MODEC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MODEC Bundle

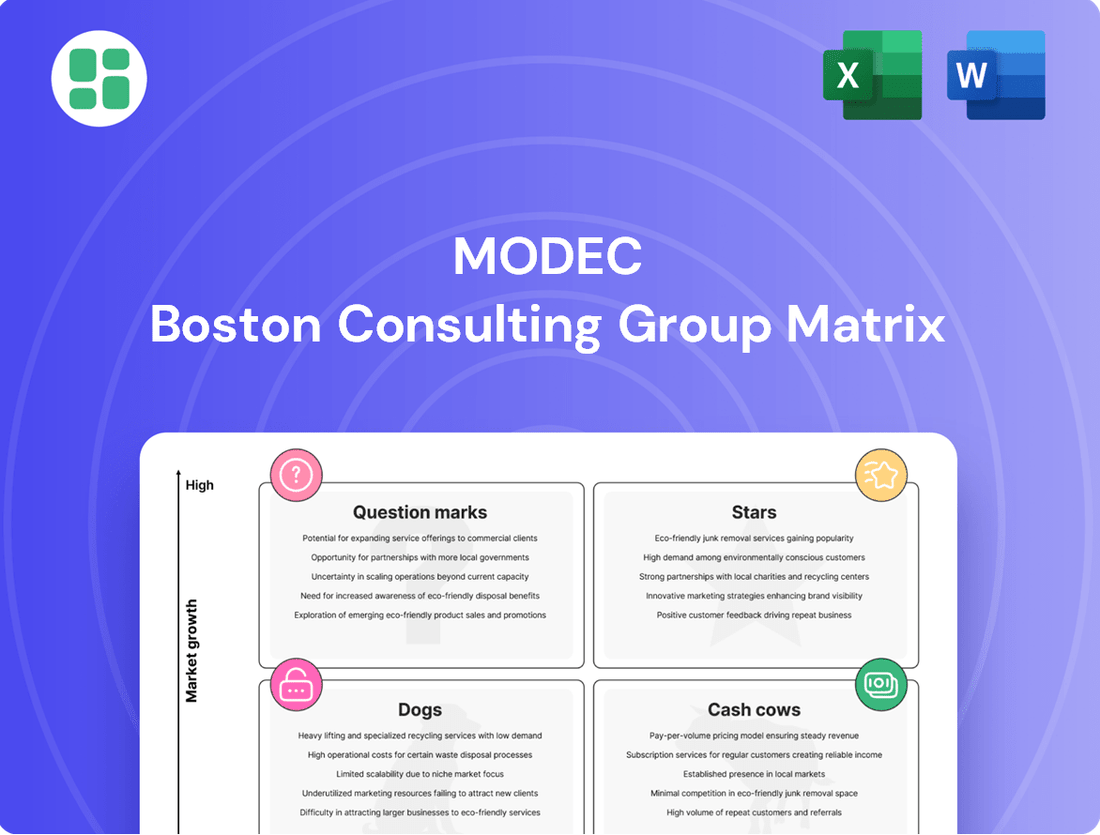

Understand the strategic positioning of a company's product portfolio with the MODEC BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of market share and growth potential. Unlock actionable insights and make informed decisions to optimize resource allocation and drive future success.

Ready to transform your product strategy? Purchase the full MODEC BCG Matrix for a comprehensive breakdown of each quadrant, including detailed analysis and tailored recommendations. Gain the clarity you need to identify high-performers, manage underperformers, and capitalize on emerging opportunities.

Stars

MODEC's development of next-generation FPSO designs, featuring innovations like double hull structures for enhanced production capacity, signifies a powerful growth driver. These advanced vessels, exemplified by their deployment for the BM-C-33 field, are engineered for superior efficiency and environmental compliance in demanding deepwater settings. This technological edge positions MODEC at the forefront of a rapidly expanding sector.

The deepwater and ultra-deepwater FPSO market is a significant growth area, and MODEC is a major player. Their involvement in projects like the Gato do Mato FPSO for Shell in Brazil highlights their strength in these demanding offshore environments. This segment of the offshore industry is expanding, and MODEC's specialized capabilities allow them to capture a substantial portion of this market.

MODEC is making significant investments in digital solutions, such as AI-powered failure prediction and digital twins for their offshore facilities. This strategic move aims to boost operational efficiency and minimize downtime, a critical factor in the offshore energy sector.

By embracing digital transformation in its operations and maintenance services, MODEC is positioning itself as a leader in the rapidly expanding market for smart offshore asset management. This aligns perfectly with the industry's increasing adoption of automation and AI technologies.

For instance, the offshore oil and gas industry saw a significant increase in digital twin adoption in 2024, with reports indicating a 25% rise in projects utilizing this technology for predictive maintenance and operational optimization. MODEC's proactive approach in this area underscores its commitment to leveraging cutting-edge technology for enhanced performance.

Decarbonization Technologies for FPSOs

MODEC is heavily investing in decarbonization technologies for Floating Production Storage and Offloading (FPSO) units. A prime example is their development of Blue Ammonia FPSOs, a product area poised for significant growth due to global decarbonization mandates. This strategic move allows MODEC to meet escalating societal demands for climate change mitigation and solidify its market leadership.

This pioneering initiative, which secured Approval in Principle in early 2025, positions MODEC at the forefront of sustainable offshore energy production. By integrating technologies that capture and process carbon dioxide, MODEC aims to significantly reduce the environmental footprint of its FPSO operations. The company's commitment to innovation in this space is crucial for maintaining a competitive edge in an evolving energy landscape.

Key aspects of MODEC's decarbonization strategy for FPSOs include:

- Development of Carbon Capture, Utilization, and Storage (CCUS) technologies integrated into FPSO designs.

- Exploration and implementation of renewable energy sources to power FPSO operations, reducing reliance on fossil fuels.

- Focus on ammonia as a low-carbon fuel and feedstock, with Blue Ammonia FPSOs targeting the capture of CO2 generated during ammonia production.

- Ongoing research into novel materials and operational efficiencies to minimize energy consumption and emissions.

Expansion into Strategic Emerging Offshore Basins

MODEC's strategic move into emerging offshore basins, exemplified by its significant presence in Guyana, positions it as a strong contender in high-growth markets. The company's securing of a key contract for the Uaru development, a project expected to contribute substantially to Guyana's burgeoning oil production, underscores this strategic initiative.

This expansion is crucial for MODEC's growth trajectory, allowing it to tap into regions with increasing offshore exploration and production activities. By establishing a permanent office in Guyana in 2025, MODEC demonstrates a long-term commitment to capturing market share in these developing energy frontiers.

- Guyana's Oil Production Growth: Guyana's offshore oil production is projected to reach 1.2 million barrels per day by the end of 2024, highlighting the immense potential of this emerging basin.

- Uaru Project Significance: The Uaru project, where MODEC secured a contract, is estimated to have over 1 billion barrels of recoverable oil, representing a substantial revenue opportunity.

- MODEC's Market Capture: This strategic expansion allows MODEC to solidify its global leadership by securing a significant portion of the rapidly expanding offshore market in regions like Guyana.

MODEC's "Stars" represent its most promising and high-growth business areas. These are segments where the company possesses a strong competitive advantage and where market demand is expected to surge. Their leadership in next-generation FPSO technology and their strategic expansion into emerging basins like Guyana are prime examples of these star performers.

The company's investments in decarbonization, particularly Blue Ammonia FPSOs, and its embrace of digital solutions like AI and digital twins are also key components of its star portfolio. These initiatives position MODEC to capitalize on the global energy transition and the increasing demand for smart, sustainable offshore operations.

For example, the offshore oil and gas industry saw a significant increase in digital twin adoption in 2024, with reports indicating a 25% rise in projects utilizing this technology for predictive maintenance and operational optimization. MODEC's proactive approach in this area underscores its commitment to leveraging cutting-edge technology for enhanced performance.

Guyana's oil production is projected to reach 1.2 million barrels per day by the end of 2024, underscoring the immense potential of this emerging basin where MODEC has secured significant contracts.

| Business Area | Growth Potential | MODEC's Strength | Market Trend |

|---|---|---|---|

| Next-Gen FPSO Technology | High | Technological innovation, efficiency | Increasing demand for advanced offshore solutions |

| Decarbonization (Blue Ammonia FPSOs) | Very High | Pioneering sustainable solutions | Global push for reduced emissions |

| Digital Solutions (AI, Digital Twins) | High | Operational efficiency, predictive maintenance | Industry-wide adoption of digital transformation |

| Emerging Basins (Guyana) | Very High | Strategic market expansion, key contracts | Rapid growth in offshore exploration and production |

What is included in the product

The MODEC BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions.

Clear visualization of business unit performance, simplifying strategic decision-making.

Cash Cows

MODEC's long-term FPSO Operations and Maintenance (O&M) contracts represent a significant cash cow for the company. These contracts, often lasting for decades, provide a highly stable and predictable revenue stream, drawing from a substantial portfolio of existing FPSO units. This consistent cash flow is a cornerstone of MODEC's financial stability.

The reliability of these core O&M services was underscored by MODEC's strong financial performance in 2024. The company reported increased profit attributable to owners, a direct reflection of the steady income generated from these mature, long-term operational assets in established markets.

Engineering, Procurement, Construction, and Installation (EPCI) services for conventional Floating Production, Storage, and Offloading (FPSO) units in mature oil and gas basins are a cornerstone of MODEC's business. These established markets, characterized by stable production profiles, offer consistent revenue streams.

Despite potentially slower growth rates in mature regions, MODEC's dominant market position and extensive operational history allow it to maintain strong profitability in this segment. The company's strategic emphasis on enhancing the financial performance of its core FPSO operations directly reflects the importance of these cash-generating assets.

For instance, in 2024, MODEC continued to secure contracts for FPSO upgrades and life extension projects in regions like the North Sea, a testament to the ongoing demand for its EPCI expertise in mature basins. This focus on its established FPSO capabilities ensures a reliable contribution to the company's overall financial health.

MODEC's business model thrives on the leasing of its Floating Production Storage and Offloading (FPSO) fleet, a core element that generates consistent, recurring revenue. These long-term, availability-based contracts provide a predictable income stream with minimal additional capital expenditure once the FPSO is operational.

This stable charter business significantly bolstered MODEC's financial performance throughout 2024. For instance, the company reported a substantial increase in its operating income in the first half of 2024, largely attributed to the reliable earnings from its leased FPSO units, demonstrating their role as a key cash cow.

Established Global Supply Chain and Project Execution Capabilities

MODEC's established global supply chain and proven project execution capabilities are central to its position as a Cash Cow. These strengths enable efficient delivery and cost control for complex, large-scale offshore projects, ensuring profitability even in challenging market conditions.

The company's operational excellence is further bolstered by its expanding infrastructure, including new offices in Malaysia and India dedicated to EPCI (Engineering, Procurement, Construction, Installation) support. This strategic expansion enhances their ability to manage projects effectively and maintain high profit margins.

- Global Reach: MODEC operates a sophisticated supply chain network, sourcing components and services worldwide to optimize project costs and timelines.

- Project Execution Prowess: The company has a consistent track record of successfully delivering intricate offshore projects, demonstrating robust project management and execution skills.

- Cost Efficiency: These capabilities translate into strong profit margins, even when facing competitive pressures and slower market growth, contributing to stable financial performance.

Maintenance and Upgrade Services for Existing Clients

Maintenance and upgrade services for MODEC's existing client base, particularly for their installed FPSOs and offshore facilities, represent a significant cash cow. These essential services, including integrity management and ongoing upkeep, ensure the continued operational efficiency and reliability of these complex assets.

This segment generates consistent, high-margin revenue streams, benefiting from a loyal customer base that depends on MODEC for the longevity of their investments. For instance, in fiscal year 2023, MODEC reported a robust order backlog, a portion of which is directly attributable to these recurring service contracts, underscoring their stability.

- Consistent Revenue: Ongoing maintenance and integrity management provide a predictable income stream.

- High Margins: Specialized services for complex offshore assets typically command higher profit margins.

- Client Loyalty: Essential services foster strong relationships and repeat business with existing clients.

- Asset Longevity: Upgrades and maintenance directly contribute to the extended operational life of MODEC's facilities.

MODEC's established FPSO fleet operations and maintenance (O&M) contracts are its primary cash cows. These long-term, availability-based agreements generate stable, recurring revenue with minimal further capital investment needed once the FPSO is operational, ensuring consistent cash flow. This core business was a key driver of MODEC's financial strength in 2024, with increased profit attributable to owners reflecting the reliable earnings from these mature assets.

The company's expertise in Engineering, Procurement, Construction, and Installation (EPCI) for conventional FPSOs in mature basins also contributes significantly to its cash cow status. These established markets provide consistent revenue streams, and MODEC's dominant market position allows for strong profitability. For example, in 2024, MODEC continued to secure upgrade and life extension projects in mature regions like the North Sea, reinforcing the cash-generating capacity of its core FPSO capabilities.

Maintenance and upgrade services for MODEC's existing client base are another vital cash cow. These essential, high-margin services ensure the continued efficiency of complex offshore assets, fostering client loyalty and repeat business. The robust order backlog reported in fiscal year 2023, partly from these recurring service contracts, highlights their stability and contribution to MODEC's financial health.

| Segment | Contribution to Cash Flow | Key Strengths | 2024 Performance Indicator |

|---|---|---|---|

| FPSO Operations & Maintenance (O&M) | Highly stable and predictable revenue stream | Long-term contracts, minimal capex post-operation | Increased profit attributable to owners |

| EPCI for Conventional FPSOs (Mature Basins) | Consistent revenue from established markets | Dominant market position, extensive operational history | Secured upgrade/life extension contracts in North Sea |

| Maintenance & Upgrade Services | Consistent, high-margin revenue | Client loyalty, essential services for asset longevity | Robust order backlog (FY2023) from recurring contracts |

What You See Is What You Get

MODEC BCG Matrix

The MODEC BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content; you get the complete, professionally formatted strategic tool ready for immediate application in your business planning and analysis.

Dogs

Older Floating Storage and Offloading (FSO) and Floating Production, Storage, and Offloading (FPSO) units within MODEC's fleet, particularly those with less advanced technology or operating in fields with dwindling reserves, would likely fall into the 'Dogs' category of the BCG matrix. These assets often face increasing operational costs and declining revenue streams.

For instance, a 2024 analysis might reveal that several of MODEC's older FPSOs are experiencing higher maintenance expenditures per barrel of oil equivalent produced compared to their newer counterparts. This inefficiency, coupled with the maturity of the fields they serve, limits their competitive edge and potential for future growth.

These units could be candidates for strategic divestment or decommissioning if their economic viability is compromised. The market for older, less efficient FPSO/FSO technology is shrinking, making redeployment or conversion challenging without substantial investment, further solidifying their 'Dog' status.

Niche services in declining offshore regions, particularly those catering to small-scale, specialized needs in rapidly depleting or economically unviable fields, would fall into the Dogs category of the MODEC BCG Matrix. These operations typically offer low returns and face limited growth prospects, potentially diverting valuable resources from more promising ventures.

Legacy technologies with a high environmental footprint, such as older offshore production platforms or inefficient processing equipment, represent a significant challenge for MODEC. These systems often have higher greenhouse gas emissions, contributing to climate change and potentially falling short of evolving environmental standards. For instance, older gas turbines used in FPSOs can be less fuel-efficient, leading to increased CO2 output per unit of energy produced.

Continuing to rely on these older, carbon-intensive assets without substantial investment in upgrades or replacement poses considerable financial and reputational risks. As global pressure mounts for decarbonization, companies operating with outdated, polluting technologies face potential penalties, increased operating costs due to carbon pricing, and a diminished market appeal. In 2023, the International Energy Agency reported that the oil and gas sector’s emissions intensity remained a critical concern, highlighting the need for technological modernization.

MODEC's strategic commitment to minimizing greenhouse gas and other emissions across its operations means that these legacy technologies are prime candidates for divestment, significant retrofitting, or phased retirement. The company’s focus on sustainable solutions, including the development of floating solar power generation and carbon capture technologies, underscores the imperative to transition away from high-emission legacy assets to align with both regulatory demands and its long-term environmental, social, and governance (ESG) objectives.

Non-core, Unsuccessful Small Ventures

Non-core, unsuccessful small ventures within MODEC's portfolio would represent investments in experimental projects or side businesses that have not achieved significant market penetration or profitability. These ventures typically exhibit low growth prospects and hold a small market share, acting as resource drains without contributing meaningfully to MODEC's overall financial health or strategic objectives. For instance, if MODEC explored a niche renewable energy technology in 2023 that required substantial R&D but yielded minimal commercial return, it would fit this category.

Such ventures are characterized by their inability to scale or find a sustainable market niche, leading to a negative return on investment. For example, a small, unproven offshore wind turbine component supplier MODEC might have invested in, which failed to secure major contracts by the end of 2024, would exemplify this. These projects consume capital and management attention that could be better allocated to more promising areas.

- Low Growth & Low Market Share: These ventures struggle to expand their customer base or revenue streams, often operating in highly specialized or nascent markets with limited demand.

- Resource Drain: They consume financial capital, research and development resources, and management bandwidth without generating commensurate returns or strategic advantages.

- Divestiture/Discontinuation Candidates: Typically, these ventures are prime candidates for divestment, sale, or outright discontinuation to free up resources and refocus on core, higher-potential business areas.

Operations in Politically Unstable or High-Risk Jurisdictions

Operations in politically unstable or high-risk jurisdictions, often classified as Dogs in the BCG Matrix, represent areas where MODEC faces significant geopolitical instability, regulatory uncertainty, or elevated operational risks. These regions typically feature a limited existing footprint and low market share for MODEC. For instance, in 2024, emerging markets with nascent energy infrastructure and volatile political landscapes present such challenges.

The inherent high risk and low potential for sustainable growth in these areas make them unattractive for continued investment. Companies operating in these Dog segments might experience minimal returns or even substantial losses. Geopolitical risks are a recognized and impactful factor in the business environment, directly affecting project viability and profitability.

- Geopolitical Instability: Regions with frequent government changes or civil unrest increase operational disruption and investment risk.

- Regulatory Uncertainty: Shifting legal frameworks and unpredictable policy changes can hinder long-term planning and profitability.

- Elevated Operational Risks: Factors like inadequate infrastructure, security concerns, and supply chain vulnerabilities contribute to higher operating costs.

- Limited Market Share: A small presence in these markets suggests low competitive advantage and difficulty in scaling operations.

Dogs in MODEC's portfolio represent business units or assets with low market share and low growth potential. These are often older technologies or ventures that have not gained significant traction. For example, a 2024 assessment might identify certain legacy FPSO units as Dogs due to declining field production and increasing maintenance costs.

These segments typically consume resources without generating substantial returns, making them candidates for divestment or restructuring. The strategic imperative is to either revitalize these Dogs through significant investment or to exit these markets to reallocate capital to more promising Stars or Cash Cows.

MODEC's approach to managing these Dog assets involves a careful evaluation of their remaining economic life and potential for turnaround. In 2023, the company continued to assess its fleet for optimal deployment, with older, less efficient units being prime candidates for retirement or sale if their operational costs outweighed their revenue generation.

The financial performance of these units, characterized by low profitability and limited future prospects, necessitates a clear strategy for their disposition.

Question Marks

Offshore Carbon Capture and Storage (CCS) solutions represent a burgeoning high-growth market, though MODEC's current penetration in this emerging sector is likely minimal. These ventures, crucial for environmental sustainability, demand significant upfront R&D investment with no immediate assurance of profit, aligning with MODEC's strategic exploration in its mid-term business plan.

MODEC's venture into floating offshore wind power represents a strategic move into a high-growth alternative energy sector, capitalizing on their established proficiency in floating platform technologies. This segment is characterized by substantial future potential but currently sees MODEC with a relatively small market share against more entrenched competitors.

The company's position in the dynamic offshore wind market places floating wind firmly in the Question Mark quadrant of the BCG Matrix. This is due to the significant capital infusion required to scale operations and capture a more dominant market presence in this emerging field.

As of early 2024, the global floating offshore wind market is projected to grow significantly, with estimates suggesting it could reach hundreds of gigawatts by 2050, demanding substantial investment to achieve competitive scale.

Offshore hydrogen and ammonia production facilities represent a nascent but high-growth sector within the alternative energy landscape. MODEC's exploration, evidenced by their Approval in Principle for a Blue Ammonia FPSO, signals early strategic positioning in this emerging market.

While this area shows significant future potential, MODEC's current market share is virtually non-existent, necessitating substantial capital infusion to build infrastructure and secure a competitive advantage. The global offshore wind market, a related sector, saw investments exceeding $60 billion in 2023, indicating the scale of capital required for offshore energy infrastructure development.

Modularized FPSO Solutions for Marginal Fields

The trend towards modularized Floating Production Storage and Offloading (FPSO) units for marginal fields presents a significant opportunity. These smaller, standardized FPSOs are designed to reduce upfront costs and speed up deployment, making previously uneconomical offshore reserves viable. This segment is expected to see substantial growth as operators seek more cost-efficient development solutions.

MODEC, a leader in FPSO technology, is well-positioned to capitalize on this evolving market. While the company has extensive experience with large-scale projects, its market share specifically within the smaller, modularized FPSO segment for marginal fields may still be in its growth phase. Strategic investments in developing and scaling these specific solutions will be crucial for capturing a larger portion of this emerging market.

The economic viability of marginal fields is directly enhanced by the cost-effectiveness of modular FPSOs. For instance, the typical cost for a smaller FPSO unit can range from $300 million to $700 million, a significant reduction compared to the billion-dollar investments for larger field developments. This cost reduction is a key driver for the adoption of modular solutions.

- Market Growth Potential: The global market for FPSOs serving marginal fields is projected to expand, driven by the need for economic development of smaller offshore reserves.

- MODEC's Position: While MODEC has a strong overall FPSO presence, its specific market share in the modularized segment for marginal fields is still developing, indicating a growth opportunity.

- Cost-Effectiveness: Modular FPSOs offer a lower entry barrier for marginal field development, with unit costs significantly lower than traditional large-scale FPSO projects.

- Strategic Investment: To maximize its participation in this high-growth segment, MODEC may need to focus strategic investments on further refining and scaling its modularized FPSO offerings.

Advanced Robotics and Drone-based Inspection Services

Investments in advanced robotics and drone-based inspection services for Floating Production Storage and Offloading (FPSO) units represent a significant technological advancement. MODEC's collaboration with Terra Drone highlights this commitment to innovation in a high-growth sector. These technologies aim to enhance efficiency and safety during inspections and maintenance operations.

The market for these specialized services is still developing, with widespread adoption and MODEC's specific market share in offering them as distinct services requiring further growth. The global drone services market was valued at approximately $21.2 billion in 2023 and is projected to reach $131.6 billion by 2030, indicating substantial expansion potential for robotics and drone integration in offshore industries.

- High Growth Potential: The integration of advanced robotics and drones for FPSO inspections is in a rapidly expanding technological landscape.

- Efficiency and Safety Gains: These innovations are expected to significantly improve operational efficiency and worker safety in offshore environments.

- Market Evolution: Widespread adoption and MODEC's market penetration for these as standalone services are still in their formative stages, necessitating continued market development.

- Industry Investment: Companies like MODEC are actively investing in R&D, exemplified by their joint agreement with Terra Drone, to stay at the forefront of this technological shift.

Floating offshore wind power and offshore hydrogen/ammonia production are key areas for MODEC that fit the Question Mark profile. These sectors offer high growth potential but require substantial investment for MODEC to gain significant market share. The company is strategically positioning itself in these emerging markets, as seen with its Approval in Principle for a Blue Ammonia FPSO and its involvement in floating wind.

These ventures, while promising, demand considerable capital to scale and compete effectively. The global offshore wind market alone saw investments exceeding $60 billion in 2023, underscoring the financial commitment needed. MODEC's early-stage involvement in offshore hydrogen and ammonia production, with virtually no current market share, highlights the investment required to build infrastructure and secure a competitive edge in these nascent, high-growth sectors.

MODEC's focus on modularized FPSOs for marginal fields also aligns with the Question Mark strategy. While the company is a leader in FPSOs, its specific share in the smaller, modular segment is still developing. The cost-effectiveness of these units, typically ranging from $300 million to $700 million, makes them attractive for marginal field development, representing a significant growth opportunity.

The integration of advanced robotics and drone-based inspection services for FPSOs is another area with high growth potential, though MODEC's market penetration for these as distinct services is still formative. The global drone services market, valued at approximately $21.2 billion in 2023, is expected to reach $131.6 billion by 2030, indicating substantial expansion opportunities for such technological integrations in offshore operations.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust data foundation, integrating financial disclosures, market research reports, and competitive intelligence to provide a comprehensive view of product portfolio performance.