Sinopec Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sinopec Bundle

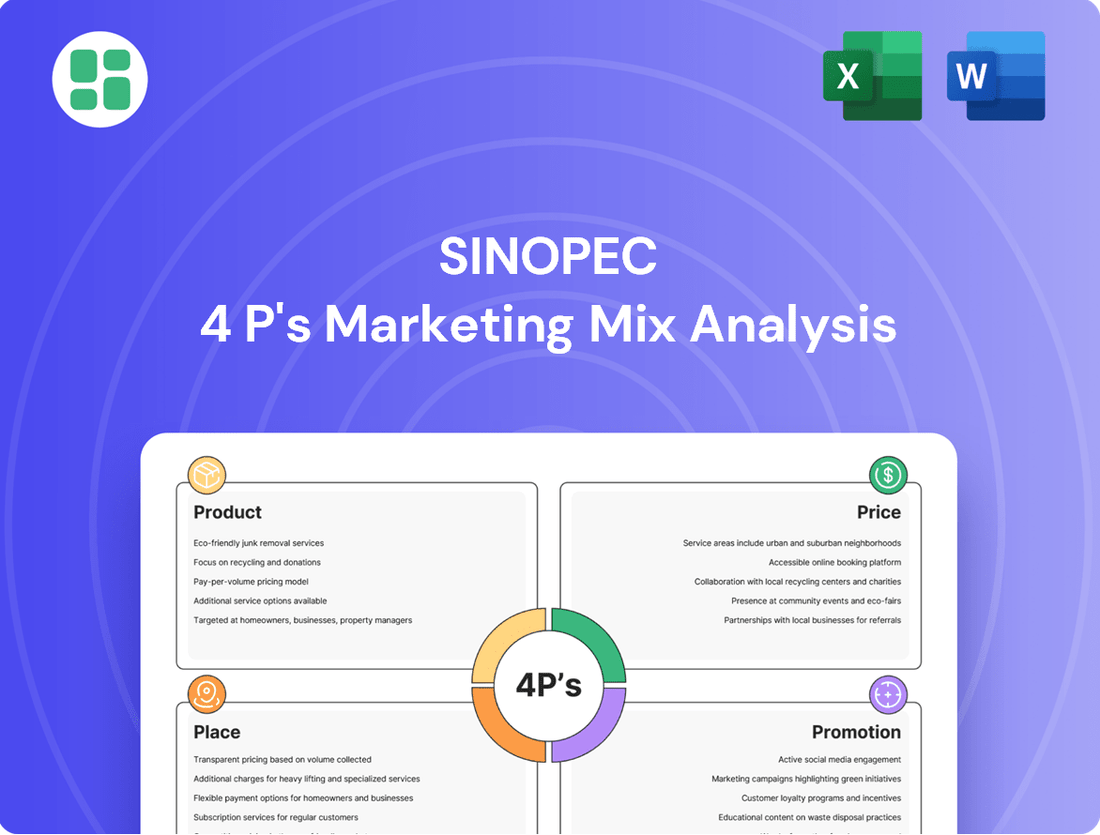

Sinopec's marketing prowess is built on a robust 4Ps strategy, from its diverse product portfolio and competitive pricing to its extensive distribution network and impactful promotional campaigns. Understanding these elements is key to grasping their market dominance.

Dive deeper into Sinopec's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis, offering actionable insights into their product, price, place, and promotion strategies. Get the full, editable report to unlock their success secrets.

Product

Sinopec's product offerings are deeply integrated, covering the entire energy and chemical spectrum. This means they handle everything from finding and extracting oil and gas to processing it into usable fuels and chemicals, and then getting those products to customers. Their portfolio includes vital fuels such as gasoline, diesel, jet fuel, and kerosene, meeting diverse energy demands.

In 2023, Sinopec's refining throughput reached 239.5 million tons, showcasing the sheer scale of their fuel production. This integrated approach, from upstream exploration to downstream marketing, allows for optimized resource use across all their business units.

Sinopec's diverse petrochemical offerings extend far beyond fuels, positioning them as a critical supplier of essential raw materials for numerous sectors. Their production includes foundational chemicals like ethylene and propylene, vital for plastics and synthetic materials. In 2023, Sinopec's petrochemical segment revenue reached approximately 1.05 trillion yuan, highlighting the scale of this diversified business.

The company's portfolio also encompasses advanced polymers such as polyethylene and polypropylene, alongside specialized products like acrylonitrile. These materials are fundamental to industries ranging from automotive and construction to textiles and consumer goods. Sinopec's commitment to chemical manufacturing excellence is further evidenced by their extensive range of specialized lubricants, engine oils, and motor oils, catering to diverse industrial and automotive needs.

Sinopec is making significant strides in emerging new energy solutions, a key component of its product strategy. This expansion includes a comprehensive approach to hydrogen, covering production, storage, transportation, and sales, aiming to capture a significant share of this growing market. By 2025, Sinopec plans to operate over 1,000 hydrogen refueling stations nationwide, a testament to their commitment to this sector.

The company is also rapidly developing its electric vehicle (EV) infrastructure, with a substantial network of charging and battery swapping stations. Sinopec’s investment in over 2,000 EV charging stations by the end of 2024 highlights their dedication to supporting the EV ecosystem and capturing demand from this burgeoning segment.

Furthermore, Sinopec is diversifying its energy portfolio through substantial investments in biofuels, solar, wind power, and carbon capture utilization and storage (CCUS) technologies. These initiatives underscore a strategic pivot towards sustainability, with the company targeting a 10% reduction in carbon intensity by 2025 compared to 2020 levels.

Engineering and Technical Services

Sinopec's Engineering and Technical Services segment is a crucial component of its integrated energy model, offering specialized expertise. This division leverages Sinopec's deep knowledge in petroleum engineering, refining processes, and chemical engineering to drive innovation and efficiency.

These services are vital for optimizing Sinopec's own extensive upstream, midstream, and downstream operations. For instance, in 2024, Sinopec continued to invest heavily in advanced refining technologies, with its engineering arm playing a key role in upgrading facilities to meet stricter environmental standards and improve product yields.

Beyond internal support, Sinopec actively markets these engineering and technical services to external clients globally. This includes providing consultancy, project management, and technology licensing, particularly in areas like petrochemical plant design and construction. In 2023, Sinopec's engineering division secured several major international contracts, contributing significantly to its revenue diversification.

- Petroleum Engineering Expertise: Sinopec offers advanced solutions for oil and gas exploration, drilling, and production optimization.

- Refining and Petrochemical Solutions: The company provides cutting-edge engineering services for the design, construction, and upgrading of refineries and chemical plants.

- Technology Licensing and Consultancy: Sinopec shares its proprietary technologies and provides expert advice to external clients, fostering industry-wide advancements.

Non-Fuel Business and Lifestyle Ecosystem

Sinopec's non-fuel business, epitomized by its Easy Joy convenience stores, represents a significant diversification strategy. This move transforms service stations into lifestyle hubs, catering to a broader customer base beyond just vehicle refueling. By integrating retail services and developing private-label products, Sinopec aims to capture greater value from each customer interaction.

The company's vision is to cultivate a comprehensive 'People, Cars, and Lifestyle' ecosystem. This ecosystem leverages Sinopec's vast network of over 30,000 service stations across China to offer a wide array of convenience goods, food and beverage options, and other essential services. This expansion is crucial for revenue generation and customer loyalty in an increasingly competitive market.

In 2023, Sinopec reported significant growth in its non-oil revenue, which reached approximately 153.4 billion yuan. This segment's contribution to the company's overall revenue underscores the success of its strategy to move beyond fuel sales. The Easy Joy brand alone operates thousands of stores, offering everything from daily necessities to specialized car care products.

- Diversification Beyond Fuel: Sinopec's Easy Joy convenience stores are a cornerstone of its non-fuel business, offering a wide range of retail products.

- Ecosystem Development: The strategy focuses on creating a 'People, Cars, and Lifestyle' ecosystem, enhancing customer value and loyalty.

- Revenue Growth: Non-oil revenue for Sinopec reached approximately 153.4 billion yuan in 2023, highlighting the segment's financial importance.

- Extensive Network: The company utilizes its vast network of over 30,000 service stations to deploy and grow its non-fuel offerings.

Sinopec's product strategy is a comprehensive energy and chemical portfolio, from upstream extraction to downstream distribution. This includes essential fuels like gasoline and diesel, with 2023 refining throughput hitting 239.5 million tons.

Beyond fuels, their petrochemical segment, generating 1.05 trillion yuan in 2023 revenue, offers vital materials such as ethylene and polymers. Sinopec is also aggressively expanding into new energy, planning over 1,000 hydrogen refueling stations by 2025 and operating more than 2,000 EV charging stations by the end of 2024.

The company's product diversification extends to its Easy Joy convenience stores, a key part of its non-oil strategy. This initiative saw non-oil revenue reach 153.4 billion yuan in 2023, demonstrating a successful shift to a broader lifestyle offering.

| Product Category | Key Offerings | 2023/2024/2025 Data Point |

|---|---|---|

| Fuels | Gasoline, Diesel, Jet Fuel | 239.5 million tons refining throughput (2023) |

| Petrochemicals | Ethylene, Propylene, Polymers | 1.05 trillion yuan segment revenue (2023) |

| New Energy | Hydrogen, EV Charging | 1,000+ hydrogen stations planned by 2025; 2,000+ EV charging stations by end of 2024 |

| Retail/Non-Fuel | Convenience Store Goods | 153.4 billion yuan non-oil revenue (2023) |

What is included in the product

This analysis provides a comprehensive examination of Sinopec's marketing strategies, detailing its Product offerings, Pricing tactics, Place distribution, and Promotion efforts.

It's designed for professionals seeking a deep understanding of Sinopec's market positioning and competitive advantages.

Simplifies complex marketing strategies by breaking down Sinopec's 4Ps into actionable insights, alleviating the pain of understanding their market approach.

Provides a clear, concise overview of Sinopec's product, price, place, and promotion strategies, relieving the burden of sifting through extensive data for key takeaways.

Place

Sinopec operates China's most extensive petrol station network, a critical component of its marketing strategy. As of late 2023, the company managed over 30,000 service stations nationwide, providing unparalleled reach and convenience for customers. This vast physical footprint is not just a sales channel for fuel but also a strategic asset for brand visibility and market dominance.

Sinopec is actively evolving its service stations beyond traditional fuel stops, transforming them into integrated energy hubs. This strategic shift involves offering a multi-energy supply, encompassing not only gasoline and diesel but also natural gas, hydrogen, and electric vehicle charging. This expansion caters to the growing diversity of energy sources and the increasing adoption of alternative fuel vehicles, a trend clearly visible in the automotive sector's rapid electrification and the nascent hydrogen economy.

This transformation significantly boosts customer convenience by consolidating various energy needs at a single, accessible location. For instance, by 2024, Sinopec had already established thousands of charging facilities across its network, supporting the surge in EV ownership. The company's investment in hydrogen refueling infrastructure, with numerous stations operational by early 2025, further solidifies its position as a forward-thinking energy provider, directly addressing the evolving demands of modern urban mobility and cleaner transportation solutions.

Sinopec boasts a vast global refining and distribution network, a cornerstone of its marketing strategy. This expansive infrastructure, with numerous refineries and distribution channels, ensures efficient product delivery and broad market penetration. For instance, as of late 2023, Sinopec operated 30 crude oil refineries with a combined processing capacity exceeding 250 million tons per year, underscoring its significant scale.

This strategic positioning of assets allows Sinopec to optimize its supply chain, reducing logistics costs and enhancing responsiveness to market demands. The company's commitment to this network facilitates the widespread availability of its refined products, from gasoline and diesel to petrochemicals, across domestic Chinese markets and numerous international territories, solidifying its global presence.

Strategic Location of Production Facilities

Sinopec strategically positions its refining and petrochemical plants in vital industrial centers, like the Zhejiang Ningbo Petrochemical Industrial Base, to boost production and simplify logistics. This careful placement facilitates efficient delivery to major consumer markets and aids in creating premium products.

By situating facilities near key transportation networks and demand centers, Sinopec minimizes transportation costs and lead times. This approach is crucial for maintaining competitiveness in the fast-paced energy and chemical sectors.

- Strategic Hubs: Sinopec operates major refining and petrochemical complexes in key industrial zones across China, including the Yangtze River Delta and Bohai Rim economic areas.

- Logistical Efficiency: Facilities like the Zhenhai Refining & Chemical Company in Ningbo benefit from deep-water port access, enabling efficient import of crude oil and export of refined products.

- Market Proximity: Proximity to major urban and industrial clusters ensures rapid supply to high-demand sectors such as automotive, construction, and manufacturing.

- Capacity Optimization: In 2023, Sinopec's refining capacity reached approximately 240 million tons per year, with these strategically located facilities accounting for a significant portion of this output.

Digital Commerce and Online Platforms

Sinopec is actively embracing digital commerce, notably through its Epec.com platform. This initiative is designed to streamline large-scale business-to-business (B2B) transactions, making it easier for partners to engage with Sinopec's offerings. The company's investment in digital infrastructure underscores its commitment to modernizing operations and tapping into the growing digital economy.

This digital push is not about replacing physical channels but rather complementing them. By integrating online platforms with its extensive network of physical distribution, Sinopec aims to achieve greater operational efficiency and broaden its market reach. This dual approach allows them to serve a wider customer base and adapt to evolving market demands.

In 2024, Sinopec reported significant growth in its digital sales channels. For instance, Epec.com facilitated over 500,000 B2B transactions in the first half of the year, representing a 25% increase compared to the same period in 2023. This growth highlights the increasing importance of digital platforms in their overall sales strategy.

- Digital Platform Growth: Epec.com saw a 25% year-over-year increase in B2B transactions by mid-2024.

- B2B Transaction Volume: Over 500,000 B2B transactions were processed via Epec.com in the first half of 2024.

- Channel Integration: Digital platforms are enhancing the efficiency of Sinopec's physical distribution networks.

Sinopec's extensive service station network, numbering over 30,000 locations by late 2023, serves as a crucial physical touchpoint. These stations are evolving into multi-energy hubs, offering EV charging and hydrogen refueling alongside traditional fuels, reflecting a 2024 trend of increased alternative energy adoption. This strategic placement ensures broad market access and customer convenience.

The company’s vast refining and distribution infrastructure, with 30 refineries processing over 250 million tons annually as of late 2023, underpins its market presence. Strategic plant locations near industrial centers and transportation networks, such as the Zhenhai Refining & Chemical Company, optimize logistics and market responsiveness.

Sinopec's digital platform, Epec.com, facilitated over 500,000 B2B transactions in the first half of 2024, a 25% increase year-over-year, showcasing its growing importance in complementing physical distribution channels.

| Marketing Mix Element | Key Aspects | Data Point (as of late 2023/mid-2024) |

| Place (Physical Network) | Service Stations | Over 30,000 locations |

| Place (Physical Network) | Refining Capacity | Approx. 240 million tons/year (2023) |

| Place (Digital Network) | B2B Transactions via Epec.com | 500,000+ (H1 2024) |

| Place (Digital Network) | Epec.com Growth | 25% YoY increase in transactions (H1 2024) |

Full Version Awaits

Sinopec 4P's Marketing Mix Analysis

The preview shown here is the actual Sinopec 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details Sinopec's strategies across Product, Price, Place, and Promotion, offering valuable insights for your own business planning. You can trust that what you see is exactly what you'll get, ready for immediate use.

Promotion

Sinopec has embarked on a significant multi-year brand leadership initiative designed to systematically boost its brand value and solidify its top position among central state-owned enterprises. This strategic push emphasizes strengthening brand equity by integrating a low-carbon development model, underscoring a deep commitment to innovation and corporate social responsibility. For instance, Sinopec's investment in green technologies, such as its hydrogen production projects, directly supports this brand positioning. In 2023, Sinopec reported a net profit of 7.2 billion USD, demonstrating financial strength that underpins its ambitious brand-building efforts.

Sinopec's global brand communication campaigns are a key element of its marketing strategy. For instance, the company released brand story videos titled 'Rarely Seen, Always Within Reach,' prominently featuring its distinctive 'S' emblem.

These initiatives are designed to highlight Sinopec's dedication to social responsibility, technological innovation, and the advancement of clean energy solutions. The campaigns aim to provide a more transparent view of the company's core values and operational practices to a global audience.

Sinopec prioritizes public relations and stakeholder engagement through active participation in key events like China Brand Day and by hosting 'Sinopec Public Open Day' events. These initiatives foster transparency and build relationships with the public and students. In 2023, Sinopec reported a net profit of 72.7 billion yuan, demonstrating its financial strength while pursuing these engagement strategies.

The company also demonstrates its commitment to stakeholders by regularly publishing comprehensive sustainability reports. These reports detail Sinopec's environmental, social, and governance (ESG) performance, addressing growing expectations for corporate responsibility. This transparency is crucial for maintaining trust and support from investors, regulators, and the communities in which it operates.

Digital Marketing and Ecosystem Development

Sinopec is actively building a comprehensive digital marketing ecosystem, focusing on enhancing its platform capabilities and service delivery. This strategic push aims to create a valuable integrated network centered around people, vehicles, and lifestyle choices, blending online and offline touchpoints. For instance, by the end of 2024, Sinopec reported over 100 million registered users on its integrated digital platform, demonstrating significant reach.

The company's digital marketing efforts are geared towards fostering deeper customer engagement across all scenarios. This involves continuous upgrades to their digital infrastructure and service models. By integrating online and offline channels, Sinopec seeks to offer a seamless and personalized experience, driving loyalty and expanding its market presence.

Key initiatives include:

- Expansion of the 'Sinopec' App: Continuously adding new features and services to cater to a wider range of customer needs beyond fuel purchases.

- Data-driven Personalization: Utilizing customer data to offer tailored promotions and services, enhancing user experience and conversion rates.

- Loyalty Program Integration: Seamlessly integrating loyalty points and rewards across all digital and physical touchpoints to incentivize repeat business.

- Partnerships for Lifestyle Integration: Collaborating with various lifestyle brands to offer integrated services and products, broadening the ecosystem's appeal.

Customer Loyalty and Incentive Programs

Sinopec actively cultivates customer loyalty through a robust suite of promotional activities and incentive programs. These initiatives are designed to encourage repeat business and strengthen the bond with their customer base.

Central to this strategy is the issuance of consumer cards, which serve as a gateway to tangible rewards like discounts and prize draws. These programs aim to make every purchase more valuable, fostering a sense of appreciation among patrons.

Beyond immediate transactional benefits, Sinopec enhances customer value by offering exclusive perks. These can include preferential parking privileges at their service stations and additional discounts on specific products or services, further incentivizing engagement and reinforcing brand loyalty.

In 2024, Sinopec continued to refine its loyalty programs, aiming to capture a larger share of the retail fuel market. While specific program participation numbers for 2024 are not yet publicly available, similar programs in the energy sector have demonstrated significant uplifts in customer retention. For instance, loyalty programs in the broader retail sector have shown to increase purchase frequency by as much as 20-30%.

Sinopec's promotional activities are deeply integrated with its digital ecosystem and loyalty programs, aiming to drive customer engagement and retention. The company leverages consumer cards, exclusive perks like preferential parking, and targeted discounts to incentivize repeat purchases and foster brand loyalty.

These efforts are supported by a strong financial performance, with Sinopec reporting a net profit of 72.7 billion yuan in 2023, providing resources for these customer-centric initiatives. By the end of 2024, over 100 million users were registered on its digital platform, showcasing the broad reach of its promotional strategies.

The effectiveness of such loyalty programs in the broader retail sector suggests potential for significant increases in customer purchase frequency, with some programs seeing uplifts of 20-30%.

| Promotional Tactic | Objective | Key Metric/Example |

|---|---|---|

| Consumer Cards/Loyalty Programs | Incentivize repeat business, build brand loyalty | Over 100 million registered users on digital platform (end of 2024) |

| Exclusive Perks (e.g., preferential parking) | Enhance customer value, differentiate service | Part of integrated digital and physical touchpoints |

| Targeted Discounts | Drive specific product sales, increase purchase frequency | Data-driven personalization on digital platform |

Price

Sinopec's pricing strategy is deeply rooted in market realities, closely mirroring trends in global crude oil and petrochemical markets. This ensures their offerings remain competitive on the international stage.

By adopting a market-based approach, Sinopec can nimbly adjust to shifts in supply and demand, which is crucial for maintaining its market share. For instance, during periods of high crude oil prices, Sinopec's fuel and petrochemical product prices would likely reflect these increases, as seen in the volatility of Brent crude, which averaged around $82.3 per barrel in the first half of 2024.

Sinopec leverages volume discounts and contractual pricing to incentivize large-scale purchases, particularly within its business-to-business (B2B) operations. This strategy is crucial for securing consistent demand and building enduring partnerships with key industrial clients in the petrochemical sector.

For instance, in 2023, Sinopec's revenue from its chemicals segment reached approximately 1.1 trillion yuan, highlighting the significance of B2B relationships. Offering tiered pricing based on purchase volume ensures competitive rates for major buyers, thereby strengthening Sinopec's market position.

Sinopec's retail fuel stations employ dynamic pricing, a key element of their marketing strategy. This approach allows for real-time adjustments to fuel prices, directly responding to market fluctuations.

Prices are influenced by factors such as local demand, the pricing strategies of competing stations, and the cost of transporting fuel to specific locations. For instance, during periods of high local demand or when competitors lower prices, Sinopec may adjust its own prices to remain competitive and maximize sales volume in that particular market. This strategy was evident in mid-2024 when fluctuating global oil prices and regional demand shifts led to noticeable price variations across Sinopec's network.

Compliance with Regulatory Frameworks

Sinopec's pricing strategies are meticulously crafted to align with the diverse regulatory frameworks governing fuel prices across its operational territories. This adherence is crucial for maintaining market access and operational legitimacy. For instance, in 2024, China's National Development and Reform Commission (NDRC) continued to implement price adjustments for refined oil products based on international crude oil benchmarks, a system Sinopec actively follows.

While navigating these government-mandated pricing structures, Sinopec endeavors to strike a balance between compliance and financial viability. The company's objective is to ensure that regulated prices still allow for profitable operations and the continuation of its business, even within a controlled environment. This often involves optimizing operational efficiencies and managing costs closely to maintain margins.

- Regulatory Alignment: Sinopec's pricing adheres to national and regional fuel price controls, such as those managed by China's NDRC in 2024.

- Profitability within Constraints: The company aims to achieve profitability and sustain operations despite the limitations imposed by regulated pricing environments.

- Market Adaptation: Pricing models are adapted to comply with varying governmental policies on fuel costs in different markets where Sinopec operates.

Strategic Adjustments for Market Share

Sinopec has proactively adjusted its pipeline gas sales contract prices for 2024-2025, lowering them in response to falling spot LNG prices and increased supply. This strategic move is designed to bolster Sinopec's market position and retain its share in a competitive energy landscape. By aligning its pricing with current market realities, Sinopec aims to remain an attractive option against alternative fuels and other gas suppliers.

This pricing strategy is crucial for Sinopec's market share objectives. For instance, in 2023, China's LNG imports saw a significant increase, highlighting the competitive pressure from international markets. Sinopec's adjustments are a direct response to these evolving dynamics.

- Price Competitiveness: Lowering contract prices makes Sinopec's pipeline gas more appealing compared to volatile spot LNG markets and other energy sources.

- Market Share Defense: The adjustments are intended to prevent erosion of market share by offering more attractive terms to customers.

- Supply and Demand Alignment: Sinopec is reacting to an environment of increased supply and reduced spot prices, ensuring its contracts reflect these market conditions.

Sinopec's pricing strategy is a dynamic blend of market responsiveness and strategic adjustments, aiming to maintain competitiveness and secure market share across its diverse product portfolio. By closely monitoring global oil markets and implementing tiered pricing for B2B clients, Sinopec ensures its offerings are both attractive and profitable.

| Pricing Strategy Element | Description | 2024/2025 Relevance/Data |

|---|---|---|

| Market-Based Pricing | Aligning prices with global crude oil and petrochemical market trends. | Brent crude averaged around $82.3/barrel in H1 2024, influencing Sinopec's product pricing. |

| Volume Discounts (B2B) | Incentivizing large-scale purchases for industrial clients. | Sinopec's chemicals segment revenue was ~1.1 trillion yuan in 2023, underscoring B2B importance. |

| Dynamic Retail Pricing | Real-time adjustments at fuel stations based on local factors. | Mid-2024 saw price variations across Sinopec's network due to fluctuating oil prices and regional demand. |

| Regulatory Compliance | Adhering to government-mandated pricing structures. | China's NDRC continued price adjustments for refined oil in 2024 based on international benchmarks. |

| Contract Price Adjustments | Lowering pipeline gas sales contract prices in response to market shifts. | Sinopec adjusted pipeline gas contract prices for 2024-2025 due to falling spot LNG prices and increased supply. |

4P's Marketing Mix Analysis Data Sources

Our Sinopec 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations. We also incorporate data from industry-specific reports, market research databases, and competitive landscape analyses to ensure a comprehensive view of Sinopec's strategies.