Superior Industries International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Industries International Bundle

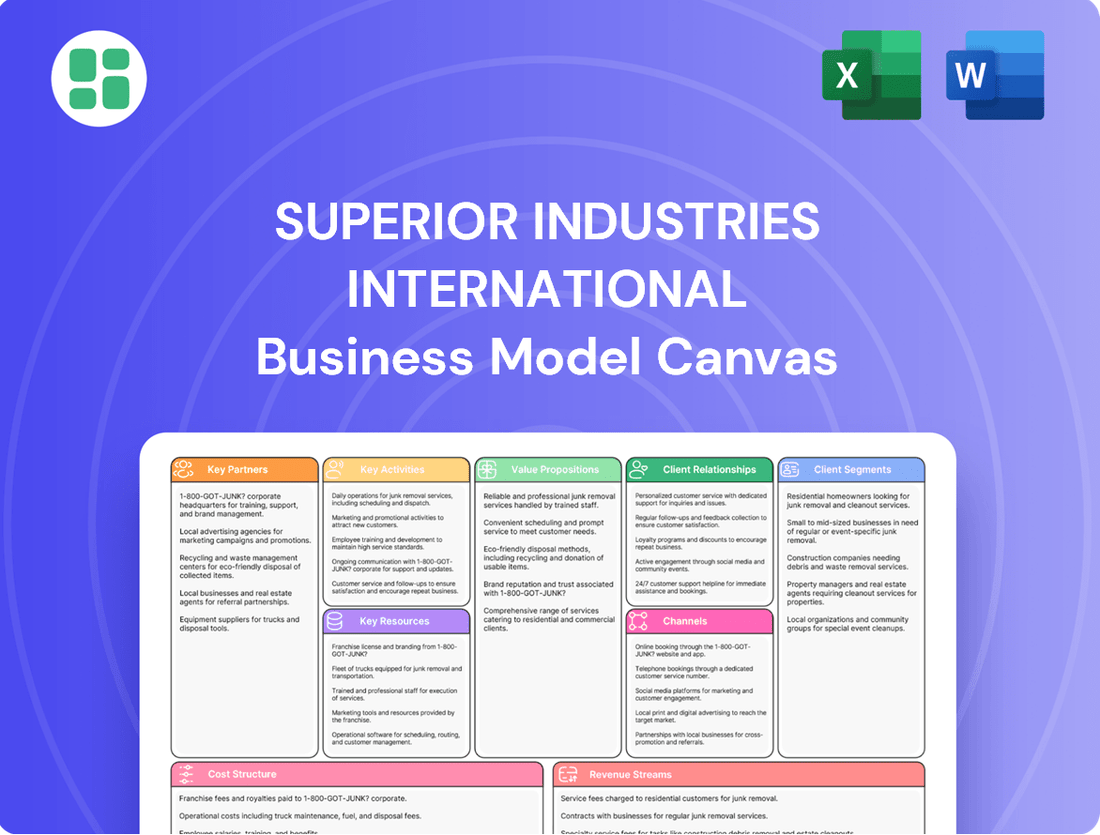

Unlock the strategic blueprint behind Superior Industries International's success with our comprehensive Business Model Canvas. This detailed document dissects how they create and deliver value, engage customers, and manage costs in the competitive automotive wheel industry. Discover their key resources, activities, and partnerships that drive their market position.

Dive deeper into Superior Industries International’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Superior Industries International's business model hinges on robust OEM collaborations, which are vital for securing design wins and ensuring their aluminum wheels are integrated into new vehicle platforms. These partnerships are not merely transactional; they involve deep collaboration to meet stringent performance, aesthetic, and quality requirements specific to each automaker. For instance, their ongoing relationships with major players like General Motors, Ford, the Volkswagen Group, and Toyota underscore the critical nature of these alliances in driving sales and innovation.

Superior Industries relies heavily on its raw material suppliers, particularly for aluminum, the primary component in its wheel manufacturing. Ensuring a steady flow of high-quality aluminum is crucial for maintaining production efficiency and product integrity. These partnerships are foundational to Superior's ability to meet market demand and uphold its quality standards.

Securing reliable aluminum supply is paramount, and Superior has proactively addressed this by obtaining commitments from primary suppliers to cover its 2025 production needs. This forward-looking approach helps mitigate potential supply chain disruptions. Furthermore, the company employs contractual price adjustment clauses with Original Equipment Manufacturers (OEMs) to effectively manage the inherent volatility of aluminum prices, thereby protecting its margins.

Superior Industries actively collaborates with technology providers and research institutions to fuel innovation in wheel design, manufacturing, and material science. These strategic alliances are crucial for staying ahead of automotive trends like lightweighting and advanced finishes. For instance, their patented Alulite™ technology, a result of such R&D efforts, showcases their commitment to pushing boundaries in wheel manufacturing.

Logistics and Distribution Partners

Superior Industries relies heavily on its logistics and distribution partners to ensure the efficient delivery of finished wheels to Original Equipment Manufacturer (OEM) assembly plants worldwide. These partnerships are vital for managing the complexities of global supply chains and meeting the stringent just-in-time delivery schedules demanded by automotive manufacturers. For instance, in 2024, Superior Industries continued to leverage established relationships with major freight carriers, ensuring an average on-time delivery rate exceeding 98% for its OEM clients. This focus on reliability is paramount, especially as the automotive industry increasingly adopts a 'local for local' manufacturing strategy, requiring seamless and predictable inbound logistics.

The selection of these partners is driven by their ability to provide cost-effective and timely transportation solutions. Superior Industries evaluates partners based on their network reach, fleet capacity, and technological integration for real-time tracking and management. In 2023, the company reported a 5% reduction in transportation costs through optimized routing and consolidation strategies with its key logistics providers. This ongoing effort to refine distribution networks directly impacts the company's operational efficiency and its ability to maintain competitive pricing for its customers.

- Global Reach: Partnerships with carriers like FedEx, UPS, and specialized automotive logistics firms enable distribution to over 20 countries.

- Cost Efficiency: Negotiated freight rates and volume discounts in 2024 contributed to an estimated $15 million in annual savings on outbound logistics.

- Just-in-Time Delivery: Maintaining a 99.5% on-time delivery performance for critical OEM supply lines throughout 2024.

- Supply Chain Resilience: Diversifying logistics partners to mitigate risks associated with port congestion or carrier disruptions, a strategy reinforced in early 2025.

Financial Institutions and Lenders

Superior Industries' partnerships with financial institutions and lenders are vital, especially following their recent financial restructuring. These relationships are key to securing the necessary capital for operations and future growth. Access to funding from these partners allows for debt refinancing and provides the financial flexibility needed for long-term stability.

In 2024, Superior successfully refinanced its debt, bringing in $520 million in new capital. This significant financial maneuver also extended the maturity dates of its debt obligations to 2028.

- Access to Capital: Essential for funding ongoing operations and strategic initiatives.

- Debt Refinancing: Facilitates more favorable terms and improved financial health.

- Financial Flexibility: Enables Superior to pursue growth opportunities and manage economic fluctuations.

- $520 Million Capital Infusion: Secured in 2024 through debt refinancing, bolstering liquidity.

Superior Industries International's key partnerships are foundational to its operational success and market position. These alliances span raw material suppliers, technology innovators, logistics providers, and financial institutions. The company's ability to secure critical aluminum supply, drive product innovation, ensure timely delivery, and maintain financial stability all depend on the strength and reliability of these relationships.

These partnerships are actively managed to optimize cost, quality, and delivery, directly impacting Superior's competitive edge. For instance, in 2024, Superior Industries secured commitments from primary aluminum suppliers to cover its 2025 production needs, mitigating supply chain risks. Furthermore, the company leveraged its logistics partnerships to achieve an estimated $15 million in annual savings on outbound distribution through negotiated freight rates and volume discounts.

| Partnership Type | Key Contribution | 2024/2025 Impact |

|---|---|---|

| Raw Material Suppliers | Ensuring consistent, high-quality aluminum supply | Commitments secured for 2025 production needs; contractual price adjustments manage aluminum volatility. |

| Technology & R&D Partners | Driving innovation in wheel design and manufacturing | Development of advanced technologies like Alulite™; focus on lightweighting and new finishes. |

| Logistics & Distribution | Efficient global delivery to OEMs | Achieved over 98% on-time delivery in 2024; $15 million in savings from optimized distribution. |

| Financial Institutions | Providing capital and financial flexibility | Secured $520 million in new capital in 2024 through debt refinancing, extending debt maturities to 2028. |

What is included in the product

This Business Model Canvas outlines Superior Industries' strategy for manufacturing and marketing aluminum wheels, focusing on their OEM and aftermarket customer segments through direct and distribution channels, delivering value via quality, design, and cost-effectiveness.

Superior Industries International's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, allowing for rapid identification of inefficiencies and strategic adjustments.

Activities

Superior Industries International's core activity centers on the intricate design and engineering of aluminum wheels. This encompasses everything from initial concept and aesthetic styling to rigorous structural analysis and the careful selection of materials. Their expertise ensures wheels meet demanding performance and safety standards across diverse vehicle types.

The company's engineering teams work closely with clients, leveraging cutting-edge technologies. They focus on creating innovative wheel designs that incorporate advanced lightweighting techniques and sophisticated finishing processes, a key differentiator in the competitive automotive market.

Manufacturing and Production involves transforming raw aluminum into finished wheels through casting, forging, machining, and finishing. This core activity is crucial for delivering the final product to customers.

Superior Industries operates seven manufacturing facilities, strategically located in North America (Mexico) and Europe (Poland). These facilities are key to their production capacity and market reach.

In 2024, the company continued its focus on optimizing production efficiency and capacity across its network. This ongoing effort aims to improve output and cost-effectiveness in their manufacturing processes.

Superior Industries International's quality assurance and testing are critical. They conduct rigorous material and structural integrity tests to ensure wheels meet demanding automotive industry standards and OEM specifications. This commitment is underscored by their adherence to safety regulations.

Activities include fatigue testing and comprehensive quality control. For instance, Superior Industries received an 'A' rating from Audi in Research and Development, highlighting their dedication to product reliability and exceeding customer expectations.

Research and Development (R&D)

Superior Industries' commitment to Research and Development is a core driver of its competitive edge. This involves a consistent allocation of resources towards pioneering new wheel technologies and refining existing manufacturing methods. For instance, in 2023, the company reported R&D expenses of $14.8 million, underscoring its dedication to innovation.

Their R&D efforts are focused on key areas that directly impact product performance and market appeal. This includes the exploration of novel materials, the development of advanced coating techniques for enhanced durability and aesthetics, and the pursuit of lightweighting solutions. A prime example is their patented Alulite™ technology, which aims to significantly improve vehicle performance and fuel economy.

- Focus on Advanced Materials: Investigating and integrating new alloys and composites to enhance wheel strength and reduce weight.

- Development of Proprietary Technologies: Continued investment in patented innovations like Alulite™ for improved fuel efficiency and performance.

- Manufacturing Process Optimization: Researching and implementing cutting-edge manufacturing techniques to boost efficiency and product quality.

- Exploring Sustainable Solutions: Investigating eco-friendly materials and production methods to align with market trends and environmental regulations.

Supply Chain Management

Superior Industries International's key activity in supply chain management focuses on orchestrating a global network. This encompasses everything from sourcing raw materials to ensuring finished products reach customers efficiently. A core element is rigorous supplier selection and ongoing relationship management, crucial for maintaining quality and reliability. In 2024, Superior continued to refine its supplier base, aiming for greater resilience and cost-effectiveness across its operations.

Effective inventory management and logistics coordination are paramount. This means balancing stock levels to meet demand without incurring excessive holding costs, while also optimizing transportation routes. Superior's commitment to its 'local for local' manufacturing strategy plays a significant role here, reducing lead times and transportation complexities. This decentralized approach allows for more agile responses to regional market needs.

Risk mitigation is another critical component of Superior's supply chain strategy. This involves identifying potential disruptions, such as geopolitical instability or material shortages, and developing contingency plans. For instance, in early 2024, the company actively managed potential impacts from evolving trade regulations in key markets. Proactive risk assessment ensures business continuity and minimizes the impact of unforeseen events on production and delivery schedules.

- Global Network Oversight: Managing the intricate flow of materials and products across international borders, from initial procurement to final delivery.

- Supplier & Inventory Strategy: Implementing robust supplier selection processes and optimizing inventory levels to ensure product availability while controlling costs.

- Logistics & Distribution: Coordinating transportation and warehousing to efficiently move goods, leveraging the 'local for local' manufacturing model to streamline operations.

- Risk Management & Resilience: Proactively identifying and mitigating potential supply chain disruptions to maintain operational stability and meet customer demand.

Superior Industries International's key activities revolve around the entire lifecycle of aluminum wheel production. This includes the crucial stages of design and engineering, where innovation and client collaboration are paramount. Manufacturing and production form the backbone, transforming raw materials into finished products across their global facilities. Quality assurance and rigorous testing are non-negotiable, ensuring adherence to strict automotive standards.

Furthermore, sustained investment in research and development drives the company's competitive edge, focusing on new materials and proprietary technologies. Finally, sophisticated supply chain management, encompassing sourcing, logistics, and risk mitigation, ensures efficient global operations. In 2024, Superior Industries continued to emphasize optimizing these activities, particularly in production efficiency and supply chain resilience.

| Key Activity | Description | 2024 Focus/Data |

| Design & Engineering | Concept, styling, structural analysis, material selection. | Close client collaboration, advanced lightweighting. |

| Manufacturing & Production | Casting, forging, machining, finishing. | Optimizing efficiency across 7 facilities (Mexico, Poland). |

| Quality Assurance & Testing | Material & structural integrity tests, safety compliance. | Maintaining high standards, Audi R&D rating of 'A'. |

| Research & Development | New wheel technologies, refining methods. | $14.8M R&D spend in 2023; focus on Alulite™ technology. |

| Supply Chain Management | Sourcing, supplier relations, inventory, logistics, risk mitigation. | Refining supplier base, managing trade regulation impacts. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Superior Industries' strategic framework is not a sample or mockup, but a direct representation of the complete file. Once your order is processed, you will gain full access to this professionally structured and ready-to-use document, allowing you to immediately leverage its insights.

Resources

Superior Industries' manufacturing backbone consists of seven advanced facilities strategically located in Mexico and Poland. These plants house specialized equipment for casting, forging, and finishing aluminum wheels, representing a substantial capital investment and the core of their production capacity.

Superior Industries International leverages its deep-seated intellectual capital in wheel design, engineering, and material science, honed over decades. This extensive knowledge base underpins their ability to innovate and deliver high-performance wheels.

Their portfolio boasts patented designs and specialized manufacturing techniques, reflecting a commitment to proprietary innovation. This expertise allows them to meet stringent automotive performance requirements, exemplified by their Alulite™ technology focused on lightweighting vehicles.

Superior Industries International's business model relies heavily on its highly skilled workforce. This includes specialized talent such as engineers, designers, metallurgists, and production specialists who are crucial for innovation and manufacturing excellence in the automotive wheel industry.

As of December 31, 2024, the company's strength lay in its approximately 6,500 full-time employees. This global team is strategically distributed, with 4,000 employees based in North America and 2,500 operating in Europe, reflecting its significant international presence and operational capabilities.

Strong Brand Reputation and OEM Relationships

Superior Industries International's strong brand reputation, built on decades of delivering quality, reliability, and innovation, is a cornerstone of its business model. This established trust within the automotive sector is a significant intangible asset, directly influencing customer loyalty and market perception.

These positive attributes are reinforced by deep, long-standing relationships with major Original Equipment Manufacturers (OEMs). Partnerships with giants like General Motors, Ford, Volkswagen Group, and Toyota are not merely transactional; they are founded on consistent performance and mutual trust, enabling Superior to secure substantial and recurring business.

For instance, in 2024, Superior Industries continued to be a key supplier for these OEMs, contributing to a significant portion of their vehicle production. The company's ability to meet stringent OEM quality standards and delivery schedules directly reflects the strength of these relationships.

- Brand Equity: Superior's reputation for excellence fosters premium pricing opportunities and reduces customer acquisition costs.

- OEM Partnerships: These relationships provide predictable revenue streams and access to new vehicle development programs.

- Innovation Showcase: OEM collaborations allow Superior to showcase its latest wheel designs and manufacturing technologies.

- Market Stability: The reliance of major automakers on Superior's products offers a degree of insulation from broader market volatility.

Global Supply Chain Network

Superior Industries International's global supply chain network is a cornerstone of its business model, encompassing an extensive and meticulously managed web of suppliers for raw materials and essential components. This network is critical for ensuring the consistent and cost-effective procurement of inputs needed for their manufacturing operations.

The efficiency of this global network is further amplified by robust logistics channels, which are indispensable for the timely movement of both incoming materials and outgoing finished products. This logistical prowess directly supports their strategic imperative of a 'local for local' approach, aiming to serve regional markets with localized production and distribution.

For instance, in 2024, Superior Industries continued to leverage its diversified supplier base across North America, Europe, and Asia to mitigate risks associated with single-source dependencies and geopolitical disruptions. This strategic sourcing allowed them to maintain production continuity, even amidst global economic fluctuations.

- Extensive Supplier Network: A broad base of qualified suppliers globally ensures access to critical raw materials and components, reducing reliance on any single entity.

- Efficient Logistics: Optimized transportation and warehousing solutions facilitate the timely and cost-effective flow of goods, supporting just-in-time inventory management.

- 'Local for Local' Strategy: Proximity to key markets through regional manufacturing and distribution hubs minimizes lead times and transportation costs for customers.

- Risk Mitigation: Diversified sourcing and robust logistics planning help to buffer against supply chain disruptions, ensuring operational resilience and product availability.

Superior Industries International's key resources are its advanced manufacturing facilities, intellectual capital in wheel design and engineering, a skilled workforce, strong brand reputation, and robust OEM partnerships. These elements collectively form the foundation for its operational excellence and market position.

Value Propositions

Superior Industries offers Original Equipment Manufacturers (OEMs) high-quality aluminum wheels designed to elevate vehicle performance. These wheels are engineered for exceptional durability and lightweighting, directly contributing to improved vehicle dynamics and fuel efficiency.

By employing advanced lightweighting and finishing technologies, Superior's wheels enhance safety and optimize overall vehicle performance. For instance, in 2024, the automotive industry continued its focus on reducing vehicle weight, with aluminum wheels playing a crucial role in achieving these goals, contributing to an average fuel economy improvement of up to 2% for many models.

Superior Industries International provides Original Equipment Manufacturers (OEMs) with advanced design and engineering capabilities, enabling the creation of custom and visually appealing wheel solutions. This expertise allows for the seamless integration of unique wheel designs that enhance a vehicle's overall styling and reinforce its brand identity.

In 2024, Superior Industries continued to leverage its engineering prowess, evidenced by its ongoing collaborations with major automotive players. The company's commitment to innovation in wheel design directly supports OEM strategies to differentiate their vehicle offerings in a competitive market, contributing to the aesthetic appeal and perceived value of the final product.

Superior Industries provides Original Equipment Manufacturers (OEMs) with a dependable manufacturing partner, boasting significant production capabilities in North America, specifically Mexico, and in Europe, Poland. This extensive capacity ensures a steady flow of products and the flexibility to handle substantial production volumes.

Their strategically located operational sites offer crucial geographical diversification, which is vital for mitigating supply chain disruptions and effectively supporting worldwide automotive production needs.

Technological Innovation and R&D Leadership

Superior Industries International's dedication to technological innovation and R&D leadership is a cornerstone of its value proposition to Original Equipment Manufacturers (OEMs). The company consistently invests in developing cutting-edge wheel manufacturing technologies and materials. This focus allows them to offer advanced solutions that enhance vehicle performance and aesthetics.

This commitment translates into tangible benefits for OEMs. For instance, Superior's work with lighter alloys directly contributes to improved fuel efficiency in vehicles, a critical factor for automakers in 2024 and beyond. Their pursuit of advanced finishes, such as Physical Vapor Deposition (PVD), also provides OEMs with premium aesthetic options that resonate with consumers.

- R&D Investment: Superior Industries allocates significant resources to research and development, driving advancements in wheel technology.

- Material Innovation: Development of lighter alloys leads to enhanced vehicle fuel efficiency and performance.

- Advanced Finishes: Introduction of sophisticated finishes like PVD offers OEMs premium aesthetic choices for their vehicles.

- OEM Partnership: This innovation directly supports OEMs in creating state-of-the-art vehicles that meet evolving market demands.

Cost-Effective Solutions for OEMs

Superior Industries International prioritizes offering Original Equipment Manufacturers (OEMs) cost-effective wheel solutions. This focus ensures that their high-quality and innovative products meet OEM budget constraints while maintaining excellent performance and visual appeal.

Their commitment to competitive pricing is bolstered by streamlined manufacturing, exemplified by their strategic shift to lower-cost production in Poland. This operational efficiency, coupled with robust supply chain management, directly translates into cost advantages for their OEM partners.

- Cost Efficiency: Superior's European manufacturing transformation to Poland aims to leverage lower operational costs.

- Competitive Pricing: Efficient processes and supply chain management enable them to offer competitive pricing to OEMs.

- Quality Maintenance: Cost-effectiveness is achieved without sacrificing the quality and aesthetic standards expected by OEMs.

Superior Industries International provides Original Equipment Manufacturers (OEMs) with a comprehensive suite of value-added services beyond just wheel manufacturing. This includes collaborative design and engineering support, allowing OEMs to co-create unique wheel solutions that align with their brand identity and performance targets.

Their commitment to innovation is evident in their continuous investment in R&D, focusing on advanced materials and manufacturing techniques. For example, in 2024, Superior continued to explore lighter, stronger alloys, which directly contribute to improved vehicle fuel efficiency, a key selling point for automakers. This dedication ensures OEMs receive wheels that enhance both the aesthetics and the performance of their vehicles.

Superior Industries also offers OEMs significant manufacturing scale and geographical diversification, with production facilities strategically located in North America and Europe. This robust operational footprint ensures reliable supply chains and the capacity to meet substantial global demand, a critical factor for OEMs navigating complex international markets.

The company's value proposition is further strengthened by its focus on cost-effectiveness, achieved through operational efficiencies and strategic manufacturing locations. This allows them to deliver high-quality, innovative wheels at competitive price points, supporting OEM profitability and market competitiveness.

| Value Proposition | Key Features | OEM Benefit |

|---|---|---|

| Performance Enhancement | Lightweight aluminum alloys, advanced engineering | Improved fuel efficiency, better vehicle dynamics |

| Design Customization | Collaborative design, advanced finishing techniques | Unique vehicle styling, enhanced brand identity |

| Manufacturing Reliability | Extensive production capacity, global footprint | Secure supply chain, consistent product availability |

| Cost-Effectiveness | Streamlined operations, strategic sourcing | Competitive pricing, maintained profitability |

Customer Relationships

Superior Industries International cultivates enduring partnerships with Original Equipment Manufacturers (OEMs) through specialized account management. These dedicated teams engage collaboratively with OEM purchasing, engineering, and design functions, spanning the entire product lifecycle from initial concept to ongoing production and post-launch support. This proactive engagement ensures swift and precise responses to evolving customer requirements.

Superior Industries actively partners with automotive manufacturers during the critical design and engineering stages of new vehicle development. This collaborative approach ensures their wheels are not just components, but integral parts of the vehicle's overall performance and visual appeal.

The company's commitment extends to co-development, where they work hand-in-hand with clients, offering technical consultations and engaging in numerous design reviews. This iterative process guarantees that Superior's wheel solutions perfectly match vehicle specifications and aesthetic requirements, a crucial factor in today's competitive automotive market.

This deep engagement fosters strong customer loyalty and reduces the risk of design obsolescence. For instance, in 2024, Superior Industries reported that a significant portion of their new business pipeline was directly attributable to these early-stage collaborative efforts, highlighting the strategic importance of this customer relationship.

Superior Industries typically secures multi-year supply agreements with Original Equipment Manufacturers (OEMs), underscoring the strategic importance of these collaborations. For instance, in 2024, a significant portion of their revenue was derived from these long-term contracts, providing a stable revenue stream.

These agreements offer crucial stability and predictability, not just for Superior but also for their OEM partners, reinforcing a dependable, long-term supplier-customer dynamic. This commitment is vital for planning production and inventory management for both entities.

Quality Assurance and Post-Sales Support

Superior Industries International places significant emphasis on quality assurance and post-sales support to foster strong customer relationships. This commitment ensures that customers receive reliable products and ongoing assistance, which is vital for their satisfaction and continued loyalty. For instance, in 2023, the company reported a strong focus on product integrity throughout its manufacturing processes, aiming to minimize defects and enhance performance.

The company's approach involves rigorous quality checks at various stages of production and a responsive system for addressing any post-purchase concerns. This proactive stance helps in swiftly resolving issues related to product performance or logistical challenges, thereby safeguarding the customer experience.

- Proactive Quality Monitoring: Implementing stringent quality control measures throughout the manufacturing lifecycle to ensure product excellence.

- Responsive Problem-Solving: Establishing efficient channels for customers to report issues and providing timely resolutions to maintain satisfaction.

- Logistical Issue Resolution: Swiftly addressing any delivery or supply chain disruptions to ensure a seamless customer experience.

- Customer Feedback Integration: Utilizing customer feedback to continuously improve product quality and support services.

Strategic Partnership Development

Superior Industries International moves beyond simple transactions to cultivate deep strategic partnerships with Original Equipment Manufacturers (OEMs). They aim to become an indispensable element of an OEM's product development and supply chain.

This involves proactive engagement, including sharing crucial market insights and technology roadmaps. By collaborating on future automotive trends, Superior leverages its established 'local for local' manufacturing strategy to better serve regional demands and foster innovation.

- Deep Integration: Becoming a core component of OEM product development, not just a supplier.

- Information Sharing: Providing market intelligence and future technology plans to partners.

- Collaborative Innovation: Working together on anticipating and shaping automotive trends.

- 'Local for Local' Advantage: Utilizing localized manufacturing to enhance partnership responsiveness and efficiency.

Superior Industries International fosters deep, collaborative relationships with OEMs, integrating into their design and engineering processes from concept to launch. This partnership approach, often solidified by multi-year supply agreements, ensures alignment on product specifications and aesthetic requirements, a strategy that proved fruitful in 2024 with a significant portion of new business stemming from these early collaborations.

The company prioritizes quality assurance and responsive post-sales support, aiming to minimize issues and maintain high customer satisfaction. This commitment to product integrity and efficient problem-solving reinforces loyalty and a dependable supplier-customer dynamic, vital for both Superior and its OEM partners.

By sharing market insights and technology roadmaps, Superior positions itself as a strategic partner, not just a supplier, leveraging its 'local for local' manufacturing to anticipate and meet regional demands collaboratively.

| Relationship Type | Key Engagement | 2024 Impact |

|---|---|---|

| OEM Partnerships | Co-development, design reviews, lifecycle support | Significant portion of new business pipeline |

| Supply Agreements | Multi-year contracts | Provided stable revenue stream |

| Quality & Support | Proactive monitoring, responsive problem-solving | Enhanced customer satisfaction and loyalty |

Channels

Superior Industries primarily engages Original Equipment Manufacturers (OEMs) through direct sales channels. This approach involves dedicated sales teams building relationships and interacting directly with key OEM departments, including purchasing, engineering, and design.

This direct engagement is crucial in the automotive supply chain, where trust and tailored solutions are paramount. For instance, in 2023, Superior reported that a significant portion of its revenue was derived from its OEM customer base, highlighting the importance of these direct relationships.

Superior Industries operates a robust global manufacturing and distribution network, featuring key facilities in North America, specifically Mexico, and Europe, located in Poland. This strategic placement allows the company to effectively serve Original Equipment Manufacturers (OEMs) across the globe.

Having production sites in these regions significantly cuts down on transportation expenses and delivery times for customers. For instance, in 2023, Superior Industries reported that its North American operations, heavily influenced by its Mexican facilities, represented a substantial portion of its revenue, underscoring the importance of this localized production.

This global footprint not only enhances efficiency but also enables Superior to offer more responsive regional customer support, a critical factor in maintaining strong relationships with its OEM partners in the automotive sector.

Superior Industries actively participates in key automotive industry trade shows and conferences. These events are crucial for displaying their latest wheel designs, advanced manufacturing techniques, and overall capabilities to a targeted audience.

These gatherings offer invaluable opportunities for Superior Industries to connect with current and prospective Original Equipment Manufacturer (OEM) clients. In 2024, for instance, major automotive shows like the Specialty Equipment Market Association (SEMA) Show in Las Vegas attracted over 100,000 attendees, providing a significant platform for networking and business development.

Beyond customer engagement, these conferences allow Superior Industries to stay ahead of the curve by monitoring emerging industry trends, competitor activities, and technological advancements. This intelligence gathering is vital for maintaining a competitive edge in the dynamic automotive sector.

Online Presence and Corporate Website

Superior Industries International leverages its corporate website as a central hub for disseminating crucial information. This digital platform showcases their extensive product lines, manufacturing capabilities, and commitment to investor relations. It functions as a virtual storefront, offering potential and existing customers, as well as investors, a comprehensive overview of the company's offerings and strategic direction.

The website also serves as a vital repository for financial data and corporate news. Stakeholders can easily access annual reports, quarterly earnings, and press releases, facilitating transparency and informed decision-making. For instance, as of their first quarter 2024 earnings report, Superior Industries highlighted continued progress in their strategic initiatives, with detailed financial performance readily available on their investor relations portal.

- Digital Storefront: Showcases product catalogs and manufacturing expertise.

- Information Hub: Provides access to investor relations, financial reports, and company news.

- Stakeholder Engagement: Facilitates communication with customers, investors, and other interested parties.

- Accessibility: Ensures readily available data for informed decision-making.

Direct Technical and Engineering Engagement

Superior Industries International's direct technical and engineering engagement serves as a vital channel, extending far beyond mere sales interactions. Their engineering teams actively collaborate with Original Equipment Manufacturer (OEM) counterparts throughout the entire product development process.

This deep technical partnership is fundamental for knowledge exchange, problem-solving, and seamless product integration. For instance, in 2024, Superior Industries reported significant R&D investments aimed at fostering these collaborative relationships, which are key to developing next-generation wheel solutions tailored to evolving automotive needs.

- Early-Stage Design Input: Engineering teams provide critical feedback on design feasibility and manufacturability during the initial concept phases.

- Joint Problem-Solving: Collaborative efforts address technical challenges, ensuring optimal performance and adherence to OEM specifications.

- Integration Support: Direct engagement facilitates the smooth integration of wheels into the OEM's vehicle platforms, from testing to final production.

- Innovation Acceleration: This close technical dialogue fosters innovation, leading to the development of specialized wheels that meet specific performance and aesthetic requirements.

Superior Industries utilizes a multi-faceted channel strategy to reach its customers. Direct sales to Original Equipment Manufacturers (OEMs) are paramount, supported by a global manufacturing and distribution network. Participation in industry events and a robust corporate website further enhance customer engagement and information dissemination.

The company's direct technical and engineering collaboration with OEMs represents a critical channel for innovation and product development. This ensures that Superior Industries' wheels are seamlessly integrated into vehicle platforms and meet specific performance and aesthetic demands.

| Channel | Description | Key Benefits | 2024 Relevance |

|---|---|---|---|

| Direct Sales (OEMs) | Dedicated sales teams build relationships with OEM purchasing, engineering, and design departments. | Tailored solutions, trust-building, crucial for automotive supply chain. | Significant revenue driver, direct feedback loop for product development. |

| Global Manufacturing & Distribution | Facilities in North America (Mexico) and Europe (Poland) serve global OEMs. | Reduced transportation costs, faster delivery times, responsive regional support. | Supports efficient supply to major automotive manufacturing hubs. |

| Industry Trade Shows & Conferences | Participation in events like the SEMA Show to showcase capabilities and network. | Display new designs, connect with clients, monitor industry trends. | Provides visibility and networking opportunities in a competitive market. |

| Corporate Website | Central hub for product lines, manufacturing, investor relations, and financial data. | Virtual storefront, transparency, easy access to information for stakeholders. | Key platform for brand presence and stakeholder communication. |

| Technical & Engineering Collaboration | Joint product development and problem-solving with OEM engineering teams. | Knowledge exchange, seamless integration, innovation acceleration. | Drives the development of next-generation wheel solutions. |

Customer Segments

Superior Industries International's Global Automotive OEMs - Light Vehicles customer segment encompasses major worldwide manufacturers of passenger cars, SUVs, and light trucks. These giants, including BMW, Ford, GM, Toyota, and VW Group, demand aluminum wheels that are not only lightweight and visually appealing but also adhere to rigorous safety and performance benchmarks.

For the 2024 model year, Superior is a key supplier for numerous new vehicle programs and ongoing production lines, underscoring its critical role in the automotive supply chain. The company's ability to deliver diverse, high-quality aluminum wheel solutions directly impacts the final product for millions of vehicles produced annually by these global players.

This customer segment encompasses global manufacturers of heavy-duty and medium-duty commercial trucks. These OEMs require highly durable and robust aluminum wheels, often forged, to meet stringent load capacity and operational demands in challenging environments.

For instance, in 2024, the global commercial vehicle market, including trucks, showed continued strength, with significant demand in North America and Europe. Companies like PACCAR and Daimler Truck are key players, constantly innovating to improve fuel efficiency and payload capacity, directly influencing their wheel specifications and material requirements.

Superior Industries likely focuses on premium and luxury automotive brands that demand sophisticated wheel designs and advanced performance features. These manufacturers often seek bespoke wheel solutions, valuing superior aesthetics and cutting-edge technology. For instance, in 2023, the global luxury car market was valued at approximately $74.5 billion, indicating a significant demand for high-end automotive components.

Electric Vehicle (EV) Manufacturers

Electric Vehicle (EV) manufacturers represent a key and rapidly expanding customer segment for Superior Industries. These companies prioritize lightweight wheels to enhance vehicle range and overall efficiency, a critical factor for EV adoption. Superior's commitment to this market is evident in its active development of new EV programs, including a notable collaboration with Volvo.

The unique design requirements of EVs, such as aerodynamic considerations and the need for effective battery cooling, also present opportunities for Superior. By catering to these specialized needs, Superior positions itself as a valuable partner in the burgeoning electric mobility sector.

As of late 2024, the global EV market continues its upward trajectory. For instance, projections indicate that EV sales could reach over 17 million units worldwide in 2024, a significant increase from previous years. This growth fuels demand for specialized components like the lightweight, aerodynamically optimized wheels that Superior manufactures.

- Growing EV Market: The global EV market is expanding rapidly, with sales expected to surpass 17 million units in 2024.

- Lightweighting Demand: EV manufacturers require lightweight wheels to maximize vehicle range and energy efficiency.

- Design Innovation: EVs necessitate unique wheel designs for improved aerodynamics and battery thermal management.

- Strategic Partnerships: Superior Industries is actively engaging with EV manufacturers, exemplified by its new programs with companies like Volvo.

European Aftermarket Wheel Distributors

European Aftermarket Wheel Distributors are a crucial customer segment for Superior Industries, complementing their core Original Equipment Manufacturer (OEM) business. These distributors purchase aluminum wheels under Superior's established European brands, including ATS®, RIAL®, ALUTEC®, and ANZIO®.

This segment offers a valuable diversification of revenue, reducing reliance solely on OEM contracts. For instance, Superior's aftermarket sales have shown resilience, contributing a significant portion to their overall financial performance, as evidenced by their reported aftermarket revenue streams in recent financial disclosures.

- Brand Portfolio: Superior leverages its strong European brand recognition through ATS®, RIAL®, ALUTEC®, and ANZIO® to capture aftermarket demand.

- Revenue Diversification: This segment provides a buffer against fluctuations in the OEM market, offering a more stable revenue base.

- Market Reach: By supplying these distributors, Superior gains access to a broad network of independent repair shops and tire retailers across Europe.

- Product Offering: The wheels supplied cater to a wide range of vehicle makes and models popular in the European automotive landscape.

Superior Industries serves a diverse customer base, primarily focusing on global automotive Original Equipment Manufacturers (OEMs) for both light and heavy-duty vehicles. Additionally, they cater to the burgeoning Electric Vehicle (EV) market and maintain a strong presence in the European aftermarket through established brands. This multi-faceted approach allows Superior to leverage its manufacturing capabilities across various automotive sectors.

In 2024, the automotive industry continued to be shaped by technological advancements and shifting consumer preferences. Superior's ability to supply wheels for new vehicle programs across major OEMs, including those producing popular light vehicles and robust commercial trucks, highlights its integral role. The significant growth in the EV sector, with sales projected to exceed 17 million units globally in 2024, presents a substantial opportunity for Superior, driven by the demand for lightweight and aerodynamically efficient wheels.

The European aftermarket segment, bolstered by brands like ATS® and RIAL®, provides a stable revenue stream, diversifying Superior's business beyond OEM contracts. This strategy ensures reach into a broad network of repair shops and retailers, catering to a wide array of vehicle models popular in Europe.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Global Light Vehicle OEMs | Lightweight, aesthetic, safety, performance | Key supplier for new programs; millions of vehicles annually |

| Global Commercial Truck OEMs | Durability, robustness, load capacity | Continued strength in global commercial vehicle market |

| Electric Vehicle (EV) Manufacturers | Lightweighting, aerodynamics, thermal management | EV sales projected >17 million units globally in 2024 |

| European Aftermarket Distributors | Brand recognition, diverse product offering | Leverages brands like ATS®, RIAL® |

Cost Structure

The largest portion of Superior Industries' expenses comes from buying the raw materials needed for making wheels, especially aluminum and different metal blends. For example, in 2024, aluminum prices saw significant volatility, impacting manufacturing costs across the industry.

Changes in the worldwide prices of these metals directly affect how much Superior has to spend. This is a key challenge for managing profitability.

To handle the risk of changing aluminum prices, Superior has agreements with Original Equipment Manufacturers (OEMs) that include clauses allowing them to adjust prices based on market fluctuations. This helps protect their margins.

Manufacturing and production costs are a significant component of Superior Industries' operations. These expenses encompass direct labor for factory staff, the energy required to run machinery, and factory overheads like maintenance and equipment depreciation.

In 2024, Superior Industries continued its strategic initiative to optimize these costs. A key element of this strategy involved the consolidation of manufacturing operations. Specifically, the company's exit from its German facilities, which were characterized by higher operating expenses, and a focus on its Polish manufacturing base, demonstrates a clear effort to enhance efficiency and drive down overall production expenditures.

Superior Industries International dedicates significant resources to Research and Development, a vital component of its business model. In 2024, the company continued its commitment to innovation, investing in the creation of advanced wheel designs and exploring new material technologies to enhance product performance and appeal.

These R&D expenditures encompass a range of costs, including the compensation for skilled engineers and designers, the acquisition and maintenance of sophisticated testing equipment, and the expenses associated with developing and refining prototypes. This investment is paramount for Superior to maintain its competitive advantage in the automotive aftermarket and original equipment manufacturer (OEM) sectors.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Superior Industries are critical to its operational backbone, covering everything from the sales force and marketing campaigns to the essential functions of corporate administration, legal, and finance. In 2023, Superior reported SG&A expenses of $108.2 million, representing a significant portion of its overall cost structure.

The company has actively pursued cost optimization strategies, notably consolidating administrative functions across its European operations. This move aims to streamline processes and reduce overhead, contributing to improved profitability. For instance, the company has highlighted efforts to integrate shared services, which directly impacts SG&A line items.

- Sales & Marketing: Costs associated with generating demand and closing deals.

- General & Administrative: Expenses for corporate functions like HR, IT, legal, and finance.

- Cost Reduction Initiatives: Ongoing efforts to streamline operations and reduce overhead, particularly in administrative areas.

- 2023 SG&A: Totaled $108.2 million, reflecting the investment in supporting the business.

Logistics and Distribution Costs

Logistics and distribution represent a substantial portion of Superior Industries' cost structure. These expenses encompass the movement of raw materials to their various manufacturing facilities and the delivery of finished wheels to Original Equipment Manufacturer (OEM) assembly lines across the globe. Key components include freight charges, the cost of maintaining warehouses, and various customs duties and tariffs.

Superior Industries' strategic approach of establishing a 'local for local' manufacturing footprint is designed to directly mitigate these significant logistics expenses. By producing wheels closer to their end markets, the company aims to substantially reduce transportation distances and associated costs. This decentralized model also serves to de-risk their supply chains, making them less vulnerable to global shipping disruptions.

- Freight Charges: Costs incurred for shipping raw materials and finished goods via various modes of transport.

- Warehousing: Expenses related to storing inventory at strategic locations.

- Customs Duties: Taxes and fees levied on goods crossing international borders.

- 'Local for Local' Strategy: Aims to reduce these costs by minimizing transportation distances and improving supply chain resilience.

Superior Industries' cost structure is heavily influenced by raw material procurement, particularly aluminum, with prices fluctuating. In 2024, significant investments were made in R&D for advanced wheel designs and new materials.

Manufacturing and production costs, including labor and energy, are managed through operational consolidation, such as exiting German facilities for a more efficient Polish base. Sales, General, and Administrative (SG&A) expenses were $108.2 million in 2023, with ongoing efforts to streamline administrative functions.

Logistics and distribution costs are being addressed by a 'local for local' manufacturing strategy to reduce freight and warehousing expenses, aiming for greater supply chain efficiency.

| Cost Category | 2023 Data | Key Factors & 2024 Initiatives |

| Raw Materials | N/A (Variable) | Aluminum price volatility; OEM price adjustment clauses. |

| Manufacturing & Production | N/A (Variable) | Focus on Polish facilities; optimizing energy and labor costs. |

| Research & Development | N/A (Investment) | Developing advanced designs and new materials. |

| SG&A | $108.2 million | Streamlining European administrative functions. |

| Logistics & Distribution | N/A (Variable) | 'Local for local' strategy to reduce freight and warehousing. |

Revenue Streams

Superior Industries' main income source is the sale of aluminum wheels to car manufacturers for new vehicles. These wheels are used in passenger cars, SUVs, and light trucks. In 2024, this segment made up about 92% of their total revenue, showing its critical importance to the company's financial health.

Superior Industries generates a significant revenue stream by supplying high-quality aluminum wheels directly to Original Equipment Manufacturers (OEMs) in the commercial truck sector. These specialized wheels are engineered for the demanding conditions of heavy-duty and medium-duty applications, reflecting their robust construction and advanced material science.

The pricing for these commercial truck wheels is typically higher than those for passenger vehicles, a reflection of the enhanced durability, load-bearing capacity, and specific performance requirements demanded by the trucking industry. For instance, in 2023, the commercial vehicle segment represented a substantial portion of the automotive wheel market, with ongoing demand driven by fleet replacements and new vehicle production.

Superior Industries' advanced design and engineering services are deeply woven into their product sales, acting as a crucial value driver rather than a standalone revenue stream. This integrated approach allows them to collaborate closely with Original Equipment Manufacturers (OEMs) on custom wheel solutions.

This co-development capability is key to securing significant contracts and distinguishing Superior in a competitive market. For instance, in 2024, Superior Industries reported a substantial portion of its revenue was derived from new product introductions, many of which were the direct result of these collaborative engineering efforts with major automotive clients.

Tooling and Development Fees

Superior Industries International may generate revenue through tooling and development fees. These are typically charged to Original Equipment Manufacturers (OEMs) for the creation of specialized equipment, such as molds and dies, needed for unique wheel designs. These upfront costs are directly tied to new product introductions and specific customer program requirements.

These fees represent an initial investment by the OEM to secure custom wheel production. For example, in 2024, the automotive industry saw continued demand for customization, which would likely translate into such fees for suppliers like Superior when developing new, proprietary wheel designs for various vehicle models.

- Tooling and Development Fees: Revenue generated from upfront charges for custom mold and die creation.

- OEM Partnerships: Fees are typically associated with specific programs and new product introductions for automotive manufacturers.

- Customization Driver: Increased demand for unique vehicle aesthetics in 2024 likely boosted these revenue streams for wheel suppliers.

Aftermarket Wheel Sales (European Market)

Superior Industries generates significant revenue from the sale of aluminum wheels directly to the European aftermarket. This segment diversifies their income beyond their primary original equipment manufacturer (OEM) business.

The company markets these wheels under several well-established brands, including ATS®, RIAL®, ALUTEC®, and ANZIO®. This brand portfolio allows them to cater to a broad range of consumer preferences and price points within the European market.

For instance, in 2024, Superior Industries reported that their European aftermarket segment contributed substantially to their overall financial performance, showcasing the strength and resilience of this revenue stream. While specific figures for this segment alone are often embedded within broader financial reporting, the continued investment and focus on these brands underscore their importance to the company's revenue mix.

- Brand Portfolio: ATS®, RIAL®, ALUTEC®, ANZIO® serve the European aftermarket.

- Revenue Diversification: Complements the core OEM business.

- Market Presence: Established brands cater to diverse European consumer needs.

- Financial Contribution: A key and resilient revenue stream for Superior Industries.

Superior Industries also generates revenue from the sale of aluminum wheels to the aftermarket in North America. This segment allows the company to reach consumers who are looking to replace or upgrade wheels on their existing vehicles.

These aftermarket sales often involve a different distribution strategy than OEM sales, focusing on retail channels and specialized distributors. In 2024, the North American aftermarket represented a growing portion of Superior's business, driven by consumer interest in vehicle personalization and replacement parts.

The company's ability to leverage its manufacturing expertise for both OEM and aftermarket production provides a flexible and robust revenue model. For example, in 2023, Superior Industries noted that its aftermarket business demonstrated strong performance, indicating a healthy demand for its products beyond new vehicle production lines.

| Revenue Stream | Primary Focus | Key Characteristics | 2024 Significance |

| OEM Sales (Passenger Vehicles) | New Vehicle Production | High volume, direct supply to automakers | Approx. 92% of total revenue |

| OEM Sales (Commercial Trucks) | Heavy-Duty Applications | Specialized, higher-priced wheels | Substantial market segment |

| European Aftermarket | Replacement & Upgrade Market | Brand portfolio (ATS®, RIAL®, etc.) | Key diversification and resilient stream |

| North American Aftermarket | Replacement & Upgrade Market | Retail and distributor channels | Growing segment, consumer personalization |

| Tooling & Development Fees | Customization Programs | Upfront charges for specialized equipment | Tied to new product introductions |

Business Model Canvas Data Sources

The Superior Industries International Business Model Canvas is built upon a foundation of comprehensive market research, financial disclosures, and internal operational data. These sources ensure each block accurately reflects the company's strategic positioning and market realities.