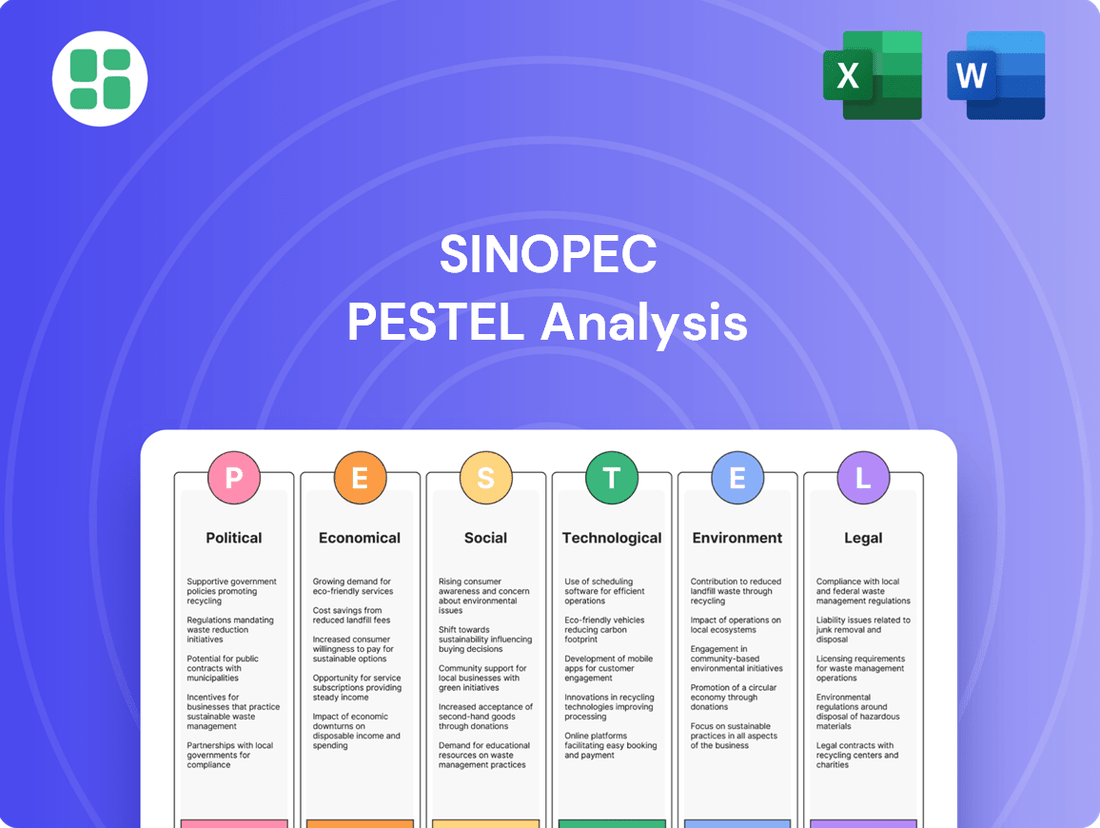

Sinopec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

Navigate the complex global landscape affecting Sinopec with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its operations and future growth. Gain a critical edge by leveraging these expert insights for your own strategic planning and investment decisions. Download the full PESTLE analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

As a state-owned enterprise, Sinopec operates under significant control from the Chinese government, influencing its strategic direction and investment choices. This government backing offers stability and preferential treatment within the domestic market.

However, this close relationship also means Sinopec is directly subject to shifts in government policy, particularly concerning energy security, industrial restructuring, and environmental objectives. For instance, China's commitment to achieving carbon neutrality by 2060, announced in 2020, directly impacts Sinopec's long-term investment in fossil fuels versus renewable energy sources.

China's unwavering commitment to national energy security significantly shapes Sinopec's strategic direction, especially in its domestic exploration and production endeavors. This national imperative directly impacts Sinopec's investment decisions and operational focus within China's oil and gas sectors, prioritizing the development of these resources.

The government's proactive stance on boosting domestic energy output to curb import dependency is a key driver for Sinopec's upstream capital allocation and production goals. For instance, China's stated aim to increase domestic crude oil production by 10% by 2025, reaching approximately 4.5 million barrels per day, directly translates into Sinopec's upstream investment priorities.

Geopolitical tensions and evolving trade relations significantly influence Sinopec's global reach. The company's extensive international operations and reliance on crude oil imports mean that sanctions, trade disputes, and changing international alliances directly impact its supply chains, investment prospects, and market access. For instance, the ongoing trade friction between the US and China, including discussions around potential tariffs on liquefied natural gas (LNG), highlights the vulnerability of energy markets to political shifts.

'Dual Carbon' Goals and Energy Transition

China's ambitious 'dual carbon' goals, targeting peak emissions before 2030 and carbon neutrality by 2060, are a major political driver for Sinopec. This policy landscape mandates a significant shift in Sinopec's operational focus and investment priorities.

Consequently, Sinopec is compelled to accelerate its development of new energy sources, such as solar and wind power, while also investing heavily in emissions reduction technologies for its existing oil and gas operations. For instance, by the end of 2023, Sinopec had made substantial progress in its hydrogen energy sector, with over 100 hydrogen refueling stations operational across China.

- Accelerated Investment in Green Technologies: Sinopec is directing substantial capital towards Carbon Capture, Utilization, and Storage (CCUS) projects and the burgeoning hydrogen economy.

- Operational Emission Reductions: The company is under political pressure to implement stricter emission controls and efficiency improvements across its refining and petrochemical facilities.

- Diversification into New Energy: Government policy actively encourages Sinopec to expand its portfolio beyond fossil fuels into renewable energy generation and storage solutions.

Industrial Policies and Market Restructuring

China's industrial policies are actively reshaping the energy and chemical landscape, directly impacting Sinopec. For instance, the government's drive to curb overcapacity in refining and petrochemicals, a sector where Sinopec is a major player, necessitates strategic adjustments. This push aims to foster higher-value product development and operational efficiency across the industry.

These government directives often translate into encouraging consolidation and the divestment of underperforming assets. Sinopec, as a state-owned enterprise, is expected to align with these national strategies, potentially leading to portfolio optimization. For example, in 2023, China's National Development and Reform Commission continued to emphasize the need for rationalizing refining capacity, signaling ongoing pressure for structural upgrades.

- Refining Capacity Optimization: Policies are targeting a reduction in inefficient refining units, pushing for consolidation among players.

- Petrochemical Sector Upgrades: Emphasis is placed on shifting production towards specialty chemicals and new materials, away from basic commodities.

- Green Development Mandates: Industrial policies increasingly incorporate environmental standards, influencing investment in cleaner technologies and processes for Sinopec.

- State-Owned Enterprise Reform: Ongoing SOE reforms encourage market-oriented restructuring, potentially leading to asset sales or mergers within the sector.

The Chinese government's strategic direction heavily influences Sinopec, particularly its commitment to energy security and environmental goals. China's aim to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 is a significant political driver, pushing Sinopec to invest more in renewables and cleaner technologies. For instance, by the end of 2023, Sinopec had over 100 hydrogen refueling stations operational nationwide, reflecting this policy shift.

Government policies also focus on optimizing the refining and petrochemical sectors, encouraging consolidation and a move towards higher-value products. Sinopec, as a state-owned enterprise, must align with these directives, which may involve divesting less efficient assets. The National Development and Reform Commission's continued emphasis on rationalizing refining capacity in 2023 underscores this ongoing pressure for structural upgrades.

Geopolitical factors, including trade relations and international alliances, also play a crucial role in Sinopec's global operations. Sanctions or trade disputes can directly impact the company's supply chains and market access, as seen in ongoing trade friction with the US that has included discussions on potential LNG tariffs.

| Policy Area | Government Objective | Sinopec's Response/Impact |

|---|---|---|

| Carbon Neutrality | Achieve carbon neutrality by 2060 | Increased investment in hydrogen energy (e.g., 100+ stations by end of 2023), CCUS, and renewables. |

| Industrial Restructuring | Reduce refining overcapacity, promote high-value chemicals | Focus on operational efficiency, potential divestment of underperforming assets, and upgrading petrochemical production. |

| Energy Security | Increase domestic energy production, reduce import dependency | Prioritization of domestic oil and gas exploration and production, aiming for increased output (e.g., 10% rise in crude oil production by 2025). |

| Geopolitics | Navigate international trade relations and potential sanctions | Vulnerability of supply chains and market access to trade disputes and changing alliances. |

What is included in the product

This Sinopec PESTLE analysis examines the critical external macro-environmental factors influencing the company's operations, including political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks.

It provides a comprehensive understanding of the opportunities and threats Sinopec faces by detailing how these six dimensions impact its strategic decision-making and market position.

This PESTLE analysis provides a clear, summarized version of Sinopec's external environment, offering quick referencing during meetings and simplifying complex external factors for better strategic decision-making.

Economic factors

Global oil and gas price volatility significantly impacts Sinopec's financial performance. Fluctuations in crude oil and natural gas prices directly affect its revenue, profitability, and capital expenditure decisions. For instance, in early 2024, Brent crude oil prices hovered around $80-$90 per barrel, a level that presents a mixed bag for Sinopec.

While lower crude prices can reduce input costs for Sinopec's refining segment, boosting margins, they simultaneously exert downward pressure on profits from its upstream exploration and production activities. This necessitates a more selective and cautious approach to capital investments in exploration and development projects to ensure returns in a fluctuating market.

China's economic expansion is a primary driver for Sinopec's domestic energy demand. The nation's GDP growth, projected to be around 5% in 2024 and a similar pace in 2025, directly correlates with energy consumption. However, the economy is undergoing significant structural changes.

While total electricity demand continues to rise, driven by digitalization and services, the demand for traditional refined fuels like gasoline and diesel is softening. This is largely due to the rapid adoption of electric vehicles (EVs), which are expected to account for over 50% of new car sales in China by 2025, and a deliberate governmental push to de-emphasize heavy industrial output.

China's refining and petrochemical industries are grappling with significant overcapacity, creating intense competition that squeezes Sinopec's profit margins. This situation is a major economic hurdle for the company.

To navigate this, Sinopec must strategically optimize its product mix, aggressively pursue cost reductions, and pivot towards higher-value, specialized petrochemical products. For instance, in 2024, while demand for basic chemicals remained robust, the oversupply in commodity plastics put downward pressure on prices, highlighting the need for Sinopec to enhance its specialty chemical portfolio.

Investment in New Energy and Infrastructure

Sinopec is significantly boosting its investment in new energy sectors, including natural gas, hydrogen, wind, and solar power. This strategic pivot is directly influenced by China's ambitious environmental goals and the growing market appetite for sustainable energy solutions. For instance, in 2023, Sinopec announced plans to invest heavily in hydrogen energy infrastructure, aiming to build a significant portion of the country's hydrogen refueling stations.

This increased capital expenditure in cleaner energy and the associated infrastructure is reshaping Sinopec's investment landscape. The company's financial performance is expected to be positively impacted as it aligns with national energy transition strategies and captures emerging market opportunities. By 2025, Sinopec aims to have a substantial portion of its energy production from non-fossil fuel sources, reflecting a commitment to a greener energy future.

- Increased CAPEX: Sinopec is channeling more funds into natural gas, hydrogen, wind, and solar projects.

- Government Influence: National policies promoting clean energy are a key driver for these investments.

- Market Demand: Growing consumer and industrial demand for sustainable energy sources fuels this strategic shift.

- Portfolio Impact: This focus on new energy will alter Sinopec's overall investment mix and financial outlook.

Exchange Rate Fluctuations

Sinopec, as a global energy giant, is significantly impacted by exchange rate fluctuations. A stronger Yuan can make imported crude oil cheaper, benefiting Sinopec's refining operations. However, it also reduces the value of its overseas earnings when repatriated.

Conversely, a weaker Yuan increases the cost of imported oil, squeezing profit margins. Yet, it can boost the value of international revenues and assets denominated in foreign currencies. For instance, in early 2024, the Yuan experienced periods of depreciation against the US dollar, presenting both challenges and opportunities for Sinopec's international business.

- Impact on Import Costs: Fluctuations in the Yuan-Dollar exchange rate directly affect the cost of crude oil, Sinopec's primary raw material, which is largely priced in USD.

- Effect on Overseas Revenue: A weaker Yuan can enhance the value of revenues earned from international operations when converted back into Yuan.

- Valuation of Foreign Assets: Exchange rate movements influence the reported value of Sinopec's overseas investments and subsidiaries.

- Competitive Positioning: Exchange rates can alter Sinopec's cost competitiveness in international markets compared to global peers.

China's economic growth trajectory directly fuels Sinopec's domestic demand for energy products. With the nation's GDP anticipated to grow around 5% in both 2024 and 2025, this expansion underpins consumption. However, the energy mix is shifting; while overall electricity demand rises due to sectors like digitalization, the demand for traditional refined fuels such as gasoline and diesel is declining, largely driven by the rapid adoption of electric vehicles, which are projected to constitute over half of new car sales in China by 2025.

Intense competition in China's refining and petrochemical sectors, stemming from significant overcapacity, poses a major economic challenge by compressing Sinopec's profit margins. This environment necessitates strategic product mix optimization, aggressive cost reduction initiatives, and a focused pivot towards higher-value, specialized petrochemical products to maintain profitability. For example, while basic chemical demand remained strong in 2024, an oversupply in commodity plastics exerted downward pricing pressure, underscoring the need for Sinopec to bolster its specialty chemical offerings.

Sinopec's strategic investments are increasingly directed towards new energy sectors, including natural gas, hydrogen, wind, and solar power, a move heavily influenced by China's ambitious environmental targets and the escalating market demand for sustainable energy solutions. By 2025, the company aims for a substantial portion of its energy production to originate from non-fossil fuel sources, reflecting a commitment to energy transition and capturing emerging green market opportunities.

Preview Before You Purchase

Sinopec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Sinopec PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering valuable insights for strategic planning.

Sociological factors

Chinese consumers are increasingly prioritizing environmental sustainability, with a growing preference for electric vehicles (EVs). This shift directly impacts Sinopec, as demand for traditional gasoline and diesel fuels is expected to decline. For instance, China's EV sales in 2023 surpassed 9 million units, a significant increase from previous years, highlighting this powerful trend.

This evolving consumer landscape necessitates that Sinopec adapt its business model. The company must not only diversify its product portfolio to include more sustainable options but also invest heavily in new energy infrastructure, such as EV charging stations. Sinopec's commitment to expanding its non-fuel retail segment, which includes convenience stores and EV charging services, is a direct response to these changing preferences.

China's rapid urbanization continues to fuel demand for petrochemicals, essential for everything from building materials to everyday consumer products. As of 2024, urban populations in China are projected to exceed 930 million, representing a significant market for Sinopec's diverse product portfolio.

Sinopec is actively responding to this trend by investing heavily in advanced petrochemical facilities. For instance, its Zhenhai Refining & Chemical Company complex, a cornerstone of its operations, has undergone significant expansion, increasing its ethylene capacity to over 1.2 million tons per year, demonstrating a commitment to meeting escalating domestic needs and fostering industrial growth in key regions.

Sinopec, as a massive industrial entity, is under constant public observation concerning its safety protocols and the environmental ripple effects on nearby populations. Ensuring robust health, safety, and environmental (HSE) management is paramount for community trust and maintaining its social license to operate. In 2023, Sinopec reported a 12% decrease in major safety incidents compared to 2022, a step towards addressing these concerns.

Workforce Demographics and Skill Requirements

Sinopec faces the challenge of managing a workforce undergoing significant demographic shifts. As the company pivots towards digital transformation and new energy sectors, there's a growing demand for specialized skills in areas like data analytics, AI, and renewable energy technologies. This necessitates strategic investment in employee training and development programs. For instance, by the end of 2023, Sinopec had invested heavily in upskilling its workforce, with over 100,000 employees participating in digital transformation training initiatives.

Adapting human resource strategies is crucial to attract and retain talent equipped for these evolving requirements. Sinopec's talent acquisition efforts in 2024 are increasingly focused on recruiting graduates with expertise in emerging fields. The company aims to bridge the skills gap by fostering a culture of continuous learning and offering competitive career paths in its new energy ventures.

- Demographic Shifts: Sinopec's workforce composition is changing, with an aging population in traditional roles and a younger demographic entering with new skill sets.

- Skill Demand: There is a pronounced need for digital literacy, data science capabilities, and expertise in green technologies, including hydrogen and carbon capture.

- Talent Acquisition: In 2024, Sinopec is prioritizing recruitment of university graduates specializing in fields like artificial intelligence and sustainable energy engineering.

- Training Investment: The company allocated approximately 5 billion RMB in 2023 for employee training, with a significant portion directed towards digital and new energy skill development.

Corporate Social Responsibility and Local Community Engagement

Sinopec places significant emphasis on corporate social responsibility (CSR), recognizing its importance for community relations and public perception. This commitment is demonstrated through initiatives like local job creation, community welfare programs, and environmental stewardship. For instance, in 2023, Sinopec's domestic operations contributed to significant employment opportunities, supporting local economies.

Community engagement is particularly crucial for Sinopec, especially in regions where its operations might be perceived as impactful or during the development of large-scale projects. The company actively invests in welfare programs aimed at improving living standards and access to essential services for residents in its operational areas.

Sinopec's environmental stewardship efforts are also a key component of its CSR strategy. The company is increasingly focused on reducing its environmental footprint, investing in cleaner technologies and sustainable practices.

- Local Job Creation: In 2023, Sinopec's domestic subsidiaries directly employed thousands of local residents, fostering economic growth in surrounding communities.

- Community Welfare: The company allocated substantial funds in 2023 towards educational support, healthcare initiatives, and infrastructure development in its operational vicinities.

- Environmental Stewardship: Sinopec reported a notable reduction in key emissions in 2023 compared to previous years, driven by investments in greener energy solutions and pollution control technologies.

- Stakeholder Relations: Proactive engagement with local communities helps Sinopec navigate potential social license challenges and build trust, particularly during sensitive project phases.

Sinopec's workforce is experiencing demographic shifts, with an aging workforce in traditional roles and a younger generation entering with new digital and green technology skills. This necessitates a focus on retraining and upskilling, with over 100,000 employees participating in digital transformation training by the end of 2023. The company is actively recruiting graduates in AI and sustainable energy engineering for 2024 to bridge the skills gap.

Corporate social responsibility is a key focus, with Sinopec's 2023 operations creating thousands of local jobs and significant investment in community welfare programs. Environmental stewardship is also paramount, marked by emission reductions in 2023 through greener technologies. These efforts are crucial for maintaining social license and building trust with local stakeholders.

| Sociological Factor | Description | Sinopec's Response/Data (2023/2024) |

|---|---|---|

| Consumer Preferences | Growing demand for EVs and sustainability. | China's EV sales surpassed 9 million in 2023; Sinopec expanding non-fuel retail and EV charging. |

| Urbanization | Increased demand for petrochemicals. | China's urban population projected over 930 million in 2024; Sinopec expanding petrochemical facilities. |

| Workforce Demographics | Need for digital and green skills. | Over 100,000 employees in digital training (2023); prioritizing AI/sustainability graduates for recruitment (2024). |

| Corporate Social Responsibility | Community welfare, job creation, environmental impact. | Thousands of local jobs created (2023); significant investment in community welfare (2023); emission reductions (2023). |

Technological factors

Sinopec is heavily investing in cutting-edge technologies for exploring and extracting oil and gas, especially in challenging deep and ultra-deep reserves, and in developing shale oil and gas. This strategic focus is crucial for bolstering China's domestic energy security.

Key initiatives like Project Deep Earth and the Fuling Shale Gas Field are central to Sinopec's strategy. These projects aim to significantly boost proven reserves and improve extraction efficiency from difficult geological formations, reflecting a commitment to advanced technological solutions.

Technological innovation is paramount for Sinopec to boost efficiency and cut costs in its refining and petrochemical operations. This focus allows for the creation of more valuable products, a key driver for growth.

Sinopec's Zhenhai refinery expansion, for instance, is a prime example, integrating cutting-edge units and smart manufacturing. This strategic move aims to increase both production capacity and the yield of specialty chemicals and advanced materials, aligning with market demands for higher-value outputs.

Sinopec is significantly boosting its R&D and rollout of new energy solutions, focusing on hydrogen production, carbon capture, utilization, and storage (CCUS), and renewables like wind, solar, and geothermal. These initiatives are the bedrock of its strategic shift towards a greener, lower-carbon operational model.

In 2023, Sinopec announced plans to invest approximately $10 billion in hydrogen energy over the next five years, aiming to become a leading hydrogen producer. This commitment underscores the company's proactive stance in the evolving energy landscape, aligning with national goals for carbon neutrality.

Digitalization and Artificial Intelligence (AI) Integration

Sinopec is actively integrating digitalization and artificial intelligence across its operations. This includes deploying digital twin systems for its intelligent factories, which allows for real-time monitoring and optimization of production processes. For instance, in 2023, Sinopec announced plans to build over 100 intelligent chemical production lines, showcasing a significant push towards advanced manufacturing.

The company is also leveraging AI through initiatives like AI digital employees at its energy stations. These digital assistants are designed to enhance customer service and streamline operations, contributing to a more responsive and efficient customer experience. This strategic adoption of AI aims to bolster Sinopec's competitive edge in the evolving energy landscape.

- Digital Twin Implementation: Sinopec is building numerous intelligent chemical production lines, enhancing operational efficiency.

- AI for Customer Service: AI digital employees are being deployed at energy stations to improve customer interactions.

- Operational Efficiency Gains: The integration of these technologies is geared towards smarter decision-making and improved overall performance.

- Strategic Digital Transformation: This push signifies Sinopec's commitment to becoming a more intelligent and responsive enterprise.

Innovation in Advanced Materials

Sinopec is heavily investing in technological innovation, particularly in advanced materials. This includes a focus on developing and producing high-end polyolefins, advanced composites, and specialty chemicals. For instance, in 2023, Sinopec announced plans to increase its R&D spending by 15% year-on-year, with a significant portion allocated to new material development.

This strategic pivot aims to capture higher-value markets and meet the sophisticated demands of industries like automotive, aerospace, and electronics. The company's commitment to R&D is crucial for creating differentiated products that offer superior performance and sustainability, thereby moving up the global value chain.

Key areas of innovation include:

- High-performance polyolefins: For applications requiring enhanced strength and durability.

- Advanced composites: Lightweight materials for fuel efficiency in transportation.

- Specialty chemicals: Tailored solutions for niche industrial needs.

- Sustainable materials: Development of biodegradable and recyclable polymers.

Sinopec's technological advancements are driving efficiency and expansion in both traditional and new energy sectors. The company is prioritizing digital transformation, integrating AI and digital twins to optimize operations, as seen with its plan for over 100 intelligent chemical production lines in 2023.

Significant investments are being made in hydrogen energy, with a projected $10 billion over five years, positioning Sinopec as a key player in the green energy transition. Furthermore, Sinopec is enhancing its focus on advanced materials, increasing R&D spending by 15% in 2023 to develop high-value products for demanding industries.

These technological pursuits aim to bolster domestic energy security, improve cost-effectiveness, and create a competitive edge in the evolving global energy market.

| Technology Focus | Key Initiatives/Investments | Impact/Goal |

|---|---|---|

| Exploration & Extraction | Deep/ultra-deep reserves, shale oil/gas (e.g., Fuling Shale Gas Field) | Boost domestic reserves, improve extraction efficiency |

| Refining & Petrochemicals | Smart manufacturing, advanced units (e.g., Zhenhai refinery expansion) | Increase yield of specialty chemicals, higher-value products |

| New Energy | Hydrogen production, CCUS, renewables (wind, solar, geothermal) | Achieve lower-carbon operations, become a leading hydrogen producer |

| Digitalization & AI | Digital twins, AI digital employees (energy stations) | Enhance operational efficiency, improve customer service |

| Advanced Materials | High-end polyolefins, composites, specialty chemicals | Capture higher-value markets, meet industry demands |

Legal factors

Sinopec faces rigorous adherence to China's evolving environmental laws, covering air, water, waste, and carbon emissions. For instance, China's 2024 environmental targets emphasize reducing major pollutant emissions by 3-4% and increasing forest coverage.

Meeting these mandates requires substantial capital allocation towards advanced pollution abatement systems and greener operational strategies. In 2023, Sinopec invested over 50 billion yuan in environmental protection initiatives, a figure expected to rise in 2024 as regulations tighten.

Sinopec must strictly adhere to China's Work Safety Law and related occupational health regulations, which are continually updated. In 2023, the State Administration of Work Safety reported a 5% decrease in major industrial accidents across the energy sector, a trend Sinopec actively contributes to through its rigorous safety protocols. Failure to comply can result in substantial fines and operational shutdowns, impacting production targets.

Sinopec, as a major force in China's energy and chemical industries, operates under strict anti-monopoly and competition laws. These regulations are designed to ensure fair market practices and prevent any single entity from dominating the market, which directly impacts Sinopec's strategic decisions. For instance, the Anti-Monopoly Law of the People's Republic of China, enacted in 2008 and amended in 2022, provides the framework for regulating market concentration and preventing abuse of dominant market positions.

These legal factors can significantly shape Sinopec's market behavior, influencing everything from its pricing strategies to its approach to mergers and acquisitions. The aim is to maintain a competitive landscape, preventing monopolistic tendencies that could harm consumers or stifle innovation. For example, regulatory bodies might scrutinize proposed acquisitions to ensure they don't unduly reduce competition in key sectors like oil refining or petrochemical production.

International Trade and Investment Laws

Sinopec's global operations, encompassing significant crude oil imports and substantial overseas investments, necessitate strict adherence to a complex web of international trade laws, investment treaties, and sanctions. Navigating these diverse legal landscapes is fundamental to its continued global expansion and effective risk mitigation strategies.

The company's commitment to compliance ensures its ability to operate smoothly across various jurisdictions, avoiding potential legal entanglements that could disrupt its supply chains or investment projects. For instance, in 2023, Sinopec's international trade volume reached trillions of yuan, underscoring the sheer scale of its cross-border legal obligations.

- International Trade Compliance: Adherence to World Trade Organization (WTO) agreements and bilateral trade pacts is paramount for Sinopec's import and export activities.

- Investment Treaty Adherence: Sinopec must comply with Bilateral Investment Treaties (BITs) and international arbitration rules when engaging in overseas projects, particularly in regions like Africa and the Middle East where it has a significant presence.

- Sanctions Regime Navigation: The company actively monitors and complies with international sanctions imposed by entities like the United Nations and individual countries, which can impact its access to certain markets or technologies.

Corporate Governance and Disclosure Requirements

As a major publicly traded entity on both the Hong Kong and Shanghai stock exchanges, Sinopec is bound by rigorous corporate governance standards and extensive disclosure mandates. This means they must regularly report on their financial health, operational performance, and increasingly, their environmental, social, and governance (ESG) initiatives. For instance, in their 2023 annual report, Sinopec detailed its adherence to the Hong Kong Stock Exchange’s Corporate Governance Code, including board diversity and remuneration policies.

These requirements are designed to foster transparency and ensure accountability to a wide array of stakeholders, including investors, regulatory bodies, and the public. Sinopec’s commitment to these standards is evident in its consistent publication of detailed financial statements and sustainability reports, which often include specific metrics on carbon emissions reduction and social responsibility programs. In 2024, the company continued to emphasize its commitment to robust internal controls and ethical business practices as outlined in its corporate governance framework.

Key aspects of Sinopec's compliance include:

- Regular Financial Reporting: Submission of quarterly and annual financial statements adhering to international accounting standards.

- ESG Disclosures: Comprehensive reporting on environmental impact, social contributions, and governance structures, often aligned with GRI or SASB standards.

- Shareholder Communication: Maintaining open channels for communication with shareholders through annual general meetings and investor relations portals.

- Regulatory Compliance: Adherence to the listing rules and regulations of both the Hong Kong Stock Exchange and the Shanghai Stock Exchange.

Sinopec must navigate China's evolving environmental regulations, including ambitious 2024 targets for emission reductions and increased forest coverage, necessitating significant investment in green technologies. The company allocated over 50 billion yuan to environmental protection in 2023, a figure expected to grow as compliance demands intensify.

Environmental factors

Sinopec is under considerable pressure to meet China's ambitious 'dual carbon' targets, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060. This necessitates a strategic shift towards reducing greenhouse gas emissions throughout its extensive value chain, impacting everything from oil and gas extraction to refining and chemical production.

In 2023, Sinopec reported a 1.4% reduction in carbon dioxide emissions intensity compared to 2022, a step towards its climate goals. The company is investing heavily in green technologies, including hydrogen production and carbon capture, utilization, and storage (CCUS), with plans to increase its renewable energy portfolio significantly by 2030.

The global and domestic push towards cleaner energy, including natural gas, hydrogen, wind, and solar, significantly shapes Sinopec's future. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes a reduction in coal consumption and a substantial increase in the share of non-fossil fuels in primary energy consumption, targeting 20% by 2025. This directly influences Sinopec's strategic direction.

In response, Sinopec is actively diversifying its energy offerings and channeling investments into new energy infrastructure. By the end of 2023, Sinopec had established over 1,000 hydrogen refueling stations nationwide, positioning itself as a leader in this emerging sector. This strategic pivot aims to ensure the company's long-term competitiveness and sustainability amidst evolving energy landscapes.

Water resources are absolutely vital for Sinopec's extensive refining and petrochemical operations. These processes are quite water-intensive, making access to reliable water supplies a fundamental requirement for their business.

The increasing challenge of water scarcity in various parts of China is a significant environmental factor. This reality compels Sinopec to implement robust water management strategies, focusing heavily on recycling water and advanced wastewater treatment to maintain sustainable operations and adhere to environmental regulations.

In 2023, China's overall water resource per capita was approximately 2,069 cubic meters, which is significantly lower than the global average, highlighting the national context of water stress that impacts companies like Sinopec.

Pollution Control and Waste Management

Sinopec faces significant challenges in managing pollution, particularly air emissions like volatile organic compounds (VOCs) and wastewater discharge. In 2023, China's Ministry of Ecology and Environment reported a 2% increase in industrial wastewater discharge nationally, highlighting the ongoing need for robust treatment systems. The company must invest in advanced technologies to meet increasingly stringent environmental regulations, aiming to reduce its ecological impact and avoid substantial fines.

Key areas of focus for Sinopec's pollution control and waste management include:

- Air Emission Reduction: Implementing technologies to capture and treat VOCs and other harmful gases from refining and chemical processes.

- Wastewater Treatment: Upgrading facilities to ensure discharged water meets or exceeds national and local environmental standards.

- Solid Waste Management: Developing strategies for the safe disposal and potential recycling of solid waste generated from operations.

- Compliance and Investment: Allocating capital for new pollution control equipment and ongoing maintenance to ensure adherence to environmental laws, which saw China invest over 1.4 trillion yuan (approximately $200 billion USD) in environmental protection in 2023.

Biodiversity Protection and Land Use

Sinopec's extensive exploration and production operations, particularly in ecologically sensitive regions, necessitate a robust approach to biodiversity protection and responsible land use. The company's commitment to minimizing its environmental footprint is crucial for maintaining ecological balance and preserving local habitats.

In 2023, Sinopec reported investing significantly in environmental protection initiatives, with a focus on ecological restoration and biodiversity conservation in its operational areas. For instance, projects in nature reserves and areas with high biodiversity value underwent rigorous environmental impact assessments, leading to the implementation of specific mitigation strategies. These strategies often include habitat restoration and the establishment of wildlife corridors to reduce the impact of infrastructure development.

- Environmental Impact Assessments: Sinopec conducts thorough EIAs for all new projects, especially those in or near ecologically sensitive zones, to identify potential risks to biodiversity.

- Mitigation Measures: The company implements targeted measures such as land reclamation, reforestation, and the establishment of protected areas to offset operational impacts.

- Biodiversity Monitoring: Ongoing monitoring programs are in place to track the effectiveness of mitigation efforts and the health of local ecosystems, with data informing adaptive management strategies.

- Sustainable Land Use Planning: Sinopec integrates sustainable land use principles into its project planning, aiming to minimize land disturbance and promote coexistence with natural environments.

Sinopec is actively responding to China's ambitious climate goals, aiming to reduce emissions intensity and increase its renewable energy portfolio. The company invested in hydrogen and CCUS technologies, with over 1,000 hydrogen refueling stations operational by the end of 2023, aligning with national energy transition plans emphasizing non-fossil fuels.

Water scarcity in China, with per capita resources around 2,069 cubic meters in 2023, necessitates Sinopec's focus on water recycling and advanced treatment to meet operational needs and environmental regulations.

Pollution control remains a key environmental challenge, with Sinopec investing in technologies to reduce air emissions and improve wastewater treatment to meet stringent standards, supported by China's substantial environmental protection investment of over 1.4 trillion yuan in 2023.

Protecting biodiversity and ensuring responsible land use are critical for Sinopec's operations, especially in sensitive areas, involving rigorous environmental impact assessments and mitigation strategies like habitat restoration, as demonstrated by its 2023 environmental protection investments.

PESTLE Analysis Data Sources

Our Sinopec PESTLE analysis is built on a robust foundation of data from official Chinese government publications, international energy agencies, and leading financial news outlets. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and societal trends to provide a comprehensive overview.