Superior Industries International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

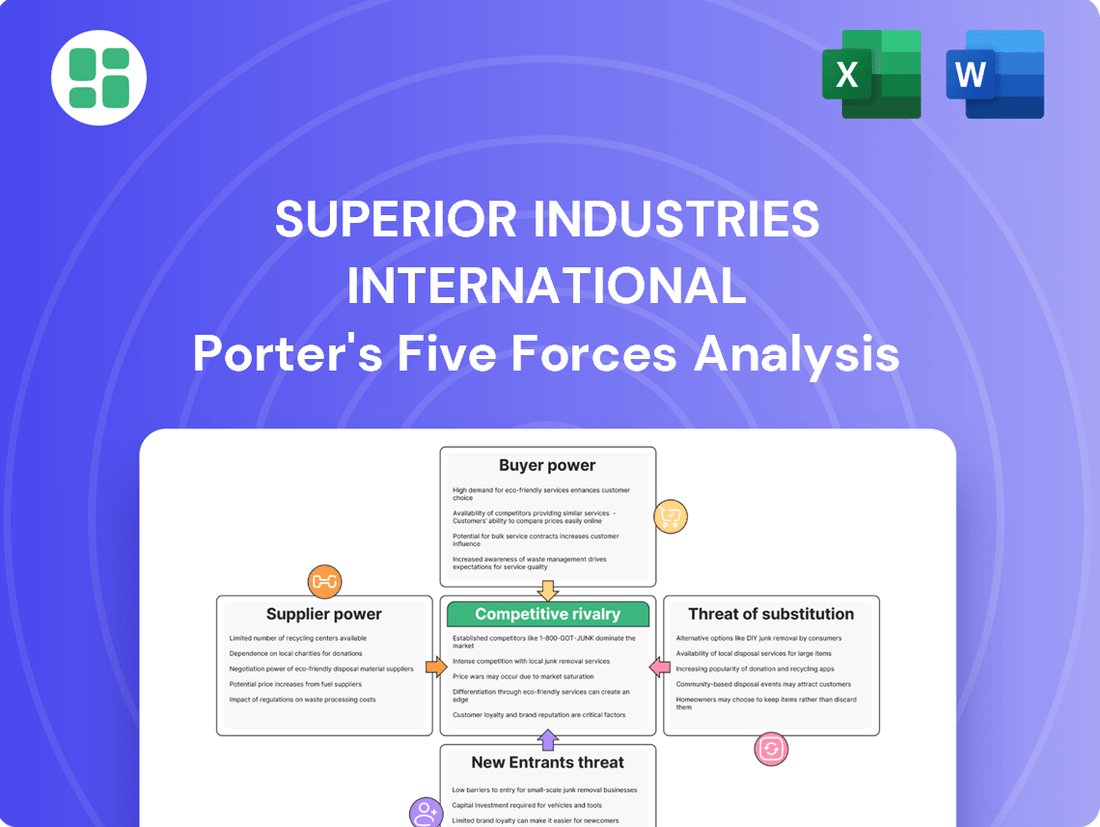

Superior Industries International faces moderate buyer power, as customers have some alternatives, but brand loyalty and product differentiation can mitigate this. The threat of new entrants is also a key consideration, with capital requirements and established brand recognition posing barriers.

The complete report reveals the real forces shaping Superior Industries International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Superior Industries International's suppliers is significantly shaped by the concentration of aluminum providers. While aluminum itself is widely available, the specific alloys and stringent quality standards demanded by the automotive sector can narrow the field of approved suppliers, thereby enhancing their negotiating strength.

The landscape for Superior Industries is further complicated by trade policies. For instance, the US tariffs on aluminum imports, which have been a recurring factor in recent years including into 2024, can affect both the cost and the accessibility of raw materials. This situation often bolsters the position of domestic suppliers or those benefiting from advantageous trade pacts.

Superior Industries International faces moderate switching costs for its core raw material, aluminum. Shifting to a new aluminum supplier necessitates rigorous qualification of new materials and potential adjustments to manufacturing processes to ensure consistent product quality and performance. For instance, in 2024, the automotive industry's demand for specialized aluminum alloys meant that any supplier change for Superior would require extensive testing to meet stringent OEM specifications.

Despite these switching costs, Superior has implemented contractual price adjustment clauses with its original equipment manufacturer (OEM) customers. These clauses provide a degree of protection by allowing the company to pass on significant increases in aluminum prices, thereby mitigating the direct impact of supplier cost hikes on its profitability. This mechanism suggests a balanced negotiation dynamic where Superior can partially offset the bargaining power of its aluminum suppliers.

For Superior Industries International, the availability of substitutes for aluminum, their primary input, is a key factor in supplier bargaining power. While aluminum is cost-effective and performs well for high-volume automotive wheel production, emerging alternatives like carbon fiber and magnesium alloys are gaining traction in niche, high-performance sectors. For instance, in 2024, the automotive industry continued to explore advanced materials, with some luxury and electric vehicle manufacturers increasing their use of carbon fiber composites, which could eventually impact aluminum demand.

Importance of Superior's Business to Suppliers

Superior Industries, as a major global supplier of aluminum wheels to original equipment manufacturers (OEMs), represents a significant customer for its raw material providers, particularly those focused on automotive-grade aluminum. This substantial business volume can foster more equitable negotiations. For instance, in 2023, the automotive industry's demand for aluminum was robust, with global aluminum consumption in the sector reaching over 20 million metric tons.

However, the bargaining power of suppliers can still be considerable, especially for large, diversified aluminum producers. Their scale of operations and extensive global supply chains can give them an advantage in price and supply negotiations. These suppliers often cater to multiple industries, reducing their reliance on any single customer like Superior Industries.

- Significant Customer Base: Superior Industries' substantial order volumes make it a key client for automotive-grade aluminum suppliers.

- Industry Dependence: The automotive sector's reliance on aluminum for lightweighting vehicles underscores the importance of aluminum suppliers.

- Supplier Scale: Large, globally integrated aluminum producers can leverage their size to influence pricing and terms.

- Market Dynamics: Fluctuations in aluminum prices, influenced by global supply and demand, directly impact supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of aluminum suppliers integrating forward into complex automotive wheel manufacturing for companies like Superior Industries is generally low. This is primarily because producing these wheels requires highly specialized design, intricate engineering, and rigorous testing capabilities, which are not core competencies for most raw material producers.

Furthermore, the substantial capital investment needed for advanced manufacturing facilities, including sophisticated machinery and quality control systems, presents a significant hurdle for potential entrants. For instance, a typical automotive wheel manufacturing plant can involve hundreds of millions of dollars in upfront costs.

While raw material producers possess the financial capacity to move downstream, the deeply entrenched relationships with Original Equipment Manufacturers (OEMs) and the unique technical expertise demanded in automotive wheel production create formidable barriers to entry. These barriers protect existing players like Superior Industries from direct competition from their own suppliers.

- Specialized Capabilities: Automotive wheel manufacturing demands advanced design, engineering, and testing, areas typically outside raw material suppliers' expertise.

- High Capital Investment: Setting up modern wheel production facilities requires significant capital, often hundreds of millions of dollars, acting as a deterrent.

- OEM Relationships: Established trust and long-term contracts between existing wheel manufacturers and automotive OEMs are difficult for new entrants to replicate.

- Technical Expertise: The intricate knowledge of metallurgy, manufacturing processes, and regulatory compliance specific to automotive wheels is a key barrier.

The bargaining power of Superior Industries' suppliers is moderate, influenced by factors like supplier concentration and switching costs. While aluminum is a commodity, specialized automotive grades and trade policies, such as US tariffs on aluminum imports in 2024, can shift leverage towards suppliers.

Superior's substantial order volumes for automotive-grade aluminum, exceeding 20 million metric tons globally in 2023 for the sector, give it some negotiation strength. However, large, diversified aluminum producers can still exert considerable influence due to their scale and reduced reliance on any single customer.

The threat of suppliers integrating forward into wheel manufacturing is low, given the high capital investment and specialized expertise required. These barriers protect companies like Superior from direct competition from their raw material providers.

| Factor | Impact on Supplier Bargaining Power | Notes |

| Supplier Concentration | Moderate to High | Limited number of approved automotive-grade aluminum suppliers. |

| Switching Costs | Moderate | Requires material qualification and process adjustments. |

| Customer Volume (Superior) | Moderate | Superior is a key client for automotive aluminum. |

| Supplier Scale | High | Large producers serve multiple industries, reducing dependency. |

| Trade Policies (e.g., US Tariffs) | High | Affects raw material cost and availability, empowering domestic suppliers. |

| Availability of Substitutes | Low to Moderate | Aluminum is dominant, but alternatives like carbon fiber are emerging. |

| Threat of Forward Integration | Low | High capital and specialized expertise needed for wheel manufacturing. |

What is included in the product

This analysis of Superior Industries International reveals the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the automotive wheel manufacturing industry.

Instantly understand competitive pressures within the automotive wheel industry, allowing Superior Industries to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Superior Industries' customer base is heavily concentrated among major Original Equipment Manufacturers (OEMs) like BMW, Daimler, Ford, GM, Toyota, and VW Group. In 2024, a few of these large automotive clients represented substantial portions of the company's annual consolidated net sales. This concentration directly translates into significant bargaining power for these customers.

Because these OEMs purchase wheels in exceptionally high volumes, they can leverage their purchasing power to negotiate more favorable terms, including pricing and delivery schedules, from Superior Industries. This dynamic places considerable pressure on Superior to remain competitive and responsive to the demands of its key automotive partners.

For Original Equipment Manufacturers (OEMs), the process of changing wheel suppliers is far from simple. It involves substantial investments in re-tooling production lines, redesigning vehicle components to integrate new wheels, and rigorous re-qualification processes to ensure compliance with strict automotive safety and performance standards. These hurdles significantly increase the cost and complexity of switching, thereby raising switching costs for Superior Industries' customers.

These elevated switching costs act as a crucial buffer for Superior Industries, effectively dampening the bargaining power of its OEM clients once a supply agreement is established. For example, in the automotive sector, the average cost to re-tool a production line can range from hundreds of thousands to millions of dollars, depending on the complexity of the components and the level of automation involved. This financial commitment makes OEMs hesitant to switch suppliers frequently, providing Superior with a degree of pricing power and contract stability.

Original Equipment Manufacturers (OEMs) in the automotive sector exhibit significant price sensitivity. This stems from the fiercely competitive nature of the vehicle market and the continuous drive to lower production expenses. For instance, the average profit margin for automotive OEMs can be quite thin, making every cost component, including wheels, a critical negotiation point.

This sensitivity is further amplified by projected declines in OEM production volumes. With an anticipated drop in overall vehicle output for 2025, wheel suppliers like Superior Industries face intensified pressure to offer highly competitive pricing to secure business and maintain market share.

Availability of Alternative Suppliers

The availability of alternative suppliers significantly impacts the bargaining power of customers, particularly original equipment manufacturers (OEMs) in the automotive industry. OEMs often maintain relationships with multiple qualified suppliers to mitigate risks and to foster a competitive environment. This practice directly enhances their leverage when negotiating pricing and terms.

For Superior Industries International, a key player in aluminum wheel manufacturing, the presence of other global aluminum wheel producers means that OEMs are not solely reliant on Superior. This competitive landscape allows OEMs to compare offerings, negotiate more aggressively, and potentially switch suppliers if terms are not met. For instance, in 2024, the automotive supply chain continued to emphasize diversification, with many OEMs actively seeking to broaden their supplier base to avoid disruptions, further strengthening customer bargaining power.

- OEMs diversify supplier bases to enhance negotiation leverage.

- Global competition among aluminum wheel manufacturers provides OEMs with alternatives.

- The ability to switch suppliers increases customer bargaining power for favorable terms.

Threat of Backward Integration by Customers

The threat of original equipment manufacturers (OEMs) backward integrating into aluminum wheel production for companies like Superior Industries is generally considered low. This is primarily because wheel manufacturing demands highly specialized expertise, substantial capital investment, and a dedicated focus that most automakers find impractical to develop internally.

Automakers typically choose to outsource the production of non-core components, such as aluminum wheels, to specialized suppliers. This strategy allows them to concentrate their resources and efforts on their core competencies, which include vehicle design, engineering, assembly, and marketing. For instance, in 2024, the automotive supply chain continues to emphasize specialization, with OEMs relying on partners for complex manufacturing processes.

- Low Expertise: OEMs generally lack the deep, specialized knowledge in metallurgy, casting, machining, and finishing required for high-volume aluminum wheel production.

- High Capital Outlay: Establishing and maintaining state-of-the-art aluminum wheel manufacturing facilities requires significant upfront investment in specialized machinery and technology.

- Focus on Core Competencies: Automakers prioritize their core business of vehicle design, assembly, and brand management, viewing wheel production as a peripheral activity.

- Supplier Relationships: Established relationships with dedicated wheel suppliers like Superior Industries provide OEMs with flexibility, scalability, and access to innovation without the burden of in-house manufacturing.

Superior Industries faces considerable customer bargaining power due to its concentrated customer base among major OEMs like BMW, Ford, and Toyota. These large automotive clients, purchasing wheels in massive volumes, can negotiate favorable pricing and terms, putting pressure on Superior to remain competitive. For instance, in 2024, a few key OEMs accounted for substantial portions of Superior's net sales, directly amplifying their leverage.

While OEMs face high switching costs, estimated in the hundreds of thousands to millions of dollars for re-tooling, their price sensitivity remains high given thin profit margins in the competitive automotive market. Projected production volume declines in 2025 will likely intensify this pressure, making pricing a critical negotiation point for Superior Industries.

The availability of alternative suppliers further strengthens customer bargaining power. OEMs actively diversify their supplier bases to mitigate risks and foster competition, meaning they are not solely reliant on Superior. This global competitive landscape allows OEMs to negotiate more aggressively, as seen in 2024 when many sought broader supplier diversification.

| Factor | Impact on Superior Industries | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High bargaining power for key OEMs | Major OEMs represented significant portions of net sales. |

| Purchasing Volume | Leverage for price and term negotiation | High volume purchases by OEMs. |

| Switching Costs | Dampens bargaining power once established | Millions of dollars in re-tooling costs for OEMs. |

| Price Sensitivity | Intensifies negotiation pressure | Thin profit margins for OEMs. |

| Alternative Suppliers | Increases customer leverage | OEMs actively diversifying supplier bases. |

Full Version Awaits

Superior Industries International Porter's Five Forces Analysis

This preview showcases the complete Superior Industries International Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the automotive wheel industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into industry attractiveness and strategic positioning.

Rivalry Among Competitors

The automotive aluminum wheel market features a moderate number of substantial global competitors. Key players such as Maxion Wheels, Enkei, Ronal Group, Borbet, and Accuride compete directly with Superior Industries International. This concentration of significant entities suggests a dynamic environment where market share is actively contested.

The global automotive wheel market is experiencing robust expansion. Projections indicate the automotive wheel rims market will reach $45.21 billion by 2025, growing at a compound annual growth rate (CAGR) of 8.0%. The broader automotive wheel market is anticipated to see a 5.5% CAGR from 2025 through 2034.

This significant industry growth can act as a moderating force on competitive rivalry. As the market expands, companies may find opportunities to increase their market share through expansion rather than engaging in aggressive competition for a static customer base.

Superior Industries International actively differentiates its aluminum wheels beyond basic functionality. They focus on sophisticated design, rigorous engineering, and advanced testing, incorporating lightweighting and specialized finishing techniques. This approach aims to set their products apart in a market that could otherwise appear commoditized.

While these product features offer differentiation, the real strength for Superior lies in the high switching costs for Original Equipment Manufacturers (OEMs). Once a specific wheel design is deeply integrated into a vehicle's platform, changing suppliers becomes a complex and costly undertaking. This integration creates significant customer loyalty and makes it challenging for competitors to win over existing contracts.

Exit Barriers

Exit barriers in the automotive wheel manufacturing sector are substantial. Companies face immense capital outlays for advanced manufacturing plants and specialized equipment, often running into hundreds of millions of dollars. For instance, establishing a state-of-the-art aluminum wheel production facility can easily exceed $200 million.

Furthermore, long-term supply agreements with Original Equipment Manufacturers (OEMs) create significant contractual obligations. Breaking these contracts can result in hefty penalties, making a swift exit financially unviable. These high fixed costs and contractual ties mean that even during periods of low demand or profitability, firms are compelled to continue operations, intensifying competition.

- High Capital Investment: Significant upfront costs for manufacturing facilities and specialized machinery.

- Long-Term OEM Contracts: Binding agreements with automakers that are costly to terminate.

- Specialized Assets: Machinery and tooling are often specific to automotive wheel production, limiting resale value.

- Workforce Expertise: Skilled labor and established supply chains are difficult and expensive to dismantle or transfer.

Strategic Commitments and Market Share Objectives

Superior Industries International has demonstrated significant strategic commitments, evident in its 2024 European manufacturing footprint transformation and successful debt refinancing. These moves are designed to bolster its competitive standing and improve profitability. For instance, the company's ongoing efforts to optimize its production capabilities across Europe signal a long-term investment in its operational efficiency and market reach.

This aggressive strategic positioning is mirrored by its competitors, who are also heavily investing in technological advancements and expanding their global presence. The automotive wheel industry, where Superior operates, is characterized by intense rivalry. Companies are continuously vying to secure and grow their market share, making it a dynamic and challenging landscape. This ongoing competition necessitates constant innovation and strategic adaptation from all players.

- Strategic Investments: Superior Industries' 2024 initiatives, including European manufacturing restructuring and debt refinancing, underscore its commitment to enhancing its competitive edge.

- Competitor Actions: Rival companies are also making substantial investments in technology and expanding their international operations to capture greater market share.

- Market Share Focus: The industry's competitive nature means that securing and growing market share is a primary objective for all participants, fueling ongoing rivalry.

Competitive rivalry within the automotive aluminum wheel market is intense, driven by a moderate number of large global players like Maxion Wheels and Enkei, all vying for market share. Superior Industries International differentiates itself through advanced design and engineering, but the high switching costs for Original Equipment Manufacturers (OEMs) due to integration into vehicle platforms create strong customer loyalty for existing suppliers. This dynamic, coupled with significant exit barriers such as massive capital investments exceeding $200 million for new plants and long-term OEM contracts, compels companies to remain competitive even during downturns, intensifying the struggle for dominance.

| Competitor | Estimated 2024 Market Share (approx.) | Key Differentiators |

|---|---|---|

| Maxion Wheels | 15-20% | Global scale, broad product portfolio |

| Enkei | 10-15% | Performance and aftermarket focus, lightweight technology |

| Ronal Group | 8-12% | European presence, OEM and aftermarket supply |

| Borbet | 7-10% | Lightweight alloy wheels, OE supplier |

| Accuride | 5-8% | Commercial vehicle wheels, growing light vehicle presence |

| Superior Industries International | 3-5% | Design innovation, OEM integration, European expansion |

SSubstitutes Threaten

The primary substitute for aluminum wheels is steel. While steel wheels are generally heavier and offer less aesthetic variety, they are a more budget-friendly option. This cost advantage makes them prevalent on entry-level vehicles.

However, the automotive industry's strong push towards lightweighting to boost fuel efficiency and enhance performance significantly favors aluminum. In 2024, the average vehicle weight reduction targets continue to drive demand for lighter materials like aluminum in wheel manufacturing.

Aluminum wheels offer substantial performance and aesthetic advantages over traditional steel wheels. Their lighter weight directly translates to better fuel economy, improved vehicle handling, and quicker acceleration. Furthermore, aluminum's malleability allows for more intricate and appealing designs, enhancing a vehicle's visual appeal.

Emerging materials like carbon fiber and magnesium alloys present even more compelling lightweighting solutions. While these advanced materials are currently more prevalent in high-performance and luxury vehicle segments due to their higher cost, they represent a growing threat of substitution for aluminum wheels. For instance, by 2024, the global carbon fiber market is projected to reach over $2.5 billion, indicating increasing adoption in automotive applications.

Customers, both original equipment manufacturers (OEMs) and those in the aftermarket, constantly evaluate the price versus performance of various wheel materials. For instance, in 2024, the significant cost difference between steel wheels and aluminum alloy wheels often leads consumers to choose aluminum for its lighter weight, improved fuel efficiency, and enhanced aesthetics, despite the premium price.

While aluminum offers a compelling balance, even higher-performing materials like carbon fiber and magnesium present a steeper price point. These advanced materials, though offering superior weight reduction and strength, are typically reserved for high-performance vehicles or specialized applications due to their substantially higher manufacturing costs, limiting their broad market penetration in 2024.

Customer Willingness to Adopt Substitutes

Customer willingness to adopt substitutes for wheels is highly dependent on the vehicle type and what the buyer wants. For instance, in the entry-level car market, where price is a major factor, original equipment manufacturers (OEMs) and buyers might lean towards steel wheels because they are generally cheaper.

However, the picture changes significantly for mid-range to luxury vehicles. Here, the desire for lighter weight, better fuel efficiency, and a more premium look often drives demand for aluminum wheels. This trend is even more pronounced in the electric vehicle (EV) sector, where weight reduction is critical for maximizing range. There's also a growing interest in more advanced materials for their performance benefits.

- Vehicle Segment Impact: Entry-level vehicles favor cost-effective steel, while luxury and EV segments prioritize aluminum for weight and performance.

- Material Preferences: Aluminum remains dominant for aesthetic and performance-driven mid-range to luxury vehicles and EVs.

- Emerging Trends: Advanced materials are gaining traction for their performance enhancements, particularly in performance-oriented vehicles.

- Cost vs. Benefit: While steel offers a lower initial cost, aluminum's benefits in weight reduction and performance often justify its higher price, especially in higher-tier vehicle segments.

Technological Advancements in Substitutes

Technological progress is a key driver in the threat of substitutes for Superior Industries International. For instance, advancements in materials like carbon fiber and magnesium alloys, coupled with more efficient manufacturing, are making them increasingly viable alternatives to traditional alloy wheels.

These material innovations can lead to lighter, stronger, and potentially more aesthetically pleasing wheel options. For 2024, the automotive sector saw continued investment in lightweighting technologies, with a focus on reducing vehicle emissions and improving fuel efficiency, directly impacting the appeal of alternative wheel materials.

Even innovations within steel wheel technology, aiming to reduce weight or enhance visual appeal, could pose a threat. While current market trends lean towards alloy wheels, ongoing R&D in steel could reintroduce it as a more competitive substitute in certain vehicle segments.

- Advancements in Carbon Fiber and Magnesium Alloys: Ongoing improvements in manufacturing processes and cost reductions are making these materials more competitive as wheel substitutes.

- Lightweighting Trends in Automotive: The industry's focus on reducing vehicle weight for emissions and efficiency gains in 2024 directly benefits lighter substitute materials.

- Steel Wheel Innovations: Developments in steel wheel technology, such as weight reduction and aesthetic enhancements, could present a future threat.

The threat of substitutes for aluminum wheels is moderate, primarily stemming from steel wheels and emerging advanced materials. Steel wheels offer a significant cost advantage, making them a viable option for entry-level vehicles where price sensitivity is high. However, the automotive industry's strong emphasis on lightweighting for fuel efficiency and performance, a trend amplified in 2024, favors aluminum.

Advanced materials like carbon fiber and magnesium alloys present a more significant, albeit niche, threat. While currently more expensive, their superior weight reduction and performance characteristics are increasingly adopted in high-performance and electric vehicles. For example, the global carbon fiber market was projected to exceed $2.5 billion in 2024, indicating its growing automotive relevance.

Customer preference for substitutes is heavily influenced by vehicle segment and desired attributes. Entry-level segments often opt for steel due to cost, whereas mid-range and luxury segments, including the EV market, increasingly favor aluminum for its performance and aesthetic benefits. This dynamic suggests that while steel remains a substitute, the trend towards performance and efficiency is bolstering aluminum's position.

| Substitute Material | Key Advantages | Key Disadvantages | Market Segment Relevance | 2024 Trend Impact |

| Steel Wheels | Lower Cost | Heavier, Less Aesthetic Variety | Entry-Level Vehicles | Cost-conscious demand persists |

| Carbon Fiber | Extremely Lightweight, High Strength | High Cost, Complex Manufacturing | High-Performance, Luxury, EVs | Growing adoption due to lightweighting push |

| Magnesium Alloys | Lightweight, Good Strength-to-Weight Ratio | Higher Cost than Aluminum, Corrosion Potential | Performance Vehicles | Increasing consideration for specialized applications |

Entrants Threaten

The automotive aluminum wheel manufacturing sector demands considerable capital. Companies need to invest heavily in sophisticated machinery for casting and forging, alongside robust testing equipment. For instance, a new, state-of-the-art aluminum wheel production line can easily cost tens of millions of dollars, making it a significant hurdle for newcomers.

Established manufacturers like Superior Industries International leverage significant economies of scale. This advantage is particularly pronounced in raw material procurement, such as aluminum, where bulk purchasing by incumbents leads to lower per-unit costs compared to smaller, newer entrants. In 2023, the automotive wheel market saw continued consolidation, with larger players benefiting from their established supply chains.

Securing access to established original equipment manufacturer (OEM) supply chains and cultivating enduring relationships with major automotive manufacturers presents a significant hurdle for potential new entrants. Superior Industries has spent years building a diverse global customer base across North America and Europe, including key OEMs, making it difficult for newcomers to replicate this network.

Proprietary Technology and Expertise

The development and production of advanced aluminum wheels, particularly those utilizing proprietary technologies like flow forming or sophisticated 3D printing for complex designs, represent a substantial barrier for potential new entrants. Superior Industries International, for instance, has invested significantly in its engineering capabilities and manufacturing processes to maintain its edge. In 2024, the automotive industry's increasing demand for lightweight components continues to drive innovation in wheel manufacturing, requiring newcomers to either possess or acquire similar technological prowess and specialized knowledge to even enter the market.

This high level of technical sophistication translates into considerable upfront investment for any aspiring competitor. Acquiring or developing the necessary design, engineering, and advanced manufacturing expertise is a significant hurdle. For example, companies specializing in additive manufacturing for automotive parts saw substantial growth in 2024, but the specific application to high-volume, high-performance wheels still requires specialized know-how that is not easily replicated.

- Proprietary Technology: Access to patented designs and advanced manufacturing techniques like flow forming or specialized casting methods is crucial.

- Engineering Expertise: A deep understanding of metallurgy, stress analysis, and vehicle dynamics is essential for developing competitive wheel products.

- R&D Investment: New entrants must commit substantial resources to research and development to match the innovation curves of established players.

- Capital Expenditure: The cost of setting up state-of-the-art manufacturing facilities capable of producing high-quality, lightweight wheels is a significant barrier.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the automotive supply sector, such as for Superior Industries International. The automotive industry is heavily regulated, with stringent safety standards, emissions controls, and fuel efficiency mandates that vary by region. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce emissions standards, requiring manufacturers to invest heavily in compliance technology.

Navigating these complex regulatory landscapes presents a substantial barrier for potential new entrants. These hurdles can involve lengthy approval processes, significant capital investment in research and development to meet new standards, and ongoing costs for compliance monitoring and reporting. These factors increase the overall cost and time required to establish a competitive presence, thereby deterring new players.

- Stringent Safety Standards: Requirements like those mandated by the National Highway Traffic Safety Administration (NHTSA) in the US necessitate advanced engineering and testing, adding to initial investment.

- Environmental Regulations: Compliance with emissions and fuel economy standards, such as the Corporate Average Fuel Economy (CAFE) standards, requires continuous technological upgrades, increasing operational costs for all players.

- Quality Certifications: Industry-specific certifications like IATF 16949 are often prerequisites for supplying major automakers, demanding robust quality management systems from the outset.

- Trade Policies and Tariffs: Changes in international trade agreements and tariffs can affect the cost of imported components and the competitiveness of domestic production, influencing entry decisions.

The threat of new entrants for Superior Industries International is relatively low due to substantial capital requirements and established economies of scale. Significant upfront investment in specialized machinery, advanced technology, and R&D is necessary, creating a high barrier. Furthermore, securing OEM supply chains and navigating stringent regulatory environments demands considerable time and resources, making market entry challenging for newcomers.

Porter's Five Forces Analysis Data Sources

Our Superior Industries Porter's Five Forces analysis is built upon a foundation of data from company annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and trade publications to capture a comprehensive view of the competitive landscape.