Sinopec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

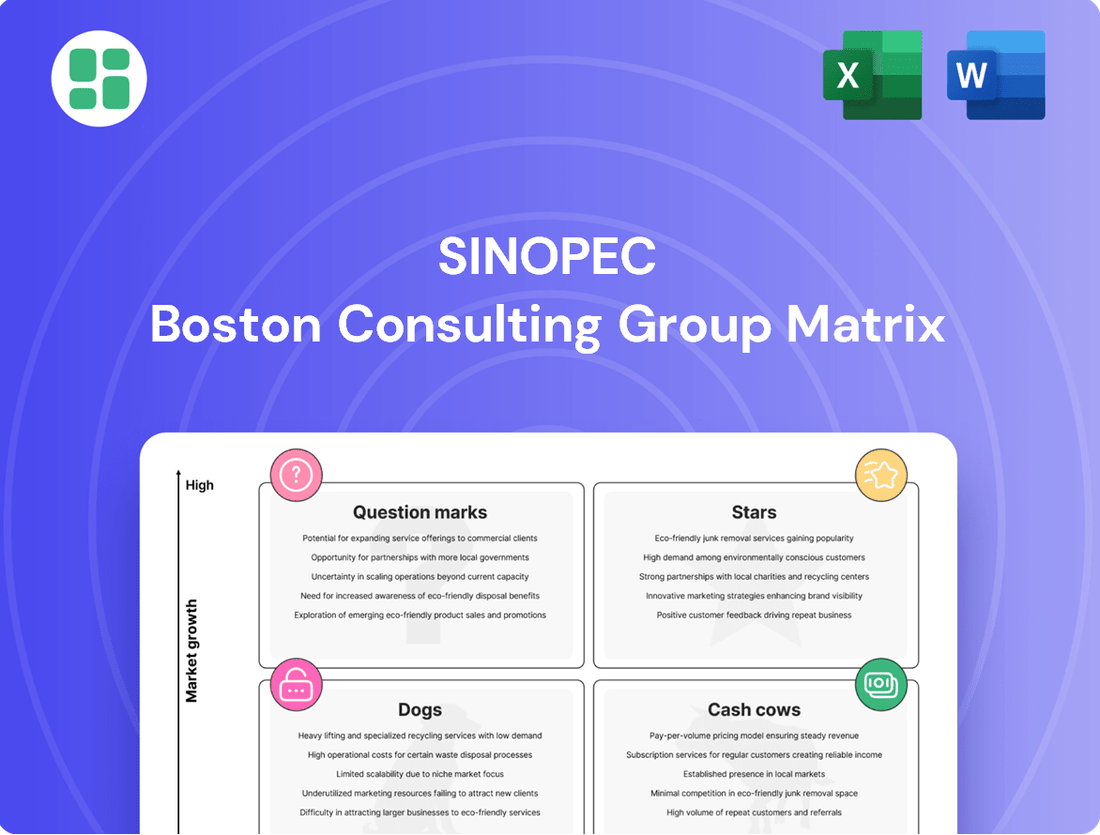

Curious about Sinopec's strategic positioning? Our BCG Matrix analysis reveals how its diverse portfolio stacks up – from high-growth Stars to stable Cash Cows, underperforming Dogs, and promising Question Marks.

This preview offers a glimpse into the core of Sinopec's product strategy. To truly unlock actionable insights and understand the nuances of each quadrant's potential, you need the full picture.

Purchase the complete Sinopec BCG Matrix today for a detailed breakdown of market share and growth rates, empowering you to make informed decisions about resource allocation and future investments.

Stars

Hydrogen Energy is a burgeoning star for Sinopec. By 2025, the company aims to be China's leading hydrogen producer, targeting 1,000 refueling stations and substantial green hydrogen output. This aligns with national decarbonization efforts and benefits from robust policy backing, indicating a high-growth trajectory.

The significant capital investment required for this segment is offset by its strategic importance and rapid market expansion. Sinopec's commitment to green hydrogen production, a key area for future energy solutions, solidifies its position as a major player in this developing industry.

Sinopec is significantly boosting its output of advanced petrochemical materials, particularly high-end polyolefins and specialty chemicals. This strategic move is evident in projects like the Zhenhai Refinery expansion, which is designed to increase production of these value-added products.

This segment is crucial for Sinopec as it caters to a rising demand for sophisticated materials across sectors like automotive and electronics. These advanced materials typically command higher profit margins than traditional petrochemicals, enhancing overall profitability.

The company's commitment to developing and localizing core technologies in this area is a key factor in solidifying its competitive edge. For instance, Sinopec's investment in research and development for new polymer grades aims to capture a larger share of the high-growth advanced materials market.

Sinopec is stepping into the Sustainable Aviation Fuel (SAF) market, a sector poised for significant growth. In collaboration with TotalEnergies, they are developing a new SAF production facility. This unit will utilize Sinopec's own SRJET technology and process waste oils, a smart move towards circular economy principles.

The timing is opportune, as regions like the EU are expected to introduce SAF blending mandates as early as 2025. This, coupled with the broader global drive to decarbonize aviation, positions Sinopec's SAF venture as a nascent but promising area of early leadership. The company is clearly aiming to capture demand for more environmentally friendly aviation fuels.

Natural Gas Exploration and Production

Sinopec is strategically prioritizing natural gas exploration and production, with a notable increase in capital expenditure targeting shale and tight gas reserves. The company aims for a substantial production boost by 2025, reflecting the growing demand for cleaner energy sources in China.

Natural gas is positioned as a vital transition fuel, offering a cleaner alternative to traditional fossil fuels and aligning with China's environmental goals. Sinopec's increased investment in this sector allows it to leverage the expanding domestic market, enhancing both its market share and overall profitability.

- Production Growth: Sinopec targets a significant increase in natural gas output by 2025.

- Strategic Focus: Increased capital expenditure on shale and tight gas development.

- Market Demand: Capitalizing on growing domestic demand for cleaner energy.

- Profitability: Aiming to improve financial performance through natural gas expansion.

Carbon Capture, Utilization, and Storage (CCUS) Technology

Sinopec is making significant strides in Carbon Capture, Utilization, and Storage (CCUS), a technology crucial for decarbonizing existing industrial processes. The company operates China's first large-scale CCUS project and has ambitious plans to launch two more by 2025, demonstrating a strong commitment to this emerging field.

While CCUS is still maturing, Sinopec's early engagement positions it favorably. This technology is vital for reducing emissions from fossil fuel infrastructure, a key challenge in achieving global carbon neutrality targets. Sinopec's proactive investment could lead to future commercialization and licensing opportunities in the expanding environmental technology market.

- Sinopec's CCUS Leadership: Operates China's first large-scale CCUS plant, with two more planned by 2025.

- Strategic Importance: CCUS is essential for reducing emissions from fossil fuels and meeting carbon neutrality goals.

- Market Potential: Early investment and development could enable Sinopec to commercialize and license CCUS technology.

Hydrogen Energy is a burgeoning star for Sinopec. By 2025, the company aims to be China's leading hydrogen producer, targeting 1,000 refueling stations and substantial green hydrogen output. This aligns with national decarbonization efforts and benefits from robust policy backing, indicating a high-growth trajectory.

The significant capital investment required for this segment is offset by its strategic importance and rapid market expansion. Sinopec's commitment to green hydrogen production, a key area for future energy solutions, solidifies its position as a major player in this developing industry.

Sinopec is significantly boosting its output of advanced petrochemical materials, particularly high-end polyolefins and specialty chemicals. This strategic move is evident in projects like the Zhenhai Refinery expansion, which is designed to increase production of these value-added products.

This segment is crucial for Sinopec as it caters to a rising demand for sophisticated materials across sectors like automotive and electronics. These advanced materials typically command higher profit margins than traditional petrochemicals, enhancing overall profitability.

The company's commitment to developing and localizing core technologies in this area is a key factor in solidifying its competitive edge. For instance, Sinopec's investment in research and development for new polymer grades aims to capture a larger share of the high-growth advanced materials market.

Sinopec is stepping into the Sustainable Aviation Fuel (SAF) market, a sector poised for significant growth. In collaboration with TotalEnergies, they are developing a new SAF production facility. This unit will utilize Sinopec's own SRJET technology and process waste oils, a smart move towards circular economy principles.

The timing is opportune, as regions like the EU are expected to introduce SAF blending mandates as early as 2025. This, coupled with the broader global drive to decarbonize aviation, positions Sinopec's SAF venture as a nascent but promising area of early leadership. The company is clearly aiming to capture demand for more environmentally friendly aviation fuels.

Sinopec is strategically prioritizing natural gas exploration and production, with a notable increase in capital expenditure targeting shale and tight gas reserves. The company aims for a substantial production boost by 2025, reflecting the growing demand for cleaner energy sources in China.

Natural gas is positioned as a vital transition fuel, offering a cleaner alternative to traditional fossil fuels and aligning with China's environmental goals. Sinopec's increased investment in this sector allows it to leverage the expanding domestic market, enhancing both its market share and overall profitability.

- Production Growth: Sinopec targets a significant increase in natural gas output by 2025.

- Strategic Focus: Increased capital expenditure on shale and tight gas development.

- Market Demand: Capitalizing on growing domestic demand for cleaner energy.

- Profitability: Aiming to improve financial performance through natural gas expansion.

Sinopec is making significant strides in Carbon Capture, Utilization, and Storage (CCUS), a technology crucial for decarbonizing existing industrial processes. The company operates China's first large-scale CCUS project and has ambitious plans to launch two more by 2025, demonstrating a strong commitment to this emerging field.

While CCUS is still maturing, Sinopec's early engagement positions it favorably. This technology is vital for reducing emissions from fossil fuel infrastructure, a key challenge in achieving global carbon neutrality targets. Sinopec's proactive investment could lead to future commercialization and licensing opportunities in the expanding environmental technology market.

- Sinopec's CCUS Leadership: Operates China's first large-scale CCUS plant, with two more planned by 2025.

- Strategic Importance: CCUS is essential for reducing emissions from fossil fuels and meeting carbon neutrality goals.

- Market Potential: Early investment and development could enable Sinopec to commercialize and license CCUS technology.

Hydrogen energy represents a significant growth opportunity for Sinopec, with ambitious targets for production and refueling infrastructure by 2025. This aligns with national decarbonization goals and benefits from strong policy support, positioning it as a star segment.

Advanced petrochemical materials are another star, driven by increasing demand for high-performance products in key industries. Sinopec's investment in R&D and facility upgrades, like the Zhenhai Refinery expansion, aims to capture higher margins in this growing market.

Sustainable Aviation Fuel (SAF) is emerging as a promising star, with Sinopec leveraging proprietary technology and partnerships. The anticipated 2025 EU mandates for SAF create a favorable market entry for this environmentally conscious venture.

Natural gas, while a transition fuel, is also a star for Sinopec due to increasing domestic demand and its cleaner profile compared to traditional fuels. Strategic investments in exploration and production by 2025 are set to boost output and market share.

| Segment | BCG Category | Key Initiatives/Facts | Market Outlook | Sinopec's Position |

|---|---|---|---|---|

| Hydrogen Energy | Star | Target: 1,000 refueling stations by 2025; leading green hydrogen producer in China. | High growth, driven by decarbonization policies. | Significant investment and policy backing. |

| Advanced Petrochemical Materials | Star | Focus on high-end polyolefins and specialty chemicals; Zhenhai Refinery expansion. | Rising demand in automotive, electronics; higher profit margins. | Commitment to R&D and technology localization. |

| Sustainable Aviation Fuel (SAF) | Star | Developing SAF production facility using SRJET technology; processing waste oils. | Poised for significant growth, potential EU mandates by 2025. | Early leadership through partnerships and proprietary tech. |

| Natural Gas | Star | Increased CAPEX for shale/tight gas; aim for substantial production boost by 2025. | Growing demand for cleaner energy in China; transition fuel. | Leveraging expanding domestic market for share and profitability. |

| CCUS | Question Mark (potential Star) | Operates China's first large-scale CCUS; two more planned by 2025. | Crucial for decarbonizing industrial processes; maturing technology. | Early engagement and investment for future commercialization. |

What is included in the product

This overview highlights which Sinopec business units to invest in, hold, or divest based on market growth and share.

Sinopec BCG Matrix offers a clear, actionable overview of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Sinopec's refining and marketing of traditional fuels represents a significant Cash Cow within its business portfolio. The company commands a substantial portion of China's refining capacity, complemented by a widespread retail network for gasoline and diesel. This robust infrastructure and established market presence allow it to generate consistent and considerable cash flow, even as domestic demand for refined oil products saw a minor dip in Q1 2025.

Sinopec's dominance in basic petrochemicals like ethylene and propylene, essential for plastics and synthetic fibers, underpins its Cash Cow status. As China's largest chemical producer, Sinopec commands a significant market share in these foundational products.

Despite potentially slower market growth rates for these commodities, their high production volumes and consistent demand across diverse industries translate into substantial and stable profit margins. This steady demand ensures robust cash flow generation for Sinopec.

In 2023, Sinopec's ethylene production capacity reached approximately 15.2 million tons per year, highlighting its massive scale. The company's propylene capacity also stood at a considerable 8.3 million tons annually, reinforcing its position in these critical markets.

Sinopec's domestic crude oil production, particularly from mature fields like Shengli, acts as a vital cash cow, supplying essential feedstock for its extensive refining network. In 2023, Sinopec reported a total crude oil production of approximately 278.2 million barrels, with a significant portion originating from its domestic assets.

While domestic production growth may be measured, the sheer volume and reliability of output from these established fields ensure a consistent and substantial contribution to Sinopec's cash flow. This stable upstream supply chain is crucial for maintaining profitability across its integrated operations, providing a bedrock of financial strength.

Lubricants and Asphalt Business

Sinopec's lubricants and asphalt businesses are classic cash cows, benefiting from mature markets and Sinopec's vast distribution network and strong brand. These segments generate reliable, steady cash flows, even if growth is modest.

The established infrastructure and customer loyalty, stemming from Sinopec's core refining and marketing operations, ensure efficient delivery and consistent revenue for these businesses. This synergy allows them to maintain a high market share and stable demand.

- High Market Share: These businesses command a significant portion of their respective mature markets.

- Stable Demand: Lubricants and asphalt are essential products with consistent, predictable consumption patterns.

- Consistent Cash Flow: They provide a reliable source of funds for Sinopec, supporting other business areas.

- Leveraged Infrastructure: Existing distribution networks and customer relationships minimize operational costs and maximize efficiency.

Pipeline Transportation and Storage Services

Sinopec's pipeline transportation and storage services form a robust Cash Cow within its BCG Matrix. This segment benefits from an extensive network of oil and gas pipelines and storage facilities across China, representing critical infrastructure.

These assets operate in a mature market characterized by high barriers to entry, ensuring stable and predictable revenue streams derived from tariffs and storage fees. For instance, in 2023, Sinopec's pipeline transportation business generated significant revenue, with its integrated energy and chemical operations contributing substantially to overall profitability.

- Stable Revenue Generation: The infrastructure's essential nature guarantees consistent demand and income.

- High Barriers to Entry: Significant capital investment and regulatory hurdles protect Sinopec's market position.

- Low Investment Needs: Ongoing operations require minimal new capital expenditure, maximizing cash flow.

- Strategic Importance: Its role in China's energy security ensures continued operational support and profitability.

Sinopec's refining and marketing of traditional fuels, along with its basic petrochemicals segment, are prime examples of its Cash Cows. These businesses benefit from substantial market share and consistent demand, translating into reliable cash flow generation. For instance, Sinopec's ethylene production capacity reached approximately 15.2 million tons per year in 2023, underscoring its scale in these foundational petrochemicals.

Domestic crude oil production, particularly from established fields, also functions as a significant cash cow. In 2023, Sinopec produced around 278.2 million barrels of crude oil, with mature domestic assets providing a stable feedstock supply. Furthermore, its lubricants and asphalt businesses leverage extensive distribution networks and brand loyalty, ensuring steady revenue streams.

The pipeline transportation and storage segment is another critical cash cow, characterized by high barriers to entry and stable, tariff-based revenue. These mature businesses require minimal new capital investment, maximizing their cash flow contribution to Sinopec's overall financial strength.

| Business Segment | Market Position | Cash Flow Generation | Key Data Point (2023) |

|---|---|---|---|

| Refining & Marketing (Traditional Fuels) | Dominant in China | High & Stable | Significant portion of China's refining capacity |

| Basic Petrochemicals (Ethylene, Propylene) | Largest Producer in China | High & Stable | Ethylene capacity ~15.2 million tons/year |

| Domestic Crude Oil Production | Key Supplier | Consistent & Substantial | Total crude oil production ~278.2 million barrels |

| Lubricants & Asphalt | Strong Brand & Network | Reliable & Steady | Leverages existing distribution infrastructure |

| Pipeline Transportation & Storage | Critical Infrastructure | Predictable & Stable | High barriers to entry, tariff-based revenue |

What You See Is What You Get

Sinopec BCG Matrix

The Sinopec BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready strategic tool for Sinopec's business units. You can confidently use this preview as a direct representation of the high-quality, professionally designed report that will be instantly downloadable after your transaction. Prepare to leverage this comprehensive BCG Matrix for informed strategic decision-making and robust business planning.

Dogs

Some of Sinopec's older refining units, characterized by outdated technology and higher operational expenses, are likely experiencing squeezed profit margins. These facilities may struggle to keep pace with the efficiency and scale of newer plants.

These less efficient units, often with smaller capacities, face intense competition in a mature refining market. Their limited market share in terms of profitability and operational effectiveness positions them as 'dogs' within Sinopec's business portfolio, potentially requiring strategic decisions regarding divestment or modernization.

Certain niche, low-demand chemical products within Sinopec's portfolio, such as specialized industrial solvents or legacy petrochemical intermediates, might be categorized as Dogs. These products often face declining market relevance due to the rise of more sustainable or cost-effective alternatives, leading to reduced sales volumes and squeezed profit margins. For example, if a specific type of plasticizer sees its demand plummet by 15% year-over-year due to new bio-based materials entering the market, it would fit this profile.

These "Dog" products can represent a drain on resources, requiring capital investment for production and maintenance without yielding substantial returns. Sinopec's 2024 financial reports might highlight specific segments where revenue growth is stagnant or negative, and profitability is minimal, indicating potential Dog categories. Divesting or phasing out such offerings allows Sinopec to reallocate capital towards higher-growth areas, improving overall portfolio efficiency and financial health.

Overseas marginal oil fields for Sinopec likely fall into the 'Dogs' category of the BCG matrix. These fields may be experiencing declining production and profitability, characterized by high operational costs and dwindling reserves, making them less attractive for further investment.

In 2024, Sinopec's international oil and gas production faced challenges, with some overseas assets potentially exhibiting lower returns due to factors like increased geopolitical instability in certain regions and rising extraction expenses. These marginal fields contribute minimally to overall output and profit margins.

Non-core, Underperforming Retail Outlets

While Sinopec's extensive retail network is a significant contributor to its overall success, certain individual service stations may be categorized as non-core and underperforming. These locations often operate in highly saturated markets or areas with consistently low customer traffic, leading to diminished sales volumes for both fuel and ancillary non-fuel items. For instance, in 2024, a portion of Sinopec's over 30,000 service stations might exhibit sales figures significantly below the network average, impacting overall profitability.

These underperforming outlets can represent a drag on resources, as they incur operational overheads such as staffing, utilities, and maintenance without generating commensurate revenue. The strategic decision to address these non-core assets often involves evaluating their potential for turnaround or considering divestment. Sinopec's management may analyze specific station performance data, such as declining fuel sales or low non-fuel revenue per customer, to identify these candidates.

- Underperforming Stations Identified: A percentage of Sinopec's retail outlets in 2024 might show sales volumes below the company's profitability thresholds.

- Resource Drain Potential: These stations could consume operational resources without contributing significantly to Sinopec's profit margins.

- Strategic Portfolio Optimization: Sinopec may consider closure or sale of these non-core assets to reallocate capital to more promising ventures.

Older, High-Emission Coal-Based Hydrogen Production

Older, high-emission coal-based hydrogen production facilities within Sinopec's portfolio represent a significant challenge. In 2024, these plants, primarily relying on coal gasification, contribute to a substantial carbon footprint. For instance, coal-to-hydrogen processes typically emit around 10-15 kilograms of CO2 per kilogram of hydrogen produced, a stark contrast to the near-zero emissions of green hydrogen.

These operations are increasingly vulnerable to evolving environmental regulations and the growing global demand for decarbonization. As Sinopec invests in green hydrogen technologies, the economic viability of these older, high-emission assets diminishes. The rising cost of carbon emissions, coupled with potential penalties or taxes, makes 'grey' hydrogen less competitive. By 2025, it's projected that the cost differential between grey and green hydrogen could narrow significantly in many regions, further pressuring these legacy assets.

- High Carbon Intensity: Coal-based hydrogen production can generate over 10 kg of CO2 per kg of H2.

- Regulatory Risk: Increasing carbon pricing and emissions standards threaten profitability.

- Market Shift: Growing preference for 'green' hydrogen reduces demand for 'grey' hydrogen.

- Obsolescence: Facilities may become economically unviable as cleaner alternatives emerge.

Dogs in Sinopec's portfolio represent business units or products with low market share and low growth potential, often consuming resources without generating significant returns. These can include older, less efficient refining units struggling with modernization costs and facing intense competition.

Certain niche chemical products with declining demand due to market shifts towards sustainable alternatives also fall into this category. For example, a specialized industrial solvent whose demand dropped 15% year-over-year due to new bio-based materials would be a Dog.

Marginal overseas oil fields with declining production and high operational costs, contributing minimally to overall output, are also considered Dogs. In 2024, some of Sinopec's international assets faced challenges with lower returns due to rising extraction expenses and geopolitical instability.

Underperforming retail service stations in saturated markets or low-traffic areas can also be classified as Dogs. In 2024, a portion of Sinopec's over 30,000 stations might have shown sales significantly below the network average, impacting overall profitability.

| Business Unit/Product | Market Share | Market Growth | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Older Refining Units | Low | Low/Declining | Low/Negative | Divestment or Modernization |

| Niche Chemical Products | Low | Low/Declining | Low | Phasing out or Repurposing |

| Marginal Overseas Oil Fields | Low | Low/Declining | Low | Divestment or Reduced Investment |

| Underperforming Retail Stations | Low | Low | Low | Closure or Sale |

Question Marks

Sinopec's entry into deep geothermal power generation, with its first pilot project connected to the grid in 2024, positions it in a high-growth renewable energy sector. However, its current market share in this nascent area is negligible, reflecting its early stage of development.

For geothermal power generation to ascend to a 'Star' in Sinopec's BCG matrix, substantial capital investment and successful large-scale implementation are critical. The global geothermal market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% through 2030, presenting a substantial opportunity if Sinopec can effectively scale its operations.

Sinopec's crude-to-olefins (CTO) technology is a game-changer, directly converting crude oil into valuable olefins like ethylene and propylene. This bypasses traditional refining, streamlining production. In 2024, Sinopec announced a successful trial, showcasing its potential to disrupt the petrochemical industry.

While CTO technology holds immense promise for higher yields and reduced costs, its commercial rollout is still nascent. This positions it as a high-potential, low-market-share innovation within Sinopec's portfolio, akin to a question mark in the BCG matrix. The company is actively working on scaling up this technology.

Sinopec's 400 km inter-provincial green hydrogen pipeline represents a significant investment in a nascent but high-potential market. This project positions Sinopec to capture future growth in hydrogen distribution, a sector currently underdeveloped but crucial for a hydrogen-based economy.

While hydrogen offers immense promise as a clean fuel and industrial input, the existing distribution infrastructure remains a bottleneck. Sinopec's pipeline development addresses this gap, aiming to establish a foundational network for wider hydrogen adoption.

This venture into hydrogen pipelines falls into the "Question Marks" category of the BCG matrix due to its high growth potential coupled with a currently low market share in this specific infrastructure segment. The success of such projects will determine its future market position.

New Energy Vehicle (NEV) Charging and Swapping Stations

Sinopec's venture into NEV charging and battery swapping stations represents a strategic pivot in response to the burgeoning electric vehicle market, which is steadily eroding traditional fuel consumption. While Sinopec's established dominance in oil and gas is undeniable, its footprint in the NEV charging infrastructure sector is nascent, positioning it as a potential challenger in a high-growth, albeit competitive, arena.

This expansion into NEV charging and swapping stations can be viewed through the lens of the BCG matrix, likely categorizing it as a 'Question Mark' for Sinopec. The market is experiencing rapid expansion, with global NEV sales projected to reach over 20 million units in 2024. However, Sinopec's current market share in this segment is minimal, presenting both significant opportunity and considerable risk.

- Market Growth: The global EV charging infrastructure market is expected to grow substantially, with projections indicating a CAGR of over 25% through 2030.

- Sinopec's Position: Sinopec's existing network of fuel stations offers a unique advantage for co-locating charging facilities, but significant investment is required to build out this new capability.

- Strategic Imperative: This move is crucial for Sinopec to adapt to the energy transition and maintain relevance in the evolving automotive landscape.

- Uncertainty: The long-term profitability and competitive positioning of Sinopec in this segment remain to be seen, given established players and evolving technology.

Carbon Dioxide Enhanced Oil Recovery (CO2-EOR) Projects

Sinopec leverages captured carbon dioxide for enhanced oil recovery (CO2-EOR) across its oil fields, a dual-purpose strategy that sequesters carbon while increasing crude oil output. This approach aligns with growing carbon management initiatives and presents significant growth potential.

The economic feasibility and scalability of CO2-EOR as a standalone business model, separate from its role in augmenting existing oil production, are still under active assessment. Sinopec's 2023 annual report indicated continued investment in CCUS (Carbon Capture, Utilization, and Storage) technologies, including CO2-EOR, as part of its sustainability roadmap.

- Growth Potential: CO2-EOR is positioned as a key component in China's broader carbon reduction strategies, offering a pathway for industrial CO2 utilization.

- Economic Viability: While it supports oil production, the long-term profitability of CO2-EOR as an independent revenue stream is subject to evolving carbon pricing mechanisms and operational efficiencies.

- Scalability Challenges: Expanding CO2-EOR projects requires substantial infrastructure for CO2 capture, transportation, and injection, posing significant investment hurdles.

- Sinopec's Commitment: The company is actively exploring and implementing CCUS technologies, with CO2-EOR playing a role in its environmental performance targets.

Sinopec's ventures into deep geothermal power, crude-to-olefins technology, green hydrogen pipelines, NEV charging infrastructure, and CO2-Enhanced Oil Recovery (CO2-EOR) all share a common characteristic: they represent significant investments in areas with high growth potential but currently low market share within Sinopec's overall portfolio. These initiatives are classic examples of "Question Marks" in the Boston Consulting Group (BCG) matrix. They require substantial capital and strategic focus to mature into Stars or Cash Cows, with the risk that they may not gain sufficient traction and could become Dogs.

The success of these "Question Mark" initiatives hinges on Sinopec's ability to navigate technological challenges, secure necessary funding, and adapt to evolving market dynamics. For instance, the global geothermal market is growing, but Sinopec's presence is nascent. Similarly, while the NEV market is booming, Sinopec's share in charging infrastructure is minimal. The company's strategic decisions in these areas will dictate whether they become future revenue drivers or costly diversions.

Sinopec's commitment to these new energy frontiers is evident through its ongoing investments and pilot projects. The company is essentially betting on future market trends to offset potential declines in traditional fossil fuel businesses. The critical question for each of these ventures is whether they can achieve the scale and profitability needed to justify their continued investment and eventually contribute significantly to Sinopec's overall performance.

These "Question Marks" represent Sinopec's strategic response to the global energy transition. They are areas where the company is exploring new revenue streams and business models to ensure long-term sustainability and competitiveness. The company's ability to effectively manage the inherent risks and capitalize on the opportunities presented by these nascent markets will be a key determinant of its future success.

BCG Matrix Data Sources

Our Sinopec BCG Matrix is built on comprehensive data, integrating financial disclosures, market research reports, and internal performance metrics to provide a clear strategic overview.