The Murugappa Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

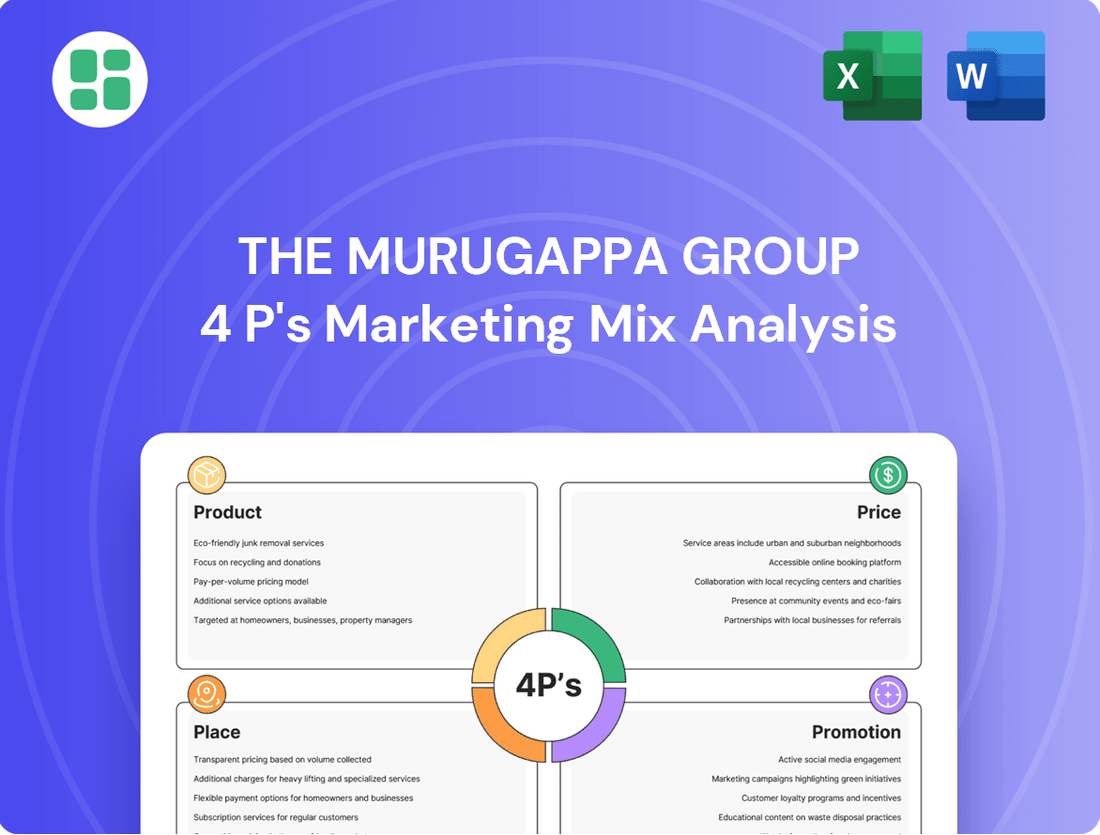

Discover how The Murugappa Group masterfully leverages its Product, Price, Place, and Promotion strategies to achieve market dominance. This analysis offers a clear roadmap of their approach.

Dive deeper into the specifics of their product innovation, pricing structures, distribution networks, and communication campaigns. Unlock actionable insights to inform your own marketing endeavors.

Save valuable time and gain a competitive edge with this ready-to-use, editable 4Ps Marketing Mix Analysis of The Murugappa Group. Perfect for students, professionals, and strategists.

Product

The Murugappa Group boasts a remarkably diverse portfolio, spanning engineering, financial services, abrasives, automotive components, fertilizers, and plantations. This broad reach allows them to serve both industrial and consumer markets, creating a robust business model that can weather sector-specific challenges. For instance, in the fiscal year ending March 31, 2024, the group reported a consolidated revenue of INR 74,047 crore, demonstrating the scale and breadth of their operations across these varied segments.

This diversification extends to their product and service mix, encompassing tangible goods like bicycles and industrial ceramics alongside essential services such as insurance and wealth management. This comprehensive approach ensures they meet a wide array of customer needs, from everyday consumer products to specialized industrial solutions. Their commitment to innovation is evident, with ongoing investments in research and development across their various business verticals.

The Murugappa Group's product strategy emphasizes leadership in both niche and core industries, a testament to its diversified portfolio and deep market penetration. This leadership is built on a foundation of quality and value, as seen with Carborundum Universal's dominant position in India's abrasives market. For example, in FY23, Carborundum Universal reported a revenue of ₹4,755 crore, showcasing its significant market share.

Tube Investments of India exemplifies this core industry strength, being a major player in precision tubes and bicycles, with its revenue reaching ₹4,987 crore in FY23. This dual focus allows the group to leverage established strengths while exploring specialized segments, ensuring sustained growth and market relevance across its varied business interests.

The group's influence extends to vital sectors like agriculture through Coromandel International, a leader in providing integrated solutions to farmers. In FY23, Coromandel International achieved revenues of ₹10,061 crore, highlighting its crucial role in supporting India's agricultural productivity. Similarly, Cholamandalam Investment and Finance Company, a key player in financial services, reported a profit after tax of ₹2,167 crore for FY23, underscoring the group's financial sector prowess.

The Murugappa Group's product strategy extends beyond conventional offerings, with a significant push into advanced materials and high-tech solutions. This forward-looking approach is exemplified by Carborundum Universal's development of building solutions utilizing advanced ceramics, targeting sectors like aerospace, defense, and providing blast-proof protection for electric vehicles.

Further demonstrating this commitment, CG Power and Industrial Solutions, a key entity within the group, is actively engaged in semiconductor manufacturing. This venture serves critical industries including industrial, automotive, and power sectors, underscoring the group's dedication to embracing and leading in cutting-edge technological advancements.

Strategic Expansion into Emerging Sectors

The Murugappa Group is actively diversifying its product portfolio by venturing into high-growth, emerging sectors. This strategic move is evident in their significant investments and development activities within the electric vehicle (EV) and semiconductor industries. For instance, TI Clean Mobility Private Ltd (TICMPL) is spearheading the development of a range of electric vehicles, including cargo vehicles, tractors, rickshaws, and heavy commercial vehicles, aiming to capture a substantial share of the rapidly expanding green mobility market.

Further solidifying its commitment to future-forward industries, the group is also establishing a presence in semiconductor manufacturing. A key initiative includes a joint venture for an Outsourced Semiconductor Assembly and Test (OSAT) facility in Gujarat. This move is particularly significant given the global push for localized semiconductor production, with India aiming to become a major hub. The OSAT facility is expected to commence operations in the coming years, contributing to the domestic semiconductor ecosystem.

- Electric Vehicle Expansion: TI Clean Mobility Private Ltd (TICMPL) is a key subsidiary driving the group's EV strategy, focusing on electric three-wheelers, tractors, and heavy commercial vehicles.

- Semiconductor Manufacturing: A joint venture is established for an OSAT facility in Gujarat, marking the group's entry into the critical semiconductor value chain.

- Market Opportunity: These expansions target rapidly growing markets, driven by government incentives and increasing consumer adoption of cleaner technologies and advanced electronics.

- Strategic Alignment: The focus on EVs and semiconductors aligns with global trends and India's national manufacturing priorities, positioning the Murugappa Group for long-term growth.

Customer-Centric Development

Customer-centric development is a cornerstone of the Murugappa Group's strategy, ensuring its offerings resonate deeply with user needs. This focus is evident in how companies like Coromandel International tailor agri-solutions, aiming to boost farmer yields. In 2023, Coromandel reported a revenue of INR 237.6 billion, underscoring the market's positive reception to its farmer-focused approach.

Cholamandalam Investment and Finance Company Limited exemplifies this by providing a broad spectrum of financial products, from vehicle and home loans to personal loans, serving diverse nationwide customer requirements. As of March 31, 2024, their Assets Under Management (AUM) stood at INR 1.29 trillion, reflecting significant customer trust and adoption of their tailored financial solutions.

- Coromandel International's integrated agri-solutions directly address farmer needs to improve crop productivity.

- Cholamandalam Investment and Finance offers a wide array of financial products to meet varied customer demands.

- The Group's commitment to customer-centricity drives product development and market relevance.

- This approach fosters strong customer relationships and sustained business growth.

The Murugappa Group's product strategy is deeply rooted in catering to diverse market needs, from essential agricultural inputs to advanced industrial components and emerging technologies. This customer-centric approach ensures relevance and market penetration across its varied business verticals.

Companies like Coromandel International focus on providing tailored solutions for farmers, directly addressing their needs to enhance crop yields and farm productivity. Similarly, Cholamandalam Investment and Finance offers a comprehensive suite of financial products designed to meet a wide spectrum of individual and business requirements nationwide.

The group's forward-looking product development is highlighted by its significant investments in electric vehicles through TI Clean Mobility and its entry into semiconductor manufacturing with an OSAT facility in Gujarat. These initiatives demonstrate a commitment to aligning product offerings with future market demands and national strategic priorities.

This dedication to customer-centricity and future-proofing its product portfolio underpins the Murugappa Group's sustained growth and market leadership across its diverse business segments.

| Business Vertical | Key Products/Services | FY23 Revenue (INR Crores) | Key Customer Focus |

|---|---|---|---|

| Agri-Solutions | Fertilizers, Crop Protection, Seeds | 10,061 (Coromandel International) | Farmers, Agricultural Sector |

| Engineering & Industrial | Abrasives, Industrial Ceramics, Precision Tubes, Bicycles | 4,755 (Carborundum Universal) 4,987 (Tube Investments of India) |

Industrial Manufacturers, Consumers |

| Financial Services | Vehicle Loans, Home Loans, Insurance | INR 1.29 Trillion AUM (Cholamandalam Investment and Finance) | Individuals, Businesses |

| Emerging Technologies | Electric Vehicles, Semiconductor Assembly | N/A (New Ventures) | EV Market Participants, Electronics Industry |

What is included in the product

This analysis provides a comprehensive breakdown of The Murugappa Group's marketing mix, detailing their product diversification, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand The Murugappa Group's market positioning and competitive advantages through a data-driven examination of their 4Ps.

Simplifies the Murugappa Group's marketing strategy by clearly outlining its 4Ps, providing a quick solution for understanding their approach to product, price, place, and promotion.

Offers a clear, actionable framework for identifying and addressing potential gaps in the Murugappa Group's marketing efforts, acting as a problem-solver for their go-to-market strategy.

Place

The Murugappa Group's extensive pan-India distribution network is a cornerstone of its market penetration strategy. This vast reach ensures their diverse product portfolio, spanning from financial services to engineering goods, is readily available to consumers and businesses across the nation. For example, Cholamandalam Investment and Finance Company, a key entity within the group, boasted over 1,254 branches nationwide as of March 2024, significantly enhancing its accessibility in the vehicle finance sector.

This robust network is vital for serving a broad spectrum of customers, from individual two-wheeler owners to large fleet operators and agricultural tractor buyers. The strategic placement of these touchpoints allows the group to effectively manage customer relationships and provide localized support, a critical factor in building brand loyalty and driving sales in a diverse market like India.

The Murugappa Group extends its influence far beyond India, establishing a robust global market presence. This international footprint is crucial for its growth, with key subsidiaries actively engaged in overseas markets. For instance, Carborundum Universal is a significant exporter of advanced materials, reaching customers worldwide.

Further solidifying its international reach, Wendt (India) operates a wholly-owned subsidiary in Thailand, demonstrating a direct investment in key foreign markets. This global engagement, however, means the group's export performance is susceptible to external factors.

Recent financial reports highlight how geopolitical uncertainties and potential global recessionary trends can directly impact the group's export revenues. For the fiscal year ending March 31, 2024, the consolidated revenue from international operations for key subsidiaries like Carborundum Universal showed a notable contribution, underscoring the importance of this global presence while also highlighting its vulnerability to global economic shifts.

The Murugappa Group leverages a multi-channel distribution strategy to effectively reach diverse customer segments for its varied product lines. This approach is crucial given the group's extensive portfolio, which spans industrial goods, financial services, and consumer products.

For its industrial offerings, direct sales channels are paramount, allowing for specialized engagement with business clients. In contrast, financial services, such as those provided by Cholamandalam Investment and Finance Company, benefit from an extensive branch network, fostering trust and accessibility. For consumer-facing products like bicycles from brands such as BSA, Hercules, and Montra, the group utilizes widespread retail channels to ensure broad market penetration.

This adaptive distribution model is a key component of the Murugappa Group's marketing mix, ensuring that each product category, whether it's complex engineering solutions or everyday consumer items, achieves optimal reach and market presence. For instance, in FY23, the group's financial services segment reported a significant growth in assets under management, underscoring the effectiveness of its wide network.

Strategic Location of Manufacturing and Operational Hubs

The Murugappa Group's strategic placement of manufacturing and operational hubs is key to its market presence. These facilities are spread across India and in select international locations, designed to streamline production and delivery across its diverse portfolio, which includes everything from abrasives and engineering parts to vital agricultural inputs like fertilizers and sugar. This widespread network ensures efficient supply chain management, a critical component of their marketing strategy.

Capital expenditure in fiscal year 2023-24 saw substantial allocations towards expanding production capacities and upgrading existing facilities. For instance, investments were directed towards enhancing output at their engineering component plants and modernizing fertilizer production units. These upgrades are vital for maintaining competitiveness and meeting growing market demand.

- Geographic Diversification: Manufacturing and operational hubs strategically located across India and key international markets.

- Segment Support: Facilities cater to diverse business segments including abrasives, engineering, fertilizers, and sugar.

- Capacity Enhancement: Fiscal year 2023-24 saw significant capital expenditure focused on capacity expansion and modernization.

- Efficiency Focus: Location strategy aims to optimize production processes and distribution networks for enhanced operational efficiency.

Digital Initiatives Enhancing Accessibility

Murugappa Group, while rooted in tradition, is actively embracing digital advancements to broaden access to its offerings. This strategic shift is evident across its diverse portfolio, aiming to meet evolving customer expectations in the digital age.

Cholamandalam MS General Insurance exemplifies this digital push. By leveraging Data Analytics and Artificial Intelligence, their SAHAI mobile application streamlines the claims process, significantly boosting efficiency and customer satisfaction. This initiative highlights a commitment to making insurance services more accessible and user-friendly.

The group's digital initiatives are not limited to insurance. Other group companies are also exploring and implementing digital platforms to enhance customer engagement and service delivery. For instance, in 2023, the group saw a notable increase in online customer interactions across various businesses, indicating a growing reliance on digital channels.

- Digital Transformation: Murugappa Group companies are integrating digital tools to improve accessibility.

- AI in Claims: Cholamandalam MS General Insurance uses AI via SAHAI app for efficient claims processing.

- Customer Convenience: Digital initiatives aim to enhance user experience and service accessibility.

- Growing Digital Footprint: The group experienced a rise in online customer engagement in 2023.

The Murugappa Group's strategic placement of manufacturing and operational hubs is key to its market presence, with facilities spread across India and select international locations. This widespread network ensures efficient supply chain management, a critical component of their marketing strategy. Capital expenditure in fiscal year 2023-24 saw substantial allocations towards expanding production capacities and upgrading existing facilities, vital for maintaining competitiveness and meeting growing market demand.

| Business Segment | Key Locations (India) | International Presence | FY24 Focus |

|---|---|---|---|

| Abrasives & Ceramics | Chennai, Ranipet | USA, UK, Australia | Capacity expansion for advanced materials |

| Engineering | Hosur, Chennai | Thailand (Wendt India subsidiary) | Modernization of component plants |

| Agri-Inputs (Fertilizers) | Vizag, Cuddalore | N/A | Upgrading fertilizer production units |

| Financial Services | Pan-India Network | N/A | Digitalization and branch network optimization |

What You Preview Is What You Download

The Murugappa Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the Murugappa Group's Product, Price, Place, and Promotion strategies, offering valuable insights for your business. You'll gain a complete understanding of their marketing approach.

Promotion

The Murugappa Group’s integrated brand communication strategy is built on its enduring legacy and unwavering commitment to quality, fostering trust across its diverse portfolio. This approach ensures that while individual brands like Hercules (bicycles), Chola (financial services), and Gromor (fertilizers) retain their unique market presence, they all benefit from the robust foundation of reliability established by the parent group.

The Murugappa Group employs sector-specific marketing and advertising strategies, customizing its approach for diverse audiences. For instance, consumer-facing businesses like TI Cycles leverage broad advertising campaigns, while industrial segments such as Carborundum Universal focus on technical specifications and direct client engagement. This tailored approach ensures maximum impact and relevance across their varied product lines.

In 2023, the group's financial services arm, Cholamandalam Investment and Finance Company (Chola), reported a significant increase in its customer base, driven by targeted digital marketing initiatives. Similarly, Coromandel International, a key player in agri-inputs, utilizes localized campaigns and farmer outreach programs, demonstrating a commitment to sector-specific communication that resonates with agricultural communities.

The Murugappa Group leverages public relations and Corporate Social Responsibility (CSR) to cultivate a strong, positive brand image and foster community relationships. These efforts are integral to their marketing strategy, building trust and goodwill that extends beyond their core business operations.

A prime example is Cholamandalam Investment and Finance Company's 'Chola Chess' initiative, which actively supports and develops chess talent nationwide. This program highlights the group's dedication to societal contribution, demonstrating a commitment that transcends purely commercial objectives and reinforces their role as a responsible corporate citizen.

Such strategic CSR engagements significantly bolster the Murugappa Group's overall reputation. In 2023, the group reported a consolidated revenue of INR 74,000 crore, underscoring the importance of maintaining a positive social license to operate, which is crucial for sustained growth and stakeholder confidence.

Digital Engagement and Online Presence

The Murugappa Group acknowledges the importance of digital engagement to connect with its diverse stakeholder base. While specific 2024-2025 digital marketing expenditure figures are not publicly detailed, the group maintains a robust online presence through corporate websites and dedicated investor portals. This digital footprint is crucial for disseminating information and fostering transparency.

The group's financial services arms, such as Cholamandalam Investment and Finance Company Limited (Chola MS), are particularly attuned to digital trends. In the competitive financial services landscape, digital platforms are essential for customer acquisition, onboarding, and ongoing engagement. This strategic focus on online channels is expected to intensify in 2024-2025 as the sector continues its digital transformation.

- Corporate Website & Investor Relations: The Murugappa Group's primary corporate website serves as a central hub for information, including annual reports, financial results, and corporate governance details, crucial for investor relations.

- Digital Customer Acquisition: Financial services entities within the group likely invest in digital advertising, social media marketing, and search engine optimization (SEO) to attract new customers.

- Online Engagement Platforms: The group leverages platforms like LinkedIn for professional networking and corporate communications, reaching a broad audience of industry professionals and potential partners.

- Media Mentions & Online News: A significant portion of the group's online presence is driven by news articles and media coverage, highlighting their activities and performance, which contributes to their digital footprint.

Trade Shows and Direct Customer Engagement

For its business-to-business (B2B) segments, including industrial ceramics, abrasives, and engineering solutions, Murugappa Group heavily relies on direct customer engagement. This is particularly evident through participation in key trade shows and industry events. For example, Carborundum Universal Limited (CUMI), a prominent Murugappa Group company, actively showcases its advanced abrasives and industrial ceramics at events like the India Manufacturing Show, often highlighting innovations in material science. These platforms are essential for demonstrating product features and technical capabilities directly to potential clients.

This direct interaction is vital for building robust client relationships, which are foundational for securing substantial industrial contracts and developing bespoke solutions. In 2023, CUMI reported a significant portion of its revenue derived from industrial clients, underscoring the importance of this B2B engagement strategy. The sales force plays a critical role, acting as the frontline for technical discussions and relationship management, ensuring that Murugappa Group's offerings meet the specific, often complex, needs of industrial partners.

- Trade Show Presence: Murugappa Group companies regularly exhibit at major industrial exhibitions globally and domestically, providing direct product demonstrations.

- Technical Demonstrations: Events allow for showcasing the performance and application of industrial ceramics and abrasives, crucial for B2B sales.

- Relationship Building: Direct engagement fosters trust and collaboration, essential for long-term industrial contracts and custom product development.

- Sales Force Integration: The direct sales team leverages these opportunities to connect with key decision-makers and address specific client requirements.

The Murugappa Group's promotional efforts are multifaceted, blending broad brand building with targeted sector-specific outreach. Their integrated approach leverages the group's legacy and commitment to quality to foster trust across its diverse portfolio, from consumer goods like Hercules bicycles to financial services under Chola. This strategy ensures individual brands benefit from the overarching reliability of the parent entity.

Digital engagement is increasingly vital, with financial arms like Chola MS actively using online channels for customer acquisition and engagement. While specific 2024-2025 digital spend isn't detailed, the group maintains a strong online presence, crucial for information dissemination and transparency. This digital focus is a key driver for growth in competitive sectors.

For their B2B segments, direct customer engagement through trade shows and industry events is paramount. Companies like Carborundum Universal Limited (CUMI) showcase technical innovations to industrial clients, fostering relationships essential for securing contracts. This direct interaction, supported by a skilled sales force, ensures tailored solutions for complex industrial needs.

The group also utilizes public relations and Corporate Social Responsibility (CSR) initiatives, such as the 'Chola Chess' program, to build a positive brand image and community goodwill. These efforts, coupled with strong financial performance, like the reported consolidated revenue of INR 74,000 crore in 2023, underscore the importance of a positive social license for sustained growth.

| Company | Key Promotional Strategy | 2023 Highlight |

| Murugappa Group (Overall) | Integrated Brand Communication, CSR | INR 74,000 crore consolidated revenue |

| Cholamandalam Investment and Finance Company (Chola) | Targeted Digital Marketing, CSR (Chola Chess) | Increased customer base via digital initiatives |

| Carborundum Universal Limited (CUMI) | Trade Shows, Direct Client Engagement | Significant revenue from industrial clients |

Price

For its industrial and engineering solutions, like abrasives and precision components, the Murugappa Group likely uses value-based pricing. This strategy focuses on the long-term advantages and enhanced performance these high-quality products deliver to industrial customers. For instance, in 2024, the industrial sector's demand for efficiency gains in manufacturing processes, driven by factors like energy cost volatility, would make Murugappa's solutions that promise significant operational savings highly attractive.

In consumer and agri markets, Murugappa Group companies like TI Cycles and Coromandel International navigate intensely competitive pricing landscapes. Pricing is a delicate balance, directly influenced by what rivals charge and the prevailing economic climate in specific regions. This means strategies must be agile and responsive.

For Coromandel International, a key player in agricultural inputs, pricing for fertilizers and crop protection products is particularly sensitive. Factors such as the strength of the monsoon season and fluctuations in raw material costs directly impact their ability to set prices. In fiscal year 2024, Coromandel International reported a revenue of ₹22,096 crore, demonstrating the scale of operations where these pricing dynamics play out.

Cholamandalam Investment and Finance Company, part of The Murugappa Group, employs tiered and segmented pricing across its diverse financial offerings. This strategy allows them to tailor offerings, such as vehicle, home, and personal loans, to specific customer segments and risk profiles.

For instance, interest rates on vehicle loans in early 2024 varied significantly, with new car loans potentially starting around 8.5% to 9.5% for prime borrowers, while used car loans or those with lower credit scores could see rates upwards of 10% to 12% or more. This segmentation ensures competitiveness and risk management.

This approach is crucial for managing market risk and profitability, as demonstrated by their ability to attract a broad customer base. Their focus on different loan types, from SME financing to retail loans, necessitates flexible pricing structures to meet varied demands and economic conditions.

Strategic Capital Expenditure Influencing Cost Structure

The Murugappa Group's strategic capital expenditure is a key driver in shaping its cost structure. In fiscal year 2023-24, the group allocated approximately ₹3,129 crore towards significant capital expenditure programs. These investments are strategically focused on expanding production capacities, addressing bottlenecks, and modernizing existing facilities.

These substantial investments are designed to foster greater production efficiencies and unlock economies of scale across the group's diverse business segments. By enhancing operational capabilities, the group aims to optimize its cost base, which can translate into more competitive pricing strategies or improved profit margins over time.

- Expansion Projects: Funding for increasing manufacturing output and market reach.

- Debottlenecking Initiatives: Investments to remove production constraints and improve throughput.

- Modernization Efforts: Upgrading technology and infrastructure for enhanced efficiency.

- Cost Structure Impact: Potential for reduced per-unit production costs and improved profitability.

Impact of External Factors on Pricing Decisions

External factors significantly shape Murugappa Group's pricing strategies, especially for export-focused entities like Wendt (India). Geopolitical shifts and economic downturns in key international markets can directly impact sales volumes and profit margins, necessitating agile pricing adjustments. For instance, a global economic slowdown in 2024 could pressure pricing for specialized industrial components exported by Wendt.

Domestically, government policies and input costs are equally crucial. Subsidies in sectors like fertilizers, for example, can influence the final consumer price, while fluctuating raw material expenses, such as sugar cane prices, directly affect production costs and, consequently, pricing decisions for the sugar business. The group must constantly monitor these variables to maintain competitive pricing.

Consider these specific influences:

- Geopolitical Instability: Tensions in Southeast Asia, a key export region for some Murugappa products, could lead to supply chain disruptions and increased shipping costs, forcing price increases for products like automotive components.

- International Economic Recessions: A projected slowdown in global manufacturing output for 2024-2025 could reduce demand for industrial goods, compelling price reductions or value-added offerings.

- Government Subsidies: The Indian government's fertilizer subsidy programs directly impact the affordability and pricing of products from Coromandel International, making them sensitive to policy changes.

- Raw Material Volatility: Fluctuations in global commodity prices, such as the price of sugar or rubber, directly influence the cost of goods sold for corresponding Murugappa businesses, necessitating careful price management.

The Murugappa Group employs a multi-faceted pricing strategy across its diverse portfolio, adapting to market dynamics and product types. For industrial solutions, value-based pricing is common, emphasizing long-term benefits and performance gains for customers, especially relevant in 2024's efficiency-driven manufacturing sector. In contrast, consumer and agri-focused businesses like TI Cycles and Coromandel International operate in competitive markets where pricing is heavily influenced by rivals and the economic climate.

Cholamandalam Investment and Finance Company utilizes tiered and segmented pricing for its financial products, such as vehicle and home loans, catering to different customer risk profiles and market conditions. For example, vehicle loan interest rates in early 2024 ranged from approximately 8.5% for prime borrowers to over 10% for higher-risk segments, showcasing this segmentation.

The group's pricing is also shaped by its substantial capital expenditures, with ₹3,129 crore allocated in FY 2023-24 for capacity expansion and modernization, aiming to improve cost efficiencies. External factors like geopolitical shifts and government policies, such as fertilizer subsidies impacting Coromandel International, also play a crucial role in determining final pricing strategies for various group entities.

| Business Segment | Pricing Strategy Example | Key Influences | Relevant Data Point (2024/2025) |

| Industrial Solutions (Abrasives, Components) | Value-Based Pricing | Performance benefits, operational savings | Demand for manufacturing efficiency gains due to energy cost volatility. |

| Consumer Goods (Cycles) | Competitive Pricing | Rival pricing, economic climate | Navigating intensely competitive landscapes. |

| Agri-Inputs (Fertilizers, Crop Protection) | Market-Sensitive Pricing | Monsoon strength, raw material costs, government subsidies | Coromandel International revenue: ₹22,096 crore (FY24), sensitive to policy changes. |

| Financial Services (Loans) | Tiered & Segmented Pricing | Customer risk profiles, loan type, economic conditions | Vehicle loan rates: ~8.5%-9.5% (new cars, prime borrowers) vs. 10%-12%+ (used cars, lower credit). |

| Exports (Industrial Components) | Market-Responsive Pricing | Geopolitical shifts, international economic conditions | Global economic slowdown in 2024 could pressure prices for exported components. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for The Murugappa Group is built upon a foundation of publicly available information, including annual reports, investor presentations, and official company websites. We also incorporate insights from industry analyses and competitive intelligence to provide a comprehensive view of their marketing strategies.