Middleby Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

Middleby's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any stakeholder looking to navigate this industry effectively.

The complete report reveals the real forces shaping Middleby’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration plays a key role in Middleby's bargaining power. For specialized components like advanced electronics or unique alloys, a limited number of suppliers can significantly boost their leverage. This is a common challenge across many manufacturing sectors.

Middleby operates with a vast global network for its components and raw materials, serving its commercial foodservice, food processing, and residential kitchen equipment divisions. This scale, combined with a broad product range, provides Middleby with considerable negotiating strength. For instance, in 2023, Middleby reported a cost of goods sold of $3.2 billion, indicating substantial purchasing volume that can be leveraged.

While supplier concentration can be a risk, Middleby's size and diversified product lines enable it to mitigate this by exploring alternative suppliers or negotiating more favorable terms. The company's ability to source from a wide geographical area also helps in managing potential supply chain disruptions and supplier power.

Switching costs for Middleby's suppliers can be a mixed bag. For common, standardized components, the ability to switch easily keeps supplier power in check, allowing Middleby to negotiate favorable terms.

However, when Middleby relies on highly specialized or proprietary parts, the landscape shifts. The significant expenses and time involved in retooling, re-engineering, and qualifying new suppliers for these custom items can substantially increase Middleby's dependence on existing providers, thus amplifying supplier bargaining power.

Suppliers who provide unique or patented technologies, specialized materials, or highly integrated systems for Middleby's advanced equipment, such as IoT-enabled ovens or high-capacity food processors, would naturally command greater bargaining power. This is because Middleby would have fewer alternative sources for these critical components.

Middleby's commitment to continuous innovation and product development often necessitates reliance on specific suppliers for cutting-edge components. For instance, in 2024, Middleby's investment in smart kitchen technology likely increased its dependence on suppliers of advanced sensors and connectivity modules, thus strengthening those suppliers' positions.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into equipment manufacturing, known as forward integration, is typically minor for Middleby. This is because entering Middleby’s various markets demands significant investment, specialized knowledge, and a strong existing customer base, all of which are difficult for suppliers to replicate. For instance, in 2023, Middleby’s capital expenditures were $237.5 million, highlighting the substantial investment needed to compete in their sectors.

However, a niche supplier providing a highly specialized component could potentially bypass Middleby and offer their products directly to end-users as sub-assemblies or integrated modules. This action, while not a full takeover of manufacturing, could subtly shift bargaining power. Such a move would allow the supplier to capture more value and potentially dictate terms more forcefully, impacting Middleby’s cost structure and supply chain flexibility.

Consider these factors regarding supplier forward integration:

- Complexity and Capital Intensity: Middleby operates in diverse, often capital-intensive segments like commercial foodservice equipment and residential appliances, making direct competition by suppliers challenging.

- Established Market Presence: Middleby benefits from strong brand recognition and extensive distribution networks, which are difficult for suppliers to quickly establish.

- Specialized Component Suppliers: A supplier of a critical, unique component might have the leverage to offer integrated solutions directly to Middleby’s customers.

- Subtle Leverage Shift: Even without full manufacturing, offering modules could reduce Middleby’s control over the final product and increase supplier influence.

Importance of Middleby to Suppliers

Middleby's significant purchasing volume across its commercial foodservice, residential foodservice, and industrial segments positions it as a crucial customer for numerous suppliers. This substantial demand grants Middleby considerable bargaining power, particularly with smaller or less diversified suppliers. For instance, in 2023, Middleby's total revenue reached $4.1 billion, indicating the scale of its procurement operations.

This leverage allows Middleby to negotiate favorable terms, including competitive pricing, higher quality standards, and reliable delivery schedules. The company's global presence further amplifies its influence, enabling it to consolidate purchasing power across different regions and secure advantageous agreements.

- Significant Purchasing Volume: Middleby's multi-billion dollar revenue underscores its substantial demand for supplier goods and services.

- Supplier Dependence: Smaller or less diversified suppliers may rely heavily on Middleby's business, increasing Middleby's leverage.

- Global Reach Advantage: Operating worldwide allows Middleby to centralize procurement and exert greater influence on supplier terms.

Middleby's bargaining power with suppliers is generally strong due to its significant purchasing volume and diversified operations. However, this power is somewhat tempered by the reliance on specialized components for its innovative product lines. The company's 2023 cost of goods sold, totaling $3.2 billion, highlights the substantial scale of its procurement, which naturally grants it leverage with many suppliers.

The threat of suppliers integrating forward into Middleby's markets is minimal, given the capital intensity and specialized knowledge required. For instance, Middleby's 2023 capital expenditures of $237.5 million illustrate the significant investment needed to compete in its sectors, a barrier for most suppliers. However, niche suppliers of critical, unique components could potentially exert subtle leverage by offering integrated solutions directly to end-users.

Middleby's ability to source globally and its broad product range allow it to mitigate supplier concentration risks. This diversification helps maintain competitive pricing and ensures supply chain resilience. The company's 2023 revenue of $4.1 billion further solidifies its position as a key customer, enabling it to negotiate favorable terms and quality standards.

The bargaining power of Middleby's suppliers is influenced by factors such as supplier concentration and the switching costs associated with specialized components. While common parts offer little leverage to suppliers, reliance on proprietary technologies for advanced equipment, such as IoT-enabled ovens, can increase supplier influence. Middleby's 2024 investments in smart kitchen technology likely amplified this trend for specific component providers.

| Factor | Impact on Middleby | Supporting Data (2023) |

|---|---|---|

| Supplier Concentration | Can increase supplier power for specialized components. | N/A (Qualitative assessment) |

| Purchasing Volume | Significantly increases Middleby's bargaining power. | Cost of Goods Sold: $3.2 billion |

| Product Diversification | Enhances negotiation leverage and mitigates supplier risk. | Revenue: $4.1 billion |

| Switching Costs (Specialized Parts) | Can increase supplier leverage due to retooling/qualification expenses. | N/A (Qualitative assessment) |

| Forward Integration Threat | Generally low due to market entry barriers. | Capital Expenditures: $237.5 million |

What is included in the product

This analysis dissects Middleby's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Middleby's customer base is quite varied, ranging from massive restaurant chains and large food processing companies to smaller institutions and even individual homeowners. This broad spectrum means that while very large customers can exert significant influence due to their substantial order volumes, the sheer number of customers across different segments actually spreads out and reduces the overall bargaining power of any single customer or group.

For instance, a major fast-food chain might negotiate favorable terms for its large equipment purchases, but this power is tempered by the fact that Middleby also serves thousands of other smaller, less influential clients. The planned separation of their Food Processing business in 2024 is expected to further segment these customer relationships, potentially altering the bargaining dynamics for both the remaining commercial foodservice business and the newly independent food processing entity.

Switching costs for Middleby's commercial and food processing clients are a significant factor, often involving the expense of replacing specialized equipment, retraining staff on new systems, and reconfiguring operational workflows. These investments can make it difficult for customers to switch to competitors, even if prices are slightly lower.

For Middleby's residential customers, while the direct financial cost of switching appliances might be lower, the integration of appliances into kitchen aesthetics and the established brand reputation can create a form of loyalty and hesitancy to change. This emotional and design-related stickiness adds another layer to switching costs.

Middleby actively works to increase these switching costs through its robust service network, ensuring prompt repairs and maintenance, which is crucial for commercial operations. Furthermore, the company's focus on innovation, like the introduction of smart kitchen technology, further ties customers to its ecosystem by offering enhanced functionality and convenience that would be lost with a competitor's product.

Commercial and food processing customers, a key segment for Middleby, often exhibit significant price sensitivity. This is primarily due to their focus on operational efficiency and the direct impact of equipment costs on their return on investment (ROI). For instance, in 2024, many businesses were keenly watching input costs and seeking ways to optimize their capital expenditures, making price a critical factor in purchasing decisions.

In contrast, residential customers, especially those in the premium or luxury market, may place less emphasis on the absolute price. For these buyers, brand reputation, innovative features, superior design, and the overall user experience often outweigh minor price differences. This was evident in 2024 as consumer spending patterns showed resilience in the high-end market, with buyers willing to pay a premium for perceived value and quality.

Broader macroeconomic factors also play a crucial role in shaping price sensitivity across all customer segments. In 2024, persistent inflation and rising interest rates put pressure on household budgets and business operating costs. This environment naturally heightened price awareness, forcing many consumers and businesses to scrutinize purchases and seek the best possible value, impacting Middleby's pricing strategies.

Availability of Substitute Products/Services for Customers

Customers seeking commercial foodservice, food processing, or residential kitchen equipment face a wide array of choices. These options extend beyond direct competitors to include less specialized alternatives that can fulfill similar needs, thereby amplifying customer leverage.

The market is characterized by a rapid influx of innovative solutions, particularly in areas like automation and energy efficiency. For instance, by 2024, the global commercial kitchen equipment market was projected to reach over $30 billion, with a significant portion driven by technological advancements that provide customers with more alternatives and thus greater bargaining power.

- Diverse Product Landscape: Customers can select from numerous brands and types of equipment, including those offering automation and enhanced energy efficiency.

- Technological Advancements: Rapid innovation provides customers with increasingly sophisticated and often interchangeable equipment options.

- Competitive Pricing Pressure: The wide availability of substitutes naturally leads to increased price competition among manufacturers.

- Customer Choice Amplification: As more alternatives emerge, customers gain more power to demand better terms, features, and pricing.

Threat of Backward Integration by Customers

The threat of customers like large restaurant chains engaging in backward integration, meaning they would manufacture their own commercial kitchen equipment, is generally quite low for Middleby. This is primarily because the specialized manufacturing expertise, substantial capital investment, and the need for significant economies of scale to produce such complex machinery efficiently are considerable barriers. While some major chains might opt for custom-designed equipment, undertaking the full-scale manufacturing process themselves is rarely a practical or cost-effective endeavor.

This limited likelihood of backward integration significantly curtails the bargaining power customers can exert through this specific channel. For instance, in 2024, the commercial kitchen equipment manufacturing sector, which includes specialized food service machinery, demands highly specific engineering knowledge and advanced production facilities. The investment required to establish such capabilities would likely outweigh any potential cost savings for most customer organizations, keeping this threat at bay.

Consider these points regarding the threat of backward integration:

- Specialized Expertise: Manufacturing commercial kitchen equipment requires advanced engineering and production skills not readily available to most customer businesses.

- High Capital Outlay: Establishing the necessary manufacturing infrastructure, including specialized machinery and assembly lines, demands a significant financial commitment.

- Economies of Scale: Existing manufacturers like Middleby benefit from economies of scale, making their production costs lower than what a single customer could achieve on their own.

- Limited Practicality: While customization is common, full backward integration into manufacturing is typically impractical and uneconomical for the vast majority of Middleby's customer base.

Middleby's bargaining power of customers is generally moderate, influenced by customer segmentation and switching costs. While large clients can negotiate, the diverse customer base and high switching costs limit their overall leverage. The company's strategy of increasing switching costs through service and innovation further strengthens its position.

Price sensitivity varies, with commercial clients being more cost-conscious than premium residential buyers. Macroeconomic factors in 2024, like inflation, also heightened price awareness across all segments.

The threat of backward integration by customers is low due to the specialized nature and high capital investment required for manufacturing Middleby's equipment. This significantly reduces a potential avenue for increased customer bargaining power.

| Customer Segment | Price Sensitivity | Switching Costs | Backward Integration Threat |

|---|---|---|---|

| Large Restaurant Chains | High | High | Low |

| Food Processing Companies | High | High | Low |

| Smaller Institutions | Moderate | Moderate | Very Low |

| Residential Customers (Premium) | Low | Moderate (Brand/Design) | Very Low |

What You See Is What You Get

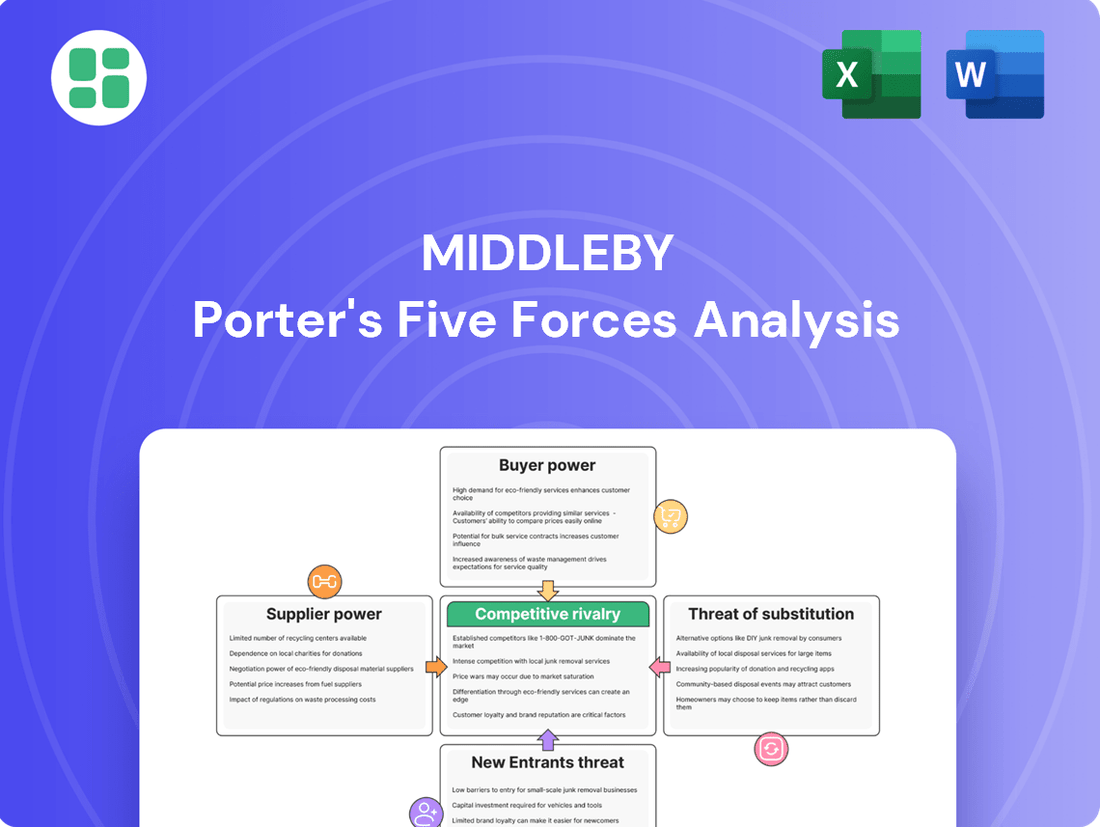

Middleby Porter's Five Forces Analysis

This preview shows the exact Middleby Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting Middleby Corporation, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The commercial kitchen equipment market is generally expected to grow, suggesting a somewhat appealing industry landscape. For instance, the global commercial kitchen equipment market was valued at approximately $35.7 billion in 2023 and is projected to reach around $56.9 billion by 2030, growing at a CAGR of 6.9% during this period.

However, Middleby's performance within this market shows a more nuanced picture. While the food processing segment has demonstrated robust growth, Middleby's commercial foodservice and residential segments have encountered some downturns. This uneven growth across Middleby's operations can lead to heightened competitive pressures in the specific areas experiencing slower growth.

The commercial foodservice, food processing, and residential kitchen equipment sectors are characterized by significant fragmentation and intense competition, with a multitude of global and local entities vying for market share. Middleby faces a broad spectrum of rivals, encompassing large, diversified manufacturers as well as smaller, highly specialized firms, all contributing to a fiercely competitive landscape.

In 2024, the global commercial kitchen equipment market alone was valued at approximately $30 billion, underscoring the sheer scale and the numerous participants within this segment alone. This vast market size fuels the presence of many competitors, from established giants like Ali Group and ITW Food Equipment Group to smaller, innovative companies focusing on specific product categories.

Middleby distinguishes itself significantly through relentless innovation and the integration of advanced technologies like IoT and automation across its extensive product lines. This focus on cutting-edge features sets their offerings apart in a crowded market.

The company boasts a vast portfolio of over 120 highly respected brands, fostering strong brand equity and customer loyalty. This broad market presence, coupled with superior product performance and competitive pricing, creates a significant barrier for rivals seeking to match Middleby's market penetration.

Furthermore, Middleby emphasizes short lead times and exceptional after-sale service, critical factors that enhance customer satisfaction and retention. Their ongoing strategy of launching new, innovative products and acquiring complementary brands ensures they consistently maintain a competitive advantage and address evolving market demands.

Exit Barriers

Exit barriers in industries where Middleby operates are substantial, primarily due to the significant capital investment required for manufacturing facilities, specialized machinery, and extensive distribution networks. These high upfront costs and the difficulty in liquidating specialized assets mean that exiting the market is often financially punitive. For instance, the food service equipment sector demands substantial investment in precision engineering and global supply chains, making divestment challenging.

These high exit barriers compel companies to continue operating and competing, even when facing difficult market conditions or lower profitability. This persistence, driven by the inability to easily exit, directly fuels sustained competitive rivalry. Companies are essentially "locked in," leading to a more intense and prolonged competition among existing players.

The impact of these barriers is evident in industry consolidation trends. For example, in the commercial kitchen equipment market, where Middleby is a major player, companies often face challenges selling off specialized production lines or established dealer relationships. This can lead to a situation where even struggling firms remain active participants, intensifying competition for market share.

- High Capital Investment: Significant outlays in specialized manufacturing equipment and facilities are common, making asset liquidation difficult.

- Specialized Assets: The nature of machinery and technology often lacks broad market appeal, limiting resale value upon exit.

- Distribution Networks: Established and often exclusive distribution channels represent a sunk cost that is hard to recover or transfer.

- Operational Lock-in: The commitment to ongoing operations and employment obligations can further deter companies from exiting prematurely.

Strategic Stakes

Middleby's strategic decision to spin off its Food Processing business by early 2026 highlights significant strategic stakes. This move aims to unlock value by allowing each business to concentrate on its distinct growth opportunities and competitive landscapes. The company is positioning itself for enhanced focus and potentially higher valuations for both the remaining kitchen equipment business and the newly independent food processing entity.

The separation is expected to sharpen management focus, enabling tailored strategies for each segment. This could lead to more efficient capital allocation and a clearer articulation of value propositions to investors. For instance, Middleby's Commercial Foodservice segment reported net sales of $1.3 billion in 2023, demonstrating its substantial market presence that could be further amplified with dedicated strategic direction.

- Strategic Focus: The spin-off allows Middleby to concentrate on its core commercial and residential kitchen equipment businesses.

- Value Unlocking: Separating the food processing unit is intended to realize greater shareholder value by allowing each entity to pursue independent growth strategies.

- Market Positioning: Each standalone company will be better positioned to navigate its specific market dynamics and competitive pressures.

Middleby operates in highly competitive markets, facing numerous global and specialized rivals. The sheer size of the commercial kitchen equipment market, valued at around $30 billion in 2024, ensures a crowded field of players, from giants like Ali Group to niche innovators. This intense rivalry is further fueled by high exit barriers, such as significant capital investments in specialized manufacturing and distribution networks, which lock companies into continued competition.

| Competitor Type | Examples | Impact on Middleby |

|---|---|---|

| Large Diversified Manufacturers | Ali Group, ITW Food Equipment Group | Intense price competition, need for continuous innovation. |

| Specialized Niche Players | Various companies focusing on specific equipment types | Pressure to maintain product differentiation and technological leadership. |

| Global Brands | Various international brands | Requires strong brand equity and consistent product quality to compete. |

SSubstitutes Threaten

Technological advancements are constantly introducing new ways for customers to achieve their goals, potentially bypassing traditional equipment. For instance, the rise of ventless cooking solutions and AI-powered kitchen management systems offers alternative operational efficiencies. Middleby itself is investing in these areas, as seen in its 2023 fiscal year where research and development spending increased, demonstrating a proactive approach to integrating such innovations and thus mitigating the threat of external substitutes.

Shifts in how people eat, like ordering more takeout and delivery, can change what commercial kitchens need. For instance, the rise of ghost kitchens, which focus solely on delivery, might require different equipment than traditional restaurants. In 2024, the food delivery market continued its strong growth, with services like DoorDash and Uber Eats reporting significant order volumes, indicating a sustained consumer preference for convenience.

The attractiveness of substitutes hinges on their price-performance ratio relative to Middleby's commercial kitchen solutions. For example, while the rise of cloud kitchens may lessen the demand for extensive on-site cooking facilities, these operations still necessitate specialized, albeit potentially smaller, equipment.

Middleby counters this by emphasizing the superior efficiency and advanced features of its products, thereby reinforcing its value proposition against more budget-friendly or less sophisticated alternatives. This focus on innovation allows Middleby to command a premium by offering solutions that deliver greater long-term operational benefits.

Regulatory or Environmental Shifts

The increasing focus on sustainability and energy efficiency presents a significant threat of substitutes for traditional commercial kitchen equipment. As regulations tighten and consumer preferences shift towards eco-friendly operations, businesses may seek out alternative cooking methods or entirely different operational models that require less energy or produce fewer emissions. For instance, a restaurant might explore induction cooking technologies or even shift towards more localized, less energy-intensive food preparation methods, bypassing the need for conventional ovens and fryers.

Middleby is actively addressing this threat by investing in and promoting energy-efficient product lines. Their commitment to developing solutions with lower energy consumption, such as advanced convection ovens and efficient refrigeration systems, helps to mitigate the impact of substitutes. This proactive approach allows Middleby to not only counter the threat but also to capitalize on the growing market demand for sustainable kitchen technology. For example, in 2023, Middleby reported continued growth in its residential kitchen segment, partly driven by consumer interest in energy-saving appliances.

The company’s strategic investments are designed to ensure its product portfolio remains competitive and relevant in a market increasingly shaped by environmental concerns. By offering innovative, sustainable alternatives, Middleby aims to retain its customer base and attract new clients who prioritize environmental responsibility. This strategy is crucial for maintaining market share against emerging technologies and operational paradigms that might offer a more environmentally sound substitute for their existing offerings.

Key aspects of Middleby's adaptation include:

- Development of advanced, energy-saving technologies

- Focus on sustainable materials and manufacturing processes

- Marketing of eco-friendly operational benefits to customers

- Adaptation to evolving regulatory landscapes concerning energy use and emissions

DIY or Less Specialized Solutions

For smaller commercial kitchens or even residential users, less specialized or consumer-grade appliances can sometimes act as substitutes for Middleby's more basic professional equipment. These alternatives might be cheaper upfront, offering a lower barrier to entry for certain operations.

However, the performance, longevity, and specific features designed for commercial use that Middleby offers create a significant differentiation. For instance, while a home oven might bake, it lacks the precise temperature control, rapid recovery, and durability needed for high-volume, continuous commercial operation. Middleby's commitment to robust engineering and specialized functionalities generally keeps these less specialized solutions from posing a substantial threat to their core market.

- Performance Gap: Consumer appliances typically don't match the consistent temperature, speed, and specialized cooking capabilities of professional-grade equipment.

- Durability Concerns: Commercial kitchens demand equipment built for heavy, continuous use, a standard most consumer products cannot meet.

- Specialized Features: Middleby's products often include unique features for specific cooking methods or efficiency gains that substitutes lack.

The threat of substitutes for Middleby's commercial kitchen equipment is evolving with technological advancements and changing consumer habits. For example, the rise of ventless cooking and AI-driven kitchen management systems offers alternative efficiencies, though Middleby is investing in these areas. Shifts towards takeout and delivery, exemplified by the continued growth of services like DoorDash in 2024, also influence equipment needs.

Entrants Threaten

The capital requirements for entering Middleby's core markets are substantial. Manufacturing high-quality commercial foodservice, food processing, and premium residential kitchen equipment demands significant upfront investment in research and development, advanced manufacturing facilities, and robust distribution channels. For instance, establishing a new, competitive manufacturing plant can easily run into tens or even hundreds of millions of dollars, a considerable hurdle for potential new players.

Established players like Middleby leverage significant economies of scale in manufacturing, procurement, and distribution. This allows them to achieve lower per-unit production costs, a substantial barrier for newcomers. For instance, Middleby's extensive global supply chain and high-volume production in 2024 likely translate to cost advantages that are difficult for new entrants to replicate quickly.

New entrants would face immense challenges in matching these cost efficiencies without achieving comparable sales volumes. The initial investment required to build a manufacturing and distribution network capable of competing on price would be prohibitive, making it hard to gain market share against established, cost-optimized competitors.

Middleby's formidable brand loyalty, cultivated through over 120 recognized brands and a consistent reputation for innovation and quality, presents a significant hurdle for new entrants. Achieving comparable brand recognition and customer allegiance demands immense time, substantial capital investment, and unwavering product superiority, making it exceptionally difficult for newcomers to gain traction.

Access to Distribution Channels

Middleby benefits from deeply entrenched global distribution channels, encompassing direct sales forces, extensive dealer networks, and customer-facing showrooms. Newcomers would struggle to replicate this reach, which is vital for accessing varied customer bases across the globe.

Building out a comparable distribution and service infrastructure presents a substantial capital investment and time commitment for potential new entrants.

- Established Global Reach: Middleby's network spans numerous countries, facilitating immediate market penetration for its products.

- Service and Support Infrastructure: The company's service capabilities are critical for customer retention and brand loyalty, a difficult barrier for new players.

- Dealer Relationships: Long-standing relationships with dealers provide preferential access and marketing support that new entrants would need years to cultivate.

Regulatory Hurdles and Intellectual Property

The manufacturing of foodservice and food processing equipment is heavily influenced by stringent regulatory frameworks. Companies like Middleby must comply with a complex web of safety, health, and environmental standards, which can be costly and time-consuming for new players to navigate. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce rigorous standards for food contact materials and equipment sanitation, adding a significant compliance burden.

Furthermore, Middleby benefits from a robust portfolio of patents and proprietary technologies. These intellectual property assets create substantial barriers to entry by making it difficult and legally perilous for new competitors to develop comparable products. As of early 2025, Middleby's ongoing investment in research and development, evidenced by its 2023 R&D spending of approximately $145 million, continues to expand this technological moat, solidifying its competitive advantage.

- Regulatory Compliance Costs: New entrants face significant upfront investment in ensuring adherence to global safety and environmental regulations.

- Intellectual Property Barriers: Middleby's extensive patent portfolio protects its innovative designs and manufacturing processes.

- Technological Sophistication: Replicating Middleby's advanced, often patented, equipment requires substantial R&D investment and expertise.

- Legal Challenges: Potential infringements on existing patents can lead to costly litigation for new market entrants.

The threat of new entrants for Middleby is generally low due to significant barriers. High capital requirements for advanced manufacturing and R&D, coupled with established economies of scale in production and procurement, make it difficult for newcomers to compete on cost. Middleby's strong brand loyalty, extensive global distribution networks, and robust service infrastructure further solidify its market position.

Navigating complex regulatory environments and overcoming Middleby's substantial intellectual property portfolio, including numerous patents, represent additional significant hurdles. For instance, Middleby's 2023 R&D investment of approximately $145 million underscores its commitment to technological advancement, creating a formidable barrier for potential entrants seeking to replicate its product sophistication.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for R&D, advanced manufacturing, and distribution networks. | High; prohibitive for many potential new players. |

| Economies of Scale | Lower per-unit costs achieved through high-volume production and procurement. | High; difficult for new entrants to match cost efficiencies. |

| Brand Loyalty & Reputation | Cultivated through quality, innovation, and over 120 recognized brands. | High; requires substantial time and investment to replicate. |

| Distribution & Service Network | Entrenched global channels, dealer relationships, and service capabilities. | High; challenging and costly to build comparable reach and support. |

| Regulatory Compliance | Adherence to stringent safety, health, and environmental standards. | Moderate to High; costly and time-consuming to navigate. |

| Intellectual Property | Patents and proprietary technologies protect innovative designs. | High; legal risks and R&D investment required to circumvent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Middleby leverages a comprehensive data strategy, incorporating publicly available financial statements, investor relations materials, and industry-specific market research reports. This ensures a robust understanding of competitive dynamics, including supplier and buyer power.