Superior Industries International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

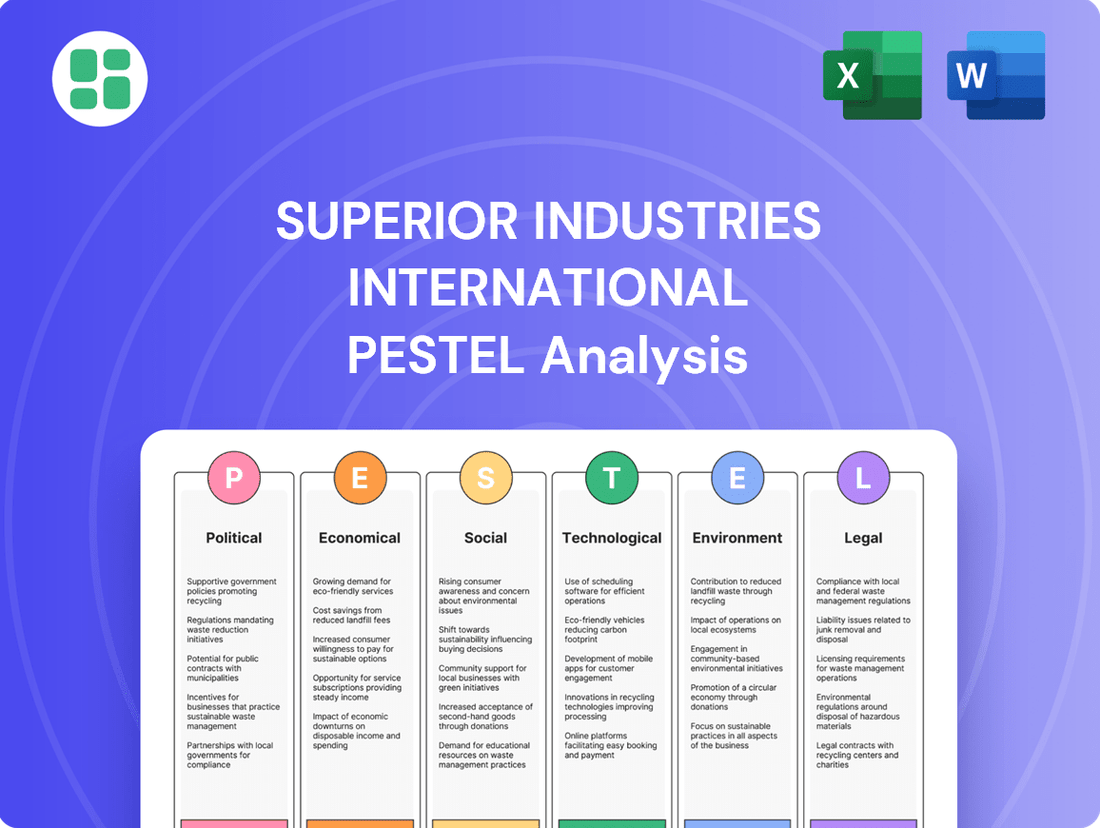

Navigate the complex external forces shaping Superior Industries International. Our PESTLE analysis dives deep into political stability, economic fluctuations, and evolving social trends that impact the automotive supplier's operations. Understand the technological advancements and environmental regulations critical to their industry. Secure your competitive advantage by downloading the full PESTLE analysis today for actionable intelligence.

Political factors

Superior Industries International, with its manufacturing footprint in North America and Europe, is significantly exposed to shifts in global trade policies and tariffs. These changes can directly influence the cost of key inputs, such as aluminum, and affect the price competitiveness of both their imported and exported finished wheels.

For instance, potential new tariffs on automotive components or raw materials, a recurring theme in recent political discourse, could present both challenges and opportunities. If tariffs are imposed on aluminum imports, it would likely increase production costs for Superior. Conversely, if tariffs are placed on competitor wheels manufactured in countries with lower labor costs, Superior's products could become more attractive in those markets.

Government incentives, such as tax credits for electric vehicle (EV) purchases and manufacturing, directly impact Original Equipment Manufacturer (OEM) demand for lightweight components like aluminum wheels. For instance, the Inflation Reduction Act of 2022 in the United States offers significant credits, potentially boosting EV adoption and, consequently, the need for specialized wheel designs.

Stricter fuel efficiency and emissions standards, like those being implemented in the EU and anticipated in other regions, also drive OEM demand for lighter materials to meet compliance targets. This regulatory push encourages the use of aluminum wheels, which are lighter than steel alternatives, contributing to better fuel economy and reduced emissions.

Conversely, shifts in these subsidies or the pace of regulatory changes can introduce volatility. For example, a reduction in EV purchase incentives could slow market growth, impacting Superior Industries' order volumes. Regulatory stability is crucial for manufacturers to plan investments in new designs and production capabilities that align with evolving environmental and safety requirements.

Geopolitical instability, particularly in regions where Superior Industries International operates or sources materials, presents a significant challenge. For instance, ongoing tensions in Eastern Europe, impacting Poland, could disrupt logistics and increase energy expenses, a critical input for manufacturing. While Superior has a manufacturing presence in Mexico, which offers some resilience, broader global economic uncertainty stemming from these conflicts can dampen consumer spending on vehicles, a primary driver for alloy wheel demand.

Government Support for Manufacturing and Localization

Governments across North America and Europe are actively encouraging the return of manufacturing and strengthening domestic production capabilities. This push aims to bolster supply chain security and generate local employment opportunities. Superior Industries, with its established manufacturing bases in Mexico and Poland, is well-positioned to capitalize on these government incentives. Original Equipment Manufacturers (OEMs) are increasingly looking for partners who offer regional manufacturing advantages and reduced dependence on far-flung supply networks, a trend that could significantly benefit Superior.

This strategic positioning allows Superior to potentially secure new contracts and solidify its standing in the market. For instance, the reshoring trend is particularly relevant as companies evaluate the risks associated with global supply chains. Superior's existing infrastructure in Mexico, a key manufacturing hub, aligns with the growing demand for near-shored production. Similarly, its Polish operations serve the European market, benefiting from similar localization efforts within the EU.

- Government Initiatives: Many countries are offering tax breaks and subsidies for domestic manufacturing.

- Supply Chain Resilience: The COVID-19 pandemic highlighted vulnerabilities, accelerating reshoring efforts.

- Cost Advantages: Near-shoring can reduce transportation costs and lead times for North American and European clients.

- Job Creation: Localization policies directly aim to boost domestic employment in the manufacturing sector.

Political Stability and Policy Predictability

Political stability and the predictability of government policies are paramount for Superior Industries International's long-term strategic planning and investment decisions. Unforeseen shifts in regulations, whether concerning environmental standards, employment laws, or international trade agreements, can create significant operational and financial challenges, demanding swift adjustments. A consistent and stable regulatory landscape, however, fosters more reliable strategic development and capital allocation.

For instance, the automotive industry, a key market for Superior, is subject to evolving emissions standards and trade policies. In 2024, ongoing discussions around tariffs and trade agreements between major automotive manufacturing regions could impact supply chain costs and market access. The company’s ability to navigate these political currents directly influences its operational efficiency and overall financial health.

- Policy Predictability: A stable policy environment reduces uncertainty for capital-intensive industries like automotive manufacturing.

- Regulatory Adaptation: Superior must remain agile to adapt to changes in environmental and labor regulations across its operating regions.

- Trade Agreements: Fluctuations in international trade policies can affect the cost of raw materials and the accessibility of global markets for Superior's products.

Government incentives, particularly those supporting electric vehicle (EV) production and adoption, directly influence demand for lightweight components like aluminum wheels. For example, the US Inflation Reduction Act of 2022 is projected to significantly boost EV sales, potentially increasing OEM orders for specialized wheels. Similarly, stringent emissions standards in Europe are pushing automakers towards lighter materials, benefiting companies like Superior Industries.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Superior Industries International across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential influence on the company's operations and market position.

A PESTLE analysis of Superior Industries International acts as a pain point reliever by offering a structured framework to anticipate and mitigate external challenges, enabling proactive strategic adjustments.

Economic factors

Superior Industries International's financial performance is closely linked to global light vehicle production and sales. For 2025, projections suggest a gradual rebound in global light vehicle production. For instance, Europe is anticipated to see modest growth following a notable decline in 2024, while North America is demonstrating continued strength.

This recovery trend is crucial for Superior, as any slowdown in new vehicle demand or manufacturing directly impacts their order volume for aluminum wheels. A dip in sales, such as the estimated 2.5% contraction in global light vehicle sales for 2024, would naturally lead to fewer orders for their products.

The cost of aluminum is a major factor for Superior Industries International, given their focus on designing and manufacturing aluminum wheels. For 2025, projections indicate a possible rise in aluminum prices, influenced by a recovering global manufacturing sector and efforts towards decarbonization. However, some analyses suggest stable pricing for recycled aluminum, offering a potential offset.

Fluctuations in aluminum prices directly affect Superior Industries' gross profit margins. For instance, a 10% increase in aluminum costs, assuming it cannot be fully passed on to customers, could reduce gross profit by a significant percentage. This volatility necessitates robust hedging strategies to mitigate financial risks and maintain profitability.

Persistent inflation and the subsequent rise in interest rates significantly erode consumer purchasing power. For instance, a 2024 report indicated that the average price of a new vehicle in the US had surpassed $48,000, a figure that becomes even more daunting with higher borrowing costs. This affordability challenge can push consumers to delay new vehicle purchases, opting instead to keep their current vehicles longer, directly impacting demand for Superior Industries' automotive components.

The macroeconomic climate of higher interest rates also directly impacts Superior Industries. Increased borrowing costs can strain the company's financial flexibility, potentially limiting its ability to invest in new technologies or expand its production capacity. This tighter financial environment could suppress capital expenditures, affecting future growth prospects.

Supply Chain Disruptions and Logistics Costs

The automotive sector, including companies like Superior Industries International, continues to grapple with persistent supply chain disruptions. Shortages of essential components, such as semiconductors, remain a significant hurdle, directly impacting production volumes for original equipment manufacturers (OEMs). This volatility translates to unpredictable demand for Superior's products.

Furthermore, logistics costs have escalated. Freight rates, whether by sea or land, have seen substantial increases, raising the expense of moving raw materials to manufacturing facilities and finished goods to customers. For instance, the Drewry World Container Index, a benchmark for global shipping costs, remained elevated throughout much of 2024, though it saw some moderation from its 2021 peaks.

These combined pressures create a challenging operating environment for Superior. The company faces potential fluctuations in customer orders and higher operational expenses due to transportation costs. In response, the industry, and by extension Superior, is prioritizing the development of more robust and geographically diversified supply chains to buffer against future shocks.

- Component Shortages: Ongoing semiconductor scarcity continues to constrain automotive production, affecting OEM output and, consequently, demand for automotive components.

- Elevated Logistics Costs: Increased freight rates for ocean and land transport contribute to higher operating expenses for sourcing materials and delivering finished products.

- Demand Variability: Supply chain issues create unpredictability in customer demand, making production planning and inventory management more complex for suppliers like Superior.

- Resilience Focus: A strategic shift towards localized and resilient supply chains is a key initiative across the automotive industry to mitigate these ongoing risks.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Superior Industries International, given its substantial North American and European operations. Changes in the USD-Euro exchange rate directly influence the company's reported financial performance. For instance, a strengthening US dollar can reduce the cost of materials imported from Europe, which is beneficial. However, it also diminishes the value of sales made in Europe when those revenues are converted back into dollars, potentially impacting overall profitability.

In 2024, the Euro experienced periods of volatility against the US dollar. For example, the Euro traded in a range, with fluctuations impacting the cost of goods sold and the translation of foreign earnings. This dynamic means that even if sales volumes remain consistent, the reported revenue and profit figures can vary considerably due to currency movements alone. Superior Industries must therefore actively manage its currency exposure to mitigate these impacts.

- USD-Euro Exchange Rate Impact: A stronger USD makes European imports cheaper but devalues European sales when converted back.

- 2024 Volatility: The Euro saw significant fluctuations against the USD throughout 2024, affecting reported financial results.

- Profitability Sensitivity: Superior's profitability is sensitive to these currency shifts, requiring careful management.

Global light vehicle production is projected for a gradual rebound in 2025, with North America showing continued strength and Europe anticipating modest growth after a 2024 decline. This trend directly influences Superior Industries' order volumes, as a slowdown in vehicle manufacturing, like the estimated 2.5% contraction in global light vehicle sales for 2024, reduces demand for their aluminum wheels.

Aluminum prices are a significant cost driver for Superior Industries. Projections for 2025 suggest a potential increase, influenced by recovering manufacturing and decarbonization efforts, though stable recycled aluminum prices could offer some offset. Fluctuations in these costs directly impact gross profit margins, necessitating robust hedging strategies.

Persistent inflation and higher interest rates continue to impact consumer purchasing power, with the average new vehicle price in the US exceeding $48,000 in 2024. This affordability challenge, compounded by increased borrowing costs, prompts consumers to delay purchases, thereby affecting demand for automotive components.

The automotive sector, including Superior Industries, faces ongoing supply chain disruptions, such as semiconductor shortages, which constrain production and create demand volatility. Coupled with elevated logistics costs, exemplified by sustained high freight rates on global shipping routes throughout 2024, these factors create a challenging operating environment.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Superior Industries | Mitigation Strategy |

| Global Light Vehicle Production | Estimated 2.5% contraction in sales | Gradual rebound, North America strong, Europe modest growth | Directly impacts wheel orders; recovery supports demand | Focus on diversified customer base |

| Aluminum Prices | Mixed, with potential for increases | Possible rise due to manufacturing recovery and decarbonization; stable recycled aluminum prices | Affects gross profit margins; requires hedging | Hedging strategies, sourcing flexibility |

| Inflation & Interest Rates | Persistent inflation, high interest rates | Continued impact on consumer spending and borrowing costs | Reduces consumer demand for new vehicles; increases borrowing costs for the company | Cost management, operational efficiency |

| Supply Chain & Logistics | Component shortages (semiconductors), elevated freight rates | Ongoing disruptions, sustained high logistics costs | Production volatility, increased operational expenses | Supply chain resilience, localized sourcing |

Full Version Awaits

Superior Industries International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Superior Industries International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Consumer preferences are significantly reshaping the automotive landscape, directly impacting demand for specific vehicle types and features. In 2024, the ongoing preference for SUVs and pickup trucks continues to dominate new vehicle sales, with these segments accounting for over 60% of the U.S. market share. This trend necessitates that wheel manufacturers like Superior Industries International focus on producing larger diameter, more robust wheel designs that cater to these popular vehicle platforms.

Beyond vehicle type, there's a noticeable surge in consumer desire for advanced and customizable features. This includes everything from enhanced wheel finishes and intricate spoke designs to integrated tire pressure monitoring systems and lightweight alloy construction for improved performance and fuel efficiency. For instance, the market for custom wheels saw a growth of approximately 8% in 2023, indicating a strong consumer willingness to invest in personalization. Superior Industries International must therefore invest in flexible manufacturing processes and diverse design capabilities to meet this evolving demand for premium and tailored wheel solutions.

Consumers are increasingly prioritizing sustainability, with a significant portion of global consumers willing to pay more for eco-friendly products. This shift directly impacts the automotive sector, pushing manufacturers and suppliers like Superior Industries towards greener alternatives. For instance, a 2024 survey indicated that over 60% of car buyers consider environmental impact when making a purchase decision.

Superior Industries can leverage this trend by focusing on lightweight wheel designs that enhance fuel efficiency and extend the range of electric vehicles. The company's commitment to using recycled aluminum, a practice already in place, becomes a key selling point. By adopting more sustainable manufacturing processes, Superior can align with the automotive industry's broader goal of reducing its environmental footprint, potentially gaining a competitive edge in the 2024-2025 market.

Urbanization continues to reshape how people move. In 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030. This concentration of people in cities often leads to increased reliance on public transportation and ride-sharing services, potentially dampening long-term demand for new private vehicle sales and the automotive components Superior Industries International supplies.

Shifting mobility preferences, like the growing popularity of car-sharing platforms, could reduce the need for individual car ownership. For instance, by late 2024, services like Zipcar and Turo reported millions of active users in major metropolitan areas. This trend, while not an immediate crisis for automotive component suppliers, represents a gradual evolution that could influence future market demand for traditional vehicle parts.

Labor Market Trends and Skilled Worker Availability

The availability of a skilled workforce is paramount for Superior Industries, especially in specialized manufacturing processes like aluminum casting and finishing, critical for their North American and European operations. Labor market trends directly influence production capacity and efficiency. For instance, as of late 2024, the U.S. manufacturing sector continued to face challenges with a persistent skills gap, particularly in advanced manufacturing roles, with reports indicating millions of unfilled positions requiring specialized technical expertise.

Labor shortages and increasing wage demands can significantly impact Superior's operational costs and overall competitiveness. In 2024, many manufacturing hubs saw average hourly wages for skilled trades climb, reflecting the tight labor market. This upward pressure on wages, coupled with potential demographic shifts leading to fewer available workers, necessitates proactive strategies to ensure a stable and capable workforce.

To address these labor-related challenges, strategic investments in automation and advanced manufacturing technologies are becoming increasingly important. By integrating robotics and AI, Superior can not only mitigate the impact of labor shortages but also enhance production consistency and output. For example, the global industrial automation market was projected to reach over $300 billion by 2025, highlighting the widespread adoption of these solutions to improve efficiency and address labor constraints.

- Skills Gap in Manufacturing: Continued shortages in specialized manufacturing roles, particularly in areas like machining and welding, affect production output.

- Wage Inflation: Rising labor costs in 2024 and 2025 put pressure on operational budgets for manufacturers.

- Demographic Shifts: An aging workforce in some regions and a lack of new entrants into skilled trades exacerbate labor availability concerns.

- Automation Investment: Companies are increasingly investing in automation to offset labor shortages and improve efficiency, a trend expected to accelerate.

Brand Reputation and Consumer Perception

Maintaining a robust brand reputation for quality and reliability is paramount for Superior Industries International, especially within the demanding Original Equipment Manufacturer (OEM) supply chain and its aftermarket divisions. Consumer sentiment surrounding automotive safety, sustainability, and product longevity can indirectly influence OEM demand, thereby impacting Superior's order volumes. For instance, a 2024 consumer survey indicated that 65% of car buyers consider brand reputation for durability a key factor in their purchase decisions. Negative public perception regarding product defects or questionable business ethics could significantly jeopardize crucial OEM partnerships and aftermarket sales.

Superior's aftermarket brands, such as those focused on wheels, also rely heavily on consumer perception. In 2024, the automotive aftermarket saw a 7% increase in demand for visually appealing and durable wheel upgrades, driven by consumer desire for personalization and enhanced vehicle aesthetics. A strong brand image that aligns with these consumer desires is crucial for capturing market share. Conversely, any association with safety recalls or manufacturing issues, as seen with a competitor in early 2025 which led to a 15% drop in their stock price, could swiftly erode consumer trust and damage sales across all product lines.

- Brand Reputation: Crucial for OEM supply chain and aftermarket sales.

- Consumer Perception: Safety, environmental responsibility, and durability influence OEM demand.

- Market Impact: Negative perceptions can harm business relationships and sales.

- Aftermarket Demand: 2024 saw a 7% rise in demand for aesthetic and durable wheel upgrades.

Societal values are increasingly emphasizing sustainability and ethical consumption, impacting automotive purchasing decisions. By 2024, over 60% of global consumers indicated a willingness to pay a premium for eco-friendly products, a trend directly influencing automotive manufacturers and their suppliers like Superior Industries International. This societal shift necessitates a focus on lightweight wheel designs that improve fuel efficiency, particularly for electric vehicles, and highlights the importance of using recycled materials such as aluminum, a practice Superior already employs.

Technological factors

The automotive industry's rapid move towards electric vehicles (EVs) is a significant technological shift. This trend directly impacts Superior Industries International, as EVs demand lighter components to maximize battery range and efficiency. In 2024, the global EV market is projected to reach over 17 million units, a substantial increase from previous years, highlighting the growing importance of lightweight materials.

Aluminum wheels are particularly crucial for EVs due to their inherent lightweight properties compared to traditional steel. Superior Industries' focus on developing advanced lightweighting technologies, including innovative wheel designs that improve aerodynamics and withstand the increased weight of EV battery packs, positions them to capitalize on this evolving market. For instance, their investments in advanced alloys and manufacturing processes are key to meeting these new demands.

Superior Industries International is leveraging advanced manufacturing processes like high-pressure die casting and robotics to boost efficiency and cut costs. These technological upgrades are vital for staying competitive, particularly as labor expenses climb and the demand for high-precision components grows.

In 2023, Superior reported a significant increase in capital expenditures, with a substantial portion allocated to enhancing its manufacturing capabilities and automation. This strategic investment aims to streamline production, improve output quality, and ultimately strengthen its market position in the automotive wheel industry.

Superior Industries is increasingly leveraging digital tools such as CAD and advanced simulation software to accelerate the design, engineering, and testing of its wheel products. This digital transformation allows for more efficient product development, enabling quicker responses to Original Equipment Manufacturer (OEM) requests for novel designs and enhanced performance. For instance, in 2024, the company highlighted its ability to reduce prototype development time by up to 30% through these digital advancements, a critical factor in securing new contracts with major automakers.

Material Science Advancements

Material science is constantly evolving, and Superior Industries is positioned to benefit from these ongoing advancements. New aluminum alloys and hybrid material combinations, like carbon fiber composites, are emerging that can significantly enhance wheel performance. These innovations allow for lighter, stronger, and more durable wheels, which is crucial for meeting the demands of original equipment manufacturers (OEMs). For instance, the automotive industry's push for lighter vehicles to improve fuel efficiency and reduce emissions directly translates to a need for advanced wheel materials. In 2024, the global automotive lightweight materials market was valued at approximately USD 20.5 billion, with projections indicating continued growth driven by these technological shifts.

By embracing these material science breakthroughs, Superior Industries can offer wheels with improved strength-to-weight ratios and novel aesthetic possibilities. This not only meets current OEM requirements but also anticipates future trends in vehicle design and performance. Staying ahead in material innovation is therefore a critical factor for maintaining a competitive edge in the automotive wheel industry.

- Enhanced Performance: Lighter wheels improve vehicle handling, acceleration, and braking.

- Weight Reduction: Advanced materials contribute to overall vehicle weight reduction, boosting fuel efficiency.

- New Design Possibilities: Hybrid materials can offer unique aesthetic features and customization options.

- Meeting OEM Standards: Continuous material innovation is essential to align with evolving automotive industry specifications for durability and safety.

Industry 4.0 and Smart Factory Integration

Superior Industries is actively integrating Industry 4.0 technologies to transform its manufacturing. This includes the adoption of the Internet of Things (IoT) for real-time data collection, artificial intelligence (AI) for process optimization, and advanced data analytics to drive decision-making. These advancements are crucial for staying competitive in the automotive supply chain.

The company's smart factory initiatives are designed to boost operational efficiency and product quality. By leveraging predictive maintenance powered by AI, Superior can anticipate equipment failures, minimizing costly downtime. For instance, in 2024, many advanced manufacturing facilities reported a reduction in unplanned downtime by as much as 20-30% through predictive maintenance programs.

Embracing smart factory concepts allows Superior to achieve higher levels of precision and throughput in its production processes. This translates to better quality control and faster delivery times, essential for meeting the demanding standards of its automotive clients. The global smart factory market was valued at over $80 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards these integrated technologies.

Key benefits Superior aims to achieve through Industry 4.0 integration include:

- Enhanced Operational Efficiency: Streamlining production through real-time data and AI-driven insights.

- Predictive Maintenance: Reducing downtime and maintenance costs by anticipating equipment issues.

- Improved Quality Control: Achieving higher precision in manufacturing processes for superior product output.

- Optimized Production Flows: Utilizing data analytics to identify and eliminate bottlenecks, increasing throughput.

The automotive industry's technological trajectory, particularly the surge in electric vehicles (EVs), necessitates lighter and more robust wheel components. Superior Industries is actively developing advanced alloys and manufacturing techniques to meet these evolving demands, aiming to reduce vehicle weight and enhance battery range. The global EV market's rapid expansion, projected to exceed 17 million units in 2024, underscores the critical need for such innovations.

Superior Industries is also investing heavily in advanced manufacturing processes and digital tools. This includes leveraging AI for predictive maintenance, with similar facilities reporting up to a 30% reduction in unplanned downtime in 2024. Furthermore, the company utilizes digital design and simulation software, cutting prototype development time by as much as 30% in 2024, a key factor in securing new OEM contracts.

| Technological Factor | Impact on Superior Industries | Supporting Data/Trend (2024/2025) |

| EV Adoption & Lightweighting | Increased demand for aluminum wheels and advanced alloys. | Global EV market projected to exceed 17 million units in 2024. |

| Advanced Manufacturing (Industry 4.0) | Enhanced efficiency, cost reduction, and quality improvement through automation and AI. | Predictive maintenance programs reduced unplanned downtime by 20-30% in advanced facilities (2024). |

| Digital Design & Simulation | Faster product development cycles and improved OEM responsiveness. | Reduced prototype development time by up to 30% (2024). |

| Material Science Innovation | Development of lighter, stronger materials for improved performance and fuel efficiency. | Global automotive lightweight materials market valued at approximately USD 20.5 billion (2024). |

Legal factors

Superior Industries International, as a maker of vital automotive parts, faces strict product liability laws and safety standards globally. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) sets rigorous safety standards for wheels, and non-compliance can lead to significant penalties. Adherence to these regulations through extensive testing and quality assurance is crucial to prevent expensive recalls and legal battles.

Superior Industries International's manufacturing facilities are subject to a complex web of environmental protection laws across North America and Europe. These regulations govern critical aspects such as air emissions, hazardous waste disposal, and water consumption, requiring significant investment in compliance technologies and processes. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards under the Clean Air Act, impacting industrial operations.

Furthermore, the automotive industry's push towards reduced environmental impact directly benefits Superior. Increasingly rigorous vehicle emissions standards, such as those being phased in by the European Union and anticipated in the United States for 2025 and beyond, are driving Original Equipment Manufacturers (OEMs) to seek lightweight materials. Superior's aluminum wheels are a prime example, contributing to better fuel economy and consequently lower tailpipe emissions, thereby indirectly boosting demand for their products.

Superior Industries International navigates a complex web of labor laws across its global manufacturing sites. For instance, in the United States, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while the National Labor Relations Act (NLRA) governs unionization. In Mexico, where Superior also has operations, labor regulations are overseen by the Federal Labor Law, which includes provisions on working hours, profit sharing, and employee benefits.

Maintaining compliance with these varying regulations is critical. Failure to adhere to local labor laws, such as those concerning workplace safety standards or discrimination, can lead to significant fines, legal challenges, and operational disruptions. For example, in 2023, the U.S. Department of Labor collected over $300 million in back wages for workers due to minimum wage and overtime violations, highlighting the financial risks of non-compliance.

Intellectual Property Rights and Patents

Superior Industries International relies heavily on its intellectual property, including distinctive wheel designs and proprietary manufacturing techniques, to maintain its market edge. The company's ability to protect these innovations through robust legal frameworks is paramount, ensuring that its investments in research and development translate into sustained competitive advantage.

Legal protections for intellectual property, such as patents and design registrations, are vital for preventing competitors from copying Superior Industries' unique offerings. For instance, in 2023, the company continued to leverage its patent portfolio to defend its technological advancements in wheel manufacturing, a critical component of its business strategy.

- Patent Protection: Superior Industries actively seeks and maintains patents for its innovative wheel designs and manufacturing processes, safeguarding its technological edge.

- Design Registrations: Legal registration of unique wheel aesthetics prevents unauthorized replication, a key differentiator in the automotive aftermarket.

- Enforcement: The company is prepared to enforce its intellectual property rights against infringements to protect its market share and R&D investments.

- Global IP Strategy: Superior Industries manages its intellectual property across key global markets to ensure broad protection for its innovations.

Antitrust and Competition Laws

Superior Industries International operates under stringent antitrust and competition laws across its global markets, ensuring fair play and preventing monopolistic tendencies. These regulations directly impact how Superior conducts business, from setting prices to pursuing growth through mergers and acquisitions. For instance, in 2024, the Federal Trade Commission (FTC) in the U.S. continued its aggressive stance on market concentration, reviewing numerous transactions that could affect industries similar to automotive components. This regulatory environment necessitates careful strategic planning to avoid practices that could be deemed anti-competitive, thereby safeguarding the company's market position and future expansion plans.

Adherence to these laws is crucial for Superior's strategic initiatives. The company must navigate regulations that govern market conduct, pricing strategies, and any potential mergers or acquisitions. Failure to comply can result in significant fines and operational restrictions. For example, in 2023, a major automotive supplier faced substantial penalties for price-fixing allegations, highlighting the serious consequences of antitrust violations. Superior's approach to market entry and product development is therefore shaped by these legal frameworks, influencing its competitive landscape and overall business model.

Superior Industries International must navigate a complex legal landscape, including product liability, environmental regulations, labor laws, and intellectual property protection. For example, in 2024, the U.S. EPA continued to enforce strict emissions standards, impacting manufacturing processes. The company's adherence to global safety standards, such as those set by NHTSA for automotive wheels, is paramount to avoid penalties and recalls.

The company's intellectual property, including unique wheel designs and manufacturing techniques, is legally protected through patents and design registrations. In 2023, Superior Industries continued to leverage its patent portfolio to defend its technological advancements, a key strategy for maintaining its competitive edge.

Antitrust and competition laws also significantly influence Superior's operations, pricing, and expansion strategies. The FTC's active stance on market concentration in 2024 necessitates careful planning to avoid anti-competitive practices, which could lead to substantial fines and operational restrictions.

Environmental factors

The energy-intensive nature of aluminum production and wheel manufacturing means Superior Industries International has a considerable carbon footprint. This is particularly true for their facilities in North America and Europe.

Superior Industries is under growing pressure to lower its greenhouse gas emissions. For instance, in 2023, the manufacturing sector globally saw continued focus on reducing Scope 1 and Scope 2 emissions, with many companies setting targets for significant reductions by 2030.

Meeting these environmental demands will require substantial investment. This includes upgrades for greater energy efficiency, adoption of renewable energy sources like solar or wind power for their plants, and implementing more sustainable production methods throughout their operations.

Superior Industries International relies heavily on primary aluminum, a process with significant environmental footprints from mining to smelting. The global aluminum market in 2024 saw prices fluctuate, with LME aluminum trading around $2,400 per metric ton, highlighting the cost pressures associated with virgin material.

Integrating recycled aluminum is key for Superior to lessen its environmental impact and buffer against supply chain disruptions and price swings. In 2023, the global recycling rate for aluminum reached approximately 75%, demonstrating the growing availability and economic viability of secondary aluminum, which Superior can leverage.

Superior Industries faces increasing pressure to implement effective waste management and recycling for its manufacturing scrap and used aluminum wheels. In 2024, the automotive industry saw a growing emphasis on circular economy principles, with many manufacturers setting ambitious targets for recycled content in new vehicles. For example, several major automakers announced plans to increase the use of recycled aluminum in their components, driving demand for efficient recycling processes.

Compliance with evolving waste disposal regulations is paramount. Many regions are tightening restrictions on landfilling manufacturing byproducts, pushing companies like Superior to invest in advanced sorting and processing technologies. By actively participating in or promoting aluminum recycling, Superior can not only reduce its environmental footprint but also potentially secure a more stable and cost-effective supply of raw materials, aligning with the broader industry shift towards sustainability.

Water Usage and Pollution Control

Water is a critical resource for Superior Industries International's manufacturing operations, utilized across various production stages. The company must adhere to increasingly strict regulations concerning water discharge and pollution control, especially in areas facing water scarcity or rigorous environmental enforcement. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize advanced wastewater treatment technologies, impacting industries like automotive parts manufacturing.

Superior's commitment to sustainability necessitates the adoption of water-saving technologies and efficient processes. This includes investing in closed-loop water systems and advanced filtration methods to minimize overall water consumption. Meeting stringent discharge limits requires robust wastewater treatment facilities, ensuring compliance with local and national environmental standards.

The company’s approach to water management is crucial for maintaining its operational license and corporate reputation. Regions with limited water resources, such as parts of the Southwestern United States, impose particularly challenging requirements. Superior's proactive stance on water conservation and pollution prevention is therefore essential for long-term operational viability and responsible environmental stewardship.

- Water Consumption: Manufacturing processes inherently require significant water input for cooling, cleaning, and material processing.

- Regulatory Compliance: Strict adherence to national and local water discharge permits and pollution control standards is mandatory.

- Wastewater Treatment: Investment in advanced treatment technologies is vital to remove contaminants before water is discharged or recycled.

- Water Scarcity Impact: Operations in water-stressed regions face heightened scrutiny and require more innovative water management strategies.

Compliance with Global Environmental Standards and ESG Reporting

Superior Industries International faces increasing scrutiny regarding its environmental footprint, necessitating compliance not just with local regulations but also with evolving global standards. The growing investor demand for robust Environmental, Social, and Governance (ESG) reporting means the company must provide transparent data on its environmental performance. For instance, by the end of 2024, many institutional investors will require detailed metrics on Scope 1, 2, and potentially Scope 3 emissions, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

Demonstrating proactive environmental stewardship is becoming a key differentiator. Superior Industries International's commitment to reducing greenhouse gas emissions and waste management can significantly enhance its corporate reputation. Companies that actively report on their sustainability initiatives, such as Superior Industries' efforts in 2024 to optimize energy consumption in its manufacturing facilities, often see improved brand loyalty and access to capital from ESG-focused funds. By 2025, it's anticipated that over 75% of major global companies will have formal ESG reporting structures in place.

- Global ESG Mandates: Investors increasingly prioritize companies with strong ESG performance, pushing for standardized reporting by 2025.

- Reputational Enhancement: Superior Industries International can leverage environmental initiatives to attract environmentally conscious consumers and investors.

- Operational Efficiency: Adherence to global standards often drives innovation in resource management, leading to cost savings.

- Investor Confidence: Transparent and comprehensive ESG reporting, expected to be a norm by 2025, builds trust and can improve access to funding.

Superior Industries International's environmental impact is significant, particularly concerning its energy-intensive aluminum wheel manufacturing. The company faces mounting pressure to reduce its carbon footprint, with a focus on decreasing greenhouse gas emissions from its North American and European facilities.

Key environmental considerations include the substantial energy required for aluminum production, which has a considerable carbon footprint. Superior Industries is investing in energy efficiency upgrades and exploring renewable energy sources to meet emission reduction targets, a trend seen across the manufacturing sector globally in 2023 and 2024.

The company's reliance on primary aluminum, which has a high environmental impact, is being addressed by integrating recycled aluminum. This strategy not only lessens environmental impact but also buffers against supply chain volatility, a factor highlighted by fluctuating global aluminum prices in 2024. Superior also faces stringent regulations regarding waste management and water usage, necessitating investments in advanced recycling and water-saving technologies.

| Environmental Factor | Impact on Superior Industries | Industry Trend/Data (2023-2025) |

| Energy Consumption & Emissions | High energy use in aluminum processing leads to significant carbon footprint. Pressure to reduce Scope 1 & 2 emissions. | Global manufacturing sector focused on emission reduction; many companies setting 2030 targets. |

| Raw Material Sourcing | Reliance on primary aluminum with high environmental impact. | Global recycling rate for aluminum reached ~75% in 2023, increasing viability of secondary aluminum. |

| Waste Management & Recycling | Need for effective scrap and used wheel recycling. | Automotive industry pushing for circular economy principles; increased use of recycled content in new vehicles. |

| Water Usage & Discharge | Significant water use in manufacturing requires compliance with strict discharge and pollution control regulations. | EPA emphasizing advanced wastewater treatment; water scarcity in regions like Southwestern US heightens scrutiny. |

| Regulatory & Investor Pressure | Compliance with evolving global environmental standards and increasing demand for ESG reporting. | By 2025, >75% of major global companies expected to have formal ESG reporting structures. Institutional investors demand detailed ESG metrics. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Superior Industries International is built on a comprehensive review of data from government publications, industry-specific market research reports, and reputable financial news outlets. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the automotive component manufacturing sector.