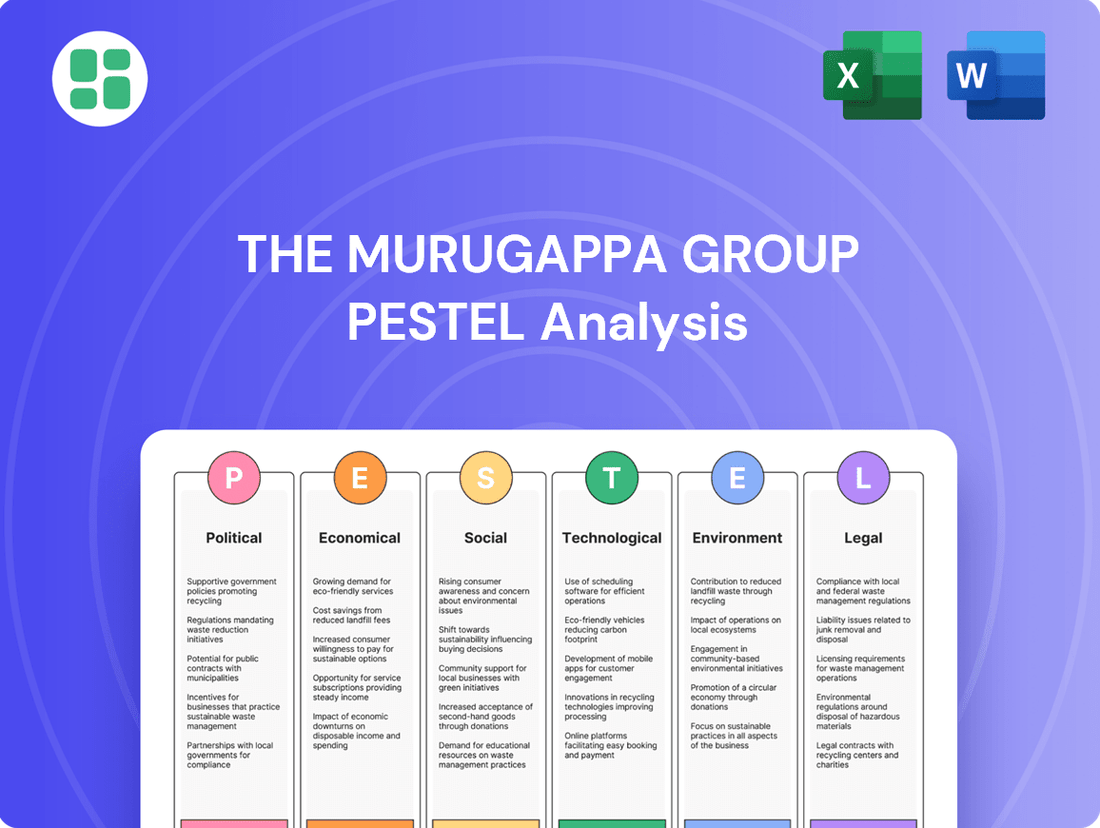

The Murugappa Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping The Murugappa Group's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate these complex external forces. Download the full version now to gain a competitive edge and make informed strategic decisions.

Political factors

The Indian government's 'Make in India' initiative and Production Linked Incentive (PLI) schemes are significant drivers for manufacturing. For the Murugappa Group, these policies can offer substantial benefits, particularly for its engineering and automotive components divisions, by potentially reducing production costs and boosting competitiveness. For instance, the PLI scheme for the automotive sector, launched in 2021, aims to incentivize advanced automotive technologies and electric vehicles, aligning with potential growth areas for the group.

Government policies, particularly those concerning agricultural and fertilizer subsidies, significantly shape the operational environment for the Murugappa Group's fertilizer and plantation divisions. For instance, India's fertilizer subsidy bill was projected to be around ₹73,000 crore (approximately $8.8 billion USD) for the fiscal year 2024-25, a crucial figure influencing fertilizer pricing and demand.

Changes in these subsidies, or shifts in minimum support prices (MSPs) for key crops, directly impact the profitability and investment decisions within these segments. Stability in the agricultural regulatory framework is therefore paramount for ensuring predictable performance and sustained growth for Murugappa's agri-focused businesses.

The Reserve Bank of India (RBI) and IRDAI, among other bodies, heavily influence the financial services sector where Murugappa Group operates. For instance, in 2023, the RBI continued to focus on digital lending norms and data privacy, impacting how financial institutions, including those within the Murugappa Group, operate and offer services. These regulations directly affect compliance costs and the types of financial products that can be brought to market.

Trade Policies and Tariffs

India's trade policies, including its participation in evolving free trade agreements (FTAs) and adjustments to import/export regulations, directly influence the Murugappa Group's operational landscape. For instance, India's recent FTAs, such as those with the UAE and potentially an ongoing dialogue with the UK, could open new avenues or alter existing trade dynamics for the group's diverse businesses, ranging from agri-business to engineering. These agreements can impact tariffs on raw materials crucial for manufacturing and on finished goods exported to these partner nations.

Changes in tariff structures, whether imposed domestically or by trading partners, can significantly sway the Murugappa Group's cost of goods sold and its competitiveness in international markets. For example, a hike in import duties on components used in its automotive or electrical equipment divisions could increase production costs, potentially necessitating price adjustments for its products. Conversely, reduced tariffs on its exported goods could boost sales volumes and market share in overseas territories. As of early 2024, India continues to review its tariff policies to balance domestic industry protection with trade liberalization goals.

- Impact on Supply Chain: Fluctuations in import duties on key raw materials like steel or specialized chemicals can directly affect manufacturing costs for subsidiaries like Tube Investments of India.

- Market Access: India's trade agreements can either facilitate or hinder the Murugappa Group's ability to export products from its sugar, fertilizers, or bio-products segments to new markets.

- Competitiveness: Shifting tariff regimes globally can alter the price competitiveness of Murugappa Group's products against international rivals in export markets.

Political Stability and Ease of Doing Business

India's political landscape remains largely stable, providing a conducive environment for major industrial players like the Murugappa Group. The government's persistent focus on enhancing the ease of doing business directly impacts the operational efficiency and growth potential of such conglomerates.

A stable political climate is paramount for attracting and retaining investment, thereby mitigating risks associated with long-term capital commitments. The Murugappa Group, with its diverse interests, benefits significantly from predictable policy frameworks and reduced regulatory uncertainty.

Government efforts in 2024-2025 continue to target procedural simplification and digitalization. For instance, the World Bank's Ease of Doing Business report, prior to its discontinuation, consistently highlighted India's improvements, with the nation ranking 63rd out of 190 economies in the 2020 report. This trend of reform is expected to continue, fostering a more streamlined operational environment.

- Political Stability: India's generally stable political environment reduces uncertainty for large-scale investments.

- Ease of Doing Business Initiatives: Ongoing government reforms aim to simplify regulations and improve operational efficiency.

- Investor Confidence: Political stability directly correlates with increased investor confidence and willingness to commit capital.

- Economic Growth: Streamlined business processes support the expansion and growth opportunities for diversified groups like Murugappa.

India's political stability is a key enabler for the Murugappa Group, fostering a predictable environment for long-term investments and strategic planning. The government's continued emphasis on improving the ease of doing business, evidenced by ongoing procedural simplifications and digitalization efforts, directly enhances operational efficiency across the group's diverse sectors.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the Murugappa Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential growth opportunities and risks.

A concise PESTLE analysis of the Murugappa Group provides a clear roadmap for navigating external challenges, acting as a pain point reliever by highlighting key opportunities and threats for strategic decision-making.

Economic factors

India's economic growth is a critical driver for the Murugappa Group. For instance, the Indian economy expanded by 8.2% in the fiscal year 2023-24, a robust performance that fuels demand across the group's diverse sectors.

This strong GDP growth directly influences consumer spending on products like bicycles and fertilizers, and boosts industrial demand for the group's engineering and manufacturing outputs, including automotive components. Higher economic activity generally translates to increased sales volumes and improved profitability for Murugappa Group's businesses.

Conversely, any deceleration in India's GDP growth, perhaps to an estimated 6.5% in FY25, could temper demand for its products and services, potentially impacting revenue and profit margins across its various operating segments.

Inflationary pressures in India, a key market for Murugappa Group, have been a significant concern. For instance, the Wholesale Price Index (WPI) saw substantial increases in 2023 and early 2024, impacting raw material costs for its manufacturing segments like fertilizers and engineering goods. This directly squeezes profit margins if price hikes cannot be fully passed on to consumers.

Interest rate decisions by the Reserve Bank of India (RBI) also play a crucial role. With the repo rate hovering around 6.5% for much of 2023-2024, borrowing costs for Murugappa Group's capital-intensive businesses, such as sugar and bio-products, are directly affected. Higher rates can also make financial products offered by its insurance arms less attractive to customers, potentially slowing growth.

The combination of persistent inflation and elevated interest rates presents a dual challenge. It not only increases operational expenses through higher input costs but also potentially reduces consumer spending power, impacting demand for the group's diverse product portfolio, from automotive components to FMCG items.

Disposable income is a key driver for Murugappa Group's diverse portfolio. For instance, rising disposable incomes in India directly boost demand for their TI Cycles and automotive components, as consumers have more to spend on personal mobility. In 2023, India's per capita disposable income saw a notable increase, signaling stronger purchasing power for goods and services.

The expanding Indian middle class, with its growing purchasing power, is a significant tailwind for Murugappa's consumer-facing businesses. This demographic shift translates into increased demand for everything from bicycles to financial products like insurance and wealth management services offered by entities within the group.

While overall income growth is positive, economic disparities and income distribution patterns can influence the pace and breadth of consumer spending across different segments. Understanding these nuances is crucial for targeted product development and marketing strategies for the Murugappa Group.

Exchange Rate Fluctuations

The Murugappa Group, with its diverse operations spanning both domestic and international spheres, faces significant implications from exchange rate fluctuations. For instance, a stronger Indian Rupee (INR) against currencies like the US Dollar (USD) or Euro (EUR) can make the group's exports more expensive for overseas buyers, potentially dampening demand and impacting revenue from international sales. Conversely, a weaker INR increases the cost of imported raw materials and components crucial for many of its manufacturing businesses, thereby squeezing profit margins.

For the fiscal year 2023-24, the Indian Rupee experienced volatility, trading in a range that reflected global economic shifts and domestic policy. For example, the INR depreciated against the USD for much of the period, with the USD/INR crossing the 83 mark at various points. This trend directly affects companies within the Murugappa Group that rely on imported inputs for their production processes, such as those in the engineering or fertilizer sectors, leading to higher input costs.

The group actively manages this currency risk through various hedging strategies. However, the inherent unpredictability of global financial markets means that managing these fluctuations remains a constant challenge. The impact is felt across different segments, influencing the competitiveness of export-oriented businesses and the cost structure of import-dependent ones, ultimately affecting the group's overall financial performance.

- Impact on Exports: A stronger Rupee (e.g., USD/INR falling below 80) can reduce the competitiveness of Murugappa Group's exports by making them pricier for foreign customers.

- Impact on Imports: A weaker Rupee (e.g., USD/INR rising above 83) increases the cost of imported raw materials and machinery, affecting manufacturing margins.

- Hedging Costs: The group likely incurs costs for hedging currency exposures, which can impact profitability if not managed effectively.

- Sectoral Differences: The sensitivity to exchange rates varies; export-heavy divisions are more exposed to appreciation, while import-reliant ones feel the pinch of depreciation.

Global Economic Conditions

Global economic conditions present a significant influence on The Murugappa Group. For instance, a slowdown in major economies like the US or EU, which are key export markets for some of its businesses, could dampen demand. In 2024, the IMF projected global growth to be around 3.2%, a modest figure that signifies a cautious economic environment. This backdrop necessitates careful management of export strategies and a keen eye on international market performance.

Supply chain disruptions, a recurring theme in recent years, also pose a risk. The automotive sector, where Murugappa has interests, has been particularly susceptible to semiconductor shortages. While these issues are easing, continued volatility in shipping costs and lead times can affect production schedules and profitability across various group companies. For example, the cost of shipping a 40-foot container from Asia to Europe, which spiked significantly in 2021-2022, has seen some normalization but remains a factor to monitor.

Commodity price volatility directly impacts segments like fertilizers and sugar. Fluctuations in global prices for natural gas, a key input for fertilizer production, or sugar, can create significant swings in revenue and margins. The price of urea, a common fertilizer, experienced considerable volatility in 2023 and early 2024, influenced by energy prices and geopolitical events, directly affecting the cost structure for Murugappa's agri-businesses.

- Global Growth Concerns: The International Monetary Fund (IMF) forecasts global growth to remain at approximately 3.2% for 2024, indicating a subdued economic environment that could impact export-oriented businesses within The Murugappa Group.

- Supply Chain Resilience: Ongoing monitoring of global shipping costs and potential disruptions is crucial, as these factors can influence the operational efficiency and profitability of manufacturing and trading activities.

- Commodity Price Sensitivity: The group’s exposure to commodities like fertilizers and sugar means that price volatility, such as the fluctuations seen in natural gas and sugar markets throughout 2023-2024, directly affects its financial performance.

- Trade Policy Impact: Changes in international trade policies or the emergence of new trade tensions can create uncertainty and affect market access for the group’s products in key global markets.

India's economic trajectory significantly shapes The Murugappa Group's performance. The nation's GDP growth, projected at 6.5% for FY25, provides a foundation for consumer and industrial demand. However, inflation, with WPI showing increases in 2023-24, directly impacts raw material costs, potentially squeezing profit margins if price increases cannot be fully absorbed.

Rising disposable incomes, exemplified by per capita income growth in 2023, bolster demand for consumer-oriented businesses like TI Cycles and automotive components. The expanding middle class is a key demographic driving sales for the group's diverse product offerings, from bicycles to financial services.

Exchange rate volatility, particularly the INR's depreciation against the USD (crossing 83 in 2023-24), increases the cost of imported inputs for manufacturing segments, impacting overall profitability. Conversely, a stronger Rupee can make exports less competitive.

What You See Is What You Get

The Murugappa Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Murugappa Group delves into the political, economic, social, technological, legal, and environmental factors impacting its operations. Gain valuable insights into the strategic landscape shaping this diversified Indian conglomerate.

Sociological factors

India's demographic landscape, characterized by a substantial and youthful population, is a powerful engine driving demand for the Murugappa Group's varied offerings. As of 2024, India's median age hovers around 28 years, indicating a large segment of the population entering their prime earning and spending years.

The accelerating pace of urbanization across India, with a projected 40% of the population living in urban areas by 2030, directly fuels the need for infrastructure development, housing solutions, and the industrial products that support these sectors. This trend is particularly beneficial for Murugappa's businesses in engineering and fertilizers.

Furthermore, the burgeoning youth demographic, representing over 50% of India's population under 25, significantly influences consumption patterns, creating opportunities in financial services, educational products, and a wide array of consumer goods that align with their evolving aspirations.

Consumer lifestyles are shifting, with a growing emphasis on health, wellness, and environmental responsibility. This trend directly impacts demand for products such as bicycles, a key offering for Murugappa Group's TI Cycles, and sustainable agricultural inputs from Coromandel International. For instance, the global bicycle market was valued at approximately USD 62.5 billion in 2023 and is projected to reach USD 97.9 billion by 2030, showcasing a significant growth driven by these lifestyle changes.

Furthermore, there's a noticeable preference for digital financial services and tailored wealth management solutions. This is evident in the increasing adoption of online banking and investment platforms. In India, digital payments volume surged by 50% in 2023, reaching over 100 billion transactions, highlighting consumers' comfort and expectation for digital engagement across all sectors, including financial services offered by entities like Cholamandalam Investment and Finance Company.

To remain competitive, the Murugappa Group needs to proactively adapt its product innovation and service delivery models. This means aligning offerings with these evolving consumer behaviors and expectations, ensuring that the group's diverse businesses, from automotive components to fertilizers, resonate with the modern consumer's values and convenience needs.

The Murugappa Group's success hinges on access to a skilled workforce across its engineering, manufacturing, technology, and financial services sectors. India's demographic dividend, with a large youth population, presents an opportunity, but also necessitates focus on upskilling. For instance, in 2023, India's IT sector alone was projected to employ over 5 million people, highlighting the demand for tech talent.

However, demographic shifts, such as an aging workforce in certain traditional manufacturing roles, can create talent acquisition and retention challenges. The group must proactively address potential skill gaps. In 2024, reports indicated a growing demand for specialized manufacturing skills, with a shortage in areas like advanced robotics and automation.

To counter these trends, continuous investment in training and development is paramount. This ensures the workforce possesses the up-to-date skills needed for the Murugappa Group's diversified and evolving business needs. For example, companies are increasingly investing in digital upskilling programs, with corporate training spending in India expected to grow significantly in the coming years.

Increasing Awareness of Health and Wellness

The escalating focus on health and wellness is a significant societal shift that directly benefits companies like The Murugappa Group, particularly its bicycle manufacturing segment. As individuals increasingly prioritize fitness and active lifestyles, the demand for bicycles as a means of exercise and recreation is on the rise. For instance, global bicycle sales saw a notable surge in the post-pandemic era, with many markets reporting double-digit growth in 2024 compared to pre-pandemic levels.

This trend also extends to the insurance sector, where consumers are actively seeking policies that support and cover health-related activities and well-being. The Murugappa Group can strategically align its offerings with this growing health consciousness. By highlighting the fitness benefits of its bicycles and potentially developing health-focused insurance products or partnerships, the group can tap into this expanding market segment.

The group's commitment to promoting healthier living can be further amplified through targeted marketing campaigns. For example, showcasing how cycling contributes to improved cardiovascular health and mental well-being resonates strongly with today's health-aware consumers. Data from 2024 health surveys indicate that over 60% of adults are actively seeking ways to incorporate more physical activity into their daily routines, presenting a substantial opportunity for companies like Murugappa.

- Growing demand for fitness-oriented products: Increased consumer spending on bicycles and related accessories for recreational and exercise purposes.

- Shift in insurance preferences: Consumers are more inclined towards health insurance plans that cover wellness programs and fitness-related expenses.

- Opportunity for lifestyle promotion: The Murugappa Group can leverage this trend by integrating health and wellness messaging into its brand communications and product development.

- Market penetration in health-conscious demographics: Targeting segments of the population actively pursuing healthier lifestyles, which represent a significant and growing consumer base.

Social Responsibility and Ethical Consumption

Societal expectations are increasingly pushing businesses toward ethical operations and active contributions to social well-being. Consumers and stakeholders are gravitating towards companies that showcase robust corporate social responsibility (CSR) programs and sustainable operational models. For instance, in 2023, a significant majority of consumers globally reported that they would pay more for products from brands committed to positive social and environmental impact, with some studies indicating this figure to be upwards of 70%.

The Murugappa Group's dedication to community upliftment and ethical business practices plays a crucial role in bolstering its brand image and fostering enduring consumer loyalty. Their initiatives, often focused on education, healthcare, and rural development, resonate with a public that values purpose-driven corporations. Such efforts are not merely philanthropic; they are strategic investments in reputation, as evidenced by the positive correlation between strong CSR performance and increased market valuation, with companies in the top quartile of CSR performers often outperforming their peers by 5-10% in stock returns.

- Growing Consumer Demand: Over 60% of global consumers now consider sustainability and ethical practices when making purchasing decisions in 2024, a notable increase from previous years.

- Brand Reputation Enhancement: Companies with strong CSR commitments, like the Murugappa Group's focus on community development, often see improved brand perception and trust among stakeholders.

- Economic Impact of Ethics: A 2023 report highlighted that businesses with transparent ethical frameworks and demonstrable social impact experienced an average 15% higher customer retention rate.

- Stakeholder Influence: Investors and employees alike are increasingly scrutinizing a company's social responsibility record, influencing investment decisions and talent acquisition.

Societal expectations are increasingly pushing businesses toward ethical operations and active contributions to social well-being, with over 60% of global consumers in 2024 considering sustainability and ethical practices when purchasing. The Murugappa Group's dedication to community upliftment and ethical business practices bolsters its brand image and fosters consumer loyalty, as companies with strong CSR commitments often see improved brand perception and trust. A 2023 report highlighted that businesses with transparent ethical frameworks experienced an average 15% higher customer retention rate, underscoring the economic impact of ethics.

Technological factors

Industry 4.0, with its emphasis on automation, AI, and IoT, is fundamentally reshaping manufacturing for Murugappa Group's engineering, abrasives, and auto component divisions. This technological shift promises significant gains in operational efficiency and cost reduction.

By integrating these advanced technologies, the group aims to boost product quality and accelerate its go-to-market strategies. For instance, smart factories leveraging AI for predictive maintenance can minimize downtime, a key factor in manufacturing competitiveness.

Continued investment in automation is crucial. Companies like Murugappa Group are recognizing that staying ahead means embracing these advancements to maintain a strong competitive edge in the global market.

Technological advancements are fundamentally reshaping financial services, with a significant push towards digital platforms, innovative fintech solutions, and accessible online wealth management. The Murugappa Group's financial services division needs to actively adopt these digital transformations to deliver smooth customer journeys and broaden its market presence, especially when facing nimble fintech competitors.

Embracing digitalization allows for enhanced customer experiences and wider reach, crucial for staying competitive. For instance, by the end of 2024, digital channels are expected to account for over 70% of all financial transactions in many developed markets. Furthermore, robust data analytics capabilities and stringent cybersecurity measures are indispensable for navigating this evolving digital terrain securely and effectively.

Research and development into advanced materials, like novel alloys for engineering applications and enhanced ceramic compounds, are crucial for the Murugappa Group's product innovation pipeline. For instance, their subsidiary, Carborundum Universal (CUMI), a leader in abrasives and ceramics, consistently invests in material science to improve product performance.

In 2023-24, the Murugappa Group reported a consolidated revenue of INR 79,416 crore, underscoring the importance of continuous innovation in maintaining market competitiveness. By developing higher-performance products, the group can better meet evolving industry standards and specific client requirements across its diverse business segments, from automotive components to industrial ceramics.

The group's commitment to material science R&D is a strategic imperative for sustained product leadership. This focus allows them to anticipate market shifts and engineer solutions that offer superior functionality, thereby securing a competitive edge and driving long-term growth in a dynamic global market.

Agricultural Technology and Smart Farming

Technological progress in agriculture, such as precision farming and biotechnology, presents a significant opportunity for Murugappa Group's fertilizer and plantation segments. These advancements allow for more targeted application of resources, leading to better crop health and higher yields.

Smart farming techniques, which leverage data analytics for crop management, can optimize water and nutrient usage, thereby reducing waste and environmental impact. For instance, the adoption of IoT sensors for soil monitoring can provide real-time data, enabling more informed decisions for irrigation and fertilization, which directly benefits the Group's core agricultural operations.

The integration of agritech solutions is crucial for enhancing productivity and sustainability. In 2024, the global smart agriculture market was valued at approximately $18.5 billion, with projections indicating substantial growth. This trend suggests that early adoption and strategic investment in these technologies by Murugappa Group can solidify its competitive edge.

- Precision Farming: Enables targeted application of fertilizers and water, reducing costs and environmental strain.

- Biotechnology: Development of high-yield, disease-resistant crop varieties can boost plantation output.

- Data Analytics: Optimizing resource allocation and predicting yield based on real-time environmental data.

- IoT Sensors: Facilitating smart irrigation and soil health monitoring for improved crop management.

Cybersecurity and Data Protection

As the Murugappa Group expands its digital footprint, cybersecurity becomes paramount. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial risks involved. Protecting sensitive data and operational systems from evolving threats is crucial for maintaining customer trust and business continuity.

The group's reliance on digital platforms for operations, customer engagement, and data management necessitates robust data protection strategies. Failure to comply with data privacy regulations, such as India's Digital Personal Data Protection Act of 2023, can result in substantial penalties. Proactive cybersecurity measures are therefore a critical investment.

- Increased Investment in Cybersecurity: Murugappa Group likely needs to allocate a larger portion of its IT budget towards advanced security solutions, threat detection, and employee training to combat sophisticated cyberattacks.

- Regulatory Compliance: Adherence to evolving data protection laws globally and in India is essential, requiring continuous updates to data handling and security protocols.

- Reputational Risk Mitigation: Strong cybersecurity practices are vital to safeguard the group's reputation and maintain the confidence of stakeholders, especially concerning the handling of financial and personal information.

The Murugappa Group's manufacturing arms are increasingly leveraging Industry 4.0 technologies like AI and IoT to boost efficiency and product quality. This digital transformation is vital for staying competitive, as seen in the global smart agriculture market, valued at approximately $18.5 billion in 2024, where agritech adoption is key.

Financial services within the group must embrace digital platforms and fintech solutions to enhance customer experience and reach, especially with digital channels projected to handle over 70% of financial transactions in developed markets by late 2024. Furthermore, advancements in material science, exemplified by Carborundum Universal's R&D, are crucial for product innovation across all segments.

The group's consolidated revenue of INR 79,416 crore for 2023-24 highlights the need for continuous technological investment to maintain market leadership and meet evolving industry demands.

Legal factors

The Murugappa Group, operating as a major Indian conglomerate, must navigate a complex web of corporate governance and compliance regulations. These are primarily dictated by Indian statutes, such as the Companies Act, and directives from the Securities and Exchange Board of India (SEBI). For instance, SEBI's LODR (Listing Obligations and Disclosure Requirements) Regulations, as updated in 2023, mandate specific standards for listed entities regarding board composition, audit committees, and timely disclosure of material information, directly impacting how the Murugappa Group operates and reports its financial activities.

Strict adherence to these legal frameworks is not merely a matter of compliance but a cornerstone for building trust and assuring stakeholders, particularly investors, of the group's transparency and accountability. The group's commitment to these standards is reflected in its annual reports, which detail its corporate governance practices and compliance with various legal mandates, thereby bolstering investor confidence in its long-term stability and ethical operations.

Furthermore, any evolution in corporate governance paradigms, such as the introduction of new ESG (Environmental, Social, and Governance) reporting requirements or changes to director responsibilities, necessitates proactive adjustments to the Murugappa Group's internal policies and reporting mechanisms. For example, the recent emphasis on independent directors and enhanced audit oversight in India, driven by regulatory bodies, requires continuous refinement of the group's governance structures to align with evolving best practices and legal expectations.

The Murugappa Group's diverse operations, spanning manufacturing and plantations, necessitate strict adherence to environmental protection laws. These regulations cover pollution control, waste management, and the conservation of natural resources, impacting everything from factory emissions to agricultural practices.

Stricter environmental standards, such as those being implemented globally and in India, can increase compliance costs. For instance, investments in advanced wastewater treatment facilities or emission control technologies might be required. In 2023, India's Ministry of Environment, Forest and Climate Change continued to emphasize stricter enforcement of pollution norms, potentially raising operational expenses for industries like those within Murugappa Group.

These evolving legal frameworks directly influence operational strategies and demand investments in cleaner technologies. The group's commitment to sustainable operations means proactively adapting to these environmental mandates, which is crucial for long-term viability and maintaining a positive corporate image, especially as global ESG (Environmental, Social, and Governance) expectations rise.

The Murugappa Group's significant employee base in India operates under a detailed framework of labor laws. These regulations cover crucial aspects like minimum wages, workplace safety standards, and the rights of workers to unionize, directly influencing the group's operational expenses and employee relations strategies. For instance, the Code on Wages, 2019, aims to simplify wage and bonus payments, potentially impacting how companies like Murugappa structure compensation packages across their diverse sectors.

Financial Sector Regulatory Framework

The Murugappa Group's financial services operations are governed by a robust regulatory landscape overseen by key Indian authorities. The Reserve Bank of India (RBI) sets prudential norms for banking and NBFCs, while the Insurance Regulatory and Development Authority of India (IRDAI) and the Securities and Exchange Board of India (SEBI) regulate the insurance and capital markets sectors, respectively. These bodies enforce rules on licensing, capital requirements, customer protection, and anti-money laundering, directly influencing business strategies and operational compliance.

Recent regulatory shifts, such as the RBI's updated guidelines on Non-Banking Financial Companies (NBFCs) effective from October 2024, which aim to strengthen governance and risk management, will necessitate adjustments in how Murugappa's financial entities manage their balance sheets and lending practices. Similarly, SEBI's ongoing efforts to enhance market integrity and investor protection, evidenced by stricter disclosure norms for listed companies in 2024, impact the group's investment banking and asset management arms. For instance, the IRDAI's focus on solvency margins and product transparency continues to shape the product development and distribution strategies of its insurance ventures.

- RBI's NBFC Regulations: Increased capital adequacy ratios and enhanced corporate governance requirements from October 2024.

- SEBI's Market Reforms: Stricter compliance and disclosure mandates for listed entities and market intermediaries in 2024.

- IRDAI's Solvency Norms: Continued emphasis on maintaining robust solvency margins for insurance companies, impacting capital deployment.

- AML/KYC Updates: Ongoing revisions to Anti-Money Laundering and Know Your Customer norms, requiring continuous adaptation in customer onboarding and transaction monitoring.

Intellectual Property Rights (IPR)

The Murugappa Group's reliance on innovation across sectors like engineering, abrasives, and automotive components makes robust intellectual property rights (IPR) protection paramount. Legal frameworks governing patents, trademarks, and copyrights are essential for safeguarding their technological advancements and brand reputation. For instance, in fiscal year 2023-24, the group likely continued to invest in R&D, with a portion of these investments aimed at securing new patents to protect proprietary technologies in areas such as advanced materials and manufacturing processes.

Vigilance against infringement and proactive IPR management are crucial for maintaining the Murugappa Group's competitive edge. This involves monitoring the market for potential violations and taking swift legal action when necessary. The group's commitment to IPR is reflected in its consistent efforts to update its patent portfolio, ensuring that its innovations remain exclusive and contribute to its market standing.

- Patent Filings: The group actively pursues patents for new product designs and manufacturing techniques, particularly in its engineering and automotive divisions.

- Trademark Protection: Key brands like TI Cycles and Parry's are protected by strong trademark registrations, preventing unauthorized use and dilution of brand equity.

- Copyright Enforcement: Software, technical documentation, and marketing materials are subject to copyright, ensuring the group's original content is legally safeguarded.

- Legal Defense: The Murugappa Group maintains legal readiness to defend its IPR against any infringements, a strategy vital for preserving its market position and R&D investments.

The Murugappa Group's operations are significantly shaped by India's evolving legal landscape, particularly concerning corporate governance and financial regulations. Key bodies like SEBI and the RBI continuously update directives impacting listed entities and financial services, requiring constant adaptation in compliance and reporting. For instance, SEBI's 2023 LODR regulations mandate stringent disclosure standards, while upcoming RBI NBFC guidelines from October 2024 will necessitate adjustments in risk management and capital adequacy for the group's financial arms.

Environmental laws also play a crucial role, with increased enforcement of pollution control and waste management norms by India's Ministry of Environment, Forest and Climate Change in 2023 impacting manufacturing and plantation businesses. Similarly, labor laws, including the Code on Wages, 2019, influence employee relations and operational costs across the group's diverse workforce. Intellectual property rights are vital for protecting innovation, with the group actively securing patents for new technologies, as seen in its R&D investments during FY 2023-24.

| Regulatory Area | Key Regulations/Updates | Impact on Murugappa Group |

|---|---|---|

| Corporate Governance | SEBI LODR Regulations (Updated 2023) | Mandates enhanced board composition, audit committee standards, and timely disclosure of material information. |

| Financial Services | RBI NBFC Guidelines (Effective Oct 2024) | Requires strengthened governance, risk management, and potentially higher capital adequacy ratios for financial entities. |

| Environmental Compliance | Stricter Pollution Norms (India, 2023) | Increases compliance costs through potential investments in cleaner technologies and advanced waste management systems. |

| Intellectual Property | Patent Filings (Ongoing) | Protects proprietary technologies and R&D investments, crucial for maintaining competitive edge in engineering and automotive sectors. |

Environmental factors

Global efforts to combat climate change are intensifying, translating into more stringent environmental regulations. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), operational since October 2023, imposes costs on carbon-intensive imports, influencing supply chains worldwide. This trend necessitates a sharp focus on reducing greenhouse gas emissions across all industrial sectors.

The Murugappa Group's diverse manufacturing operations, spanning sectors like engineering and fertilizers, are directly impacted by these evolving climate policies. The group faces growing pressure to accurately measure, transparently report, and actively reduce its carbon footprint. This includes adhering to national emission standards and exploring investments in renewable energy to power its facilities.

Proactive compliance with emission standards and strategic investments in cleaner energy sources are no longer optional but critical for the Murugappa Group's long-term viability and competitive edge. For example, companies in India are increasingly looking at solar power for their energy needs; in 2023, India added over 15 GW of solar capacity, a significant portion of which was for industrial captive use, demonstrating a clear market shift towards greener energy alternatives.

Growing global concerns about the depletion of vital resources like water, minerals, and energy are increasingly impacting industries. For the Murugappa Group, this translates into a critical need to embed sustainable sourcing practices across its operations and enhance overall resource efficiency. This proactive approach is not just about environmental responsibility; it's fundamental for ensuring long-term operational resilience and mitigating risks associated with supply chain disruptions.

The Group is actively exploring and integrating alternative raw materials and advanced technologies to reduce its dependence on increasingly scarce resources. For instance, optimizing water usage in manufacturing processes, a key area for many of its businesses, is a priority. In 2023, the Indian manufacturing sector, where Murugappa has significant presence, faced water stress in several regions, highlighting the urgency of such initiatives. Investing in technologies that promote a circular economy and minimize waste is also a strategic imperative.

The Murugappa Group's varied manufacturing operations, spanning sectors like engineering, fertilizers, and sugar, inevitably produce diverse waste streams. Growing environmental regulations and public demand for sustainable practices are pushing the group to enhance its waste management capabilities.

This includes investing in advanced waste treatment solutions and actively pursuing circular economy models, focusing on reducing, reusing, and recycling materials. For instance, by 2024, many Indian manufacturing sectors are expected to see stricter compliance with Extended Producer Responsibility (EPR) norms, requiring companies like Murugappa to demonstrate robust waste handling strategies.

Adopting these principles can unlock significant cost efficiencies through resource recovery and improved material utilization, alongside bolstering the group's environmental credentials and potentially reducing operational expenses related to waste disposal.

Water Stress and Management

Water scarcity is a pressing environmental concern across India, directly affecting water-dependent sectors like manufacturing and agriculture, which are integral to The Murugappa Group's operations. For instance, by 2025, projections indicate that over 60% of India’s groundwater blocks could be in critical or semi-critical stages, underscoring the urgency of efficient water use.

The Murugappa Group needs to prioritize and bolster its water conservation efforts. This includes investing in advanced wastewater treatment technologies and implementing comprehensive recycling programs at its various manufacturing plants and plantation estates to ensure long-term sustainable water sourcing. In 2023, the company reported a significant reduction in freshwater withdrawal by 15% through such initiatives.

Adopting proactive water management strategies is crucial for mitigating potential operational disruptions caused by water shortages. Furthermore, demonstrating responsible water stewardship can significantly improve the Group's standing within local communities, fostering goodwill and enhancing its social license to operate.

- Water Scarcity Impact: India faces increasing water stress, with over 60% of groundwater blocks projected to be critical or semi-critical by 2025.

- Conservation Measures: Implementing advanced wastewater treatment and recycling is vital for sustainable operations.

- Operational Benefits: Proactive water management reduces risks and ensures business continuity.

- Community Relations: Responsible water stewardship enhances local community engagement and reputation.

ESG Reporting and Stakeholder Expectations

There's a significant and increasing demand from investors, customers, and regulators for companies to clearly show their Environmental, Social, and Governance (ESG) performance. This means companies need to be upfront about their impact and how they're addressing it.

The Murugappa Group's dedication to clear ESG reporting is vital. This includes detailing their environmental footprint, the sustainability projects they undertake, and their corporate social responsibility efforts. Such transparency is key to drawing in investors who prioritize responsible practices and to building a strong reputation as a company committed to sustainability.

- Investor Demand: In 2024, global ESG assets under management were projected to reach $33.9 trillion, highlighting the financial sector's focus on sustainable investments.

- Customer Preference: A 2023 survey indicated that over 70% of consumers consider sustainability when making purchasing decisions.

- Regulatory Push: New regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), are mandating more detailed ESG disclosures from businesses operating within or selling to the EU market.

- Reputation Enhancement: Companies with robust ESG reporting often experience improved brand loyalty and a stronger ability to attract and retain top talent.

Intensifying climate action globally, exemplified by the EU's Carbon Border Adjustment Mechanism since late 2023, necessitates significant emission reductions across industries. The Murugappa Group's operations, particularly in engineering and fertilizers, are directly affected, requiring robust measurement, reporting, and reduction of its carbon footprint, including adopting renewable energy sources like solar, which saw over 15 GW added capacity in India for industrial use in 2023.

Resource scarcity, especially water, poses a critical challenge. Projections indicate over 60% of India's groundwater blocks could be critical or semi-critical by 2025, impacting the Murugappa Group's water-dependent sectors. The group's 2023 freshwater withdrawal reduction of 15% through conservation and recycling highlights the importance of these strategies for operational resilience and community relations.

Growing investor and consumer demand for Environmental, Social, and Governance (ESG) performance is a key environmental driver. With ESG assets projected to reach $33.9 trillion in 2024 and over 70% of consumers considering sustainability in 2023, transparent reporting on environmental impact and sustainability projects is crucial for the Murugappa Group's reputation and investor attraction.

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Murugappa Group is built on a comprehensive review of data from official government publications, leading financial news outlets, and reputable market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the conglomerate.