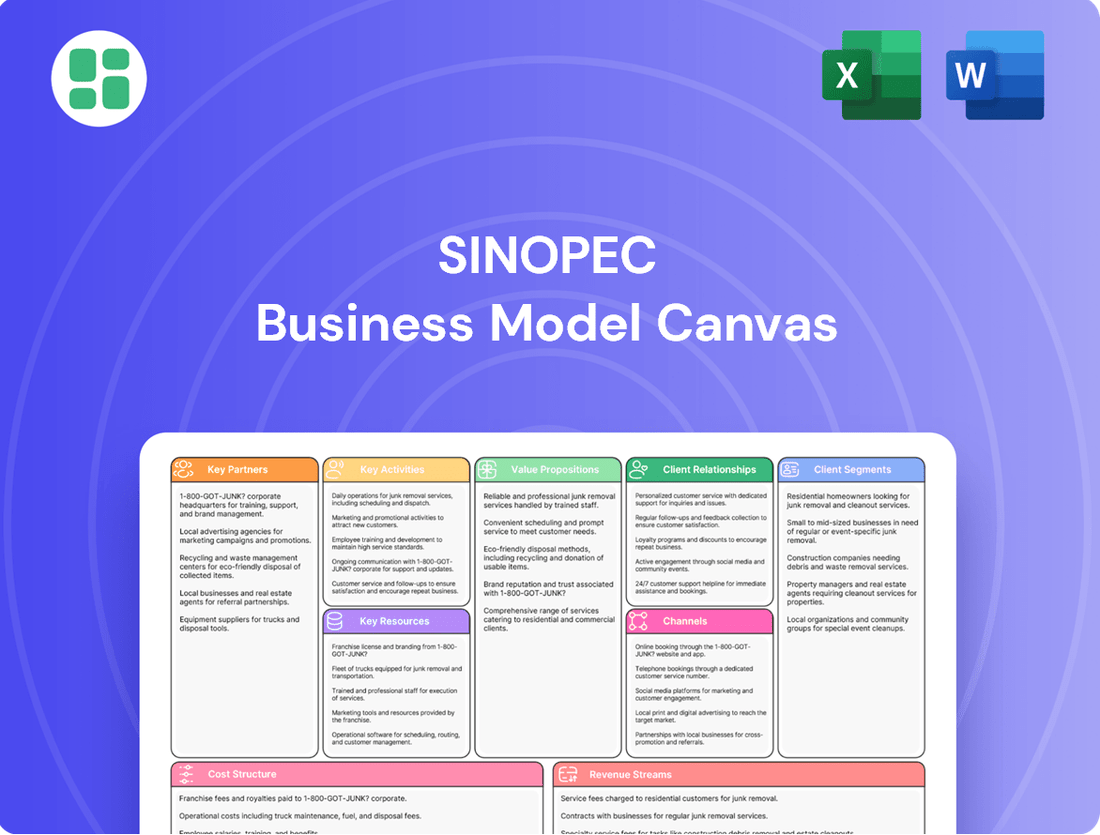

Sinopec Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

Discover the intricate workings of Sinopec's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Get the full canvas to understand how Sinopec navigates the global energy market and identify potential strategies for your own ventures.

Partnerships

Sinopec, as a major state-owned enterprise, cultivates essential partnerships with various Chinese government entities. These collaborations are critical for obtaining necessary operating licenses and favorable policy support, which are fundamental to its extensive operations across the energy sector.

Furthermore, Sinopec engages in strategic alliances with other state-owned enterprises to undertake and execute large-scale infrastructure projects. A prime example is its agreement with SONATRACH, Algeria's national oil company, to jointly explore and develop hydrocarbon resources, underscoring the importance of these inter-SOE relationships for international expansion and resource acquisition.

Sinopec actively partners with leading universities and research institutions to foster innovation across critical areas like new energy, advanced materials, and environmental solutions. These collaborations are vital for staying at the forefront of technological development.

These partnerships often manifest as joint research and development platforms, frequently integrated with national key laboratories, facilitating deep scientific inquiry and practical application. This industry-academia synergy is designed to accelerate technological breakthroughs.

For instance, Sinopec's investment in R&D reached approximately 16.1 billion RMB in 2023, a significant portion of which supports these collaborative research efforts aimed at driving future growth and sustainability.

Sinopec actively collaborates with major international energy firms through strategic partnerships and joint ventures. These alliances are crucial for both upstream exploration and production activities, as well as downstream refining and marketing projects. This approach allows Sinopec to leverage global expertise and capital.

A prime example of this collaboration is Sinopec's deepening partnership with TotalEnergies. Their joint efforts are focused on developing innovative solutions in areas like sustainable aviation fuel (SAF), green hydrogen production, and carbon capture, utilization, and storage (CCUS) technologies. This partnership highlights Sinopec's commitment to advancing cleaner energy solutions.

Suppliers and Equipment Manufacturers

Sinopec’s operational backbone relies heavily on robust partnerships with suppliers of essential resources like crude oil and natural gas. These relationships are vital for maintaining the consistent flow of raw materials needed for its extensive refining and petrochemical operations. In 2023, Sinopec’s crude oil procurement volume was significant, underpinning its status as a major global energy player.

Beyond raw materials, Sinopec cultivates strong ties with manufacturers of specialized equipment. This is particularly crucial for supporting its ongoing large-scale refinery expansions and technological upgrades. The company’s capital expenditures in 2023 reflected substantial investments in new facilities and equipment, highlighting the importance of these supplier collaborations.

- Supply Chain Stability: Securing consistent access to crude oil and natural gas is paramount for Sinopec's integrated refining and petrochemical value chain.

- Equipment Procurement: Partnerships with equipment manufacturers ensure access to specialized technology for refinery expansions and modernization projects.

- Operational Efficiency: Strong supplier relationships contribute to cost-effectiveness and operational reliability across Sinopec's vast network.

Local Communities and Public Sector

Sinopec actively cultivates partnerships with local communities and public sector entities to secure its social license to operate, a crucial element for large-scale endeavors. For instance, its desert water pipeline project in Algeria highlights the significance of these collaborations. These engagements underscore Sinopec's dedication to corporate social responsibility and fostering sustainable development within the regions it operates.

These alliances are vital for smooth project execution and long-term operational stability. By working closely with local stakeholders, Sinopec can better understand and address community needs, thereby mitigating potential conflicts and building trust. In 2024, Sinopec continued to emphasize community engagement programs, with investments in social infrastructure and local employment initiatives across its global operations.

- Social License to Operate: Essential for large projects, ensuring community acceptance and cooperation.

- Corporate Social Responsibility: Demonstrating commitment through community support and sustainable practices.

- Algeria Desert Water Pipeline: A prime example where community and public sector partnerships are critical.

- Sustainable Development: Aligning business objectives with the well-being of local populations and environments.

Sinopec's key partnerships are foundational to its expansive operations, spanning government bodies for regulatory support and other state-owned enterprises for large-scale projects, like its collaboration with SONATRACH for resource development.

Strategic alliances with international energy firms, such as TotalEnergies, are crucial for advancing cleaner energy technologies like sustainable aviation fuel and green hydrogen, reflecting significant R&D investment. Sinopec's 2023 R&D expenditure was approximately 16.1 billion RMB, much of which supports these innovative collaborations.

Robust supplier relationships, particularly for crude oil and natural gas, ensure operational continuity, while partnerships with equipment manufacturers support refinery upgrades. Sinopec's 2023 capital expenditures highlighted substantial investment in new facilities, underscoring the importance of these ties.

Furthermore, community and public sector partnerships are vital for Sinopec's social license to operate, as seen in its Algerian water pipeline project. In 2024, the company continued to invest in local communities, promoting sustainable development and stakeholder trust.

| Type of Partnership | Key Focus Areas | Examples/Impact | Data Point (2023/2024) |

| Government Entities | Licenses, Policy Support | Facilitates operations across energy sector | N/A (Ongoing strategic alignment) |

| Other State-Owned Enterprises | Large-scale infrastructure, resource development | SONATRACH collaboration in Algeria | N/A (Project-specific) |

| International Energy Firms | Clean energy tech (SAF, H2), CCUS | TotalEnergies partnership | R&D Investment: ~16.1 billion RMB (2023) |

| Suppliers (Raw Materials & Equipment) | Crude oil, natural gas, specialized machinery | Ensures supply chain stability, supports refinery upgrades | Capital Expenditures reflect significant equipment investment (2023) |

| Local Communities & Public Sector | Social license, CSR, sustainable development | Algeria Desert Water Pipeline, community programs | Continued investment in social infrastructure (2024) |

What is included in the product

A comprehensive, pre-written business model tailored to Sinopec's strategy, detailing customer segments, channels, and value propositions.

Reflects Sinopec's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

The Sinopec Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their complex operations, allowing for faster identification of inefficiencies and strategic adjustments.

Activities

Sinopec's primary function is the exploration, development, and production of crude oil and natural gas. This encompasses both its operations within China and its international ventures, forming the backbone of its energy supply chain.

In 2024, Sinopec reported a notable increase in its natural gas output, alongside a rise in domestic crude oil production. The company actively pursued strategies to expand its reserves, aiming for greater resource security and future production capacity.

A core activity for Sinopec is transforming crude oil into essential products like gasoline, diesel, and jet fuel. This refining process is fundamental to their operations and meets significant energy demands.

In 2024, Sinopec processed an impressive 252 million tonnes of crude oil. This highlights the sheer scale of their refining capacity and their crucial role in the global energy supply chain.

Further demonstrating their commitment to expansion and modernization, Sinopec's Zhenhai refinery saw its capacity grow, solidifying its position as China's largest petrochemical industrial base.

Sinopec's core activities revolve around the extensive manufacturing and distribution of diverse petrochemical products. This includes crucial building blocks like ethylene and paraxylene (PX), along with a broad range of polymers essential for numerous industries.

In 2024, Sinopec demonstrated significant production capacity, achieving an annual ethylene output of 13.47 million tonnes. This robust production underpins its extensive distribution network, which saw chemical product sales reach an impressive 83.45 million tonnes for the same year.

New Energy Development and Application

Sinopec is aggressively pursuing new energy development and application. This includes significant investment in green hydrogen, aiming to be China's largest producer by 2025. They are also advancing biofuels and carbon capture, utilization, and storage (CCUS) technologies.

- Green Hydrogen Production: Sinopec plans to significantly scale up its green hydrogen production capacity, targeting leadership in China by 2025.

- Biofuel Initiatives: The company is developing and deploying advanced biofuels derived from various feedstocks.

- CCUS Technology: Sinopec is actively involved in carbon capture, utilization, and storage projects to reduce its carbon footprint.

- Strategic Partnerships: Sinopec is forming collaborations to accelerate the development and commercialization of these new energy solutions.

Engineering and Technical Services

Sinopec's engineering and technical services are a cornerstone of its business, drawing on decades of experience in complex energy and chemical projects. The company offers a comprehensive suite of services, from initial design and feasibility studies to construction, installation, and ongoing operational support. This expertise allows Sinopec to tackle massive undertakings, providing clients with integrated solutions that span the entire project lifecycle.

The company's technical prowess is evident in its advanced technology offerings, including proprietary processes for refining, petrochemical production, and new energy development. Sinopec is a significant player in global engineering, procurement, and construction (EPC) contracts. For instance, in 2023, Sinopec's engineering segment secured new contracts totaling over 200 billion yuan, highlighting its robust project pipeline and international reach.

- Expertise in Large-Scale Projects: Sinopec has a proven track record in managing and executing complex, multi-billion dollar energy and chemical infrastructure projects worldwide.

- Advanced Technology Solutions: The company provides access to cutting-edge technologies in areas like petrochemical processing, refining, and the development of sustainable energy solutions.

- Global Project Management: Sinopec offers end-to-end project management services, ensuring efficient delivery from conception through to commissioning and operation for international clients.

- Contribution to Revenue: In 2023, Sinopec's engineering and technical services segment contributed significantly to the company's overall revenue, demonstrating its commercial importance.

Sinopec's key activities encompass the full energy value chain. This includes upstream exploration and production of oil and gas, midstream refining and processing, and downstream marketing and distribution of refined products and petrochemicals. Furthermore, Sinopec is heavily invested in new energy development, focusing on green hydrogen, biofuels, and carbon capture technologies.

| Activity Area | Key Functions | 2024 Data/Focus |

|---|---|---|

| Exploration & Production | Discovering and extracting crude oil and natural gas | Increased natural gas output; expanded domestic crude oil reserves. |

| Refining & Processing | Transforming crude oil into fuels and petrochemical feedstocks | Processed 252 million tonnes of crude oil; Zhenhai refinery capacity growth. |

| Petrochemicals | Manufacturing and distributing chemicals and polymers | 13.47 million tonnes ethylene output; 83.45 million tonnes chemical product sales. |

| New Energy | Developing and deploying sustainable energy solutions | Investing in green hydrogen (aiming for China's largest producer by 2025), biofuels, CCUS. |

| Engineering & Technical Services | Providing project management, design, and construction for energy infrastructure | Secured over 200 billion yuan in new contracts in 2023. |

Preview Before You Purchase

Business Model Canvas

The Sinopec Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting of the final deliverable, not a simplified sample or placeholder. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

Sinopec's vast oil and gas reserves are a cornerstone of its upstream operations, providing a reliable foundation for production. In 2024, the company saw a notable increase in these crucial assets, with crude oil proved reserves growing by 4.7%.

This expansion in reserves is directly linked to the company's exploration and development efforts. Furthermore, Sinopec's commitment to natural gas is evident in the 6% increase in its natural gas proved reserves during the same year, underscoring its strategic focus on diversifying its energy portfolio.

Sinopec's extensive refining and petrochemical infrastructure, including its Zhenhai refinery, is a cornerstone of its operations. This network allows for the efficient processing of crude oil into a wide array of refined products and petrochemicals.

In 2023, Sinopec's refining capacity reached approximately 240 million tons per year, underscoring the sheer scale of its operational backbone. This robust infrastructure is key to meeting global energy demands and supplying essential materials for various industries.

Sinopec's commitment to advanced technology and R&D is a cornerstone of its business model, driving innovation across its operations. The company consistently invests a significant portion of its revenue into research, evidenced by its extensive portfolio of patents and proprietary know-how in key sectors like refining, petrochemicals, and new energy.

This robust R&D infrastructure allows Sinopec to pioneer advancements, such as its leadership in green hydrogen production technologies, a critical area for future energy solutions. In 2023 alone, Sinopec reported significant progress in developing and scaling up these eco-friendly energy sources, further solidifying its technological edge.

Furthermore, Sinopec leverages its R&D capabilities to develop advanced materials, contributing to higher-value products and more sustainable industrial processes. This focus on innovation not only enhances its competitive positioning but also aligns with global trends towards decarbonization and technological advancement in the energy sector.

Widespread Distribution and Marketing Network

Sinopec’s widespread distribution and marketing network is a cornerstone of its business model. This vast infrastructure, encompassing over 30,000 retail gas stations across China, ensures efficient delivery of refined oil products and natural gas directly to consumers. In 2024, this network continued to be a critical asset, facilitating broad market reach and customer access.

Beyond traditional fuel, Sinopec is actively integrating new energy solutions into its distribution channels. The network now includes charging and battery swapping stations, reflecting a strategic pivot towards electric mobility. This expansion allows Sinopec to serve a growing segment of the automotive market, enhancing its relevance in the evolving energy landscape.

The sheer scale of Sinopec's logistical capabilities is impressive:

- Extensive Pipeline and Storage Facilities: Crucial for the efficient movement and storage of large volumes of oil and gas.

- Over 30,000 Retail Gas Stations: Providing unparalleled access to end-users across China.

- Integrated Charging and Battery Swapping Stations: Catering to the burgeoning electric vehicle market.

Skilled Human Capital and Expertise

Sinopec's extensive workforce, comprising a vast pool of skilled engineers, scientists, and operational personnel, is a cornerstone of its business model. This human capital is indispensable for managing the company's intricate operations, spanning the entire energy value chain from upstream exploration and production to downstream refining and retail distribution.

The company actively invests in the continuous development and well-being of its employees, recognizing that expertise and dedication are crucial for sustained success. This commitment is evident in its focus on enhancing ESG (Environmental, Social, and Governance) management practices and prioritizing employee welfare.

- Skilled Workforce: Sinopec employs over 430,000 individuals globally, with a significant portion possessing specialized engineering and technical expertise.

- Talent Development: The company invests heavily in training and development programs, aiming to foster innovation and maintain a high level of operational efficiency.

- ESG Focus: Sinopec's commitment to ESG principles includes initiatives focused on employee safety, health, and professional growth, contributing to a stable and motivated workforce.

Sinopec's key resources are its substantial oil and gas reserves, which saw a 4.7% increase in crude oil proved reserves in 2024, alongside a 6% rise in natural gas reserves. Its extensive refining and petrochemical infrastructure, including the Zhenhai refinery with a capacity of approximately 240 million tons per year in 2023, forms another critical resource. The company also boasts a strong R&D foundation, leading in areas like green hydrogen, and a vast distribution network of over 30,000 retail stations, increasingly incorporating EV charging facilities. Finally, its workforce of over 430,000 skilled employees is vital for its integrated operations.

| Resource Category | Key Asset | 2023/2024 Data Point |

|---|---|---|

| Reserves | Crude Oil Proved Reserves | +4.7% growth in 2024 |

| Reserves | Natural Gas Proved Reserves | +6% growth in 2024 |

| Infrastructure | Refining Capacity | ~240 million tons/year (2023) |

| Distribution | Retail Gas Stations | Over 30,000 |

| Human Capital | Global Workforce | Over 430,000 employees |

Value Propositions

Sinopec ensures a consistent and broad range of critical energy products, such as gasoline, diesel, jet fuel, and natural gas. This diverse offering caters to the varied demands of both individual consumers and industrial sectors throughout China.

In 2024, Sinopec achieved a significant milestone, reporting a total sales volume of refined oil products amounting to 239 million tonnes. This figure underscores the company's capacity to meet substantial market demand reliably.

Sinopec provides a broad spectrum of superior petrochemical goods, including plastics, synthetic fibers, and diverse chemicals. These are fundamental building blocks for a multitude of manufacturing sectors, underscoring their critical role in the industrial landscape.

The company’s significant investment in expanding its Zhenhai facility is projected to boost its annual petrochemical output by roughly 8 million tonnes. This enhanced capacity directly translates to a greater availability of high-quality materials for downstream industries.

Sinopec's strength lies in its integrated energy and chemical solutions, a core value proposition that touches everything from oil and gas exploration to the final sale of refined products and chemicals. This seamless integration allows them to optimize their entire value chain, capturing more value at each stage.

By controlling operations from upstream exploration and production to midstream refining and marketing, and finally downstream chemical manufacturing, Sinopec creates significant operational synergies. For instance, in 2023, Sinopec's refining and chemicals segment reported revenue of approximately 2.4 trillion yuan, showcasing the sheer scale and interconnectedness of its operations.

This comprehensive approach means they can efficiently convert crude oil into a wide array of chemical products, offering customers a bundled solution. This integrated model not only enhances efficiency but also provides a competitive edge by ensuring a stable supply of raw materials for their chemical businesses.

Commitment to Green and Low-Carbon Development

Sinopec is deeply committed to a green and low-carbon development path, actively investing in cutting-edge new energy technologies. This includes significant capital allocation towards hydrogen production and Carbon Capture, Utilization, and Storage (CCUS) projects.

The company's strategic direction is closely aligned with China's national objectives to achieve carbon peak by 2030 and carbon neutrality by 2060. Sinopec's efforts are crucial in supporting these ambitious environmental targets.

- Hydrogen Production: Sinopec aims to become a leading hydrogen energy company, with plans to build over 1,000 hydrogen refueling stations by 2025.

- CCUS Initiatives: The company operates multiple CCUS demonstration projects, capturing millions of tons of CO2 annually.

- New Energy Investments: In 2023, Sinopec announced plans to invest approximately 30 billion yuan in new energy and technological innovation, with a focus on green development.

- Renewable Energy Expansion: Sinopec is also expanding its solar and wind power generation capacity, integrating these sources into its operations.

Expert Engineering and Technical Services

Sinopec offers industrial clients highly specialized engineering and technical services, drawing on its extensive experience in executing massive projects. This expertise translates into the delivery of state-of-the-art facilities and the cultivation of enduring global partnerships.

These services are crucial for clients seeking to build and maintain advanced industrial operations. Sinopec's proven track record in complex project management ensures efficiency and reliability.

- Specialized Engineering: Sinopec provides tailored engineering solutions for diverse industrial needs.

- Technical Services: Decades of operational experience underpin their technical support offerings.

- Global Project Execution: Proven ability to manage and deliver large-scale projects worldwide.

- Long-Term Cooperation: Focus on building and maintaining sustained relationships with clients.

Sinopec's value proposition centers on providing a comprehensive and integrated energy and chemical portfolio. This includes a wide array of refined oil products and essential petrochemicals, meeting diverse consumer and industrial needs across China.

The company's integrated model, from exploration to chemical manufacturing, optimizes the value chain and ensures supply stability. This is exemplified by their substantial revenue from refining and chemicals, demonstrating the scale of their interconnected operations.

Furthermore, Sinopec is a key player in China's green transition, actively investing in new energy technologies like hydrogen and CCUS, aligning with national carbon reduction goals.

Sinopec also offers specialized engineering and technical services, leveraging extensive project execution experience to deliver advanced industrial solutions globally and foster long-term client relationships.

| Value Proposition | Description | Key Data/Fact |

|---|---|---|

| Integrated Energy & Chemical Solutions | Comprehensive offering from oil/gas to chemicals, optimizing value chain. | 2023 Refining & Chemicals Revenue: ~2.4 trillion yuan |

| Broad Product Portfolio | Consistent supply of refined oil products and diverse petrochemicals. | 2024 Refined Oil Product Sales: 239 million tonnes |

| Green & Low-Carbon Development | Investment in new energy technologies and CCUS projects. | Plan: 1,000+ hydrogen refueling stations by 2025 |

| Specialized Engineering & Technical Services | Expertise in large-scale project execution and client partnerships. | 2023 New Energy Investment: ~30 billion yuan |

Customer Relationships

Sinopec cultivates enduring partnerships with major industrial and wholesale clients, providing specialized account management. This approach ensures tailored energy and chemical solutions, fostering strategic collaborations for bespoke product development to meet unique client demands.

Sinopec cultivates strong customer relationships by prioritizing service excellence at its extensive network of retail fuel stations. This commitment is evident in their continuous expansion, with 29 new service stations added in 2024, bringing their total to over 30,000 locations.

To foster loyalty, Sinopec focuses on providing convenient and high-quality service, potentially complemented by targeted loyalty programs designed to reward repeat customers.

Sinopec offers specialized technical support and consulting to its B2B petrochemical clients, aiming to enhance their operational efficiency and product integration. This ensures clients can leverage Sinopec's offerings to their fullest potential.

In 2024, Sinopec's commitment to customer success in the B2B space was evident through a 15% increase in dedicated technical support staff, focusing on advanced petrochemical applications. This bolstered their ability to provide tailored solutions.

The consulting services provided by Sinopec in 2024 helped clients achieve an average of 8% cost reduction in their production processes by optimizing the use of Sinopec's chemical products and intermediates.

Public Relations and Corporate Social Responsibility (CSR)

Sinopec prioritizes maintaining trust and a positive public image through transparent reporting and active community engagement. This is a cornerstone of their customer relationships, ensuring stakeholders feel informed and valued.

The company’s commitment to sustainability is evident in its detailed annual sustainability reports. These reports outline Sinopec's environmental, social, and governance (ESG) performance, offering a clear view of their operations and impact.

- Transparent Reporting: Sinopec’s 2023 Sustainability Report highlighted a 3.5% reduction in carbon emission intensity compared to 2022, demonstrating a tangible commitment to environmental stewardship.

- Community Engagement: In 2023, Sinopec invested over $50 million in community development projects across China, focusing on education, poverty alleviation, and environmental protection.

- Stakeholder Dialogue: The company actively engages with local communities through open forums and feedback mechanisms, ensuring their initiatives align with societal needs and expectations.

- Brand Reputation: These efforts contribute to Sinopec being recognized as a responsible corporate citizen, fostering goodwill and long-term customer loyalty.

Digital Engagement and Online Platforms

Sinopec actively uses digital platforms to connect with its customers. This includes their official website and mobile applications, which serve as key channels for information sharing and customer service. For instance, during 2023, Sinopec's digital initiatives aimed to enhance user experience and streamline service delivery across its vast network.

These online presences are crucial for modern customer relationship management, offering convenience and accessibility. They allow for efficient communication, whether it’s providing updates on fuel availability, promoting new products, or handling service inquiries. This digital engagement is vital for maintaining customer loyalty in a competitive market.

- Digital Platforms: Sinopec utilizes its website and mobile apps for customer interaction and information.

- Customer Service: Online channels facilitate inquiries, service requests, and feedback for improved customer relations.

- B2B Engagement: Digital platforms may also support business-to-business transactions and communication for corporate clients.

- 2023 Focus: Enhancing digital engagement was a priority, reflecting a commitment to modern customer relationship management.

Sinopec nurtures customer relationships through a multi-faceted approach, blending personalized service for industrial clients with widespread accessibility at retail locations. Their commitment to customer success is underscored by specialized technical support for B2B partners, demonstrated by a 15% increase in technical staff in 2024 dedicated to advanced petrochemical applications, and consulting services that yielded an average 8% cost reduction for clients that year.

Transparency and community engagement are key pillars, with detailed sustainability reports and significant community investments, such as over $50 million in 2023 projects. Digital platforms, including their website and mobile apps, are central to customer interaction, aiming to enhance user experience and streamline service delivery, a focus that continued through 2023.

| Customer Relationship Aspect | Key Activities/Initiatives | 2023/2024 Data/Impact |

|---|---|---|

| B2B Client Support | Specialized account management, technical support, consulting | 15% increase in technical support staff (2024); 8% average client cost reduction via consulting (2024) |

| Retail Customer Experience | Service excellence at fuel stations, loyalty programs | 29 new service stations added (2024); over 30,000 total locations |

| Corporate Responsibility | Transparent reporting, community engagement | 3.5% reduction in carbon emission intensity (2023); over $50 million invested in community projects (2023) |

| Digital Engagement | Website, mobile applications for information and service | Enhanced user experience and service delivery prioritized (2023) |

Channels

Sinopec's vast retail service station network, boasting over 30,000 locations throughout China, is a cornerstone of its business model. This extensive footprint allows for direct distribution of essential products like gasoline, diesel, and lubricants to a massive customer base, encompassing individual motorists and commercial enterprises.

This widespread presence is crucial for Sinopec's market reach, ensuring that its fuel and lubricant products are readily accessible across diverse geographical areas. By 2024, Sinopec continued to solidify its position as a dominant player in China's fuel retail landscape through this expansive channel.

Sinopec directly engages large industrial and commercial customers, including power plants and manufacturers, for bulk sales of crude oil, natural gas, refined products, and petrochemicals. This involves a dedicated sales team that negotiates bespoke, long-term agreements, securing stable demand and revenue streams for its business-to-business operations.

In 2023, Sinopec's revenue from oil and gas products and petrochemicals reached approximately 2.86 trillion yuan, with a significant portion attributed to these direct industrial sales, underscoring the channel's importance in its overall financial performance.

Sinopec leverages extensive wholesale distribution networks to deliver refined oil products and petrochemicals to a broad base of distributors and other energy sector players. This strategy is crucial for penetrating diverse regional markets and catering to the specific needs of various industrial sectors beyond its direct retail operations.

In 2024, Sinopec's wholesale segment played a significant role in its overall sales volume, with refined oil product sales reaching approximately 230 million tons. This vast network ensures that Sinopec's products reach end-users efficiently, supporting industries ranging from manufacturing to transportation across China and beyond.

Online Platforms and Digital Services

Sinopec leverages online platforms for enhanced corporate communication and investor relations, making information more accessible. These digital services are crucial for streamlining interactions with stakeholders.

The company is expanding its digital footprint to include potential B2B order management and customer service functions through its online channels. This move aims to improve operational efficiency and customer engagement.

- Digital Investor Relations: Sinopec actively uses its investor relations website and social media platforms to disseminate financial reports and company news, facilitating transparent communication with shareholders.

- B2B E-commerce Potential: The company is exploring or has implemented online portals for business-to-business transactions, potentially allowing for more efficient procurement and sales processes for its industrial clients.

- Customer Service Enhancement: Digital channels are being utilized to provide customer support and manage inquiries, offering a more convenient and responsive experience for end-users of Sinopec's products and services.

Engineering and Technical Service Contracts

Sinopec's engineering and technical services operate through direct contracts with clients worldwide, focusing on project-based engagements. These services encompass design, construction, and technical consulting within the energy and chemical industries. In 2024, Sinopec's engineering and construction segment secured significant international projects, contributing to its robust revenue streams.

These channels are crucial for Sinopec's global expansion and technological advancement. The company leverages its expertise to deliver complex projects, reinforcing its position as a comprehensive energy and chemical solutions provider. The financial performance of these contracts directly impacts Sinopec's overall profitability and market share in key regions.

- Global Reach: Direct contracts enable Sinopec to serve diverse international markets.

- Project Scope: Engagements cover the full lifecycle from design to construction and ongoing technical support.

- Industry Focus: Expertise is concentrated in the energy and chemical sectors.

- 2024 Performance: Significant project wins in international markets bolstered the engineering and construction division's results.

Sinopec utilizes a multi-channel approach to reach its diverse customer base. Its extensive retail network, comprising over 30,000 service stations, ensures direct product distribution across China. Beyond retail, Sinopec engages directly with large industrial clients through dedicated sales teams for bulk sales of oil, gas, and petrochemicals, securing long-term agreements.

The company also relies on broad wholesale distribution networks to supply regional markets and various industrial sectors. Furthermore, Sinopec is enhancing its digital presence, exploring B2B e-commerce and improving online customer service to streamline operations and engagement. These channels are vital for market penetration and revenue generation.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Retail Service Stations | Direct sales of fuel, lubricants to individual and commercial customers. | Over 30,000 locations across China. |

| Direct Industrial Sales | Bespoke, long-term agreements for bulk sales to power plants, manufacturers. | Secures stable demand for crude oil, refined products, petrochemicals. |

| Wholesale Distribution | Supplying distributors and energy sector players to reach diverse regional markets. | Refined oil product sales ~230 million tons in 2024. |

| Digital Channels | Investor relations, potential B2B e-commerce, customer service. | Enhancing operational efficiency and stakeholder communication. |

Customer Segments

Retail consumers and vehicle owners represent Sinopec's broadest customer base, encompassing individual drivers and households who rely on its extensive network of service stations for fuel and automotive products. For this mass market, convenience and strong brand recognition are paramount, driving their purchasing decisions.

In 2024, Sinopec continued to serve millions of these customers daily across China. The company's extensive retail footprint, boasting over 30,000 service stations, ensures accessibility for a vast number of vehicle owners, facilitating frequent transactions for gasoline, diesel, and lubricants.

Industrial manufacturers and chemical processors represent a core B2B customer segment for Sinopec. These businesses, spanning sectors like plastics, textiles, agriculture, and construction, depend on Sinopec's extensive portfolio of petrochemical products as essential raw materials for their own production processes. Sinopec's ongoing investments in expanding its petrochemical capacity directly benefit these industries by ensuring a stable and growing supply chain.

Transportation and logistics companies, including airlines, shipping firms, and railway operators, represent a core customer segment for Sinopec. These businesses rely heavily on Sinopec for consistent, high-volume supplies of essential fuels like jet fuel, diesel, and marine fuels to keep their operations running smoothly. For instance, in 2023, global aviation fuel demand reached approximately 3.5 million barrels per day, highlighting the scale of need within this sector.

Government and Public Utilities

Sinopec's customer segment includes government and public utilities, providing them with essential energy products and infrastructure services. As a major state-owned enterprise in China, these relationships are foundational to its operations and strategic direction.

For instance, in 2023, Sinopec continued to be a primary supplier of refined oil products and natural gas to various government agencies and municipal utility companies across China, ensuring stable energy supply for public services and infrastructure projects.

- Energy Supply Security: Governments rely on Sinopec for consistent and reliable access to fuels like gasoline, diesel, and jet fuel to power public transportation, emergency services, and national infrastructure.

- Infrastructure Development: Public utilities, such as city gas networks and power generation facilities, depend on Sinopec for the supply of natural gas and other feedstocks vital for their operations.

- Strategic Partnerships: Sinopec's role as a state-owned entity necessitates close collaboration with government bodies on national energy strategies, environmental regulations, and the development of new energy sources.

- Economic Stability: By ensuring energy availability to public services, Sinopec contributes directly to the economic stability and functioning of cities and regions throughout China.

Other Energy Companies and Traders

Sinopec engages in significant wholesale transactions of crude oil, natural gas, and refined products. These transactions are primarily with other major energy companies and specialized trading houses, both within China and on the global stage. In 2024, Sinopec continued to be a cornerstone supplier in these wholesale energy markets, leveraging its extensive production and refining capabilities.

As a major integrated energy company, Sinopec's role extends beyond mere participation; it actively shapes supply dynamics. Its position as a key producer and refiner allows it to offer substantial volumes of essential energy commodities, making it a critical partner for many entities in the energy value chain.

- Wholesale Transactions: Sinopec's wholesale activities in 2024 encompassed vast quantities of crude oil, natural gas, and refined fuels, serving a wide array of B2B clients.

- Key Supplier Status: The company’s integrated operations solidify its reputation as a primary supplier, crucial for the stability of energy markets.

- Market Reach: Sinopec’s wholesale operations span both domestic Chinese markets and international energy trading hubs, reflecting its global footprint.

Sinopec's customer base is diverse, ranging from individual vehicle owners to large industrial enterprises and government entities. This broad reach underscores its integral role in China's energy landscape.

The company caters to millions of retail consumers through its vast network of over 30,000 service stations, providing essential fuels and automotive products. Simultaneously, industrial manufacturers and transportation firms rely on Sinopec for critical petrochemicals and fuels, forming a robust B2B segment.

Furthermore, Sinopec serves as a vital supplier to government and public utilities, ensuring energy security and supporting infrastructure development. Its wholesale operations also involve significant transactions with other energy companies and trading houses, solidifying its position in both domestic and international markets.

Cost Structure

The largest element in Sinopec's cost structure is the acquisition of crude oil and natural gas, the fundamental inputs for its refining and petrochemical businesses. In 2024, global oil prices saw volatility, directly influencing Sinopec's raw material expenses, which are heavily tied to international benchmarks.

Sinopec's upstream operations, encompassing exploration and production, represent a substantial cost center. These expenses cover critical activities such as geological surveys to identify potential reserves, the complex process of drilling wells, and ongoing production activities including well maintenance and field development. In 2024, Sinopec reported an oil and gas lifting cost of RMB745.40 per tonne, illustrating the significant investment required to extract these resources.

Sinopec's refining and manufacturing operating costs encompass significant expenditures on energy, labor, and maintenance for its extensive network of plants. In 2023, the company reported that its refining segment's operating expenses, excluding crude oil costs, were substantial, reflecting the capital-intensive nature of these operations. Sinopec continually strives to enhance efficiency through technological upgrades and process optimization to manage these costs effectively.

Distribution, Marketing, and Sales Expenses

Sinopec's distribution, marketing, and sales expenses are significant, reflecting the vast logistics network required to move refined products and chemicals. This includes costs for operating pipelines, rail, and road transportation, as well as managing its extensive network of service stations. For example, in 2023, Sinopec reported substantial expenditures in its marketing and distribution segment, contributing to its overall operational costs.

These costs are crucial for reaching end consumers and maintaining market presence. The operational expenses for Sinopec's over 30,000 service stations worldwide, including retail operations and brand promotion, are a major component. The company's marketing efforts aim to build brand loyalty and drive sales volumes across its diverse product portfolio.

- Distribution Costs: Expenses associated with transporting refined oil products and petrochemicals via pipelines, railways, and road tankers.

- Marketing and Advertising: Investments in brand building, promotional campaigns, and customer engagement initiatives to drive product demand.

- Retail Operations: Costs related to managing and operating Sinopec's extensive network of service stations, including staffing, maintenance, and inventory management.

- Logistics and Warehousing: Expenditures for storing and managing inventory of fuel and chemical products at various distribution points.

Capital Expenditure (CAPEX) and R&D Investment

Sinopec's cost structure heavily features capital expenditure (CAPEX) for growth and maintenance. In 2024, the company continued its significant investment in expanding refining capacity and developing its petrochemical businesses. This includes building new facilities and upgrading existing ones to improve efficiency and product quality.

Research and Development (R&D) is another critical component of Sinopec's cost. The company is channeling substantial funds into areas like new energy sources, such as hydrogen and biofuels, and advanced materials. This focus is crucial for long-term competitiveness and adapting to evolving energy landscapes.

- Capital Expenditure: Sinopec's 2023 CAPEX reached approximately RMB 230 billion (around $32 billion USD), with a significant portion allocated to oil and gas exploration, refining, and petrochemical projects.

- R&D Investment: The company's R&D spending in 2023 was around RMB 20 billion (approximately $2.8 billion USD), with a growing emphasis on green and low-carbon technologies.

- Asset Maintenance: A considerable portion of CAPEX is also dedicated to maintaining and modernizing its vast network of oil and gas fields, pipelines, and refining assets to ensure operational reliability.

- Technological Upgrades: Investments are continuously made in adopting advanced digital technologies and automation across its operations to enhance productivity and safety.

Sinopec's cost structure is dominated by the procurement of crude oil and natural gas, with prices fluctuating significantly in 2024, directly impacting these raw material expenses. Upstream exploration and production activities, including drilling and field development, represent another major cost, with 2024 oil and gas lifting costs averaging RMB745.40 per tonne.

Operational expenses for refining and manufacturing are substantial, covering energy, labor, and maintenance for its extensive facilities. Distribution, marketing, and sales costs are also significant, driven by the vast logistics network and the operation of over 30,000 service stations globally.

Capital expenditure, particularly in 2024 for refining and petrochemical expansion, alongside R&D investments in new energy and advanced materials, form key cost drivers. In 2023, CAPEX reached approximately RMB 230 billion, while R&D spending was around RMB 20 billion, highlighting a commitment to future growth and technological advancement.

| Cost Category | Key Components | 2023/2024 Data Points |

|---|---|---|

| Raw Materials | Crude Oil & Natural Gas Acquisition | Global oil price volatility in 2024; Lifting costs RMB745.40/tonne (2024) |

| Upstream Operations | Exploration, Drilling, Production | Significant investment in field development and maintenance |

| Refining & Manufacturing | Energy, Labor, Maintenance | Substantial operating expenses excluding crude; focus on efficiency upgrades |

| Distribution & Marketing | Logistics, Retail Operations, Branding | Costs for pipelines, rail, road transport, and 30,000+ service stations |

| Capital Expenditure (CAPEX) | Capacity Expansion, Upgrades | Approx. RMB 230 billion in 2023 for refining & petrochemical projects |

| Research & Development (R&D) | New Energy, Advanced Materials | Approx. RMB 20 billion in 2023; focus on green technologies |

Revenue Streams

Sinopec's primary revenue generator is the sale of refined petroleum products. This includes essential fuels like gasoline and diesel, aviation fuel (kerosene), and various lubricants. These products are sold to a broad customer base, encompassing individual consumers at retail stations and larger commercial entities.

In 2024, Sinopec achieved a significant sales volume of 239 million tonnes for its refined oil products. This substantial figure underscores the company's dominant position in supplying critical energy resources to both the domestic Chinese market and international customers.

Sinopec generates substantial revenue by selling a diverse array of petrochemical products. These include essential materials like synthetic resins, synthetic fibers, and synthetic rubber, along with fundamental organic chemicals. These products are crucial inputs for various industrial manufacturers.

In 2024, Sinopec achieved a significant sales volume of 83.45 million tonnes for its chemical products, underscoring the importance of this revenue stream.

Sinopec generates significant revenue from selling natural gas and liquefied petroleum gas (LPG). These sales cater to a broad customer base, including industrial facilities, commercial enterprises, and individual households. This diversification in customer segments helps stabilize income streams.

The natural gas sector experienced a particularly strong performance in 2024, with the profitability of the entire industry chain reaching an all-time high. This trend directly benefits Sinopec's revenue generation from its natural gas operations, reflecting robust market demand and favorable pricing conditions.

Engineering and Technical Service Fees

Sinopec's engineering and technical services are a significant revenue driver, offering specialized expertise in areas like engineering, procurement, and construction (EPC) to external clients within the energy and chemical industries. This segment leverages Sinopec's deep technical know-how and project management capabilities.

In 2024, Sinopec continued to expand its service offerings, securing contracts for complex projects. For instance, its subsidiaries are involved in designing and building advanced petrochemical facilities and upgrading existing infrastructure. This diversification beyond its core refining and marketing operations provides a stable income stream.

- EPC Project Execution: Sinopec undertakes large-scale engineering, procurement, and construction projects for third parties, including the design and build of refineries, chemical plants, and pipelines.

- Technical Consulting: The company provides expert advice on process optimization, safety management, environmental compliance, and technology selection for energy and chemical enterprises.

- Specialized Services: Revenue is also generated from specialized technical support, such as equipment maintenance, testing, and digital transformation solutions for the industry.

Emerging New Energy Product Sales

Sinopec is actively expanding its revenue through sales of new energy products. This diversification includes offerings like green hydrogen and biofuels, tapping into the growing demand for sustainable energy solutions. The company's commitment is evident in its infrastructure development, having already established over 1,000 hydrogen fueling stations.

These new energy ventures represent a significant shift for Sinopec, moving beyond traditional fossil fuels. Revenue growth is expected as these segments mature and market adoption increases. The strategic investment in hydrogen infrastructure, for example, positions Sinopec to capture a substantial share of the emerging hydrogen economy.

- Green Hydrogen Sales: Revenue generated from the production and sale of hydrogen produced using renewable energy sources.

- Biofuel Sales: Income derived from the sale of biofuels, such as ethanol and biodiesel, as alternatives to conventional fuels.

- Hydrogen Fueling Services: Revenue from operating and utilizing its extensive network of over 1,000 hydrogen fueling stations.

- Potential Charging/Battery Swapping: Future revenue streams from electric vehicle charging infrastructure and battery swapping services as the company expands its EV support ecosystem.

Sinopec's revenue streams are diverse, anchored by the sale of refined petroleum products and petrochemicals. The company also generates income from natural gas sales and engineering services. A growing segment is the sale of new energy products, including green hydrogen and biofuels, reflecting a strategic pivot towards sustainability.

| Revenue Stream | 2024 Data/Key Facts | Description |

|---|---|---|

| Refined Petroleum Products | 239 million tonnes sold | Includes gasoline, diesel, aviation fuel, and lubricants. |

| Petrochemical Products | 83.45 million tonnes sold | Includes synthetic resins, fibers, rubber, and organic chemicals. |

| Natural Gas & LPG | Industry chain profitability at all-time high | Sales to industrial, commercial, and household sectors. |

| Engineering & Technical Services | Secured complex project contracts | EPC, technical consulting, and specialized industry support. |

| New Energy Products | Over 1,000 hydrogen fueling stations | Includes green hydrogen and biofuels, with potential EV charging services. |

Business Model Canvas Data Sources

The Sinopec Business Model Canvas is meticulously constructed using a combination of internal financial reports, extensive market research on the energy sector, and strategic analyses of global oil and gas trends. These diverse data sources ensure a comprehensive and accurate representation of Sinopec's operations and market position.