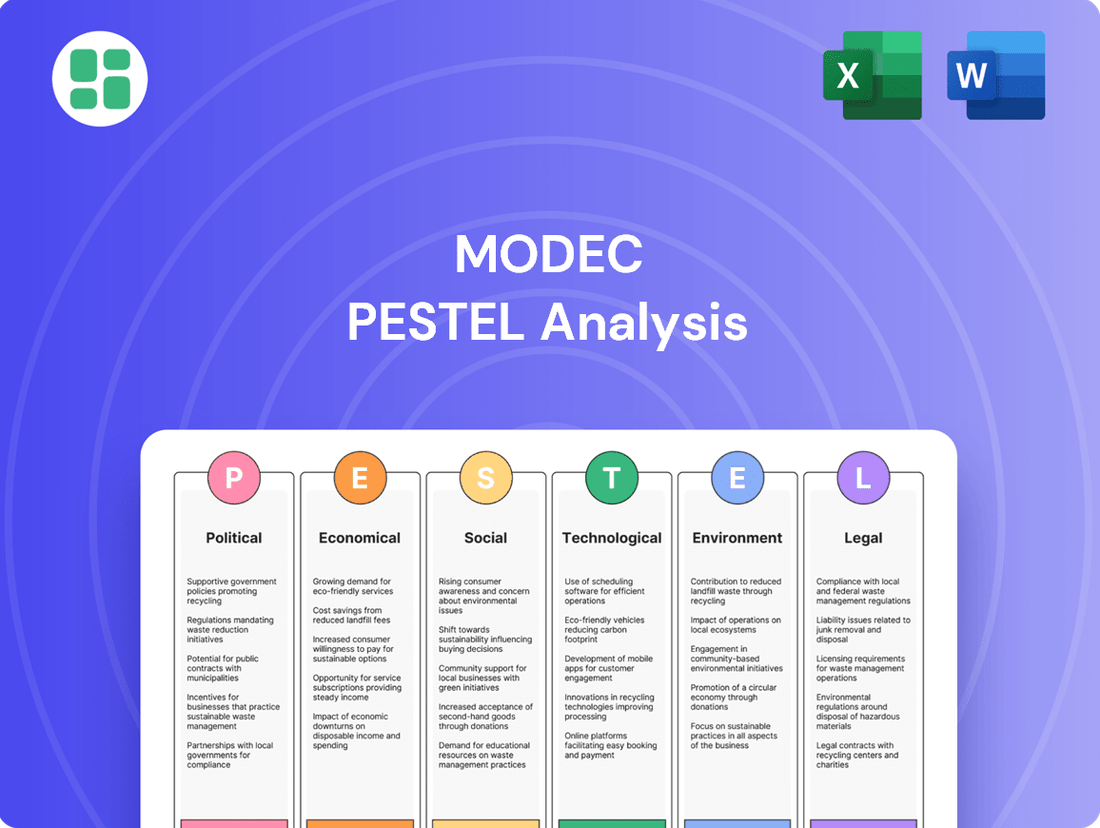

MODEC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MODEC Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping MODEC's strategic landscape. Our expertly crafted PESTLE analysis provides actionable intelligence to anticipate challenges and seize opportunities. Secure your competitive advantage by downloading the full version today.

Political factors

Government policies and regulations are a significant influence on MODEC. Policies concerning offshore oil and gas exploration, production, and environmental standards directly shape the company's operational landscape. For example, changes in licensing rounds, tax structures, and local content mandates in crucial markets like Brazil and Guyana can substantially impact the feasibility and profitability of MODEC's projects.

The United States' offshore leasing program, which has seen a reduction in new lease sales over its five-year plan, illustrates how governmental decisions can affect future market opportunities for companies like MODEC. These policy shifts can create both challenges and openings, requiring MODEC to adapt its strategies to align with evolving regulatory frameworks and market access.

Geopolitical stability is a significant concern for MODEC, particularly in regions where its operations and supply chains are concentrated. Tensions in areas like the Eastern Mediterranean, for example, directly impact project execution by causing delays and escalating operational risks. This instability can ripple through the global oil and gas supply chain, affecting MODEC's ability to secure resources and deliver projects efficiently.

Global trade policies, particularly tariffs enacted by major economies, directly influence the cost of materials and equipment crucial for constructing and maintaining Floating Production Storage and Offloading (FPSO) units. For instance, the US-China trade tensions, which saw increased tariffs on various goods throughout 2019-2020, could have indirectly affected component sourcing for MODEC's projects, potentially raising capital expenditure. These policy shifts can squeeze MODEC's profit margins and disrupt the smooth operation of its global supply chains, impacting project timelines and overall cost-effectiveness.

Energy Transition Policies

Governments worldwide are increasingly prioritizing the energy transition, aiming to reduce carbon emissions and combat climate change. This shift directly impacts the political landscape for energy companies like MODEC, influencing support for traditional fossil fuel projects. For instance, many nations are setting ambitious renewable energy targets, with the International Energy Agency (IEA) reporting that global renewable capacity additions grew by 50% in 2023 compared to 2022, reaching nearly 510 gigawatts.

These policy shifts can manifest as incentives for cleaner energy sources, such as tax credits for solar and wind power, or conversely, stricter regulations on emissions from oil and gas operations. MODEC must navigate this evolving regulatory environment, adapting its strategies to capitalize on opportunities in renewable energy while managing the risks associated with fossil fuel-dependent projects. The Biden administration's Inflation Reduction Act, for example, provides significant tax credits for clean energy manufacturing and deployment, signaling a clear political direction.

- Global Decarbonization Push: Over 140 countries have set or are considering net-zero emission targets, creating a strong political mandate for energy transition.

- Shift in Investment: Global investment in clean energy is projected to reach $2 trillion annually by 2030, according to the IEA, diverting capital from fossil fuels.

- Regulatory Scrutiny: Expect increased regulations on methane emissions and carbon capture technologies, impacting operational costs and project viability for oil and gas sector players.

International Relations and Sanctions

International relations and sanctions significantly impact MODEC's operational landscape. For instance, geopolitical tensions in regions like the Middle East or Eastern Europe can lead to supply disruptions, directly influencing oil prices and the demand for offshore projects. In 2024, the ongoing geopolitical instability, particularly concerning the Russia-Ukraine conflict and its ripple effects on global energy markets, continues to create uncertainty for energy infrastructure investments.

MODEC, as a company involved in large-scale offshore projects, must closely monitor and adapt to evolving international sanctions regimes. These can restrict access to certain markets, technologies, or financing, thereby affecting project timelines and profitability. For example, sanctions imposed on countries with significant offshore oil reserves can deter investment and limit the scope of MODEC's potential contracts.

- Geopolitical Risk: Increased geopolitical tensions globally can lead to supply chain disruptions and volatility in oil prices, impacting MODEC's project economics. For example, the ongoing conflicts in 2024 have heightened the risk premium for energy investments.

- Sanctions Impact: Evolving sanctions on oil-producing nations or related entities can restrict market access and financing for MODEC's projects, potentially delaying or cancelling planned developments.

- Trade Relations: Shifting trade policies and international agreements influence the cost of materials and equipment for offshore projects, directly affecting MODEC's procurement strategies and project budgets.

- Regulatory Compliance: MODEC must ensure strict adherence to international sanctions and trade regulations, which adds complexity and cost to its global operations.

Government policies and regulations are a significant influence on MODEC. Policies concerning offshore oil and gas exploration, production, and environmental standards directly shape the company's operational landscape. For example, changes in licensing rounds, tax structures, and local content mandates in crucial markets like Brazil and Guyana can substantially impact the feasibility and profitability of MODEC's projects.

The United States' offshore leasing program, which has seen a reduction in new lease sales over its five-year plan, illustrates how governmental decisions can affect future market opportunities for companies like MODEC. These policy shifts can create both challenges and openings, requiring MODEC to adapt its strategies to align with evolving regulatory frameworks and market access.

Governments worldwide are increasingly prioritizing the energy transition, aiming to reduce carbon emissions and combat climate change. This shift directly impacts the political landscape for energy companies like MODEC, influencing support for traditional fossil fuel projects. For instance, many nations are setting ambitious renewable energy targets, with the International Energy Agency (IEA) reporting that global renewable capacity additions grew by 50% in 2023 compared to 2022, reaching nearly 510 gigawatts.

International relations and sanctions significantly impact MODEC's operational landscape. For instance, geopolitical tensions in regions like the Middle East or Eastern Europe can lead to supply disruptions, directly influencing oil prices and the demand for offshore projects. In 2024, the ongoing geopolitical instability, particularly concerning the Russia-Ukraine conflict and its ripple effects on global energy markets, continues to create uncertainty for energy infrastructure investments.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting MODEC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential influence on MODEC's operations and market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global oil and gas prices are a critical factor for MODEC. Fluctuations in crude oil and natural gas prices directly impact the financial viability of offshore projects, influencing investment decisions by oil majors and, consequently, demand for MODEC's Floating Production Storage and Offloading (FPSO) services. For instance, Brent crude oil prices averaged around $83 per barrel in early 2024, showing relative stability. However, forecasts for late 2024 and into 2025 suggest a potential softening, with some analysts predicting prices to hover in the $70-$80 range, which could impact the sanctioning of new offshore projects.

The general health of the global economy significantly influences how much money is invested in the energy sector. When the world economy is doing well, companies are more likely to fund new offshore projects and expand existing ones, which directly increases the need for MODEC's specialized services like engineering, procurement, construction, and installation (EPCI), as well as operations and maintenance (O&M).

This positive economic outlook is reflected in the projected growth of the Floating Production Storage and Offloading (FPSO) market. Analysts anticipate this market will expand to $46.2 billion by 2033, showing a compound annual growth rate of 6.3% from 2024 to 2033. Such robust growth signals a strong and sustained appetite for the types of offshore energy infrastructure that MODEC provides.

The availability and cost of capital are paramount for projects like FPSO construction. In 2024 and 2025, oil and gas majors are focusing on capital discipline, meaning MODEC must present compelling project economics to win new business. For instance, offshore Engineering, Procurement, Construction, and Installation (EPCI) expenditures in the U.S. Gulf of Mexico are projected to decrease in 2025 compared to 2024, highlighting the competitive financing landscape.

Inflation and Currency Fluctuations

Inflationary pressures are a significant concern for MODEC, as they directly increase the costs associated with materials, labor, and essential services for their complex offshore projects. For instance, rising commodity prices in 2024 and early 2025 could squeeze profit margins on existing contracts.

Currency exchange rate volatility presents another challenge. MODEC's global footprint means that fluctuations in major currencies like the US Dollar, Japanese Yen, and Brazilian Real can impact both the revenue recognized from international contracts and the cost of imported components.

- Inflationary Impact: Higher material and labor costs in 2024 could reduce MODEC's project profitability if not adequately passed on to clients.

- Currency Risk: Volatility in USD/JPY exchange rates, for example, can affect MODEC's reported earnings and the cost of its global supply chain.

- Global Operations: MODEC's international contracts expose it to diverse economic environments and currency risks across different regions.

Competition and Market Dynamics

The floating production solutions market is highly competitive, with established players and emerging companies vying for contracts. Recent market trends indicate a growing demand for newbuild Floating Production Storage and Offloading (FPSO) units, a segment where MODEC is actively investing. For instance, MODEC announced in early 2024 its commitment to building new FPSOs, aiming to capture a larger share of this growing market, contrasting with the industry trend of conversions for some projects.

This competitive pressure directly influences pricing power and MODEC's market share. Companies that can deliver cost-effective, technologically advanced solutions, like MODEC's focus on new construction FPSOs, are better positioned to secure lucrative contracts. The market is also seeing some consolidation, which could further reshape the competitive landscape and impact contract awards in the coming years.

MODEC's strategic advantage hinges on its ability to offer innovative and competitive solutions. The company's emphasis on new construction FPSOs, rather than solely relying on conversions, reflects a strategy to meet evolving client needs and potentially achieve better project economics. This approach is crucial in a market where efficiency and technological superiority are key differentiators.

- Market Share Dynamics: Increased competition can lead to price wars, potentially impacting MODEC's profit margins if it cannot maintain its competitive edge.

- Innovation Drive: The push for new construction FPSOs by MODEC is a direct response to market demand for more efficient and purpose-built solutions.

- Consolidation Impact: Potential mergers or acquisitions among competitors could alter contract bidding dynamics and MODEC's strategic partnerships.

- Pricing Pressures: The ability to offer competitive pricing, alongside technological innovation, is paramount for securing future projects in the offshore energy sector.

Economic factors significantly influence MODEC's performance, with global oil and gas prices directly impacting project sanctioning and demand for FPSO services. For instance, Brent crude averaged around $83/barrel in early 2024, with forecasts suggesting a potential dip to $70-$80 by late 2024/2025, which could affect new offshore project investments.

Full Version Awaits

MODEC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of MODEC covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the external forces shaping MODEC's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable strategic tool.

Sociological factors

Growing environmental awareness is significantly shaping public perception of fossil fuels, directly impacting investor sentiment and the social license to operate for companies like MODEC. Many regions are witnessing substantial public opposition to new offshore drilling projects, reflecting a broader societal shift towards cleaner energy alternatives.

The availability of skilled labor for highly specialized offshore operations and engineering is a critical factor for MODEC. The company needs to attract and retain top talent in a highly competitive global market, especially for complex projects.

MODEC's investment in training programs is key to addressing this. For instance, their initiatives launched in Guyana in 2024, and planned for future offshore operations, aim to build a robust local workforce. This focus on skill development directly impacts operational efficiency and project execution.

Maintaining a robust Health, Safety, Security, and Environment (HSSE) culture is non-negotiable in the offshore industry, given its inherently hazardous nature. MODEC's dedication to safety and operational excellence directly impacts its standing, adherence to regulations, and ability to draw in and retain qualified personnel. In 2023, the offshore oil and gas sector reported a total recordable incident rate (TRIR) of 0.85 per 200,000 hours worked, underscoring the constant vigilance required.

Community Relations and Local Content

MODEC's commitment to fostering strong community relations is crucial for its social license to operate. By actively engaging with local populations and prioritizing local content, the company aims to ensure seamless operations and broad acceptance in its host countries. This approach is particularly evident in its recent expansion, with MODEC establishing a new office in Guyana, a region experiencing significant energy sector growth.

Adherence to local content requirements, such as increasing local employment and supporting supplier development, directly translates into tangible economic benefits for the operating region. For instance, MODEC's initiatives in Guyana are designed to build local capacity and contribute to the nation's development goals. These efforts are not just about compliance; they are about building trust and ensuring long-term sustainability.

- Local Employment Focus: MODEC's strategy includes prioritizing the hiring and training of local talent, contributing to job creation and skill development within the communities where it operates.

- Supplier Development: The company actively seeks to integrate local businesses into its supply chain, fostering economic growth and capacity building for Guyanese enterprises.

- Community Engagement: Through its new office and ongoing training programs in Guyana, MODEC demonstrates a dedication to being a responsible corporate citizen and building positive, lasting relationships.

Ethical and Responsible Business Practices

Societal expectations are increasingly pushing companies like MODEC towards greater accountability in ethical and responsible business practices. This means a closer look at how they manage their operations, from ensuring fair labor conditions throughout their supply chains to upholding robust corporate governance. For instance, the growing demand for transparency means companies are expected to openly report on their environmental, social, and governance (ESG) performance. In 2024, investor focus on ESG metrics continued to intensify, with a significant portion of institutional capital being allocated based on these factors, reflecting a societal shift towards valuing sustainability and ethical conduct.

Adherence to international standards and frameworks is becoming non-negotiable. Companies are evaluated not just on their financial performance but also on their commitment to human rights and fair business dealings. This scrutiny extends to every level of operation, demanding that MODEC demonstrate a clear and actionable commitment to ethical conduct. Reports in late 2024 indicated a rise in regulatory actions and consumer boycotts against companies found to be lacking in these areas, underscoring the tangible business risks associated with neglecting ethical responsibilities.

- Increased investor demand for ESG reporting: By 2025, it's projected that over 70% of major investment firms will integrate ESG factors into their primary investment decisions.

- Focus on supply chain transparency: Companies are facing pressure to map and monitor their entire supply chains for ethical labor practices and environmental impact.

- Human rights due diligence: Legislation in key markets is mandating that businesses conduct thorough human rights impact assessments for their operations and business relationships.

- Corporate governance reforms: Shareholder activism is driving changes in board structures and executive compensation to better align with long-term ethical and sustainable business goals.

Societal expectations are increasingly pushing companies like MODEC towards greater accountability in ethical and responsible business practices, impacting investor sentiment and public perception. In 2024, investor focus on ESG metrics continued to intensify, with a significant portion of institutional capital being allocated based on these factors, reflecting a societal shift towards valuing sustainability and ethical conduct.

Adherence to international standards and frameworks is becoming non-negotiable, with companies evaluated on their commitment to human rights and fair business dealings. Reports in late 2024 indicated a rise in regulatory actions and consumer boycotts against companies found to be lacking in these areas, underscoring the tangible business risks associated with neglecting ethical responsibilities.

MODEC's investment in training programs, such as those launched in Guyana in 2024, aims to build a robust local workforce and integrate local businesses into its supply chain. This focus on skill development and local content directly impacts operational efficiency and project execution, fostering economic growth and capacity building.

| Societal Factor | Impact on MODEC | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Awareness | Shapes public perception of fossil fuels, influences social license to operate. | Growing public opposition to offshore drilling projects reported in various regions. |

| Skilled Labor Availability | Critical for specialized offshore operations; impacts operational efficiency. | High competition for talent in the global market for complex projects. |

| Health, Safety, Security, Environment (HSSE) Culture | Affects regulatory adherence, talent retention, and operational excellence. | Offshore oil and gas sector reported a TRIR of 0.85 per 200,000 hours worked in 2023. |

| Community Relations & Local Content | Ensures seamless operations and broad acceptance; builds trust. | MODEC established a new office in Guyana in 2024 to enhance local engagement and capacity building. |

| Ethical & Responsible Practices | Drives demand for transparency in ESG performance and fair labor conditions. | Over 70% of major investment firms projected to integrate ESG factors into decisions by 2025. |

Technological factors

Continuous innovation in Floating Production, Storage, and Offloading (FPSO) vessel design is paramount for MODEC's competitive edge. Recent advancements focus on increasing capacities, boosting processing capabilities, and incorporating double-bottom designs to simplify maintenance and minimize downtime.

These technological leaps directly translate to enhanced operational efficiency, a critical factor in the offshore oil and gas industry. For instance, the development of more complex processing units on FPSOs allows for greater value extraction from crude oil directly at sea, reducing the need for extensive onshore infrastructure.

The industry saw significant FPSO contract awards in 2023 and early 2024, indicating a strong demand for these advanced units. MODEC's ability to integrate cutting-edge design features, such as modular construction for faster deployment and improved fuel efficiency systems, will be key to securing future projects and maintaining market leadership.

The drive for decarbonization is reshaping the FPSO sector, with a significant focus on reducing operational emissions. Technologies like gas turbine combined cycle (GTCC) systems are gaining traction, offering improved energy efficiency and lower fuel consumption. For instance, GTCC can boost power generation efficiency by up to 20% compared to simple cycle turbines, directly impacting the carbon footprint of FPSOs.

Carbon capture technologies are also becoming crucial for FPSOs to meet stringent environmental regulations and corporate sustainability goals. While the exact figures for current FPSO-specific carbon capture deployment are still emerging, the global market for carbon capture, utilization, and storage (CCUS) is projected to grow substantially, with offshore applications expected to play a key role. MODEC is actively investing in and deploying these advanced solutions, aiming to lead in sustainable offshore production.

MODEC is actively integrating advanced digital technologies such as artificial intelligence, robotics, and digital twins. This strategic adoption is aimed at optimizing offshore facility operations, enabling predictive maintenance, and significantly enhancing safety protocols. For instance, by 2024, the company is expected to see substantial gains in operational efficiency through these digital solutions.

The implementation of these digital tools allows MODEC to reduce its reliance on manual labor while simultaneously boosting overall efficiency. This focus on automation is a key driver in their strategy to maintain a competitive edge in the evolving energy sector, with a reported 15% increase in predictive maintenance accuracy in pilot projects by early 2025.

Subsea Technology Integration

Advancements in subsea technology are crucial for MODEC, enabling deeper and more complex hydrocarbon extraction. The integration of Floating Production, Storage, and Offloading (FPSO) units with sophisticated subsea systems allows access to previously uneconomical or inaccessible reserves. For instance, the development of enhanced subsea processing and power distribution systems is key to unlocking reserves in ultra-deepwater environments, a significant growth area for the offshore energy sector.

The increasing sophistication of subsea technology directly impacts MODEC's ability to deploy and manage FPSOs for challenging projects. Innovations in areas like subsea multiphase pumping and subsea compression are extending the economic viability of fields. By 2024, the global subsea processing market was projected to reach over $10 billion, highlighting the significant investment and technological progress in this domain.

- Deepwater Access: Subsea technology advancements, including improved remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), facilitate exploration and production in waters exceeding 3,000 meters.

- Enhanced Recovery: Technologies like subsea separation and boosting systems improve oil and gas recovery rates from existing fields, extending their operational life.

- Cost Efficiency: Integration of these advanced subsea systems with FPSOs can reduce the need for surface facilities, leading to significant cost savings and faster project execution.

Alternative Energy Solutions and Diversification

MODEC is strategically diversifying its technological focus beyond traditional oil and gas. They are actively exploring opportunities in floating offshore wind power, a move that leverages their established expertise in floating solutions. This pivot aligns with the global shift towards cleaner energy sources.

This diversification is crucial as the energy sector undergoes a significant transition. For instance, the global offshore wind market is projected to grow substantially. By 2030, it's estimated that offshore wind capacity could reach 300 GW, with floating wind playing an increasingly important role in deeper waters where fixed foundations are not feasible.

- Floating Offshore Wind: MODEC's involvement in projects like the Hywind Tampen in Norway demonstrates their commitment to this burgeoning sector, applying their floating platform technology.

- Energy Transition Alignment: This strategic move positions MODEC to capitalize on the growing demand for renewable energy infrastructure, reducing reliance on fossil fuels.

- Leveraging Core Competencies: The company's deep understanding of offshore operations and floating structures provides a strong foundation for success in the alternative energy space.

Technological advancements in FPSO design, such as increased capacities and double-bottoms for easier maintenance, are crucial for MODEC's competitiveness. These innovations enhance operational efficiency and allow for greater value extraction at sea. The strong demand for advanced FPSOs, evidenced by numerous contract awards in 2023 and early 2024, highlights the importance of integrating features like modular construction for faster deployment and improved fuel efficiency.

Legal factors

MODEC's extensive global operations are deeply intertwined with international maritime law, encompassing stringent regulations on vessel construction, operational safety, navigation standards, and crucial pollution prevention measures. Staying compliant with these dynamic rules is paramount for uninterrupted business continuity.

For instance, the International Maritime Organization (IMO) continuously updates safety and environmental standards, such as those related to emissions (e.g., IMO 2020 sulfur cap) and ballast water management, directly impacting MODEC's fleet operations and capital expenditure planning for vessel upgrades or new builds.

Environmental regulations are tightening globally, impacting offshore vessel operations. The EU's Monitoring, Reporting, and Verification (MRV) Regulation, for instance, mandates detailed tracking of greenhouse gas emissions from maritime transport, including offshore support vessels. This means companies like MODEC must meticulously monitor and report their emissions, with compliance becoming a critical operational aspect.

Further strengthening these requirements, the EU's FuelEU Maritime initiative, set to be fully implemented by 2030, will require a gradual increase in the use of renewable and low-carbon fuels for ships calling at European ports. This policy aims to reduce the carbon intensity of maritime transport by at least 2% in 2025, rising to 6% by 2030, directly influencing fuel choices and operational strategies for companies like MODEC operating in these waters.

Contract law is fundamental to MODEC's operations, particularly for its Engineering, Procurement, Construction, and Installation (EPCI) and Operations & Maintenance (O&M) agreements. These contracts, often spanning decades for offshore projects, are subject to diverse legal frameworks across different jurisdictions, requiring meticulous drafting to ensure enforceability and mitigate risk. For instance, the enforceability of force majeure clauses in long-term offshore contracts, crucial in the face of increasing climate-related disruptions, is a key consideration in 2024 and 2025.

Navigating these legal complexities is vital for securing robust agreements, especially for the long-term service contracts that form a significant part of MODEC's recurring revenue. The global offshore wind sector, a key growth area for MODEC, saw significant investment in 2023, with over $30 billion committed, underscoring the need for legally sound contracts that can withstand market volatility and evolving regulatory landscapes through 2025.

Labor Laws and Workforce Regulations

MODEC must navigate a complex web of international labor laws, impacting everything from worker safety protocols to employment conditions and local hiring mandates across its global operations. Failure to comply can lead to significant fines and operational disruptions.

These regulations directly influence MODEC's human resources strategies and can substantially affect operational costs. For instance, varying minimum wage laws or requirements for specific employee benefits in different regions add layers of complexity to workforce management and budgeting.

- Worker Safety: Adherence to stringent safety standards, such as those mandated by the International Labour Organization (ILO) or specific national legislation, is paramount in the offshore industry.

- Employment Conditions: Compliance with laws governing working hours, overtime pay, and leave entitlements, which differ significantly between countries like Brazil and Singapore, is crucial.

- Local Hiring: Many nations have quotas or preferences for local employment, requiring MODEC to develop strategies for workforce development and integration.

Intellectual Property and Technology Licensing

Protecting MODEC's proprietary technologies and managing its intellectual property (IP) rights are paramount. This involves robust patent strategies and trade secret protection to maintain a competitive edge in the offshore engineering and construction sector. For instance, as of early 2024, the global IP market continues to see significant activity, with companies actively seeking to secure and leverage their technological innovations.

Navigating licensing agreements for third-party technologies is equally critical for MODEC. These agreements dictate access to essential software, specialized equipment designs, and operational methodologies. The complexity of these contracts requires careful legal review to ensure favorable terms and compliance with evolving technology standards. In 2023, the value of global technology licensing deals reached hundreds of billions of dollars, underscoring the financial importance of these arrangements.

- Patent Portfolio Management: MODEC must continuously monitor and update its patent portfolio to safeguard its innovations in areas like floating production systems and subsea technologies.

- Licensing In and Out: Securing licenses for advanced software or manufacturing processes, while also potentially licensing its own patented technologies to other entities, is a key legal strategy.

- Enforcement and Defense: Legal frameworks for enforcing IP rights against infringement and defending against claims are vital for protecting MODEC's market position.

- Compliance with International IP Laws: Operating globally means adhering to diverse intellectual property laws across different jurisdictions, which requires specialized legal expertise.

Legal frameworks significantly shape MODEC's operational landscape, from international maritime regulations to national labor laws and intellectual property rights. Compliance with these diverse and evolving legal requirements is essential for mitigating risks, ensuring smooth operations, and maintaining a competitive advantage. For instance, the ongoing enforcement of environmental regulations like the EU's FuelEU Maritime initiative, which aims for a 2% reduction in maritime transport's carbon intensity by 2025, directly influences MODEC's fuel sourcing and fleet management strategies.

Contract law is particularly critical, especially for long-term EPCI and O&M agreements, which are subject to varying international legal systems. The enforceability of clauses, such as force majeure, is a key consideration for MODEC in 2024 and 2025, particularly given the increasing frequency of climate-related disruptions. The global offshore wind sector's growth, with over $30 billion invested in 2023, highlights the necessity of robust, legally sound contracts to navigate market volatility.

Intellectual property protection is also paramount, requiring proactive management of patent portfolios and trade secret defense to safeguard innovations in floating production systems and subsea technologies. The global IP market's continued activity in early 2024 underscores the importance of securing and leveraging technological advancements through effective legal strategies, including licensing agreements for both inbound and outbound technologies.

Environmental factors

The global push to address climate change is creating significant demand for cleaner energy solutions and more sustainable operational practices within the oil and gas sector. This shift directly impacts companies like MODEC, pushing them to innovate towards lower-carbon footprints.

MODEC is actively responding to these pressures by setting targets to reduce CO2 emissions from its Floating Production Storage and Offloading (FPSO) units. For instance, their commitment includes exploring and implementing carbon capture technologies, a key strategy for decarbonizing offshore operations.

The urgency is underscored by international agreements and investor expectations; for example, many energy companies are setting net-zero targets by 2050, influencing capital allocation towards greener technologies. MODEC's focus on FPSO emission reduction aligns with this broader industry trend, aiming to enhance the environmental performance of its assets.

MODEC's offshore operations, particularly in areas with rich marine biodiversity, face scrutiny regarding their environmental footprint. Stringent regulations are in place to minimize disruption, focusing on effective waste management and robust spill prevention protocols. For instance, the International Maritime Organization's (IMO) Ballast Water Management Convention, fully effective since 2017 and with ongoing compliance efforts, aims to prevent the spread of invasive aquatic species, a critical aspect of ecosystem protection.

MODEC's environmental performance hinges on its robust waste management and pollution control strategies. The company prioritizes the safe handling of operational waste, particularly hazardous materials generated from offshore operations. Preventing pollution, such as oil spills and uncontrolled wastewater discharge, is a paramount concern, directly impacting marine ecosystems and regulatory standing.

Compliance with stringent environmental regulations is non-negotiable for MODEC. For instance, in 2024, the International Maritime Organization's (IMO) updated regulations on sulfur emissions (IMO 2020, with ongoing enforcement and review) continue to shape operational practices for vessels. Adopting industry best practices, including advanced containment systems and spill response protocols, further underscores MODEC's commitment to minimizing its environmental footprint.

Resource Depletion and Energy Transition

The global pivot from fossil fuels to renewables is reshaping the energy landscape, creating both hurdles and avenues for companies like MODEC. This transition is driven by increasing concerns over resource scarcity and climate change, pushing for sustainable energy solutions.

MODEC is actively navigating this shift by investing in floating offshore wind and other alternative energy technologies. This strategic move aligns with the broader global energy transition, aiming to capitalize on emerging markets and reduce reliance on traditional hydrocarbon resources.

For instance, the International Energy Agency (IEA) projected in its 2024 outlook that renewable energy sources are expected to account for over 50% of global electricity generation by 2025. This underscores the significant market potential for companies involved in the energy transition.

- Global Renewable Energy Growth: Renewables are projected to reach over 50% of global electricity generation by 2025, signaling a major market shift.

- MODEC's Strategic Focus: The company is prioritizing floating offshore wind and alternative energy development to align with this transition.

- Investment in Future Technologies: MODEC's strategy reflects a commitment to adapting to evolving energy demands and resource availability.

Regulatory Scrutiny and Environmental Compliance

MODEC faces heightened scrutiny from environmental regulators and non-governmental organizations, demanding robust environmental management systems and transparent reporting. For instance, in 2023, the company reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a figure closely watched by stakeholders.

Non-compliance with evolving environmental standards, such as stricter emissions limits or waste disposal regulations, can result in substantial fines and damage to MODEC's brand image. The International Maritime Organization's (IMO) 2023 regulations on sulfur oxide emissions, for example, require significant investment in compliance technologies across the industry.

- Increased regulatory oversight: Environmental agencies globally are intensifying their focus on offshore energy operations.

- Transparency demands: Stakeholders expect clear and verifiable data on MODEC's environmental performance.

- Financial and reputational risks: Non-compliance can lead to significant penalties and a loss of public trust.

- Industry-wide compliance challenges: New regulations, like those concerning carbon intensity, impact operational costs and strategies.

Environmental factors are increasingly shaping MODEC's operational landscape and strategic direction. The global imperative to combat climate change is driving demand for cleaner energy solutions, pushing companies like MODEC to innovate towards lower-carbon footprints and invest in renewable energy technologies.

MODEC is actively responding to these pressures by setting targets to reduce CO2 emissions from its FPSO units and exploring carbon capture technologies, aligning with broader industry trends and investor expectations for net-zero commitments. Stringent regulations on waste management and pollution control, such as the IMO's Ballast Water Management Convention, are critical for protecting marine ecosystems and ensuring compliance.

The energy transition, with renewables projected to exceed 50% of global electricity generation by 2025, presents both challenges and opportunities, prompting MODEC to invest in floating offshore wind. Increased scrutiny from regulators and NGOs necessitates robust environmental management systems and transparent reporting, with non-compliance risking substantial fines and reputational damage.

| Environmental Factor | Impact on MODEC | Relevant Data/Regulation |

|---|---|---|

| Climate Change & Decarbonization | Demand for cleaner energy, pressure to reduce emissions | MODEC setting CO2 emission reduction targets for FPSOs; exploring carbon capture. |

| Pollution Control & Waste Management | Need for stringent protocols to protect marine ecosystems | IMO Ballast Water Management Convention (fully effective 2017); focus on spill prevention. |

| Energy Transition | Shift towards renewables creates new markets and challenges | IEA 2024 projection: Renewables >50% global electricity by 2025; MODEC investing in floating offshore wind. |

| Regulatory Scrutiny & Compliance | Risk of fines and reputational damage for non-compliance | MODEC reported 5% reduction in Scope 1 & 2 GHG emissions (2023 vs 2020 baseline); IMO 2023 sulfur regulations. |

PESTLE Analysis Data Sources

Our MODEC PESTLE analysis is meticulously constructed using data from reputable industry associations, financial news outlets, and governmental publications. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both comprehensive and accurate.