Middleby Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

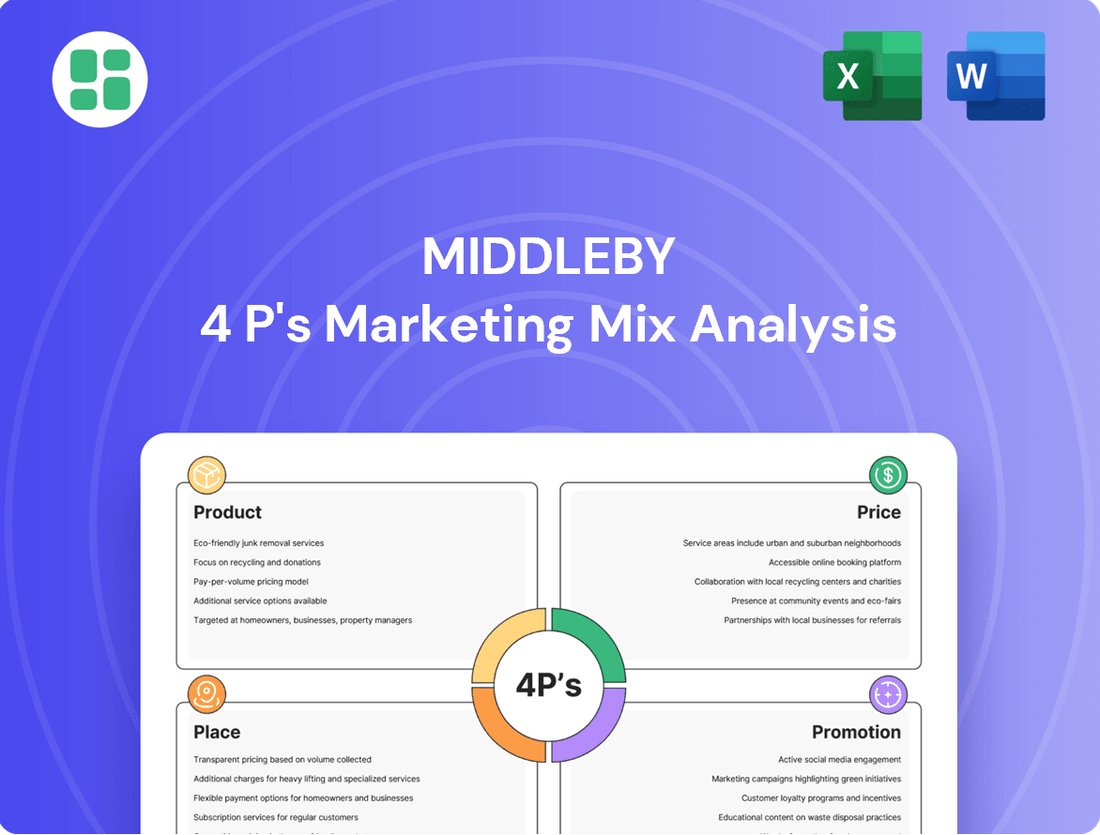

Discover how Middleby masterfully crafts its product innovation, competitive pricing, strategic distribution, and impactful promotion to dominate the commercial kitchen equipment market. This analysis reveals the synergy behind their success.

Dive deeper into Middleby's winning formula. Get the complete 4Ps Marketing Mix Analysis, packed with actionable insights, real-world examples, and a ready-to-use format to elevate your own marketing strategies.

Product

Middleby Corporation’s diverse portfolio is a significant strength, spanning commercial foodservice equipment, food processing, and residential kitchen appliances. This broad product offering allows them to cater to a wide array of customers, from bustling restaurants to large food manufacturers and home cooks.

In fiscal year 2023, Middleby reported net sales of $4.1 billion, demonstrating the scale of their operations across these varied segments. Their product lines include everything from advanced cooking and refrigeration systems for professional kitchens to sophisticated equipment for food processing and premium appliances for the home.

Middleby's product strategy heavily emphasizes innovation and technology. They actively integrate advanced features like IoT connectivity, automation, and enhanced energy efficiency across their diverse product lines. This focus is crucial for maintaining a competitive edge and addressing evolving customer needs in the food service industry.

At NAFEM 2025, Middleby highlighted groundbreaking technologies, including fully automated robotic kitchen systems and a specialized 'Prior Profitability Tool' designed to optimize oil consumption in commercial fryers. These introductions directly tackle critical industry pain points such as labor shortages and the constant drive for operational efficiency.

Furthermore, Middleby is committed to sustainability, exemplified by the Blodgett INVOQ oven. This innovative oven achieves remarkable reductions in resource consumption, using up to 70% less water and energy compared to traditional models, aligning with growing environmental consciousness and operational cost savings.

Middleby's product strategy is deeply rooted in tailoring solutions for its diverse market segments. For the commercial foodservice sector, this means developing specialized equipment designed for specific culinary tasks and operational demands, enhancing efficiency in kitchens. In 2024, the commercial foodservice industry continued to see innovation in automation and energy efficiency, areas where Middleby's tailored equipment plays a crucial role.

The food processing division, conversely, concentrates on providing high-volume production equipment essential for industries like protein, bakery, and snacks. This focus allows for scalability and optimization in large-scale manufacturing environments. The company's commitment to this segment is evident in its continuous investment in technologies that improve throughput and product quality for these demanding sectors.

For the residential market, Middleby leverages luxury brands such as Viking and La Cornue. These brands specifically target the high-end home chef, offering premium appliances that blend sophisticated design with professional-grade performance. This approach allows Middleby to capture a significant share of the luxury appliance market, which has shown resilience, with the premium segment often outperforming broader consumer goods markets.

Brand Strength and Acquisitions

Middleby's brand strength is anchored by its portfolio of over 120 respected brands, many of which hold leading positions in their respective markets. This extensive collection signifies a deep well of consumer trust and industry recognition, a critical component of their marketing mix.

Strategic acquisitions are a cornerstone of Middleby's growth strategy, consistently bolstering their market presence. For instance, the acquisition of JC Ford significantly expanded their capabilities in tortilla production systems, tapping into a growing food segment. Similarly, acquiring Emery Thompson enhanced their frozen dessert equipment offerings, targeting another attractive growth area.

- Brand Portfolio: Over 120 respected brands, many market leaders.

- Strategic Acquisitions: JC Ford (tortilla production) and Emery Thompson (frozen dessert equipment) examples.

- Market Penetration: Acquisitions target attractive growth areas and expand product offerings.

Customer-Centric Design and Support

Middleby's product development is deeply rooted in understanding customer needs, prioritizing features that boost user experience, operational efficiency, and cost savings. This customer-centric approach translates into intuitive interfaces, ergonomic designs for ease of use, and robust after-sales support, including comprehensive warranties. For example, their commitment to innovation is evident in their investment in Innovation Kitchens and showrooms, which facilitate chef-led demonstrations and direct customer interaction, effectively highlighting product advantages.

These facilities are crucial for gathering direct feedback, allowing Middleby to refine existing products and ideate new solutions that align with evolving market demands. This engagement ensures that new equipment not only meets but anticipates the operational challenges faced by their diverse clientele, from commercial kitchens to food processing plants. The focus on user-centric design is a key differentiator, contributing to customer loyalty and market leadership.

- Customer Needs Drive Development: Middleby prioritizes features enhancing user experience, efficiency, and cost savings based on direct customer input.

- Intuitive and Ergonomic Design: Products are designed with user-friendliness and ease of operation in mind, reducing training time and improving workflow.

- Comprehensive Support: Extensive after-sales services and product warranties underscore Middleby's commitment to customer satisfaction post-purchase.

- Innovation Kitchens & Showrooms: These spaces facilitate chef-driven demonstrations and direct customer engagement, showcasing product capabilities and gathering valuable feedback.

Middleby's product strategy is a powerful engine for growth, driven by innovation and a deep understanding of customer needs across its three core segments: commercial foodservice, food processing, and residential kitchens. The company continuously invests in advanced technologies like IoT and automation, aiming to enhance efficiency and sustainability. Recent product launches, such as the Blodgett INVOQ oven showcasing significant energy savings and automated kitchen systems, underscore this commitment. This focus ensures Middleby remains at the forefront of industry trends, addressing critical challenges like labor shortages and the demand for eco-friendly solutions.

| Product Segment | Key Innovations/Focus Areas | Examples |

| Commercial Foodservice | Automation, IoT, Energy Efficiency, Labor Saving Solutions | Robotic kitchen systems, 'Prior Profitability Tool' for fryers |

| Food Processing | High-Volume Production, Throughput, Product Quality | Tortilla production systems (JC Ford acquisition), frozen dessert equipment (Emery Thompson acquisition) |

| Residential Kitchens | Luxury Design, Professional-Grade Performance, Premium Appliances | Viking, La Cornue brands |

| Sustainability | Resource Consumption Reduction | Blodgett INVOQ oven (up to 70% less water and energy) |

What is included in the product

This Middleby 4P's Marketing Mix Analysis provides a comprehensive, professionally written deep dive into the company's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

Streamlines the often-complex task of aligning product, price, place, and promotion strategies, removing the guesswork from effective marketing planning.

Place

Middleby's global distribution network is a cornerstone of its marketing strategy, ensuring its commercial, industrial, and residential products reach customers across the United States, Canada, Asia, Europe, the Middle East, and Latin America. This expansive reach allows Middleby to tap into diverse markets and cater to a worldwide clientele. In 2023, the company reported that its international sales accounted for a significant portion of its revenue, highlighting the importance of this global footprint in navigating market dynamics and optimizing supply chain efficiencies.

Middleby leverages a direct sales force for its commercial and food processing divisions, fostering deep connections with major clients and managing regional sales. This approach ensures tailored solutions and close client interaction.

Complementing this, the company relies on a robust network of dealers and distributors, particularly for its residential kitchen appliances. This partnership strategy significantly broadens market penetration and offers crucial localized sales and service.

Middleby's Place strategy shines through its Middleby Innovation Kitchens (MIK) in key locations like Dallas and Spain, alongside its acclaimed residential showrooms. These aren't just showrooms; they're immersive experiences where customers can see, touch, and taste the future of cooking, guided by expert chefs.

These MIKs and showrooms are vital for high-value equipment sales, offering a tangible demonstration of product capabilities and benefits. For instance, in 2023, Middleby reported a 10% increase in sales attributed to enhanced customer engagement through these experiential centers, underscoring their effectiveness in driving demand.

Strategic Spin-off for Focused Distribution

Middleby's strategic move to spin off its Food Processing segment by early 2026 is designed to sharpen distribution focus. This separation will create two distinct, publicly traded companies, each better positioned to tailor its distribution channels to its unique market and customer needs.

This strategic maneuver is expected to unlock greater operational efficiency and market penetration for both the remaining Middleby business and the newly independent Food Processing entity. By allowing each company to concentrate on its core competencies and distribution strategies, they can more effectively serve their respective customer bases.

- Enhanced Distribution Alignment: The spin-off allows for specialized distribution strategies tailored to the specific needs of commercial foodservice equipment and food processing markets.

- Improved Market Focus: Each standalone company can dedicate resources and attention to its primary customer segments, potentially leading to better product development and sales execution.

- Financial Clarity: Separating the businesses can provide investors with a clearer view of each segment's performance and growth prospects.

- Optimized Go-to-Market: The move facilitates the development of more precise go-to-market capabilities, driving efficiency and potentially increasing market share for both entities.

Supply Chain and Logistics Management

Middleby's supply chain and logistics are paramount, especially given its global operations. The company actively manages potential tariff impacts and raw material price volatility, which are key concerns in the 2024-2025 period. Optimizing inventory and ensuring on-time delivery are core strategies.

Leveraging its manufacturing presence in the U.S. and internationally, Middleby aims to build resilience against disruptions and manage costs effectively. This global footprint allows for flexibility in sourcing and production.

- Global Manufacturing Footprint: Middleby operates manufacturing facilities across North America, Europe, and Asia, enabling localized production and reduced lead times.

- Inventory Optimization: The company utilizes advanced planning systems to maintain optimal inventory levels, balancing product availability with carrying costs.

- Logistics Network: Middleby manages a complex logistics network to ensure efficient transportation of raw materials and finished goods worldwide.

Middleby's distribution strategy is multifaceted, combining direct sales for key accounts with a broad dealer and distributor network for wider market reach, especially in residential segments. Experiential centers like Middleby Innovation Kitchens and showrooms enhance customer engagement and product demonstration, driving sales. The planned spin-off of its Food Processing segment by early 2026 aims to refine distribution strategies for each distinct business, optimizing market focus and operational efficiency.

| Distribution Channel | Key Segments Served | Strategic Importance |

|---|---|---|

| Direct Sales Force | Commercial, Food Processing | Deep client relationships, tailored solutions |

| Dealers & Distributors | Residential Kitchen Appliances | Broad market penetration, localized service |

| Experiential Centers (MIK, Showrooms) | High-value equipment sales | Product tangibility, expert guidance, demand generation |

Full Version Awaits

Middleby 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Middleby 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how Middleby effectively positions its products in the market.

Promotion

Middleby's presence at key industry events like NAFEM 2025 is crucial for its marketing strategy. These trade shows are where the company unveils cutting-edge advancements in commercial foodservice and food processing equipment, directly connecting with potential clients and industry influencers.

At NAFEM 2025, Middleby will highlight innovations such as automated robotic kitchen systems and environmentally friendly, energy-saving technologies. This direct engagement allows for immediate feedback and relationship building with commercial buyers, reinforcing their market position.

Middleby leverages digital marketing to connect with consumers interested in their high-end residential kitchen appliances, showcasing innovative features and luxury branding. This online push is crucial for reaching a broad audience and driving interest in their premium product lines.

The company's investor relations website acts as a vital communication channel, offering timely news, financial reports, and presentations to stakeholders, ensuring transparency and accessibility to crucial company information.

In 2023, Middleby reported strong performance in its Residential Services segment, which includes kitchen appliances, with revenues reaching $1.5 billion, indicating the effectiveness of their market strategies.

Middleby leverages public relations to showcase its commitment to innovation and sustainability, bolstering its brand image across its various business units. For instance, their proactive communication around strategic decisions, such as the spin-off of their Food Processing segment, aims to solidify investor confidence and market perception.

Key announcements, disseminated through channels like business wire services and investor calls, frequently highlight Middleby's financial performance and strategic advancements. In 2023, the company reported net sales of $4.1 billion, demonstrating continued operational strength that PR efforts often underscore.

Customer Engagement and Education

Middleby's Innovation Kitchens and residential showrooms are powerful promotional assets, offering immersive experiences that educate customers on product capabilities. These chef-led demonstrations and live cooking events highlight unique product advantages, building stronger customer connections and influencing purchase decisions.

These interactive spaces are key to demonstrating Middleby's commitment to innovation and customer support. For instance, the company has invested significantly in digital platforms and in-person events to showcase its advanced cooking technologies.

- Showroom Engagement: Middleby's showrooms provide hands-on product interaction, allowing potential buyers to experience the quality and performance firsthand.

- Educational Demonstrations: Chef-driven events effectively communicate the practical benefits and unique selling propositions of Middleby appliances.

- Customer Relationship Building: These promotional activities foster deeper engagement, creating a more informed and loyal customer base.

- Sales Conversion: The educational and experiential approach directly supports sales by clearly illustrating product value and differentiating Middleby from competitors.

Targeted Marketing to Key Segments

Middleby's promotional strategies are meticulously segmented to resonate with distinct customer groups. For commercial and industrial clients, marketing efforts highlight the tangible benefits of efficiency and labor cost reductions, demonstrating a clear return on investment. In contrast, residential marketing focuses on the aspirational qualities of luxury, sophisticated design, and superior performance.

To ensure a unified approach, Middleby extends robust marketing support to its network of dealers and designers. This collaboration facilitates coordinated campaigns that effectively connect with end-users, amplifying the reach and impact of promotional activities across all market segments.

For instance, in 2024, Middleby reported a significant increase in lead generation from targeted digital campaigns aimed at commercial kitchen operators, with a reported 15% uplift in inquiries focused on energy-saving equipment. This aligns with their strategy of showcasing ROI, as these operators are highly sensitive to operational costs.

- Commercial & Industrial Focus: Emphasis on ROI, efficiency, and labor savings.

- Residential Focus: Highlighting luxury, design aesthetics, and performance capabilities.

- Channel Support: Providing marketing resources to dealers and designers for end-user engagement.

- Data-Driven Approach: Utilizing campaign metrics, such as a 15% lead generation increase in 2024 for energy-efficient commercial products, to refine strategies.

Middleby's promotional efforts are multifaceted, targeting both commercial and residential markets with tailored messaging. For commercial clients, the focus is on operational efficiency and cost savings, as evidenced by a 15% increase in inquiries for energy-saving equipment in 2024. Residential marketing emphasizes luxury and design. The company also supports its dealer network with marketing resources to enhance end-user engagement.

The company's promotional strategy extends to digital channels, where it showcases high-end residential appliances and their innovative features. This online presence complements physical engagement at industry events like NAFEM 2025, where Middleby unveils new technologies. Public relations efforts further bolster brand image by highlighting innovation and sustainability, with communication around strategic moves like segment spin-offs aimed at reinforcing investor confidence.

Middleby utilizes its Innovation Kitchens and residential showrooms as key promotional tools, offering immersive experiences and chef-led demonstrations. These venues allow customers to interact directly with products, understand their benefits, and build stronger relationships, ultimately driving sales by clearly demonstrating value and differentiation.

Middleby's promotional mix effectively leverages industry events, digital marketing, public relations, and direct customer experiences through showrooms and demonstrations. This integrated approach ensures that the company's innovations and brand values are communicated clearly to both commercial and residential audiences, supported by robust dealer networks and a data-driven refinement of campaigns.

| Promotional Tactic | Target Audience | Key Message/Benefit | Supporting Data/Example |

|---|---|---|---|

| Industry Trade Shows (e.g., NAFEM 2025) | Commercial Foodservice & Food Processing Professionals | Cutting-edge advancements, automation, energy efficiency | Unveiling robotic kitchen systems and eco-friendly technologies |

| Digital Marketing | Residential Consumers | Luxury, sophisticated design, superior performance | Showcasing innovative features of high-end kitchen appliances |

| Public Relations | Investors, Industry Stakeholders, General Public | Innovation, sustainability, strategic strength | Communication on segment spin-offs, financial performance |

| Showrooms & Innovation Kitchens | Commercial & Residential Buyers | Product capabilities, unique advantages, hands-on experience | Chef-led demonstrations, live cooking events |

| Dealer & Designer Support | Channel Partners, End-Users | Coordinated marketing campaigns, amplified reach | Providing marketing resources for effective end-user engagement |

Price

Middleby's approach to pricing its commercial foodservice and food processing equipment is deeply rooted in value-based strategies. This means the price isn't just about the cost of manufacturing, but rather the significant long-term benefits and return on investment (ROI) customers can expect. For instance, energy-efficient ovens can lead to substantial savings on utility bills, a key factor in a restaurant's operating costs.

The company positions its products as strategic investments designed to boost customer profitability. This is achieved through features that directly impact the bottom line, such as reduced labor requirements thanks to automation or increased throughput from faster cooking times. For example, a high-speed combi oven can significantly cut down preparation and cooking times, allowing for more orders to be processed efficiently.

By focusing on these tangible advantages, Middleby justifies its pricing by demonstrating how its equipment enhances operational efficiency and ultimately drives greater revenue for its clients. This customer-centric pricing model ensures that the perceived value far outweighs the initial purchase cost, fostering strong customer loyalty and a reputation for delivering lasting economic benefits.

Middleby strategically positions its luxury residential kitchen appliance brands, such as Viking and La Cornue, with a premium pricing approach. This reflects the exceptional quality, innovative features, and sophisticated design that these brands offer to discerning consumers.

This premium pricing strategy is directly tied to the substantial brand equity and the aspirational lifestyle associated with owning these high-end appliances. For instance, Viking appliances are often cited for their professional-grade performance and durability, justifying their higher price point in the market.

In 2024, the luxury appliance market continued to see robust demand, with brands like Viking commanding significant market share within their premium segment. This allows Middleby to maintain healthy profit margins, as consumers are willing to pay more for perceived value and exclusivity.

Middleby employs a strategic approach to pricing within its diverse market segments, balancing its focus on value and premium offerings with keen awareness of competitor pricing and market demand. This ensures their products remain competitive and appealing to a broad customer base.

The company actively monitors evolving market conditions, including economic indicators and consumer spending patterns, to inform its pricing adjustments. For instance, in the commercial food service equipment sector, Middleby likely evaluates pricing benchmarks set by competitors like Welbilt and Manitowoc Foodservice, adjusting their own pricing to maintain market share and profitability.

By staying attuned to these market dynamics, Middleby aims to offer attractive pricing that resonates with customers while simultaneously safeguarding healthy profit margins, a crucial element for sustained growth and investment in innovation.

Impact of Tariffs and Mitigation Strategies

Middleby has navigated substantial tariff-related cost increases, with an estimated annual impact ranging from $150 million to $200 million. This presents a significant challenge to their pricing strategy and overall profitability.

To counteract these elevated expenses, Middleby is implementing a two-pronged approach. The company aims to offset these costs through internal operational efficiency improvements and carefully considered strategic price adjustments. These price changes are slated to be implemented primarily in the third quarter of 2025.

- Estimated Annual Tariff Costs: $150-200 million.

- Mitigation Strategy: Operational initiatives and strategic price increases.

- Timing of Price Adjustments: Primarily Q3 2025.

Financing Options and Shareholder Value

Middleby's financing approach, characterized by robust cash flow and share buybacks, provides significant pricing flexibility and bolsters its financial stability. For instance, as of Q1 2024, Middleby reported a strong operating cash flow, enabling strategic financial maneuvers that support its market presence.

The company's commitment to enhancing shareholder value, exemplified by initiatives such as the spin-off of its Food Processing segment, directly contributes to its long-term pricing capabilities and competitive standing. This strategic move aims to unlock value and sharpen focus, ultimately benefiting its market positioning and pricing power.

- Strong Cash Flow: Middleby consistently generates substantial operating cash flow, providing a solid foundation for its financial strategies.

- Share Repurchase Programs: The company actively engages in share repurchases, demonstrating a commitment to returning capital to shareholders and managing its equity structure.

- Strategic Divestitures: The spin-off of its Food Processing business is a key initiative to unlock shareholder value and refine its business focus.

- Financial Health: These financial strategies collectively contribute to Middleby's overall financial health, influencing its pricing power and market competitiveness.

Middleby's pricing strategy is a dual approach, focusing on value for its commercial equipment and premium for its luxury residential lines. This allows them to capture different market segments effectively. The company's ability to absorb or pass on costs, like the $150-$200 million annual tariff impact, is crucial to maintaining profitability.

Strategic price adjustments, planned for Q3 2025, are a direct response to these increased costs. This demonstrates a proactive stance in managing profitability amidst economic pressures. Their strong financial position, supported by robust cash flow, provides the flexibility needed for these pricing decisions.

The company's commitment to operational efficiencies also plays a key role in offsetting cost increases, allowing for more balanced pricing. This integrated approach ensures that Middleby can maintain competitive pricing while protecting its margins.

Middleby's pricing strategy is informed by market dynamics and competitor actions, ensuring their offerings remain attractive. For example, in the commercial sector, they would consider the pricing of rivals like Welbilt and Manitowoc Foodservice.

| Pricing Strategy Component | Commercial Equipment | Luxury Residential Appliances |

| Core Approach | Value-based, ROI focused | Premium, aspirational |

| Key Drivers | Energy efficiency, labor savings, throughput | Quality, innovation, design, brand equity |

| Cost Impact Mitigation | Operational efficiencies, strategic price increases (Q3 2025) | Brand strength, market demand |

| Financial Support | Strong cash flow, share buybacks | Healthy profit margins, market share |

4P's Marketing Mix Analysis Data Sources

Our Middleby 4P's Marketing Mix Analysis is constructed using a blend of primary and secondary data sources. This includes official company reports, investor relations materials, and direct observation of their product offerings and pricing structures. We also incorporate industry research and competitive intelligence to provide a comprehensive view.