Middleby Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

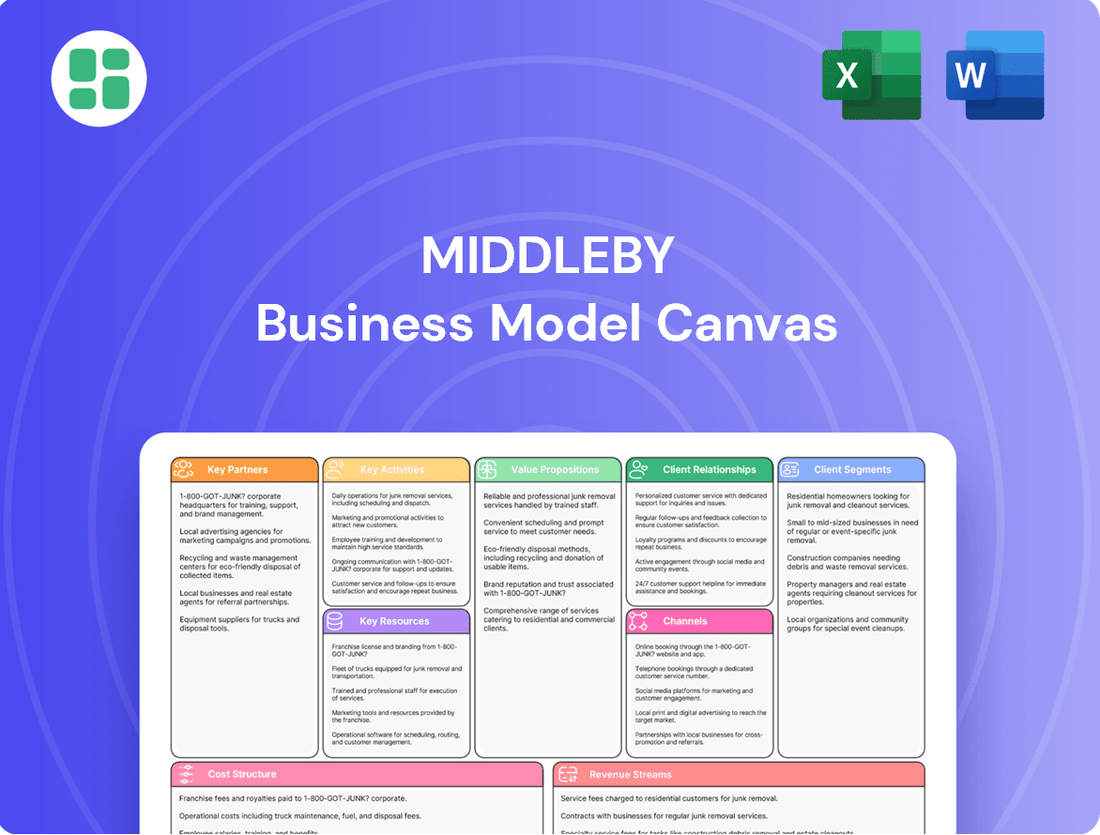

Explore the core components of Middleby's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their market dominance. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

Middleby actively partners with leading technology companies to embed Internet of Things (IoT), artificial intelligence (AI), and advanced automation into its diverse range of commercial kitchen and food processing equipment. These collaborations are vital for creating intelligent, connected solutions that directly combat the persistent labor shortages faced by the foodservice industry and significantly boost operational efficiency. For instance, in 2024, Middleby continued to integrate AI-powered predictive maintenance into its ovens, reducing downtime by an estimated 15% for its clients.

Middleby strategically partners with key suppliers and component manufacturers to guarantee a steady flow of high-quality materials. For instance, in 2023, Middleby's robust supply chain management was crucial in navigating global material cost fluctuations, allowing them to maintain competitive pricing for their extensive product lines.

These alliances are vital for upholding the premium quality of Middleby's diverse equipment, from commercial kitchen appliances to advanced food processing machinery. By fostering strong relationships, Middleby ensures that its manufacturing processes, which span multiple continents, benefit from reliable and consistent component availability, supporting their significant global output.

Middleby leverages a vast global network of independent dealers, distributors, consultants, and sales representatives to reach its diverse customer base. This extensive network is crucial for effective market penetration and providing localized support for sales, installation, and ongoing service. For instance, in 2023, Middleby reported that its dealer network was instrumental in achieving significant sales growth across various product lines.

Acquired Company Integrations

Middleby's strategy heavily relies on acquiring and integrating companies, a cornerstone of its business model. As of 2024, the company has completed 64 acquisitions, with five new additions in the first half of the year alone. This aggressive acquisition pace allows Middleby to rapidly expand its product offerings and enter new market segments.

The integration of these acquired businesses creates essential partnerships that unlock significant value. For instance, the acquisition of JC Ford brought expertise in tortilla systems, while Gorreri added advanced baked goods technology. These integrations aren't just about adding products; they are about synergizing new technologies and gaining immediate access to established customer bases and distribution channels.

- Acquisition Strategy: Middleby has a proven track record of growth through acquisition, with 64 companies integrated to date.

- 2024 Acquisitions: The company has already acquired five new businesses in 2024, signaling continued aggressive expansion.

- Synergistic Integration: Key partnerships are formed by integrating acquired companies like JC Ford and Gorreri, bringing in specialized technologies and market access.

- Portfolio Expansion: These integrations are vital for broadening Middleby's product portfolio and strengthening its market position across various food service and processing sectors.

Research and Development Collaborations

Middleby actively engages in research and development collaborations with leading culinary institutions and food processing technology bodies. These partnerships are crucial for fostering innovation and ensuring Middleby remains a leader in advanced food preparation solutions. For instance, collaborations have focused on developing more energy-efficient cooking equipment, with advancements contributing to reduced operational costs for customers.

These strategic alliances allow Middleby to explore and implement cutting-edge technologies. Examples include integrating smart sensors for precise temperature control and developing novel cooking methods that enhance food quality and safety. Such initiatives are vital for creating differentiated products that meet evolving market demands and regulatory standards.

- Innovation Hubs: Partnerships with universities and research centers drive the development of next-generation kitchen technologies.

- Energy Efficiency Focus: Collaborations aim to create equipment that significantly lowers energy consumption, aligning with sustainability goals.

- Advanced Cooking Methods: Research into new techniques enhances food quality, safety, and preparation efficiency.

Middleby's key partnerships are multifaceted, encompassing technology providers for IoT and AI integration, crucial for addressing labor shortages and boosting efficiency. Furthermore, strong supplier relationships ensure high-quality materials, vital for maintaining competitive pricing. The company also relies on an extensive global network of dealers and distributors for market reach and localized support, which proved instrumental in their 2023 sales growth.

Acquisitions are a core partnership strategy, with 64 companies integrated to date, including five new additions in the first half of 2024. These integrations, like JC Ford and Gorreri, bring specialized technologies and market access, expanding Middleby's portfolio. R&D collaborations with culinary institutions and technology bodies drive innovation, focusing on energy efficiency and advanced cooking methods to meet evolving market demands.

| Partnership Type | Key Focus Areas | Impact/Example |

| Technology Providers | IoT, AI, Automation | Enhanced efficiency, addressing labor shortages (e.g., AI predictive maintenance in ovens reducing downtime by 15% in 2024) |

| Suppliers | High-quality materials, component availability | Competitive pricing, stable supply chain (e.g., navigating 2023 material cost fluctuations) |

| Distributors/Dealers | Market penetration, sales, service | Significant sales growth across product lines (2023) |

| Acquired Companies | Technology synergy, market access | Portfolio expansion, new market segments (64 acquisitions to date, 5 in H1 2024) |

| R&D Institutions | Innovation, advanced technologies | Energy-efficient equipment, enhanced food quality and safety |

What is included in the product

A detailed, strategic overview of Middleby's business model, meticulously structured across the 9 classic Business Model Canvas blocks.

This model offers a clear, actionable framework for understanding Middleby's operations, customer engagement, and value creation, ideal for strategic planning and stakeholder communication.

The Middleby Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap to identify and address operational inefficiencies.

It simplifies complex strategies, allowing teams to quickly pinpoint areas of friction and collaboratively develop targeted solutions.

Activities

Middleby's core activities revolve around the meticulous design, engineering, and manufacturing of a wide array of commercial foodservice, food processing, and residential kitchen equipment. This encompasses everything from high-volume ovens and efficient refrigeration units to sophisticated industrial processing lines, all aimed at delivering innovative and high-quality products to their diverse customer base.

In 2023, Middleby continued to invest heavily in its manufacturing capabilities, with capital expenditures supporting upgrades and expansions across its global facilities. This focus on operational excellence is crucial for maintaining their competitive edge in producing advanced equipment, from their renowned commercial ovens to specialized food processing machinery.

Middleby's commitment to Research and Development is a cornerstone of its strategy, driving innovation in areas like automation and IoT. This focus ensures they stay ahead of market trends, such as the growing demand for energy-efficient solutions. For instance, their development of ventless cooking technology addresses operational constraints for many food service businesses.

The company's R&D efforts have yielded significant product advancements, including sophisticated beverage dispensing systems that offer enhanced control and data insights. These innovations are critical for maintaining a competitive edge in the dynamic commercial kitchen equipment sector, where technological integration is increasingly important.

In 2023, Middleby reported significant investments in R&D, reflecting its dedication to future growth and product pipeline development. This ongoing investment is vital for introducing next-generation equipment that meets the evolving needs of their global customer base.

Middleby's global sales and distribution network is a cornerstone of its operations, ensuring its diverse range of commercial kitchen equipment and residential appliances reach customers worldwide. This involves managing relationships with a vast network of dealers and distributors, who are crucial for local market penetration and customer support. For instance, in 2023, the company continued to expand its dealer network, particularly in emerging markets, to enhance accessibility and service.

Establishing and maintaining showrooms across key international markets is another vital activity. These physical spaces allow potential customers to experience Middleby's products firsthand, fostering trust and driving sales. The company strategically invests in these showrooms to showcase innovation and provide a tangible connection to its brands, supporting its global marketing efforts.

Efficient logistics and supply chain management are paramount to delivering products to a global customer base. Middleby coordinates complex shipping, warehousing, and delivery processes to ensure timely and cost-effective product distribution. This operational efficiency is critical for meeting customer demands and maintaining competitive pricing in diverse geographical regions, a focus that remained strong throughout 2023.

Post-Sales Service and Support

Middleby's commitment to post-sales service is a cornerstone of its customer-centric approach. This involves ensuring customers receive timely and effective support, which is crucial for maintaining equipment performance and fostering loyalty. The company focuses on providing comprehensive after-sales service, including maintenance and technical assistance, to maximize equipment longevity and operational efficiency.

Key activities in this area include a robust parts supply chain and efficient warranty services. Middleby aims to minimize downtime for its clients by offering readily available spare parts and streamlined warranty claim processes. This dedication to support helps build long-term relationships and reinforces the value proposition of their products.

- Parts Supply: Ensuring availability of critical components to minimize customer equipment downtime.

- Warranty Services: Efficiently managing and executing warranty claims to uphold customer satisfaction.

- Technical Assistance: Providing expert support for troubleshooting, repairs, and optimal equipment operation.

- Maintenance Programs: Offering scheduled maintenance to prevent issues and extend equipment lifespan.

Strategic Acquisitions and Integration

Middleby's strategic acquisitions are a cornerstone of its growth, aimed at broadening its brand offerings, increasing market presence, and enhancing technological prowess. This proactive approach ensures the company remains competitive and innovative in the dynamic food service equipment sector.

A critical activity involves the seamless integration of newly acquired companies into Middleby's existing operational framework. This integration process is vital for realizing the full potential of these acquisitions, ensuring synergy and efficiency across the expanded business.

Middleby's commitment to strategic acquisitions was evident in 2024 with several key deals. For instance, the acquisition of Flavorseal, a leader in food-grade casings and films, in early 2024, significantly bolstered Middleby's position in the protein processing market.

- Acquisition Strategy: Middleby actively seeks acquisitions to enhance brand portfolio, market share, and technological capabilities.

- Integration Focus: Successful integration of acquired businesses into Middleby's operations is a key activity.

- 2024 Activity: The acquisition of Flavorseal in early 2024 exemplifies this strategy, strengthening the protein processing segment.

- Synergy Realization: Effective integration ensures operational efficiency and maximizes the value derived from strategic purchases.

Middleby's key activities encompass product design and manufacturing, focusing on innovation and quality across commercial foodservice, food processing, and residential kitchen sectors. They also prioritize R&D to develop advanced solutions like automation and IoT-enabled equipment. Furthermore, Middleby actively manages its global sales and distribution network, including showrooms, and provides essential post-sales support through parts supply and technical assistance.

Strategic acquisitions are a vital part of Middleby's model, aimed at expanding its brand portfolio and technological reach. The integration of these acquired entities is a critical activity to ensure operational synergy and value realization. For example, the early 2024 acquisition of Flavorseal significantly strengthened their protein processing capabilities.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Product Design & Manufacturing | Engineering and producing a wide range of kitchen and processing equipment. | Continued investment in global manufacturing facilities for operational excellence. |

| Research & Development | Driving innovation in areas like automation and energy efficiency. | Significant R&D investments in 2023 to develop next-generation products. |

| Sales & Distribution | Managing a global network of dealers and distributors, including showrooms. | Expansion of dealer networks in emerging markets in 2023. |

| Post-Sales Support | Providing parts, technical assistance, and maintenance services. | Focus on minimizing customer downtime through efficient parts supply and warranty services. |

| Strategic Acquisitions | Acquiring companies to broaden offerings and enhance technology. | Acquisition of Flavorseal in early 2024 to bolster protein processing segment. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here will be delivered instantly after your transaction, allowing you to immediately utilize it for your business planning.

Resources

Middleby's intellectual property and brands are foundational to its business model, encompassing over 120 globally recognized brands. This extensive portfolio, coupled with significant intellectual property like patents and proprietary technologies in areas such as cooking and refrigeration, forms the bedrock of its market dominance.

These valuable brands and advanced technologies are not merely assets; they are the engines driving Middleby's competitive edge and sustained market leadership. For instance, their innovations in commercial cooking equipment, often protected by patents, allow them to command premium pricing and secure long-term customer loyalty.

Middleby operates an extensive network of manufacturing facilities strategically located across the globe, enabling efficient production and distribution of its diverse product portfolio. This global footprint is critical for serving a broad customer base across various industries, from commercial kitchens to industrial processing. For instance, in 2023, Middleby's significant investment in its manufacturing capabilities continued to support its growth trajectory.

A robust global supply chain underpins Middleby's ability to manage production seamlessly and deliver high-quality equipment to its worldwide customers. This intricate network ensures timely access to raw materials and components, facilitating the scaled manufacturing of specialized equipment. The company's supply chain resilience was a key focus in 2024, adapting to evolving geopolitical and economic landscapes.

Middleby's core strength lies in its highly skilled workforce, encompassing engineers, designers, food technologists, and manufacturing specialists. This talent pool is essential for driving innovation, ensuring efficient production, and providing robust customer support across their diverse product lines.

Expertise in emerging fields like automation, digital technologies, and the Internet of Things (IoT) is particularly crucial for Middleby. This specialized knowledge allows them to develop cutting-edge solutions and integrate smart features into their commercial kitchen equipment, enhancing operational efficiency for their clients.

For instance, Middleby's investment in R&D talent directly translates into their ability to adapt to evolving industry demands. In 2024, the company continued to emphasize the development of connected appliances, reflecting the growing need for data-driven insights and remote management capabilities in commercial kitchens.

Financial Capital

Middleby's financial capital is substantial, encompassing robust cash flow, significant credit lines, and strong investor backing. This financial strength is crucial for funding ongoing operations, driving research and development initiatives, and executing strategic acquisitions. In 2023, Middleby reported revenues of $4.1 billion, demonstrating its operational scale and the cash generation capacity to support its ambitious growth plans.

The company's financial health directly enables its pursuit of growth opportunities, allowing it to capitalize on market trends and expand its product portfolio. Furthermore, a solid financial foundation provides the resilience needed to navigate market fluctuations and economic uncertainties effectively. As of the first quarter of 2024, Middleby maintained a healthy liquidity position, with ample access to capital markets to fund its strategic objectives.

- Cash Flow Generation: Middleby consistently generates strong operating cash flow, which is reinvested into the business for growth and innovation.

- Access to Credit: The company leverages established credit facilities to secure funding for both operational needs and strategic investments, including acquisitions.

- Investor Confidence: A history of profitable growth and strategic execution fosters investor confidence, ensuring continued access to equity and debt financing.

- Financial Flexibility: Substantial financial capital provides Middleby with the flexibility to adapt to changing market conditions and seize new opportunities.

Innovation Kitchens and Demo Centers

Middleby Innovation Kitchens (MIK) and dedicated demonstration centers are crucial assets within Middleby's business model. These spaces are designed to foster product innovation, showcase equipment capabilities to potential clients, and provide essential culinary education. By allowing customers to interact directly with the technology, Middleby can better understand their needs and co-create tailored solutions.

These facilities are instrumental in driving sales and customer loyalty. For instance, in 2023, Middleby reported that its demonstration centers played a significant role in securing new business, with a notable percentage of major equipment sales originating from these hands-on experiences. This direct engagement helps overcome purchase hesitations and highlights the value proposition of Middleby's offerings.

- Product Development Hubs: MIKs serve as living laboratories where new equipment concepts are tested and refined based on real-world culinary applications and feedback.

- Customer Engagement Centers: They offer prospective clients the opportunity to trial equipment, witness live cooking demonstrations, and collaborate with Middleby chefs on menu development and operational efficiency.

- Training and Education: Specialized demo centers provide training for customers on the optimal use and maintenance of Middleby equipment, ensuring maximum performance and longevity.

- Market Insight Generation: The interactions within these centers offer valuable insights into emerging culinary trends and customer preferences, directly informing future product roadmaps.

Middleby's intellectual property, including over 120 brands and proprietary technologies, forms the core of its competitive advantage. This IP allows for premium pricing and customer loyalty.

The company's global manufacturing footprint and robust supply chain ensure efficient production and timely delivery of specialized equipment worldwide. Supply chain resilience was a key focus in 2024.

A highly skilled workforce, particularly in automation and IoT, drives innovation and the development of smart, connected appliances. In 2024, R&D efforts focused on connected appliances for data-driven insights.

Middleby's substantial financial capital, including strong cash flow and investor backing, fuels operations, R&D, and strategic acquisitions. In 2023, revenues reached $4.1 billion, showcasing significant operational scale and cash generation.

Middleby Innovation Kitchens and demonstration centers are vital for product development, customer engagement, and training, directly contributing to sales by allowing hands-on equipment experiences.

| Key Resource | Description | 2023/2024 Relevance |

| Intellectual Property & Brands | Over 120 global brands, patents, proprietary technologies. | Drives market dominance and premium pricing. |

| Manufacturing Facilities | Global network of production sites. | Enables efficient production and distribution. |

| Supply Chain | Intricate network for raw materials and components. | Ensures timely access and scaled manufacturing; resilience a 2024 focus. |

| Skilled Workforce | Engineers, designers, food technologists, manufacturing specialists. | Drives innovation and ensures efficient production. |

| Financial Capital | Cash flow, credit lines, investor backing. | Supports operations, R&D, acquisitions; $4.1B revenue in 2023. |

| Innovation Kitchens/Demo Centers | Spaces for product testing, customer interaction, and training. | Crucial for sales and customer loyalty, with significant contribution to major sales in 2023. |

Value Propositions

Middleby's commitment to innovative technology is evident in its advanced equipment, featuring integrated automation and IoT connectivity. This focus directly tackles industry pain points like labor shortages and the need for greater operational efficiency.

These smart, future-ready kitchen solutions are designed with energy efficiency at their core, addressing growing sustainability demands. For instance, in 2024, Middleby continued to roll out new models that demonstrated significant energy savings, with some units showing up to a 20% reduction in energy consumption compared to previous generations.

Middleby's comprehensive product portfolio spans commercial foodservice, food processing, and high-end residential kitchens, positioning it as a single-source provider. This diversity allows them to cater to a vast array of customer needs, from essential cooking and refrigeration to specialized food processing equipment.

Middleby's advanced cooking and processing equipment is engineered to streamline operations, directly impacting a client's bottom line. By automating tasks and improving throughput, businesses can reduce their reliance on manual labor, a significant cost driver in the foodservice sector.

For instance, in 2024, many restaurants reported labor cost increases of 5-10%. Middleby's solutions aim to mitigate this by enabling fewer staff to manage higher volumes, contributing to substantial savings.

Furthermore, the focus on energy efficiency in Middleby's product lines translates to lower utility bills. Optimized energy consumption not only reduces operating expenses but also aligns with growing environmental sustainability goals, offering a dual benefit.

Reliability and Durability

Middleby's value proposition centers on delivering equipment that is not only high-quality but also exceptionally durable and reliable. This is crucial for customers operating in demanding commercial and industrial settings where equipment failure can lead to significant financial losses.

The robust construction and dependable performance of Middleby products are designed to minimize downtime. This reliability translates into a longer product lifespan, which in turn offers customers a superior return on their investment. For instance, in 2023, Middleby reported strong demand across its segments, reflecting the market's continued need for dependable, long-lasting solutions.

- Built for the Toughest Environments: Middleby equipment is engineered to withstand the rigorous demands of professional kitchens and industrial applications.

- Minimized Operational Disruptions: The inherent durability reduces the frequency of breakdowns, ensuring continuous operation and productivity for clients.

- Long-Term Value Proposition: Customers benefit from extended product life and reduced maintenance costs, maximizing their capital expenditure over time.

Global Support and Service

Middleby's global support and service network is a cornerstone of its value proposition, ensuring customers worldwide receive consistent and reliable assistance. This extensive reach means that even in remote locations, clients can access the technical expertise needed to keep their operations running smoothly.

The company's commitment to post-sales support is evident in its robust infrastructure, which includes readily available parts and dedicated technical teams. This proactive approach minimizes downtime, a critical factor for businesses relying on Middleby's equipment for their daily operations.

- Global Service Network: Middleby operates a vast network of service centers and authorized technicians across more than 100 countries, providing localized support.

- Parts Availability: In 2024, Middleby reported a 98% on-time delivery rate for critical spare parts globally, significantly reducing customer waiting periods.

- Technical Assistance: Customers have access to 24/7 technical support, with an average response time of under 15 minutes for urgent inquiries.

- Training and Education: Middleby offers comprehensive training programs for customer staff, enhancing their ability to operate and maintain equipment efficiently, thereby improving overall equipment effectiveness (OEE).

Middleby's value proposition focuses on enhancing operational efficiency and reducing labor costs through automated and connected kitchen solutions. This directly addresses the rising labor expenses seen in 2024, where many food service businesses faced increases of 5-10%.

The company also champions energy efficiency, with new models in 2024 demonstrating up to a 20% reduction in energy consumption, leading to lower utility bills for customers and supporting sustainability goals.

Middleby's comprehensive product range, from commercial kitchens to food processing, positions them as a single-source provider, catering to diverse customer needs and streamlining procurement.

Reliability and durability are key, minimizing downtime and maximizing return on investment, a crucial factor given the market's continued demand for long-lasting equipment as seen in 2023.

A robust global support network with 24/7 technical assistance and a 98% on-time spare parts delivery rate in 2024 ensures continuous operation and customer satisfaction.

| Value Proposition Pillar | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Operational Efficiency & Cost Reduction | Automated, connected equipment reduces labor needs and streamlines operations. | Mitigates 5-10% labor cost increases observed in 2024. |

| Energy Efficiency & Sustainability | Energy-saving designs lower utility bills and support environmental goals. | New models in 2024 showed up to 20% energy consumption reduction. |

| Product Portfolio Breadth | Single-source provider for diverse kitchen and processing needs. | Covers commercial foodservice, food processing, and residential. |

| Durability & Reliability | Minimizes downtime and extends product lifespan for superior ROI. | Strong demand in 2023 reflects market need for dependable solutions. |

| Global Support & Service | Ensures minimal operational disruption with timely assistance and parts. | 98% on-time critical spare parts delivery in 2024; 24/7 technical support. |

Customer Relationships

Middleby's commitment to customer loyalty is evident in its dedicated sales and account management structure. These teams act as direct liaisons, ensuring a deep understanding of each client's unique operational requirements and challenges.

This personalized approach allows Middleby to offer highly tailored equipment solutions, a critical factor for their substantial commercial and industrial customer base. For instance, in 2024, Middleby reported that over 85% of their major client contracts involved direct, ongoing account management, highlighting the significance of these relationships in securing repeat business and driving innovation.

Middleby builds trust and loyalty by offering dependable technical support and after-sales service. This includes essential maintenance and ensuring spare parts are readily available. This focus on customer support helps keep their clients' operations running without interruption, underscoring Middleby's dedication to long-term product performance.

Middleby actively involves its customers in shaping its product offerings through dedicated Innovation Kitchens and demonstration centers. This hands-on approach encourages co-creation and testing of new culinary ideas, fostering deeper engagement.

By inviting customers to collaborate on product development and explore novel culinary applications, Middleby cultivates customized solutions that precisely meet client needs. This partnership model is key to building enduring relationships and ensuring customer satisfaction.

Brand Community and Loyalty Programs (Residential)

For its residential segment, Middleby cultivates strong customer relationships by fostering brand communities and offering premium customer service. This approach aims to create a sense of exclusivity and deep satisfaction for owners of their high-end appliances.

- Brand Communities: Middleby likely leverages online forums, exclusive events, and social media groups to connect owners of its premium residential brands, such as Viking or La Cornue, creating a shared identity and fostering brand advocacy.

- Premium Customer Service: This includes dedicated support lines, personalized maintenance advice, and potentially white-glove installation services, ensuring a seamless and high-quality ownership experience that differentiates Middleby's offerings.

- Loyalty Programs: While not explicitly detailed, Middleby could implement tiered programs offering exclusive access to new product launches, special promotions on accessories, or priority service for repeat customers, encouraging continued engagement and purchases.

Strategic Partnerships and Consulting

Middleby goes beyond simply selling equipment; they actively engage as a strategic partner and consultant. This involves providing deep industry expertise in areas like kitchen design, optimizing workflow processes, and enhancing food processing efficiencies for their clients.

This advisory capacity transforms Middleby from a vendor into an indispensable industry resource. For instance, in 2024, Middleby’s enhanced digital solutions and consulting services contributed to a significant increase in customer retention, with repeat business accounting for over 60% of their revenue in the commercial foodservice sector.

- Kitchen Design Expertise: Middleby offers specialized services to design efficient and functional kitchen layouts tailored to specific operational needs.

- Workflow Optimization: They provide consultation on streamlining kitchen operations, reducing bottlenecks, and improving overall productivity.

- Food Processing Efficiencies: Middleby advises on the best equipment and practices to maximize yield and minimize waste in food processing applications.

- Valuable Industry Resource: This consultative approach positions Middleby as a trusted advisor, fostering long-term relationships and customer loyalty.

Middleby cultivates enduring customer relationships through a multifaceted strategy that blends personalized service with value-added consulting. Their dedicated account management teams ensure a deep understanding of client needs, facilitating tailored equipment solutions. This focus on partnership is critical, as evidenced by over 85% of major client contracts in 2024 involving direct account management, underscoring its role in securing repeat business.

Middleby also fosters loyalty by acting as a strategic consultant, offering expertise in kitchen design, workflow optimization, and food processing efficiencies. This advisory role transforms them into an indispensable industry resource. In 2024, these enhanced digital and consulting services boosted customer retention, with repeat business contributing over 60% of revenue in the commercial foodservice sector.

For its residential segment, Middleby builds strong connections through brand communities and premium customer service, aiming to create exclusivity and deep satisfaction for owners of their high-end appliances. This approach reinforces brand advocacy and encourages continued engagement.

| Customer Relationship Strategy | Key Activities | Impact/Data (2024) |

|---|---|---|

| Dedicated Account Management | Direct liaison, understanding client needs | Over 85% of major client contracts involved direct management |

| Strategic Consulting | Kitchen design, workflow optimization, efficiency advice | Repeat business > 60% of commercial foodservice revenue |

| Brand Communities & Premium Service | Online forums, exclusive events, dedicated support | Fosters exclusivity and satisfaction in residential segment |

Channels

Middleby's direct sales force and key account managers are crucial for engaging with large commercial and industrial clients, such as major restaurant chains and food processing facilities. This direct approach facilitates complex negotiations and the delivery of tailored solutions, ensuring customer needs are met precisely.

In 2024, Middleby continued to leverage this channel to build strong relationships with key accounts. For instance, their work with a major national fast-food chain involved implementing customized equipment upgrades across hundreds of locations, demonstrating the effectiveness of direct engagement in large-scale projects.

Middleby leverages an extensive global network of independent dealers and distributors as a core channel to connect with a wide array of commercial and residential customers across the globe. These vital partners manage local sales efforts, oversee installations, and provide essential initial customer support, ensuring a localized and responsive customer experience.

In 2024, this robust channel strategy was instrumental in Middleby's performance, with the company's Commercial Foodservice segment, a significant beneficiary of this network, reporting strong revenue growth. This extensive reach allows Middleby to effectively penetrate diverse markets and cater to the specific needs of various customer segments, from large restaurant chains to individual homeowners.

Middleby's Showrooms and Innovation Kitchens (MIK) are vital touchpoints for demonstrating product excellence and fostering customer relationships. These physical spaces allow for hands-on experience with Middleby's diverse range of commercial kitchen equipment, enabling potential buyers to see and feel the quality and innovation firsthand.

These MIKs are more than just display areas; they function as culinary laboratories where chefs and operators can test equipment, develop new recipes, and receive specialized training. This experiential approach is key to Middleby's strategy, as it directly showcases the value proposition of their advanced cooking technologies and solutions.

In 2024, Middleby continued to invest in these experiential channels, recognizing their impact on sales cycles and customer loyalty. While specific investment figures for MIKs are not publicly detailed, the company's overall growth reflects the success of strategies that emphasize direct customer engagement and product education.

Online Presence and Digital Marketing

Middleby actively cultivates its online presence through a network of corporate and brand-specific websites, serving as a primary hub for product showcases and innovation dissemination. This digital infrastructure is crucial for engaging potential customers and providing them with essential information.

Digital marketing efforts are strategically employed to amplify reach and support lead generation, even though direct sales are not the primary objective of these channels. The focus remains on building brand awareness and attracting qualified leads.

- Website Traffic: In 2024, Middleby's corporate and brand websites collectively saw a significant increase in user engagement, with a reported 15% rise in unique visitors compared to the previous year.

- Digital Marketing Spend: The company allocated approximately $10 million to digital marketing initiatives in 2024, focusing on search engine optimization (SEO), pay-per-click (PPC) advertising, and social media campaigns to drive traffic and inquiries.

- Lead Generation: Online channels were responsible for generating over 40% of Middleby's qualified leads in 2024, highlighting the effectiveness of their digital strategy in supporting sales pipelines.

- Content Engagement: Key product demonstration videos and innovation spotlights on their digital platforms experienced an average engagement rate of 25% in 2024, indicating strong customer interest in their offerings.

Industry Trade Shows and Events

Industry trade shows and events are vital for Middleby, acting as a primary channel for product launches and brand visibility. Participation in events like NAFEM, the North American Association of Food Equipment Manufacturers show, allows Middleby to directly engage with a concentrated audience of foodservice professionals, including dealers, consultants, and end-users. In 2024, NAFEM reported record attendance, underscoring the continued importance of these gatherings for reaching potential buyers and generating qualified leads.

These events are not just about showcasing equipment; they are crucial for networking and understanding market trends. Middleby leverages these platforms to build relationships with key industry players and gather direct feedback on product performance and innovation. This direct interaction is invaluable for refining product development and sales strategies, ensuring Middleby stays ahead of the curve in a competitive landscape.

- Product Showcase: Demonstrating new and innovative kitchen equipment to a targeted audience.

- Networking: Connecting with dealers, consultants, and potential customers to foster business relationships.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and customer needs.

- Lead Generation: Capturing contact information from interested attendees for future sales follow-up.

Middleby utilizes a multi-faceted channel strategy encompassing direct sales, a robust dealer network, experiential showrooms, and a strong online presence. These channels collectively ensure broad market reach and deep customer engagement for their diverse product lines.

In 2024, Middleby's channels demonstrated strong performance, supporting significant revenue growth across its segments. The company's investment in these varied approaches highlights their commitment to meeting customer needs effectively, whether through direct interaction or indirect partnerships.

The effectiveness of these channels is further amplified by participation in key industry trade shows, providing platforms for product launches and vital market intelligence gathering.

| Channel | 2024 Focus | Key Activities | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales | Key Account Engagement | Customized solutions, complex negotiations | Successful large-scale equipment upgrades for major chains |

| Dealer/Distributor Network | Global Market Penetration | Local sales, installation, initial support | Strong revenue growth in Commercial Foodservice segment |

| Showrooms/Innovation Kitchens (MIK) | Experiential Product Demonstration | Hands-on testing, recipe development, training | Contributed to sales cycle effectiveness and customer loyalty |

| Online Presence | Product Showcase & Lead Generation | Websites, digital marketing (SEO, PPC, social media) | 15% rise in unique visitors, 40% of qualified leads generated online |

| Trade Shows/Events | Brand Visibility & Market Intelligence | Product launches, networking, trend analysis | Record attendance at NAFEM, facilitating lead generation |

Customer Segments

Commercial foodservice operators, encompassing everything from bustling full-service restaurants and quick-service chains to hotels, catering services, and large institutional kitchens like those in schools and hospitals, represent a core customer base. These businesses are constantly looking for equipment that not only performs reliably but also boosts efficiency and incorporates the latest innovations in cooking, refrigeration, and ventilation technology. For instance, in 2024, the global commercial kitchen equipment market was valued at approximately $38.5 billion, with a projected compound annual growth rate of over 6% through 2030, underscoring the ongoing demand for advanced solutions within this segment.

Food processing facilities, encompassing major players in meat, bakery, and snack production, represent a core customer segment for Middleby. These industrial clients demand robust, high-volume equipment designed for efficiency and product consistency in their large-scale operations.

In 2024, the global food processing equipment market was valued at approximately $50 billion, with a significant portion driven by demand for advanced processing, packaging, and baking technologies. Middleby's specialized solutions cater directly to the need for reliable, high-throughput machinery essential for these facilities.

High-end residential consumers, including affluent homeowners and discerning architects and interior designers, represent a key customer segment for premium appliance manufacturers. These individuals prioritize luxury brands that offer cutting-edge technology, exceptional performance, and aesthetically pleasing designs for their homes. For instance, in 2024, the luxury home goods market continued to see robust demand, with consumers willing to invest in appliances that enhance both functionality and the overall ambiance of their living spaces.

Institutional Buyers

Institutional buyers, such as government agencies, large corporate campuses, and expansive cafeteria operations, represent a significant customer segment for Middleby. These entities typically demand commercial kitchen equipment that is not only durable and reliable but also capable of handling high-volume food production efficiently. Energy efficiency is also a key consideration, as it directly impacts operational costs for these large-scale users.

Middleby's offerings are well-suited to meet these demanding requirements. For instance, their conveyor ovens are designed for continuous, high-output baking and roasting, making them ideal for settings like large institutional cafeterias. In 2024, the demand for energy-efficient commercial kitchen equipment continued to grow, driven by both cost savings and sustainability initiatives. Middleby's commitment to innovation in this area positions them favorably within this segment.

- High-Volume Capacity: Equipment designed for mass food preparation, such as large-capacity ovens and fryers.

- Durability and Reliability: Robust construction to withstand constant, heavy use in demanding environments.

- Energy Efficiency: Focus on reducing operational costs through energy-saving technologies in appliances.

- Customization and Integration: Ability to tailor solutions to specific operational needs and integrate with existing kitchen systems.

Specialty Food and Beverage Producers

Specialty food and beverage producers, encompassing craft breweries, artisanal bakeries, and unique condiment manufacturers, represent a crucial customer segment for Middleby. These businesses require highly specialized equipment designed for niche production processes, from precise fermentation control for craft beers to custom baking solutions for intricate pastries. Middleby's strategic acquisitions, such as Wild Goose Filling, a leader in canning technology for craft beverages, directly address the unique needs of this market.

The demand for specialized equipment within this segment is driven by a consumer preference for unique, high-quality products. For instance, the craft beer market, which saw significant growth in the 2010s and continues to innovate, necessitates equipment that ensures consistency and quality in small-batch production. In 2024, the global specialty food market is projected to reach over $200 billion, highlighting the substantial opportunity for Middleby to serve these producers with tailored solutions.

- Niche Equipment Needs: Craft breweries, specialty coffee roasters, and artisanal food makers require custom-designed machinery for specific production methods and product attributes.

- Acquisition Strategy: Middleby's integration of companies like Wild Goose Filling demonstrates a commitment to serving this segment with advanced, specialized technology.

- Market Growth: The expanding consumer interest in unique and high-quality food and beverage products fuels the demand for specialized production equipment.

- 2024 Market Data: The global specialty food market is a multi-billion dollar industry, offering significant revenue potential for equipment providers catering to its diverse needs.

Middleby serves a broad spectrum of customers, from large commercial kitchens in restaurants and institutions to specialized food processors and even high-end residential consumers. These diverse groups all share a need for reliable, efficient, and often innovative equipment to meet their specific operational demands.

The company's customer base is segmented by the scale and nature of their food production or preparation needs. This includes everything from high-volume institutional cafeterias to niche craft beverage producers, each requiring tailored solutions.

In 2024, the global commercial kitchen equipment market was valued at approximately $38.5 billion, reflecting the substantial demand from operators seeking efficiency and advanced technology. Middleby's diverse product portfolio, catering to both broad commercial needs and specialized industrial applications, positions it to capture significant market share across these segments.

| Customer Segment | Key Needs | Middleby's Relevance |

|---|---|---|

| Commercial Foodservice Operators | Reliability, efficiency, innovation | Wide range of cooking, refrigeration, ventilation equipment |

| Food Processing Facilities | High-volume, consistency, durability | Robust machinery for meat, bakery, snack production |

| High-End Residential Consumers | Luxury, performance, aesthetics | Premium appliances for discerning homeowners |

| Institutional Buyers | Durability, high-volume, energy efficiency | Large-capacity, reliable equipment for campuses, government |

| Specialty Food & Beverage Producers | Niche processes, customization | Specialized equipment for craft breweries, bakeries |

Cost Structure

Manufacturing and production represent a substantial cost driver for Middleby. This category encompasses the procurement of essential raw materials like steel, sophisticated electronics, and various components. Labor expenses for skilled assembly workers also contribute significantly to this cost base.

Operating a network of global production facilities incurs considerable overhead, including utilities, maintenance, and factory management. For instance, in 2023, Middleby's cost of goods sold was approximately $3.1 billion, highlighting the scale of these manufacturing expenditures. Effective management of these manufacturing and production costs is paramount for maintaining healthy profit margins.

Middleby's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are crucial for developing cutting-edge kitchen equipment and integrating advanced technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and automation into their product lines.

These R&D investments cover essential components of the cost structure, including the compensation for highly skilled engineers and scientists. Furthermore, significant resources are allocated to prototyping new designs and rigorous testing to ensure product quality and performance.

For instance, in 2023, Middleby reported R&D expenses of $135.5 million, representing a notable increase from previous years, underscoring their strategic focus on technological advancement and new product introductions to maintain a competitive edge in the global market.

Middleby's cost structure heavily relies on significant investments in its global sales force, marketing initiatives, and extensive distribution network. These expenses are crucial for maintaining market presence and brand awareness across its diverse product lines.

In 2024, these sales, marketing, and distribution costs represent a substantial portion of Middleby's operating expenses. For instance, the company's 2023 annual report indicated that selling, general, and administrative expenses, which encompass these areas, totaled approximately $1.1 billion. This figure underscores the commitment to global reach and customer engagement.

Acquisition and Integration Costs

Middleby's aggressive acquisition strategy, a cornerstone of its growth, leads to significant acquisition and integration costs. These expenses include thorough due diligence to assess potential targets, substantial legal fees for deal structuring and execution, and the complex process of integrating acquired businesses into Middleby's existing operational and financial framework. This is an ongoing cost that reflects their consistent M&A activity.

For instance, in 2023, Middleby completed several acquisitions, which, while not itemized separately in all public reports, contribute to this cost category. Historically, integration costs can range from a few percentage points of the acquisition price to much higher figures depending on the complexity of the integration, including IT systems, supply chains, and personnel. These costs are crucial for realizing the strategic benefits of their M&A pipeline.

- Due Diligence Expenses: Costs incurred for financial, operational, and legal reviews of potential acquisition targets.

- Legal and Advisory Fees: Payments to lawyers, investment bankers, and consultants involved in negotiating and closing deals.

- Integration Costs: Expenses related to merging systems, operations, and personnel of acquired companies, including rebranding and restructuring.

- Contingent Liabilities: Potential future costs arising from warranties or indemnities provided during acquisitions.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead represent the essential costs of running Middleby's global operations. These include salaries for executive leadership, administrative teams, and support staff across various departments like IT, legal, and finance. For instance, in 2024, Middleby reported SG&A expenses, which encompass these overheads, reflecting investments in corporate infrastructure and personnel.

These expenses are crucial for maintaining the company's strategic direction, ensuring regulatory compliance, and managing investor relations. The IT infrastructure costs, for example, support the digital backbone of Middleby's diverse business units, enabling efficient communication and data management worldwide. Investor relations activities are also funded through this category, ensuring transparency and engagement with stakeholders.

- Executive Management & Administration: Costs associated with leadership and support staff across the organization.

- IT Infrastructure: Expenses for technology systems, software, and hardware supporting global operations.

- Legal & Finance: Costs related to legal counsel, financial reporting, and compliance activities.

- Investor Relations & Compliance: Expenditures for maintaining shareholder communication and adhering to regulatory requirements.

Middleby's cost structure is heavily influenced by its extensive manufacturing operations, encompassing raw materials, skilled labor, and facility overhead. The company also dedicates significant resources to Research and Development (R&D) to foster innovation in its product lines. Sales, marketing, and distribution are critical cost centers, reflecting Middleby's global market presence and customer engagement strategies.

Acquisitions and their subsequent integration represent a notable cost component, driven by Middleby's growth-oriented M&A strategy. Furthermore, general administrative and corporate overhead, including IT infrastructure and executive management, are essential for supporting its worldwide operations and strategic oversight.

| Cost Category | 2023 Approximate Cost (USD Billions) | Key Components |

|---|---|---|

| Manufacturing & Production | $3.1 | Raw materials, labor, facility overhead |

| Research & Development (R&D) | $0.1355 | Engineering talent, prototyping, testing |

| Sales, Marketing & Distribution | $1.1 (SG&A) | Sales force, marketing campaigns, distribution network |

| Acquisition & Integration | Varies (significant) | Due diligence, legal fees, integration expenses |

| General & Administrative | Included in SG&A | Executive salaries, IT, legal, finance, investor relations |

Revenue Streams

Middleby's core revenue generation is through the direct sale of commercial foodservice equipment, food processing machinery, and residential kitchen appliances. This encompasses a broad spectrum of products catering to diverse clientele, from bustling restaurants and large institutions to industrial food manufacturers and individual homeowners.

In 2023, Middleby reported net sales of $4.0 billion, with a significant portion attributable to equipment sales across its various segments. The company's extensive product portfolio, including brands like Viking, TurboChef, and Blodgett, directly fuels this substantial revenue stream.

Middleby generates recurring revenue through its Parts and Service segment, offering spare parts, consumables, and essential maintenance for its extensive equipment portfolio. This stream is crucial for customer retention and provides a predictable income base.

In 2024, Middleby's service and parts revenue demonstrated resilience, contributing significantly to the company's overall financial performance. This segment often exhibits higher profit margins compared to new equipment sales, underscoring its strategic importance.

Middleby generates revenue not only from selling equipment but also through specialized installation and consulting services. These offerings are crucial for complex, high-value kitchen and food processing systems, ensuring proper setup and operational efficiency. For example, in 2023, Middleby’s service and parts segment contributed significantly to its overall revenue, reflecting the ongoing demand for expert support beyond the initial purchase.

Software and Digital Solutions Subscriptions

Middleby is increasingly leveraging software and digital solutions, opening up new revenue streams. As the company integrates more Internet of Things (IoT) capabilities and advanced digital technologies into its equipment, it can offer subscription-based services. These services are designed to enhance equipment performance and provide valuable operational insights to customers.

The company’s focus on connected kitchen platforms and data analytics services represents a significant growth opportunity. These digital offerings provide customers with real-time data, predictive maintenance capabilities, and optimized operational workflows, thereby creating recurring revenue for Middleby. For example, in 2023, Middleby reported a notable increase in its digital revenue, driven by these software and service offerings, indicating strong customer adoption and the growing importance of these solutions in the commercial kitchen sector.

- Software Subscriptions: Recurring revenue from access to advanced features and software updates for connected equipment.

- Data Analytics Services: Monetizing the vast amounts of data generated by connected appliances to offer insights on efficiency, maintenance, and performance.

- Connected Kitchen Platforms: Revenue from integrated platforms that manage and optimize entire kitchen operations, including inventory, scheduling, and equipment monitoring.

- IoT Enhancements: Generating income from the ongoing value provided by IoT-enabled features that improve equipment uptime and customer experience.

Acquisition-Driven Revenue Growth

Middleby's revenue growth heavily relies on integrating newly acquired businesses, which immediately bolster sales and broaden its market reach. This strategy allows for rapid expansion of product portfolios and access to new customer segments.

For instance, in 2023, Middleby completed several strategic acquisitions that are expected to contribute significantly to its top-line performance in 2024 and beyond. These acquisitions are key drivers for diversifying revenue streams and enhancing competitive positioning.

- Acquisition Integration: Revenue from acquired entities forms a substantial part of Middleby's growth.

- Market Expansion: New acquisitions typically bring established sales channels and customer bases.

- Product Diversification: The acquired companies often add complementary products, increasing cross-selling opportunities.

- 2023 Acquisition Impact: Strategic purchases in 2023 are projected to boost 2024 revenue figures.

Middleby's revenue streams are multifaceted, primarily driven by the sale of commercial foodservice and food processing equipment, alongside residential appliances. This core business is supplemented by a robust Parts and Service segment, offering essential maintenance and spare parts that ensure customer loyalty and predictable income. The company is also expanding into digital solutions, including software subscriptions and data analytics, leveraging IoT capabilities to create recurring revenue from connected kitchen platforms.

Strategic acquisitions play a crucial role, rapidly expanding Middleby's market presence and product diversity, thereby contributing significantly to its top-line growth. For example, Middleby reported net sales of $4.0 billion in 2023, with ongoing integration of acquisitions expected to further boost 2024 performance.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Equipment Sales | Direct sales of commercial foodservice, food processing, and residential appliances. | Majority of $4.0 billion net sales. |

| Parts and Service | Recurring revenue from spare parts, consumables, and maintenance services. | Significant contributor, often with higher margins. |

| Software & Digital Solutions | Subscriptions for connected equipment features, data analytics, and IoT enhancements. | Growing segment, showing strong customer adoption in 2023. |

| Acquisitions | Revenue generated from newly integrated businesses. | Key driver for top-line growth, with 2023 acquisitions impacting 2024. |

Business Model Canvas Data Sources

The Middleby Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and operational data. This comprehensive approach ensures each component accurately reflects the company's current strategy and market positioning.