The Murugappa Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

The Murugappa Group, a diversified Indian conglomerate, demonstrates significant strengths in its established market presence and diverse portfolio across various sectors like agri-business, engineering, and financial services. However, understanding the nuances of its opportunities and the potential threats it faces is crucial for strategic decision-making. Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Murugappa Group's strength lies in its remarkably diversified business portfolio, spanning sectors like engineering, financial services, abrasives, automotive components, fertilizers, and plantations. This broad operational base acts as a significant risk mitigator, cushioning the group against sector-specific downturns and ensuring a more stable overall revenue stream.

This diversification not only provides resilience but also allows the Murugappa Group to capitalize on growth opportunities across various economic segments. For instance, in FY23, the group's consolidated revenue reached ₹76,765 crore, showcasing the collective strength derived from these varied business interests.

The Murugappa Group commands strong market leadership across several key sectors. For instance, Carborundum Universal (CUMI) is a dominant force in the abrasives industry, and Cholamandalam Investment and Finance Company Limited (Chola) holds a significant position in financial services. This market dominance allows the group to leverage economies of scale and brand recognition, which are crucial for maintaining profitability and competitive advantage.

The Murugappa Group showcases robust financial performance, evidenced by a notable 15.2% rise in net profit, reaching ₹7,885 crore in FY24. This growth was complemented by a 4.9% increase in turnover, which stood at ₹77,881 crore for the same fiscal year.

Furthermore, the group's manufacturing entities generated a healthy free cash flow of ₹1,229 crore. This strong cash generation reflects sound operational efficiency and disciplined financial management, underpinning the group's overall financial strength.

Extensive Domestic and International Presence

The Murugappa Group's extensive domestic and international presence is a significant strength, enabling it to serve a wide array of customers across various geographies. This broad reach diversifies revenue streams and mitigates risks associated with reliance on a single market. For instance, in 2024, the group's consolidated revenue saw contributions from its various international ventures, reflecting its global operational capacity.

This global footprint allows the Murugappa Group to leverage different economic cycles and market opportunities. Its operations span multiple continents, enhancing its resilience and adaptability. The group's strategic investments in emerging markets, coupled with its established presence in developed economies, provide a balanced approach to growth and market penetration.

Key aspects of this strength include:

- Global Market Access: Serving customers in over 50 countries as of recent reports, significantly broadening its customer base beyond India.

- Diversified Revenue Streams: Income generated from various international subsidiaries, reducing over-reliance on the Indian market.

- Operational Synergies: Ability to implement best practices and technological advancements across its global operations, fostering efficiency.

- Market Adaptability: Greater capacity to respond to diverse regulatory environments and consumer preferences worldwide.

Legacy and Strong Governance

The Murugappa Group's legacy, stretching over 120 years, is underpinned by a strong commitment to ethical business practices and robust corporate governance. This deep-rooted history cultivates significant trust among its stakeholders, including investors, business partners, and employees, which is crucial for sustained stability and long-term growth. For instance, their consistent adherence to ethical standards has been a cornerstone of their enduring presence in diverse sectors.

This established reputation for integrity is a powerful asset, translating into a stable foundation for future endeavors. The group's focus on research and development, coupled with its dedication to social welfare initiatives, further bolsters this image, driving innovation and reinforcing its standing. In 2023, the group reported a consolidated revenue of approximately INR 74,000 crore, reflecting its substantial market presence and operational scale.

- Established Reputation: Over 120 years of operation have built a strong, trustworthy brand image.

- Ethical Governance: A proven track record of sound corporate governance enhances stakeholder confidence.

- Innovation Driver: Commitment to R&D and social welfare fosters a culture of progress and positive impact.

- Financial Stability: The group's legacy contributes to its perceived financial resilience and long-term viability.

The Murugappa Group's diversified business model is a cornerstone of its strength, allowing it to navigate economic fluctuations effectively. Its robust financial performance, highlighted by a 4.9% increase in turnover to ₹77,881 crore in FY24 and a 15.2% rise in net profit to ₹7,885 crore, underscores this resilience. The group's market leadership in key sectors like abrasives and financial services, exemplified by Carborundum Universal and Cholamandalam Investment and Finance Company, further solidifies its competitive edge.

| Metric | FY23 (Approx.) | FY24 | Change |

|---|---|---|---|

| Consolidated Revenue (₹ crore) | 76,765 | 77,881 | +1.45% |

| Net Profit (₹ crore) | ~6,845 | 7,885 | +15.2% |

| Manufacturing Free Cash Flow (₹ crore) | N/A | 1,229 | N/A |

What is included in the product

Delivers a strategic overview of The Murugappa Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to address the Murugappa Group's identified weaknesses and threats, enabling strategic mitigation and opportunity maximization.

Weaknesses

The Murugappa Group's extensive diversification, spanning sectors from engineering to financial services, presents significant operational complexities. Managing such a broad portfolio, which includes businesses like Tube Investments of India and Cholamandalam Investment and Finance Company, requires intricate coordination of strategies and resources. This can strain management bandwidth and potentially lead to inefficiencies across different business units, impacting overall synergy and optimal performance.

Recent reports highlight ongoing challenges within the Murugappa Group regarding the division of its business empire among family factions. A significant point of contention appears to be the substantial appreciation in the value of key companies, such as CG Power, which has reportedly reached a market capitalization of over ₹70,000 crore as of early 2024. These internal disagreements can unfortunately divert crucial management focus and impede strategic decision-making.

While the Murugappa Group's diversified portfolio offers resilience, individual business segments are not immune to sector-specific challenges. For example, EID-Parry's sugar operations are directly influenced by the volatility of global sugar prices, which can significantly impact its profitability.

Similarly, Cholamandalam Investment and Finance Company, a key player in the group's financial services, faces risks associated with interest rate fluctuations, affecting its lending margins and overall financial performance.

Coromandel International, a significant contributor in the agri-solutions space, saw its net sales decrease in the fiscal year 2024, highlighting the susceptibility of even established segments to market headwinds and economic conditions.

Return on Capital Employed (ROCE) Decline in Manufacturing

The Murugappa Group's manufacturing segments experienced a notable dip in efficiency, with Return on Capital Employed (ROCE) falling to 21.3% in FY24 from 27.9% in FY23. This decline suggests that the capital invested in these operations is generating lower returns. It could signal challenges in optimizing asset utilization or a growing need for capital investment that isn't yet matched by a proportional increase in profitability.

This trend warrants attention as it may impact the group's ability to create long-term shareholder value within its manufacturing businesses. Investors and strategists will be closely monitoring whether this is a temporary setback or indicative of more persistent issues in capital efficiency.

- FY24 ROCE (Manufacturing): 21.3%

- FY23 ROCE (Manufacturing): 27.9%

- Implication: Potential decrease in capital efficiency and profitability within manufacturing segments.

Impact of Geopolitical Uncertainties on Exports

Murugappa Group's export-oriented businesses, particularly in segments like abrasives, have felt the pinch of global geopolitical uncertainties and slowing economies in key international markets. This has led to a noticeable dip in export sales, impacting revenue streams that are heavily reliant on these overseas markets. The group's exposure to international economic headwinds and political instability directly translates into risks for export volumes and overall growth.

For instance, during fiscal year 2023-24, the abrasives division, a significant contributor to exports, saw its performance tempered by these external factors. While specific figures for export revenue decline due to geopolitical issues are not publicly itemized separately, the broader economic slowdown in regions like Europe and North America, often exacerbated by geopolitical tensions, has demonstrably impacted demand for industrial goods. This reliance on global demand makes the group vulnerable to fluctuations in international trade and economic stability.

- Exposure to Global Economic Slowdowns: Recessionary trends in key export markets directly reduce demand for Murugappa Group's products.

- Impact on Abrasives Division: The abrasives segment, a notable exporter, has experienced reduced sales volumes due to these global economic pressures.

- Geopolitical Risk Factor: International political instability creates uncertainty, potentially disrupting supply chains and dampening export growth.

- Revenue Vulnerability: The group's dependence on international sales makes it susceptible to external economic and political shocks.

The Murugappa Group's extensive diversification, while a strength, also creates significant operational complexities. Managing a wide array of businesses, from engineering to financial services, demands intricate coordination and can strain management bandwidth, potentially leading to inefficiencies across different units.

Internal disagreements, particularly concerning the division of the business empire and the appreciation of key company values like CG Power (market cap over ₹70,000 crore in early 2024), can divert crucial management focus and impede strategic decision-making.

Sector-specific challenges also pose a weakness. For instance, EID-Parry's sugar operations are susceptible to volatile global sugar prices, and Cholamandalam Investment and Finance Company faces risks from interest rate fluctuations. Coromandel International's net sales decrease in FY24 underscores the vulnerability of even established segments to market headwinds.

Furthermore, manufacturing segments saw a decline in capital efficiency, with Return on Capital Employed (ROCE) falling to 21.3% in FY24 from 27.9% in FY23, indicating a potential decrease in profitability and asset utilization.

What You See Is What You Get

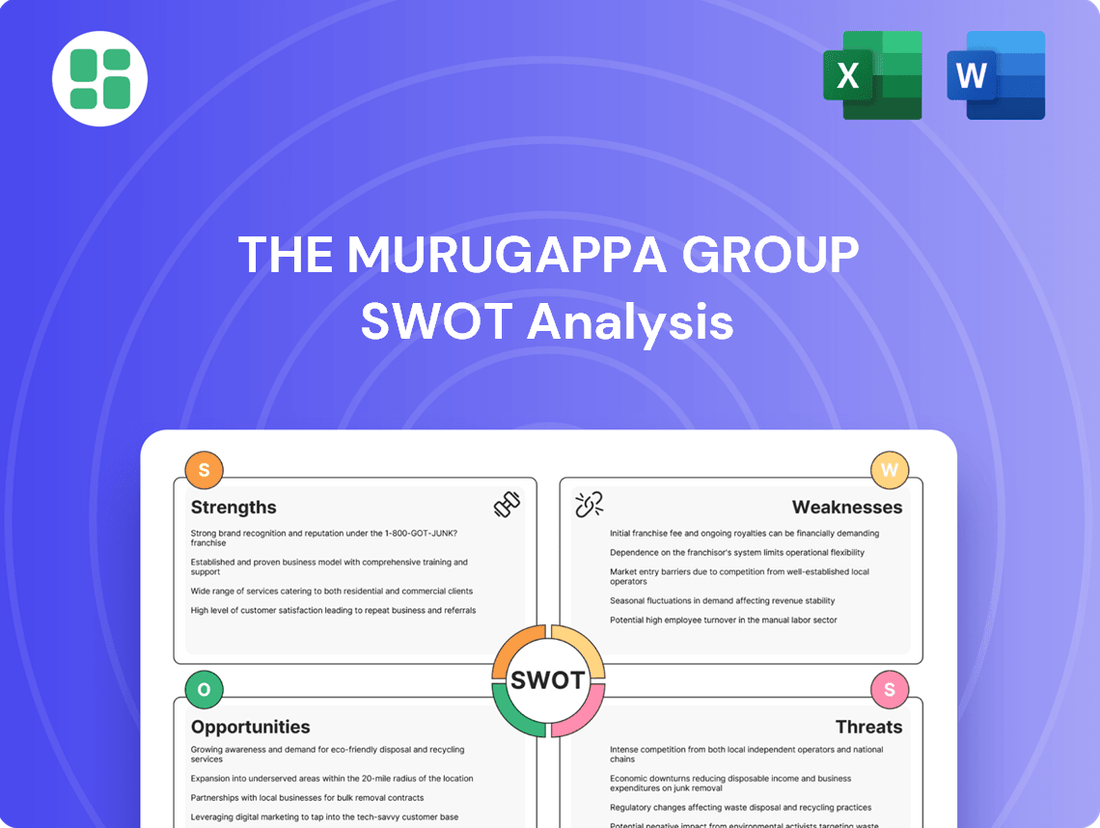

The Murugappa Group SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This includes a comprehensive breakdown of the Murugappa Group's Strengths, Weaknesses, Opportunities, and Threats. You'll gain access to the full, detailed analysis immediately upon completing your purchase.

Opportunities

The Murugappa Group, via Tube Investments of India (TII), is strategically expanding into the burgeoning electric vehicle (EV) market. This includes significant investments in three-wheelers, tractors, and heavy commercial vehicles, positioning the group for substantial future revenue growth.

This move into EVs represents a key opportunity for market leadership in a sector poised for rapid expansion. For instance, the Indian EV market is projected to reach $150 billion by 2030, according to government estimates, highlighting the immense potential.

The financial services arm, especially Cholamandalam Investment and Finance, is a significant growth engine for the Murugappa Group. In fiscal year 2024, it reported a robust increase in assets under management, driven by strategic expansion.

Cholamandalam is actively pursuing digital transformation, aiming to enhance customer experience and streamline operations. This includes investing in technology to support its foray into new business areas such as consumer loans and loans for small enterprises.

This digital push and diversification into new lending segments present a substantial opportunity to tap into previously underserved markets and improve overall efficiency, thereby accelerating growth in this key sector.

The Murugappa Group is strategically positioned to benefit from India's expanding agricultural sector, a market poised for significant growth. Through its subsidiary Coromandel International, the group is a key player in providing essential agri-inputs and advanced farming solutions, directly addressing the increasing demand from India's extensive rural population.

This focus on agricultural solutions, combined with strategic ventures like Parry's Consumer Products venturing into FMCG, offers a dual growth avenue. By boosting farm productivity and catering to changing consumer preferences, these initiatives are set to drive substantial revenue increases. For instance, Coromandel International reported a revenue of ₹20,019 crore for the fiscal year ending March 31, 2023, highlighting its substantial market presence.

Strategic Acquisitions and Partnerships

The Murugappa Group has a proven track record with strategic acquisitions, exemplified by Tube Investments of India's acquisition of CG Power and the acquisition of Payswiff by Cholamandalam Investment. This approach is crucial for future growth.

Continuing this acquisition strategy, particularly in dynamic sectors such as medical technology, for instance, the group's investment in Lotus Surgicals, and the burgeoning field of semiconductor manufacturing, presents significant opportunities. These moves can facilitate swift market penetration and diversification into lucrative new business areas.

- Acquisition of CG Power: Tube Investments of India's acquisition of CG Power in late 2020, valued at approximately INR 779 crore, strengthened its position in the electrical sector.

- Cholamandalam Investment's Payswiff Acquisition: Cholamandalam Investment and Finance Company's acquisition of a majority stake in Payswiff, a digital payment solutions provider, in 2022, marked an entry into the fintech space.

- Lotus Surgicals Investment: The group's investment in Lotus Surgicals, a medical device manufacturer, signifies a strategic push into the high-growth healthcare industry.

- Semiconductor Manufacturing Focus: Exploring acquisitions or partnerships in semiconductor manufacturing aligns with global trends and India's push for domestic chip production, potentially offering substantial returns.

Focus on Sustainability and ESG Initiatives

The Murugappa Group's commitment to sustainability and ESG principles, evident across its diverse portfolio, is a significant opportunity. This focus helps attract a growing segment of investors prioritizing ethical and environmentally sound investments. For instance, many of its listed entities are actively working on reducing their carbon footprint and enhancing social impact, aligning with global trends.

Strong ESG performance can translate into tangible business benefits. It enhances brand image, making the group more attractive to customers and partners. Furthermore, robust ESG practices can lead to improved operational efficiency through resource optimization and reduced waste. This can also unlock new avenues for capital, as financial institutions increasingly favor companies with strong sustainability credentials.

The group's proactive approach to ESG positions it favorably to navigate evolving regulatory landscapes. As governments worldwide implement stricter environmental and social governance mandates, companies with established ESG frameworks are better equipped to comply and even lead. This foresight can mitigate risks and create a competitive advantage.

- Attracting Socially Conscious Investors: Growing demand for ESG-aligned investments means the group can tap into a larger pool of capital.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability boosts public perception and customer loyalty.

- Improved Operational Efficiency: ESG initiatives often drive innovation in resource management, reducing costs and waste.

- Regulatory Compliance and Risk Mitigation: Proactive ESG adoption ensures adherence to current and future environmental and social regulations.

The Murugappa Group is well-positioned to capitalize on the expanding Indian electric vehicle market, particularly through Tube Investments of India. This strategic move into EV manufacturing, including three-wheelers and tractors, aligns with India's ambitious sustainability goals and offers significant growth potential. The Indian government aims for 30% EV penetration by 2030, indicating a massive market opportunity.

The group's financial services arm, Cholamandalam Investment and Finance, is a key growth driver. Its digital transformation initiatives and expansion into new lending areas like consumer and MSME loans are expected to boost assets under management and profitability. In FY24, Cholamandalam reported strong growth in its AUM, demonstrating its market traction.

Leveraging its expertise in agri-inputs through Coromandel International, the group is set to benefit from the growth in India's agricultural sector. Coromandel International's focus on advanced farming solutions and its substantial revenue, which was ₹20,019 crore in FY23, underscores its market leadership and potential for further expansion.

The group's consistent strategy of strategic acquisitions, such as Tube Investments' acquisition of CG Power and Cholamandalam's investment in Payswiff, provides avenues for diversification and market penetration. Future acquisitions in high-growth sectors like medical technology and semiconductors could further enhance its market position and revenue streams.

A strong commitment to ESG principles is attracting socially conscious investors and improving the group's brand reputation. This focus on sustainability not only enhances operational efficiency through resource optimization but also positions the group favorably for evolving regulatory landscapes, potentially unlocking new capital sources.

Threats

The Murugappa Group's diversified operations expose it to a broad spectrum of intense competition. For instance, in the highly competitive automotive components sector, the group faces rivals like Bosch and ZF Friedrichshafen, both global powerhouses with extensive R&D capabilities and established market presences. Similarly, its presence in the sugar industry contends with large domestic players and fluctuating global commodity prices, impacting profitability.

Changes in government policies, regulations, and taxation across key sectors like agriculture, financial services, and manufacturing pose a significant threat to The Murugappa Group. For example, shifts in agricultural subsidies or new environmental regulations could directly impact their agri-business segment, while changes in banking or insurance laws might affect their financial services arm. The group must remain agile to adapt to these evolving policy landscapes.

The Murugappa Group's significant international presence exposes it to substantial risks from global economic volatility. A worldwide economic slowdown or recessionary pressures, which have been a concern throughout 2024 and are projected to continue into 2025, can directly dampen demand for its diverse range of products, from engineering goods to fertilizers.

This global economic uncertainty, coupled with ongoing geopolitical tensions, has already impacted the group's export volumes. For instance, a slowdown in key export markets like Europe or Southeast Asia can lead to reduced orders and lower revenue realization for its manufacturing and engineering segments, directly affecting top-line growth.

Commodity Price Fluctuations

The Murugappa Group's manufacturing and agriculture-focused businesses, like fertilizers and sugar, are particularly vulnerable to the unpredictable swings in commodity prices. For instance, disruptions in global supply chains or shifts in demand can lead to sharp increases or decreases in the cost of raw materials, directly impacting the group's operational expenses and the revenue generated from its products.

These price volatilities can significantly compress profit margins. For example, if fertilizer prices surge unexpectedly, the cost of production for agricultural inputs rises, potentially forcing the company to absorb some of the increase or pass it on to farmers, which could affect sales volumes. Conversely, a sharp drop in sugar prices could reduce the revenue from the group's sugar segment, even if production costs remain stable.

Recent data highlights this sensitivity. For the fiscal year ending March 31, 2024, global urea prices, a key component in fertilizer production, experienced considerable volatility. While prices saw a dip in early 2024 compared to the highs of 2023, they remained susceptible to geopolitical events and energy costs, which directly influence Murugappa's fertilizer division.

- Exposure to Volatile Raw Material Costs: Businesses like Coromandel International and E.I.D. Parry are directly impacted by fluctuations in prices of key inputs such as natural gas, rock phosphate, and sulphur for fertilizers, and sugarcane for sugar.

- Impact on Profitability: Significant price swings in these commodities can lead to margin compression or expansion, affecting the overall financial performance of the group. For example, a sharp rise in urea prices in late 2023 and early 2024 put pressure on fertilizer manufacturers' margins.

- Revenue Sensitivity: The selling prices of agricultural products, like sugar, are also subject to market forces, including global supply and demand, government policies, and weather patterns, directly influencing the revenue streams of the group's agri-business segments.

- Mitigation Strategies: The group may employ hedging strategies or long-term supply contracts to manage some of this commodity price risk, but inherent volatility remains a significant threat.

Technological Disruptions and Rapid Innovation

The Murugappa Group faces the threat of technological disruptions across its varied businesses. While the group is actively investing in areas like electric vehicles (EVs) and semiconductors, the pace of innovation in these and other sectors, such as advanced materials and digital manufacturing, could quickly render current business models obsolete. For instance, the automotive sector is rapidly shifting towards electric and autonomous driving technologies, demanding continuous adaptation from companies like Tube Investments of India.

Failure to anticipate and integrate emerging technologies could result in a significant loss of market share. In 2023, global R&D spending in the semiconductor industry alone was projected to exceed $100 billion, highlighting the intense competitive landscape driven by technological advancement. Companies that do not invest sufficiently in research and development risk falling behind competitors who embrace newer, more efficient, or disruptive technologies.

- Rapid advancements in battery technology for EVs could challenge existing powertrain solutions.

- The increasing adoption of AI and automation in manufacturing may disrupt traditional production methods.

- Emerging digital platforms could alter customer engagement and sales channels for consumer goods businesses.

- The semiconductor industry's constant evolution requires substantial and ongoing capital investment to remain competitive.

Intense competition across its diverse sectors, from automotive components to sugar, presents a significant hurdle. For instance, in the automotive sector, the group competes with global giants like Bosch, which reported revenues exceeding €78 billion in 2023. Similarly, the agri-business segment faces pressure from large domestic players and volatile global commodity prices, impacting profitability and market share.

SWOT Analysis Data Sources

This analysis is built on a foundation of credible data, including the Murugappa Group's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate assessment.