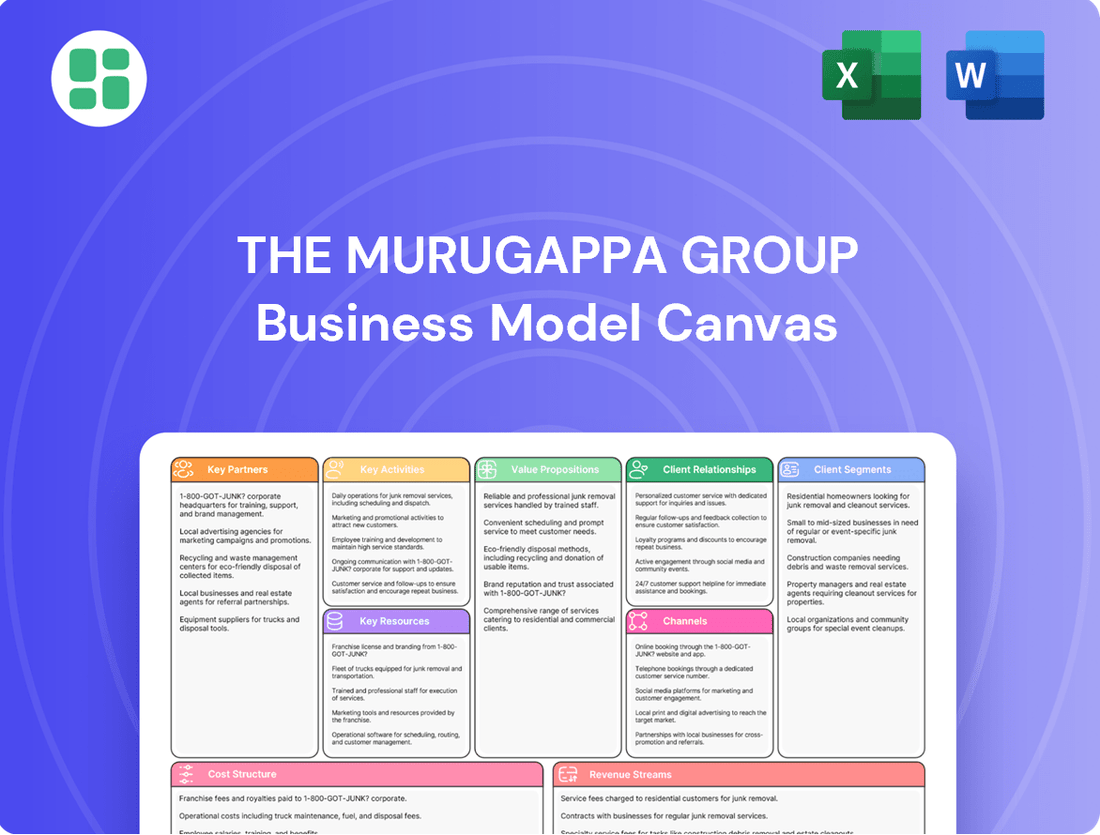

The Murugappa Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

Discover the intricate workings of The Murugappa Group's diversified business empire with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable strategic insights. Perfect for those aiming to understand and replicate success in complex markets.

Partnerships

The Murugappa Group actively cultivates strategic alliances with global leaders to drive technological advancement and innovation. These partnerships are crucial for acquiring cutting-edge technologies and adopting international best practices, particularly in areas like advanced manufacturing and the development of new products.

These collaborations are vital for enhancing the Group's competitive position across its various business segments. For instance, their involvement in semiconductor manufacturing and the burgeoning electric vehicle sector highlights a commitment to staying at the forefront of industry evolution.

In 2024, the Group continued to invest in these strategic relationships, recognizing their impact on R&D capabilities and market expansion. For example, their joint ventures in areas like specialty chemicals and renewable energy solutions are designed to leverage shared expertise and accelerate growth.

The Murugappa Group actively forms strategic alliances, exemplified by its joint venture in Cholamandalam MS General Insurance with Mitsui Sumitomo. This partnership leverages global insurance expertise to enhance its offerings in the Indian market.

Further demonstrating this commitment, the group is exploring new ventures in electric vehicles and semiconductor manufacturing, signaling a proactive approach to diversification. These collaborations are designed to tap into emerging sectors and capitalize on future growth opportunities.

These joint ventures are instrumental in sharing specialized knowledge, broadening market access, and diversifying the group's business interests. For instance, in 2023, Cholamandalam MS General Insurance reported a Gross Written Premium of INR 6,098 crore, showcasing the success of such strategic partnerships in driving financial performance.

The Murugappa Group's extensive supplier networks are foundational to its manufacturing prowess, securing essential raw materials and components. For instance, in 2023, their automotive component segment relied heavily on a robust supply chain to meet demand, with key suppliers providing specialized alloys and precision parts, contributing to the segment's revenue growth.

Their distributor networks are equally critical, acting as the arteries for product delivery to a wide array of customers. In 2024, Tube Investments of India, a key Murugappa entity, leveraged its vast distributor base to achieve a significant market share in the bicycle segment, reaching over 500 cities across India and expanding its export footprint in Southeast Asia.

Acquisition Targets and Integration Partners

The Murugappa Group actively seeks strategic acquisitions to bolster its market position and diversify its portfolio. Recent examples include the acquisition of Hubergroup's printing inks and chemicals business, significantly expanding its global reach in this sector. Similarly, its investment in NACL Industries aims to strengthen its agrochemicals division.

Successful integration of these acquired entities is paramount. This necessitates robust partnerships with specialized integration firms and strong financial institutions to manage the transition effectively. These collaborations are crucial for realizing the anticipated synergies and ensuring operational efficiency post-acquisition.

Key partnerships in this area focus on:

- Identifying synergistic acquisition targets: Leveraging market intelligence and financial analysis to pinpoint companies that align with strategic growth objectives.

- Securing financial backing: Establishing strong relationships with banks and financial investors to fund acquisitions and integration efforts.

- Facilitating smooth operational integration: Partnering with management consultants and technology providers to streamline processes and systems post-acquisition.

- Driving market expansion: Collaborating with distribution networks and channel partners to maximize the reach of newly acquired businesses.

Research and Development Collaborations

The Murugappa Group actively pursues research and development collaborations with leading research institutions and technology firms. These partnerships are crucial for driving innovation and ensuring continuous improvement across its diverse business segments, including agriculture, engineering, and emerging sectors like electric vehicles.

These collaborations are not just about new product development; they also focus on enhancing existing processes and adopting cutting-edge technologies. For instance, in the agriculture sector, partnerships aim to develop more sustainable farming practices and advanced crop protection solutions. In engineering, collaborations focus on next-generation materials and manufacturing techniques.

The group's strategic investments in new ventures, such as electric vehicles, heavily rely on these R&D partnerships. These alliances provide access to specialized expertise and accelerate the development of innovative mobility solutions. For example, in 2024, the group announced a significant collaboration with a prominent battery technology firm to advance its EV battery research.

- Agricultural Innovation: Partnerships with agricultural research institutes to develop drought-resistant seeds and advanced pest management solutions, aiming to boost crop yields by an estimated 15-20% in pilot programs.

- Engineering Advancements: Collaborations with technology firms to integrate AI and IoT into manufacturing processes, leading to an expected 10% improvement in production efficiency in 2024.

- Electric Vehicle Technology: Joint research with battery technology specialists to enhance EV range and charging speed, with a target of launching a new battery prototype by late 2025.

- New Materials Research: Collaborations with material science universities to explore and develop lightweight, high-strength composites for automotive and industrial applications.

The Murugappa Group's key partnerships are critical for leveraging external expertise and resources to drive innovation and market expansion. These include collaborations with global leaders for technology acquisition, joint ventures in new sectors like EVs and semiconductors, and strategic alliances for market access and knowledge sharing.

In 2024, the Group's focus on strategic alliances was evident in its continued investment in R&D capabilities and market reach, exemplified by joint ventures in specialty chemicals and renewable energy. The partnership with Mitsui Sumitomo in Cholamandalam MS General Insurance highlights the successful integration of global expertise into the Indian market.

Furthermore, the Group's supplier and distributor networks are vital operational partnerships, ensuring access to raw materials and efficient product delivery. For instance, Tube Investments of India's extensive distributor base in 2024 facilitated significant market share gains in the bicycle segment.

The Group also actively engages in research and development collaborations with academic institutions and technology firms, particularly in areas such as agricultural innovation and advanced EV battery technology, aiming for tangible improvements in efficiency and product performance.

| Partnership Type | Example Entity/Area | 2023/2024 Data Point | Strategic Benefit |

|---|---|---|---|

| Joint Venture | Cholamandalam MS General Insurance (with Mitsui Sumitomo) | INR 6,098 crore Gross Written Premium (2023) | Leveraging global insurance expertise for Indian market growth |

| R&D Collaboration | EV Battery Technology (announced 2024) | Targeting new battery prototype by late 2025 | Accelerating development of innovative mobility solutions |

| Acquisition Integration | Hubergroup's printing inks and chemicals business | Expansion of global reach | Strengthening portfolio and market position |

| Supplier Network | Automotive Component Segment | Securing specialized alloys and precision parts | Meeting demand and driving revenue growth |

| Distributor Network | Tube Investments of India (Bicycle Segment) | Presence in over 500 Indian cities (2024) | Maximizing product delivery and market share |

What is included in the product

A diversified conglomerate's business model, detailing its various business units, customer bases, and revenue streams across sectors like engineering, finance, and agriculture.

Organized into 9 classic BMC blocks, it showcases the group's strategic approach to value creation, customer relationships, and key resources.

The Murugappa Group Business Model Canvas acts as a pain point reliver by offering a clear, visual representation of their diverse operations, enabling swift identification of synergies and inefficiencies across their conglomerate.

Activities

The Murugappa Group's manufacturing prowess spans a diverse product portfolio, encompassing abrasives, automotive components, bicycles, industrial ceramics, and fertilizers. This extensive reach necessitates meticulous management of intricate production cycles, stringent quality assurance protocols, and continuous optimization of operational efficiency across its many manufacturing sites. For example, in fiscal year 2023, the group's manufacturing entities contributed significantly to its overall revenue, with automotive components alone seeing robust demand.

The Murugappa Group's financial services operations, primarily through Cholamandalam Investment and Finance Company (Chola) and Cholamandalam MS General Insurance, are centered around crucial activities like vehicle finance, home loans, and personal loans. In 2024, Chola continued to expand its retail loan portfolio, demonstrating a commitment to growth in these core areas.

Insurance underwriting for general insurance products, encompassing motor, health, and property insurance, forms another vital pillar. These operations demand stringent risk assessment models and a strong focus on customer service to ensure sustained profitability and market presence.

Wealth management services are also a key activity, offering investment advisory and portfolio management solutions. Regulatory compliance and robust risk management are paramount across all these financial services, ensuring adherence to evolving legal frameworks and safeguarding stakeholder interests.

The Murugappa Group's key activities in agricultural inputs and agri-solutions are primarily driven by Coromandel International and E.I.D. Parry. These entities focus on manufacturing and distributing a wide range of products essential for farming, including fertilizers, crop protection chemicals, and sugar. This comprehensive offering supports farmers throughout the agricultural cycle.

Beyond product provision, the group actively engages in agricultural research to develop innovative solutions and improve crop yields. They also implement extensive farmer outreach programs to disseminate knowledge and best practices. Furthermore, efficient supply chain management is crucial for ensuring timely delivery of these vital farm inputs.

In fiscal year 2024, Coromandel International reported a revenue of approximately ₹20,300 crore, with its Agri-solutions segment contributing significantly. E.I.D. Parry's sugar division also played a vital role, with the group's consolidated revenue reflecting the strong performance across these agricultural ventures.

Research, Development, and Digital Transformation

The Murugappa Group actively invests in Research and Development, demonstrating a commitment to innovation. This is clearly visible in their strategic expansion into emerging sectors like electric vehicles and semiconductor manufacturing, signaling a forward-looking approach to product development and market positioning.

Digital transformation is a core component of their strategy. Initiatives are focused on bolstering e-commerce capabilities and digital service offerings to streamline operations and deepen customer relationships.

- R&D Investment: The Group prioritizes significant capital allocation towards R&D to foster innovation and enhance existing product lines.

- Electric Vehicle Venture: Their entry into the electric vehicle market underscores a commitment to sustainable mobility solutions and future growth areas.

- Semiconductor Manufacturing: The Group's involvement in semiconductor production highlights a strategic move into a critical high-technology sector.

- Digital Enhancement: Investments in e-commerce platforms and digital services aim to improve operational efficiency and customer engagement across their diverse businesses.

Global Market Expansion and Acquisitions

The Murugappa Group actively pursues global market expansion, leveraging exports and strategic acquisitions to broaden its international footprint. A prime example is their recent acquisition of Hubergroup, a significant move to bolster their presence in key overseas markets.

This expansion strategy involves rigorous market analysis to identify promising regions and thorough due diligence for potential acquisitions. The group focuses on seamlessly integrating newly acquired businesses into their existing global operational framework, ensuring synergy and maximizing value.

- International Expansion: The Murugappa Group is actively growing its global presence through exports and strategic acquisitions.

- Strategic Acquisition: The recent acquisition of Hubergroup exemplifies their commitment to expanding into new international markets.

- Operational Integration: Key activities include detailed market analysis, comprehensive due diligence for acquisitions, and the effective integration of new businesses into their global operations.

The Murugappa Group's key activities in manufacturing involve the production of a wide array of goods, from automotive components and bicycles to industrial ceramics and fertilizers. This requires efficient production planning, stringent quality control, and continuous process improvement across its various facilities. In fiscal year 2023, the group's manufacturing segment demonstrated strong performance, with automotive components showing particularly robust demand.

Financial services, led by entities like Cholamandalam Investment and Finance Company, focus on crucial activities such as vehicle finance and home loans. In 2024, Chola continued to grow its retail loan book, indicating a strategic focus on expanding its customer base and product offerings in these areas. Complementing this, insurance underwriting for general products like motor and health insurance necessitates sophisticated risk assessment and a strong customer service orientation.

The group's agricultural solutions segment, spearheaded by Coromandel International and E.I.D. Parry, is dedicated to providing essential farm inputs. Key activities include the manufacturing and distribution of fertilizers and crop protection chemicals, alongside sugar production. Coromandel International reported revenues of approximately ₹20,300 crore in fiscal year 2024, highlighting the significant contribution of its Agri-solutions business.

Innovation and digital transformation are central to the group's strategy. This includes substantial investment in Research and Development, particularly in emerging sectors like electric vehicles and semiconductor manufacturing. Digital initiatives are geared towards enhancing e-commerce capabilities and digital service delivery, aiming to streamline operations and deepen customer engagement across the diverse business units.

| Key Activity | Focus Area | Recent Performance/Initiative (FY24 unless stated) |

|---|---|---|

| Manufacturing | Automotive Components, Bicycles, Fertilizers | Robust demand in automotive components in FY23. |

| Financial Services | Vehicle Finance, Home Loans, General Insurance | Chola expanded retail loan portfolio in 2024. |

| Agri-Solutions | Fertilizers, Crop Protection, Sugar | Coromandel International FY24 revenue ~₹20,300 crore. |

| R&D and Digital Transformation | EVs, Semiconductors, E-commerce | Strategic expansion into EVs and semiconductor manufacturing. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for the Murugappa Group that you're previewing is the authentic document you will receive upon purchase. This isn't a generic sample, but a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll immediately download this exact, detailed Business Model Canvas, ready for your strategic review.

Resources

The Murugappa Group's extensive manufacturing infrastructure is a cornerstone of its business model, featuring a wide array of plants and facilities. These operations span critical sectors such as engineering, abrasives, and automotive components, enabling large-scale production and diverse product portfolios.

In 2024, the group continued to leverage this robust physical asset base, which underpins its ability to meet significant market demand across its various business units. This infrastructure is vital for maintaining competitive pricing and ensuring consistent product quality.

The Murugappa Group's robust financial standing is a cornerstone of its business model. In fiscal year 2024, the group demonstrated strong performance with significant turnover and profit after tax, underscoring its operational efficiency and market demand for its diverse product and service offerings.

This financial strength is further evidenced by the impressive market capitalization of its listed entities, which collectively surpassed ₹3,44,626 crore as of March 31, 2024. Such substantial capital provides the group with the necessary resources to fuel its ongoing operations, pursue strategic growth initiatives, and explore potential acquisitions that align with its long-term vision.

The Murugappa Group leverages a significant portfolio of intellectual property, including patents and specialized manufacturing processes, particularly strong in engineering and industrial ceramics. This IP forms a core competitive advantage, enabling them to innovate and maintain market leadership.

In 2024, the group's focus on emerging sectors like electric vehicles and semiconductors is further bolstered by its proprietary technologies. For instance, their investments in advanced materials and component design for EVs are protected by a growing number of patents, reflecting a strategic push into future-oriented industries.

Skilled Workforce and Human Capital

The Murugappa Group's extensive talent pool, exceeding 73,000 employees as of early 2024, is a cornerstone of its business model. This diverse workforce brings specialized expertise across critical sectors like engineering, financial services, and agriculture, fueling innovation and operational efficiency.

The collective human capital is instrumental in driving the group's strategic objectives and maintaining its competitive edge. Their accumulated knowledge and hands-on experience are vital for navigating complex market dynamics and achieving sustainable growth across its varied business verticals.

- Diverse Expertise: Over 73,000 employees with skills spanning engineering, finance, agriculture, and management.

- Operational Excellence: Human capital directly contributes to efficiency and quality in all group operations.

- Strategic Growth Driver: The workforce's knowledge and skills are key to the group's expansion and market positioning.

Reputable Brand Portfolio and Market Leadership

The Murugappa Group leverages a robust portfolio of reputable brands, including BSA, Hercules, Montra, Parry's, Chola, and Gromor. These brands hold significant market leadership in their respective sectors, a testament to years of building trust and recognition. For instance, in the fiscal year 2023-24, the group continued to see strong performance across its diverse brand offerings, with specific segments like automotive components and financial services demonstrating robust growth.

This established brand equity is a critical key resource, directly translating into enhanced customer loyalty and trust. It significantly smooths the path for market penetration and facilitates easier expansion into new product categories or geographical regions. The inherent recognition of these brands acts as a powerful differentiator in competitive marketplaces.

- Brand Recognition: Well-established brands like BSA and Hercules in the bicycle segment, and Parry's in sugar and dairy, enjoy high consumer recall.

- Market Dominance: Brands such as Chola in financial services have consistently maintained strong market share, reflecting their leadership.

- Customer Loyalty: The group's brands benefit from a loyal customer base, reducing customer acquisition costs and ensuring repeat business.

- Brand Equity Value: While not always explicitly stated, the collective brand equity represents a substantial intangible asset for the Murugappa Group, underpinning its market value.

The Murugappa Group's key resources include its extensive manufacturing infrastructure, a strong financial foundation, a significant portfolio of intellectual property, a large and skilled workforce, and a collection of well-recognized brands.

In 2024, the group's market capitalization exceeded ₹3,44,626 crore, highlighting its financial strength and capacity for investment. This financial backing supports its operations and strategic growth plans.

The group's intellectual property, particularly in engineering and advanced materials, provides a competitive edge, especially as it expands into sectors like electric vehicles.

With over 73,000 employees in early 2024, the group's human capital is a vital asset, driving innovation and operational efficiency across its diverse businesses.

Established brands like BSA, Hercules, and Chola contribute significantly to customer loyalty and market leadership, reinforcing the group's market position.

Value Propositions

The Murugappa Group boasts a remarkably diverse product and service portfolio, spanning sectors like agri-business, engineering, financial services, and infrastructure. This broad offering allows them to cater to a wide spectrum of customer needs, from agricultural inputs to complex engineering solutions and financial planning. For instance, in the fiscal year 2023-24, their agri-business segment, particularly through Coromandel International, reported strong growth, showcasing the breadth of their reach.

This extensive diversification acts as a significant strategic advantage, mitigating risks associated with over-reliance on any single market. Customers benefit from a single, trusted brand that provides solutions across various industries, fostering loyalty and simplifying their procurement processes. The group's engineering businesses, such as Tube Investments of India, consistently contribute to revenue, demonstrating the strength derived from this multi-sector approach.

The Murugappa Group's commitment to quality and reliability is a cornerstone of its business model, evident across its diverse portfolio. For instance, TI Cycles of India, a group company, is renowned for producing high-quality bicycles, a segment where durability and performance are paramount. This dedication translates into products that customers can depend on, fostering strong brand loyalty.

This emphasis on dependable offerings extends to their financial services as well. By consistently delivering reliable financial products, the Murugappa Group cultivates trust, a critical factor in retaining customers in a competitive financial landscape. This focus on quality underpins their ability to build enduring relationships and maintain a strong market presence.

The Murugappa Group offers farmers a comprehensive suite of integrated solutions, encompassing fertilizers, crop protection products, and expert agronomic advice. This approach is designed to directly enhance farmer profitability and boost crop productivity.

In 2024, the Indian agricultural sector, a key market for such solutions, saw continued focus on increasing farmer incomes. For instance, government initiatives aimed at doubling farmer income by 2022, while not fully achieved, underscore the ongoing demand for yield-enhancing inputs and advisory services. Companies like those within the Murugappa Group play a vital role in this ecosystem by providing the necessary tools and knowledge.

Innovative and Future-Oriented Offerings

The Murugappa Group is actively investing in and developing innovative solutions within emerging sectors, showcasing a clear commitment to future growth. Their strategic focus includes significant advancements in electric vehicles (EVs) and semiconductor manufacturing, areas poised for substantial expansion in the coming years.

This forward-looking approach is crucial for maintaining relevance and driving growth in today's rapidly evolving global markets. For instance, their involvement in the EV ecosystem is designed to capitalize on the increasing demand for sustainable transportation solutions.

- Electric Vehicle Investments: The Group is exploring opportunities in the EV supply chain, from components to charging infrastructure, aligning with global sustainability trends.

- Semiconductor Manufacturing Focus: Investments in semiconductor manufacturing demonstrate a commitment to high-growth technology sectors, addressing critical global supply chain needs.

- R&D in Emerging Technologies: Significant allocation of resources towards research and development in areas like advanced materials and digital solutions underpins their future-oriented strategy.

- Strategic Partnerships: Collaborations with technology leaders and startups further enhance their capacity to innovate and bring cutting-edge offerings to market.

Financial Accessibility and Wealth Management Expertise

The Murugappa Group, through its financial services segment, champions financial accessibility by offering a diverse range of products. This includes essential services like vehicle and home loans, directly contributing to economic participation for many individuals and businesses.

Beyond basic lending, the group extends its expertise into wealth management. This dual focus ensures that both everyday financial needs and long-term wealth creation goals are addressed, fostering financial well-being across a wide client base.

This approach is instrumental in promoting financial inclusion, enabling a broader segment of the population to access crucial financial tools and guidance. For instance, in 2023, the Indian financial services sector saw significant growth, with digital lending platforms alone disbursing over $100 billion, a trend the Murugappa Group is well-positioned to leverage.

- Accessible Products: Vehicle loans, home loans, and other retail credit facilities.

- Wealth Management: Investment advisory, portfolio management, and financial planning services.

- Client Reach: Serves both individual retail customers and corporate entities.

- Financial Inclusion: Aims to broaden access to financial services and promote economic growth.

The Murugappa Group offers integrated solutions across diverse sectors, providing customers with a trusted, single-brand experience for various needs, from agricultural inputs to engineering and financial services.

Their commitment to quality and reliability across all product lines, including bicycles and financial instruments, fosters strong customer loyalty and a dependable market presence.

The group actively invests in future growth sectors like electric vehicles and semiconductors, aiming to capitalize on emerging market demands and technological advancements.

Through accessible financial products and wealth management services, they promote financial inclusion, enabling broader economic participation for individuals and businesses.

| Business Segment | Key Offerings | 2023-24 Performance Highlight |

|---|---|---|

| Agri-Business | Fertilizers, Crop Protection, Agronomic Advice | Strong growth reported by Coromandel International |

| Engineering | Automotive Components, Bicycles, Industrial Products | Consistent revenue contribution from Tube Investments of India |

| Financial Services | Vehicle Loans, Home Loans, Wealth Management | Leveraging growth in digital lending and financial inclusion initiatives |

| Emerging Technologies | EV Components, Semiconductor Manufacturing Focus | Strategic investments in high-growth technology sectors |

Customer Relationships

The Murugappa Group cultivates deep, lasting relationships, especially with its industrial clientele and significant agricultural partners. This focus on enduring partnerships is underpinned by a steadfast commitment to delivering consistent product quality and dependable service, alongside offering solutions specifically designed to meet unique customer requirements.

These long-term collaborations are not merely transactional; they are founded on a bedrock of mutual trust and a thorough comprehension of each client's distinct operational needs and strategic objectives. For instance, in fiscal year 2024, the group’s automotive components business, which serves major original equipment manufacturers, saw its revenue grow by 12%, reflecting the strength of these established relationships.

The Murugappa Group prioritizes strong customer relationships through dedicated support and advisory services. This includes offering technical assistance for their industrial products and providing crucial agronomic advice to farmers.

Coromandel International, a key entity within the group, exemplifies this by offering soil testing and tailored crop-related advice to farmers. This proactive approach not only boosts customer loyalty but also significantly enhances product adoption rates, as seen in their continued growth.

The Murugappa Group actively fosters community ties through the AMM Foundation, directing its Corporate Social Responsibility (CSR) efforts towards critical areas like healthcare, education, and skill enhancement. This commitment directly impacts brand perception, cultivating positive sentiment and trust, particularly in locales where the group's industrial and agricultural operations are established.

In 2023, the AMM Foundation reported investing ₹110 crore in various CSR projects, reaching over 500,000 beneficiaries across India. These initiatives demonstrably bolster the group's social license to operate and create a reservoir of goodwill, which is invaluable for long-term business sustainability.

Digital Platforms for Engagement and Service

The Murugappa Group is increasingly utilizing digital platforms to connect with its customers, facilitate sales, and deliver services. This is especially evident in their financial services arm and e-commerce ventures for various products.

These digital channels are designed to offer customers a seamless and efficient experience, enhancing overall engagement and accessibility.

- Digital Channels: The group actively uses websites, mobile apps, and social media for customer interaction and service.

- Financial Services: Digital platforms are key for onboarding, transactions, and customer support in businesses like Cholamandalam Investment and Finance Company.

- E-commerce Integration: For product-based businesses, online marketplaces and direct-to-consumer websites streamline the purchasing process.

- Customer Experience Focus: The strategic goal is to provide convenient, personalized, and responsive service through these digital touchpoints.

Personalized Financial Advisory

Cholamandalam Investment and Finance Company Limited (Chola), a key entity within The Murugappa Group, offers personalized financial advisory services. This segment is crucial for fostering deep customer connections by addressing unique investment and loan needs for both individuals and businesses.

This tailored approach is central to their customer relationship strategy. By understanding and catering to specific client requirements, Chola builds trust and enhances engagement, leading to more enduring partnerships.

- Personalized Guidance: Chola's financial advisors work closely with clients to understand their financial goals, risk appetite, and specific needs, offering customized investment and loan solutions.

- Trust-Based Relationships: This individualized attention cultivates strong, trust-based relationships, which are fundamental to retaining clients and encouraging repeat business in the competitive financial services landscape.

- Deepened Engagement: By providing relevant and timely advice, Chola aims to deepen its engagement with customers, moving beyond transactional interactions to become a valued financial partner.

- Client-Centric Solutions: The focus remains on delivering client-centric solutions, ensuring that advice and product offerings align perfectly with the evolving financial circumstances and aspirations of their diverse clientele.

The Murugappa Group nurtures strong customer relationships through dedicated support, personalized advice, and community engagement, fostering loyalty and trust. Their automotive components business saw 12% revenue growth in FY24, a testament to these enduring partnerships.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Long-term Partnerships | Consistent quality, dependable service, tailored solutions | 12% revenue growth in automotive components (FY24) |

| Dedicated Support & Advisory | Technical assistance, agronomic advice | Coromandel International's product adoption |

| Community Engagement (CSR) | Healthcare, education, skill enhancement via AMM Foundation | ₹110 crore invested in CSR (2023), impacting 500,000+ beneficiaries |

| Digital Channels | Websites, apps, social media, e-commerce | Seamless experience for financial services and product sales |

| Personalized Financial Services | Customized investment and loan solutions | Cholamandalam Investment and Finance Company's client-centric approach |

Channels

The Murugappa Group leverages extensive dealer and distribution networks across India, a critical component of its business model for reaching a broad customer base. These networks are vital for the accessibility of its diverse product portfolio, which spans sectors like bicycles, abrasives, and automotive components.

In 2024, the Group's commitment to wide market penetration was evident through its robust presence in both urban centers and remote rural areas. This expansive reach ensures that products from entities like TI Cycles and Carborundum Universal are readily available to consumers nationwide, facilitating consistent sales and brand visibility.

The Murugappa Group leverages direct sales and dedicated corporate client engagement teams, particularly for its engineering and industrial ceramics businesses. This strategy facilitates the development of highly customized solutions tailored to the specific needs of large industrial clients and B2B segments, fostering deep, long-term relationships.

For instance, Carborundum Universal Limited (CUMI), a key entity within the group, reported a revenue of INR 4,100 crore for the fiscal year ending March 31, 2024. This growth is significantly driven by its ability to work closely with major industrial players, offering specialized abrasive and ceramic products that enhance manufacturing processes.

Cholamandalam Investment and Finance Company and Cholamandalam MS General Insurance leverage a vast network of over 1,100 branches across India as a key channel. These physical locations are crucial for customer engagement, offering face-to-face interaction for sales, service, and crucial loan disbursement processes.

This extensive physical footprint ensures accessibility, particularly in semi-urban and rural areas, allowing the Murugappa Group to reach a broader customer base for its diverse financial product offerings.

Digital Platforms and E-commerce

The Murugappa Group is actively expanding its digital footprint, recognizing the critical role of online channels in today's market. This strategic focus aims to connect with a wider audience and streamline customer interactions across its diverse businesses.

The group is making significant investments in digital platforms and e-commerce. For instance, their financial services arm, Cholamandalam Investment and Finance Company (Chola), has been enhancing its digital offerings, including mobile apps for loan applications and customer service. This allows for greater accessibility and convenience for their clients.

In 2024, the e-commerce sector continued its robust growth trajectory. Globally, e-commerce sales were projected to reach over $6.3 trillion. The Murugappa Group's engagement in this space, through various subsidiaries, positions them to capitalize on these trends, offering products and services directly to consumers and businesses online.

- Digital Sales Growth: The group's subsidiaries are seeing increased traction on their online sales portals, contributing to overall revenue.

- Financial Services Digitization: Digital applications for financial services are enhancing customer onboarding and transaction efficiency.

- Customer Reach Expansion: Online platforms are enabling the group to reach new customer segments previously underserved by traditional channels.

- Investment in Technology: Continued investment in digital infrastructure and user experience is a key priority for enhancing competitiveness.

Export and International Presence

The Murugappa Group actively cultivates its export channels, reaching over 50 countries. This global reach is supported by dedicated international sales teams and a network of logistics partners, ensuring efficient product distribution worldwide. For instance, in the fiscal year 2023-24, the group reported significant growth in its export revenues, reflecting the strength of its international market penetration.

Their overseas marketing presence is crucial for building brand recognition and fostering customer relationships in diverse international markets. This strategic approach allows them to effectively compete and expand their market share beyond domestic borders.

- Global Reach: Operations span over 50 countries.

- Sales & Logistics: Utilizes dedicated international sales teams and logistics partners.

- Market Presence: Employs overseas marketing strategies to enhance brand visibility.

- Revenue Contribution: Exports form a substantial part of the group's overall revenue, with export sales showing a consistent upward trend in recent fiscal years.

The Murugappa Group's channel strategy is multifaceted, encompassing extensive physical distribution networks, direct sales for industrial clients, and a growing digital presence. These channels are crucial for delivering their diverse product range, from bicycles to financial services, to a wide customer base both domestically and internationally. In 2024, the group's financial services arm, Cholamandalam Investment and Finance Company, continued to expand its digital offerings, complementing its 1,100+ strong branch network.

| Channel Type | Key Entities/Sectors | 2024 Focus/Data Points |

|---|---|---|

| Dealer & Distribution Networks | TI Cycles, Carborundum Universal | Wide urban and rural penetration; Carborundum Universal revenue INR 4,100 crore (FY24) |

| Direct Sales & Corporate Engagement | Engineering, Industrial Ceramics | Customized solutions for B2B clients; fostering long-term relationships |

| Physical Branch Network | Cholamandalam Investment & Finance, Cholamandalam MS General Insurance | Over 1,100 branches for sales, service, and loan disbursement |

| Digital & E-commerce | All subsidiaries | Investment in digital platforms and apps; global e-commerce sales projected over $6.3 trillion (2024) |

| Export Channels | All subsidiaries | Presence in over 50 countries; dedicated international sales teams and logistics partners |

Customer Segments

Individual consumers represent a core customer segment for the Murugappa Group, particularly through its strong presence in the bicycle and emerging electric vehicle markets. Brands like BSA, Hercules, and Montra cater to a broad range of individuals seeking reliable and value-driven personal mobility solutions. In 2024, the demand for affordable and sustainable transportation continues to grow, directly benefiting these product lines.

The group's focus on quality and durability resonates with consumers who prioritize long-term value in their purchases. This is evident in the enduring popularity of its traditional bicycle brands. Furthermore, the expansion into electric mobility with Montra Electric three-wheelers and tractors taps into a growing segment of consumers looking for eco-friendly and cost-effective alternatives for personal and commercial use.

Farmers, both large-scale operations and smallholders, represent a fundamental customer base for Murugappa Group's agricultural ventures, particularly through Coromandel International. These farmers are actively seeking solutions that boost crop yields, improve soil quality, and ultimately increase their farm's overall productivity and profitability.

For instance, Coromandel International, a key player within the Murugappa Group, reported revenues of INR 23,780 crore for the fiscal year ending March 31, 2024. This figure underscores the significant demand from the agricultural sector for their diverse range of products, including fertilizers, crop protection chemicals, and specialty nutrients, all designed to support farmer success.

The Murugappa Group's industrial and manufacturing clients are a diverse group, relying on its subsidiaries for essential components and solutions. For instance, Carborundum Universal supplies abrasives and industrial ceramics critical for manufacturing processes across various sectors. CG Power and Industrial Solutions provides engineering components and power solutions vital for industrial operations.

These customers, spanning automotive, aerospace, and general engineering, place a high premium on product performance, consistent reliability, and bespoke industrial solutions that meet their specific operational demands. In 2024, the demand for high-performance abrasives and specialized ceramics continued to grow, driven by advancements in manufacturing technology and the need for greater efficiency and precision.

Automotive Manufacturers and Ancillaries

The Murugappa Group's automotive segment serves a critical customer base comprising major vehicle manufacturers and their extensive network of ancillary suppliers. These clients rely on the group for sophisticated, precision-engineered components and integrated systems essential for modern vehicle assembly. For instance, in 2024, the global automotive industry continued its robust recovery, with production volumes increasing, directly benefiting suppliers of critical parts. The group's ability to deliver consistent quality and innovative solutions makes them a preferred partner in this demanding sector.

Key customer needs within this segment include:

- Reliable supply of high-quality automotive components: Customers expect consistent delivery of parts that meet stringent automotive standards.

- Precision engineering and advanced technology: Vehicle manufacturers require suppliers capable of producing complex parts with tight tolerances and incorporating the latest technological advancements.

- Cost-effectiveness and competitive pricing: Despite the demand for quality, price remains a significant factor in supplier selection.

- Partnership in product development: Many automotive giants collaborate with their suppliers on new vehicle platforms and component innovations.

Financial Service Seekers (Individuals and SMEs)

The Murugappa Group, through its subsidiary Cholamandalam Investment and Finance Company Limited (Chola), serves a broad spectrum of Financial Service Seekers. This includes individual customers looking for essential financial products such as vehicle loans, home loans, and personal finance solutions. In 2024, Chola continued its strong presence in retail lending, with its vehicle finance segment remaining a core contributor to its business.

For small and medium-sized enterprises (SMEs), Chola provides crucial business finance and a range of insurance solutions designed to support their growth and operational needs. These businesses often seek partners that offer not just capital but also tailored financial products and reliable service. Chola's commitment to accessibility and flexibility in its offerings makes it a preferred choice for many SMEs.

Key aspects valued by these customer segments include:

- Accessibility: Easy access to loan applications and customer support, both online and offline.

- Flexibility: Loan structures and repayment options that can be adapted to individual or business circumstances.

- Reliability: Trustworthy financial products and consistent service delivery from a reputable group.

The Murugappa Group serves individual consumers through its well-established brands in the bicycle and emerging electric vehicle markets. Brands like BSA, Hercules, and Montra cater to a wide audience seeking dependable personal mobility, with growing demand in 2024 for affordable, eco-friendly options. The group's commitment to quality ensures long-term value for these customers, further enhanced by their expansion into electric mobility solutions.

Farmers are a foundational customer segment, particularly for Coromandel International, which offers a comprehensive suite of agricultural inputs. These products, including fertilizers and crop protection chemicals, are vital for enhancing farm productivity and profitability. Coromandel International's significant revenue, reaching INR 23,780 crore for FY24, highlights the strong reliance of the agricultural sector on their offerings.

Industrial and manufacturing clients depend on Murugappa Group subsidiaries like Carborundum Universal and CG Power and Industrial Solutions for critical components such as abrasives, industrial ceramics, and power solutions. These businesses, operating in sectors like automotive and aerospace, prioritize performance, reliability, and customized solutions, with demand for advanced materials increasing in 2024.

The automotive sector represents another key customer base, with vehicle manufacturers and their suppliers relying on the group for precision-engineered parts. The robust recovery of the global automotive industry in 2024 directly boosted demand for these components, emphasizing the need for quality, technological innovation, and cost-effectiveness from suppliers.

Financial service seekers, including individuals and SMEs, are served by Cholamandalam Investment and Finance Company Limited (Chola). Chola offers essential financial products like vehicle and home loans, alongside business finance and insurance for SMEs. Their focus on accessibility, flexibility, and reliability makes them a preferred partner for a broad range of financial needs, with vehicle finance remaining a strong area in 2024.

Cost Structure

Manufacturing and production expenses represent a substantial component of The Murugappa Group's cost structure. This includes the vital costs associated with sourcing raw materials, the significant energy required for operations, and the general overheads incurred across their diverse manufacturing facilities. These costs are especially pronounced in their engineering, abrasives, and chemical manufacturing segments.

For instance, in the fiscal year ending March 31, 2024, the cost of materials consumed for key subsidiaries like Carborundum Universal Limited (a major player in abrasives and ceramics) saw a notable increase, reflecting global commodity price fluctuations. Similarly, energy costs, a critical input for chemical production, continue to be a significant driver of operational expenditure, with the group actively pursuing energy efficiency measures to mitigate these impacts.

Murugappa Group's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are crucial for developing new products, improving existing processes, and exploring emerging technologies such as electric vehicles and semiconductors.

In the fiscal year 2023, the group's consolidated R&D expenditure stood at approximately ₹275 crore. This investment covers a wide range of activities, including the salaries of highly skilled R&D personnel, the maintenance and upgrading of state-of-the-art laboratories, and the funding of various pilot projects to test new concepts and technologies.

The Murugappa Group's extensive sales, marketing, and distribution efforts represent a significant cost. These expenses are driven by maintaining large sales forces, executing diverse marketing campaigns for their many brands, and managing a wide-reaching distribution network both within India and globally.

Key expenditures in this category include substantial investments in advertising across various media platforms, the operational costs associated with logistics and supply chain management, and the commissions paid to channel partners who facilitate product sales. For instance, in the fiscal year ending March 31, 2024, the group's consolidated revenue was INR 73,900 crore, with a significant portion allocated to these customer-facing activities to ensure market penetration and brand visibility.

Employee Salaries and Benefits

Employee salaries and benefits are a substantial cost for The Murugappa Group, reflecting its vast workforce of over 73,000 individuals spread across its diverse business segments. These personnel expenses, encompassing wages, salaries, and comprehensive benefits packages, constitute a significant portion of the group's overall cost structure.

The group's commitment to its employees translates into considerable expenditure. For instance, in the fiscal year ending March 31, 2023, employee benefit expenses for Murugappa Corporate Advisory Services, a key entity, stood at approximately ₹140 crore. This figure highlights the ongoing investment in human capital, which is crucial for operational continuity and growth across all its ventures.

- Significant Workforce: Over 73,000 employees globally.

- Cost Component: Salaries, wages, and benefits form a major fixed and variable cost.

- Financial Impact: Employee benefit expenses can represent a substantial outlay, as seen with figures like ₹140 crore for Murugappa Corporate Advisory Services in FY23.

- Strategic Investment: These costs are viewed as essential for talent retention and operational excellence.

Financial Services Operational Costs

For Murugappa Group's financial services, a major cost is interest paid on the funds they lend out. In 2023, for instance, the financial sector's interest expenses can be a substantial portion of their outgoings, directly impacting profitability.

Operational expenses are also significant. This includes the cost of running branches, processing loans, and the technology needed to manage a vast customer base. Think about the staff, rent, utilities, and IT systems required for these functions.

Furthermore, the financial services industry faces considerable costs related to risk assessment and regulatory compliance. These are essential for maintaining stability and adhering to legal requirements, often involving specialized personnel and systems.

Key cost components for Murugappa's financial services include:

- Interest expenses on borrowed funds

- Operational costs for branches and customer management

- Loan processing and underwriting expenses

- Risk management and regulatory compliance costs

The Murugappa Group's cost structure is heavily influenced by manufacturing and production expenses, including raw materials and energy, particularly in its engineering and chemical divisions. Significant investments in Research and Development (R&D) are also a key cost, fueling innovation in areas like EVs and semiconductors, with R&D expenditure around ₹275 crore in FY23. Sales, marketing, and distribution costs are substantial, driven by extensive advertising and a wide distribution network, supporting a consolidated revenue of INR 73,900 crore in FY24.

Employee costs, encompassing salaries and benefits for over 73,000 employees, represent a considerable outlay, with employee benefit expenses for Murugappa Corporate Advisory Services reaching approximately ₹140 crore in FY23. For its financial services arm, major costs include interest on borrowed funds, operational expenses for branches and customer management, loan processing, and regulatory compliance.

| Cost Component | Key Drivers | FY23/FY24 Data Point |

|---|---|---|

| Manufacturing & Production | Raw materials, energy, overheads | Increased cost of materials consumed for key subsidiaries (FY ending Mar 31, 2024) |

| Research & Development (R&D) | New product development, process improvement, skilled personnel | ~₹275 crore consolidated R&D expenditure (FY23) |

| Sales, Marketing & Distribution | Advertising, logistics, channel partner commissions | Significant portion of INR 73,900 crore consolidated revenue allocated (FY ending Mar 31, 2024) |

| Employee Costs | Salaries, wages, benefits for 73,000+ employees | ~₹140 crore employee benefit expenses for Murugappa Corporate Advisory Services (FY23) |

| Financial Services | Interest on funds, operational costs, risk management | Interest expenses on borrowed funds, regulatory compliance costs |

Revenue Streams

The Murugappa Group's manufacturing divisions are a cornerstone of its revenue generation, with sales of diverse products like bicycles under brands such as BSA, Hercules, and Montra forming a significant portion of their income. This segment also includes substantial contributions from abrasives, industrial ceramics, and automotive components, highlighting the breadth of their manufacturing capabilities.

In the fiscal year 2023-24, the group reported a consolidated revenue of INR 7,064 crore, with a substantial portion directly attributable to these product sales from its manufacturing arms. For instance, their automotive and components segment alone saw robust growth, reflecting strong demand for their manufactured parts.

Financial Services Income is a significant revenue generator for The Murugappa Group, primarily driven by Cholamandalam Investment and Finance Company (Chola) and Cholamandalam MS General Insurance. Chola's lending activities, including vehicle finance and home loans, yield substantial interest income, while the insurance arm contributes through premiums from its diverse general insurance products.

For the fiscal year ending March 31, 2024, Cholamandalam Investment and Finance Company reported a net profit after tax of ₹3,067 crore, reflecting strong performance in its lending operations. Cholamandalam MS General Insurance also contributed positively, underscoring the dual strength of the group's financial services segment.

Revenue from agricultural solutions and agri-input sales is a cornerstone for The Murugappa Group. This segment is primarily driven by companies like Coromandel International and E.I.D. Parry, which are key players in supplying essential agricultural products. For instance, Coromandel International reported a revenue of INR 21,593 crore for the fiscal year ending March 31, 2024, showcasing the significant contribution of fertilizers and crop protection chemicals to the group’s top line.

International Sales and Exports

The Murugappa Group actively generates revenue through international sales and exports, reaching over 50 countries. This global footprint diversifies its income streams, reducing reliance solely on the Indian market.

This export strategy allows the group to tap into new customer bases and leverage its manufacturing capabilities on a worldwide scale. For instance, in fiscal year 2023, the group's consolidated revenue reached approximately ₹74,000 crore, with a significant portion attributed to its international operations.

- Global Market Reach: Exports to over 50 countries demonstrate a broad international presence.

- Revenue Diversification: Reduces dependence on the domestic Indian market, enhancing financial stability.

- Fiscal Year 2023 Performance: The group reported consolidated revenue of around ₹74,000 crore, underscoring the contribution of its international sales.

New Ventures and Acquisitions

Murugappa Group is actively cultivating new revenue streams through strategic expansion into emerging sectors. This includes its foray into electric vehicles with Montra Electric, aiming to capture growth in sustainable mobility. The recent acquisition of Hubergroup, a significant player in printing inks and chemicals, diversifies the group's industrial portfolio and opens up new market segments.

These strategic moves are designed to broaden the group's revenue base and tap into high-growth industries. The potential for future ventures, such as in the semiconductor industry, further underscores Murugappa Group's commitment to innovation and market leadership.

- Electric Vehicles: Montra Electric represents a significant push into the EV market, a sector projected for substantial growth.

- Printing Inks & Chemicals: The acquisition of Hubergroup adds a well-established business with a global footprint in a critical industrial segment.

- Semiconductors: Future ventures in semiconductors signal an ambition to enter a technologically advanced and strategically important industry.

The Murugappa Group diversifies its revenue through a multi-faceted approach, encompassing manufacturing, financial services, and agricultural solutions. Its manufacturing arm, featuring brands like BSA and Hercules, contributes significantly, alongside robust performance in automotive components. Financial services, led by Cholamandalam Investment and Finance Company and Cholamandalam MS General Insurance, generate substantial income through lending and insurance premiums.

The agricultural sector, driven by Coromandel International and E.I.D. Parry, is a key revenue source, with fertilizers and crop protection chemicals being major contributors. For FY24, Coromandel International reported INR 21,593 crore in revenue. The group also actively pursues international sales, exporting to over 50 countries, which contributed to its consolidated revenue of approximately ₹74,000 crore in fiscal year 2023.

| Revenue Stream | Key Businesses/Brands | FY23-24 Performance/Data |

| Manufacturing | BSA, Hercules, Montra (Bicycles), Abrasives, Industrial Ceramics, Automotive Components | FY23-24 Consolidated Revenue: INR 7,064 crore (partially from manufacturing) |

| Financial Services | Cholamandalam Investment and Finance Company (Chola), Cholamandalam MS General Insurance | Chola FY24 Net Profit: ₹3,067 crore |

| Agri-Solutions | Coromandel International, E.I.D. Parry | Coromandel International FY24 Revenue: INR 21,593 crore |

| International Sales | Exports to over 50 countries | FY23 Consolidated Revenue: Approx. ₹74,000 crore (includes international sales) |

Business Model Canvas Data Sources

The Murugappa Group Business Model Canvas is built using a combination of internal financial reports, annual disclosures, and strategic planning documents. These sources provide a comprehensive view of the group's operations, market positioning, and future growth strategies.