MODEC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MODEC Bundle

MODEC's strengths lie in its established reputation and technological expertise in the FPSO market, while its opportunities stem from the growing global demand for offshore energy solutions. However, potential threats like fluctuating oil prices and intense competition require careful navigation.

Want the full story behind MODEC's strategic advantages, potential pitfalls, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

MODEC stands as a prominent global leader in floating production solutions for the offshore oil and gas sector, leveraging over 55 years of industry expertise. This deep experience translates into a strong ability to secure significant international contracts, solidifying its dominant market position and sterling reputation.

The company's continued leadership is evident in recent contract wins, including the Gato do Mato FPSO project in Brazil and several FPSO units destined for Guyana's burgeoning offshore fields. These achievements highlight MODEC's ongoing success in securing key projects within vital offshore energy production regions.

MODEC's integrated EPCI and O&M capabilities are a significant strength, offering clients a complete lifecycle solution for offshore facilities. This means they handle everything from the initial design and construction to the ongoing operation and upkeep. This comprehensive approach not only streamlines projects but also creates predictable, recurring revenue for MODEC, as seen in their long-term O&M contracts.

This full-service model allows MODEC to maintain tight control over project quality and operational efficiency. By managing the entire process, they can ensure higher standards and better performance throughout the life of an asset. This integrated strategy fosters deeper, more robust client relationships, built on reliability and a proven track record of end-to-end service delivery.

MODEC showcased impressive financial results, with revenues climbing to ¥487.6 billion in fiscal year 2024, a notable increase from the previous year. This strong performance was underpinned by a substantial order backlog, which reached ¥1.2 trillion as of March 2025, ensuring a solid base for future earnings and operational continuity.

Advanced Technology and Innovation

MODEC is a leader in developing cutting-edge technology for the offshore industry. This includes innovative double hull designs for Floating Production Storage and Offloading (FPSO) units and custom-engineered next-generation hulls built for longevity. These advancements are crucial for operating in demanding offshore conditions.

The company's dedication to innovation isn't limited to hull design; it actively explores decarbonization technologies and advanced inspection methods, such as drone-based systems. This forward-thinking approach ensures MODEC stays ahead of evolving industry standards and environmental regulations.

- Technological Leadership: MODEC is at the forefront of developing advanced offshore technologies.

- FPSO Innovation: The company is creating new double hull designs and next-generation FPSO hulls with extended lifespans.

- Decarbonization Focus: MODEC is investing in and exploring technologies to reduce emissions in its operations.

- Advanced Inspection: The implementation of drone-based inspection systems enhances operational efficiency and safety.

Proven Track Record and Client Relationships

MODEC boasts a proven track record, having successfully delivered 19 Floating Production Storage and Offloading (FPSO) units, notably for the crucial Brazilian market. This extensive experience underscores their capability in handling complex offshore projects. Their consistent performance on significant contracts with industry giants such as ExxonMobil and Shell highlights their reliability and technical expertise.

These successful deliveries have fostered enduring partnerships with major oil and gas companies. This deep client trust often translates into repeat business and a preferred position for MODEC when new projects arise, solidifying their market standing. For instance, their ongoing involvement in projects like the Bacalhau FPSO for Equinor in Brazil, a significant undertaking, further exemplifies these strong relationships.

MODEC's deep industry experience and strong reputation are significant assets, enabling them to secure major international contracts and maintain a dominant market position. Their integrated EPCI and O&M capabilities offer clients comprehensive lifecycle solutions, fostering long-term relationships and predictable revenue streams. This end-to-end service model ensures quality control and operational efficiency, further solidifying their standing. The company's commitment to technological innovation, including advanced hull designs and decarbonization efforts, keeps them at the forefront of the offshore industry.

| Metric | FY 2024 (ending March 2025) | FY 2023 (ending March 2024) |

|---|---|---|

| Revenue | ¥487.6 billion | ¥450.1 billion |

| Order Backlog (as of March 2025) | ¥1.2 trillion | ¥1.1 trillion |

| FPSO Units Delivered | 19 (cumulative) | 18 (cumulative) |

What is included in the product

Analyzes MODEC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Highlights key strategic advantages and potential risks, enabling targeted problem-solving.

Weaknesses

MODEC faces significant financial exposure due to the immense capital required for constructing FPSO vessels and other offshore infrastructure, a key weakness in its operational model.

The protracted timelines for Engineering, Procurement, Construction, and Installation (EPCI) contracts mean that project delays, budget overruns, or unexpected technical hurdles can severely affect MODEC's financial performance, as seen in past industry challenges.

Effectively managing these large-scale, intricate projects necessitates robust risk assessment frameworks and proactive mitigation plans to counter inherent complexities and potential disruptions.

MODEC's primary operations are deeply tied to the offshore oil and gas sector. This industry is notoriously sensitive to shifts in crude oil prices and global political events, creating a volatile environment for the company. For instance, a significant drop in oil prices, like the ones seen in early 2020, can directly impact client spending on new projects.

When energy markets weaken, oil and gas companies often scale back their capital expenditures. This directly translates to fewer new contract awards for MODEC and can even affect their existing service agreements. This strong reliance on the cyclical nature of oil and gas demand introduces considerable market unpredictability for MODEC's revenue streams.

MODEC's global footprint, with significant operations in regions like Guyana and Brazil, inherently exposes the company to a spectrum of geopolitical risks. These can manifest as unexpected political instability, trade disputes, or shifts in national priorities that impact energy sector investments. For instance, changes in local content regulations in Brazil, which aim to boost domestic industry, could increase MODEC's operational costs or necessitate complex supply chain adjustments.

Furthermore, evolving environmental policies across different jurisdictions present a continuous challenge. As nations increasingly focus on decarbonization and stricter emissions standards, MODEC must adapt its technologies and operational practices. Failure to comply with these dynamic regulatory landscapes could lead to penalties, reputational damage, or even the suspension of projects, directly impacting revenue streams and project timelines.

Intense Competition in a Niche Market

MODEC faces significant challenges in its niche market for floating production solutions, where competition is fierce. Established rivals and emerging companies constantly compete for lucrative contracts, forcing MODEC to prioritize innovation, cost-effectiveness, and flawless project delivery. This intense rivalry can squeeze profit margins and hinder the acquisition of new, high-value projects, impacting overall growth potential.

For instance, in 2024, the offshore oil and gas sector saw increased bidding activity for FPSO (Floating Production Storage and Offloading) units. While MODEC secured several key contracts, the competitive landscape meant that margins on these projects were carefully managed. The ongoing demand for energy, particularly in deepwater and challenging environments, continues to attract new players, intensifying the pressure on existing market leaders like MODEC to maintain their edge.

- Intense Rivalry: Competitors like BW Offshore and SBM Offshore actively pursue similar contracts.

- Margin Pressure: Aggressive bidding to win projects can lead to lower profit margins.

- Innovation Demands: Continuous investment is needed to stay ahead in technological advancements for floating production systems.

Sustainability Transition Challenges

MODEC's core business, supporting the fossil fuel industry, presents a significant weakness in the face of global decarbonization efforts. This reliance on carbon-intensive operations exposes the company to increasing reputational risks and potential regulatory pressures. For instance, as of early 2025, the International Energy Agency (IEA) continues to highlight the urgent need for reduced fossil fuel investment to meet climate targets, a trend that directly impacts MODEC's traditional market.

The company's current business model, while profitable, requires substantial future investment to pivot towards more sustainable offshore energy solutions. Without a robust diversification strategy, MODEC risks being left behind as the energy landscape shifts. This transition necessitates not only technological advancements but also a significant capital allocation, potentially straining financial resources if not managed proactively. For example, the offshore wind sector, a potential area for diversification, saw global investment reach over $70 billion in 2023, indicating the scale of capital required to compete in new energy markets.

- Reliance on Fossil Fuels: MODEC's primary revenue streams are tied to the exploration and production of oil and gas, a sector facing intense global pressure to transition away from carbon-intensive energy sources.

- Reputational Risks: Continued association with fossil fuels could lead to negative public perception and investor scrutiny, especially as environmental, social, and governance (ESG) factors become increasingly critical in investment decisions.

- Diversification Imperative: Significant investment is required to develop and implement new service offerings in sustainable offshore energy, such as floating offshore wind, to align with evolving market demands and future energy trends.

MODEC's substantial capital expenditure requirements for FPSO construction and offshore infrastructure represent a significant financial vulnerability. The lengthy EPCI timelines also expose the company to substantial risks from project delays and cost overruns, which can severely impact financial performance, as historical industry trends have demonstrated.

The company's deep integration with the offshore oil and gas sector makes it highly susceptible to fluctuations in crude oil prices and global political events. A downturn in energy markets, for example, can lead to reduced client spending and fewer contract awards, directly impacting MODEC's revenue stability.

MODEC's global operations, particularly in regions like Brazil, expose it to geopolitical risks and evolving environmental regulations. Changes in local content rules or stricter emissions standards can increase operational costs and necessitate complex adjustments, potentially affecting project timelines and profitability.

Intense competition within the floating production solutions market forces MODEC to maintain a strong focus on innovation and cost-efficiency. This rivalry can compress profit margins and limit the acquisition of new, high-value projects, thereby impacting overall growth prospects.

MODEC's reliance on the fossil fuel industry presents a weakness amidst global decarbonization trends. This dependence carries reputational risks and potential regulatory challenges, as the energy sector increasingly shifts towards sustainable solutions. For instance, the IEA's continued emphasis on reducing fossil fuel investment by early 2025 directly affects MODEC's traditional market base.

The imperative to diversify into sustainable offshore energy solutions, such as floating offshore wind, requires substantial future investment. Without a proactive diversification strategy, MODEC risks falling behind market shifts, which could strain financial resources. Global investment in offshore wind alone exceeded $70 billion in 2023, highlighting the capital intensity of new energy markets.

What You See Is What You Get

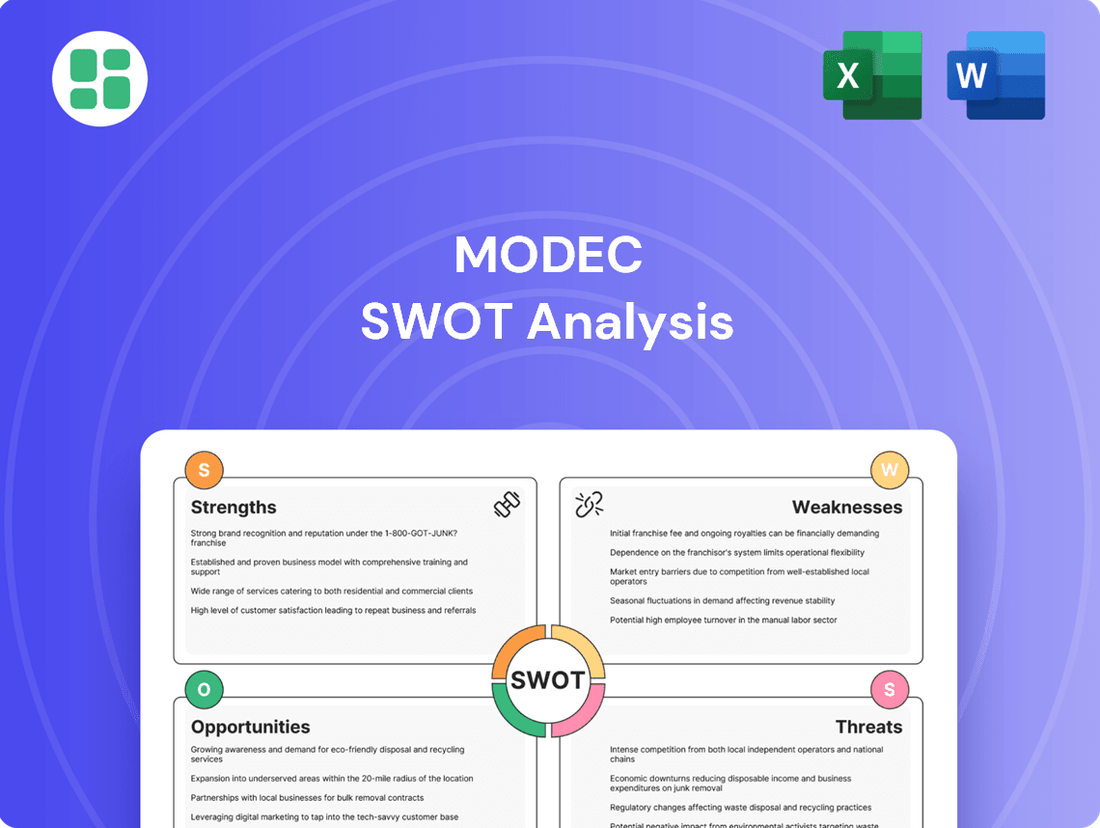

MODEC SWOT Analysis

This is the same MODEC SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual MODEC SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real MODEC SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global offshore drilling market is expected to see robust expansion, fueled by heightened exploration and production efforts in burgeoning areas like Guyana and Brazil. MODEC is strategically positioned to benefit from new project approvals and the development of deep and ultra-deepwater fields in these dynamic regions, creating substantial opportunities for securing new contracts and increasing its market presence.

MODEC is well-positioned to capitalize on the growing demand for offshore wind farm infrastructure, a sector projected to see significant investment through 2030. Its proven capabilities in complex offshore project execution are directly transferable to the installation and maintenance of wind turbines and their associated subsea systems.

Expanding into Carbon Capture, Utilization, and Storage (CCUS) presents another avenue for growth. As global efforts to decarbonize intensify, the need for offshore CCUS infrastructure, including CO2 injection and storage facilities, is expected to rise. MODEC's experience with subsea pipelines and processing equipment can be a key differentiator in this burgeoning market.

Furthermore, the company can explore opportunities in the emerging hydrogen economy, particularly in the production and transportation of green hydrogen offshore. Developing floating production systems for hydrogen or contributing to the infrastructure for its transport aligns with MODEC's core competencies and offers a pathway to new revenue streams, reducing reliance on traditional oil and gas projects.

MODEC can leverage the increasing adoption of digitalization, automation, and AI across the offshore sector. These technologies offer a pathway to more efficient design, construction, and operation of facilities.

Investing in smart FPSO solutions, which incorporate predictive maintenance and advanced data analytics, presents a clear opportunity. This can lead to significant cost reductions and enhanced operational safety, as seen in the industry's drive towards Industry 4.0 principles.

The company's embrace of these technological advancements will be crucial for maintaining a competitive edge. For instance, enhanced data analytics can optimize asset performance, potentially leading to improved uptime and revenue generation, a key focus for offshore operators in 2024 and 2025.

Increased Focus on Local Content and Training Programs

Countries like Guyana are increasingly mandating local content in their offshore energy sectors, aiming to boost domestic economies. For MODEC, this translates into a significant opportunity to build its local workforce and supply chain through targeted training and partnerships. This approach not only ensures regulatory compliance but also cultivates positive community relations and potentially lowers operational costs.

By investing in local talent and suppliers, MODEC can align with national development goals. For instance, Guyana’s Local Content Act of 2021 requires a certain percentage of goods and services to be sourced locally, a trend likely to expand across other resource-rich nations.

- Develop robust training programs to upskill local personnel in specialized offshore operations.

- Forge strategic partnerships with local businesses to build a reliable and cost-effective supply chain.

- Prioritize local hiring and knowledge transfer to foster long-term community engagement and operational efficiency.

- Adapt business models to seamlessly integrate local content requirements, turning policy into a competitive advantage.

Long-term O&M Contracts and Asset Optimization

Securing long-term Operations and Maintenance (O&M) contracts offers a significant opportunity for stable, recurring revenue streams. MODEC's 20-year agreement with Shell for the Gato do Mato project is a prime example of this strategy, providing predictable income.

Further leveraging this opportunity involves optimizing the performance and efficiency of existing Floating Production Storage and Offloading (FPSO) assets. By focusing on extending operational life and enhancing output, MODEC can maximize the long-term profitability and value of its deployed fleet.

- Long-term O&M contracts provide predictable revenue: MODEC's 20-year contract with Shell for Gato do Mato highlights this stability.

- Asset optimization enhances profitability: Improving FPSO efficiency and lifespan directly boosts long-term financial returns.

- Focus on maximizing asset value: Strategic O&M can unlock greater economic potential from existing infrastructure.

The global offshore drilling market's expansion, particularly in regions like Guyana and Brazil, presents significant growth prospects for MODEC. The company is poised to secure new contracts by leveraging its expertise in deep and ultra-deepwater projects, which are seeing increased exploration and production activity. For instance, Guyana's offshore sector alone is projected to see substantial investment in the coming years, with multiple FPSO units anticipated for deployment to support new oil discoveries.

MODEC's capabilities are also well-suited for the burgeoning offshore wind sector, a market expected to attract considerable investment through 2030 and beyond. The company can apply its offshore project execution experience to the installation and maintenance of wind turbines and associated subsea infrastructure, tapping into a growing demand for renewable energy solutions.

Furthermore, the expansion into Carbon Capture, Utilization, and Storage (CCUS) and the emerging hydrogen economy offers new revenue streams. As decarbonization efforts accelerate, the demand for offshore CCUS infrastructure, including CO2 injection and storage, is projected to rise. MODEC’s existing experience with subsea pipelines and processing equipment positions it favorably to contribute to these critical environmental initiatives.

The company can also capitalize on the increasing adoption of digitalization and automation across the offshore industry. Investing in smart FPSO solutions, incorporating predictive maintenance and advanced data analytics, can lead to enhanced operational efficiency and cost reductions, aligning with Industry 4.0 principles and improving asset performance in 2024-2025.

| Opportunity Area | Key Drivers | MODEC's Advantage | Market Insight (2024-2025) |

| Offshore Drilling Expansion (Guyana, Brazil) | Increased E&P, deepwater development | Expertise in FPSO for deepwater | Guyana's offshore production expected to reach 1.5 million bpd by 2027. |

| Offshore Wind Infrastructure | Renewable energy investment | Proven offshore project execution | Global offshore wind capacity projected to double by 2030. |

| CCUS and Hydrogen Economy | Decarbonization efforts | Subsea pipeline and processing experience | Growing government incentives for CCUS projects globally. |

| Digitalization & Automation | Efficiency and cost reduction | Smart FPSO solutions | Industry focus on predictive maintenance for asset optimization. |

Threats

Global oil price volatility presents a significant threat to MODEC. For instance, during periods of sustained low oil prices, such as the downturn experienced in 2020, exploration and production companies often scale back capital expenditures. This directly impacts MODEC's order pipeline for FPSOs and other floating production systems, as clients postpone or cancel new project awards.

Market downturns also compel clients to renegotiate existing contracts or seek more favorable terms, potentially squeezing MODEC's profit margins. The unpredictable nature of crude oil prices, influenced by geopolitical events and supply-demand dynamics, makes forecasting future demand for MODEC's services and long-term strategic planning exceptionally difficult.

Increasing global pressure for decarbonization, exemplified by the Paris Agreement's goals, translates into stricter environmental regulations for companies like MODEC. This could significantly increase compliance costs for their offshore operations and new projects, potentially impacting profitability. For instance, enhanced emissions standards or stricter waste management protocols might necessitate substantial capital outlays for new technologies or operational adjustments.

New environmental regulations could also impose significant liabilities related to the decommissioning of older offshore assets. As fields mature, the cost of safely dismantling and removing structures becomes a growing concern, with potential liabilities increasing under more stringent rules. This is particularly relevant as many offshore oil and gas assets are nearing the end of their operational life.

The accelerating global shift away from fossil fuels, driven by climate change concerns, poses a threat to the long-term viability of traditional offshore oil and gas projects. This trend can negatively impact investor sentiment towards companies heavily invested in this sector, potentially affecting MODEC's access to capital and the overall valuation of its existing and future projects.

Global supply chain vulnerabilities, coupled with rising raw material costs and persistent inflation, pose a significant threat to MODEC's Engineering, Procurement, Construction, and Installation (EPCI) projects. For instance, the average cost of key materials like steel, a primary component in offshore structures, saw substantial increases throughout 2024, impacting project budgets.

These escalating expenses for labor and logistics directly translate to higher project costs and potential delivery delays, squeezing MODEC's profit margins. The ongoing geopolitical tensions and trade disputes observed in 2024 and early 2025 further amplify these supply chain and cost challenges, creating an unpredictable operating environment.

Emergence of Disruptive Technologies or Business Models

The offshore energy sector is experiencing rapid technological evolution. For instance, advancements in floating solar farms and offshore wind turbine efficiency are constantly reshaping energy production landscapes. MODEC, while a leader in FPSO technology, faces the threat of these emerging solutions potentially offering more cost-effective or environmentally friendly alternatives, impacting demand for its core offerings.

New business models, such as decentralized energy grids or direct power-to-X applications utilizing offshore resources, could bypass traditional large-scale production infrastructure. This shift could reduce the reliance on FPSOs, a key component of MODEC's business, potentially diminishing its market share if it cannot adapt its services or asset portfolio.

The increasing focus on decarbonization and renewable energy sources presents a significant challenge. While MODEC is exploring opportunities in this area, a rapid acceleration in the adoption of entirely new offshore renewable technologies, such as advanced tidal or wave energy converters, could outpace MODEC's strategic pivot, rendering its existing expertise in hydrocarbon extraction less relevant.

- Technological Disruption: The global offshore wind market is projected to reach over $100 billion by 2030, indicating rapid innovation and potential displacement of existing technologies.

- New Business Models: The rise of green hydrogen production facilities offshore could offer alternative revenue streams for offshore infrastructure, potentially diverting investment from traditional oil and gas FPSO projects.

- Renewable Energy Integration: Investment in offshore renewable energy projects, including those for hydrogen production, saw significant growth in 2023, with global commitments exceeding $100 billion.

Increased Competition and Consolidation in the Offshore Sector

The offshore energy sector is a fiercely competitive arena, with established companies and emerging players constantly vying for dominance. This intense rivalry can significantly impact profit margins, as companies may be forced to lower bids to secure crucial projects. For instance, in 2024, the average bid-to-cost ratio for FPSO (Floating Production Storage and Offloading) projects saw a noticeable decline compared to previous years, reflecting this heightened competition.

Furthermore, a notable trend of consolidation within the offshore sector presents a dual challenge. On one hand, it can lead to a smaller pool of potential clients, intensifying the fight for available contracts. On the other hand, larger, consolidated entities often possess greater bargaining power, potentially leading to more stringent contract terms and further margin compression for service providers like MODEC. This environment necessitates strategic agility and cost efficiency to navigate successfully.

The pressure from increased competition and industry consolidation directly impacts MODEC's ability to secure new contracts and maintain healthy project margins. For example, reports from early 2025 indicate that several major offshore engineering, procurement, construction, and installation (EPCI) contracts have been awarded at significantly lower margins than anticipated, a direct consequence of intense bidding wars among a shrinking number of major players.

- Intensified Bidding Wars: Increased competition leads to more aggressive bidding for offshore projects, potentially reducing profit margins.

- Consolidation Impact: Industry consolidation can result in fewer clients and increased negotiation leverage for those clients.

- Margin Pressure: The combined effect of competition and consolidation exerts downward pressure on project profitability.

- Contract Acquisition Challenges: Securing new contracts becomes more difficult and potentially less lucrative in this evolving market landscape.

Intensified competition and industry consolidation pose significant threats to MODEC. Increased competition leads to more aggressive bidding for offshore projects, potentially reducing profit margins, as evidenced by lower bid-to-cost ratios observed in 2024 for FPSO projects. Industry consolidation can result in fewer clients and increased negotiation leverage for those clients, further squeezing profitability.

The combined effect of competition and consolidation exerts downward pressure on project profitability, making contract acquisition more challenging and potentially less lucrative. For example, reports from early 2025 indicate that several major offshore EPCI contracts were awarded at significantly lower margins due to intense bidding wars among a shrinking number of major players.

| Threat Category | Specific Threat | Impact on MODEC | Supporting Data/Trend (2024-2025) |

| Competition & Consolidation | Intensified Bidding Wars | Reduced Profit Margins | Lower bid-to-cost ratios for FPSO projects in 2024. |

| Competition & Consolidation | Consolidation Impact | Fewer clients, increased client leverage | Major offshore EPCI contracts awarded at lower margins in early 2025. |

| Competition & Consolidation | Margin Pressure | Decreased project profitability | Reports indicate a trend of reduced profitability on secured contracts. |

SWOT Analysis Data Sources

This MODEC SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary to provide a robust and actionable strategic overview.