MODEC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MODEC Bundle

Discover the core components of MODEC's successful strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates how MODEC effectively delivers value and maintains its competitive edge.

Unlock the full strategic blueprint behind MODEC's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

MODEC’s success hinges on its strategic alliances with global shipyards and fabrication yards. These partnerships are essential for the construction and conversion of their Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) vessels, which are the backbone of their operations.

These collaborations are critical for guaranteeing the necessary capacity and accessing specialized expertise required for complex offshore projects. For instance, in 2024, MODEC continued to leverage partnerships with yards like Keppel Offshore & Marine and Sembcorp Marine, known for their extensive experience in building large-scale offshore units, ensuring efficient project execution and adherence to stringent quality standards.

MODEC relies on key partnerships with specialized technology and equipment suppliers to integrate advanced processing, safety, and operational systems into its floating solutions. These collaborations are crucial for accessing cutting-edge innovations and ensuring the reliability of components needed for demanding offshore environments. For instance, in 2024, MODEC continued to work with leading subsea equipment manufacturers to enhance the efficiency and safety of its FPSO (Floating Production, Storage, and Offloading) units, vital for deepwater operations.

MODEC's ability to execute massive offshore projects hinges on strong ties with financial institutions and investors. These partnerships are essential for securing the billions of dollars needed for Engineering, Procurement, Construction, and Installation (EPCI) contracts. For instance, in 2024, MODEC continued to leverage syndicated loans and equity investments to fund its ongoing and upcoming floating production storage and offloading (FPSO) projects, demonstrating the critical role of these relationships in managing substantial capital expenditures and ensuring project viability.

Local Content Partners and Joint Ventures

MODEC actively pursues local content partnerships and joint ventures across its operating regions. This strategy is crucial for meeting regulatory requirements, such as those mandating local participation in the energy sector, and for building strong community ties. For instance, in 2024, MODEC's commitment to local content in Brazil contributed to significant job creation within the Brazilian supply chain for its FPSO projects.

These collaborations are instrumental in driving local economic development. They foster technology transfer, enabling the upskilling of local workforces and the growth of domestic suppliers. This approach not only enhances MODEC's social license to operate by demonstrating a commitment to the host country's development but also streamlines operations by leveraging local expertise and market understanding.

Key benefits derived from these partnerships include:

- Regulatory Compliance: Ensuring adherence to local content mandates, which can be substantial in key operating areas.

- Community Engagement: Building goodwill and fostering positive relationships with local stakeholders.

- Supply Chain Development: Cultivating a robust and reliable local supply chain for goods and services.

- Operational Efficiency: Gaining insights into regional market nuances and operational best practices through local partners.

Subcontractors for Specialized Services

MODEC relies heavily on a diverse network of subcontractors to deliver specialized offshore services. These partnerships are crucial for accessing niche expertise in areas like offshore installation, intricate commissioning processes, specialized logistics, and ongoing maintenance support. For instance, in 2024, MODEC's ongoing projects likely involved numerous specialized subcontracts, reflecting the industry's reliance on external capabilities.

These collaborations enable MODEC to efficiently navigate the complexities inherent in large-scale offshore projects. By outsourcing specific tasks, MODEC can maintain a leaner core operation while ensuring access to the necessary skills and equipment for each project phase. This strategic outsourcing is a cornerstone of their project execution model, allowing them to adapt to varying project demands.

- Access to Specialized Expertise: Subcontractors provide critical skills in areas like deepwater installation and subsea construction.

- Resource Optimization: Partnering allows MODEC to scale resources up or down based on project needs, improving cost-efficiency.

- Project Timeline Management: Specialized subcontractors often possess the dedicated resources and experience to accelerate critical project phases, contributing to timely project completion.

MODEC's key partnerships are crucial for its operational success, encompassing global shipyards, technology suppliers, financial institutions, and specialized subcontractors. These alliances are vital for vessel construction, technological integration, project financing, and the execution of complex offshore tasks. For example, in 2024, MODEC's continued reliance on partnerships with yards like Keppel Offshore & Marine and Sembcorp Marine for FPSO construction highlights the importance of these foundational relationships.

These collaborations extend to securing the substantial capital required for projects, with financial institutions playing a key role in funding MODEC's extensive EPCI contracts. Furthermore, partnerships with local entities in regions like Brazil are essential for regulatory compliance and fostering economic development, as seen in 2024 with job creation initiatives.

The company also strategically partners with specialized technology providers to integrate advanced systems into its floating solutions, ensuring operational efficiency and safety in demanding offshore environments. These diverse partnerships are fundamental to MODEC's ability to deliver large-scale, complex offshore projects effectively.

What is included in the product

A detailed, pre-built Business Model Canvas for MODEC, outlining its core strategies, customer relationships, and revenue streams.

This canvas provides a clear, structured overview of MODEC's operations, value propositions, and key resources, ideal for strategic planning and stakeholder communication.

Provides a structured framework to pinpoint and address inefficiencies, transforming complex operational challenges into actionable solutions.

Activities

MODEC's core activity is the intricate process of engineering, procurement, and construction (EPC) for its floating production units. This involves detailed design work, sourcing materials and equipment worldwide, and building these complex offshore facilities. For instance, the company secured a significant EPC contract in 2023 for a Floating Production Storage and Offloading (FPSO) vessel destined for the Bacalhau field offshore Brazil, highlighting the scale of these operations.

This crucial phase demands expertise in naval architecture, process engineering, and structural design to ensure the vessels are robust and meet all safety and operational requirements. The successful and efficient execution of EPC is absolutely vital for MODEC to deliver high-quality, reliable offshore production systems to its clients, impacting project timelines and overall profitability.

Installation and commissioning for MODEC involves the complex process of transporting and connecting Floating Production Storage and Offloading (FPSO) or Floating Storage and Offloading (FSO) units to their designated offshore sites and subsea pipelines. This phase is crucial for ensuring the vessels are ready for operation.

This critical activity demands highly specialized marine engineering and rigorous testing procedures to guarantee a safe and efficient start-up. For instance, the successful commissioning of MODEC’s *Bumi Armada Armada Perdana* FPSO in the Madura Strait, Indonesia, in 2018, was a testament to these capabilities, enabling the commencement of hydrocarbon production.

The meticulous testing and verification of all onboard systems, from processing equipment to safety mechanisms, are paramount. This ensures that the FPSO/FSO can operate reliably and meet all regulatory and client requirements from the outset of production, directly impacting revenue generation.

MODEC's Operations and Maintenance (O&M) services are crucial, offering comprehensive, long-term support for its floating production systems. These services ensure the continuous, safe, and efficient operation of these complex assets throughout their lifecycle, covering everything from routine checks to advanced performance tuning.

These O&M activities generate predictable, recurring revenue for MODEC, contributing significantly to its financial stability. For instance, in fiscal year 2023, MODEC reported revenue from its FPSO business, which heavily relies on these ongoing service contracts, reaching approximately ¥399.8 billion.

By providing robust O&M, MODEC not only guarantees the operational integrity of its delivered facilities but also cultivates strong, lasting relationships with its clients. This focus on after-sales service is a key differentiator, reinforcing client trust and encouraging repeat business.

Research and Development (R&D)

MODEC's commitment to research and development is a cornerstone of its strategy. This involves continuous investment to pioneer new technologies and refine existing ones, crucial for tackling industry shifts like decarbonization and digital advancements. For instance, in 2023, MODEC continued to invest in R&D to enhance its floating production, storage, and offloading (FPSO) solutions, aiming for greater efficiency and environmental performance.

This dedication to innovation is what fuels MODEC's competitive edge. By staying ahead in technological development, the company can offer more efficient and sustainable solutions, a critical factor in the dynamic energy sector. Their R&D efforts are directly linked to expanding their portfolio and maintaining leadership in the floating production market.

- Technological Innovation: MODEC actively researches and develops advanced FPSO designs and operational technologies.

- Decarbonization Focus: A significant portion of R&D is directed towards solutions that reduce carbon emissions in offshore operations.

- Digital Transformation: Investment in digital tools and platforms enhances operational efficiency and data analysis for their assets.

- Market Leadership: R&D ensures MODEC remains at the forefront of the industry, offering cutting-edge solutions to clients.

Project Management and Integration

Effective project management and integration are crucial for coordinating MODEC's numerous stakeholders, intricate processes, and diverse technologies in large offshore projects. This ensures timely delivery, budget adherence, and quality specifications. For instance, MODEC's successful delivery of the Sangomar FPSO project in Senegal, a significant undertaking, highlights their project management capabilities.

- Coordination of Global Stakeholders: MODEC manages a complex web of suppliers, engineering firms, and clients across different continents, requiring robust communication and oversight.

- On-time and On-budget Delivery: The company's track record demonstrates a consistent ability to meet project deadlines and financial targets, even for highly complex offshore installations.

- Technological Integration: Successfully integrating advanced subsea systems, processing equipment, and mooring systems is a core project management activity for MODEC.

- Risk Mitigation: Proactive identification and management of project risks, from regulatory compliance to operational challenges, are integral to their approach.

MODEC's key activities revolve around the end-to-end lifecycle of floating production systems. This includes the initial engineering, procurement, and construction (EPC) of these complex offshore units, followed by their installation and commissioning at sea. Crucially, MODEC also provides ongoing operations and maintenance (O&M) services, ensuring the continuous and efficient performance of these assets throughout their operational life. Furthermore, a significant focus is placed on research and development to drive technological advancements and maintain market leadership.

| Key Activity | Description | Financial Year 2023 Relevance |

| Engineering, Procurement, and Construction (EPC) | Designing, sourcing, and building floating production units. | Secured significant FPSO EPC contracts. |

| Installation and Commissioning | Deploying and preparing offshore units for operation. | Ensuring readiness for hydrocarbon production. |

| Operations and Maintenance (O&M) | Providing long-term support for offshore assets. | Contributed to ¥399.8 billion revenue from FPSO business. |

| Research and Development | Pioneering new technologies and improving existing solutions. | Invested in R&D for enhanced FPSO efficiency and environmental performance. |

What You See Is What You Get

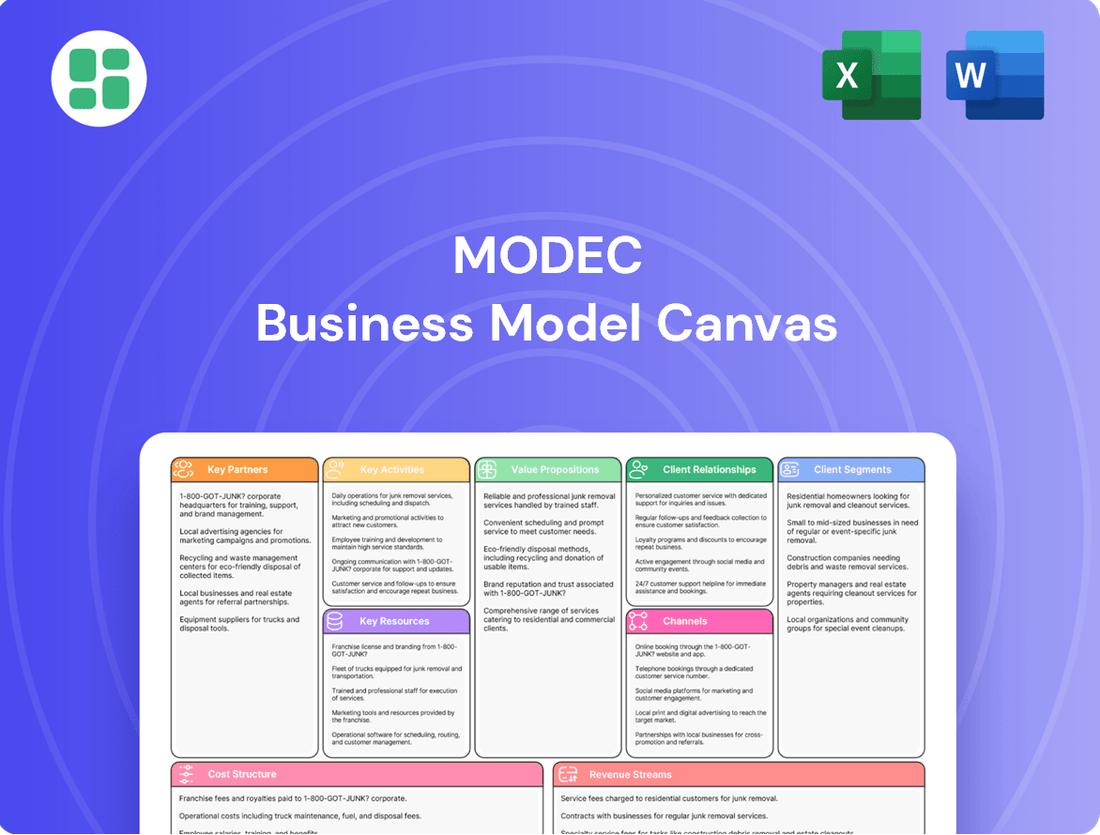

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, enabling you to immediately begin strategizing and refining your business.

Resources

MODEC's most critical resource is its highly specialized human capital. This includes world-class engineers, naval architects, and technical experts deeply skilled in offshore oil and gas production. Their collective knowledge is the bedrock of MODEC's ability to innovate and successfully execute complex projects, solidifying its competitive advantage in the industry.

This deep pool of expertise is not static; it's a constantly evolving asset. Through hands-on experience gained from delivering numerous Floating Production Storage and Offloading (FPSO) units and other offshore facilities, and through ongoing training programs, MODEC ensures its technical workforce remains at the forefront of industry advancements.

For example, in 2024, MODEC continued to leverage its extensive engineering talent to manage and deliver several large-scale projects, including the development of new FPSO units for major energy producers. The company reported a significant portion of its workforce holds advanced degrees in engineering and related technical fields, underscoring the depth of its specialized human capital.

MODEC's intellectual property, including proprietary designs and patents for FPSOs and FSOs, forms a core asset. These advanced technological solutions are crucial for their competitive edge in efficiency and safety within the offshore energy sector.

As of 2024, MODEC continues to invest in R&D to maintain its technological leadership. For instance, its innovative solutions for deep-water and harsh environments, protected by patents, allow for deployment in challenging offshore locations, a key differentiator.

MODEC's extensive global supply chain and logistics network is a critical asset, facilitating efficient sourcing of materials, equipment, and services worldwide. This robust network is essential for managing the intricate logistics involved in the construction and deployment of their floating production systems, ensuring both timely delivery and cost efficiency. For example, in 2024, MODEC continued to leverage its established relationships with key suppliers in Asia and Europe for specialized components.

Financial Capital and Access to Funding

MODEC’s ability to secure substantial financial capital and cultivate robust relationships with financial institutions is a cornerstone resource. This access is critical for undertaking complex, multi-billion dollar Engineering, Procurement, Construction, and Installation (EPCI) projects, as well as for sustaining long-term Operations and Maintenance (O&M) contracts.

Access to a diverse range of funding avenues, such as project finance and corporate loans, ensures MODEC possesses the necessary liquidity for significant capital expenditures and ongoing operational requirements. For instance, in 2024, MODEC continued to leverage these financial instruments to fund its extensive project pipeline, which includes several floating production storage and offloading (FPSO) units. The company’s financial health directly correlates with its capacity to bid on and execute these high-value projects, thereby underpinning its project viability and future growth trajectory.

- Financial Capital: Essential for large-scale EPCI projects and O&M services.

- Access to Funding: Diverse sources like project finance and corporate loans are crucial for liquidity.

- Financial Strength: Directly impacts project viability and MODEC's growth capacity.

Fleet of Owned/Operated FPSO/FSO Vessels

MODEC’s fleet of owned and operated Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) vessels forms a cornerstone of its operations. This substantial asset base is not merely a collection of hardware; it's a direct generator of consistent, long-term revenue through leasing agreements and ongoing Operations & Maintenance (O&M) contracts. For example, as of early 2024, MODEC manages a significant number of FPSOs globally, underscoring the scale of this key resource.

The practical, hands-on experience acquired from managing this diverse fleet is invaluable. It directly enhances MODEC's technical expertise and strengthens its reputation as a reliable and experienced player in the offshore oil and gas sector. This accumulated knowledge translates into greater efficiency and a proven track record, which are critical for securing future projects and maintaining competitive advantage.

- Asset Base: A significant physical and operational asset base comprising FPSO and FSO vessels.

- Revenue Generation: Generates long-term revenue through lease and Operations & Maintenance (O&M) contracts.

- Expertise and Reputation: Builds industry expertise and a strong reputation through operational experience.

MODEC’s physical assets, primarily its fleet of FPSO and FSO units, are crucial for revenue generation and operational capability. The company's extensive experience in managing these complex offshore facilities translates into a strong reputation and deep technical expertise. This operational prowess is a key resource for securing new contracts and maintaining a competitive edge in the demanding offshore energy market.

Value Propositions

MODEC's integrated end-to-end offshore production solutions provide clients with a single, accountable partner for the entire journey of floating production facilities. This covers everything from the initial blueprints and engineering to building, setting up, and maintaining the systems for years to come.

This all-in-one approach significantly simplifies complex offshore projects for clients. By consolidating all phases under one roof, MODEC minimizes the risks associated with managing multiple vendors and interfaces, ensuring a smoother and more predictable project execution.

Clients experience the advantage of seamless project delivery and a consistent, high standard of quality throughout the lifecycle of their offshore assets. This integrated model directly contributes to operational efficiency and reduced overall project costs.

MODEC's Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) units are built for unwavering reliability, even when operating in the toughest deepwater and harshest marine conditions. This translates directly into continuous hydrocarbon production for our clients, significantly reducing the financial impact of unexpected downtime.

Our commitment to robust engineering and meticulous maintenance means we consistently achieve high uptime figures. For instance, in 2024, MODEC units maintained an average operational uptime exceeding 98%, a testament to our dedication to maximizing asset utilization for our partners.

MODEC's deepwater project expertise is a cornerstone of its value proposition. The company has a proven history of successfully managing and executing projects in challenging offshore environments, often involving extreme depths and harsh weather conditions. This specialized knowledge is crucial for unlocking reserves in areas previously considered uneconomical or technically unfeasible.

This capability directly translates into client benefits, enabling the safe and efficient development of complex offshore fields. For instance, MODEC's involvement in projects like the Ichthys LNG field development in Australia, a massive undertaking in deep water, highlights its capacity to handle technically demanding scenarios. The company's ability to navigate these complexities ensures that clients can access valuable energy resources.

Cost Efficiency and Risk Mitigation through Lease/Operate Models

MODEC's lease and operate models provide substantial capital expenditure relief to clients, effectively shifting the burden of large upfront investments. This allows oil and gas companies to conserve their capital, directing it towards crucial exploration and production endeavors rather than asset acquisition.

By taking on project execution and operational responsibilities, MODEC effectively transfers significant risks away from its clients. This risk mitigation is a core benefit, enabling clients to focus on their core competencies with greater financial certainty.

The lease and operate structure offers enhanced financial flexibility and ensures predictable operational costs for clients. This predictability aids in more accurate financial planning and budgeting for their upstream activities.

For instance, MODEC's contracts often involve long-term commitments, providing a stable revenue stream for the company while offering clients a predictable cost structure. In 2024, the global offshore floating production systems market, where MODEC is a key player, was valued at approximately $25 billion, highlighting the significant scale of these arrangements.

- Capital Expenditure Relief: Clients avoid large upfront investments in production assets.

- Risk Transfer: MODEC assumes project execution and operational risks.

- Financial Flexibility: Improved cash flow management and strategic capital allocation for clients.

- Predictable Costs: Operational expenses are clearly defined, aiding financial planning.

Commitment to Safety and Environmental Performance

MODEC prioritizes safety and environmental stewardship, adhering to stringent global regulations and industry best practices. This commitment assures clients of responsible operations and minimizes ecological impact, a core element of their value proposition.

Their dedication to a robust safety culture and environmental performance is not just regulatory compliance but a fundamental part of what they offer. This translates to reduced operational risks and enhanced corporate reputation.

- Safety First: MODEC's focus on safety aims to achieve zero incidents, a benchmark many industry leaders strive for.

- Environmental Responsibility: They actively work to reduce emissions and waste, aligning with global sustainability goals.

- Regulatory Adherence: Ensuring full compliance with international environmental and safety standards is paramount.

- Client Assurance: This unwavering commitment provides clients with confidence in MODEC's operational integrity and ethical conduct.

MODEC's integrated solutions offer a single point of accountability for offshore production, simplifying complex projects and reducing client risk. Their commitment to reliability ensures high uptime, with units achieving over 98% operational uptime in 2024, directly boosting client production efficiency and profitability.

The company's expertise in deepwater projects unlocks challenging reserves, enabling safe and efficient development of previously inaccessible resources. This capability is crucial for clients seeking to maximize their hydrocarbon recovery in demanding environments.

MODEC's lease and operate models provide significant capital expenditure relief and transfer operational risks, enhancing clients' financial flexibility. This allows companies to conserve capital for exploration and core activities, with predictable costs aiding financial planning.

Safety and environmental stewardship are paramount, assuring clients of responsible operations and minimizing ecological impact. This commitment builds trust and enhances the reputation of both MODEC and its partners.

| Value Proposition | Key Benefit | Supporting Fact/Data (2024) |

|---|---|---|

| Integrated End-to-End Solutions | Simplified project execution, reduced vendor risk | Single partner for design, build, and operation |

| High Reliability & Uptime | Maximized production, minimized downtime | Operational uptime exceeding 98% |

| Deepwater Expertise | Access to challenging reserves, efficient development | Successful execution of complex deepwater projects |

| Lease & Operate Model | Capital expenditure relief, risk transfer | Shifts large upfront investment burden |

| Safety & Environmental Stewardship | Responsible operations, enhanced reputation | Adherence to stringent global regulations |

Customer Relationships

MODEC cultivates enduring strategic alliances with its core clientele in the oil and gas sector. These collaborations frequently transcend single project scopes, encompassing a portfolio of assets and sustained service contracts, reflecting a deep-seated commitment to mutual growth.

The foundation of these vital relationships rests on a bedrock of trust, consistently proven performance, and a unified dedication to achieving shared objectives. This enduring trust is crucial for securing repeat business and fostering an environment ripe for joint innovation.

In 2023, MODEC reported a backlog of approximately $12.1 billion, a significant portion of which is attributed to long-term service agreements with key partners, underscoring the financial importance of these strategic relationships.

MODEC emphasizes dedicated project management teams for each major undertaking. These teams collaborate closely with client representatives from the initial concept phase right through to commissioning and ongoing operations. This structure fosters clear communication, enables swift problem-solving, and ensures all objectives remain aligned throughout the entire project lifecycle.

This personalized approach guarantees clients receive focused attention and prompt responsiveness. For instance, in 2024, MODEC successfully delivered its first offshore wind turbine installation vessel, the "Progress," demonstrating their ability to manage complex, large-scale projects with dedicated teams, ensuring client satisfaction and project success.

MODEC's commitment extends to robust technical support and performance optimization for its operational fleet. This includes proactive assistance with troubleshooting, crucial upgrades, and ongoing efficiency improvements. For instance, in 2024, MODEC reported a 95% uptime across its FPSO fleet, a testament to the effectiveness of these services.

This continuous engagement ensures that client assets not only perform at their peak but also adapt seamlessly to changing operational demands and industry standards. Such dedicated support cultivates a strong, collaborative partnership, fostering trust and maximizing the long-term value of MODEC’s solutions.

Joint Development and Innovation Initiatives

MODEC actively partners with key clients on joint development and innovation projects, crafting tailored solutions for unique field challenges and pioneering new technologies. This collaborative strategy results in highly customized, advanced solutions, strengthening client loyalty and commitment while enabling shared knowledge and risk mitigation.

- Client-Centric Solutions: Co-creation ensures solutions precisely meet specific operational needs, fostering deeper client engagement.

- Technological Advancement: Joint efforts accelerate the development and adoption of cutting-edge technologies in the offshore sector.

- Shared Risk and Reward: Collaborating on innovation distributes development costs and potential benefits, making ambitious projects more feasible.

Post-Delivery Operations and Maintenance Contracts

Post-delivery operations and maintenance contracts are a cornerstone of MODEC's customer relationships, extending engagement well beyond the initial vessel delivery. These long-term agreements ensure MODEC's continuous involvement, providing essential services and fostering a lasting partnership throughout the asset's operational life.

These contracts establish a predictable and stable revenue stream, reinforcing MODEC's commitment to its clients. For instance, MODEC has secured multiple long-term contracts for its Floating Production Storage and Offloading (FPSO) units, demonstrating the enduring nature of these customer relationships.

- Long-Term Contracts: MODEC's business model heavily relies on securing extended operations and maintenance contracts following the delivery of its FPSO and FSO units.

- Continuous Engagement: These contracts ensure MODEC remains actively involved with its clients, providing ongoing services and support throughout the asset's lifecycle.

- Stable Partnerships: The predictable nature of these agreements fosters stable, long-term partnerships, creating a consistent revenue base for MODEC.

- Asset Lifespan Support: MODEC's commitment extends to the entire operational lifespan of the vessels, solidifying its role as a reliable service provider.

MODEC prioritizes deep, collaborative relationships with its oil and gas clients, often extending beyond single projects to encompass multiple assets and long-term service agreements. This approach is built on trust, proven performance, and shared goals, which are crucial for securing repeat business and fostering innovation. In 2024, MODEC reported a strong backlog, indicating the continued reliance of its partners on its specialized offshore solutions and ongoing support services.

| Customer Relationship Type | Key Characteristics | 2023/2024 Data/Examples |

|---|---|---|

| Strategic Alliances | Long-term partnerships, portfolio of assets, sustained service contracts | Backlog of approximately $12.1 billion in 2023, driven by long-term service agreements. |

| Dedicated Project Teams | Close collaboration from concept to operations, clear communication, swift problem-solving | Successful delivery of the offshore wind turbine installation vessel Progress in 2024. |

| Technical Support & Optimization | Proactive assistance, upgrades, efficiency improvements | 95% fleet uptime reported in 2024 for FPSO units. |

| Joint Development & Innovation | Tailored solutions, pioneering new technologies, shared knowledge | Development of customized solutions for unique field challenges. |

| Operations & Maintenance Contracts | Post-delivery engagement, essential services, asset lifespan support | Secured multiple long-term contracts for FPSO units, ensuring continuous involvement. |

Channels

MODEC's direct sales and business development teams are crucial for securing major contracts with global and national oil companies. These teams actively seek out new project opportunities, building on MODEC's strong industry reputation and extensive technical expertise.

This direct engagement model allows MODEC to offer customized solutions and foster deep, personalized relationships with clients. For instance, in 2024, MODEC secured significant orders, demonstrating the effectiveness of this client-centric strategy in a competitive market.

Competitive bidding and tender processes are the primary avenues through which MODEC secures new contracts for offshore oil and gas projects. These processes are initiated by operators seeking specialized services and equipment for their developments, and MODEC's participation is vital for growth.

MODEC's strategy involves meticulously crafting comprehensive proposals that highlight its advanced technical expertise, cost-effectiveness, and proven track record in operational execution. This detailed preparation is essential to stand out in a highly competitive landscape.

Winning these bids directly translates into new business opportunities, significantly impacting MODEC's revenue streams and market position. For instance, in 2024, the global offshore oil and gas sector saw significant tender activity, with major projects in regions like Brazil and the North Sea attracting substantial investment and competitive bids.

MODEC leverages major offshore oil and gas industry events like Offshore Technology Conference (OTC) and Nor-Shipping to demonstrate its Floating Production Storage and Offloading (FPSO) solutions and project execution expertise. These gatherings are crucial for engaging with key stakeholders, including national oil companies and supermajors, directly addressing their evolving project needs.

In 2024, participation in these high-profile events allows MODEC to highlight its technological advancements and commitment to sustainability, attracting new business opportunities. For instance, OTC 2024 saw significant interest in digitalization and decarbonization solutions for offshore operations, areas where MODEC is actively investing.

These conferences serve as vital channels for lead generation, with MODEC representatives engaging in direct discussions that can translate into future contracts. The visibility gained reinforces MODEC's position as a thought leader and reliable partner in the complex offshore energy sector, fostering brand recognition and trust.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures are crucial channels for MODEC to expand its market presence and secure project opportunities. By partnering with engineering firms or local entities, MODEC can tap into new geographical regions and leverage specialized expertise. These collaborations are particularly effective in accessing large-scale projects that require a consortium of capabilities.

For instance, in 2024, MODEC announced a joint venture with a leading Japanese engineering company to bid on a significant offshore wind farm development in Asia, a market where MODEC sought to strengthen its footprint. This strategic move allowed them to combine their offshore installation experience with the partner's local regulatory knowledge and supply chain access.

These partnerships are not just about market access; they also represent a way to share risks and capital investment for complex, high-value projects. Such collaborations enable MODEC to:

- Access new markets and project types by partnering with entities possessing local knowledge or specialized technologies.

- Leverage complementary strengths to enhance bidding competitiveness and execution capabilities.

- Mitigate risks and share capital expenditure on large-scale, complex offshore projects.

- Expand operational capacity and reach, enabling participation in projects that might be beyond MODEC's standalone capabilities.

Existing Client Relationships and Referrals

MODEC's existing client relationships are a cornerstone of its business, frequently translating into repeat contracts and crucial referrals. This organic growth avenue is fueled by a demonstrated history of successful project execution and client satisfaction.

By consistently delivering high-quality performance, MODEC cultivates trust and reinforces its reputation within the offshore energy sector. This focus on client retention is a powerful driver for securing future opportunities.

- Repeat Business: Long-term partnerships often result in preferred supplier status, leading to a higher likelihood of securing follow-on projects.

- Referral Networks: Satisfied clients actively recommend MODEC to their industry peers, opening doors to new business without extensive marketing expenditure.

- Industry Trust: A strong track record with existing clients builds significant credibility, making it easier to win bids for new, complex projects.

- Cost-Effective Growth: Leveraging existing relationships for new business is typically more cost-effective than acquiring entirely new clients.

MODEC utilizes direct sales, competitive bidding, industry events, and strategic alliances as key channels to secure projects. These methods, combined with strong client relationships, drive business growth and market penetration.

Direct engagement and competitive tenders remain the primary methods for contract acquisition, while industry events and partnerships offer avenues for market expansion and lead generation. Existing client relationships are vital for repeat business and referrals.

In 2024, MODEC's participation in events like OTC highlighted its focus on digitalization and decarbonization, attracting interest in these advanced solutions. The company also pursued strategic joint ventures, such as one in Asia for offshore wind, to broaden its market reach and capabilities.

The effectiveness of these channels is evident in MODEC's continued success in winning significant offshore projects, underscoring the importance of a multi-faceted approach to business development in the dynamic energy sector.

Customer Segments

Major International Oil Companies (IOCs) such as Shell, TotalEnergies, ExxonMobil, and Chevron are key customers, operating vast offshore fields globally. These giants demand highly reliable and technologically sophisticated floating production systems for their deepwater and ultra-deepwater ventures.

IOCs prioritize partners with a demonstrated history of success and the capacity to execute projects on a worldwide scale. For instance, in 2024, major oil companies continued to invest heavily in offshore exploration and production, with capital expenditures expected to remain robust, underscoring their need for advanced FPSO solutions.

National Oil Companies (NOCs) like Petrobras, Equinor, and Petronas are key clients, especially in areas rich with offshore oil and gas. These entities are tasked with developing their nation's energy assets, often emphasizing local content alongside high technical standards. For instance, in 2024, Equinor announced significant investments in offshore wind projects in Brazil, a market where MODEC is also active, highlighting the synergy between national resource development and advanced technology providers.

Independent Exploration and Production (E&P) companies, particularly those of smaller to medium size, are a key customer segment for MODEC. These companies often concentrate their efforts on specific offshore basins or unique development projects, requiring tailored and financially accessible solutions.

These E&Ps frequently look for flexible and cost-efficient floating production systems. They tend to favor lease-and-operate arrangements to reduce their initial capital outlay, a strategy that aligns well with MODEC's service-oriented business model. For instance, in 2024, the global offshore E&P market saw continued investment in smaller, more agile projects, highlighting the demand for MODEC’s adaptable solutions.

Deepwater and Ultra-Deepwater Operators

Deepwater and ultra-deepwater operators represent a critical customer segment for MODEC, demanding highly specialized and robust Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) units. These companies are actively exploring and developing hydrocarbon reserves in challenging offshore environments, often thousands of meters below the surface.

Their operational needs are defined by extreme pressures, low temperatures, and the necessity for sophisticated subsea infrastructure. Consequently, they place a premium on technological innovation, stringent safety protocols, and the long-term reliability of their production facilities. MODEC's proven track record in delivering advanced solutions for these demanding conditions is a significant competitive advantage.

- Technological Sophistication: These operators require FPSOs and FSOs engineered to handle complex subsea tie-backs and operate reliably in harsh weather and extreme depths.

- Safety and Reliability Focus: A paramount concern is the unwavering safety of personnel and the environment, alongside the assurance of continuous, uninterrupted production.

- Long-Term Partnerships: Deepwater projects are capital-intensive and long-duration, fostering a preference for partners who can offer sustained support and operational excellence.

- Market Context: As of early 2024, the global deepwater oil and gas market continues to see significant investment, driven by the need to replace declining reserves and access previously uneconomical resources, underscoring the demand for MODEC's specialized offerings.

Companies Seeking Long-Term Asset Management

Companies seeking long-term asset management are primarily oil and gas operators that choose to delegate the intricate and ongoing operations and maintenance of their offshore floating production systems. These entities prioritize a specialized partner capable of guaranteeing high asset availability and optimal performance over decades. For instance, in 2024, the global offshore oil and gas production market continues to rely on floating production, storage, and offloading (FPSO) units, with many operators opting for outsourcing models to manage these complex assets.

These clients are looking for providers who offer robust lifecycle management, ensuring that their investments remain efficient and compliant with evolving environmental and safety regulations. They value expertise in areas like predictive maintenance and risk mitigation to avoid costly downtime. MODEC's commitment to operational excellence directly aligns with these expectations, aiming to maximize the return on investment for their clients' offshore assets.

- Focus on Uptime: Clients in this segment demand minimal operational interruptions, understanding that each day of downtime can represent millions in lost revenue.

- Lifecycle Cost Reduction: They seek long-term partnerships that demonstrably reduce the total cost of ownership through efficient O&M practices.

- Risk Transfer: Outsourcing allows these companies to transfer the operational and technical risks associated with complex offshore assets to a specialist like MODEC.

- Regulatory Compliance: Ensuring adherence to stringent industry standards and environmental regulations throughout the asset's life is a critical concern for these operators.

MODEC's customer base is primarily composed of major international oil companies (IOCs) and national oil companies (NOCs) that require sophisticated floating production systems for deepwater operations. Independent E&P companies also represent a significant segment, seeking flexible and cost-effective solutions. A key differentiator for MODEC is its ability to serve operators focused on long-term asset management, providing specialized lifecycle support for complex offshore facilities.

In 2024, the global offshore oil and gas sector continued to see substantial investment, particularly in deepwater exploration and production, driven by the need to replenish reserves. This trend directly benefits MODEC, as these projects necessitate advanced FPSO and FSO technologies. For instance, capital expenditures by major oil companies in offshore activities were projected to remain strong throughout the year.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Major IOCs | Global operations, high demand for reliability and advanced tech. | Continued significant investment in offshore, driving demand for FPSOs. |

| NOCs | National asset development, focus on local content and technical standards. | Active in developing offshore resources, including new energy ventures like offshore wind. |

| Independent E&Ps | Project-specific focus, need for tailored, cost-efficient solutions. | Growth in smaller, agile offshore projects favoring adaptable FPSO solutions. |

| Long-Term Asset Management Seekers | Delegation of operations and maintenance, focus on uptime and lifecycle cost. | Increasing reliance on outsourcing models for complex offshore asset management. |

Cost Structure

The most substantial part of MODEC's expenses lies in the Engineering, Procurement, and Construction (EPC) phase for its Floating Production, Storage, and Offloading (FPSO) and Floating Storage and Offloading (FSO) units. These costs encompass everything from the initial design blueprints to sourcing global components and the physical building and outfitting of these complex offshore vessels.

Key expenditures within EPC include the purchase of vast quantities of steel, specialized marine machinery, intricate processing modules, and the skilled labor required at shipyards worldwide. For instance, the conversion of a typical VLCC (Very Large Crude Carrier) into an FPSO can involve hundreds of thousands of man-hours and millions of dollars in specialized equipment. Successfully managing these significant, project-specific outlays is absolutely vital for MODEC to maintain its profitability in the competitive offshore energy sector.

MODEC's Operations and Maintenance (O&M) expenses are crucial, covering the long-term upkeep of its Floating Production, Storage, and Offloading (FPSO) and Floating Storage and Offloading (FSO) units. These recurring costs are essential for ensuring the continuous and safe operation of its fleet, directly impacting asset longevity and value.

Key O&M costs include salaries for skilled offshore crews, routine preventative maintenance, procurement of essential spare parts, complex logistics for supply and personnel, and ensuring strict adherence to all regulatory compliance standards. For instance, the offshore energy sector often sees O&M as a significant portion of total operating expenses, sometimes ranging from 30-50% of the total cost over an asset's lifetime, underscoring the importance of efficient management for MODEC.

MODEC significantly invests in Research and Development (R&D) to pioneer new technologies and enhance existing designs, particularly focusing on the energy transition and digital solutions. These expenditures are crucial for maintaining a competitive edge and achieving market leadership.

In 2024, MODEC's commitment to innovation is evident in its ongoing projects. For instance, the company is actively developing advanced floating production systems to support offshore wind and hydrogen production, areas critical for future energy needs. This strategic R&D spending fuels long-term value creation and positions MODEC at the forefront of industry evolution.

Personnel and Overhead Costs

Personnel and overhead costs form a significant portion of MODEC's operational expenses. These include salaries, benefits, and training for a global workforce comprising engineers, project managers, sales personnel, and corporate staff. For instance, in 2024, MODEC's total employee compensation and benefits are projected to be a substantial figure, reflecting the specialized skills required in the offshore engineering and construction sector. Efficient management of these human capital costs directly impacts the company's financial health and its ability to fund strategic growth initiatives.

These overheads are crucial for maintaining MODEC's operational backbone and supporting its strategic expansion. The company invests in continuous training and development to ensure its teams are equipped with the latest technological expertise. Administrative expenses, encompassing office leases, utilities, and IT infrastructure across its international operations, also fall under this category. Keeping these costs in check is vital for profitability.

- Salaries and Benefits: Covering a diverse global workforce of highly skilled professionals.

- Training and Development: Investing in continuous learning to maintain a competitive edge.

- Administrative Expenses: Including global office operations, IT, and general corporate functions.

- Human Capital Management: Essential for operational efficiency and strategic growth.

Financing and Capital Costs

Financing and capital costs are a significant component for MODEC, particularly for their Floating Production Storage and Offloading (FPSO) units. These costs encompass everything involved in securing the substantial funding required for these massive offshore projects. This includes interest paid on loans, which can be substantial given the multi-billion dollar price tags of FPSOs. Facility fees, arrangement fees, and other administrative expenses tied to securing project financing also add to the overall capital cost. For instance, securing financing for a single FPSO can involve hundreds of millions of dollars in interest and fees over its lifespan.

Given the capital-intensive nature of the business, effectively managing these financing costs is paramount to ensuring project profitability and maintaining MODEC's overall financial stability. High interest rates or unfavorable financing terms can significantly erode returns. For example, a slight increase in interest rates could translate to tens of millions of dollars in additional costs for a single project. This necessitates robust financial planning and strategic negotiation with lenders.

- Interest Payments: The primary driver of financing costs, directly tied to the loan principal and prevailing interest rates.

- Facility and Arrangement Fees: One-time or recurring fees paid to banks and financial institutions for structuring and managing the loan facilities.

- Debt Servicing: Includes not only interest but also the repayment of the principal amount over the project's life.

- Impact on Profitability: Higher financing costs directly reduce the net profit margin of each FPSO project.

MODEC's cost structure is heavily dominated by the significant capital expenditures required for Engineering, Procurement, and Construction (EPC) of its FPSO and FSO units. These project-specific costs, including materials like steel and specialized equipment, along with global labor, are the largest expense drivers. For example, the construction phase for a single FPSO can easily run into billions of dollars.

Operations and Maintenance (O&M) represent substantial recurring costs, essential for the long-term functionality and safety of its fleet. These ongoing expenses, covering skilled personnel, spare parts, and compliance, can account for a considerable percentage of an asset's total lifetime cost. In 2024, efficient O&M management remains critical for profitability.

Personnel and overhead costs, including salaries, training, and administrative functions across its international operations, are also significant. These costs are fundamental to supporting MODEC's skilled workforce and global infrastructure, directly influencing operational efficiency and the capacity for strategic initiatives.

Revenue Streams

MODEC generates substantial revenue through EPCI contracts, which involve lump-sum or milestone-based payments for engineering, procurement, construction, and installation of new FPSO/FSO vessels and other floating facilities. These are significant, singular payments received upon the successful completion of project phases.

This EPCI segment represents a core component of MODEC's project-driven income. For instance, in fiscal year 2023, MODEC reported substantial order intake from new projects, reflecting the ongoing demand for these complex offshore solutions.

MODEC generates recurring revenue from long-term lease and charter agreements for its Floating Production, Storage, and Offloading (FPSO) and Floating Storage and Offloading (FSO) vessels. These contracts, often spanning many years, provide a stable and predictable income stream.

These payments are typically structured as fixed daily or monthly rates, contributing significantly to MODEC's annuity-like income. For instance, in 2024, the company secured a significant contract for an FPSO offshore Brazil, expected to generate substantial charter revenue over its projected 25-year operational life.

MODEC generates revenue through Operations and Maintenance (O&M) service fees for its Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) units. These fees can be either fixed monthly payments or tied to performance metrics, providing a stable and predictable income stream.

These long-term O&M contracts are crucial for MODEC's business model, ensuring consistent revenue generation throughout the operational life of the vessels. For instance, in fiscal year 2023, MODEC's backlog of orders, which includes O&M services, stood at approximately ¥1.2 trillion, highlighting the significance of this revenue stream.

Performance-Based Incentives and Bonuses

MODEC can generate additional revenue through performance-based incentives and bonuses. These are typically linked to key performance indicators such as operational uptime, production efficiency, and safety records, as outlined in specific client contracts.

These incentives serve to align MODEC's objectives with those of its clients, effectively rewarding the company for achieving superior operational results. Such performance-based bonuses can significantly contribute to enhancing overall project profitability.

- Incentive Alignment: Bonuses directly tie MODEC's financial success to client project performance.

- Enhanced Profitability: Meeting or exceeding performance targets boosts revenue beyond base contract value.

- Risk Mitigation: Incentives can encourage proactive maintenance and operational excellence, reducing downtime.

- Competitive Advantage: Offering performance-driven contracts can differentiate MODEC in the market.

Sale of Assets (Less Common)

While not a primary focus, MODEC can generate revenue by selling off its Floating Production Storage and Offloading (FPSO) or Floating Storage and Offloading (FSO) units. This typically happens when these assets reach the end of their operational contracts or if they are deemed non-core to the company's ongoing strategy.

This revenue stream is opportunistic, allowing MODEC to free up capital and reinvest it in newer, more profitable ventures. For instance, if MODEC sold an older FPSO for a significant sum, it could then use those proceeds to fund the development of a new, technologically advanced unit or expand its fleet.

- Asset Monetization: Allows MODEC to realize value from older or non-strategic assets.

- Capital Reallocation: Provides funds for investment in new projects or fleet upgrades.

- Opportunistic Nature: Revenue generation is dependent on market conditions and asset lifecycle.

MODEC's revenue is primarily driven by its Engineering, Procurement, Construction, and Installation (EPCI) contracts for offshore facilities, alongside long-term lease and charter agreements for its FPSO and FSO units. The company also earns through Operations and Maintenance (O&M) services, performance incentives, and opportunistic asset sales.

In fiscal year 2023, MODEC's order backlog, encompassing these diverse revenue streams, reached approximately ¥1.2 trillion, underscoring the substantial and ongoing demand for its specialized offshore solutions and services.

The company secured a significant FPSO contract in Brazil in 2024, projected to generate substantial charter revenue over its 25-year lifespan, highlighting the stability of its leasing segment.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| EPCI Contracts | Lump-sum or milestone payments for designing, building, and installing offshore facilities. | Significant order intake in FY2023 for new projects. |

| Lease & Charter Agreements | Recurring revenue from long-term leasing of FPSO/FSO vessels. | 2024 FPSO contract offshore Brazil with a 25-year operational life. |

| Operations & Maintenance (O&M) | Fees for managing and maintaining offshore units. | Included in the ¥1.2 trillion order backlog as of FY2023. |

| Performance Incentives | Bonuses tied to operational uptime, efficiency, and safety. | Aligns MODEC's success with client project performance. |

| Asset Sales | Revenue from selling FPSO/FSO units, typically at end-of-life or when non-core. | Opportunistic capital reallocation for new investments. |

Business Model Canvas Data Sources

The MODEC Business Model Canvas is built upon a foundation of robust financial data, comprehensive market research, and detailed operational insights. These sources ensure each component of the canvas is accurately represented and strategically sound.