Middleby Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

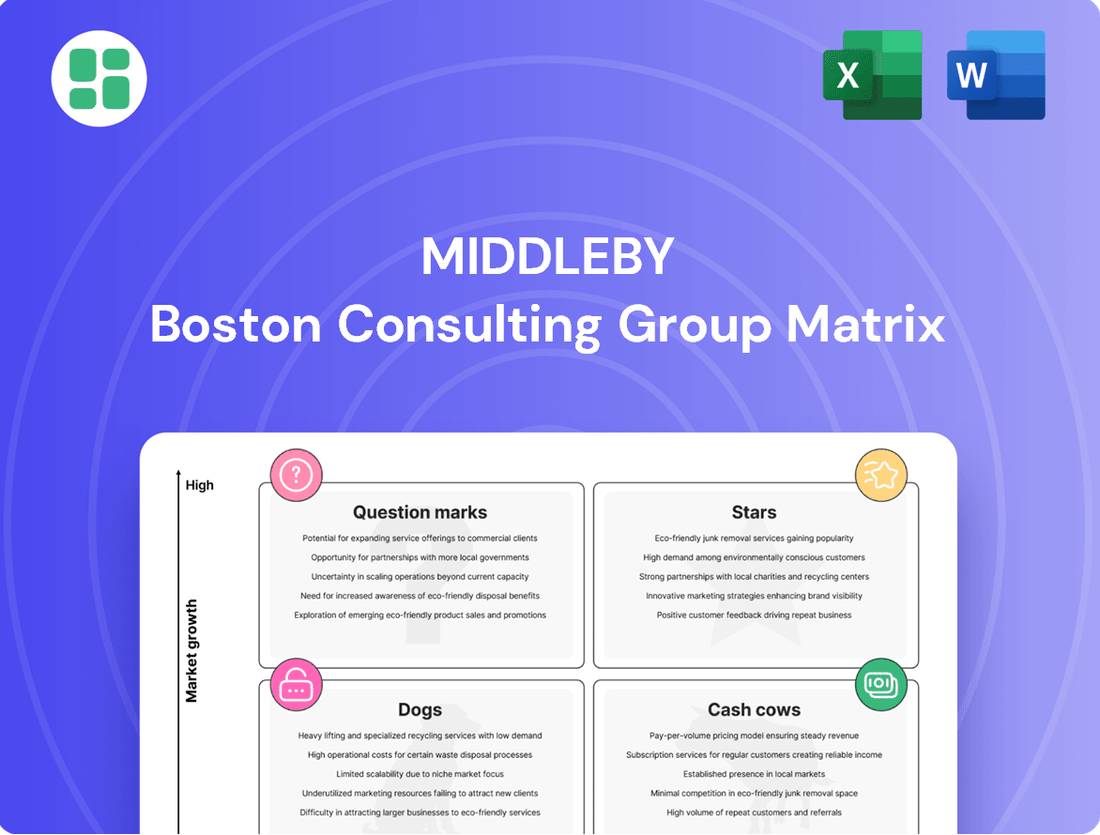

Curious about where this company's products fit in the market? Our BCG Matrix preview offers a glimpse into their potential as Stars, Cash Cows, Dogs, or Question Marks. To unlock the full strategic advantage and detailed insights needed for informed investment decisions, purchase the complete BCG Matrix report today.

Stars

Middleby's Food Processing division is positioned as a Star in the BCG matrix, reflecting its robust growth and market leadership. The planned spin-off into a standalone public company by early 2026 underscores its strategic significance and anticipated expansion.

This segment demonstrated impressive financial performance, achieving adjusted EBITDA margins of 29.6% in late 2024. Analysts describe its growth profile as best-in-class, highlighting substantial avenues for both organic scaling and strategic acquisitions within the sector.

Middleby's Advanced Automation and IoT Solutions are a significant driver of their business. These offerings, including digital robotic kitchens and connected devices, directly tackle the foodservice industry's pressing labor shortages and efficiency needs. This strategic focus places Middleby squarely in a high-growth market segment.

Middleby's expansion into the ice and beverage sector is a key growth area, reflecting a strategic move into a high-potential market within commercial foodservice.

This segment is experiencing robust demand, and Middleby's investments here are yielding significant traction, aligning with their broader vision of comprehensive kitchen solutions.

For instance, in 2024, the company has seen increased contributions from its beverage equipment divisions, signaling a successful penetration into this lucrative segment.

Strategic Acquisitions in High-Growth Niches

Middleby strategically targets acquisitions in high-growth niches to bolster its market position. For instance, its acquisition of JC Ford enhanced its capabilities in the burgeoning tortilla production equipment sector. This move underscores Middleby's commitment to capturing market share in dynamic segments.

These strategic moves are crucial for maintaining leadership in evolving markets. By investing in high-growth areas, Middleby aims to diversify its revenue streams and capitalize on emerging consumer trends.

- Targeted Acquisitions Middleby focuses on acquiring companies in rapidly expanding segments like snack food production equipment.

- Market Expansion Acquisitions such as JC Ford aim to strengthen Middleby's presence in specialized, high-demand areas like tortilla manufacturing.

- Reinforcing Leadership These strategic moves are designed to solidify Middleby's competitive advantage and market leadership in key growth sectors.

Sustainable and Energy-Efficient Equipment

Middleby's investment in sustainable and energy-efficient equipment positions it strongly within the market. This focus is driven by a clear industry shift towards eco-friendly solutions, a trend that is only expected to accelerate. For instance, by 2024, the global market for energy-efficient commercial kitchen equipment was projected to see significant growth, with sustainability becoming a key purchasing factor for many businesses.

The company's dedication to zero-waste systems, applicable across both its commercial and food processing divisions, taps into a high-growth potential. This commitment directly addresses evolving customer demands and aligns with tightening environmental regulations worldwide. Middleby's proactive approach ensures it remains competitive as sustainability moves from a niche concern to a mainstream business imperative.

This strategic direction is reflected in Middleby's product development and market penetration. The company is actively innovating in areas such as:

- Advanced refrigeration systems that reduce energy consumption by up to 30%.

- Smart cooking technologies that optimize energy usage based on demand.

- Water-saving dishwashing solutions for commercial kitchens.

- Recyclable materials and packaging initiatives across its product lines.

Middleby's Food Processing segment is a clear Star, boasting high growth and market dominance. Its planned spin-off by early 2026 highlights its strategic importance and future expansion potential.

This segment achieved impressive adjusted EBITDA margins of 29.6% in late 2024, demonstrating its best-in-class growth profile. The company is actively pursuing both organic growth and strategic acquisitions within this sector.

The company's focus on Advanced Automation and IoT Solutions, including digital robotic kitchens, directly addresses critical industry needs like labor shortages and efficiency improvements, positioning it in a high-growth market.

| Segment | BCG Category | Key Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Food Processing | Star | Market leadership, planned spin-off | 29.6% adjusted EBITDA margin |

| Advanced Automation & IoT | Star | Labor shortage solutions, efficiency gains | High-growth market penetration |

| Ice & Beverage | Star | Robust demand, strategic investments | Increased contributions from beverage equipment |

What is included in the product

The Middleby BCG Matrix analyzes product portfolio performance, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on resource allocation, highlighting which business units to invest in, hold, or divest for optimal growth.

Provides a clear, actionable roadmap by categorizing business units, simplifying strategic decision-making.

Cash Cows

The Commercial Foodservice Equipment Group stands as Middleby's dominant force, accounting for roughly 61-62% of its total revenue in 2024. This segment consistently generates substantial cash flow, evidenced by its robust adjusted EBITDA margins of 26.9% in Q1 2025, even amidst prevailing macroeconomic challenges.

Middleby's strength lies in its portfolio of over 120 established global brands, including industry leaders like Blodgett and Pitco. This extensive brand recognition, coupled with a vast distribution and service network, allows Middleby to maintain a significant market presence. These brands operate in mature but essential markets, contributing to consistent revenue streams and solid profitability for the company.

Middleby's commercial foodservice segment acts as a significant cash cow, consistently churning out robust free cash flow. In late 2024, the company reported an impressive $640 million in annual free cash flow, a testament to the segment's profitability and efficiency.

This strong financial performance continued into the first quarter of 2025, with the company generating $141.1 million in free cash flow. This substantial cash generation provides Middleby with the financial flexibility to actively reduce its debt obligations and execute significant share repurchase programs, further enhancing shareholder value.

Essential and Reliable Equipment Lines

Middleby's essential and reliable equipment lines, such as commercial cooking, refrigeration, and ventilation solutions, form a significant part of its Cash Cows in the BCG matrix. These products are fundamental to the daily operations of countless restaurants and institutions globally, ensuring consistent demand.

These offerings are characterized by long lifecycles and a steady need for replacements and upgrades. This stability translates into predictable, low-growth, yet high-margin sales for Middleby, providing a strong foundation for its business.

- Stable Demand: Essential equipment for daily restaurant operations drives consistent sales.

- Long Lifecycles: Products are built to last, requiring periodic replacements and upgrades, ensuring ongoing revenue.

- High Margins: Despite low growth, these mature product lines typically command healthy profit margins.

- Market Position: Middleby's established presence in commercial cooking and refrigeration solidifies its Cash Cow status in these segments.

Operational Excellence and Cost Control

Middleby's commitment to operational excellence and stringent cost control has been a cornerstone of its success, even when facing market headwinds. This focus has translated into impressive, record-breaking profit margins.

This efficiency isn't just about cutting costs; it's about optimizing processes within their dominant commercial segment. This strategic advantage allows Middleby to maintain robust profit margins and generate consistent, reliable cash flow, hallmarks of a true cash cow.

- Record Margins: Middleby achieved impressive margins, showcasing their ability to manage costs effectively.

- Commercial Segment Dominance: Their strong market share in the commercial sector fuels sustained profitability.

- Consistent Cash Flow: Operational efficiency ensures a steady stream of cash, vital for funding other business units.

Middleby's Commercial Foodservice Equipment Group functions as its primary cash cow within the BCG matrix. This segment, representing a substantial portion of the company's revenue, consistently generates significant free cash flow. Its mature market position and essential product offerings, like commercial cooking and refrigeration equipment, ensure stable demand and predictable, high-margin sales.

The company's operational efficiency and cost management further bolster this segment's profitability, allowing for record margins. This robust cash generation, exemplified by $640 million in annual free cash flow reported in late 2024, provides Middleby with the financial capacity to reduce debt and invest in other growth areas.

| Segment | 2024 Revenue Contribution (Est.) | Q1 2025 Adjusted EBITDA Margin | 2024 Free Cash Flow (Segment Est.) |

|---|---|---|---|

| Commercial Foodservice Equipment | ~61-62% | 26.9% | ~$640 million (Annualized) |

What You See Is What You Get

Middleby BCG Matrix

The Middleby BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after your purchase. This ensures you get a comprehensive, analysis-ready tool without any watermarks or placeholder content, ready for immediate strategic application.

Dogs

Within Middleby's diverse product offerings, certain legacy equipment or older product lines that haven't seen substantial innovation can be categorized as dogs in the BCG matrix. These items often struggle with market relevance and face fierce price wars. For instance, if a particular line of commercial ovens from the early 2010s hasn't been updated with smart technology or energy-efficient features, it might fall into this category.

These "dog" products typically exhibit slow or negative growth in market share and may only generate enough revenue to cover their costs, essentially breaking even. They can tie up valuable capital and management attention that could be better allocated to more promising segments. Imagine a specific model of industrial dishwasher that, while still functional, lacks the advanced sanitation cycles or water-saving technology demanded by modern restaurants, leading to a stagnant market position.

Within Middleby's residential segment, certain niche products might be classified as Dogs. These are offerings that, despite a general recovery in the residential market, struggle with both low market share and minimal growth. For instance, a specialized kitchen appliance with limited consumer appeal or a product in an oversaturated sub-market could fall into this category.

These underperforming niche products are likely not capturing significant consumer interest and are consequently failing to contribute substantially to the company's overall profitability. In 2023, while the broader residential market showed resilience, specific product lines that haven't adapted to evolving consumer preferences or face intense competition may have seen sales figures stagnate or even decline, reflecting a challenging market position.

Certain areas within the vast foodservice and food processing industries might see very little growth for extended periods. This can happen because people's tastes change, or older technologies become outdated. Products from Middleby that mainly cater to these slow-growing markets, especially where the company isn't a major player, would likely be considered dogs in the BCG matrix.

Inefficiently Managed Minor Brands

Middleby Corporation manages a broad portfolio of brands, and some of these, particularly smaller ones acquired historically, may not be operating at peak efficiency. These brands could be flagged as dogs in the BCG matrix if they hold a low market share within their specific segments and demand significant management resources or capital without yielding commensurate returns.

For example, a brand acquired in a niche market that has since seen declining consumer interest or increased competition might fit this description. Such brands can drain valuable resources that could otherwise be allocated to higher-growth potential businesses within Middleby's portfolio.

- Low Market Share: Brands with a minimal presence in their respective categories, indicating limited competitive strength.

- Disproportionate Resource Drain: These brands often require substantial management time and financial investment relative to the revenue or profit they generate.

- Minimal Growth Prospects: Lack of significant market growth or potential for expansion, making future turnaround unlikely without substantial strategic shifts.

- Potential for Divestiture or Restructuring: Inefficiently managed minor brands are candidates for divestment or significant internal restructuring to improve performance or free up capital.

High-Cost, Low-Volume Offerings

High-cost, low-volume offerings in Middleby's portfolio are products that demand significant investment in manufacturing or distribution but yield minimal sales and market penetration. These items often consume valuable capital and resources, hindering their contribution to the company's broader strategic goals or profitability.

Consider a niche, specialized commercial oven designed for a very specific culinary application. While its advanced technology might lead to high production costs and a premium price point, the limited demand from a small segment of restaurants means it generates low sales volume. For instance, if such a product represents only 1% of Middleby's total revenue in 2024 but accounts for 5% of its R&D expenditure, it would exemplify this category.

- High Production Costs: Specialized components or complex assembly processes drive up manufacturing expenses.

- Low Sales Volume: Limited market demand restricts the number of units sold.

- Resource Drain: Capital and operational resources are tied up without substantial returns.

- Strategic Incumbrance: These products may not align with core business objectives or offer significant competitive advantages.

Products classified as Dogs within Middleby's portfolio typically exhibit low market share and operate in slow-growth or declining markets. These offerings often require significant resources for maintenance or support but generate minimal returns, potentially hindering overall profitability.

For example, older models of industrial food processing equipment that have been superseded by more efficient technology, or niche kitchen appliances with limited consumer appeal, could be categorized as Dogs. These products might still be functional but lack the innovative features or market demand to compete effectively.

In 2024, Middleby's focus on innovation and market expansion means that products failing to gain traction or adapt to changing consumer preferences are prime candidates for this classification. Such items tie up capital and management attention that could be better invested in Stars or Question Marks.

These underperforming assets can represent a drag on the company's resources, necessitating careful evaluation for potential divestiture, restructuring, or strategic repositioning to improve their contribution to the business.

| Product Category Example | Market Share (Estimated 2024) | Market Growth Rate (Estimated 2024) | Profitability Contribution |

|---|---|---|---|

| Legacy Commercial Fryers | Low (e.g., <5%) | Stagnant to Declining | Break-even to Negative |

| Niche Residential Specialty Ovens | Low (e.g., <3%) | Slow Growth | Minimal |

| Older Model Industrial Mixers | Low (e.g., <4%) | Declining | Low |

Question Marks

Middleby is actively exploring and investing in emerging digital kitchen and AI technologies, as evidenced by their presence at industry events like NAFEM 2025, where these innovations were showcased. These advancements, including robotic kitchens and AI-driven optimization tools, represent significant potential for future growth within the food service industry.

However, the market adoption for these cutting-edge solutions is still in its early stages, classifying them as question marks within the BCG matrix. Middleby's specific market share and the current revenue generated from these nascent digital and AI offerings are still being established, indicating a need for further development and market penetration.

Middleby's strategic expansion into burgeoning food processing sectors like poultry and pet foods positions these segments as potential question marks within its BCG Matrix. These markets are characterized by robust growth potential, attracting significant investment as Middleby aims to build substantial market share.

The company’s foray into these adjacent markets requires substantial capital outlay to establish a strong foothold and competitive advantage, a hallmark of question mark businesses. For instance, the global pet food market was valued at approximately $110 billion in 2023 and is projected to grow, offering a clear avenue for Middleby’s investment and growth.

The residential outdoor kitchen product segment is emerging as a bright spot, demonstrating growth in Q1 2025. This indicates a promising high-growth market for Middleby.

Despite this positive trend, the broader residential market continues to grapple with consumer caution and ongoing macroeconomic headwinds. Therefore, sustained investment is crucial for these outdoor products to solidify a dominant market position.

New Geographic Market Entries

When Middleby ventures into new international territories where its presence is minimal but the market shows significant growth potential, these operations are categorized as question marks within the BCG Matrix framework. These initiatives demand considerable financial backing for marketing, sales, and establishing local operational capabilities to build market share.

For instance, Middleby's expansion into emerging economies in Southeast Asia or Africa in 2024 could represent such question marks. These regions often exhibit high GDP growth rates, indicating a rapidly expanding market for commercial kitchen equipment, yet Middleby’s current market penetration might be nascent.

- Emerging Market Potential: Regions like Vietnam and Nigeria, with projected GDP growth rates of over 6% in 2024, offer substantial untapped demand for Middleby's products.

- Investment Needs: Successfully penetrating these markets requires significant upfront investment in distribution networks and localized marketing campaigns, mirroring the characteristics of question mark businesses.

- Strategic Rationale: The goal is to transform these question marks into stars or cash cows by capturing early market share in high-growth environments.

Small, Recent Technology-Focused Acquisitions

Middleby strategically acquires smaller, technology-focused companies to bolster its portfolio. These companies, often possessing innovative solutions or operating in niche, high-growth markets, typically represent a low initial market share.

For instance, in 2023, Middleby continued its pattern of acquiring specialized technology firms. While specific financial details for very recent, small acquisitions are often private, the company's overall acquisition strategy aims to integrate these entities, investing in their scaling and market penetration to unlock their full potential within Middleby's broader ecosystem.

- Focus on Innovation: Middleby targets companies with cutting-edge technology.

- Low Initial Market Share: Acquired entities often start with a small footprint.

- Integration and Investment: Significant resources are dedicated to scaling these businesses.

- Growth Potential: These acquisitions are key to entering or expanding in high-growth technology sectors.

Question marks in Middleby's portfolio represent business units with low market share in high-growth markets, requiring significant investment to capture potential. These are areas where Middleby is either entering new, rapidly expanding sectors or developing nascent technologies with uncertain market acceptance. The company's strategy involves carefully selecting these opportunities and allocating capital to foster growth and eventually move them towards becoming stars.

Middleby's investment in emerging digital kitchen and AI technologies, alongside its expansion into growing food processing segments like pet food, exemplifies these question marks. Similarly, new international market entries and strategic acquisitions of smaller tech firms fall into this category, all demanding substantial capital for market penetration and development.

The company's approach is to nurture these question marks, aiming to convert their high-growth potential into market leadership. This requires a sustained commitment of resources, including capital for marketing, sales infrastructure, and product development, to overcome initial challenges and establish a strong competitive position.

| Business Area | Market Growth | Market Share | Investment Required | Strategic Focus |

| Digital Kitchen & AI Tech | High | Low | High | Development & Adoption |

| Pet Food Processing | High | Low | High | Market Penetration |

| Emerging International Markets | High | Low | High | Establishment & Growth |

| Acquired Tech Companies | High | Low | High | Integration & Scaling |

BCG Matrix Data Sources

Our Middleby BCG Matrix is constructed using comprehensive data, including internal financial reports, market share analysis, and industry growth projections to provide actionable strategic insights.