Superior Industries International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

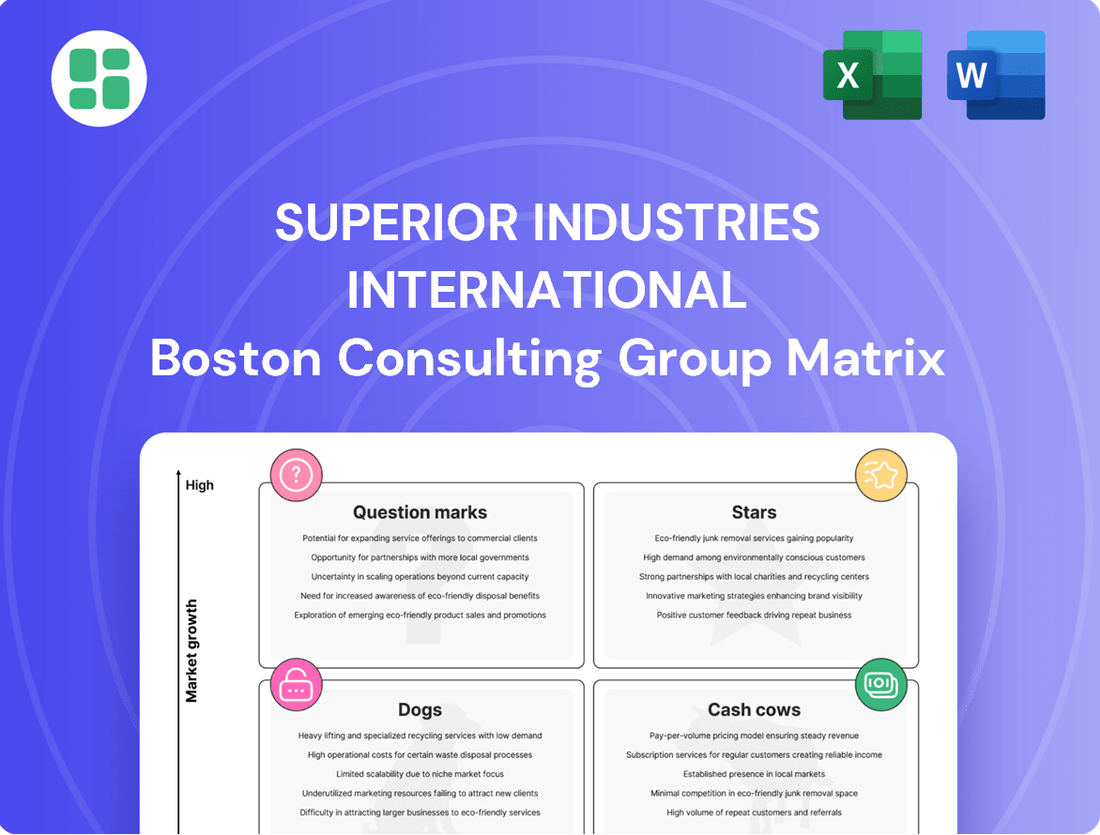

Discover the strategic landscape of Superior Industries International with our comprehensive BCG Matrix analysis. Understand which of their product lines are poised for growth as Stars, which are reliably generating cash as Cash Cows, and which may require divestment as Dogs.

This preview offers a glimpse into the core of Superior Industries' product portfolio. To unlock the full strategic advantage and make informed decisions about resource allocation and future investments, purchase the complete BCG Matrix report.

Don't miss out on the actionable insights that will guide your next strategic move. Get the full BCG Matrix today and transform your understanding of Superior Industries International's market position.

Stars

Superior Industries International is heavily invested in advanced lightweighting technologies. Their ALULITE™ patented mass reduction technology is a prime example, directly addressing the automotive industry's push for fuel efficiency and electric vehicles. This focus is critical as vehicle manufacturers strive to meet stringent emission regulations and enhance EV range.

The benefits of these lightweighting solutions are substantial. Significant mass savings translate directly into improved vehicle performance, particularly for electric vehicles where range anxiety remains a concern. As the automotive landscape continues its rapid transformation towards electrification, the demand for innovative wheel solutions like Superior's is projected to see robust and sustained growth.

Superior Industries International's premium wheel segment, encompassing 20-inch and larger wheels, is a significant growth driver, showcasing the company's strength in a high-value market. This segment's increasing sales contribution highlights a strategic focus on premium offerings.

These larger, premium wheels typically yield higher profit margins due to their sophisticated design, engineering, and finishing. For instance, in 2023, Superior Industries saw a notable increase in the average selling price of its wheels, driven by this premiumization trend.

The ongoing demand for vehicle customization and the desire for visually striking, high-performance wheels are key factors propelling growth in this lucrative category. This trend is expected to continue through 2024 and beyond.

Superior Industries International's focus on EV-specific wheel designs is a strategic move tapping into a booming market. The company's development of lightweight, aerodynamically optimized wheels directly addresses the needs of electric vehicle manufacturers seeking to improve battery efficiency and extend driving range. This specialization positions Superior to capitalize on the accelerating adoption of electric mobility.

Localized Production in High-Tariff Environments

Superior Industries International's strategically placed manufacturing hubs in Mexico and Poland are proving to be a significant advantage, particularly in markets with substantial tariffs on goods from countries like China and Morocco. This localized production model, often referred to as 'local-for-local,' allows Superior to navigate these trade barriers effectively.

This approach directly benefits Original Equipment Manufacturers (OEMs) by enabling them to comply with regional value content requirements, a crucial factor in securing new contracts. By producing closer to their end markets, Superior can offer more competitive pricing and reduce lead times, solidifying its position as a star performer in its BCG Matrix analysis.

- Strategic Location: Manufacturing facilities in Mexico and Poland reduce exposure to tariffs on imports from China and Morocco into the US and EU.

- Cost-Effectiveness: The 'local-for-local' model allows for more competitive pricing for customers.

- Meeting OEM Needs: Facilitates OEMs in meeting regional value content rules, a key criterion for new business.

- Trade Dynamic Response: Superior's positioning is a direct and effective response to evolving global trade policies.

New OEM Contracts Driven by Localization

Superior Industries International is experiencing a surge in new Original Equipment Manufacturer (OEM) contracts, largely fueled by the global push for production localization. The company reported an unprecedented level of quoting activity, leading to significant new business wins. A prime example is the recent 1.7 million-wheel deal secured with Volvo, directly attributed to automakers’ pressing need to establish local supply chains.

These strategic wins, especially in North America and Europe where tariff landscapes are particularly impactful, highlight Superior's expanding market share. The company is effectively capitalizing on high-growth segments where its established manufacturing presence is becoming indispensable for automotive manufacturers seeking to mitigate supply chain risks and costs.

- Localization Drive: OEMs are prioritizing regional production to navigate trade complexities and ensure supply chain resilience.

- Significant Wins: Superior secured a 1.7 million-wheel contract with Volvo, demonstrating its ability to meet large-scale localization demands.

- Geographic Strength: New contracts are concentrated in North America and Europe, regions with substantial tariff implications for imported components.

- Market Share Growth: These wins indicate an increasing presence in critical, high-growth automotive segments where local manufacturing is a key requirement.

Superior Industries International's premium wheel segment, focusing on 20-inch and larger wheels, is a clear star performer. This segment is experiencing robust growth, driven by consumer demand for customization and enhanced vehicle aesthetics. The higher profit margins associated with these premium offerings, as evidenced by an increase in average selling prices in 2023, further solidify its star status.

The company's strategic emphasis on lightweighting technologies, particularly its ALULITE™ patented mass reduction technology, also positions it as a star. This innovation directly addresses the automotive industry's critical need for fuel efficiency and improved electric vehicle range, a trend expected to accelerate through 2024 and beyond.

Superior's focus on EV-specific wheel designs is another key indicator of its star performance. By developing lightweight, aerodynamically optimized wheels, the company is directly catering to the burgeoning electric vehicle market, aiming to enhance battery efficiency and extend driving range.

The company’s strategically located manufacturing hubs in Mexico and Poland are a significant advantage, enabling it to effectively navigate tariffs and meet regional value content requirements for OEMs. This 'local-for-local' approach, coupled with strong new OEM contract wins, such as the 1.7 million-wheel deal with Volvo, underscores its star performer status by capitalizing on localization trends and expanding market share in key regions.

| Segment | Growth Trend | Profitability | Strategic Importance | BCG Status |

|---|---|---|---|---|

| Premium Wheels (20"+) | High, driven by customization | High margins | Addresses premiumization trend | Star |

| Lightweighting Technologies (ALULITE™) | High, driven by EV and efficiency needs | Enabling factor for premiumization | Critical for future automotive | Star |

| EV-Specific Wheel Designs | Very High, driven by EV adoption | Potential for high margins | Taps into booming EV market | Star |

| Localized Manufacturing (Mexico/Poland) | High, driven by trade policies | Cost-competitive, tariff avoidance | Key for OEM contract wins | Star |

What is included in the product

Superior Industries International's BCG Matrix provides a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Superior Industries International BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis for quick decision-making.

Cash Cows

Superior Industries' established OEM relationships for traditional aluminum wheels are a classic Cash Cow. These long-standing partnerships with major automakers in North America and Europe, supplying a vast array of light vehicles and commercial trucks, ensure a dominant market share within a mature segment of the automotive industry.

In 2024, Superior Industries continued to leverage these deep OEM ties, which are critical for their consistent revenue streams. The company’s focus on these stable, high-volume contracts provides a predictable and robust cash flow, even as the overall market for traditional wheels experiences slower growth.

Prior to experiencing customer volume losses in late 2024, Superior Industries International's North American Original Equipment Manufacturer (OEM) supply segment was a robust cash generator. This business unit, with its manufacturing operations strategically located in Mexico, historically commanded a significant share of the market, consistently contributing to the company's revenue stream.

For instance, in the fiscal year 2023, Superior Industries reported that its automotive wheel segment, which largely encompasses the North American OEM supply, generated $878.6 million in net sales. This segment benefited from strong demand and efficient production capabilities, solidifying its position as a key profit driver.

While recent contract losses, such as the previously announced discontinuation of supply to a major OEM customer in late 2024, have impacted volumes, the underlying manufacturing infrastructure and well-established supply chains remain. This suggests that the segment retains its potential as a cash cow, contingent upon securing new contracts or recovering lost volumes to stabilize operations.

Superior Industries' European aftermarket brands, ATS®, RIAL®, ALUTEC®, and ANZIO®, function as established cash cows within the company's portfolio. These brands serve a mature European market for replacement and upgrade wheels, a segment known for its stability and consistent demand, even if growth is modest.

The mature nature of this market means lower growth potential but also predictable revenue streams. Superior's established distribution networks for these brands contribute to their steady cash flow generation, requiring less aggressive marketing investment compared to their original equipment manufacturer (OEM) business.

In 2024, Superior Industries reported that its European aftermarket segment continued to be a significant contributor to overall revenue, demonstrating the resilience of these established brands in a competitive landscape. The consistent demand for replacement parts and aesthetic upgrades ensures these brands remain reliable profit generators.

Standard Cast Aluminum Wheel Production

Standard cast aluminum wheels represent Superior Industries International's core business, holding a significant market share within the mature automotive original equipment manufacturer (OEM) segment. This product line is a consistent cash generator, benefiting from streamlined production and predictable demand from vehicle manufacturers.

The company's established manufacturing capabilities and economies of scale in producing these wheels contribute to its profitability. For instance, in 2024, Superior Industries reported a notable portion of its revenue stemming from its OEM wheel segment, underscoring its strength in this area.

- High Market Share: Dominant position in the mature OEM cast aluminum wheel market.

- Consistent Demand: Stable revenue stream from long-term contracts with automotive manufacturers.

- Cash Generation: Reliable profits due to established, efficient production processes.

- Economies of Scale: Cost advantages derived from large-volume manufacturing.

Cost-Effective Manufacturing Footprint

Superior Industries International's cost-effective manufacturing footprint, particularly its facilities in Mexico and Poland, serves as a significant cash cow. These operations are highly efficient in producing large volumes of aluminum wheels, a core product line.

This optimized global presence, refined through strategic moves like the European transformation, allows Superior to achieve robust profit margins and generate substantial cash flow. Even within a mature, low-growth market for its primary offerings, this operational efficiency translates directly into strong financial performance.

- Established Mexican and Polish manufacturing sites

- High-volume aluminum wheel production efficiency

- Strong profit margins and cash flow generation

- Leverages low-growth market for core products

Superior Industries' established OEM relationships for traditional aluminum wheels represent a significant cash cow, characterized by high market share and consistent demand from major automakers. These long-standing partnerships, particularly in North America and Europe, ensure a stable revenue stream, even in a mature market segment. The company's efficient production capabilities and economies of scale further bolster profitability, making this a reliable source of cash flow. For instance, in fiscal 2023, the automotive wheel segment, largely comprising North American OEM supply, generated $878.6 million in net sales, highlighting its contribution.

| Business Segment | Market Position | Cash Flow Generation | Key Drivers | 2023 Net Sales (USD Millions) |

|---|---|---|---|---|

| North American OEM Wheels | Dominant in mature market | High and consistent | Long-term contracts, efficient production | ~878.6 (Automotive Wheel Segment) |

| European Aftermarket Brands (ATS®, RIAL®, ALUTEC®, ANZIO®) | Established in mature market | Steady and predictable | Strong distribution, consistent replacement demand | N/A (Segmented data not explicitly provided for 2023) |

Preview = Final Product

Superior Industries International BCG Matrix

The Superior Industries International BCG Matrix preview you're seeing is the complete, final document you'll receive upon purchase. This means you get the fully formatted, analysis-ready report with no watermarks or demo content, ensuring immediate strategic clarity for your business planning.

Dogs

Superior Industries International may possess older wheel designs that are no longer in high demand, perhaps due to shifting automotive aesthetics or the decline of certain vehicle types. These products likely hold a small market share within stagnant or shrinking segments.

Such designs, characterized by low sales volume, could represent a financial drag, consuming resources without generating substantial returns. In 2023, the automotive industry saw continued shifts towards SUVs and electric vehicles, potentially impacting demand for wheels designed for older sedan models or specific niche markets.

Superior Industries International's specific OEM contracts with resourced volumes are a critical component of its BCG Matrix analysis, particularly concerning its "Dogs" category. Recent notifications from major North American OEM customers about re-sourcing outstanding purchase orders highlight specific contracts or product lines that have become problematic. This sudden loss of volume, impacting 33% of expected 2025 revenue from these key accounts, signals a diminished market share in segments that were once reliable revenue streams for Superior.

Within Superior Industries International's portfolio, certain regional markets and specific vehicle segments are showing signs of underperformance. These areas, while part of its broader North American and European operations, are characterized by sluggish growth and a less dominant competitive standing for Superior. For instance, in 2024, the aftermarket demand for certain older vehicle models in specific European micro-markets saw a decline of approximately 5%, impacting sales in those niches.

These underperforming segments represent a challenge as they contribute a minor fraction to Superior's overall revenue, estimated at less than 3% in 2024. Despite their limited financial contribution, maintaining a presence in these areas often demands significant resources and strategic attention, diverting focus from more promising opportunities within the company's larger, more robust market segments.

High-Cost, Low-Volume Niche Products

High-Cost, Low-Volume Niche Products within Superior Industries International's portfolio could be classified as Dogs. This occurs when the company manufactures highly specialized or custom wheels in very limited quantities without commanding a sufficient premium price. For example, if a particular niche wheel design requires extensive manual labor and specialized tooling, driving up per-unit production costs significantly, and the market demand is too small to justify higher pricing, it becomes problematic.

These products often become cash traps because the high production costs linked to their low volume, combined with a restricted market appeal, lead to poor profitability. Consequently, they struggle to gain significant market share. In 2023, the automotive aftermarket wheel industry saw continued demand for customization, but manufacturers often faced challenges in achieving economies of scale for highly bespoke items, impacting margins on lower-volume runs.

- Low Volume, High Cost: Specialized wheels can incur production costs that are disproportionately high due to limited economies of scale.

- Insufficient Premium Pricing: If the market doesn't support a high enough price to offset these costs, profitability suffers.

- Limited Market Appeal: Niche products inherently have a smaller customer base, restricting potential market share growth.

- Cash Trap Scenario: These factors combine to create products that consume resources without generating substantial returns, acting as a drain on company finances.

Legacy Technology Wheels Without Lightweighting/Aero Features

Wheels produced using older methods or lacking modern lightweighting and aerodynamic enhancements face increasing challenges in today's automotive landscape. The industry's strong emphasis on electric vehicles and overall fuel efficiency means these traditional offerings may see declining demand. If Superior Industries International has a substantial inventory of these legacy wheels with low market uptake, they could be categorized as Dogs in the BCG Matrix.

For instance, in 2024, the automotive industry continued its aggressive push towards electrification, with EV sales projected to reach over 15% of the global market share. This trend directly impacts the demand for components that enhance efficiency, such as lightweight alloy wheels. Superior's older wheel designs, which may not incorporate advanced materials or manufacturing techniques, could be particularly vulnerable to this shift.

- Declining Market Share: Legacy wheels may experience a shrinking market share as consumers and manufacturers prioritize efficiency and performance.

- Low Growth Potential: Without significant technological upgrades, these wheels are unlikely to capture new market segments or benefit from industry growth trends.

- Inventory Management Challenges: Holding substantial inventory of outdated products can tie up capital and lead to obsolescence, impacting profitability.

- Competitive Disadvantage: Competitors offering advanced, lightweight, and aerodynamically optimized wheels will likely gain an advantage, further pressuring legacy product sales.

Superior Industries International's "Dogs" are products with low market share in slow-growing or declining segments, often characterized by older designs or technologies. These may include niche wheels for less popular vehicle models or those not optimized for current industry trends like electrification and lightweighting. For example, a 5% decline in aftermarket demand for certain older vehicle models in specific European micro-markets during 2024 highlights such a segment.

These underperforming products, contributing less than 3% of overall revenue in 2024, can become cash traps due to high production costs from low volumes and insufficient premium pricing. The recent notification from a major North American OEM customer about re-sourcing impacting 33% of expected 2025 revenue from specific accounts underscores the challenges faced by these legacy products.

The company's portfolio likely includes specialized, high-cost, low-volume niche products that struggle to gain traction. These items consume resources without generating substantial returns, representing a financial drag. The automotive industry's continued shift towards EVs in 2024, with sales projected to exceed 15% globally, further pressures older wheel designs lacking efficiency-enhancing features.

Superior Industries International's "Dogs" represent products with limited market appeal and low growth potential, often facing inventory management challenges and a competitive disadvantage against newer, more advanced offerings.

| Product Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Wheel Designs | Low | Declining | Low/Negative | Divest or phase out |

| Niche Custom Wheels (Low Volume) | Low | Stagnant | Low | Re-evaluate pricing or cost structure |

| Wheels for Obsolete Vehicle Models | Very Low | Shrinking | Negative | Discontinue |

Question Marks

Forged aluminum wheels are a high-growth segment, with demand projected to outpace the broader automotive wheel market. Superior Industries, while a leader in cast wheels, likely has a smaller market share in this premium, high-strength category.

This positions forged wheels as a potential Stars or Question Marks within Superior's portfolio, requiring strategic investment to capture market share. For instance, the global automotive forged wheels market was valued at approximately USD 6.5 billion in 2023 and is anticipated to reach over USD 9.8 billion by 2030, exhibiting a compound annual growth rate of around 6.1%.

Superior's DECOTECH™ technology is a key differentiator, enabling a vast array of colors and textures for wheels, which is crucial for aesthetic appeal in new vehicle applications. This patented finishing process offers significant potential for growth by targeting new vehicle models or increasing penetration in the market for highly customized wheels.

While DECOTECH™ provides a competitive edge, its current market share within the broader wheel finishing segment might be relatively small, positioning it as a Question Mark in the BCG matrix. For instance, in 2024, the custom wheel market continued to grow, driven by consumer demand for personalization, yet Superior's specific share of this niche, particularly with DECOTECH™, would need further analysis to confirm its Question Mark status.

Superior Industries International's exploration or recent entry into new geographic markets beyond its established North American and European base would likely place these ventures in the Question Marks category of the BCG Matrix. This signifies significant investment in infrastructure and market penetration, characterized by a currently low market share but substantial growth potential.

For instance, consider Superior's potential expansion into burgeoning Asian automotive markets. In 2024, the global automotive market, particularly in regions like Southeast Asia, has shown robust growth projections, with some analysts forecasting an average annual growth rate of over 5% through 2030. Entering these markets requires substantial upfront capital for manufacturing facilities, distribution networks, and brand building, mirroring the high investment typical of Question Marks.

Strategic Partnerships for Emerging Vehicle Platforms

Superior Industries International could strategically partner with emerging vehicle manufacturers, especially those in advanced mobility like electric or autonomous vehicles. These collaborations represent potential high-growth opportunities, even if Superior's initial market share is small.

Such ventures align with the characteristics of Stars in the BCG matrix. For instance, if Superior were to supply components for a new electric vehicle platform launched in 2024 that quickly gains traction, it would represent a low-share, high-growth scenario. In 2024, the global EV market continued its rapid expansion, with sales projected to exceed 15 million units, highlighting the potential of these emerging platforms.

- Emerging Platform Focus: Collaborations with manufacturers of electric, autonomous, or other advanced mobility solutions.

- Low Initial Share, High Growth Potential: Superior may start with a small market share in these new segments but anticipates significant future growth if the platforms gain widespread adoption.

- BCG Matrix Classification: These partnerships are considered potential Stars due to their high growth prospects in rapidly evolving automotive sectors.

- Market Context (2024): The burgeoning electric vehicle market, with projected sales of over 15 million units globally in 2024, underscores the viability of investing in these emerging platforms.

Investments in Sustainable/Recycled Aluminum Sourcing

Superior Industries International's commitment to sourcing aluminum from suppliers utilizing green electricity and post-consumer recycled content positions it within a high-growth, albeit currently niche, segment. This strategic focus on sustainability, while not immediately translating into substantial market share gains or direct revenue boosts, is crucial for future competitiveness. Consumer and Original Equipment Manufacturer (OEM) preferences are increasingly leaning towards environmentally responsible materials, making this an area requiring careful investment and development.

This initiative aligns with broader industry trends. For instance, by 2024, the global aluminum recycling market was projected to reach significant value, driven by environmental regulations and corporate sustainability goals. Superior's investment here can be seen as cultivating a future advantage in a market where "green" sourcing is becoming a key differentiator.

The investment in sustainable aluminum sourcing can be viewed as a Question Mark in the BCG matrix due to its potential for high growth but currently uncertain market share. Key considerations include:

- Alignment with Market Trends: Growing consumer and OEM demand for sustainable products is a significant driver for this investment.

- Future Competitive Advantage: Early adoption in green sourcing can lead to a strong competitive edge as regulations and preferences evolve.

- Investment for Growth: While immediate returns may be modest, the long-term growth potential in this segment is substantial.

- Nurturing Potential: This area requires continued investment and strategic development to capitalize on its high-growth potential.

Superior Industries' DECOTECH™ technology, while innovative, likely holds a small market share in the broader wheel finishing segment. This positions it as a Question Mark, requiring strategic investment to capture greater market penetration. For example, the custom wheel market in 2024 saw continued growth driven by personalization, but Superior's specific share with DECOTECH™ needs further analysis to confirm its status.

New geographic market entries, such as potential expansion into burgeoning Asian automotive markets, also fall into the Question Marks category. These ventures demand substantial upfront capital for infrastructure and brand building, mirroring the high investment characteristic of Question Marks, especially considering the robust growth projections for markets like Southeast Asia in 2024.

Investments in sustainable aluminum sourcing, utilizing green electricity and recycled content, represent another area with high growth potential but currently uncertain market share. This focus on sustainability is crucial for future competitiveness as OEM preferences increasingly lean towards environmentally responsible materials, a trend underscored by the significant projected value of the global aluminum recycling market by 2024.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including Superior Industries' financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.