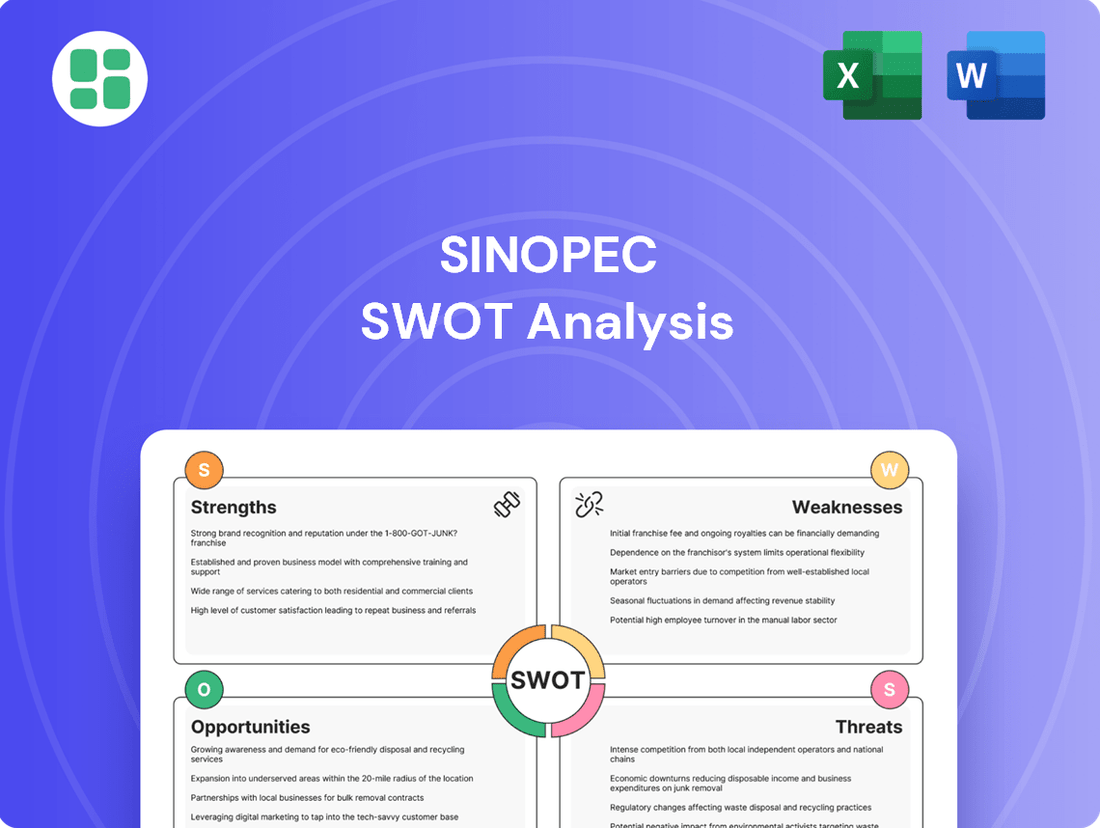

Sinopec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

Sinopec, a global energy giant, boasts immense strengths in its integrated operations and vast market reach, but also faces significant threats from evolving energy landscapes and geopolitical shifts. Understanding these dynamics is crucial for any investor or strategist looking to navigate the complex energy sector.

Want the full story behind Sinopec’s formidable market position, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment pitches, and in-depth research.

Strengths

Sinopec's integrated business model is a significant strength, encompassing the entire oil and gas value chain. This means they handle everything from finding and extracting oil and gas to refining it, selling it, and even producing petrochemicals. This end-to-end control fosters synergy and helps optimize costs.

This integrated approach provides considerable resilience. By operating across different segments of the energy market, Sinopec can better absorb shocks. If one area, like oil prices, is volatile, its refining or petrochemical businesses can offer a more stable performance, creating a balanced revenue stream.

The company's extensive network, particularly its over 30,000 service stations across China, is a testament to this integrated model's reach. This vast retail presence not only drives sales but also provides valuable market data and strengthens customer relationships, further solidifying its market position.

Sinopec enjoys a dominant market position within China, holding a significant share of the nation's energy and chemical sectors. This strong domestic footing translates into a vast and loyal customer base, bolstered by robust brand recognition. As of the first half of 2024, Sinopec reported operating revenue of RMB 1.53 trillion, underscoring its immense scale within the Chinese market.

Sinopec stands as the globe's largest oil refiner, boasting an impressive refining capacity. This scale is complemented by a vast and deeply entrenched marketing and distribution network throughout China, encompassing a substantial number of retail fuel stations.

This extensive infrastructure ensures the efficient delivery of refined products directly to consumers. The sheer breadth of its retail footprint provides Sinopec with a unique advantage, serving as a ready-made platform to introduce and scale new energy ventures, such as electric vehicle charging and hydrogen fueling stations.

Commitment to New Energy and Green Transition

Sinopec is making significant strides in new energy, especially with its focus on hydrogen. The company is investing heavily in hydrogen production and infrastructure, aiming to be a leader in China's burgeoning hydrogen economy. This commitment to a green, low-carbon transition is a key strength, aligning with national environmental targets and positioning Sinopec to benefit from the global shift towards cleaner energy sources.

By 2025, Sinopec plans to build and operate over 1,000 hydrogen refueling stations, a substantial expansion of its existing network. The company aims to produce 1 million tons of green hydrogen annually by 2025, showcasing its ambitious growth strategy in this sector.

- Hydrogen Leadership: Sinopec is actively developing its hydrogen business, targeting significant production volumes and a widespread refueling network.

- Green Transition Alignment: The company's investments in new energy directly support China's carbon neutrality goals, enhancing its corporate image and long-term sustainability.

- Market Opportunity: This strategic focus allows Sinopec to capture market share in the rapidly growing clean energy sector, diversifying its revenue streams beyond traditional fossil fuels.

Strong Research and Development Capabilities

Sinopec places a significant emphasis on scientific and technological innovation, viewing it as a cornerstone for its industrial transformation and overall competitiveness. This commitment to research and development enables the company to pioneer advanced materials, refine its production processes for greater efficiency, and actively explore emerging energy technologies.

This robust R&D capability is absolutely crucial for Sinopec to effectively adapt to the dynamic shifts in market demands and to sustain its competitive advantage within the rapidly evolving global energy sector.

In 2023, Sinopec reported significant investment in R&D, with a substantial portion allocated to areas like new energy and advanced materials, reflecting its strategic focus on future growth drivers.

- Innovation Hubs: Sinopec operates numerous research institutes and innovation centers dedicated to breakthroughs in petrochemicals, new materials, and clean energy solutions.

- Patent Portfolio: The company holds a vast portfolio of patents, underscoring its active role in generating new intellectual property and technological advancements.

- Collaboration: Sinopec actively collaborates with universities and research institutions globally to accelerate innovation and leverage external expertise.

- Digital Transformation: R&D efforts are increasingly focused on leveraging digital technologies, artificial intelligence, and big data to optimize operations and discover novel solutions.

Sinopec's integrated business model, covering exploration to retail, provides significant operational synergies and cost efficiencies. This end-to-end control allows for better management of the entire value chain, from upstream oil and gas extraction to downstream refining and marketing. The company's vast retail network, boasting over 30,000 service stations across China, is a key asset, offering direct consumer access and valuable market insights.

The company's dominant market position in China, a critical factor for its strength, is supported by robust brand recognition and a substantial customer base. In the first half of 2024, Sinopec achieved an operating revenue of RMB 1.53 trillion, highlighting its immense scale and market influence within the country.

Sinopec is a global leader in oil refining, with substantial refining capacity and an extensive marketing and distribution infrastructure throughout China. This allows for efficient product delivery and provides a strong platform for expanding into new energy areas like EV charging and hydrogen fueling.

The company's strategic focus on hydrogen is a significant strength, with ambitious plans to build over 1,000 hydrogen refueling stations and produce 1 million tons of green hydrogen annually by 2025. This aligns with China's environmental goals and positions Sinopec to capitalize on the growing clean energy market.

Sinopec's commitment to scientific and technological innovation is a crucial driver of its competitiveness. Significant R&D investments in 2023 were directed towards new energy and advanced materials, aiming to enhance production processes and explore emerging energy technologies.

| Strength | Description | Supporting Data/Facts |

| Integrated Business Model | Covers the entire oil and gas value chain, from exploration to retail. | Synergies and cost optimization across segments. |

| Dominant Market Position in China | Significant share in China's energy and chemical sectors. | H1 2024 operating revenue: RMB 1.53 trillion. Over 30,000 service stations. |

| Global Refining Leader | Largest oil refiner globally with extensive refining capacity. | Vast marketing and distribution network across China. |

| New Energy Focus (Hydrogen) | Strategic investments in hydrogen production and infrastructure. | Plan for 1,000+ hydrogen refueling stations by 2025. Aim for 1 million tons of green hydrogen annually by 2025. |

| Commitment to Innovation | Focus on R&D for advanced materials and clean energy. | Significant R&D investment in 2023 for new energy and materials. |

What is included in the product

Analyzes Sinopec’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Sinopec's competitive landscape, helping identify actionable strategies to overcome market challenges.

Weaknesses

Sinopec's profitability is heavily tied to the unpredictable swings in global oil prices. When crude oil prices fall, the company's revenue and profit margins shrink, as evidenced by its performance in early 2024. This makes Sinopec susceptible to economic downturns and market forces it cannot influence.

As a significant global energy company, Sinopec faces considerable vulnerability to geopolitical risks and escalating trade tensions. These international dynamics can directly impact its extensive supply chains and the smooth operation of its overseas ventures, creating significant uncertainty.

For example, the imposition of sanctions or the implementation of protectionist trade policies could severely limit Sinopec's access to crucial international markets or essential raw materials. This directly translates into potential operational disruptions and strategic challenges for the company.

In 2023, global energy markets experienced volatility influenced by geopolitical events, with crude oil prices fluctuating significantly. Sinopec's reliance on international trade means it is directly exposed to such shifts, impacting its revenue streams and cost structures.

Sinopec's chemical segment grappled with substantial headwinds in 2024, primarily due to persistent overcapacity and sluggish demand. This challenging market environment resulted in operating losses for the division, underscoring difficulties in achieving consistent profitability amidst intense competition.

The oversupply particularly affected key areas like olefin and aromatic hydrocarbon industries, directly impacting the chemical division's financial performance and its ability to generate healthy returns. For instance, during the first half of 2024, the average operating rate for ethylene in China remained high, contributing to price pressures and impacting Sinopec's margins in this crucial product line.

Impact of New Energy Vehicle (NEV) Adoption

The accelerating adoption of New Energy Vehicles (NEVs) in China presents a significant challenge to Sinopec's traditional fuel sales. By the end of 2024, NEVs are projected to constitute over 30% of new car sales in China, directly impacting demand for gasoline and diesel, Sinopec's core marketing products. This structural shift in transportation energy consumption creates a headwind for its legacy business, even as the company invests in NEV charging infrastructure.

This transition directly reduces the volume of refined oil products Sinopec sells. For instance, while Sinopec's retail fuel sales volume saw a modest increase in early 2024 compared to the previous year, the long-term trend is influenced by the growing NEV market share. The company's strategic investments in charging stations and battery swapping facilities aim to mitigate this impact, but the core business of selling traditional fuels faces ongoing pressure.

- Decreased Demand for Refined Products: The surge in NEV adoption, with China leading global sales, directly erodes demand for gasoline and diesel.

- Structural Market Shift: The move towards electric mobility represents a fundamental change in China's transportation energy landscape, challenging Sinopec's established market.

- Impact on Legacy Business: Despite investments in NEV infrastructure, the core revenue stream from traditional fuel sales is structurally impacted by this evolving consumer preference.

Environmental and Regulatory Scrutiny

Sinopec, as a major player in the energy and chemical sectors, is subject to intensifying environmental and regulatory scrutiny. This pressure stems from global efforts to combat climate change and reduce carbon emissions, directly impacting companies with significant fossil fuel operations.

The company faces substantial compliance costs associated with stricter environmental regulations. For instance, China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 necessitates significant investment in cleaner technologies and operational adjustments for Sinopec. These investments, coupled with potential fines for non-compliance, can weigh on financial performance.

- Increased Compliance Costs: Sinopec must invest heavily in upgrading facilities to meet evolving environmental standards, potentially diverting capital from other growth areas.

- Carbon Emission Reduction Targets: The company's traditional reliance on oil and gas makes it a primary target for policies aimed at curbing greenhouse gas emissions, requiring strategic shifts towards lower-carbon alternatives.

- Reputational Risk: Failure to adequately address environmental concerns can lead to reputational damage, impacting investor confidence and market access.

Sinopec's profitability remains highly sensitive to the volatility of global oil prices, as demonstrated by its performance in early 2024 where fluctuating crude prices directly impacted revenue and profit margins. This inherent exposure to market forces beyond its control poses a significant risk.

Geopolitical tensions and trade disputes create substantial uncertainty for Sinopec, potentially disrupting its global supply chains and overseas operations. Sanctions or protectionist policies could limit access to key markets and essential raw materials, leading to operational challenges.

The company's chemical segment faced significant headwinds in 2024 due to overcapacity and weak demand, resulting in operating losses. High ethylene operating rates in China during the first half of 2024 exacerbated price pressures, impacting Sinopec's margins.

The accelerating adoption of New Energy Vehicles (NEVs) in China, projected to exceed 30% of new car sales by the end of 2024, directly threatens Sinopec's core gasoline and diesel sales. This structural shift in transportation energy consumption poses a long-term challenge to its legacy business.

Preview the Actual Deliverable

Sinopec SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Sinopec's Strengths, Weaknesses, Opportunities, and Threats. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Sinopec is well-positioned to benefit from the burgeoning new energy sector, particularly the hydrogen economy. The company's commitment to developing hydrogen production facilities and refueling infrastructure directly supports China's ambitious decarbonization targets, opening up a significant new revenue stream.

By 2025, Sinopec aims to be China's leading producer of hydrogen for fuel, a goal bolstered by its extensive existing retail network which provides a ready-made distribution channel. This strategic move leverages current assets to tap into a future-oriented energy market.

China's natural gas demand is on a strong upward trajectory, offering Sinopec a prime opportunity to scale up its exploration, production, and distribution efforts in this sector. The company has already reported enhanced profitability from its natural gas operations, underscoring the segment's growing importance.

This expansion directly supports China's national energy security goals and the broader international trend favoring cleaner energy sources, positioning Sinopec favorably within the evolving energy landscape.

Sinopec has a significant opportunity to boost its profitability by shifting its focus towards high-end and specialized petrochemical products. This strategic move can help counter the impact of overcapacity in the bulk chemicals market. For instance, in 2024, Sinopec announced plans to invest heavily in advanced materials and specialty chemicals, aiming to capture higher margins.

The company can improve its product margins and bolster its chemical segment by transitioning its operations from simply producing refined oil products to creating chemical feedstocks and refining specialties. This strategic pivot is crucial for long-term growth and competitiveness in the evolving energy landscape.

Investing in new, large-scale petrochemical complexes presents another key opportunity. These modern facilities can replace aging infrastructure and are designed to meet the anticipated future demand for advanced chemical products, ensuring Sinopec remains at the forefront of the industry.

Leveraging Extensive Retail Network for Integrated Energy Services

Sinopec's extensive retail network, boasting over 30,000 service stations, presents a significant opportunity to evolve into an integrated energy provider. This vast footprint allows for the seamless integration of new energy services, such as electric vehicle (EV) charging and battery swapping facilities, alongside hydrogen refueling stations. By 2023, Sinopec had already established over 1,000 EV charging stations, a number projected to grow substantially in the coming years.

This strategic expansion into non-traditional energy services is crucial for mitigating the impact of declining gasoline and diesel sales, a trend expected to accelerate with the global shift towards cleaner transportation. By offering a comprehensive suite of energy solutions, Sinopec can better meet the evolving demands of consumers and secure its market position in the rapidly changing energy landscape.

- Diversification into EV Charging: Leveraging its 30,000+ stations to build out EV charging infrastructure, complementing traditional fuel sales.

- Hydrogen Refueling Expansion: Capitalizing on the growing hydrogen economy by integrating hydrogen refueling capabilities.

- Offsetting Declining Fossil Fuel Demand: Proactively adapting to market shifts by offering alternative energy solutions.

- Enhanced Customer Value Proposition: Becoming a one-stop shop for diverse energy needs, increasing customer loyalty and revenue streams.

International Expansion and Strategic Partnerships

Sinopec is well-positioned for international expansion, aiming to diversify its revenue streams and secure access to vital resources. The company's strategic partnerships are key to achieving this global reach, allowing it to tap into new markets and leverage complementary strengths.

A prime example of this strategy is Sinopec's collaboration on a major petrochemical complex with Saudi Aramco. This venture, expected to be a significant undertaking, underscores Sinopec's commitment to broadening its international footprint and solidifying its standing in the global energy and chemical industries. By engaging in such partnerships, Sinopec can mitigate risks associated with individual market volatility and enhance its competitive edge on a worldwide scale.

- International Expansion: Sinopec can tap into emerging markets in Southeast Asia and Africa, areas showing robust demand growth for refined products and chemicals.

- Strategic Partnerships: Collaborations with national oil companies and technology providers can accelerate market entry and technology acquisition for new ventures.

- Resource Access: Partnerships in regions rich in oil and gas reserves, such as the Middle East and Central Asia, can secure long-term feedstock supply for Sinopec's refining and petrochemical operations.

- Diversification: Expanding into downstream petrochemicals and specialty chemicals in international markets offers higher margins and reduces reliance on traditional refining.

Sinopec is strategically positioned to capitalize on the burgeoning new energy sector, particularly the hydrogen economy, aligning with China's decarbonization goals. By 2025, the company aims to lead in hydrogen production for fuel, leveraging its extensive retail network for distribution. Furthermore, the increasing demand for natural gas in China presents a significant opportunity for Sinopec to expand its operations, as evidenced by its reported enhanced profitability in this segment.

The company can also significantly boost its profitability by shifting towards high-end and specialized petrochemical products, a move supported by planned investments in advanced materials and specialty chemicals for 2024. Expanding its retail network into integrated energy services, such as EV charging and battery swapping, offers another avenue for growth, complementing its existing 30,000+ service stations and mitigating the impact of declining fossil fuel demand. Sinopec's international expansion, exemplified by its petrochemical complex collaboration with Saudi Aramco, further diversifies revenue and secures resource access.

| Opportunity Area | Key Initiatives | 2023/2024 Data/Projections |

|---|---|---|

| New Energy (Hydrogen) | Hydrogen production and refueling infrastructure | Aiming to be China's leading hydrogen fuel producer by 2025; established over 1,000 EV charging stations by 2023. |

| Natural Gas Expansion | Exploration, production, and distribution | Reported enhanced profitability in natural gas operations; strong upward trajectory in China's natural gas demand. |

| Petrochemicals (Specialty) | Shift to high-end and specialized products | Planned heavy investment in advanced materials and specialty chemicals (2024); transition from refined oil products to chemical feedstocks. |

| Integrated Energy Services | EV charging, battery swapping, hydrogen refueling | Leveraging 30,000+ service stations; offsetting declining fossil fuel demand. |

| International Expansion | Strategic partnerships, new market entry | Collaboration on petrochemical complex with Saudi Aramco; targeting emerging markets in Southeast Asia and Africa. |

Threats

Sinopec is navigating a highly competitive domestic landscape, facing pressure not only from fellow state-owned giants but also from a growing number of agile independent refiners. This intensified rivalry is a significant challenge, particularly as the refining sector grapples with persistent overcapacity.

The outlook for the refining sector points to prolonged overcapacity, a situation that often triggers aggressive price wars and significantly erodes profit margins for all players. For Sinopec, this competitive environment directly threatens its market share and overall profitability.

The intensifying global drive for decarbonization and achieving net-zero emissions presents a significant long-term challenge for Sinopec's primary fossil fuel operations. Stricter environmental mandates and the rapid expansion of renewable energy alternatives are poised to reduce the demand for oil and gas. Sinopec itself projects that global oil demand will likely peak around 2030, underscoring the need for strategic adaptation.

Ongoing geopolitical instabilities, including trade disputes and international sanctions, pose a significant threat to Sinopec. These factors can disrupt its global supply chains, limit access to crucial international markets, and hinder investment opportunities. For instance, the protracted trade tensions between the US and China, which saw tariffs imposed on various goods, created uncertainty for companies like Sinopec involved in global trade. The unpredictability inherent in these geopolitical shifts makes robust long-term planning and consistent operational execution exceedingly difficult for the company.

Technological Disruption and Innovation Pace

The relentless pace of technological advancement, particularly in areas like new energy and battery storage, presents a significant threat to Sinopec's established oil and gas operations. The rapid evolution of electric vehicles, for instance, directly challenges the demand for traditional fuels. By the end of 2024, global EV sales are projected to exceed 15 million units, a stark indicator of this shift.

Sinopec's ability to innovate and adapt its business model to these emerging energy landscapes is critical. Failure to do so could lead to a diminished market position. For example, while Sinopec is investing in hydrogen and renewable energy, the speed at which competitors are scaling these technologies could outpace Sinopec's efforts, potentially impacting its long-term revenue streams.

- Rapid advancements in battery technology and charging infrastructure pose a direct threat to gasoline and diesel demand.

- The increasing global adoption of electric vehicles, with projections suggesting over 30% of new vehicle sales could be electric by 2030, directly impacts Sinopec's core market.

- The development of alternative fuels, such as sustainable aviation fuel and green hydrogen, could further diversify energy sources away from traditional oil.

- The potential for disruptive innovations in energy storage and grid management could reduce reliance on centralized fossil fuel power generation.

Supply Chain Risks and Operational Disruptions

Sinopec's extensive global supply chains are inherently vulnerable to disruptions. These can range from logistical challenges and geopolitical events impacting shipping routes to severe weather events or unexpected operational failures at key facilities. For instance, in early 2024, several major shipping routes experienced significant delays due to regional conflicts, potentially impacting Sinopec's crude oil imports and product exports.

Any interruption in the reliable supply of crude oil, the lifeblood of its refining operations, or in the efficient distribution of its finished products, poses a substantial threat. Such disruptions can directly translate into considerable financial losses and severely hinder Sinopec's capacity to satisfy prevailing market demand, potentially leading to lost sales and market share. For example, a prolonged shutdown of a major refinery due to an accident could reduce output by hundreds of thousands of barrels per day.

Moreover, the volatile nature of commodity markets means that fluctuations in the prices of certain refined products or the unforeseen shutdown of individual production units can trigger asset impairment charges. This was seen in late 2023 when a slump in petrochemical prices led some companies to re-evaluate the carrying value of their related assets.

- Supply Chain Vulnerability: Sinopec's reliance on global logistics makes it susceptible to bottlenecks and delays, as witnessed in early 2024 shipping disruptions.

- Operational Interruption Impact: Disruptions in crude oil supply or product distribution can cause significant financial losses and unmet market demand.

- Market Volatility Risks: Fluctuations in product prices and facility shutdowns can lead to asset impairment, impacting financial statements.

Sinopec faces intense domestic competition, with overcapacity in refining impacting margins. Globally, the push for decarbonization and the rise of electric vehicles, projected to reach over 30% of new sales by 2030, threaten its core oil and gas business. Technological advancements in new energy, like battery storage, also pose a significant challenge to its established operations.

Geopolitical instability and supply chain vulnerabilities, evidenced by shipping disruptions in early 2024, create risks for Sinopec's global operations and market access. Market volatility in refined product prices and potential operational shutdowns can lead to asset impairment charges, as seen with petrochemical price slumps in late 2023.

| Threat Category | Specific Threat | Impact on Sinopec | Supporting Data/Event |

| Competition & Market Dynamics | Domestic Refining Overcapacity | Eroded profit margins, market share pressure | Persistent overcapacity in the refining sector |

| Energy Transition | Decarbonization Mandates & EV Growth | Reduced demand for fossil fuels, need for strategic adaptation | Global EV sales projected to exceed 15 million units by end of 2024; 30% of new sales by 2030 |

| Geopolitics & Supply Chain | Geopolitical Instabilities & Supply Chain Disruptions | Disrupted supply chains, limited market access, operational risks | Early 2024 shipping route delays due to regional conflicts |

| Technological Disruption | Advancements in New Energy & EVs | Challenges to traditional fuel demand, potential for diminished market position | Rapid evolution of electric vehicles |

| Market Volatility | Commodity Price Fluctuations & Operational Issues | Asset impairment charges, financial losses | Petrochemical price slump leading to asset re-evaluation in late 2023 |

SWOT Analysis Data Sources

This Sinopec SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses. These sources provide the necessary depth to understand the company's internal capabilities and external market positioning for strategic evaluation.