The Murugappa Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Murugappa Group Bundle

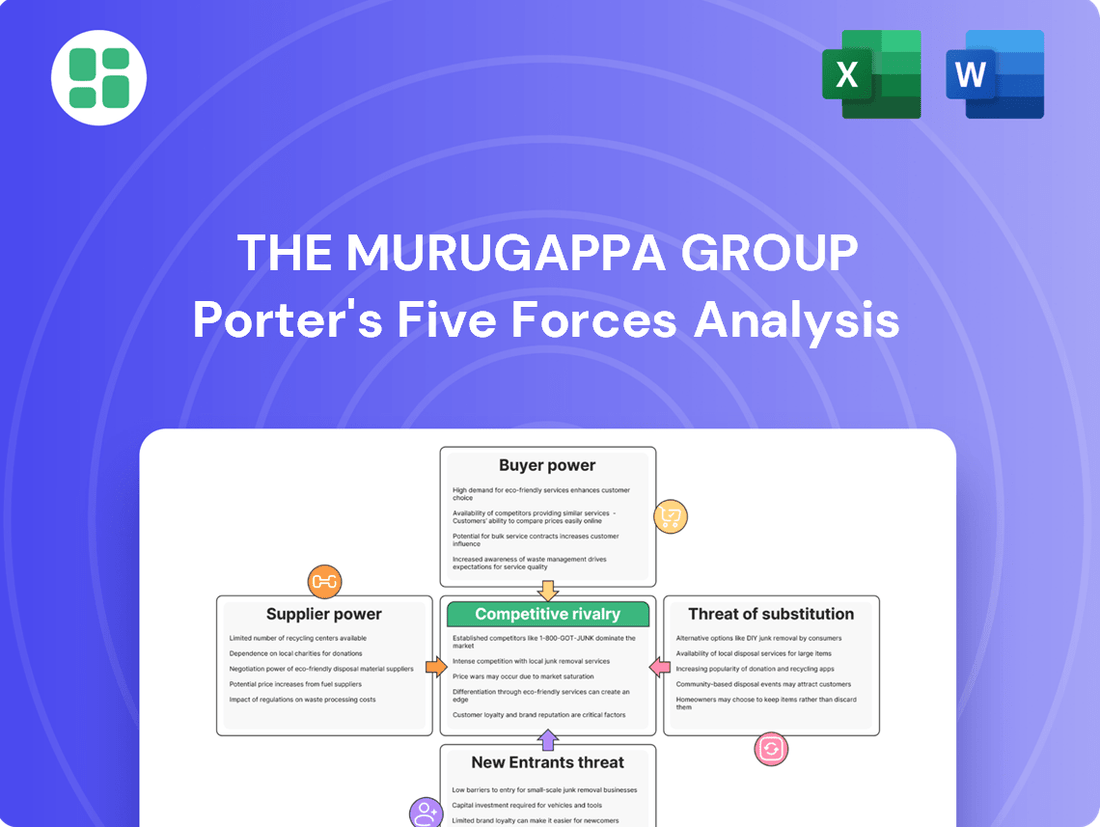

The Murugappa Group navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Murugappa Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Murugappa Group's bargaining power of suppliers is a mixed bag, largely depending on the specific industry segment. For specialized inputs, like advanced chemicals or unique automotive parts, a concentrated supplier base with proprietary technology can exert significant influence. This means Murugappa might face higher costs or tighter supply terms in these niche areas.

However, in many of its broader operations, such as those involving basic raw materials or standardized manufacturing components, Murugappa likely deals with a fragmented supplier market. This fragmentation empowers the conglomerate, allowing it to negotiate favorable pricing and terms due to the abundance of alternative suppliers. For instance, in 2024, commodity prices for many basic materials remained relatively stable or saw modest increases, suggesting that for segments relying on these, supplier power was somewhat subdued.

Switching costs for the Murugappa Group can be substantial, especially within its engineering and automotive components segments where specialized inputs or complex integrated systems are common. The financial commitment involved in qualifying new suppliers, reconfiguring production lines, and managing potential operational interruptions can effectively lock the group into existing supplier relationships, thereby bolstering supplier leverage. For instance, a significant portion of their automotive component manufacturing might rely on suppliers providing highly specific alloys or precision-engineered parts, making a switch costly and time-consuming.

Conversely, for more commoditized raw materials or standard components across its diverse portfolio, the Murugappa Group faces much lower switching costs. This disparity means that suppliers of specialized, critical inputs wield considerably more power than those providing generic goods. In 2024, the group's focus on advanced manufacturing and customized solutions in sectors like advanced materials and industrial equipment likely amplified these higher switching costs for specific input categories.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for The Murugappa Group. For instance, in their agricultural inputs segment, the presence of multiple alternative raw materials can dilute supplier leverage. However, in areas like specialized industrial ceramics, where unique chemical formulations are critical and few substitutes exist, suppliers can command higher prices and more favorable terms.

Supplier Importance to Murugappa vs. Murugappa's Importance to Supplier

For many of its smaller, specialized suppliers, the Murugappa Group's substantial purchasing volume makes it a key client. This reliance can diminish the suppliers' ability to dictate terms, as they value the consistent business. For instance, a niche component manufacturer supplying to one of Murugappa's engineering subsidiaries might find their bargaining power limited by the conglomerate's scale.

Conversely, when dealing with large, global suppliers of critical raw materials or advanced technologies, the dynamic can shift. Murugappa Group might constitute a smaller percentage of these global players' total sales. This means these major suppliers possess greater leverage, potentially influencing pricing and supply conditions, especially for essential inputs like specialized alloys or advanced manufacturing equipment.

The bargaining power of suppliers within the Murugappa Group's ecosystem is therefore highly situational. It hinges on the specific nature of the product or service required and the relative market position of both Murugappa's operating companies and their respective suppliers. For example, in 2024, the group's procurement of bulk commodities like steel might see suppliers with more pricing power compared to their dealings with providers of highly customized machinery.

- Supplier Dependence: Smaller, specialized suppliers often depend heavily on large customers like Murugappa, reducing their bargaining power.

- Global Supplier Leverage: Large international suppliers of essential inputs may have more power as Murugappa might be a minor client to them.

- Situational Power Balance: The balance of power between Murugappa and its suppliers varies significantly based on the specific goods or services procured.

Forward Integration Threat by Suppliers

The threat of forward integration by suppliers for the Murugappa Group is generally low. This is due to the sheer scale and complexity of Murugappa's manufacturing and distribution operations, which span various industries.

While a supplier might consider integrating forward to produce a specific component, it is highly improbable they would venture into the diverse end-product markets that Murugappa commands. For example, a supplier of specialized chemicals might integrate to produce a more refined chemical, but not to manufacture the finished automotive parts or agricultural machinery that Murugappa sells.

Murugappa's established market leadership and extensive distribution networks across sectors like engineering, agri-business, and financial services act as significant deterrents to any supplier contemplating such a move. The capital investment and market access required to compete directly with Murugappa in its core businesses are substantial barriers.

- Low Threat: Suppliers are unlikely to integrate forward into Murugappa's diverse end-product markets.

- Scale & Complexity: Murugappa's vast manufacturing and distribution networks deter supplier integration.

- Market Deterrents: Murugappa's market leadership and broad reach discourage potential forward integration by suppliers.

The bargaining power of suppliers for The Murugappa Group is largely dictated by the specificity of the inputs and the supplier's market position. For critical, specialized components, particularly in engineering and automotive sectors, suppliers can exert considerable influence due to high switching costs and proprietary technology. Conversely, for commoditized raw materials, Murugappa's scale allows for more favorable negotiations.

In 2024, the group's strategic focus on advanced manufacturing and customized solutions likely intensified the bargaining power of suppliers for niche inputs. However, for bulk materials, the competitive landscape for suppliers remained relatively stable, limiting their leverage. The threat of forward integration by suppliers remains low due to Murugappa's extensive market reach and operational complexity.

| Supplier Characteristic | Impact on Murugappa | Example Scenario (2024) |

|---|---|---|

| Specialized/Proprietary Inputs | High Supplier Power | Suppliers of advanced alloys for automotive components may dictate terms. |

| Commoditized Raw Materials | Low Supplier Power | Procurement of steel or basic chemicals benefits from fragmented supplier base. |

| Supplier Dependence on Murugappa | Low Supplier Power | Smaller, niche input providers value Murugappa's consistent business. |

| Murugappa's Dependence on Global Suppliers | High Supplier Power | Large international providers of essential technology may have more leverage. |

What is included in the product

This analysis of The Murugappa Group's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and offers strategic insights for navigating these forces.

Effortlessly visualize the competitive landscape of the Murugappa Group by mapping each of Porter's Five Forces onto a dynamic, interactive dashboard for immediate strategic insight.

Gain a comprehensive understanding of competitive pressures impacting the Murugappa Group, allowing for proactive adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

The Murugappa Group's customer bargaining power varies significantly by segment. In business-to-business (B2B) sectors, such as automotive components where major original equipment manufacturers (OEMs) are key buyers, these large-volume customers can indeed wield considerable influence over pricing and contract terms. For instance, a major automotive OEM might negotiate bulk discounts, impacting the profitability of Murugappa's component divisions.

Conversely, in consumer-facing businesses like bicycles or retail financial services, the customer base is typically much more fragmented. This broad distribution of individual customers means that no single customer possesses substantial bargaining power. This widespread customer base generally dilutes the ability of any one customer to dictate terms or significantly influence pricing for products like BSA cycles or offerings from Murugappa's financial services arms.

Customer switching costs for Murugappa Group products and services are not uniform. For instance, in their financial services segment, moving between providers often involves administrative steps but is typically not a major hurdle.

Conversely, industrial customers who depend on Murugappa's specialized engineering components or abrasive materials face more substantial switching barriers. These can include the expense and effort of re-calibrating machinery, ensuring compatibility with existing systems, or the disruption of losing established service and support networks. For example, a manufacturing plant utilizing Murugappa's custom-engineered parts might incur significant downtime and retooling costs if they were to switch to a new supplier, effectively locking them in.

The Murugappa Group leverages product differentiation across its diverse portfolio, a strategy that significantly curtails customer bargaining power. Brands such as BSA and Hercules in the bicycle segment, or its specialized offerings in abrasives and industrial ceramics, cultivate distinct market positions through unique features, superior quality, and established brand loyalty. This differentiation makes it challenging for customers to solely focus on price when making purchasing decisions, thereby reducing their ability to demand lower prices.

Customer Price Sensitivity

Customer price sensitivity for The Murugappa Group varies significantly depending on the product or service. In segments like consumer goods, where competition is fierce, customers are more likely to focus on price. For instance, in the two-wheeler market, price remains a key consideration for many buyers.

Conversely, in industrial sectors or specialized financial services, Murugappa's reputation for quality and reliability can reduce price sensitivity. Customers requiring critical components for manufacturing or seeking dependable financial solutions may prioritize performance and trust over the lowest price. This allows for premium pricing in certain segments.

- Price Sensitivity in FMCG: In the Fast-Moving Consumer Goods (FMCG) sector, where Murugappa has interests, price is a major driver for consumers, especially in emerging markets.

- Industrial Input Pricing: For industrial inputs like steel tubes or abrasives, buyers are often more focused on specifications and performance, making them less sensitive to minor price differences if quality is assured.

- Financial Services Premiums: In financial services, established brands like Murugappa's Cholamandalam Investment and Finance Company can command customer loyalty and potentially higher margins due to perceived trustworthiness and service quality.

Backward Integration Threat by Customers

The threat of backward integration by customers for The Murugappa Group is generally low. This is primarily due to the significant capital investment and specialized knowledge required for many of Murugappa's core manufacturing operations, such as in areas like advanced ceramics or specialized engineering products.

For instance, producing precision tubes or complex fertilizers demands sophisticated technology and extensive operational expertise, making it economically unfeasible for most customers to replicate these processes in-house. Murugappa's established economies of scale and deep technical know-how further solidify these barriers.

- High Capital Requirements: Many of Murugappa's businesses, like automotive components or fertilizers, involve substantial upfront investment in plant and machinery, deterring customers from backward integration.

- Specialized Technology and Expertise: The group's operations often rely on proprietary technology and highly skilled labor, which are difficult and costly for customers to acquire.

- Economies of Scale: Murugappa benefits from large-scale production, allowing it to achieve cost efficiencies that individual customers would struggle to match.

- Limited Customer Size: In many of Murugappa's B2B segments, individual customers are not large enough to justify the investment needed for backward integration.

The bargaining power of customers within The Murugappa Group's diverse operations is a nuanced factor, largely dictated by the specific industry segment and the nature of the customer relationship.

In its business-to-business dealings, particularly with large original equipment manufacturers (OEMs) in sectors like automotive components, Murugappa faces customers who can exert significant influence on pricing and contract terms due to their substantial order volumes. However, for many of its consumer-facing products, such as bicycles, the customer base is highly fragmented. This broad distribution of individual buyers dilutes the power of any single customer to negotiate terms or impact pricing, thereby lessening their collective bargaining leverage.

The group's product differentiation strategy, evident in brands like BSA cycles and specialized industrial offerings, further mitigates customer bargaining power by fostering brand loyalty and emphasizing quality over price. While price sensitivity is higher in consumer markets, in industrial and financial services segments, Murugappa's reputation for reliability allows it to command premium pricing, reducing the impact of price-focused negotiation.

| Segment | Customer Type | Bargaining Power Level | Key Influencing Factors |

|---|---|---|---|

| Automotive Components | Large OEMs | High | High volume purchases, potential for price negotiation |

| Bicycles (e.g., BSA) | Individual Consumers | Low | Fragmented customer base, brand loyalty |

| Industrial Abrasives/Ceramics | Industrial Manufacturers | Moderate | Switching costs, product specialization, quality focus |

| Financial Services (e.g., Cholamandalam) | Individual and Corporate Clients | Low to Moderate | Brand reputation, service quality, switching costs (administrative) |

Same Document Delivered

The Murugappa Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis of the Murugappa Group, offering a detailed examination of competitive forces within its diverse business segments. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic insight.

You're looking at the actual, professionally formatted document. Once your purchase is complete, you’ll get instant access to this exact file, detailing the strengths and weaknesses of the Murugappa Group in relation to industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Rivalry Among Competitors

The Murugappa Group navigates a highly competitive landscape, with a broad spectrum of rivals spanning regional entities to global giants. In its key sectors, such as financial services and automotive components, the group contends with numerous well-established players, making market share a constant challenge.

For instance, in the Indian automotive components market, which is projected to reach $200 billion by 2026, Murugappa faces competition from companies like Bosch India and Motherson Sumi Systems Limited. Similarly, in financial services, the group's Cholamandalam Investment and Finance Company Limited competes with a multitude of banks and non-banking financial companies, including HDFC Bank and Bajaj Finance.

This dense and varied competitive environment demands that Murugappa Group consistently drive innovation and refine its strategic approach to effectively defend and grow its market presence.

The industries where The Murugappa Group operates exhibit varied growth rates, directly influencing competitive intensity. Mature sectors often see heightened rivalry as companies fight for a larger slice of a limited market, sometimes leading to price competition.

For instance, in the automotive components sector, which is largely mature, established players like Murugappa's businesses face constant pressure to innovate and maintain cost-effectiveness. The Indian automotive industry itself is projected to grow at a CAGR of around 8-10% in the coming years, a moderate pace that sustains robust competition among suppliers.

Conversely, newer ventures in high-growth areas, such as renewable energy or electric vehicle components, might initially experience less intense rivalry. However, as these markets expand, attracting significant investment, competition is expected to escalate rapidly, requiring agility and strategic foresight from the group.

Murugappa Group benefits from strong brand recognition and distinct product offerings in sectors like bicycles, where brands such as BSA and Montra are well-established. This differentiation reduces direct price competition. For instance, their automotive components also command loyalty due to perceived quality and innovation.

However, in segments like basic fertilizers or certain financial services, achieving significant product differentiation is challenging. In these areas, competition often intensifies on price and service quality, as seen in the highly competitive agrochemical market where generic products are prevalent.

Exit Barriers for Competitors

High exit barriers in several of Murugappa Group's key sectors, like heavy manufacturing, mean competitors often stay put even when profits are low. This is due to substantial sunk costs in specialized plants and equipment, making it financially unviable for them to leave.

For instance, in the automotive components sector, where Murugappa has a strong presence, the need for advanced tooling and dedicated production lines creates significant capital tied up. This forces companies to continue operating, potentially leading to oversupply and price wars.

This situation directly impacts Murugappa's ability to benefit from competitors exiting the market, as they are less likely to do so.

- High Capital Investment: Industries like sugar and fertilizers require massive, specialized plant and machinery, representing substantial sunk costs for any player.

- Specialized Workforce & Know-how: Retraining or redeploying skilled labor and proprietary technology is often difficult and costly, discouraging exits.

- Brand Loyalty & Relationships: Established distribution networks and long-term customer relationships are assets that are hard to liquidate, keeping firms in the game.

Strategic Stakes and Acquisitions

The Murugappa Group's strategic focus on growth through acquisitions, particularly in burgeoning sectors like electric vehicles and semiconductors, indicates significant strategic stakes across its operating markets. This aggressive expansion and consolidation strategy by Murugappa naturally intensifies competitive rivalry as other industry players are compelled to respond to its proactive market maneuvers.

For instance, in 2024, the group continued its investment spree, with its subsidiary CG Power and Industrial Solutions announcing plans to invest ₹700 crore in expanding its semiconductor manufacturing capabilities. This move directly challenges established players and signals a heightened competition for market share and talent in this critical technology space.

- Strategic Acquisitions: Murugappa Group’s investments in EV components and semiconductor manufacturing in 2024 are key growth drivers.

- Heightened Rivalry: These moves increase competition as rivals must adapt to Murugappa's expanding market presence.

- Market Consolidation: The group’s strategy aims to consolidate its position, potentially leading to market consolidation and increased competitive pressure.

- Emerging Sector Focus: Investments in EVs and semiconductors highlight a strategic bet on future growth areas, intensifying rivalry among those targeting these sectors.

The Murugappa Group faces intense competition across its diverse business segments, from established giants to agile regional players. In automotive components, for example, it competes with global leaders and strong domestic firms, a dynamic reflected in India's auto component market projected to reach $200 billion by 2026. This rivalry necessitates continuous innovation and cost management to maintain market share.

The group's strategic acquisitions and investments, such as the ₹700 crore expansion in semiconductor manufacturing by CG Power and Industrial Solutions in 2024, directly escalate competition in high-growth sectors. This proactive market maneuvering forces rivals to adapt, intensifying the battle for market share and technological leadership.

Product differentiation plays a crucial role; while brands like BSA in bicycles offer distinct advantages, segments like fertilizers face price-driven competition due to the prevalence of generic products. High exit barriers in capital-intensive industries like sugar and automotive components further contribute to sustained rivalry, as firms are less likely to leave even during downturns.

| Murugappa Group Segment | Key Competitors | Market Dynamics & Competitive Factors |

|---|---|---|

| Automotive Components | Bosch India, Motherson Sumi Systems Limited | Mature market, high capital investment, innovation pressure, price sensitivity. India's auto component market projected at $200 billion by 2026. |

| Financial Services (Cholamandalam) | HDFC Bank, Bajaj Finance, other banks & NBFCs | Intense competition on pricing, service quality, and product innovation. Growth in digital lending further fuels rivalry. |

| Bicycles | TI Cycles of India (part of Tube Investments), Hero Cycles | Brand loyalty and product differentiation are key. Established brands like BSA and Montra benefit from strong recognition. |

| Semiconductors | Global semiconductor manufacturers, domestic players | Rapidly growing sector with high barriers to entry. CG Power's 2024 investment of ₹700 crore signals aggressive competition for market share and talent. |

SSubstitutes Threaten

The threat of substitutes for Murugappa Group's diverse product portfolio hinges significantly on the price-performance ratio of alternative offerings. For instance, in the bicycle segment, while electric scooters and public transportation present substitutes, the enduring appeal of traditional bicycles for affordability, health benefits, and specific recreational or utility needs can cushion this threat if the substitute's value proposition doesn't strongly outweigh the bicycle's advantages.

Customer propensity to substitute for The Murugappa Group's products is a mixed bag. For simpler agricultural inputs like fertilizers, farmers can indeed switch readily to alternatives if they perceive better value, perhaps driven by price or perceived efficacy. This flexibility is a key factor in this segment.

However, the situation changes dramatically for their more complex offerings. In areas like specialized engineering components for industries such as automotive or infrastructure, the high switching costs, the need for rigorous testing and certification, and the established relationships often make customers far less likely to substitute. For instance, a manufacturer relying on a specific Murugappa Group component for a critical part of their machinery faces significant disruption and expense if they were to change suppliers.

Similarly, in financial services, particularly for businesses seeking tailored corporate finance solutions or specialized insurance, the trust, expertise, and bespoke nature of the service create a strong barrier to substitution. Customers are less inclined to move to a competitor for these services due to the perceived risk and the effort involved in re-establishing a similar level of tailored support. For example, in 2024, the financial services sector saw continued consolidation, reinforcing the value of established, trusted providers like those within the Murugappa Group.

The threat of substitutes is a key consideration for The Murugappa Group. In financial services, the rise of fintech companies offering alternative credit and insurance solutions directly challenges traditional offerings. For instance, by mid-2024, peer-to-peer lending platforms have seen significant growth, providing a viable alternative to bank loans for many businesses and individuals.

Similarly, in industrial ceramics, advanced plastics and composite materials are increasingly capable of performing functions previously exclusive to ceramics. These substitutes, often lighter and easier to process, can erode market share if Murugappa's ceramic products do not offer distinct advantages. The group's continued investment in research and development is crucial to maintain a competitive edge against these evolving alternatives.

Cost of Switching to a Substitute

The cost for customers to switch from Murugappa Group's offerings to substitutes plays a crucial role in mitigating this threat. For example, if a customer currently uses Murugappa's high-performance industrial abrasives, transitioning to an entirely new grinding technology could involve substantial investments in new machinery and employee retraining. This financial and operational hurdle makes switching less appealing, even if the substitute technology promises long-term advantages.

This switching cost acts as a significant barrier. Consider the automotive sector, a key market for industrial components. A switch from established abrasive suppliers like Murugappa to a novel, unproven alternative might necessitate a complete overhaul of production lines. In 2024, capital expenditure for such retooling in manufacturing can easily run into hundreds of thousands, if not millions, of dollars, thereby solidifying customer loyalty to existing, reliable suppliers.

- High Retooling Costs: Significant investment required for new machinery.

- Training Expenses: Costs associated with upskilling the workforce on new technologies.

- Integration Challenges: Potential disruptions and compatibility issues with existing systems.

- Loss of Productivity: Temporary dip in output during the transition phase.

Technological Advancements Enabling Substitutes

Technological advancements continually introduce new substitutes that can disrupt established industries. For instance, the rapid evolution of electric vehicles (EVs) presents a significant long-term substitute threat to traditional automotive component manufacturers. Similarly, the rise of digital platforms is increasingly substituting conventional financial services, offering alternative ways for consumers to manage their money. The Murugappa Group's strategic investments in EV technology and digital transformation initiatives are proactive measures designed to mitigate these evolving threats and adapt to changing market landscapes.

The automotive sector, for example, saw global EV sales reach approximately 13.6 million units in 2023, a substantial increase from previous years, highlighting the growing shift away from internal combustion engine vehicles. This trend directly impacts companies supplying traditional engine parts. In the financial services realm, digital payment transactions globally are projected to exceed 1.5 trillion by 2027, demonstrating the significant displacement of traditional banking methods. Murugappa's commitment to innovation in these areas, including its subsidiary Tube Investments of India's focus on EV components and digital financial solutions, is crucial for maintaining competitiveness.

- EV Adoption Growth: Global EV sales surged by over 30% in 2023, indicating a strong substitute trend for traditional automotive products.

- Digital Finance Penetration: Over 70% of consumers in developed economies used digital banking services in 2023, showcasing the substitution of physical branches.

- Murugappa's Strategic Response: Investments in EV component manufacturing and digital platform development are key to addressing these substitute threats.

The threat of substitutes for Murugappa Group's diverse offerings varies significantly. For basic agricultural inputs, farmers have more flexibility to switch to alternatives based on price and perceived effectiveness. However, for specialized industrial components and tailored financial services, high switching costs, regulatory hurdles, and established trust create substantial barriers, making substitution less likely. For instance, in 2024, the continued growth of fintech alternatives in financial services poses a direct challenge to traditional players, but the need for bespoke solutions and proven reliability often keeps customers with established providers.

Technological advancements also introduce new substitutes. The automotive sector, a key market for Murugappa, is seeing a rapid shift towards electric vehicles, which impacts demand for traditional components. Similarly, digital platforms are increasingly replacing conventional financial services. Murugappa's strategic investments in EV components and digital financial solutions are crucial responses to these evolving substitute threats. For example, global EV sales reached approximately 13.6 million units in 2023, a clear indicator of this substitution trend.

| Segment | Potential Substitutes | Customer Propensity to Substitute | Mitigating Factors for Murugappa |

| Agricultural Inputs (e.g., Fertilizers) | Competitor brands, organic alternatives | High (price and efficacy sensitive) | Brand loyalty, distribution network |

| Bicycles | Electric scooters, public transport, e-bikes | Moderate (depends on price, utility, and lifestyle) | Affordability, health benefits, recreational appeal |

| Industrial Components (e.g., Abrasives) | Advanced plastics, composite materials, new manufacturing technologies | Low to Moderate (high switching costs, performance requirements) | Product quality, customization, established relationships |

| Financial Services | Fintech platforms, alternative lenders, digital payment solutions | Moderate to High (driven by convenience and cost) | Trust, expertise, tailored solutions, regulatory compliance |

Entrants Threaten

The Murugappa Group's diverse operations, including engineering, automotive components, and fertilizer manufacturing, are inherently capital-intensive. For instance, setting up a modern fertilizer plant can easily cost hundreds of millions of dollars, a substantial hurdle for any new competitor.

Furthermore, building robust R&D facilities and extensive distribution networks, crucial for success in these sectors, demands significant upfront investment. These high capital requirements act as a formidable barrier, effectively deterring many potential new entrants from challenging established players like Murugappa.

The Murugappa Group's deep roots and established leadership in various sectors translate into substantial economies of scale and a well-developed experience curve. This means they can produce goods and services at a lower per-unit cost than a newcomer could hope to achieve initially.

Newcomers face a significant hurdle in matching Murugappa's cost efficiencies, high production volumes, and accumulated operational expertise. Consequently, competing on price or operational effectiveness from the outset presents a formidable challenge for any potential entrant.

New players face significant hurdles in accessing established distribution channels, particularly in sectors where The Murugappa Group holds strong positions. For instance, in the competitive bicycle market, companies like TI Cycles of India, part of Murugappa, have built extensive dealer networks over decades. Establishing a comparable reach across India would necessitate massive capital outlay and considerable time, creating a formidable barrier for any new entrant aiming to compete effectively.

Government Policy and Regulation

Government policies and regulations create substantial barriers for new entrants, especially in sectors where The Murugappa Group operates, such as financial services and fertilizers. For instance, in India's financial services sector, stringent licensing requirements and capital adequacy norms, as mandated by the Reserve Bank of India (RBI), can deter new players. Similarly, environmental regulations for fertilizer production, enforced by bodies like the Central Pollution Control Board, necessitate significant upfront investment in compliance technologies.

Navigating these complex regulatory landscapes, including obtaining necessary permits and adhering to evolving standards, proves to be a costly and time-consuming endeavor for potential new competitors. Murugappa's investments in emerging sectors like semiconductors also highlight this, as government incentives and national manufacturing policies play a crucial role in shaping market entry conditions. For example, India's Production Linked Incentive (PLI) scheme for semiconductors aims to attract investment but also sets specific eligibility and performance criteria that new entrants must meet.

Key regulatory considerations that act as barriers include:

- Licensing and Approvals: Obtaining specific licenses for operations in regulated industries can be a lengthy and capital-intensive process.

- Environmental Compliance: Adhering to strict environmental protection laws requires substantial investment in pollution control and sustainable practices.

- Capital Requirements: Many sectors mandate significant minimum capital investments, serving as a financial hurdle for new businesses.

- Industry-Specific Standards: Meeting sector-specific quality and safety standards often necessitates advanced technology and rigorous testing protocols.

Brand Loyalty and Product Differentiation

The Murugappa Group benefits significantly from its established brand loyalty, cultivated over decades across its diverse business segments. For instance, brands like TI Cycles (with its popular BSA and Hercules brands) and Parry's Sugar have deep-rooted customer trust, making it challenging for new entrants to gain traction. This loyalty means new players must commit substantial resources to marketing and product development to even begin chipping away at Murugappa’s market share.

The group's commitment to quality and consistent performance across its portfolio, from engineering to agro-businesses, further solidifies customer allegiance. New entrants face the daunting task of not only matching this quality but also convincing consumers that their offerings are superior or offer better value. This necessitates significant investment in research and development, manufacturing excellence, and extensive promotional campaigns, thereby raising the barrier to entry.

Consider the automotive components sector where Murugappa’s subsidiaries are key players. In 2023, the Indian automotive industry saw significant growth, yet established players like Murugappa’s component businesses often maintain strong relationships with original equipment manufacturers (OEMs) built on reliability and a proven track record. A new entrant would need to demonstrate comparable quality standards and supply chain efficiency, a costly and time-consuming endeavor, to secure partnerships with major automotive brands.

- Brand Equity: Murugappa's brands are recognized for quality and reliability, fostering strong customer loyalty.

- Market Penetration Costs: New entrants must invest heavily in marketing and brand building to challenge established loyalty.

- Product Differentiation Imperative: Entrants need unique value propositions to persuade customers to switch from trusted brands.

- Risk of New Entrants: High initial investment and the need to overcome ingrained customer preferences present significant risks for new market participants.

The threat of new entrants for The Murugappa Group is generally moderate to low across its core businesses. Significant capital requirements, particularly in manufacturing sectors like fertilizers and engineering, create substantial entry barriers, often running into hundreds of millions of dollars for new facilities. Established economies of scale and experience curves further disadvantage newcomers, as Murugappa can leverage lower per-unit costs and operational efficiencies gained over decades of operation.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Murugappa Group is built upon a foundation of publicly available information, including the group's annual reports, investor presentations, and official press releases. We also leverage industry-specific research from reputable market intelligence firms and economic data from government and financial databases.