MODEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MODEC Bundle

MODEC operates in a dynamic offshore floating production systems market, where understanding competitive forces is paramount. Factors like intense rivalry among established players and the bargaining power of a few major oil and gas clients significantly shape its landscape. The threat of substitutes, though less pronounced, also warrants consideration.

The complete report reveals the real forces shaping MODEC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

MODEC's dependence on specialized equipment and advanced technology from a select group of global suppliers is a significant factor in its operational costs and project timelines. These suppliers, often the sole providers of proprietary subsea systems, processing modules, and sophisticated control systems, wield considerable influence. For instance, the market for certain high-pressure subsea connectors is dominated by a few key players, meaning MODEC has limited options when sourcing these critical components.

Shipyards and fabrication yards hold significant bargaining power over MODEC due to the specialized nature of FPSO construction. Building these massive, complex vessels requires immense, dedicated facilities and highly skilled labor, a capacity not readily available. For instance, the global market for constructing such large offshore structures is dominated by a limited number of major players, creating a concentrated supply base.

This concentration means these yards can dictate terms, especially when demand for FPSOs is high, as seen in periods of increased offshore oil and gas exploration. In 2024, the demand for FPSOs remains robust, driven by several large projects in regions like Brazil and Guyana, potentially allowing these yards to negotiate higher prices and more favorable contract conditions with MODEC and other operators.

MODEC's ability to successfully execute complex offshore projects hinges on securing specialized engineering and technical talent. The global pool of experts in deepwater operations and floating production systems is inherently limited. This scarcity directly translates to higher labor costs and potential delays, as seen in the competitive bidding for skilled personnel in 2024.

Raw Material Costs (e.g., Steel)

While steel is a globally traded commodity, MODEC's need for specific grades and high volumes for Floating Production Storage and Offloading (FPSO) unit construction makes it vulnerable to price volatility. Even with long-term contracts, unexpected spikes or disruptions in the steel market can give suppliers leverage. For instance, in early 2024, global steel prices experienced upward pressure due to increased demand from infrastructure projects and production constraints in key exporting regions, potentially impacting MODEC's material costs for its Engineering, Procurement, Construction, and Installation (EPCI) projects.

The bargaining power of steel suppliers for MODEC is influenced by several factors:

- Concentration of Suppliers: A limited number of major steel producers capable of supplying specialized grades for offshore applications can increase supplier power.

- Switching Costs: The effort and expense involved in changing steel suppliers, including requalification processes and potential project delays, can deter MODEC from seeking alternatives.

- Supply Chain Dynamics: Global events affecting raw material availability for steel production, such as iron ore or coking coal prices, can indirectly strengthen the position of steel manufacturers.

Logistics and Marine Services

The bargaining power of suppliers in logistics and marine services for MODEC is significant due to the specialized nature of its operations. MODEC's global projects require unique capabilities in heavy-lift vessels and offshore transportation for delivering massive equipment and modules.

A concentrated market of providers with the necessary expertise for these large-scale movements, especially for oversized components and offshore installations, means these suppliers can dictate terms. For instance, the availability of specialized offshore construction vessels, crucial for MODEC's floating production storage and offloading (FPSO) unit installations, is limited. In 2024, the charter rates for such vessels saw an upward trend, reflecting strong demand and constrained supply, directly impacting MODEC's project costs.

- Limited specialized vessel availability: The global fleet capable of handling ultra-large offshore modules is small, concentrating power with a few key operators.

- High switching costs: Establishing relationships and ensuring compliance with specialized marine service providers involves significant time and resources, making it difficult for MODEC to switch suppliers.

- Essential service provision: The critical nature of timely and safe delivery of project components means MODEC cannot afford disruptions from logistics partners.

Suppliers of specialized subsea equipment and proprietary technology hold considerable sway over MODEC. This is because the market for these critical components, such as advanced processing modules and high-pressure connectors, is often dominated by a few key global players. In 2024, the continued demand for deepwater exploration and production projects means these niche suppliers can command premium pricing and favorable contract terms, directly impacting MODEC's procurement costs.

Shipyards capable of constructing complex FPSOs represent another significant supplier group with strong bargaining power. The limited number of facilities globally equipped for these massive projects, coupled with high demand in 2024 driven by projects in regions like South America, allows these yards to negotiate advantageous terms. This concentration means MODEC has fewer alternatives, especially when project timelines are tight.

The scarcity of specialized engineering and technical talent further amplifies supplier power. Experts in deepwater operations and floating production systems are in high demand in 2024, leading to increased labor costs and potential project delays for MODEC. This limited talent pool means specialized service providers and recruitment agencies can dictate higher rates.

Steel suppliers also exert influence, particularly for the specific grades and volumes required for FPSO construction. While steel is a commodity, market dynamics in 2024, including increased demand from infrastructure and production constraints, have led to price volatility. This can empower steel producers, especially those with the capacity to supply specialized offshore grades, to negotiate higher prices with MODEC.

| Supplier Group | Key Factors Influencing Bargaining Power | Impact on MODEC (2024) |

|---|---|---|

| Specialized Equipment & Technology Providers | Limited number of global suppliers, proprietary technology, high switching costs | Premium pricing for critical components, potential for extended lead times |

| FPSO Shipyards & Fabrication Yards | Concentrated market, high capital investment, specialized facilities, strong demand | Higher construction costs, negotiation leverage on contract terms and schedules |

| Specialized Engineering & Technical Talent Providers | Global scarcity of expertise, high demand from offshore sector | Increased labor costs, potential project delays due to talent acquisition |

| Steel Suppliers (Specialized Grades) | Market price volatility, production constraints, demand from other sectors | Upward pressure on material costs for FPSO construction |

What is included in the product

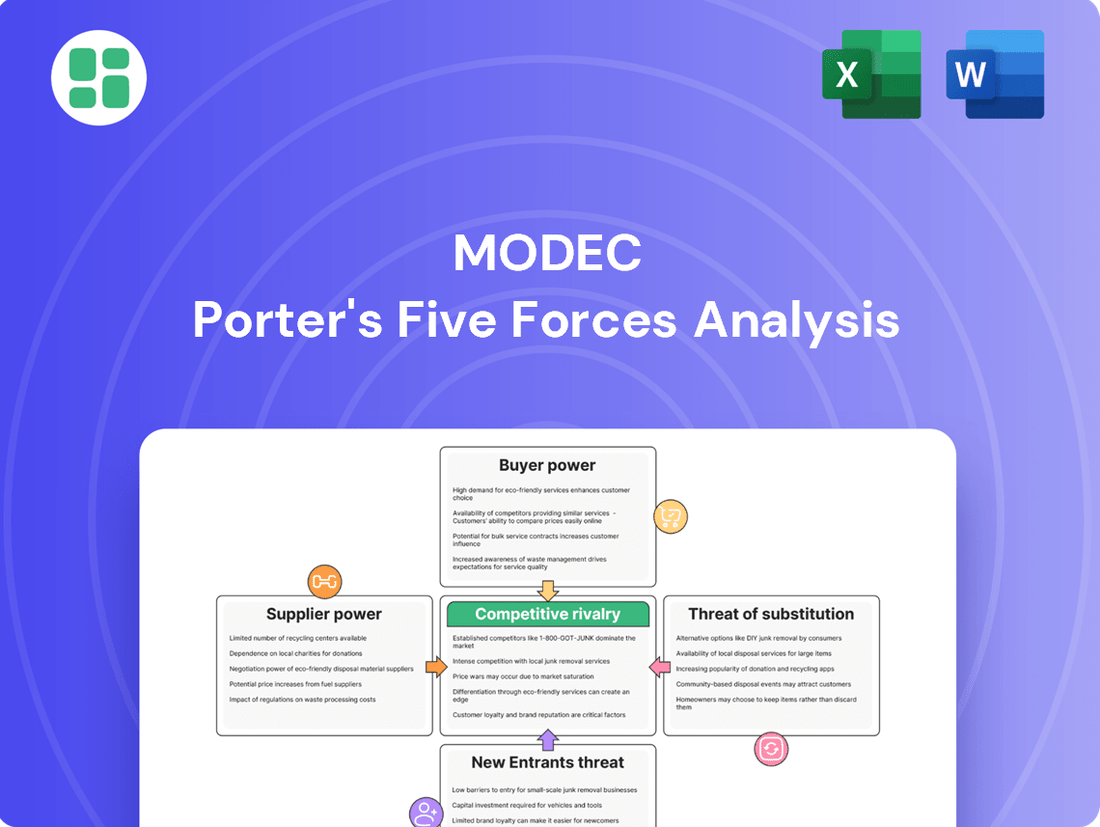

This analysis unpacks the competitive forces impacting MODEC, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the offshore floating production systems market.

Instantly visualize competitive pressures with a dynamic, interactive spider chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

MODEC's customer base is notably concentrated, primarily consisting of a few global supermajors and national oil companies (NOCs). These entities are the dominant players in the offshore oil and gas sector, managing massive, multi-billion dollar projects.

This concentration of powerful buyers grants them substantial leverage. They can, and do, negotiate aggressively for competitive pricing, favorable contract terms, and robust performance guarantees on MODEC's Floating Production Storage and Offloading (FPSO) and Floating Storage and Offloading (FSO) units. For instance, in 2023, major offshore project awards often saw multiple bidders from a select group of oil giants, intensifying price competition.

FPSO projects are massive undertakings, often costing billions of dollars. For instance, in 2024, major FPSO contracts, such as those for ExxonMobil's projects in Guyana, are valued in the multi-billion dollar range. This sheer scale of investment means customers hold significant sway during negotiations.

These contracts are not short-term affairs; they frequently extend for 15 to 20 years, sometimes even longer, encompassing operations and maintenance. This long-term commitment gives customers considerable leverage, as they are essentially securing a critical asset for decades.

Because of the vast sums involved and the extended contract durations, customers demand robust risk-sharing clauses and performance-based incentives. They also push for extensive warranties to safeguard their substantial capital investment throughout the FPSO's operational life.

Customers in the FPSO market, even for specialized solutions, actively engage multiple global providers. For instance, in 2024, major oil and gas companies often issued tenders to a select group of qualified FPSO contractors, including industry leaders like MODEC, SBM Offshore, and TechnipFMC, to ensure a competitive landscape.

This practice of competitive bidding empowers clients to meticulously compare not just the final price, but also the technological capabilities, project timelines, and risk mitigation strategies offered by each contender. This allows them to effectively leverage the inherent rivalry among these sophisticated suppliers to negotiate favorable terms and pricing for their substantial offshore developments.

Operational Demands and Performance Metrics

Customers in the offshore oil and gas sector, including major energy companies, demand exceptionally high levels of reliability and uptime for production facilities. These clients often impose stringent performance metrics and contractual penalties for any underperformance, directly impacting MODEC's revenue and reputation.

For instance, contracts frequently stipulate uptime guarantees, with penalties escalating for deviations. This forces MODEC to maintain peak operational efficiency, robust maintenance schedules, and impeccable asset integrity throughout the lifecycle of the delivered facilities, underscoring the significant leverage customers possess over ongoing operations.

- High Uptime Requirements: Offshore production assets are critical revenue generators, necessitating near-continuous operation.

- Performance-Based Penalties: Contracts often include clauses that financially penalize MODEC for failing to meet agreed-upon uptime and efficiency targets.

- Contractual Leverage: The detailed specifications and performance clauses in customer contracts give them substantial control over MODEC's operational conduct and financial outcomes.

- Asset Integrity Focus: Customers' emphasis on long-term asset integrity means MODEC must prioritize quality and safety in all operational aspects.

Strategic Importance of Projects to Customers

For major oil and gas companies, Floating Production Storage and Offloading (FPSO) projects are often the linchpin of their long-term production strategies, directly impacting revenue generation from substantial offshore reserves. This strategic criticality means customers are not passive recipients of services but are highly sophisticated and deeply involved in every facet of project oversight.

These clients possess deep technical expertise and keen market intelligence, allowing them to meticulously define project specifications and exert significant control over outcomes. Their ability to understand the intricate details of FPSO deployment and operation translates into a powerful bargaining position.

In 2024, the sustained demand for offshore energy, coupled with the increasing complexity of deepwater exploration, underscores the vital role FPSOs play. For instance, projects like the Equinor Johan Sverdrup field, which utilizes an FPSO, represent multi-billion dollar investments where the operator's influence on supplier terms is substantial. This strategic importance amplifies the bargaining power of customers, as they are not merely purchasing a service but securing a critical asset for their core business operations.

- Strategic Dependence: FPSO projects are fundamental to customers' long-term production and revenue goals, making MODEC's offerings indispensable.

- Customer Sophistication: Clients are highly knowledgeable, possessing advanced technical and market insights that inform their decision-making and negotiation leverage.

- Project Control: Customers actively manage project specifications and outcomes, reflecting their deep investment and operational stakes.

- Market Influence: The significant financial commitments involved in offshore projects empower customers to negotiate favorable terms with FPSO providers like MODEC.

MODEC's customers, primarily large national and international oil companies, wield considerable bargaining power due to the sheer scale of their projects and their strategic reliance on FPSOs. These clients, often operating in multi-billion dollar ventures, can dictate terms, demand aggressive pricing, and require stringent performance guarantees. For example, major FPSO contracts awarded in 2024, such as those for significant deepwater developments, often involve negotiations where the client's leverage is amplified by the long-term nature of these assets, frequently spanning 15 to 20 years or more.

This power dynamic is further intensified by the competitive landscape among FPSO providers. Customers actively solicit bids from a limited pool of qualified global contractors, including MODEC, SBM Offshore, and TechnipFMC, to foster price competition and secure the best possible terms. Their deep technical expertise and market knowledge enable them to scrutinize every aspect of a proposal, from technological capabilities to risk mitigation, ensuring they maximize value for their substantial capital investments.

The critical nature of FPSOs to customers' long-term production strategies means they exert significant control over project specifications and operational outcomes. This is further reinforced by contractual clauses that impose penalties for underperformance, compelling MODEC to maintain exceptionally high uptime and operational efficiency. The strategic importance of these assets, as seen in projects like Equinor's Johan Sverdrup field, underscores the customer's ability to influence supplier negotiations effectively.

| Customer Characteristic | Impact on MODEC | Example (2024 Context) |

|---|---|---|

| Concentrated Buyer Base (Supermajors, NOCs) | Increased negotiation leverage, potential for price pressure | Major oil companies issuing tenders for multi-billion dollar FPSO projects |

| Large Project Scale (Billions USD) | Customers can dictate terms and demand favorable contract conditions | Award values for new FPSO units exceeding $1 billion |

| Long-Term Contracts (15-20+ years) | Customers have sustained influence over pricing and operational performance | Long-term charter and service agreements for FPSO operations |

| High Technical Sophistication | Customers can scrutinize and influence technical specifications and project execution | Detailed technical requirements and performance metrics in tender documents |

| Strategic Reliance on FPSOs | Customers prioritize reliability and uptime, imposing strict performance clauses | Penalties for failing to meet contractual uptime guarantees, impacting revenue |

Preview the Actual Deliverable

MODEC Porter's Five Forces Analysis

This preview showcases the complete MODEC Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the Floating Production Systems industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility. You'll gain a comprehensive understanding of MODEC's strategic positioning, including threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products.

Rivalry Among Competitors

The Floating Production Storage and Offloading (FPSO) sector is dominated by a handful of major global companies, such as MODEC, SBM Offshore, TechnipFMC, and BW Offshore. These companies have the scale, specialized knowledge, and significant financial backing required to operate in this demanding industry.

Building and maintaining the necessary engineering expertise, along with a fleet of operational FPSOs, demands enormous upfront investment and ongoing high fixed costs. This capital intensity creates a highly competitive environment where players vie fiercely for new contracts to keep their expensive assets busy and cover their substantial operating expenses.

Competitive rivalry in the offshore floating production systems sector, including MODEC, is intense, with differentiation stemming from advanced technological capabilities and project execution. While core services are similar across the industry, companies like MODEC distinguish themselves through specialized technology, proven project execution, strong safety records, and deep regional knowledge. This focus on integrated Engineering, Procurement, Construction, and Installation (EPCI) and Operations & Maintenance (O&M) services makes innovation in design, efficiency, and environmental performance crucial battlegrounds.

Companies actively invest in research and development to maintain a competitive edge. For instance, in 2023, major players in the offshore energy sector, including those in FPSO technology, continued to allocate significant capital towards technological advancements. While specific R&D figures for MODEC in 2024 are not yet fully disclosed, industry trends indicate substantial ongoing investment in areas such as digital twins for operational optimization and greener energy solutions to meet evolving market demands and regulatory pressures.

The demand for Floating Production Storage and Offloading (FPSO) units, like those provided by MODEC, is intrinsically linked to the volatile investment cycles of the offshore oil and gas sector. These cycles are heavily influenced by fluctuating commodity prices, making project pipelines unpredictable. For instance, in 2023, Brent crude oil prices averaged around $82 per barrel, a figure that, while showing some recovery, still reflects the market's sensitivity to global economic conditions and geopolitical events, directly impacting exploration and production spending.

When oil prices dip, or the global economy falters, the number of new offshore projects tends to decrease significantly. This contraction in the market intensifies competition among FPSO providers. Companies are forced to bid more aggressively on fewer projects, often accepting tighter profit margins to maintain operational capacity and secure market share. This dynamic directly impacts the competitive rivalry, pushing players to optimize costs and offer more competitive terms.

Strategic Partnerships and Joint Ventures

Competitors in the offshore engineering sector, including MODEC, frequently form strategic partnerships and joint ventures for major projects. This allows them to combine resources, mitigate risks, and bolster their capacity to bid on large-scale contracts. For instance, in 2024, several consortia were formed for significant FPSO (Floating Production Storage and Offloading) projects, demonstrating this trend.

These collaborations directly intensify competitive rivalry. Companies must contend not only with direct competitors but also with the combined strength of these alliances. This can significantly alter the competitive dynamics for specific tenders, impacting market share distribution.

- Resource Pooling: Joint ventures enable companies to share expensive assets and expertise, crucial for high-capital offshore projects.

- Risk Mitigation: By distributing financial and operational risks among partners, companies can undertake more ambitious projects.

- Enhanced Bidding Power: Collaborations often result in stronger financial and technical credentials, improving the chances of winning bids against larger, established players.

Global Project Execution and Local Content Requirements

The global nature of project execution, particularly in the offshore energy sector where MODEC operates, intensifies competitive rivalry. Companies must not only possess advanced technological capabilities but also demonstrate agility in adapting to diverse local content requirements and regulatory landscapes. For instance, in 2024, many nations continued to emphasize increased local participation in their energy projects, requiring significant investment in local supply chains and workforce development.

Success hinges on a company's ability to build and maintain robust local partnerships and supply chains across different operating regions. This is critical for meeting stringent local content mandates, which can significantly impact project bidding and execution. Companies that can effectively navigate these complexities and deliver projects while adhering to local regulations gain a distinct competitive advantage.

- Global Project Execution Complexity: Companies face intense competition in executing large-scale offshore projects worldwide.

- Local Content Mandates: Varying national regulations requiring local sourcing and labor add significant complexity to project bidding and execution.

- Adaptability as a Differentiator: MODEC and its competitors must demonstrate flexibility in establishing local supply chains and partnerships to meet these demands.

- Competitive Advantage: The ability to successfully navigate diverse operational environments and fulfill local content requirements is a key factor in winning global projects.

Competitive rivalry in the FPSO sector is fierce, driven by a limited number of major global players like MODEC, SBM Offshore, and TechnipFMC. These companies compete on technological innovation, project execution capabilities, safety records, and regional expertise. The high capital intensity of building and operating FPSOs means companies must constantly secure new contracts to maintain profitability.

The industry sees significant investment in R&D, with companies like MODEC focusing on advancements in digital twins and greener energy solutions. For example, in 2023, the offshore energy sector continued substantial R&D allocation, a trend expected to persist into 2024. This innovation is crucial for differentiation and meeting evolving market demands.

Strategic partnerships and joint ventures are common strategies to enhance bidding power and mitigate risks for large-scale projects. In 2024, several consortia were formed for major FPSO tenders, highlighting this collaborative approach to competition. Furthermore, navigating complex global project execution, including diverse local content requirements, is a critical factor that intensifies rivalry.

SSubstitutes Threaten

While Floating Production Storage and Offloading (FPSO) units are dominant in deepwater, alternative offshore production methods pose a threat. Fixed platforms, tension leg platforms (TLPs), and semi-submersibles can be more economical for shallower waters or smaller fields, impacting the market share for FPSOs. For instance, in 2024, the global offshore oil and gas production market saw continued investment in both FPSOs and fixed structures, with the latter often favored for their lower capital expenditure in less challenging environments.

The rise of onshore unconventional production, particularly shale gas and tight oil, presents a significant threat of substitutes for offshore developments. By 2024, the U.S. Energy Information Administration reported that U.S. crude oil production, heavily influenced by these onshore unconventional sources, reached record highs, demonstrating the growing viability and scale of these alternatives.

These advancements translate into substantial cost reductions for onshore extraction compared to the capital-intensive nature of offshore projects, especially those requiring Floating Production Storage and Offloading (FPSO) units. As onshore becomes more economical, it can siphon investment away from offshore ventures, impacting the demand for FPSO services and related technologies.

The accelerating global shift towards renewable energy sources like offshore wind, solar, and hydrogen presents a significant long-term threat to traditional fossil fuel operations. As investments in clean energy infrastructure surge, the demand for new oil and gas extraction facilities, including Floating Production Storage and Offloading (FPSO) units, is likely to see a gradual decline.

This transition fundamentally substitutes hydrocarbon energy supply, directly impacting the future growth trajectory for companies like MODEC. For instance, in 2024, global renewable energy capacity additions are projected to reach record levels, further solidifying this trend.

Technological Advancements in Subsea Processing

Technological advancements in subsea processing present a significant threat of substitutes for MODEC's Floating Production Storage and Offloading (FPSO) units. Future innovations could enable more comprehensive subsea processing and direct-to-shore hydrocarbon evacuation, potentially reducing the demand for large surface facilities. This shift could diminish the necessity of traditional FPSO functionalities if hydrocarbons are fully processed and transported directly from the seafloor.

While still in early stages for widespread deepwater deployment, these emerging technologies represent a potential long-term substitute. For instance, companies are actively developing subsea compression and separation technologies. In 2024, significant investments were seen in R&D for subsea tie-backs and integrated subsea production systems, aiming to reduce topside infrastructure and operational costs. This trend could eventually bypass the need for FPSOs in certain field developments.

- Subsea Processing Growth: The global subsea processing market is projected to grow, indicating increasing adoption of technologies that bypass traditional surface facilities.

- Direct Evacuation Capabilities: Advancements in subsea pipelines and pumping systems are enhancing the feasibility of transporting hydrocarbons directly to shore.

- Cost Reduction Potential: Successful implementation of these technologies could offer significant cost savings compared to FPSO-based solutions, making them a more attractive alternative.

Enhanced Oil Recovery (EOR) Techniques

Advancements in Enhanced Oil Recovery (EOR) techniques pose a significant threat to new FPSO projects by extending the life and maximizing output from existing oil and gas fields. This effectively reduces the immediate need for developing new, often more complex and costly, offshore fields.

For instance, in 2024, the global EOR market was projected to reach over $30 billion, indicating substantial investment and technological progress. These improvements allow operators to extract more oil and gas from mature reservoirs, directly substituting the need for new production capacity that would typically be served by new FPSOs.

- EOR Market Growth: The EOR market is expected to continue its upward trajectory, driven by the need to optimize production from existing assets.

- Extended Field Life: Successful EOR implementation can add years to the productive life of mature fields, delaying or eliminating the requirement for new offshore infrastructure.

- Reduced Demand for New FPSOs: As EOR becomes more efficient and cost-effective, it directly competes with the demand for new Floating Production, Storage, and Offloading (FPSO) units, impacting the pipeline of new projects.

- Technological Advancements: Innovations in chemical EOR, thermal EOR, and gas injection methods are making previously uneconomical fields viable, further strengthening the substitute threat.

The threat of substitutes for Floating Production Storage and Offloading (FPSO) units is multifaceted, encompassing alternative offshore production methods and the growing dominance of onshore unconventional resources. Furthermore, the global energy transition towards renewables directly challenges the long-term demand for FPSO services.

Technological advancements in subsea processing and Enhanced Oil Recovery (EOR) also present significant substitute threats by enabling more efficient extraction from existing fields or reducing the need for extensive surface facilities.

The increasing viability and cost-effectiveness of onshore production, coupled with the accelerating shift to renewable energy, are key factors diminishing the market share for traditional offshore solutions like FPSOs.

| Substitute Category | Description | 2024 Impact/Projection |

|---|---|---|

| Onshore Unconventional Production | Shale gas and tight oil extraction | Record U.S. crude oil production driven by these sources, demonstrating cost-competitiveness. |

| Renewable Energy | Offshore wind, solar, hydrogen | Record global renewable capacity additions projected, reducing demand for new oil and gas infrastructure. |

| Subsea Processing | Direct-to-shore hydrocarbon evacuation | Growing subsea processing market and R&D in subsea tie-backs, potentially bypassing FPSOs. |

| Enhanced Oil Recovery (EOR) | Maximizing output from existing fields | Global EOR market projected over $30 billion, extending field life and reducing need for new FPSOs. |

Entrants Threaten

The barrier to entry for the Floating Production Storage and Offloading (FPSO) market is exceptionally high, demanding billions of dollars for engineering, specialized equipment, and fabrication facilities. For instance, a single large FPSO project can cost upwards of $1 billion, and MODEC's fleet management requires continuous investment in vessel upgrades and maintenance, creating a substantial financial hurdle for newcomers.

The threat of new entrants in the Floating Production Storage and Offloading (FPSO) market, particularly concerning technological complexity and specialized expertise, is significantly low. MODEC, like other established players, relies on decades of accumulated knowledge in designing, constructing, and operating these highly sophisticated vessels. This deep technical know-how, coupled with proprietary technologies and a history of successful project execution, creates a formidable barrier for newcomers. Major oil and gas companies, inherently risk-averse, prioritize proven reliability and extensive experience when awarding multi-billion dollar FPSO contracts, making it exceptionally challenging for new entrants to build the necessary credibility and secure crucial business.

The sheer length of Floating Production Storage and Offloading (FPSO) project cycles, often spanning several years from conception to operation, presents a significant barrier. For instance, a typical large-scale FPSO project can take 3-5 years for engineering, procurement, and construction alone. This extended timeline, coupled with the necessity of navigating complex international regulatory approvals and adhering to rigorous safety and environmental standards, makes entry incredibly difficult for newcomers.

Established Client Relationships and Trust

The offshore oil and gas sector thrives on deeply entrenched client relationships and trust, forged through years of successful, high-stakes project execution. MODEC, alongside its key competitors, has cultivated robust, long-term partnerships with major oil corporations, evidenced by consistent repeat business and joint ventures.

These established connections create a formidable barrier for newcomers. Without a demonstrable history of reliability, safety, and successful project delivery, new entrants struggle to gain the confidence of major oil companies. For instance, in 2024, the average contract duration for floating production storage and offloading (FPSO) units, a key area for MODEC, often extends beyond 10 years, reflecting the significant commitment and trust involved.

- Deeply Ingrained Trust: Decades of successful project delivery have solidified trust between established players like MODEC and major oil producers.

- Repeat Business: Proven performance encourages repeat business, making it difficult for new entrants to secure initial contracts.

- High Stakes Projects: The capital-intensive and high-risk nature of offshore projects necessitates reliance on proven, trusted partners.

- Client Endorsements: Positive client testimonials and a strong reputation for safety and efficiency are crucial but hard-won for new firms.

Integrated Supply Chain and Risk Management

The intricate global supply chain for Floating Production Storage and Offloading (FPSO) units, coupled with stringent risk management, acts as a formidable barrier to new entrants. Building the necessary network of specialized suppliers and subcontractors for these bespoke, mega-projects requires immense capital and time, a hurdle few newcomers can easily overcome. For instance, companies like MODEC manage a vast array of vendors for components ranging from hull fabrication to sophisticated topside modules, each requiring rigorous vetting and integration. This complexity, encompassing technical, operational, and financial risks from conception to long-term operation, deters potential competitors who lack established expertise and proven track records.

New entrants face significant challenges in replicating the integrated risk management frameworks essential for FPSO projects. These frameworks are crucial for mitigating issues like project delays, cost overruns, and operational disruptions, which are inherent in the offshore energy sector. As of 2024, the average cost of a large FPSO project can easily exceed $1 billion, with significant financial exposure to even minor setbacks. Successfully navigating these risks demands deep industry knowledge and established relationships, making it difficult for new players to compete effectively against established entities with decades of experience.

- Supply Chain Integration: MODEC's ability to integrate a global network of over 500 key suppliers and subcontractors for its FPSO projects is a critical competitive advantage.

- Risk Mitigation Expertise: The company's proven track record in managing the complex technical, operational, and financial risks associated with FPSO development and operation is a significant deterrent to new entrants.

- Capital Intensity: The substantial capital investment required to build a comparable supply chain and risk management infrastructure presents a high barrier to entry in the FPSO market.

- Project Complexity: The bespoke nature and sheer scale of FPSO projects, often involving billions of dollars in investment and multi-year timelines, demand specialized skills and experience that new entrants typically lack.

The threat of new entrants in the FPSO market is minimal due to the colossal capital requirements, often exceeding $1 billion for a single vessel, which acts as a significant financial deterrent. Furthermore, the need for highly specialized engineering expertise and proprietary technology developed over decades by established players like MODEC creates a steep learning curve and a substantial knowledge gap for any potential newcomer.

The established relationships and deep trust between incumbent FPSO providers and major oil companies, built over numerous successful, high-stakes projects, present another formidable barrier. In 2024, the average FPSO contract duration exceeding 10 years highlights the commitment and reliability clients seek, making it exceedingly difficult for new entrants to gain the necessary traction and secure initial contracts.

The intricate global supply chains and robust risk management frameworks essential for FPSO operations are difficult and time-consuming to replicate. Companies like MODEC manage extensive networks of vetted suppliers and have honed their ability to mitigate the inherent technical, operational, and financial risks, a capability that new entrants typically lack, further limiting their ability to enter the market effectively.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Extremely high initial investment for vessel construction, engineering, and infrastructure. | Deters most potential competitors due to the sheer financial outlay. | Single large FPSO project cost: ~$1 billion+ |

| Technological Expertise | Requires decades of accumulated knowledge in specialized offshore engineering and operations. | Creates a significant knowledge and capability gap for newcomers. | Proprietary designs and operational know-how are key competitive advantages. |

| Client Relationships & Trust | Long-standing partnerships with major oil companies based on proven reliability and safety. | Makes it difficult for new entrants to secure initial contracts and build credibility. | Average FPSO contract duration: 10+ years |

| Supply Chain & Risk Management | Complex global networks of specialized suppliers and sophisticated risk mitigation strategies. | Challenging to establish and manage effectively without prior experience. | MODEC manages 500+ key suppliers; significant financial exposure to project delays. |

Porter's Five Forces Analysis Data Sources

Our MODEC Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and expert analyst insights to capture the competitive landscape.