Sinopec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

Sinopec, a titan in the energy sector, faces significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating its complex market landscape.

The full Porter's Five Forces Analysis reveals the real forces shaping Sinopec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Sinopec, a titan in the energy and chemical sectors, wields considerable influence as a major purchaser of crude oil and natural gas, both within China and across global markets. While the international oil and gas landscape is broad, specific geographic areas or domestic producers can exert significant sway over supply availability and pricing.

Despite this, Sinopec's immense purchasing power, often solidified through substantial long-term supply agreements, serves to temper the bargaining strength of its raw material suppliers. For instance, in 2023, Sinopec’s crude oil imports reached approximately 250 million tons, underscoring its position as a key buyer capable of negotiating favorable terms.

Sinopec's reliance on crude oil and natural gas as its primary inputs is profound, forming the bedrock of its refining and petrochemical operations. These raw materials are not merely components; they are the lifeblood of the company's entire value chain.

The bargaining power of suppliers in this sector is significantly influenced by the global supply and demand dynamics of crude oil and natural gas. In 2024, global oil prices experienced volatility, with benchmarks like Brent crude fluctuating significantly due to geopolitical tensions and production adjustments by major oil-producing nations. This inherent price sensitivity means that any shifts in supplier output or pricing strategies can directly and substantially impact Sinopec's cost of goods sold and, consequently, its profit margins.

Switching crude oil or natural gas suppliers presents moderate switching costs for Sinopec. These costs stem from the logistics of rerouting shipments, adhering to existing contractual obligations, and the potential need to recalibrate refinery processes to accommodate different crude oil grades. For instance, adapting to a new crude blend might require adjustments to distillation units or catalyst systems, incurring time and expense.

While these costs are not insurmountable, they do limit Sinopec's agility in rapidly changing its supply base. This is particularly true given the industry's reliance on long-term strategic alliances with major oil and gas producers, which are established to guarantee a consistent and reliable supply chain. These partnerships often involve significant investment and commitment, making abrupt supplier changes impractical.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, particularly in the crude oil and natural gas sectors, poses a potential challenge. Major oil and gas producers, such as national oil companies or international energy giants, could theoretically move into downstream operations like refining or petrochemical production. This would essentially turn them into competitors for companies like Sinopec.

However, for Sinopec within its primary market in China, this threat is significantly mitigated. The sheer scale of capital investment needed to establish and operate refining and petrochemical facilities is enormous. Furthermore, China's energy landscape is already dominated by highly integrated players, including Sinopec itself, which possess established infrastructure, market access, and technological expertise. This makes it difficult for new, integrated suppliers to effectively enter and compete.

Globally, the situation is somewhat different. Some suppliers are indeed already integrated. For instance, Saudi Aramco, a major crude oil supplier, has significant investments in refining capacity and petrochemicals through joint ventures and wholly owned subsidiaries. This global trend highlights that while less of a direct threat in Sinopec's core domestic market, the potential for supplier integration exists on an international scale, impacting global supply chains and competitive dynamics.

- Capital Intensity: Establishing integrated refining and petrochemical operations requires billions of dollars in investment, creating a high barrier to entry for potential suppliers looking to integrate forward.

- Existing Market Dominance: In China, Sinopec's entrenched position and extensive infrastructure make it challenging for any new integrated supplier to gain significant market share.

- Global Integration Examples: Companies like Saudi Aramco demonstrate that forward integration by major oil producers is a reality in the international energy market, influencing global competition.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences Sinopec's bargaining power with its suppliers. While crude oil and natural gas remain foundational, Sinopec is strategically investing in and exploring alternative feedstocks for its petrochemical operations and diverse new energy sources.

Sinopec's commitment to diversifying its energy portfolio, which includes a growing emphasis on hydrogen and various renewable energy sources, is designed to progressively lessen its dependence on traditional fossil fuel suppliers. This strategic shift aims to dilute the concentrated power that suppliers of conventional energy inputs might otherwise wield over Sinopec.

- Diversification Impact: By actively pursuing alternative feedstocks and new energy sources, Sinopec weakens the leverage of traditional crude oil and natural gas suppliers.

- Reduced Reliance: Sinopec's investment in hydrogen and renewables, for example, directly reduces its singular reliance on established fossil fuel markets.

- Long-Term Strategy: This diversification is a long-term play to mitigate the bargaining power of suppliers by creating a more resilient and varied supply chain.

Sinopec's bargaining power with its suppliers is moderately high due to its massive purchasing volume, as evidenced by its 2023 crude oil imports of around 250 million tons. While global oil price volatility in 2024, influenced by geopolitical events, can shift supplier leverage, Sinopec's substantial scale allows for negotiation of favorable terms through long-term agreements.

Switching costs for Sinopec are moderate, involving logistical adjustments and potential refinery recalibrations for different crude grades, limiting rapid supplier changes. The threat of supplier forward integration is low in China due to high capital intensity and Sinopec's dominant market position, though it exists globally with entities like Saudi Aramco.

Sinopec's strategic diversification into alternative feedstocks and new energy sources like hydrogen is designed to progressively reduce its dependence on traditional fossil fuel suppliers, thereby diluting their concentrated power.

| Factor | Sinopec's Position | Impact on Supplier Bargaining Power |

| Purchasing Volume | Very High (250M tons crude oil imports in 2023) | Reduces supplier power through negotiation |

| Switching Costs | Moderate (logistics, refinery adjustments) | Limits rapid supplier changes, offering some supplier leverage |

| Supplier Forward Integration | Low in China, Moderate Globally | Limited domestic threat; global players like Saudi Aramco pose a competitive risk |

| Availability of Substitutes | Increasing (hydrogen, renewables) | Reduces reliance on traditional suppliers, weakening their power |

What is included in the product

This analysis delves into the competitive forces impacting Sinopec, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Sinopec's Porter's Five Forces analysis provides a dynamic, data-driven dashboard to anticipate and mitigate competitive threats, offering a clear visual of market pressures for agile strategic adjustments.

Customers Bargaining Power

Sinopec's customer base is incredibly broad, encompassing millions of individual consumers buying gasoline and other refined products, as well as a significant number of industrial clients who purchase petrochemicals in larger quantities. The sheer number of retail customers means that no single individual has much sway over Sinopec's pricing or terms.

However, the bargaining power shifts when considering large industrial customers. These entities, often purchasing substantial volumes of petrochemicals, can indeed exert more pressure. For instance, if a major chemical manufacturer relies on Sinopec for a significant portion of its feedstock, they might negotiate for better pricing or more favorable delivery schedules, impacting Sinopec's profitability on those specific transactions.

Customers for refined oil products like gasoline and diesel often exhibit significant price sensitivity, especially in bustling urban areas or when the economy is struggling. For instance, during periods of economic contraction, consumers tend to reduce discretionary driving, making them more attuned to fuel prices.

Similarly, clients in the petrochemical sector are keenly aware of price shifts. These fluctuations directly impact their own production costs, which are then passed down through various manufacturing supply chains. A rise in petrochemical prices can therefore ripple through multiple industries.

The global petrochemical market is projected to experience oversupply in 2024 and 2025. This excess capacity is expected to further amplify customer price sensitivity, as ample supply typically drives down prices and increases buyer leverage.

The availability of substitute products significantly impacts Sinopec's bargaining power with its customers. For refined fuels, the accelerating adoption of electric vehicles (EVs) and advancements in alternative fuels like hydrogen present a clear and growing substitution threat, potentially reducing demand for traditional gasoline and diesel.

In the petrochemical sector, while still developing, bio-based and recycled plastics are emerging as viable substitutes for conventional plastics, offering customers more environmentally friendly options. Sinopec is proactively addressing this by diversifying its business into new energy services, such as expanding its EV charging network, to mitigate the impact of these substitutions.

Customer Information and Transparency

The bargaining power of Sinopec's customers is influenced by information availability. For standardized products like refined fuels and basic chemicals, customers have increasing access to pricing and product details, enabling them to compare options and negotiate more effectively. This trend is evident as global energy markets become more transparent.

While widespread digital platforms offer price comparisons for many of Sinopec's offerings, customer knowledge for highly specialized petrochemicals can be less developed. This means that for niche products, Sinopec might retain a degree of pricing power due to less informed buyers.

- Decreasing Information Asymmetry: Customers increasingly access pricing and product data for refined products and bulk chemicals.

- Enhanced Negotiation: Greater transparency empowers customers to compare offerings and seek better deals.

- Specialized Product Knowledge Gap: Customer understanding for specialized petrochemicals may be less comprehensive, impacting their bargaining power.

- Digital Influence: Online platforms facilitate price comparisons, amplifying customer bargaining power for commoditized products.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for Sinopec, warrants consideration, particularly from large industrial buyers. These entities might explore producing their own petrochemical raw materials to gain greater control over supply and costs. However, the immense capital investment, sophisticated technical expertise, and stringent regulatory approvals required for petrochemical production significantly dampen this possibility for most of Sinopec's clientele.

For instance, establishing a new ethylene cracker, a fundamental petrochemical unit, can easily cost billions of dollars, a prohibitive barrier for many. The technical know-how for operating such complex facilities also represents a substantial hurdle. Consequently, while theoretically possible, the practical challenges make backward integration a minimal threat for Sinopec's core customer base.

- Low Likelihood: Most retail and even many industrial customers lack the scale, capital, and technical expertise to undertake backward integration into petrochemical production.

- High Capital Intensity: Building petrochemical facilities requires billions in investment, a significant deterrent for potential integrators.

- Technical Complexity: Operating advanced petrochemical plants demands specialized knowledge and skilled personnel, posing a challenge for many firms.

- Regulatory Hurdles: Environmental and safety regulations in the petrochemical sector are extensive, adding further complexity and cost to integration efforts.

Sinopec's customer bargaining power is moderate, influenced by product type and customer segment. While individual retail fuel buyers have negligible power, large industrial clients purchasing petrochemicals can negotiate better terms due to volume. The global petrochemical market's projected oversupply in 2024-2025 is expected to heighten customer price sensitivity and leverage.

The increasing availability of substitutes like EVs for refined fuels and bio-plastics for petrochemicals also empowers customers. Furthermore, enhanced information transparency through digital platforms allows customers to compare prices more effectively, increasing their bargaining power for standardized products.

| Factor | Impact on Sinopec Customer Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Low for retail, Moderate for industrial | Millions of individual fuel buyers vs. large petrochemical purchasers. |

| Price Sensitivity | High for refined fuels, Moderate for petrochemicals | Consumers reduce driving in economic downturns; petrochemical prices affect downstream costs. |

| Availability of Substitutes | Increasing | Growth of EVs and alternative fuels; emergence of bio-plastics. |

| Information Availability | Increasing for commoditized products | Digital platforms facilitate price comparisons. |

| Threat of Backward Integration | Low | High capital and technical barriers for petrochemical production. |

Preview Before You Purchase

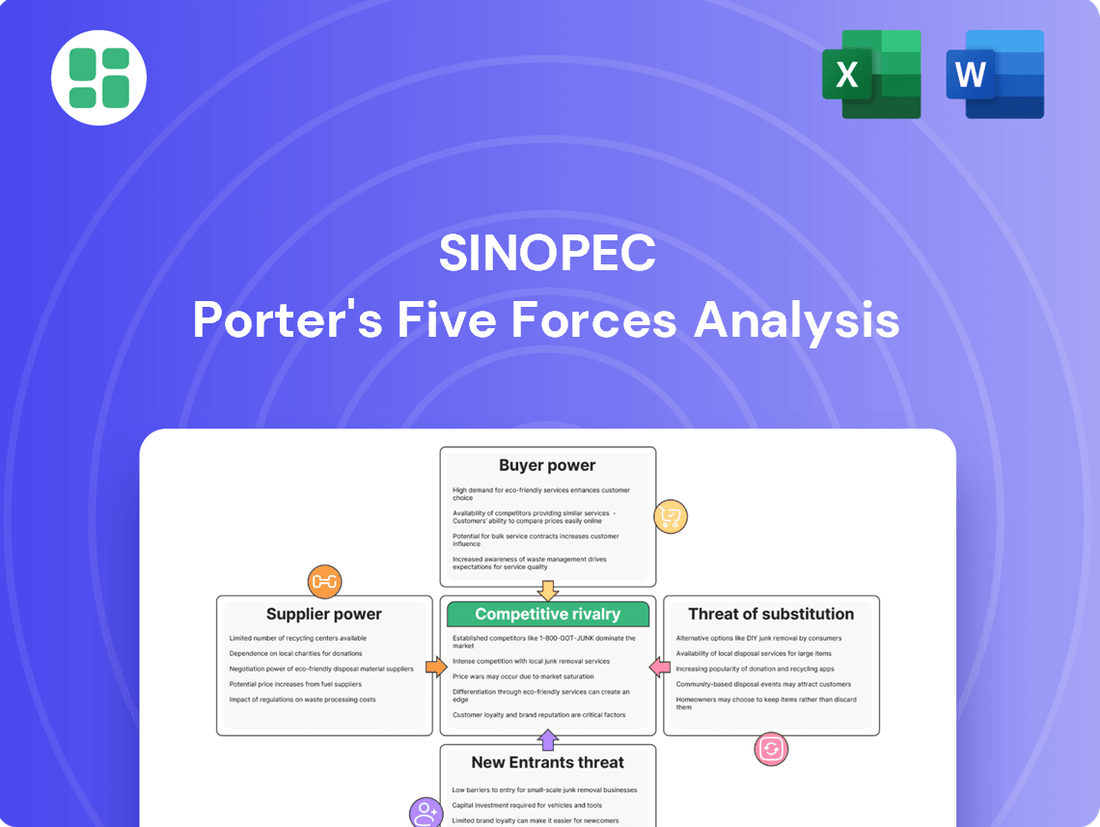

Sinopec Porter's Five Forces Analysis

This preview showcases the complete Sinopec Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the oil and gas industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that this detailed analysis will provide valuable insights for your strategic decision-making.

Rivalry Among Competitors

Sinopec navigates a fiercely competitive environment within China's energy and chemical industries. Its primary rivals are other state-owned behemoths such as PetroChina and CNOOC, alongside a multitude of international oil companies and global petrochemical manufacturers. This dense concentration of large, entrenched players significantly escalates the intensity of market rivalry.

While China's overall energy demand continues to climb, the pace of growth for traditional refined oil products is moderating. This slowdown is influenced by government-backed energy transition initiatives and the increasing adoption of electric vehicles, which directly impact gasoline and diesel consumption.

The petrochemical segment, though expanding, grapples with significant overcapacity issues, especially in key products like olefins and aromatics. This excess capacity translates into reduced plant utilization rates, typically hovering around 70-80% for many petrochemical facilities in 2024, intensifying price competition among producers.

For many of Sinopec's basic refined products and bulk petrochemicals, there's not much to set them apart, which means competition often comes down to price. In 2023, Sinopec's revenue from its refining and chemicals segment was approximately 2.2 trillion Chinese Yuan, highlighting the sheer scale of this price-sensitive market.

Sinopec works to stand out by focusing on service, like its Easy Joy convenience stores that are part of its gas stations, and by creating more specialized, high-value chemical products. This strategy aims to build loyalty beyond just the price point.

However, for customers buying standard, commodity-like products, it's usually easy to switch to another supplier. This low barrier to switching intensifies the rivalry among companies in the sector, pushing them to constantly compete on price and efficiency.

High Fixed Costs and Capacity Utilization

Sinopec operates in industries with substantial fixed costs, particularly in exploration, refining, and petrochemical production. These massive upfront investments necessitate high capacity utilization to spread costs and achieve profitability. For instance, a typical refinery can cost billions of dollars to build, requiring continuous operation to justify the capital outlay.

The drive for high capacity utilization intensifies competition, especially when the market experiences overcapacity. In 2024, the global petrochemical market faced such conditions, leading to increased price competition as companies fought to maintain production volumes and cover their fixed expenses. This dynamic forces players like Sinopec to compete aggressively on price to secure market share.

- High Fixed Costs: Energy and chemical sectors require immense capital for infrastructure like refineries and chemical plants, often running into billions of dollars.

- Economies of Scale: Companies aim for high capacity utilization to lower per-unit production costs and improve profitability.

- Overcapacity Impact: Periods of market oversupply, as seen in petrochemicals in 2024, trigger intense price wars to maintain operational levels.

Strategic Objectives and Commitments of Competitors

China's dominant energy players, including Sinopec, are state-owned enterprises. Their strategic aims go beyond simple profit, incorporating national energy security and environmental targets. This means they often maintain investment and competitive presence even when profit margins are thin. For instance, Sinopec's commitment to green initiatives is substantial, with significant investments in areas like hydrogen energy and carbon capture technologies.

These state-backed objectives can intensify rivalry. Competitors, often similarly structured, are driven by national mandates as much as market forces. Sinopec's own strategic investments highlight this, with the company allocating considerable capital towards developing new energy sources and reducing its carbon footprint. In 2023, Sinopec announced plans to invest over RMB 100 billion (approximately $14 billion USD) in new energy and green initiatives by 2025.

- National Energy Security: State-owned energy companies prioritize reliable energy supply for the nation, influencing their investment and operational strategies.

- Environmental Goals: Commitments to sustainability and emissions reduction are increasingly integrated into the core strategies of major energy firms like Sinopec.

- Sustained Investment: Strategic objectives can lead to continued investment in capacity and new technologies, even during periods of market downturn or low profitability.

- Green Initiatives: Sinopec is actively pursuing growth in new energy sectors, such as hydrogen production and charging infrastructure, reflecting a long-term strategic shift.

Sinopec faces intense competition from state-owned peers like PetroChina and CNOOC, as well as international players, particularly in petrochemicals where overcapacity in 2024 led to utilization rates around 70-80%. The market for refined oil products is also competitive, with moderating demand growth due to energy transition initiatives and EVs impacting gasoline and diesel volumes.

The commodity nature of many of Sinopec's products means price is a key differentiator, with its refining and chemicals segment generating approximately 2.2 trillion Chinese Yuan in revenue in 2023. While Sinopec attempts to differentiate through services like its Easy Joy convenience stores and higher-value chemical products, low switching costs for basic products keep rivalry high.

High fixed costs in exploration, refining, and petrochemicals necessitate high capacity utilization, intensifying price competition during oversupply periods. For example, building a refinery can cost billions, demanding continuous operation to justify the investment, a challenge amplified in the oversupplied 2024 petrochemical market.

State ownership influences Sinopec's strategy, balancing profit with national energy security and environmental goals, leading to sustained investment even with thin margins. Sinopec's commitment to green initiatives, with plans to invest over RMB 100 billion (approx. $14 billion USD) by 2025 in new energy, exemplifies this broader strategic objective.

| Competitor Type | Key Focus Areas | 2023 Revenue (Approx.) |

|---|---|---|

| State-Owned (China) | National energy security, market share, diversification | PetroChina: ~2.6 trillion CNY CNOOC: ~800 billion CNY |

| International Oil Companies | Global market access, technology, niche products | ExxonMobil: ~$245 billion USD Shell: ~$315 billion USD |

| Global Petrochemical Manufacturers | Specialty chemicals, efficiency, scale | SABIC: ~$50 billion USD |

SSubstitutes Threaten

The burgeoning electric vehicle (EV) market in China presents a substantial threat to Sinopec's core business of selling refined oil products like gasoline and diesel. By the end of 2023, China's EV sales surpassed 9 million units, a significant leap from previous years, indicating a growing shift away from traditional internal combustion engine vehicles. This trend directly impacts demand for Sinopec's primary offerings.

Sinopec is actively mitigating this threat by investing heavily in alternative energy solutions. The company is rapidly expanding its EV charging network, aiming to build thousands of new charging stations across the country in the coming years. Furthermore, Sinopec is exploring and developing hydrogen energy as a viable alternative fuel, recognizing its potential to decarbonize the transportation sector.

The increasing adoption of renewable energy sources like solar and wind power in China presents a significant threat of substitution for Sinopec's traditional fossil fuel business in power generation. China's commitment to clean energy is substantial, having already surpassed its 2030 wind and solar capacity goals by 2024, six years ahead of schedule.

While Sinopec is investing in new energy ventures, its foundational operations remain heavily reliant on fossil fuels. This strategic positioning makes the accelerating shift towards renewables a potent long-term challenge, as it directly erodes the demand for Sinopec's core products in the power sector.

Growing environmental concerns and stricter regulations are boosting the appeal of bio-based and recycled materials as alternatives to conventional petrochemicals. These sustainable options, like bioplastics and recycled polymers, are gaining traction, posing an increasing challenge to Sinopec's petrochemical business, even though they currently hold a smaller market share.

Despite economic pressures on recyclers due to low virgin polymer prices in 2024, the long-term shift towards sustainability continues to strengthen the threat of substitutes. This trend suggests that companies like Sinopec must increasingly consider and integrate these greener alternatives into their strategies to remain competitive in the evolving chemical industry landscape.

Natural Gas as a Cleaner Fuel Alternative

Natural gas presents a significant threat of substitution for Sinopec's traditional refined oil products. As a cleaner-burning fossil fuel, its adoption in industrial applications and the growing use of liquefied natural gas (LNG) in transportation directly compete with gasoline and diesel. This shift is driven by environmental regulations and cost efficiencies.

Sinopec is strategically positioning itself to benefit from this trend by significantly investing in its natural gas segment. The company is expanding its integrated natural gas value chain, which includes exploration, production, and distribution. This proactive approach aims to capture market share as demand for cleaner energy sources grows.

- Growing Natural Gas Demand: Global natural gas demand is projected to increase, with the International Energy Agency (IEA) forecasting a substantial rise in its share of the global energy mix through 2024 and beyond.

- Sinopec's Natural Gas Investments: Sinopec has been a major investor in natural gas infrastructure, aiming to boost its production and sales volumes. For instance, in 2023, Sinopec's natural gas production saw a notable increase, reflecting its commitment to this sector.

- LNG Vehicle Adoption: The number of natural gas vehicles, particularly heavy-duty trucks and buses, continues to grow globally, directly impacting the demand for traditional refined fuels.

Energy Efficiency and Conservation

Improvements in energy efficiency are a growing threat to Sinopec. For instance, advancements in vehicle fuel economy mean consumers need less gasoline, directly impacting demand for Sinopec's refined products. By 2024, the International Energy Agency reported that global energy intensity improvements were accelerating, signaling a reduced need for traditional energy sources.

Government policies further amplify this threat. Initiatives promoting energy conservation and the development of more efficient technologies, such as electric vehicles and smart grids, directly substitute for higher energy consumption. China's own ambitious targets for renewable energy integration and emissions reduction, which were being actively pursued in 2024, put further pressure on fossil fuel demand.

- Reduced Demand: Enhanced energy efficiency in sectors like transportation and manufacturing directly curtails the need for traditional fuels.

- Policy Influence: Government mandates and incentives for conservation and efficient technologies act as potent substitutes for higher energy usage.

- Technological Advancements: Innovations in areas such as electric mobility and renewable energy integration offer viable alternatives to Sinopec's core offerings.

The rise of electric vehicles and the accelerating adoption of renewable energy sources pose a significant threat of substitution for Sinopec's traditional fossil fuel products. Furthermore, advancements in energy efficiency and the growing appeal of sustainable materials directly challenge Sinopec's core businesses.

China's commitment to clean energy is substantial, with its wind and solar capacity goals for 2030 already surpassed by 2024. This rapid transition directly impacts the demand for Sinopec's refined oil products in power generation and transportation.

The petrochemical sector also faces substitution threats from bioplastics and recycled polymers, driven by environmental concerns and stricter regulations. While these alternatives currently hold a smaller market share, their long-term growth trajectory necessitates strategic adaptation by companies like Sinopec.

| Substitute | Impact on Sinopec | Key Drivers | 2024 Data/Trend |

|---|---|---|---|

| Electric Vehicles (EVs) | Reduced demand for gasoline and diesel | Environmental concerns, government incentives, falling battery costs | China's EV sales surpassed 9 million units by end of 2023; continued strong growth expected in 2024. |

| Renewable Energy (Solar, Wind) | Reduced demand for fossil fuels in power generation | Government policy, cost competitiveness, climate change mitigation | China exceeded 2030 wind and solar capacity targets by 2024. |

| Natural Gas | Competition with refined oil products in transportation and industry | Cleaner burning, cost efficiency, regulatory push | IEA forecasts substantial rise in natural gas share of global energy mix through 2024. Sinopec's natural gas production increased in 2023. |

| Energy Efficiency Improvements | Decreased overall energy consumption | Technological advancements in vehicles, industrial processes | Global energy intensity improvements accelerating in 2024. |

| Bioplastics & Recycled Polymers | Substitution for petrochemicals | Environmental regulations, consumer demand for sustainability | Long-term trend strengthening despite short-term economic pressures on recyclers in 2024. |

Entrants Threaten

The oil, gas, and petrochemical sectors demand colossal upfront capital for exploration, extraction, refining, and distribution networks. This immense financial hurdle significantly discourages new companies from attempting to build operations on a scale rivaling established giants like Sinopec.

Sinopec's projected capital expenditure for 2025 underscores this reality, with significant investments planned to maintain and expand its vast infrastructure. For instance, in 2023, Sinopec's capital expenditure reached approximately 220 billion yuan, demonstrating the scale of investment required to compete.

Government policy and regulatory hurdles significantly deter new entrants in China's energy sector, which is largely controlled by state-owned giants like Sinopec. These regulations create substantial barriers, particularly for foreign companies seeking to enter the market. For instance, access to crucial exploration licenses, refining quotas, and established distribution networks is tightly managed by the government, making it exceedingly difficult for newcomers to gain a foothold.

Sinopec's formidable advantage lies in its deeply entrenched nationwide network of pipelines, refineries, chemical plants, and retail stations, a testament to decades of strategic investment and development. This vast, integrated infrastructure is not easily replicated.

New entrants would confront staggering capital requirements and significant time lags to establish comparable operational efficiency and market access. For instance, building a single large-scale refinery can cost billions of dollars, a substantial barrier to entry.

The sheer scale and interconnectedness of Sinopec's distribution channels and infrastructure create a powerful moat, making it exceedingly difficult for newcomers to compete effectively on cost or reach in the Chinese energy market.

Brand Loyalty and Established Relationships

Sinopec enjoys significant brand loyalty in the retail fuel sector, a direct result of its extensive network and consistent service, making it challenging for new entrants to capture market share. In 2023, Sinopec operated over 30,000 service stations across China, a testament to its widespread presence and customer accessibility.

In the industrial petrochemical arena, Sinopec leverages deeply entrenched relationships with major industrial clients. These long-standing partnerships, built on reliability and integrated supply chains, act as a substantial barrier to entry, as new competitors must overcome established trust and logistical networks.

The company's Easy Joy ecosystem, which integrates loyalty programs and diverse retail offerings at its service stations, further solidifies customer relationships. This ecosystem encourages repeat business and creates a stickier customer base, increasing the difficulty for new players to attract and retain customers.

- Brand Recognition: Sinopec's brand is a household name in China, associated with reliability and widespread availability.

- Customer Loyalty Programs: Initiatives like the Easy Joy membership program foster repeat purchases and customer retention.

- Established Supply Chains: For industrial clients, Sinopec's robust and reliable supply chains are a critical factor in maintaining business relationships.

- Network Effect: The sheer number of Sinopec service stations creates a powerful network effect, making it convenient for consumers to choose Sinopec over less accessible competitors.

Access to Raw Materials and Technology

Sinopec's substantial access to critical oil and gas reserves, both within China and through international partnerships, presents a formidable barrier to new entrants. Securing comparable resource bases requires immense capital investment and long-term strategic alliances, which are difficult for newcomers to replicate. In 2024, Sinopec continued to leverage its extensive upstream operations, contributing significantly to China's energy security and its own competitive advantage.

Furthermore, the technological sophistication required for efficient exploration, extraction, and refining in the energy sector is a significant hurdle. Sinopec has invested heavily in advanced technologies, including seismic imaging and enhanced oil recovery techniques, giving it a distinct operational edge. New players would face considerable challenges in acquiring or developing similar technological capabilities to compete effectively.

- Resource Access: Sinopec's established domestic and international oil and gas reserves are a key deterrent.

- Technological Prowess: Advanced exploration and production technologies create a high entry barrier.

- Capital Requirements: The immense financial investment needed for resource acquisition and technology development is prohibitive for most new entrants.

The threat of new entrants in China's oil and gas sector, where Sinopec operates, is significantly low due to immense capital requirements and established infrastructure. New companies would need billions to replicate Sinopec's extensive refining, distribution, and retail networks. For example, Sinopec's 2023 capital expenditure of around 220 billion yuan highlights the scale of investment necessary to even begin competing.

Government regulations and licensing further restrict new players, favoring state-owned enterprises like Sinopec. Building brand loyalty and securing reliable supply chains, as Sinopec has done over decades, presents additional formidable barriers. Sinopec's vast network of over 30,000 service stations in 2023 exemplifies this entrenched market position.

Technological expertise and access to critical oil and gas reserves are also significant deterrents for potential new entrants. Sinopec's continued investment in advanced exploration and production technologies in 2024 solidifies its competitive advantage, making it exceptionally difficult for newcomers to achieve comparable operational efficiency or resource access.

| Barrier Type | Description | Sinopec's Position |

|---|---|---|

| Capital Requirements | Extremely high initial investment needed for infrastructure and operations. | Dominant, with massive existing assets and ongoing significant capital expenditure (e.g., ~220 billion yuan in 2023). |

| Government Regulation & Policy | Strict licensing, quotas, and state control over resources and distribution. | Favored as a state-owned enterprise, with deep government relationships. |

| Brand Loyalty & Customer Relationships | Established trust, extensive retail presence, and integrated loyalty programs. | Strong, with over 30,000 service stations and the Easy Joy ecosystem. |

| Access to Resources & Technology | Securing oil and gas reserves and advanced operational technologies. | Significant, with extensive domestic and international reserves and continuous tech investment. |

Porter's Five Forces Analysis Data Sources

Our Sinopec Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Sinopec's official annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable industry research firms, market intelligence platforms, and macroeconomic data providers to ensure a thorough understanding of the competitive landscape.