The Murugappa Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

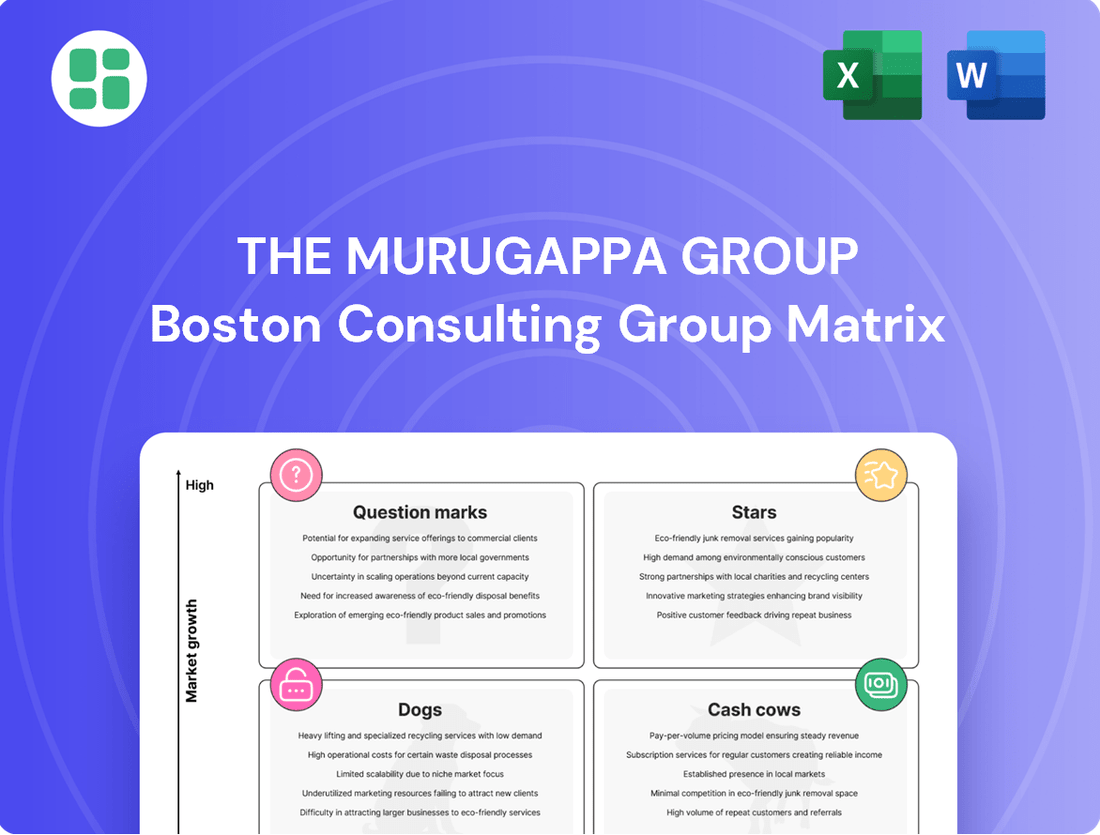

Uncover the strategic positioning of the Murugappa Group's diverse business units with our comprehensive BCG Matrix analysis. See which ventures are fueling growth and which require a closer look to optimize performance.

This preview offers a glimpse into the Murugappa Group's market standing, but the full BCG Matrix report unlocks a treasure trove of data-driven insights. Gain a clear understanding of their Stars, Cash Cows, Dogs, and Question Marks to make informed investment decisions.

Ready to transform your strategic outlook? Purchase the complete Murugappa Group BCG Matrix for actionable recommendations and a visual roadmap to navigating their business landscape effectively.

Stars

The Murugappa Group's investment in electric vehicles via TI Clean Mobility is a clear Star. This sector is experiencing rapid expansion, fueled by the Indian auto component market's anticipated growth and a significant uptick in electric vehicle adoption.

TI Clean Mobility is positioned for success in this dynamic environment. The group's strategic objective to achieve $1 billion in EV revenue by 2029 underscores its dedication to becoming a dominant player in the burgeoning electric mobility landscape.

Cholamandalam Investment and Finance Company Limited (Chola) is a Star in the Murugappa Group's BCG Matrix, showcasing both high market share and robust growth in India's financial services landscape. For the fiscal year 2024, Chola reported a remarkable 49% surge in net sales, underscoring its strong performance and significant contribution to the group's financial health.

This stellar performance is bolstered by the dynamic Indian financial services sector, which is currently experiencing accelerated expansion. Factors like rising disposable incomes and increasing digital penetration are fueling this growth, creating an environment where Chola is well-positioned to maintain and enhance its market leadership.

Tube Investments of India's (TII) Engineering segment, a core part of the Murugappa Group, is a strong player in a booming sector. Indian engineering goods exports hit an impressive USD 100 billion in FY24-25, highlighting the sector's dynamism.

TII's expertise in critical engineered solutions, such as specialized metal components and industrial chains, positions it well. The company commands a substantial market share in these areas, benefiting from the overall positive growth trajectory of the Indian engineering industry.

Strategic investments and a focused approach are key to TII's sustained leadership in this high-growth market. This segment's performance is a testament to TII's ability to capitalize on market opportunities and maintain its competitive edge.

Abrasives & Electrominerals (Carborundum Universal - CUMI)

Carborundum Universal (CUMI) is a prominent Star in the abrasives and electrominerals sector, a market benefiting from India's robust manufacturing and infrastructure expansion. This segment is characterized by consistent demand and ongoing technological advancements.

CUMI's performance in fiscal year 2025 highlights its strength, with notable growth reported in its electrominerals and advanced ceramics divisions. This indicates a healthy trajectory for its key product lines.

- Market Growth: The abrasives and electrominerals market in India is expanding due to increased industrial activity and infrastructure development.

- CUMI's Performance: CUMI reported growth in its electrominerals and ceramics segments in FY25, underscoring its strong market position.

- Competitive Edge: CUMI's established market presence and commitment to innovation in product development solidify its leadership in this growing industry.

Specialty Chemicals & Print Solutions (Hubergroup India)

Following the strategic acquisition of Hubergroup in late 2024, the specialty chemicals and print solutions business, particularly Hubergroup India, is positioned as a Star within the Murugappa Group's BCG Matrix. Hubergroup India already commands a substantial 30% market share, underscoring its robust leadership in a high-growth sector.

This expansion into specialty chemicals and print solutions through Hubergroup signifies Murugappa Group's ambition to broaden its global reach. The acquired entity's established expertise in a market ripe for strategic growth opportunities provides a strong foundation for future value creation.

- Hubergroup India's 30% market share highlights its dominant position in the specialty chemicals and print solutions market.

- The late 2024 acquisition of Hubergroup by Murugappa Group is a key strategic move.

- This segment is identified as a Star due to its high market share and the attractive growth prospects of the industry.

- The acquisition enables Murugappa Group to enhance its global presence and leverage Hubergroup's specialized knowledge.

TI Clean Mobility is a Star, capitalizing on India's burgeoning EV market, which is projected for significant growth. The group's ambitious target of $1 billion in EV revenue by 2029 demonstrates a strong commitment to this high-growth sector.

Cholamandalam Investment and Finance Company Limited (Chola) shines as a Star, driven by a 49% net sales increase in FY24 and the overall expansion of India's financial services sector. This segment benefits from rising incomes and increased digital adoption.

Tube Investments of India's (TII) Engineering segment is a Star, riding the wave of India's engineering goods exports, which reached USD 100 billion in FY24-25. TII's strong market share in specialized components fuels its stellar performance.

Carborundum Universal (CUMI) is a Star in the abrasives and electrominerals space, supported by India's infrastructure boom. Its FY25 performance shows healthy growth in electrominerals and advanced ceramics.

Hubergroup India, following its late 2024 acquisition, is a Star in specialty chemicals and print solutions, boasting a 30% market share in a rapidly expanding industry.

| Business Unit | BCG Category | Key Growth Drivers | Recent Performance Highlight |

| TI Clean Mobility | Star | EV adoption, Indian auto component market growth | Targeting $1 billion EV revenue by 2029 |

| Cholamandalam Investment and Finance Company (Chola) | Star | Rising disposable incomes, digital penetration in financial services | 49% net sales surge in FY24 |

| Tube Investments of India (TII) - Engineering | Star | Growth in engineering goods exports, industrial activity | Strong market share in specialized metal components and industrial chains |

| Carborundum Universal (CUMI) | Star | Manufacturing and infrastructure expansion, technological advancements | Growth in electrominerals and advanced ceramics in FY25 |

| Hubergroup India (Specialty Chemicals & Print Solutions) | Star | Expansion in specialty chemicals, strategic acquisition benefits | 30% market share, enhanced global presence |

What is included in the product

This BCG Matrix analysis categorizes Murugappa Group's businesses by market share and growth, guiding investment decisions.

The Murugappa Group BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Its export-ready design allows for quick integration into presentations, easing the burden of visual communication.

Cash Cows

Coromandel International stands as a significant Cash Cow within the Murugappa Group, boasting a commanding presence in India's fertilizer sector. This industry, characterized by maturity, exhibits stable and predictable growth, underpinned by government subsidies and an unwavering demand for agricultural necessities.

The company's robust financial performance in the fiscal year ending March 31, 2024, saw its revenue from operations reach ₹24,044 crore, demonstrating its strong market position. This consistent cash generation allows the Murugappa Group to allocate these funds strategically across its diverse business units or distribute them to shareholders.

Traditional abrasives and ceramics, representing established CUMI products under The Murugappa Group, serve as the company's cash cows. These segments operate in mature markets where CUMI holds a significant market share and enjoys strong brand loyalty, ensuring a steady stream of revenue.

These mature product lines, despite slower growth, are crucial for generating consistent, healthy profit margins and robust cash flow for the broader Murugappa Group. Their established market presence necessitates minimal new investment for promotion, allowing them to contribute significantly to the group's financial stability.

The Murugappa Group's bicycle division, featuring established brands like Hercules, BSA, and Mach City, operates as a classic Cash Cow within their diverse portfolio. This segment benefits from a mature Indian bicycle market where these brands command substantial market share and enjoy deep-rooted consumer trust.

These bicycle businesses consistently generate robust and predictable cash flows. The need for significant reinvestment or aggressive marketing is relatively low, allowing them to efficiently support other, more growth-oriented ventures within the Murugappa Group. For instance, in FY23, the Indian bicycle market saw a moderate growth, and brands like BSA and Hercules maintained their strong presence, contributing steadily to the group's overall financial health.

Sugar (EID Parry)

EID Parry, a significant player in India's sugar industry, is positioned as a Cash Cow within the Murugappa Group's BCG Matrix. This classification stems from the mature nature of the Indian sugar sector, which exhibits stable demand and a well-established competitive landscape.

The company likely commands a substantial and consistent market share, translating into predictable and robust cash flows. While growth prospects in this traditional industry are typically modest, EID Parry's strong market position ensures sustained profitability.

- Stable Demand: The Indian sugar market is characterized by consistent consumer demand, underpinning the mature status of the industry.

- Established Market Share: EID Parry likely holds a significant and stable position among established players, ensuring reliable revenue streams.

- Profitability: Despite lower growth potential, the company's operations are expected to generate strong and consistent profits, a hallmark of a Cash Cow.

- Cash Generation: The mature industry dynamics allow EID Parry to generate substantial cash with relatively lower reinvestment needs.

General Insurance (Cholamandalam MS General Insurance)

Cholamandalam MS General Insurance, a significant player in the financial services sector, operates as a Cash Cow within the Murugappa Group's BCG Matrix. This joint venture benefits from a stable and mature general insurance market, consistently generating substantial cash flow.

The company's performance in 2024 underscores its Cash Cow status. For the fiscal year ending March 31, 2024, Cholamandalam MS General Insurance reported a Gross Written Premium (GWP) of INR 7,167.7 crore, marking a robust growth of 16.1% compared to the previous year. This consistent premium income highlights its strong market presence and ability to generate reliable earnings in a well-established segment.

- Cholamandalam MS General Insurance's GWP reached INR 7,167.7 crore for FY24.

- This represents a 16.1% year-on-year growth, demonstrating strong revenue generation.

- The company operates in the mature general insurance segment, a characteristic of Cash Cows.

- Its stable market presence contributes to consistent cash flow for the Murugappa Group.

Coromandel International, a leader in India's fertilizer sector, exemplifies a Cash Cow for the Murugappa Group. Its operations in a mature industry with stable demand and government support generated ₹24,044 crore in revenue for the fiscal year ending March 31, 2024. This consistent performance ensures a reliable source of funds for the group.

CUMI's traditional abrasives and ceramics business also functions as a Cash Cow. These established product lines benefit from significant market share and brand loyalty, providing steady revenue streams with minimal need for aggressive reinvestment. This stability is vital for the Murugappa Group's financial health.

The Murugappa Group's bicycle division, featuring well-known brands like Hercules and BSA, operates as a classic Cash Cow. In FY23, the Indian bicycle market saw moderate growth, and these brands maintained strong consumer trust and market presence, contributing predictable cash flows that can support other group initiatives.

EID Parry's sugar business is another key Cash Cow. Operating within the mature Indian sugar industry, it benefits from stable demand and a well-established market share, ensuring consistent profitability and substantial cash generation with limited reinvestment requirements.

Cholamandalam MS General Insurance, with its robust performance in the mature general insurance market, is a significant Cash Cow. For FY24, it reported Gross Written Premium of INR 7,167.7 crore, a 16.1% increase year-on-year, highlighting its consistent revenue generation and contribution to the group's financial stability.

| Business Unit | BCG Matrix Category | FY24 Revenue/GWP (INR Crore) | Key Characteristics |

| Coromandel International (Fertilizers) | Cash Cow | 24,044 | Mature industry, stable demand, government support |

| CUMI (Abrasives & Ceramics) | Cash Cow | N/A (Segment data not separately detailed for FY24) | Established market share, brand loyalty, mature segments |

| Murugappa Bicycles (Hercules, BSA) | Cash Cow | N/A (Segment data not separately detailed for FY24) | Mature market, strong brand trust, predictable cash flow |

| EID Parry (Sugar) | Cash Cow | N/A (Segment data not separately detailed for FY24) | Stable demand, established market share, consistent profitability |

| Cholamandalam MS General Insurance | Cash Cow | 7,167.7 (GWP) | Mature market, consistent premium income, strong growth |

What You’re Viewing Is Included

The Murugappa Group BCG Matrix

The Murugappa Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously crafted by strategy experts, will be delivered to you without any watermarks or demo content, ready for immediate strategic application.

Dogs

Within the Murugappa Group's plantation segment, exemplified by Parry Agro Industries, certain niche or underperforming products could be categorized as Dogs. These might include specialized tea or coffee varieties that are struggling due to intense competition, a slump in consumer demand, or adverse market trends. For instance, if a particular single-origin coffee faced a significant price drop in 2024 due to oversupply in a niche market, it would fit this profile.

These products typically command a small market share within a mature or shrinking segment, contributing little to overall profitability. Their low growth and low market share characteristics mean they require careful management to avoid becoming a drain on resources, with little prospect for significant future returns.

Certain legacy industrial components within the Murugappa Group's engineering division could be categorized as Dogs. These are parts designed for industries experiencing a decline or have been made obsolete by newer technologies, where the group's market share is minimal and future growth prospects are dim. For instance, if a significant portion of their engineering revenue in 2024 comes from supplying parts for older, less efficient manufacturing equipment, this segment would likely fall into the Dog category.

Within the Murugappa Group's chemical portfolio, particularly in ventures like the acquired Hubergroup, commoditized chemicals represent a potential Dogs category. These products, characterized by minimal differentiation and low market share, operate in intensely competitive price environments. For instance, a basic industrial chemical produced by the group might see its price fluctuate significantly based on global supply and demand, offering little room for premium pricing.

The thin profit margins inherent in commoditized chemicals mean that even with substantial sales volume, the contribution to overall profitability can be marginal. In 2024, the global market for certain bulk chemicals saw price volatility, with some key commodities experiencing a 10-15% price decrease year-on-year due to oversupply. This environment makes it challenging for these products to generate substantial returns.

These low-margin products can inadvertently absorb valuable resources, including capital for production and management attention, without yielding proportionate returns. If a significant portion of the group's chemical business falls into this category, it could hinder investment in more promising growth areas. For example, a chemical plant dedicated to a commoditized product might operate at low capacity utilization, increasing per-unit costs and further eroding profitability.

Small-Scale, Unfocused Manufacturing Units

The Murugappa Group, a significant Indian conglomerate, likely possesses certain manufacturing units that could be categorized as question marks or even potential dogs within a BCG matrix analysis. These might be older, smaller operations with limited market reach or those struggling in highly competitive, mature industries.

These units often operate in niche or saturated markets where growth is slow, and they may lack the scale or innovation to compete effectively. For instance, a legacy textile unit or a small-scale component manufacturer might fall into this category if it hasn't adapted to modern demands or technological advancements. In 2023, the textile sector in India, while large, saw mixed performance, with some segments facing intense competition and import pressures, impacting smaller players disproportionately.

Such units can drain resources without generating substantial returns. Their contribution to the Murugappa Group's overall revenue and profit might be minimal, potentially requiring significant investment to revitalize or a strategic decision to divest. For example, if a unit’s market share has been declining consistently, say by 5% year-on-year, and its profit margins are below 3%, it would strongly indicate a dog status.

- Limited Market Share: Units operating in highly localized or saturated markets often struggle to gain significant market share, potentially holding less than 10% in their specific segments.

- Low Growth Prospects: These businesses are typically in industries with stagnant or declining growth rates, often below 2% annually.

- Minimal Profitability: They may exhibit low or even negative profit margins, contributing little to the group's bottom line.

- Resource Drain: Such units can consume capital and management attention without offering a clear path to future growth or profitability.

Non-core, Low-Value Added Farm Inputs

Within the Murugappa Group's BCG Matrix, non-core, low-value added farm inputs represent a category that, while potentially part of Coromandel International's broader portfolio, are characterized by their commoditized nature and limited differentiation. These could include basic fertilizers or older product lines that struggle to compete in a crowded market, leading to a low market share within a slow-growing segment.

The profitability of these items is typically modest, especially when contrasted with the higher margins achievable from specialty agri-inputs. For instance, while Coromandel International reported a consolidated revenue of INR 25,000 crore for the fiscal year ending March 31, 2024, a significant portion of this is driven by their more advanced and differentiated product offerings, leaving the low-value inputs as a smaller contributor to overall profitability.

- Low Market Share: These products often hold a minor position in their respective market segments.

- Low Market Growth: The demand for these basic inputs is not expanding significantly.

- Low Profitability: Margins are slim due to intense price competition and lack of unique features.

- High Competition: The market is saturated with numerous suppliers offering similar products.

Within the Murugappa Group's portfolio, certain legacy products or business units, particularly those in mature industries with declining demand or intense competition, would be classified as Dogs. These entities typically possess a low market share and operate in a low-growth environment, contributing minimally to overall revenue and profitability. For example, a specific type of industrial component for older machinery, facing obsolescence, could fit this description.

These "Dog" segments often require careful management to prevent them from becoming a significant drain on the group's resources. Their limited potential for future growth means that any investment would need to be carefully scrutinized. In 2024, many traditional manufacturing sectors experienced pressures from technological advancements and shifting consumer preferences, making it harder for established, but uninnovative, product lines to thrive.

The primary characteristics of these Dog businesses within the Murugappa Group would include a small percentage of the total market share, often below 5%, and an annual growth rate that is either stagnant or declining, potentially by 1-3% annually. Their profit margins are usually very thin, sometimes even negative, and they consume management attention without yielding substantial returns.

| Business Segment Example | Market Share | Market Growth | Profitability |

| Legacy Industrial Components | Low (e.g., < 5%) | Negative to Stagnant (e.g., -1% to 0%) | Low Margin / Negative |

| Commoditized Basic Chemicals | Low (e.g., < 10%) | Low (e.g., 1-2%) | Thin Margins |

| Niche, Low-Demand Agro-Inputs | Low (e.g., < 5%) | Low (e.g., 0-1%) | Low Margin |

Question Marks

TI Clean Mobility's recent introductions of electric small commercial vehicles and cargo three-wheelers are positioned within the burgeoning electric vehicle market. While these segments are experiencing rapid growth, these specific new models are still in the early stages of market penetration, aiming to build significant market share.

The company's strategic plans for electric tractors also fall into this high-growth, yet nascent, category. These new product lines represent potential future Stars within the Murugappa Group's BCG Matrix, but they currently demand considerable investment in brand building and production capacity expansion to transition from their current Dogs or Question Marks status.

CG Power's move into semiconductor assembly and testing (OSAT) positions it as a Question Mark within the Murugappa Group's BCG matrix. This is a new, high-growth area for the conglomerate, but as a recent entrant, its market share is currently minimal.

The OSAT venture requires substantial capital to establish a presence and compete effectively. For instance, the global OSAT market was valued at approximately $50 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity but also a considerable challenge for a new player like CG Power.

Cholamandalam Investment and Finance's integration with Payswiff and other digital/fintech initiatives positions them within India's rapidly expanding digital finance market. This sector, projected to reach $1 trillion by 2025 according to some estimates, is characterized by intense competition from both established players and nimble startups.

While these ventures operate in a high-growth segment, their current market share may be modest compared to dominant digital payment providers. For instance, in 2023, while digital payments saw significant volume growth, market leadership often remained with a few key entities, highlighting the need for continued strategic investment by Cholamandalam to gain a more substantial foothold.

Advanced Materials & New-Age Ceramics (R&D Pipeline)

Within Carborundum Universal's (a Murugappa Group company) R&D pipeline, advanced materials and new-age ceramics represent potential Stars in a BCG matrix analysis. These are cutting-edge, high-performance materials being developed for emerging sectors like aerospace and medical applications.

These segments, while offering substantial growth prospects, demand significant capital investment. Carborundum Universal’s focus on innovation in areas such as engineered ceramics for high-temperature applications or advanced abrasive materials for specialized manufacturing processes exemplifies this category. For instance, the company has been investing in R&D for materials used in electric vehicle components and renewable energy systems, which are nascent but rapidly expanding markets.

- High Growth Potential: Emerging applications in aerospace, medical, and electric vehicles offer significant future revenue streams.

- High Investment Needs: Developing and scaling these advanced materials requires substantial R&D and capital expenditure.

- Low Market Share Currently: These products are typically in early commercialization, meaning their current market penetration is minimal.

- Strategic Importance: Investing in these areas is crucial for future competitive advantage and market leadership.

Emerging Global Print & Packaging Solutions (Hubergroup expansion)

Hubergroup India, currently a Star in the Murugappa Group's BCG Matrix, is strategically expanding its global footprint into emerging print and packaging solutions. This expansion into new geographies and high-growth segments, where Hubergroup historically had minimal presence, necessitates significant strategic investment.

These expansion efforts are positioned as Question Marks within the BCG framework. Entering new international markets or niche, high-growth print/packaging segments requires substantial capital outlay to build market share and achieve leadership. For instance, Hubergroup's recent investments in sustainable packaging technologies in Europe are aimed at capturing future growth in this sector.

- Strategic Objective: Global expansion into new print and packaging solutions and geographies.

- Current Status: Hubergroup India is a Star, indicating high market share and growth.

- Expansion Classification: These global efforts are classified as Question Marks.

- Investment Rationale: Entry into new markets/segments requires strategic investment to build presence and achieve leadership.

Question Marks in the Murugappa Group's BCG Matrix represent business units or products with low market share in high-growth industries. These ventures require significant investment to develop their potential and move towards becoming Stars. Without substantial capital and strategic focus, they risk remaining in this category or even declining into Dogs.

TI Clean Mobility's electric vehicles and CG Power's semiconductor ventures are prime examples. While operating in booming sectors, they are new entrants needing to build brand recognition and production capacity. Similarly, Hubergroup India's global expansion into new packaging solutions faces the challenge of establishing a presence in unfamiliar markets.

The key characteristic of Question Marks is the uncertainty of their future success. They offer high growth potential but also carry a high risk, demanding careful management and strategic resource allocation to navigate the competitive landscape and achieve market leadership.

Cholamandalam Investment and Finance's fintech initiatives also fall into this category, operating in a crowded digital finance space where gaining significant market share from established players is a major hurdle.

BCG Matrix Data Sources

Our Murugappa Group BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research from leading publications, and expert commentary to ensure reliable, high-impact insights.