Middleby SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

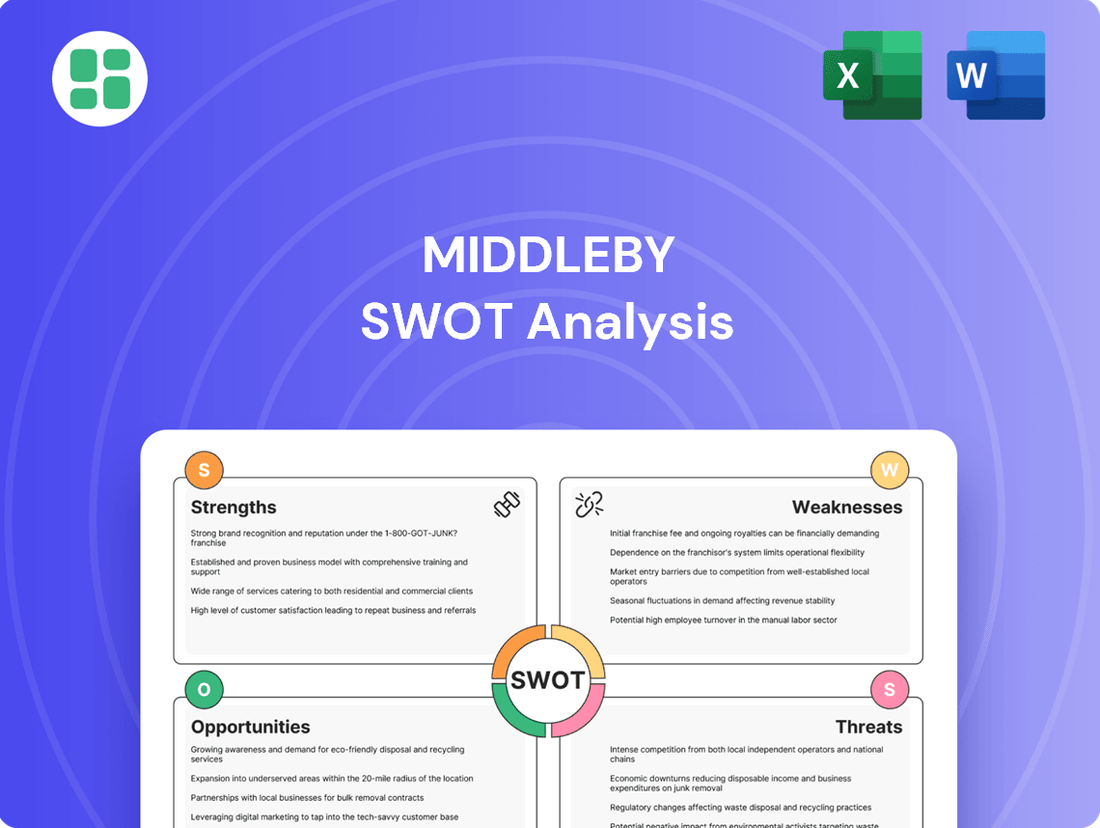

Middleby, a leader in commercial kitchen equipment, demonstrates robust strengths in innovation and brand reputation, yet faces opportunities to capitalize on emerging markets. However, potential threats from intense competition and supply chain disruptions warrant careful consideration.

Want the full story behind Middleby’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Middleby Corporation boasts a robustly diversified product portfolio, encompassing commercial foodservice equipment, food processing machinery, and premium residential kitchen appliances. This broad market presence significantly reduces dependency on any single sector, solidifying its leadership across various industries.

With a portfolio of over 120 well-established brands, Middleby commands a substantial global market share and benefits from strong, recognized brand equity. This extensive brand collection is a key driver of its market leadership and competitive advantage.

Middleby's financial performance is a significant strength, highlighted by record adjusted EBITDA margins of 24.8% in the fourth quarter of 2024. The company also generated an impressive $640 million in free cash flow annually, achieving a 140% conversion rate. This robust cash generation provides the company with substantial financial flexibility.

This strong cash flow directly supports Middleby's ability to manage its debt effectively and fund future growth initiatives. The company's strategic focus on deleveraging has paid off, with its net leverage ratio dropping to a healthy 2.0x by late 2024. This solidifies its financial footing and enhances its capacity for strategic investments and shareholder returns through buybacks.

Middleby's dedication to innovation is a significant strength, demonstrated by its consistent investment in research and development. This commitment was highlighted at NAFEM 2025 with its 'What's Hot!' Innovation awards, showcasing their forward-thinking approach.

The company is actively developing and integrating cutting-edge technologies like digital robotic kitchens, artificial intelligence, and automation solutions. This focus on advanced tech not only enhances operational efficiency for their clients but also directly addresses critical industry challenges such as labor shortages.

Furthermore, Middleby's emphasis on Internet of Things (IoT) enabled kitchen solutions, ventless cooking, and sustainable equipment aligns perfectly with current market trends and regulatory demands. This proactive stance solidifies their position as a technology leader in the commercial kitchen equipment sector.

Strategic Acquisitions and Growth Strategy

Middleby’s strength lies in its robust strategic acquisition approach, evidenced by 64 acquisitions completed with an average value of $314 million. This aggressive consolidation strategy, including notable 2024 additions like Emery Thompson, JC Ford, and Gorreri, significantly enhances its product portfolio and market penetration.

- Acquisition Prowess: Completed 64 strategic acquisitions, averaging $314 million each.

- Recent Expansion: Integrated Emery Thompson, JC Ford, and Gorreri in 2024, broadening offerings.

- Market Consolidation: Leverages acquisitions to solidify its position in fragmented industry segments.

- Synergistic Integration: Effectively incorporates new technologies and brands to fuel cross-segment growth.

Planned Spin-off for Enhanced Focus and Value Creation

The planned tax-free spin-off of Middleby's Food Processing division into a separate public company, anticipated by early 2026, is a key strategic initiative designed to boost shareholder value. This separation aims to foster two more focused businesses, enabling each to implement distinct growth strategies and optimize their capital allocation.

This strategic maneuver is projected to unlock greater potential for both the remaining Middleby entity and the newly formed food processing company. By allowing each business to concentrate on its core competencies and market dynamics, the spin-off is expected to drive enhanced long-term organic growth and improved margin performance across both organizations.

- Strategic Focus: Separation allows tailored growth strategies for both Middleby and the spun-off Food Processing division.

- Value Creation: Expected to unlock shareholder value through enhanced focus and optimized capital structures.

- Market Leadership: Each entity can better pursue market leadership in their respective industries.

- Growth Prospects: Anticipated to drive long-term organic growth and margin expansion for both companies.

Middleby's strengths are deeply rooted in its diversified product lines, spanning commercial foodservice, food processing, and residential appliances, which reduces reliance on any single market. Its portfolio of over 120 brands ensures strong market presence and brand recognition.

Financially, Middleby demonstrated exceptional performance in Q4 2024 with record adjusted EBITDA margins of 24.8% and generated $640 million in free cash flow, achieving a 140% conversion rate. This financial strength is underscored by a reduced net leverage ratio of 2.0x by late 2024, providing significant flexibility for growth and shareholder returns.

Innovation is a core strength, with consistent R&D investment and recognition at NAFEM 2025 for its 'What's Hot!' Innovation awards. The company is actively integrating advanced technologies like robotics, AI, and automation to address industry challenges such as labor shortages, while also focusing on IoT, ventless cooking, and sustainability.

Middleby's strategic acquisition approach has been highly effective, with 64 acquisitions completed, averaging $314 million each, including key 2024 additions like Emery Thompson and JC Ford. This strategy consolidates its position in fragmented markets and integrates new technologies and brands for cross-segment growth.

| Key Performance Indicators | 2023 Data | 2024 (Q4) Data | 2025 Outlook |

| Adjusted EBITDA Margin | 22.5% | 24.8% (Record) | Projected growth |

| Annual Free Cash Flow | $580 million | $640 million | Continued strong generation |

| Net Leverage Ratio | 2.3x | 2.0x (Late 2024) | Further deleveraging expected |

| Number of Acquisitions | 60+ | 64 | Continued strategic M&A |

What is included in the product

Offers a full breakdown of Middleby’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Middleby's revenue growth has shown a concerning trend, with net sales declining by 2.19% in the first quarter of 2025 compared to the prior year. This downward trajectory continued over the last twelve months, marking a 2.56% year-over-year decrease in revenue. These figures highlight a current struggle with organic revenue expansion, even as the company pursues various strategic initiatives.

Further underscoring this weakness, Middleby's overall revenue for the entirety of 2024 experienced a 4.00% contraction. This sustained period of revenue decline suggests that the company is facing headwinds that are impacting its top-line performance, posing a challenge to its growth objectives.

Middleby's performance is closely tied to economic cycles, making it vulnerable to macroeconomic shifts. For instance, the company has faced challenges from rising labor and energy costs, which directly affect operational expenses and profitability.

The residential market, a key sector for some of Middleby's offerings, has experienced a downturn due to increasing interest rates and reduced consumer spending. This can dampen demand for new equipment and services, as evidenced by the struggles in this segment, even with recent signs of stabilization.

Middleby operates in highly competitive and fragmented markets, spanning commercial foodservice, food processing, and residential kitchen equipment. This intense rivalry necessitates constant investment in brand recognition, product innovation, reliability, and service to defend its market share.

Potential Supply Chain Disruptions

Middleby faces significant vulnerabilities stemming from its supply chain. The company is susceptible to disruptions that could impact the timely delivery of essential raw materials and components. These disruptions can arise from various factors, including manufacturing capacity limitations, labor disagreements within supplier networks, or unforeseen external events.

Such supply chain interruptions have a direct effect on Middleby's operations. They can lead to increased production expenses, cause delays in fulfilling customer orders, and ultimately hinder the company's capacity to meet market demand. For instance, in early 2024, many manufacturers reported extended lead times for critical electronic components, a trend that could affect Middleby's production schedules for its technologically advanced kitchen equipment.

- Capacity Constraints: Suppliers may struggle to keep up with demand, leading to longer lead times for parts.

- Labor Disputes: Strikes or work stoppages at supplier facilities can halt component production.

- Geopolitical Risks: International trade tensions or regional instability can disrupt the flow of goods.

- Increased Costs: Supply chain disruptions often translate to higher material and logistics expenses, impacting profit margins.

Tariff Pressures and Cost Exposure

Middleby is exposed to considerable tariff pressures, with initial cost impacts estimated between $150 million and $200 million annually. A significant portion of this exposure, around 50%, is linked to China.

These tariffs can put a strain on profit margins. While the company is implementing strategies to lessen these effects, ongoing operational changes and price adjustments will likely be necessary, especially as we move into the latter half of 2025.

- Tariff Exposure: Estimated $150-200 million annually.

- China Impact: Approximately 50% of tariff exposure.

- Margin Pressure: Potential impact on profitability.

- Mitigation Efforts: Ongoing operational adjustments and price increases planned for late 2025.

Middleby's revenue has seen a downturn, with net sales decreasing by 2.19% in Q1 2025 year-over-year, and a 2.56% decline over the past twelve months. This indicates challenges in achieving organic growth despite strategic efforts. The company's overall revenue contracted by 4.00% in 2024, highlighting persistent headwinds impacting top-line performance and growth aspirations.

The company is susceptible to economic cycles and rising operational costs like labor and energy. Furthermore, the residential market, a key segment, has been affected by higher interest rates and reduced consumer spending, impacting demand for equipment. Intense competition across its diverse markets necessitates continuous investment in innovation and service to maintain market share.

| Weakness | Description | Impact |

|---|---|---|

| Revenue Decline | Q1 2025 sales down 2.19% YoY; 2024 revenue down 4.00%. | Challenges in organic growth, pressure on financial targets. |

| Macroeconomic Sensitivity | Vulnerable to economic downturns, rising labor and energy costs. | Increased operational expenses, reduced profitability. |

| Market Competition | Operates in fragmented, competitive markets (foodservice, processing, residential). | Requires constant investment to defend market share. |

| Supply Chain Vulnerabilities | Susceptible to disruptions affecting component delivery and production costs. | Potential for increased expenses and order fulfillment delays. |

| Tariff Exposure | Estimated $150-200 million annual impact, 50% linked to China. | Pressure on profit margins, necessitating operational adjustments. |

What You See Is What You Get

Middleby SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you're getting a genuine look at the comprehensive SWOT analysis for Middleby, without any hidden surprises.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can confidently assess the strengths, weaknesses, opportunities, and threats facing Middleby based on this complete report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This allows you to make an informed decision with complete transparency regarding the content you'll obtain.

Opportunities

The increasing global appetite for Western-style dining, especially in emerging economies, fuels demand for Middleby's advanced commercial foodservice equipment. As U.S. and international restaurant chains expand into these new territories, Middleby is well-positioned to supply the necessary technology and solutions.

Middleby's existing global manufacturing and distribution network provides a distinct advantage, allowing it to efficiently serve these expanding markets. This established infrastructure is crucial for capitalizing on the projected growth in international foodservice, which saw global restaurant sales reach an estimated $3.6 trillion in 2024, with emerging markets being key drivers.

The food service industry is increasingly embracing AI, automation, and IoT, presenting a significant opportunity for Middleby. For instance, the global commercial kitchen automation market was valued at approximately $2.9 billion in 2023 and is projected to reach $6.5 billion by 2030, growing at a CAGR of over 12%.

Middleby can capitalize on this by enhancing its offerings with robotic kitchen solutions and data analytics tools. These innovations directly address the persistent labor shortages and the growing customer demand for operational efficiency, further solidifying Middleby's market leadership.

Middleby's planned spin-off of its Food Processing division is a significant opportunity. This strategic move will grant both the remaining Commercial/Residential business and the new Food Processing entity greater financial agility. This enhanced flexibility is crucial for pursuing opportunistic acquisitions that can quickly boost revenue and EBITDA.

These strategic acquisitions are poised to solidify Middleby's market leadership, particularly in fragmented industries. By acquiring companies that complement its existing portfolio, Middleby can achieve rapid scale. Furthermore, this strategy opens doors to expanding into attractive adjacent markets, such as the ice and beverage sectors, which represent substantial growth potential.

Sustainability and Energy Efficiency Demand

Operators are increasingly focused on sustainability, with a growing demand for zero-waste systems and energy-efficient kitchen equipment. This trend directly benefits Middleby, as its eco-friendly innovations, such as ventless cooking solutions and technologies that optimize food yield, align perfectly with these market needs. The company's dedication to minimizing environmental impact provides a significant competitive edge in this evolving landscape.

Middleby's investment in developing and promoting sustainable technologies is paying off. For instance, their ventless equipment reduces energy consumption and ventilation needs, a key selling point for businesses aiming to cut operational costs and environmental footprint. This focus on sustainability is not just a trend but a core driver of future growth, as evidenced by the increasing number of foodservice operations seeking to improve their environmental, social, and governance (ESG) scores.

- Growing Operator Prioritization: A significant percentage of foodservice operators are now making sustainability a key factor in their purchasing decisions.

- Demand for Eco-Friendly Solutions: The market for energy-efficient and waste-reducing kitchen equipment is expanding rapidly, with projections indicating continued strong growth through 2025.

- Middleby's Competitive Advantage: The company's portfolio of ventless and yield-optimizing technologies positions it favorably to capture this increasing demand.

- Alignment with Market Trends: Middleby's commitment to reducing environmental impact resonates with consumers and regulatory bodies, further strengthening its market position.

Recovery and Growth in Residential Kitchen Market

The residential kitchen market is demonstrating a notable recovery, with Middleby poised to capitalize on this resurgence. Despite earlier economic headwinds, the company foresees sustained long-term expansion fueled by enduring consumer preferences for home-based culinary activities and a growing demand for premium kitchen appliances.

Middleby's proactive strategic investments within the residential segment are specifically designed to harness this market rebound. These initiatives are expected to drive significant benefits as the residential kitchen sector continues its upward trajectory.

- Resilient Demand: The residential kitchen sector, particularly for high-end appliances, shows resilience, with consumer spending in this area expected to grow.

- Home Cooking Trend: The sustained trend of increased home cooking continues to be a key driver for appliance upgrades and new installations.

- Strategic Investments: Middleby's targeted investments in product innovation and market penetration are positioning it favorably to capture market share in the recovering residential segment.

- Market Growth Projections: Analysts project a compound annual growth rate (CAGR) of approximately 5-7% for the global residential kitchen appliance market through 2025, indicating a robust recovery.

Middleby's strategic acquisitions in fragmented markets are key to expanding its reach and solidifying its leadership. This approach allows for rapid scaling and entry into attractive adjacent sectors like ice and beverage, which show significant growth potential. The company's focus on these strategic moves is designed to enhance revenue and EBITDA, particularly as global foodservice continues its expansion.

The increasing demand for sustainable and energy-efficient kitchen equipment presents a significant opportunity for Middleby. Its portfolio of ventless cooking solutions and technologies that minimize waste and energy consumption directly addresses operator needs and environmental concerns. This alignment with sustainability trends is a strong competitive advantage, especially as ESG factors gain prominence in purchasing decisions.

The recovery in the residential kitchen market, driven by sustained home cooking trends and demand for premium appliances, offers Middleby substantial growth prospects. The company’s strategic investments in product innovation and market penetration are well-positioned to capture share in this rebounding segment. Projections indicate a healthy CAGR for the global residential kitchen appliance market through 2025.

| Opportunity Area | Key Driver | Middleby's Advantage |

|---|---|---|

| Strategic Acquisitions | Market fragmentation, revenue/EBITDA growth | Rapid scaling, adjacent market entry (ice, beverage) |

| Sustainability Focus | Operator demand for eco-friendly solutions | Ventless tech, waste/energy reduction, ESG alignment |

| Residential Market Recovery | Home cooking trend, premium appliance demand | Product innovation, market penetration, segment rebound |

Threats

Economic downturns pose a significant threat to Middleby. A substantial economic slowdown, characterized by high interest rates and persistent inflation, could curtail commercial foodservice operators' capital spending. This directly translates to reduced demand for Middleby's professional kitchen equipment.

Furthermore, such economic conditions often lead to decreased consumer spending on discretionary items, including high-end residential kitchen appliances. This impact was evident in the recent softness observed in the residential market segment, highlighting Middleby's vulnerability to broader economic shifts.

Middleby operates in markets characterized by intense competition and fragmentation. This environment makes the company vulnerable to aggressive pricing tactics from rivals and the potential disruption from new technologies, which could squeeze margins and reduce market share. For instance, in the commercial kitchen equipment sector, while Middleby is a leader, smaller, agile competitors can sometimes offer lower-priced alternatives, particularly in specific product categories.

Ongoing global supply chain disruptions remain a significant threat, impacting Middleby's ability to secure necessary components. For instance, the semiconductor shortage, which began in 2020, continued to affect various industries throughout 2024, potentially delaying production for Middleby's technologically advanced equipment.

Volatility in raw material costs, such as stainless steel and aluminum, directly affects Middleby's cost of goods sold. In early 2024, global commodity prices saw fluctuations, with some key materials experiencing price increases of 5-10% compared to the previous year, squeezing profit margins if not effectively passed on to customers.

These factors can lead to unanticipated production delays and increased operating expenses, potentially hindering manufacturing efficiency and impacting overall profitability. Such disruptions necessitate robust inventory management and strong supplier relationships to mitigate financial impacts.

Regulatory Changes and Trade Policies

Shifting trade policies, including new tariffs or tighter import/export rules, pose a significant threat to Middleby's international business. These changes can directly affect the company's global supply chain and increase operational expenses. For instance, the projected annual tariff cost impact of $150-200 million underscores the substantial financial risk associated with evolving trade landscapes.

The company is also vulnerable to evolving regulatory environments across its diverse markets. Stricter environmental regulations or changes in food safety standards could necessitate costly adjustments to product design and manufacturing processes. Furthermore, geopolitical instability can disrupt international trade flows, impacting Middleby's ability to source materials and distribute its products efficiently.

- Tariff Impact: Projected annual tariff cost effects of $150-200 million.

- Regulatory Compliance: Need to adapt to changing environmental and safety standards globally.

- Geopolitical Risks: Potential disruptions to supply chains and market access due to international tensions.

Failure to Successfully Execute Spin-off

The planned spin-off of Middleby's Food Processing business, while intended to unlock value, presents significant execution risks. Delays in the separation process or unforeseen costs exceeding initial estimates, which can often arise in complex divestitures, could erode the anticipated financial gains. For instance, if separation costs were to exceed the projected $50 million in 2024, it would directly impact the net proceeds and potentially require additional capital.

A failure to achieve the strategic separation, meaning the two entities don't gain the intended operational focus or financial flexibility, would be a major blow. This could manifest as continued operational interdependencies or a lack of clear strategic direction for either the remaining Middleby or the spun-off food processing unit. For example, if the spun-off entity struggles to secure its own financing post-separation, impacting its growth trajectory, it would fall short of the intended benefits.

Ultimately, any missteps in executing this spin-off could negatively impact shareholder value. This could be seen in a decline in Middleby's stock price post-announcement if the market perceives execution challenges or a failure to realize the expected strategic advantages. The market's reaction to similar spin-offs in the industrial sector in 2024 has shown a sensitivity to execution clarity, with companies facing over 10% stock drops in the short term if the rationale and execution plan appear weak.

Economic headwinds, including high interest rates and persistent inflation, threaten Middleby's sales by reducing capital spending from commercial foodservice operators and discretionary spending on residential appliances. Intense competition and market fragmentation also expose Middleby to aggressive pricing and technological disruption, potentially impacting margins and market share.

SWOT Analysis Data Sources

This Middleby SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.