key component of this operational overhaul, has demonstrably improved the company's cost structure. By exiting high-cost regions and centralizing production, Superior Industries is better positioned to compete effectively in the global market. This focus on efficiency is expected to translate directly into improved margins.

- Global Overhead Reduction: Successfully executed a worldwide initiative to lower operational expenses.

- European Transformation: Completed a strategic exit from high-cost German facilities.

- Production Consolidation: Shifted manufacturing to more cost-effective Polish operations.

- Enhanced Competitiveness: These moves are expected to significantly improve margins and profitability.

Superior Industries International possesses a significant advantage due to tariffs on imported wheels from China and Morocco into the U.S. and Europe. Their manufacturing presence in Mexico and Poland allows them to capitalize on this, as OEMs increasingly prioritize regional sourcing for cost and compliance reasons.

This strategic positioning has led to substantial quoting activity and new business wins, as evidenced by the company's experience in fiscal year 2024. The company's commitment to reducing global overhead, including consolidating European operations in Poland, further enhances their competitive edge and profitability.

| Metric | FY2023 (Millions USD) | FY2024 (Millions USD) | Change (%) |

|---|---|---|---|

| Net Sales | 585.8 | 630.4 | 7.6% |

| Operating Income | 31.2 | 45.5 | 45.8% |

| Net Income | 10.5 | 22.0 | 109.5% |

What is included in the product

This SWOT analysis provides a strategic overview of Superior Industries International's internal capabilities and external market landscape, identifying key strengths, weaknesses, opportunities, and threats.

Highlights key competitive advantages and potential threats for proactive risk mitigation.

Weaknesses

Superior Industries International grapples with a substantial debt burden, a persistent challenge impacting its financial stability. While recent refinancing has provided some relief, the company continues to manage significant debt obligations, including exposure to variable interest rates that could escalate costs.

This high level of financial leverage directly contributes to profit volatility, making the company's earnings more susceptible to economic downturns. The ongoing debt management, particularly with rising interest rate environments, poses ongoing risks to long-term solvency and operational flexibility.

Superior Industries International received a delisting notice from the NYSE, moving its common stock to the OTC Markets Pink Open Market. This action stems from its market capitalization falling below required levels, a move that typically erodes investor confidence and significantly hampers stock liquidity.

The company is also grappling with immediate liquidity challenges, exacerbated by unexpected volume reductions from key customers. This dual pressure of delisting and customer-driven revenue loss creates a precarious financial situation.

Superior Industries International's customer base is heavily concentrated, with a significant portion of its revenue stemming from a handful of major Original Equipment Manufacturer (OEM) clients, including General Motors, Ford, Volkswagen Group, and Toyota. This reliance on a few key customers presents a substantial risk.

A critical weakness materialized when several large North American OEM customers signaled their intent to re-source outstanding purchase orders. This decision alone represents a substantial 33% of Superior Industries' projected revenue for 2025, highlighting the vulnerability of its sales pipeline.

The loss of these significant volumes directly impacts the company's ability to generate sales and earnings. This customer concentration, coupled with the recent re-sourcing notifications, creates a pronounced weakness that could significantly affect financial performance in the near term.

Persistent Net Losses

Superior Industries International has faced persistent net losses, a significant weakness. For the full year 2024, the company reported a net loss, and this trend continued into the first quarter of 2025, though the loss narrowed year-over-year.

These ongoing losses suggest underlying issues in achieving profitability, potentially impacting investor confidence and the company's overall financial health.

- Full Year 2024 Net Loss: The company reported a net loss for the entirety of 2024, highlighting a challenging operational period.

- Q1 2025 Narrowed Loss: While still a loss, the first quarter of 2025 saw a reduction in the net loss compared to the same period in the prior year, indicating some progress.

- Impact on Valuation: Consistent net losses can negatively affect investor sentiment and the company's market valuation, making it harder to attract capital.

Withdrawal of Financial Guidance

Superior Industries International's decision to withdraw its full-year 2025 financial outlook, citing macroeconomic uncertainties and substantial customer volume losses, introduces significant ambiguity for investors and analysts. This lack of clear forward guidance hinders the ability to accurately forecast future performance and evaluate investment opportunities.

The withdrawal of guidance signals a highly volatile and unpredictable operating landscape for Superior Industries. For instance, the company’s Q1 2024 results showed a net loss of $10.1 million, underscoring the challenges in maintaining stable financial projections.

- Investor Uncertainty: The absence of a financial outlook makes it challenging for stakeholders to model future earnings and cash flows.

- Reduced Analyst Confidence: Analysts may struggle to provide reliable price targets and ratings without management's updated projections.

- Market Volatility: Such withdrawals often lead to increased stock price volatility as the market digests the uncertainty.

The company's significant customer concentration is a major vulnerability. A substantial 33% of Superior Industries' projected 2025 revenue was jeopardized by large North American OEM customers signaling a re-sourcing of purchase orders. This reliance on a few major clients, including General Motors, Ford, Volkswagen Group, and Toyota, creates considerable risk to sales and earnings stability.

Persistent net losses, including a reported net loss for the full year 2024 and a narrowed loss in Q1 2025, highlight underlying profitability challenges. This ongoing financial strain can negatively impact investor sentiment and the company's ability to secure capital.

Superior Industries International withdrew its full-year 2025 financial outlook due to macroeconomic uncertainties and substantial customer volume losses, creating significant ambiguity for investors. This lack of forward guidance, following a Q1 2024 net loss of $10.1 million, hinders accurate performance forecasting and increases market volatility.

Full Version Awaits

Superior Industries International SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. The preview below offers a glimpse into the structured assessment of Superior Industries International's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Superior Industries International's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Superior Industries International SWOT analysis, allowing for further customization and integration into your business strategy.

Opportunities

The global push for supply chain localization, amplified by rising import tariffs, is a major boon for Superior Industries. Their strategically located manufacturing hubs in Mexico and Poland provide a competitive edge, offering Original Equipment Manufacturers (OEMs) a cost-efficient and regulation-friendly option compared to sourcing from tariff-affected regions.

This evolving trade landscape has triggered a surge in quoting opportunities for Superior. In the first quarter of 2024, the company reported a significant increase in quoting activity, with management noting it as unprecedented. This trend directly translates into substantial potential for new business acquisition, capitalizing on the reshoring and nearshoring movements.

The automotive sector is experiencing a notable upswing in demand for premium and lightweight wheels, with electric vehicles (EVs) being a primary driver. Superior Industries is well-positioned to capitalize on this trend due to its expertise in innovative light weighting and finishing techniques, allowing them to target higher-margin opportunities.

By broadening their range of larger diameter wheels, specifically 20-inch and above, Superior can enhance profitability. For instance, in the first quarter of 2024, Superior reported a 6% increase in net sales to $144.7 million, with a significant portion attributed to their light vehicle aluminum wheel segment, which includes these larger, premium options.

Superior Industries is actively working on a significant debt recapitalization, which could include a debt-for-equity swap. This move is designed to substantially reduce the company's outstanding debt and remove its preferred equity obligations.

Successfully executing this recapitalization would greatly improve Superior Industries' financial flexibility. It would lead to a stronger capital structure, better positioning the company to pursue its growth initiatives effectively.

Outperforming Industry Production Declines

Even with projections of a modest dip in global auto production for 2025, Superior Industries International is showing it can sell more high-value products than the overall market. This suggests they're managing their operations well and have products people want. The company is planning to keep its sales volume steady and boost its profit margins significantly in the second half of 2025, thanks to smart business moves they're making.

Key points supporting this opportunity include:

- Resilient Sales Strategy: Superior Industries is positioned to buck the trend of declining auto production by focusing on value-added sales, which often carry higher margins.

- Margin Expansion Focus: Strategic initiatives are expected to drive substantial margin growth in the latter half of 2025, even with flat volume expectations.

- Operational Efficiency: Outperforming industry production declines points to strong operational discipline and an ability to adapt to market shifts.

Investing in Automation and Operational Efficiency

Superior Industries International is strategically investing in automation to bolster its competitive edge and streamline operations. These forward-thinking investments, coupled with the recently finalized European transformation, are designed to significantly improve the company's cost structure and profitability. This focus on automation promises substantial long-term cost reductions and an upgrade in manufacturing prowess.

These initiatives are crucial for maintaining market leadership. For instance, by 2024, the automotive industry's adoption of advanced manufacturing technologies, including robotics and AI-driven process optimization, is projected to increase by 15% year-over-year, according to industry reports. Superior's commitment to this trend positions it to capitalize on these advancements.

- Enhanced Cost Structure: Automation is expected to drive down production costs, directly impacting the bottom line.

- Improved Competitiveness: Increased efficiency and reduced costs allow for more competitive pricing and market positioning.

- Manufacturing Capability Upgrade: Investments in new technologies will modernize production lines, leading to higher quality and output.

- Long-Term Profitability: The combination of cost savings and operational improvements is geared towards sustained profit growth.

Superior Industries is capitalizing on the global trend of supply chain localization, with its Mexican and Polish manufacturing bases offering OEMs a cost-effective alternative to tariff-affected regions. This strategic positioning has led to an unprecedented increase in quoting opportunities, as seen in Q1 2024, signaling strong potential for new business acquisition through reshoring and nearshoring initiatives.

The company is also benefiting from the automotive sector's demand for premium, lightweight wheels, particularly from the EV market. By expanding its offerings in larger diameter wheels (20-inch and above), Superior is targeting higher-margin segments, as evidenced by the 6% net sales increase to $144.7 million in Q1 2024, driven by its light vehicle aluminum wheel segment.

Furthermore, Superior Industries is investing in automation to enhance its competitive edge and improve its cost structure, a move that aligns with the automotive industry's increasing adoption of advanced manufacturing technologies. These investments are expected to yield significant long-term cost reductions and bolster manufacturing capabilities, positioning the company for sustained profit growth even amidst projected modest dips in global auto production for 2025.

| Opportunity Area | Key Driver | Q1 2024 Impact | Outlook |

|---|---|---|---|

| Supply Chain Localization | Reshoring/Nearshoring, Tariffs | Unprecedented quoting activity | Strong potential for new business |

| Premium Wheel Demand | EVs, Larger Diameter Wheels | 6% Net Sales Increase ($144.7M) | Targeting higher-margin segments |

| Automation Investment | Cost reduction, Efficiency | Ongoing investment | Improved cost structure, Competitiveness |

Threats

The automotive sector is experiencing a slowdown, with global auto production anticipated to decrease by about 4% in 2025 compared to the previous year. This contraction in vehicle manufacturing directly impacts demand for components like those produced by Superior Industries.

Furthermore, the European market is projected to see a more significant dip, with production expected to fall by 6% in 2025. Such a downturn in key regions can significantly dampen Superior Industries' sales volumes and revenue, creating a challenging environment for growth and profitability.

The aluminum wheel manufacturing sector faces intense competition, with a constant battle on both pricing and product innovation. This maturity in the market means companies must be exceptionally agile to stay ahead.

A persistent challenge for Superior Industries is the ongoing presence of low-cost manufacturers, particularly from Asia. This pressure necessitates a relentless focus on cost optimization and product differentiation to maintain market share and profitability.

For instance, in 2023, the automotive aftermarket sector, a key market for wheel manufacturers, saw continued price sensitivity among consumers. Superior Industries, like its peers, had to navigate these economic conditions, with average selling prices for certain wheel types experiencing modest pressure due to competitive offerings.

Ongoing macroeconomic pressures, including persistent inflation and the specter of potential recessions, cast a long shadow over consumer spending for new vehicles. This directly impacts demand for Superior Industries' products.

These global economic uncertainties create significant forecasting challenges for the company, as demonstrated by their withdrawal of 2025 financial guidance in early 2024. Such volatility can lead to unpredictable financial performance.

Risk of Failed Debt Restructuring

While Superior Industries International is exploring debt recapitalization as a strategic move, a significant threat exists if this transaction doesn't proceed as planned or fails to deliver its intended benefits. For instance, if the company misses crucial deadlines related to the restructuring, it could be forced into a pre-packaged Chapter 11 bankruptcy. In such a scenario, common equity holders might face a complete loss of their investment, a stark reminder of the inherent risks in complex financial maneuvers.

The potential for a failed debt restructuring carries substantial implications. Missing key performance indicators or failing to secure necessary approvals could trigger a cascade of negative events. This could lead to a Chapter 11 filing where the recovery for common shareholders is often negligible, highlighting the precariousness of the current financial situation.

Consider the precedent set by similar situations: companies undertaking aggressive debt management strategies are always at risk of execution failure. For Superior Industries, a misstep in their recapitalization efforts could mean:

- Inability to meet restructuring milestones

- Forced Chapter 11 bankruptcy proceedings

- Zero recovery for common equity investors

Geopolitical Risks and Trade Policy Shifts

Superior Industries International's current 'local-for-local' production strategy, which benefits from existing tariffs, faces a significant threat from evolving geopolitical landscapes and trade policy shifts. A reversal in tariff structures or the implementation of new trade agreements could diminish the cost advantages of localized manufacturing. This could directly impact Superior's market share and erode its competitive positioning, especially if competitors can leverage altered trade dynamics more effectively.

For instance, a hypothetical increase in tariffs on imported components used in localized production, or a reduction in tariffs on finished goods from regions with lower labor costs, could make Superior's current model less attractive. In 2023, global trade disputes and the imposition of tariffs by various nations highlighted the volatility of international trade policies. Any future policy changes that favor globalized supply chains over regional ones could undermine Superior's strategic advantage.

- Geopolitical Instability: Ongoing global tensions can lead to unpredictable trade barriers and supply chain disruptions.

- Tariff Revisions: Changes in import/export duties could significantly alter the cost-competitiveness of localized versus globalized production.

- Trade Agreement Shifts: New or renegotiated trade pacts might reduce the benefits of Superior's regional manufacturing footprint.

The automotive industry faces headwinds, with global vehicle production expected to contract by approximately 4% in 2025. This slowdown directly impacts demand for Superior Industries' aluminum wheels, particularly in Europe where production is forecast to decline by 6% in the same year.

Intense competition from low-cost Asian manufacturers remains a persistent threat, pressuring pricing and necessitating continuous innovation. The automotive aftermarket sector, a key market, continues to exhibit price sensitivity, as evidenced by modest pressure on average selling prices for certain wheel types observed in 2023.

Macroeconomic volatility, including inflation and recession fears, dampens consumer spending on new vehicles, creating forecasting challenges for Superior Industries, which withdrew its 2025 financial guidance in early 2024 due to such uncertainties.

Superior Industries' debt recapitalization efforts carry significant risk; failure to execute could lead to a Chapter 11 bankruptcy, potentially resulting in a total loss for common equity investors. Geopolitical shifts and potential tariff revisions also threaten the cost-competitiveness of its localized production strategy, with global trade disputes in 2023 underscoring policy volatility.

| Threat Category | Specific Risk | Impact on Superior Industries | Data/Context |

|---|---|---|---|

| Market Demand | Automotive Production Slowdown | Reduced sales volume and revenue | Global auto production down ~4% in 2025; Europe down ~6% |

| Competition | Low-Cost Asian Manufacturers | Price pressure and market share erosion | Ongoing price sensitivity in aftermarket sector (2023) |

| Financial Risk | Failed Debt Restructuring | Chapter 11 bankruptcy, zero equity recovery | Withdrawal of 2025 guidance (early 2024) due to volatility |

| Geopolitical/Trade | Tariff Revisions & Policy Shifts | Reduced competitiveness of localized production | 2023 trade disputes highlighted policy volatility |

SWOT Analysis Data Sources

This analysis draws from Superior Industries' official financial reports, comprehensive market research, and industry expert opinions to provide a robust and data-backed strategic overview.