Superior Industries International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

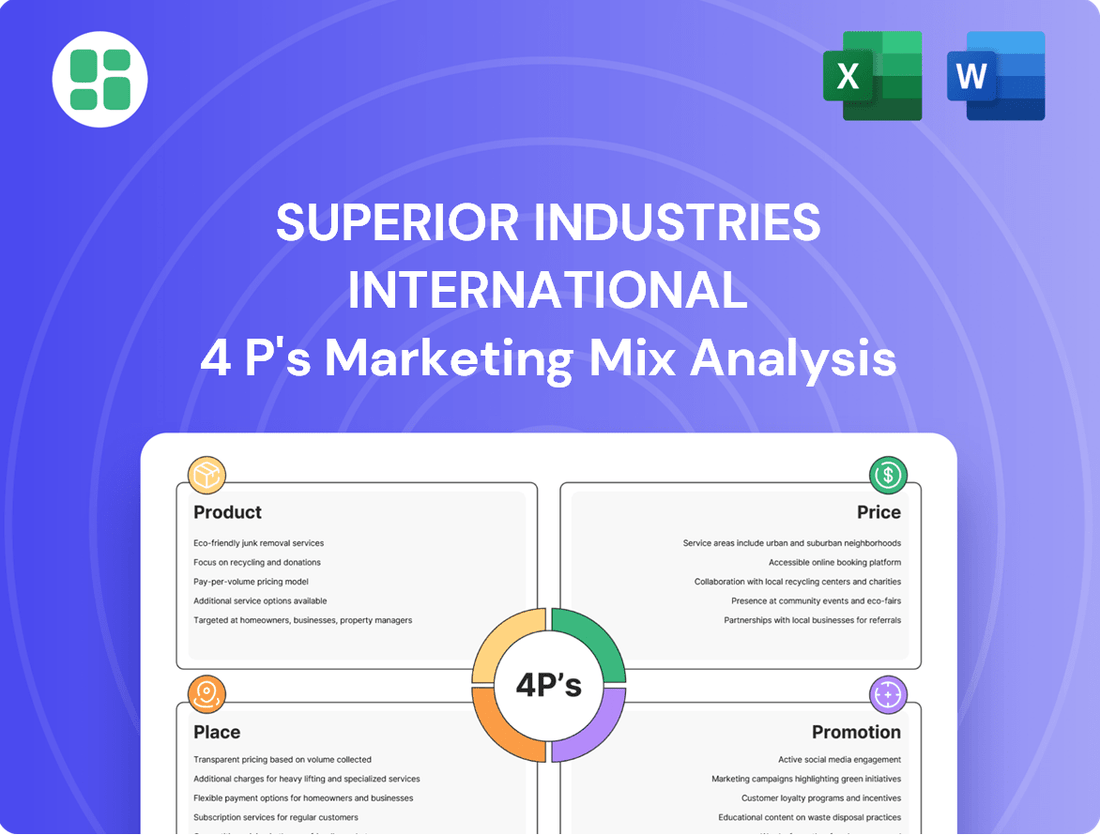

Superior Industries International's marketing strategy is a masterclass in aligning product innovation with market demand, pricing for value, and strategic distribution. Their promotional efforts effectively build brand awareness and drive customer loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Superior Industries International's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Superior Industries International's advanced aluminum wheel designs are central to their product strategy, focusing on sophisticated cast and forged aluminum solutions. Their 2024 and projected 2025 product roadmap emphasizes lightweighting technologies, aiming to improve fuel efficiency and vehicle dynamics, a critical factor as the automotive industry navigates stricter emissions standards. This innovation directly supports their OEM clients by offering wheels that blend performance enhancement with cutting-edge aesthetics, reflecting Superior's commitment to staying ahead in a competitive market.

Superior Industries International's product strategy heavily leans towards original equipment manufacturers (OEMs), a segment that represented a significant 92% of their sales in 2024. This focus on supplying directly to vehicle manufacturers for both light vehicles and commercial trucks underscores their core business.

Beyond the OEM market, Superior also cultivates a presence in the European aftermarket. They achieve this through a portfolio of well-regarded brands, including ATS, RIAL, ALUTEC, and ANZIO. This dual approach allows them to capture value across different stages of the automotive product lifecycle.

Superior Industries International's product strategy truly shines through its customization and engineering expertise. They work hand-in-hand with customers, a collaborative approach that fuels the creation of a diverse range of innovative, high-quality wheels. This focus on tailored solutions is key to meeting evolving automotive demands.

A prime example of this engineering prowess is their development of larger-diameter wheels, a trend driven by modern vehicle aesthetics and performance needs. Furthermore, Superior is at the forefront of creating advanced aerodynamic solutions, which are increasingly vital for boosting efficiency, especially in electric vehicles (EVs). For instance, their ongoing investment in advanced manufacturing techniques aims to support the projected growth in the EV market, which is expected to represent a significant portion of new vehicle sales by 2025.

Quality and Performance Standards

Superior Industries International's commitment to quality and performance is deeply ingrained, evidenced by its continuous supply to the Original Equipment Manufacturer (OEM) market since 1973. This enduring relationship highlights their consistent ability to meet the demanding quality and volume expectations of major automotive manufacturers. Their products are subjected to rigorous testing protocols, ensuring they meet critical standards for durability, safety, and overall performance, which is paramount for their OEM partners.

The company's dedication to superior manufacturing is further underscored by its performance metrics. For instance, in the fiscal year ending December 31, 2023, Superior Industries reported net sales of $594.6 million, demonstrating substantial production capacity and market acceptance. This financial performance is built upon a foundation of reliable product output.

Key aspects of their quality and performance standards include:

- ISO Certifications: Adherence to internationally recognized quality management systems like ISO 9001 ensures consistent product quality and process control.

- OEM Validation: Products must pass stringent OEM-specific testing, often exceeding general industry standards.

- Durability and Reliability: Focus on materials science and engineering to ensure components withstand rigorous use and environmental factors.

- Safety Compliance: Meeting or exceeding all relevant automotive safety regulations is a non-negotiable aspect of their product development.

Sustainability-Driven Innovation

Superior Industries International's commitment to sustainability-driven innovation is evident in its product development, focusing on fuel consumption reduction and lower greenhouse gas emissions. Their patented Alulite™ technology exemplifies this, utilizing advanced lightweighting to improve vehicle aerodynamics and efficiency. This strategic focus directly addresses the growing automotive industry trend towards environmental responsibility and a reduced carbon footprint.

This approach is crucial as global regulations tighten and consumer demand for eco-friendly vehicles escalates. For instance, by 2025, the average fuel economy for new passenger cars and light trucks sold in the U.S. is projected to reach approximately 49 miles per gallon, according to EPA estimates. Superior's lightweighting solutions directly contribute to meeting these increasingly stringent standards.

- Alulite™ Technology: Patented process for creating lighter, stronger wheels.

- Fuel Efficiency Focus: Products designed to reduce vehicle fuel consumption.

- Emissions Reduction: Contribution to lowering greenhouse gas output in transportation.

- Market Alignment: Responding to global demand for sustainable automotive solutions.

Superior Industries International's product strategy centers on advanced aluminum wheels, with a strong emphasis on lightweighting technologies for improved fuel efficiency and vehicle dynamics, crucial for meeting 2025 emissions targets. Their portfolio includes both cast and forged aluminum solutions, tailored for Original Equipment Manufacturers (OEMs), who accounted for 92% of their sales in 2024.

The company also cultivates a presence in the European aftermarket through brands like ATS and RIAL, demonstrating a dual market approach. Their engineering prowess is highlighted by the development of larger-diameter wheels and aerodynamic solutions, particularly for the growing electric vehicle (EV) market expected to be a significant segment by 2025.

Superior's commitment to quality is underscored by its continuous OEM supply since 1973 and rigorous testing protocols. Their patented Alulite™ technology exemplifies their focus on sustainability, aiming to reduce fuel consumption and emissions, aligning with projected average fuel economy standards of approximately 49 miles per gallon for new vehicles by 2025.

| Product Focus | Key Technologies | Market Segments | Sales Contribution (2024) | Sustainability Aspect |

|---|---|---|---|---|

| Advanced aluminum wheels (cast & forged) | Lightweighting, Aerodynamics, Alulite™ | OEM (Light & Commercial Vehicles), European Aftermarket | OEM: 92% | Fuel efficiency, Emissions reduction |

| Customization & Engineering | Collaborative design | OEM, Aftermarket Brands (ATS, RIAL, ALUTEC, ANZIO) | Aftermarket: 8% | Meeting evolving automotive demands |

| Performance & Durability | Rigorous testing, ISO certifications | OEM validation | N/A | Safety compliance, Reliability |

What is included in the product

This analysis provides a comprehensive breakdown of Superior Industries International's marketing strategies across Product, Price, Place, and Promotion, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking a detailed understanding of Superior Industries International's marketing mix, grounded in actual brand practices and strategic implications.

This analysis distills Superior Industries International's 4Ps strategy into actionable insights, alleviating the pain of complex marketing planning by offering a clear, concise roadmap for strategic execution.

Place

Superior Industries International's direct OEM supply channels are a cornerstone of its business, focusing on supplying aluminum wheels directly to major automotive manufacturers for factory installation. This B2B strategy, vital for their product placement, relies on robust relationships and seamless integration within the global automotive supply chain.

In 2024, Superior Industries continued to leverage these direct OEM partnerships, which accounted for a significant portion of their revenue. Their ability to meet the stringent quality and volume demands of automakers like Ford and General Motors underscores the strength of this channel. This direct approach allows for greater control over product integration and brand visibility from the point of vehicle assembly.

Superior Industries International strategically places its manufacturing operations primarily in Mexico and Poland. This 'local-for-local' approach ensures production is close to major Original Equipment Manufacturer (OEM) clients, enhancing responsiveness and reducing logistical complexities.

This global manufacturing footprint, with facilities in North America and Europe, is crucial for navigating supply chain disruptions and adapting to regional market needs. For instance, in 2024, the company's European operations are vital for serving automotive clients on the continent, while its Mexican plants cater to the significant North American market.

Superior Industries International has strategically consolidated its European manufacturing footprint, notably by establishing a primary hub in Poland. This move, which included the closure of facilities in Germany, is designed to boost operational efficiency and fortify the company's market standing across the continent.

This European operational optimization is projected to enhance profitability through streamlined supply chains and reduced overheads. For instance, the company's 2023 financial reports indicated a focus on cost management initiatives, with such consolidations being a key driver.

Efficient Logistics and Inventory Management

Superior Industries International places a strong emphasis on efficient logistics and inventory management, a critical component for success in the automotive sector's just-in-time delivery demands. This focus ensures that their alloy wheels are precisely where and when Original Equipment Manufacturers (OEMs) require them, minimizing disruptions in the automotive production lines.

Their global operational footprint is instrumental in facilitating these timely deliveries across diverse continents. For instance, in 2024, Superior reported maintaining a robust supply chain network, enabling them to meet the production schedules of major automotive clients in North America, Europe, and Asia.

- Global Distribution Network: Superior operates manufacturing facilities and distribution centers strategically located to serve key automotive markets worldwide, reducing lead times and transportation costs.

- Inventory Optimization: The company employs advanced inventory management systems to balance stock levels, ensuring product availability while minimizing carrying costs and obsolescence risks.

- Just-in-Time (JIT) Alignment: Superior's logistics are finely tuned to align with the JIT manufacturing processes of their OEM customers, a crucial factor in maintaining strong customer relationships and securing ongoing business.

- Supply Chain Resilience: In 2024, the company continued to invest in supply chain resilience, mitigating potential disruptions from global events and ensuring consistent product flow to its clients.

Strategic Localized Production

The global shift towards supply chain localization, amplified by evolving tariff landscapes, is driving Original Equipment Manufacturers (OEMs) to seek regional production capabilities. Superior Industries International is well-positioned to capitalize on this trend with its existing manufacturing footprint in Mexico and Poland.

This strategic localized production allows Superior to offer cost-effective, regional supply solutions to OEMs, directly addressing their need for shorter lead times and reduced logistical complexities. For instance, Superior's Mexico facility is a key asset in serving the North American automotive market, a sector increasingly focused on nearshoring initiatives. In 2024, the automotive industry continued to navigate supply chain challenges, making localized manufacturing a significant competitive advantage.

- Regional Manufacturing Hubs: Superior's plants in Mexico and Poland serve as critical hubs for localized production, catering to regional OEM demands.

- Cost-Effectiveness: The established infrastructure in these locations enables Superior to offer competitive pricing for localized components.

- Supply Chain Resilience: By diversifying production geographically, Superior enhances its ability to mitigate disruptions and ensure consistent supply.

- OEM Demand Alignment: The company's production strategy directly aligns with the growing OEM preference for suppliers with strong regional manufacturing capabilities.

Superior Industries International's place strategy centers on its direct supply to Original Equipment Manufacturers (OEMs), leveraging strategically located production facilities in Mexico and Poland. This approach ensures proximity to major automotive clients, facilitating efficient logistics and alignment with just-in-time delivery requirements.

The company's manufacturing footprint in Mexico is crucial for serving the North American market, while its Polish operations cater to European automotive manufacturers. This localized production model enhances supply chain resilience and cost-effectiveness, directly addressing the growing OEM preference for regional sourcing.

In 2024, Superior's commitment to optimizing its European manufacturing, including consolidating operations into Poland, further solidified its ability to meet regional demands efficiently. This strategic placement underpins its competitive advantage by minimizing lead times and transportation costs for its OEM partners.

Superior's global distribution network, coupled with advanced inventory management, ensures product availability and minimizes carrying costs, a critical factor in the automotive sector. Their ability to align with OEM production schedules, a hallmark of their place strategy, reinforces strong customer relationships.

| Manufacturing Location | Key Markets Served | Strategic Importance |

|---|---|---|

| Mexico | North America (USA, Canada, Mexico) | Proximity to major North American OEMs, supports nearshoring trends. |

| Poland | Europe | Central hub for European automotive manufacturers, operational efficiency gains. |

Full Version Awaits

Superior Industries International 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Superior Industries International's 4P's marketing mix is fully complete and ready for your immediate use. You can be confident that what you see is exactly what you'll get.

Promotion

Superior Industries International's promotion strategy in B2B relationship management prioritizes direct engagement with Original Equipment Manufacturers (OEMs). This is achieved through a specialized sales force and technical experts who collaborate closely with automotive clients throughout the entire product lifecycle, from initial design to final delivery.

In 2023, Superior reported that its dedicated sales and engineering teams actively participated in over 150 customer design reviews, underscoring the depth of their client partnerships. This hands-on approach ensures that Superior's wheel solutions are precisely tailored to OEM specifications and market demands.

Superior Industries International actively participates in major automotive industry trade shows and technical conferences. This strategy allows them to directly engage with current and prospective Original Equipment Manufacturer (OEM) partners, presenting their newest wheel designs and showcasing engineering prowess.

These events are crucial for demonstrating technological advancements and fostering relationships within the automotive sector. For instance, in 2024, Superior showcased its innovative lightweight wheel technologies at events like the Automotive Engineering Show, highlighting their commitment to performance and efficiency for future vehicle models.

Superior Industries International's technical expertise is a cornerstone of its marketing, with efforts highlighting advancements in lightweighting, finishing technologies, and aerodynamic solutions. These capabilities are showcased through various channels, emphasizing how Superior's innovative products enhance vehicle performance, improve fuel efficiency, and elevate aesthetic appeal.

In 2023, Superior Industries reported a net sales increase to $572.6 million, a testament to the market's appreciation for their technological prowess. This growth underscores the effectiveness of their strategy to communicate how their engineered solutions, such as advanced alloy wheel designs that reduce weight by up to 20%, directly contribute to tangible benefits for automotive manufacturers and end-users alike.

Corporate Reputation and Reliability

Superior Industries International's corporate reputation and reliability are cornerstones of its marketing strategy, built on decades of experience as a trusted Original Equipment Manufacturer (OEM) supplier. This long history translates into a strong perception of quality, dependability, and consistent product delivery among its automotive clients.

The company actively cultivates this reputation through transparent financial reporting and robust investor relations. For instance, Superior Industries reported net sales of $586.4 million for the fiscal year ended December 31, 2023, demonstrating operational stability and a commitment to stakeholder communication. This openness fosters trust and reinforces their image as a reliable partner in the automotive supply chain.

Key aspects of their reputation management include:

- Proven OEM Track Record: Decades of supplying major automotive manufacturers validates their quality and reliability.

- Financial Transparency: Open communication regarding financial performance, such as their 2023 net sales, builds stakeholder confidence.

- Consistent Delivery: A history of meeting production schedules and quality standards solidifies their dependable image.

- Commitment to Quality: Adherence to stringent automotive industry standards underscores their dedication to reliable products.

Sustainability and ESG Reporting

Superior Industries International actively communicates its dedication to environmental stewardship and ethical operations through its annual sustainability reports. These reports detail initiatives aimed at shrinking their carbon footprint and fostering sustainable practices with their supply chain partners, a crucial factor for Original Equipment Manufacturers (OEMs) prioritizing eco-friendly sourcing.

This focus on sustainability resonates with a growing segment of the automotive industry. For instance, in 2023, Superior Industries reported a 5% reduction in energy consumption across its manufacturing facilities compared to 2022, a tangible outcome of their ongoing environmental programs. Their commitment extends to supplier audits, with over 80% of key suppliers now adhering to their enhanced sustainability guidelines.

- Annual Sustainability Reports: Publicly available documents detailing environmental, social, and governance (ESG) performance.

- Carbon Footprint Reduction: Specific targets and achievements in lowering greenhouse gas emissions.

- Supplier Collaboration: Initiatives to ensure upstream partners meet sustainability standards.

- OEM Appeal: Demonstrating ESG commitment as a competitive advantage in securing automotive contracts.

Superior Industries International's promotion strategy heavily relies on direct engagement and showcasing technical expertise to Original Equipment Manufacturers (OEMs). Their participation in industry events and detailed technical presentations highlight advancements in lightweighting and finishing, directly linking these to improved vehicle performance and efficiency.

This approach is validated by their financial performance, with 2023 net sales reaching $586.4 million, reflecting market recognition of their engineered solutions. Furthermore, their commitment to sustainability, evidenced by a 5% energy consumption reduction in 2023, appeals to OEMs prioritizing eco-friendly sourcing.

Superior Industries International leverages its proven OEM track record and financial transparency to build a reputation for reliability. This is reinforced by consistent delivery and adherence to quality standards, solidifying their image as a dependable partner in the automotive supply chain.

| Promotional Activity | Key Focus | 2023/2024 Data Point |

|---|---|---|

| Direct Engagement | OEM Design Reviews | Over 150 customer design reviews in 2023 |

| Industry Presence | Trade Shows & Conferences | Showcased lightweight technologies at Automotive Engineering Show 2024 |

| Technical Showcasing | Product Benefits | Lightweighting reduces wheel weight by up to 20% |

| Reputation Building | Financial Performance | Net sales of $586.4 million for FYE Dec 31, 2023 |

| Sustainability Communication | Environmental Initiatives | 5% reduction in energy consumption (vs. 2022) in 2023 |

Price

Superior Industries International's pricing for Original Equipment Manufacturers (OEMs) is primarily governed by long-term contractual agreements. These contracts are often the result of competitive bidding, ensuring that Superior secures business based on its value proposition and market standing.

A key feature of these OEM contracts includes price adjustment clauses. These clauses are crucial for managing the inherent volatility of raw material costs, with aluminum being a significant factor for Superior's wheel manufacturing. For instance, the price of aluminum on the London Metal Exchange (LME) experienced fluctuations throughout 2024, impacting input costs for manufacturers like Superior.

Superior Industries International leverages value-based pricing for its advanced technological offerings, such as its Alulite™ lightweighting solutions and larger-diameter wheels. This strategy allows them to capture premium pricing by aligning costs with the tangible benefits—enhanced vehicle performance, fuel efficiency, and aesthetic appeal—that these innovations deliver to automotive manufacturers and, ultimately, consumers.

Superior Industries International actively manages raw material cost volatility by incorporating contractual price adjustment clauses into agreements with Original Equipment Manufacturer (OEM) customers. This strategy directly addresses the unpredictable nature of aluminum, silicon, and alloy premium costs, which are critical inputs for their wheel manufacturing.

For instance, in their 2024 fiscal year reporting, the company highlighted that these clauses allowed them to effectively pass through a significant portion of increased material expenses, thereby safeguarding their profit margins. This proactive approach is crucial for maintaining financial stability in a market susceptible to supply chain disruptions and commodity price swings.

Competitive Market Positioning

Superior Industries operates in a highly competitive market for aluminum wheels. Their pricing must align with their brand image as a premium, high-quality supplier. This means not necessarily being the cheapest, but offering value that justifies a higher price point.

While they face intense price competition, particularly from Asian manufacturers in the smaller wheel segments, Superior strategically focuses on its differentiated, premium product offerings. This allows them to command higher prices by emphasizing quality, design, and performance, rather than competing solely on cost.

- Market Share: Superior aims to maintain and grow its market share in the premium and specialized wheel segments, where pricing power is stronger.

- Cost Structure: Their pricing strategy considers their manufacturing costs, which may be higher than some competitors due to their focus on quality and domestic production.

- Value Proposition: Superior's pricing reflects the added value they offer, including advanced technology, superior materials, and robust quality control.

- Competitive Landscape: Pricing decisions are constantly evaluated against competitors, especially as market dynamics shift and new entrants emerge.

Strategic Financial Restructuring and Debt Management

Superior Industries International has faced significant pricing pressures due to recent financial headwinds. A notable loss of volume from key North American Original Equipment Manufacturer (OEM) customers in late 2023 and early 2024 necessitated a strategic pivot towards financial restructuring. This situation directly impacts the company's ability to offer competitive pricing, as the immediate need to secure additional loans and manage existing debt obligations limits flexibility.

The company's financial restructuring efforts, including securing new credit facilities, underscore the critical importance of cost reduction to maintain profitability and liquidity. For instance, in Q1 2024, Superior Industries reported a net loss, highlighting the impact of these volume challenges. This environment demands a rigorous focus on operational efficiencies to offset the reduced revenue and support debt servicing.

- Pricing Impact: Reduced pricing flexibility due to increased debt burden and the need to preserve cash flow.

- Cost Reduction Focus: Emphasis on efficiency gains across manufacturing and operations to improve margins.

- Liquidity Management: Securing additional loans, such as the reported $150 million senior secured term loan in early 2024, to manage working capital and debt.

- Profitability Challenge: Balancing competitive pricing with the necessity of cost controls to achieve positive earnings in a challenging market.

Superior Industries International's pricing strategy is a delicate balance between contractual obligations, value-based differentiation, and the realities of market competition and financial health. Their OEM pricing is largely dictated by long-term contracts that often include clauses to adjust for raw material costs, particularly aluminum, which saw significant price swings in 2024. For specialized, technologically advanced wheels like their Alulite™ line, they employ value-based pricing, reflecting enhanced performance and fuel efficiency benefits for automakers.

However, recent financial pressures, including volume declines from key customers in late 2023 and early 2024, have impacted pricing flexibility. The need to manage debt and preserve cash flow, exemplified by securing a $150 million senior secured term loan in early 2024, means a strong focus on cost reduction to maintain profitability. This environment necessitates rigorous operational efficiencies to offset reduced revenue and support debt servicing, making competitive pricing a significant challenge.

| Pricing Factor | Impact on Superior Industries | 2024/2025 Relevance |

|---|---|---|

| OEM Contracts | Governed by long-term agreements, often with price adjustment clauses for raw materials. | Essential for revenue stability, but subject to negotiation and market input costs. |

| Value-Based Pricing | Applied to advanced products (e.g., Alulite™), capturing premium for performance benefits. | Key to differentiating and maintaining margins on higher-tech offerings. |

| Raw Material Volatility | Aluminum and alloy premiums are critical input costs; price adjustment clauses mitigate this. | Continued monitoring of LME aluminum prices and supply chain costs is vital for 2024/2025. |

| Financial Restructuring | Increased debt burden and need for cash flow limit pricing flexibility. | Operational efficiency and cost control are paramount to support debt obligations and profitability. |

4P's Marketing Mix Analysis Data Sources

Our Superior Industries 4P analysis leverages a comprehensive blend of primary and secondary data sources. We meticulously examine company-published materials like annual reports, investor relations documents, and official press releases, alongside industry-specific reports and market intelligence data to capture product offerings, pricing strategies, distribution channels, and promotional activities.