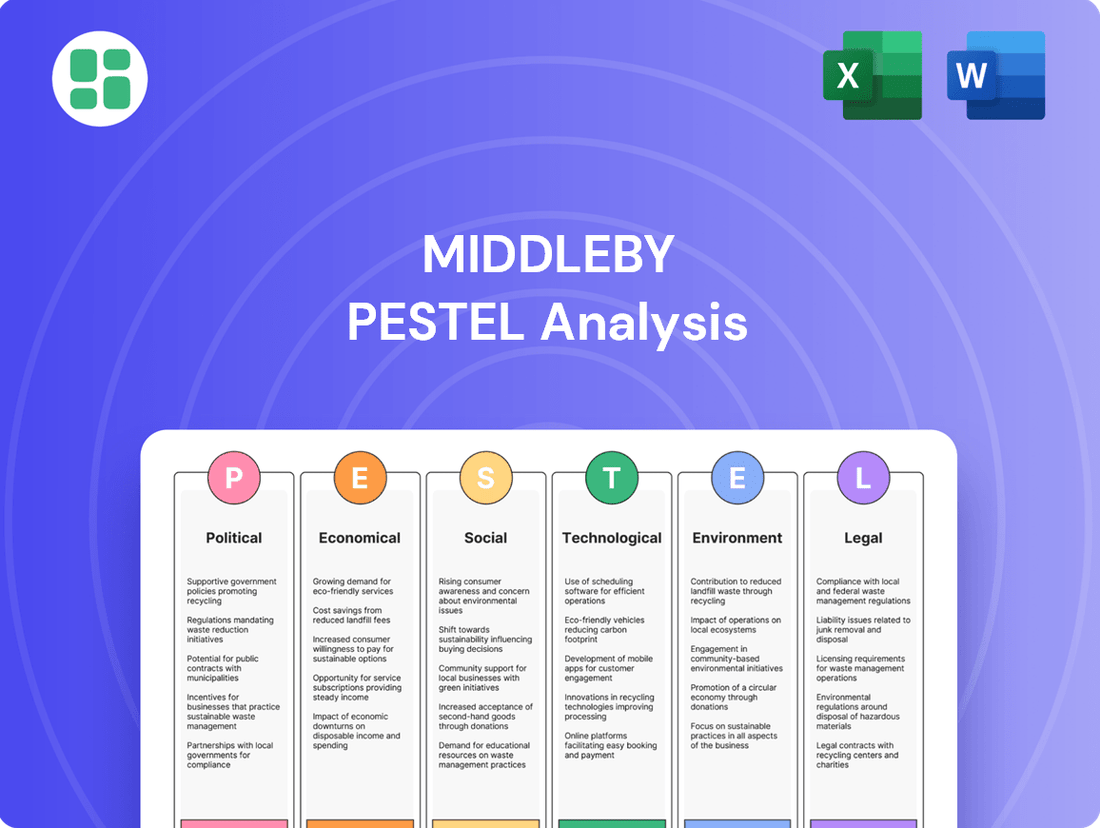

Middleby PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Middleby's future. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and threats. Gain a competitive edge by understanding these external forces. Download the full, actionable report now to inform your strategic decisions.

Political factors

Global trade policies, including tariffs on imported components and finished goods, significantly impact Middleby's manufacturing costs and pricing strategies. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which can affect the cost of raw materials used in appliance manufacturing.

Recent tariffs on steel derivative products, including home appliances, could increase costs for manufacturers like Middleby. This might force companies to adjust their supply chains or pricing to mitigate the impact, potentially affecting consumer demand for their products.

Government initiatives designed to encourage the adoption of energy-efficient appliances and sustainable building methods directly boost demand for Middleby's environmentally conscious commercial and residential kitchen equipment. These programs create a favorable market environment for products that reduce energy consumption and environmental impact.

In the United States, the Inflation Reduction Act of 2022 is a prime example, allocating significant funding to support clean energy technologies and practices. This legislation, with its focus on renewable energy and energy efficiency, directly complements Middleby's strategic direction and product development in eco-friendly solutions.

Middleby's global operations expose it to political instability and geopolitical tensions, particularly in regions like Eastern Europe and the Middle East. For instance, ongoing conflicts can disrupt critical supply chains for components and finished goods. This instability also fuels currency fluctuations, impacting Middleby's reported earnings and the cost of doing business abroad, as seen with the volatility in exchange rates affecting international trade throughout 2024.

Food Safety Regulations

Stringent government regulations regarding food safety and hygiene in commercial kitchens directly shape the engineering and functionality of Middleby's cooking and processing equipment. These rules, which are continually updated, are paramount for Middleby to gain and maintain access to key markets, ensuring their products meet the highest standards for public health. Failure to comply can severely damage brand reputation and lead to significant financial penalties.

The evolving landscape of food safety mandates, such as those from the U.S. Food and Drug Administration (FDA) and similar international bodies, are a significant driver for Middleby's research and development. For instance, the increasing focus on preventing cross-contamination and simplifying cleaning protocols pushes innovation towards features like:

- Advanced self-cleaning mechanisms to reduce manual labor and ensure thorough sanitation.

- Antimicrobial surfaces and materials integrated into equipment design to inhibit bacterial growth.

- Enhanced temperature monitoring and control systems to guarantee food is cooked and held at safe temperatures.

- Easier disassembly and reassembly for deep cleaning and maintenance, meeting stringent hygiene requirements.

Labor Policy and Minimum Wage Changes

Changes in labor policies, particularly increases in minimum wage and new state-level mandates, directly influence the operating expenses for Middleby's restaurant and foodservice clientele. For instance, in 2024, several states continued to implement phased minimum wage hikes, with some reaching or exceeding $15 per hour, adding significant pressure on businesses.

These escalating labor costs are a key driver for operators to seek out automation and efficiency-boosting equipment. Middleby, as a provider of such solutions, benefits as businesses invest in technology to mitigate rising personnel expenses and maintain profitability.

- Minimum Wage Increases: Many US states and cities have seen minimum wage rates climb, with projections indicating continued upward pressure through 2025, impacting labor-intensive industries.

- Automation Demand: Rising labor costs, estimated to add billions in operational expenses annually for the US restaurant sector, directly correlate with increased demand for labor-saving equipment.

- Regulatory Compliance: New labor regulations, beyond wages, such as scheduling laws or paid sick leave mandates, can further complicate operations and encourage investment in technological solutions.

Government incentives for energy efficiency, such as the Inflation Reduction Act of 2022, directly boost demand for Middleby's eco-friendly kitchen equipment, aligning with their product development in sustainable solutions.

Geopolitical instability and trade policies, including tariffs on components, can disrupt supply chains and increase manufacturing costs for Middleby, impacting international operations and currency exchange rates throughout 2024.

Stringent food safety regulations, like those from the FDA, necessitate continuous innovation in Middleby's equipment, driving the development of features such as advanced self-cleaning mechanisms and antimicrobial surfaces to meet hygiene standards.

Rising labor costs and minimum wage increases, with projections for continued hikes through 2025, encourage Middleby's clients in the foodservice industry to invest in automation and labor-saving equipment.

What is included in the product

This Middleby PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear framework for understanding external factors impacting Middleby's strategy.

Economic factors

The global economic outlook for 2024 and 2025 is a critical factor for Middleby. While the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight increase from 2023, this growth rate is still moderate. Consumer spending, a key driver for Middleby's markets, is influenced by inflation and interest rates. For instance, in the US, consumer spending saw a notable increase in early 2024, but the pace may moderate as higher borrowing costs continue to affect household budgets.

In the commercial foodservice sector, projected growth continues, with some analysts anticipating a compound annual growth rate (CAGR) of over 4% through 2027. However, shifts in consumer behavior, such as a greater emphasis on value-for-money options and a sustained preference for takeout and delivery, directly impact the types of kitchen equipment in demand. This means Middleby needs to adapt its offerings to cater to these evolving spending patterns.

Rising food and labor costs present a significant hurdle for Middleby's commercial clients. These increased expenses directly affect their profitability and, consequently, their ability to invest in new, advanced kitchen equipment. For instance, the U.S. Producer Price Index for food services and drinking places saw a 3.9% increase year-over-year as of April 2024, highlighting persistent cost pressures.

While inflation has shown signs of easing, it continues to squeeze restaurant margins. This environment compels operators to prioritize solutions that enhance efficiency and drive down operational expenses. In response, demand for Middleby's energy-efficient and labor-saving technologies is likely to remain robust as businesses seek to mitigate these ongoing cost pressures.

Fluctuations in interest rates directly impact Middleby's borrowing costs and influence the capital expenditure decisions of its clientele. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% as seen in early 2024, and subsequently raises it, this can increase the cost of capital for Middleby's customers.

Higher interest rates can make financing new equipment purchases more expensive for businesses, potentially leading to a slowdown in sales within Middleby's commercial and food processing segments. This is particularly relevant as many of Middleby's customers rely on financing to acquire new ovens, refrigeration units, and other essential kitchen and processing equipment.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant factor for Middleby, a global manufacturer. Fluctuations in foreign exchange rates can directly influence the reported revenues and costs associated with its international operations. For instance, a stronger U.S. Dollar can reduce the value of earnings generated in foreign currencies when translated back, potentially impacting gross profit and net sales. Conversely, a weaker U.S. Dollar can have the opposite effect.

In 2023, Middleby generated approximately 65% of its net sales from international operations, highlighting its substantial exposure to currency movements. The company's financial statements often include disclosures detailing the impact of foreign currency translation on its results. For example, in its Q3 2023 earnings report, Middleby noted that unfavorable foreign currency movements had a modest negative impact on its reported sales for the period.

- Global Reach: Over 65% of Middleby's net sales in 2023 originated from international markets, making currency fluctuations a key consideration.

- Impact on Profitability: Changes in exchange rates can lead to either an increase or decrease in reported gross profit and net sales when international earnings are converted to U.S. Dollars.

- Translation Risk: A stronger U.S. Dollar generally reduces the reported value of foreign currency-denominated revenues and profits.

- Strategic Hedging: Companies like Middleby may employ financial instruments to hedge against adverse currency movements, though the effectiveness can vary.

Residential Market Conditions

The residential kitchen appliance market is closely tied to the health of the housing sector. Factors like new home construction, existing home sales, and consumer confidence in their personal finances all play a significant role. When people are buying new homes or feel financially secure, they're more likely to invest in kitchen upgrades.

For 2024, the residential appliance market experienced some slowdowns. However, looking ahead, there's a clear trend emerging. Homeowners undertaking renovations are increasingly seeking out higher-end, technologically advanced, and energy-saving appliances. This shift indicates a potential rebound for the segment as consumers prioritize quality and features in their home improvement projects.

- Housing Market Influence: Residential appliance sales are directly impacted by new home builds and existing home sales trends.

- Disposable Income Matters: Consumer spending on appliances is sensitive to changes in disposable income and overall economic confidence.

- Renovation Demand Shift: A growing demand for premium, smart, and energy-efficient appliances is noted in home renovation projects.

- 2024 Market Conditions: The residential kitchen appliance segment faced depressed market conditions during 2024, with expectations for recovery.

Economic factors significantly shape Middleby's operating environment. Global economic growth, while projected to be moderate at around 3.2% for 2024 according to the IMF, directly influences consumer and commercial spending. Persistent inflation and elevated interest rates, with the US federal funds rate range holding at 5.25%-5.50% in early 2024, continue to pressure Middleby's clients' profitability and capital expenditure decisions. This economic climate drives demand for Middleby's efficiency-focused solutions, while currency volatility, with over 65% of 2023 net sales from international markets, adds another layer of financial complexity.

| Economic Factor | Impact on Middleby | Data Point/Trend |

|---|---|---|

| Global Economic Growth | Influences demand for commercial and residential products. | IMF projected 3.2% global growth for 2024. |

| Inflation & Interest Rates | Affects client investment capacity and Middleby's borrowing costs. | US Federal Funds Rate range: 5.25%-5.50% (early 2024). |

| Consumer Spending | Key driver for residential appliance and foodservice equipment sales. | Moderate growth in US consumer spending in early 2024, with potential moderation due to borrowing costs. |

| Cost Pressures for Clients | Drives demand for efficiency-enhancing equipment. | U.S. Producer Price Index for food services and drinking places up 3.9% year-over-year (April 2024). |

| Currency Exchange Rates | Impacts reported international revenues and costs. | Over 65% of Middleby's 2023 net sales were international. |

What You See Is What You Get

Middleby PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Middleby PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. You'll get a detailed overview of each element, providing valuable strategic insights.

Sociological factors

Consumer tastes are changing, with a notable surge in demand for convenient takeout and delivery options. This trend, amplified by the pandemic, saw the global food delivery market reach an estimated $154.5 billion in 2023, projected to grow further. Operators are thus seeking equipment that supports efficient preparation and packaging for off-premise dining.

There's also a growing appetite for healthier food choices and unique, niche cuisines. This shift means restaurants need versatile equipment capable of handling a wider variety of ingredients and cooking methods, from plant-based alternatives to globally inspired dishes. For instance, the market for plant-based foods is expanding rapidly, with projections indicating continued strong growth through 2025.

Consumers and businesses are increasingly prioritizing health, food safety, and hygiene. This shift directly impacts commercial kitchen equipment, pushing manufacturers to innovate. For instance, the demand for self-cleaning appliances and touchless technology is on the rise, reflecting a desire for reduced human contact and easier sanitation.

This health-conscious movement also fuels interest in equipment that facilitates healthier cooking methods, such as steaming or air frying, over traditional frying. As of early 2024, surveys indicated that over 60% of consumers are actively seeking healthier food options, a trend that directly translates to demand for specialized kitchen equipment.

Modern lifestyles, marked by increasing urbanization and a strong demand for convenience, are significantly shaping both commercial and residential kitchen appliance markets. Busy schedules often lead consumers to seek quick meal solutions, influencing the types of appliances they purchase.

Simultaneously, there's a noticeable resurgence in home cooking, fueling a demand for sophisticated, time-saving, and energy-efficient kitchen equipment. For instance, in 2024, the global smart kitchen appliance market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, indicating a strong consumer appetite for advanced residential cooking solutions.

Labor Shortages in Foodservice

Persistent labor shortages and high employee turnover continue to plague the foodservice sector. For instance, in 2024, the National Restaurant Association reported that 87% of restaurant operators experienced staffing challenges, a figure that remained stubbornly high. This environment directly drives demand for equipment that can automate tasks and improve operational efficiency.

Middleby's product portfolio, featuring AI-powered cooking systems and robotic solutions, directly addresses these labor-related pressures. These technologies are crucial for restaurant operators looking to maintain service quality and control labor costs amidst a tight labor market.

- Labor Shortages: 87% of US restaurant operators faced staffing difficulties in 2024, as per the National Restaurant Association.

- Turnover Impact: High turnover necessitates investments in equipment that can onboard and train staff more quickly or reduce the need for extensive training.

- Automation Demand: The need for efficiency and reduced reliance on manual labor is a key driver for Middleby's automated and AI-driven equipment sales.

Demand for Sustainable and Ethical Practices

Consumers and businesses are increasingly making purchasing decisions based on sustainability and ethical considerations, which directly impacts the demand for eco-friendly equipment and waste-reducing solutions. This societal shift is a significant driver for companies like Middleby to invest in innovation, focusing on areas such as energy-efficient appliances and advanced food waste management systems.

This growing consumer consciousness is reflected in market trends. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products from sustainable brands. This translates into a clear market signal for the commercial kitchen equipment industry, pushing for greener manufacturing processes and product lifecycles.

- Growing Consumer Demand: A significant portion of consumers, often exceeding 60% in recent surveys, express a willingness to pay a premium for sustainable products.

- Regulatory Push: Governments worldwide are implementing stricter environmental regulations, incentivizing businesses to adopt energy-efficient and waste-reducing technologies.

- Corporate Social Responsibility (CSR): Many corporations are setting ambitious sustainability targets, influencing their procurement decisions towards suppliers with strong environmental, social, and governance (ESG) credentials.

- Innovation in Eco-Friendly Tech: The market is seeing increased investment and development in areas like low-emission cooking equipment and smart waste sorting systems, driven by this demand.

Societal shifts are profoundly influencing the foodservice industry, with consumers increasingly prioritizing health and convenience. This translates to a demand for equipment that supports faster preparation and healthier cooking methods, as seen in the booming plant-based food market, which continues its strong growth trajectory through 2025.

Labor shortages remain a critical concern, with 87% of US restaurant operators reporting staffing challenges in 2024. This persistent issue drives demand for automation and AI-powered solutions, areas where Middleby's innovative product lines offer significant advantages for operators seeking efficiency and cost control.

Sustainability is also a major factor, with over 60% of consumers willing to pay more for eco-friendly products. This trend compels manufacturers like Middleby to focus on energy-efficient appliances and waste-reduction technologies, aligning with both consumer values and increasing environmental regulations.

Technological factors

The increasing integration of smart kitchen technology and the Internet of Things (IoT) is a significant technological factor. This allows for remote monitoring and real-time data tracking of appliances, which is crucial for optimizing performance and reducing operational disruptions.

For example, predictive maintenance, enabled by IoT sensors, can significantly cut down on equipment downtime. This translates to enhanced efficiency and cost savings for Middleby's diverse customer base, from high-volume commercial kitchens to individual home users.

Advancements in automation and robotics are significantly reshaping food preparation, offering solutions to persistent labor shortages and enhancing operational efficiency. Middleby is actively demonstrating its commitment to this trend with innovations like digital robotic kitchens and automated cooking systems, directly addressing the industry's increasing need for reduced manual labor. This focus is crucial as the food service sector grapples with a projected 10% labor shortage in the US by 2025, according to industry reports.

Middleby's focus on energy efficiency is paramount, with continuous innovation in appliance design driving customer value. This includes advancements like ENERGY STAR® certified products, induction cooking technologies, and improved insulation, all contributing to lower energy consumption.

These technological advancements directly translate to reduced operating costs for Middleby's customers. For instance, ENERGY STAR certified commercial cooking equipment can offer significant energy savings, with some models reporting up to 20% less energy usage compared to standard models, helping clients meet their sustainability targets and gain a competitive market advantage.

Advanced Connectivity and Data Analytics

The increasing integration of Wi-Fi, Bluetooth, and cloud-based monitoring into commercial kitchen appliances is revolutionizing operational efficiency. This advanced connectivity allows for real-time data analytics, providing businesses with deeper insights into appliance performance and usage patterns. For instance, by 2025, it's projected that over 70% of new commercial kitchen equipment will feature some form of smart connectivity, up from an estimated 45% in 2023.

These smart systems are instrumental in optimizing energy consumption, a key concern for cost-conscious operators. They also enable precise inventory tracking and facilitate predictive maintenance, which significantly reduces downtime and waste. A study by the Commercial Food Equipment Service Association in late 2024 indicated that businesses utilizing predictive maintenance saw a 15% reduction in unexpected equipment failures compared to those relying on traditional schedules.

- Enhanced Operational Insights: Cloud platforms aggregate data from connected appliances, offering detailed analytics on usage, performance, and energy consumption.

- Remote Management Capabilities: Operators can monitor and control equipment remotely, adjusting settings and troubleshooting issues without being on-site.

- Predictive Maintenance: By analyzing performance data, systems can flag potential issues before they lead to breakdowns, minimizing costly interruptions.

- Energy Optimization: Smart appliances can automatically adjust power usage based on demand and operational schedules, leading to significant energy savings.

Modular and Multi-functional Equipment Design

Technological progress is driving the creation of modular and multi-functional kitchen equipment. This innovation is crucial for businesses needing to maximize limited space, such as in ghost kitchens or smaller commercial settings. These adaptable solutions allow for greater versatility in catering to changing menu demands and kitchen configurations.

The demand for space-efficient and flexible equipment is growing. For example, the global ghost kitchen market was valued at approximately $44.6 billion in 2023 and is projected to reach $77.3 billion by 2028, highlighting the need for adaptable kitchen designs. Middleby's focus on such equipment allows operators to efficiently utilize their square footage.

- Space Optimization: Modular designs allow for compact and efficient kitchen layouts, ideal for smaller operational footprints.

- Menu Adaptability: Multi-functional equipment enables quick transitions between different cooking styles and menu items, enhancing operational agility.

- Cost-Effectiveness: Combining multiple functions into single units can reduce the need for specialized equipment, leading to lower capital expenditure.

- Operational Efficiency: Streamlined workflows and reduced equipment footprint contribute to improved overall kitchen productivity.

Technological advancements are central to Middleby's strategy, particularly in smart kitchen integration and IoT. These innovations enable remote monitoring and data analytics, crucial for optimizing performance and reducing downtime. By 2025, it's estimated that over 70% of new commercial kitchen equipment will feature smart connectivity, a significant jump from approximately 45% in 2023.

Automation and robotics are also key, addressing labor shortages and boosting efficiency. Middleby's development of digital robotic kitchens exemplifies this trend, vital as the food service sector faces projected labor shortages. Furthermore, the company's commitment to energy efficiency, seen in ENERGY STAR certified products and induction technology, directly lowers operating costs for clients, with some commercial equipment showing up to 20% less energy usage.

| Technology Area | Impact on Middleby Customers | 2024/2025 Data/Projections |

|---|---|---|

| Smart Kitchen/IoT Integration | Remote monitoring, real-time data analytics, predictive maintenance | 70%+ new commercial equipment to feature smart connectivity by 2025 |

| Automation & Robotics | Addressing labor shortages, enhancing operational efficiency | Projected 10% labor shortage in US food service by 2025 |

| Energy Efficiency | Reduced operating costs, improved sustainability | ENERGY STAR certified equipment can offer up to 20% energy savings |

Legal factors

Middleby's product safety and certification are paramount for global market access. For instance, in 2024, achieving certifications like UL for electrical safety and NSF for food equipment sanitation remains critical for their commercial kitchen appliances. Failure to meet these evolving standards, such as updated energy efficiency requirements in Europe impacting CE marking, could lead to significant delays in product launches and market penetration.

Environmental regulations are a significant factor for Middleby. Evolving rules around energy use, emissions, and waste management directly influence how they manufacture products and what features those products need. For instance, the growing demand for energy-efficient commercial kitchens means Middleby must innovate to meet these evolving standards.

Compliance with stricter energy efficiency mandates and carbon emission reporting is becoming a key consideration for their customers, particularly in the commercial building sector. This trend, which is accelerating in 2024 and projected to intensify through 2025, pushes for products that not only perform well but also minimize environmental impact, potentially influencing Middleby's research and development investments.

Intellectual property laws are paramount for Middleby, safeguarding its innovations. Patents protect its cutting-edge smart kitchen technologies and automation solutions, while trademarks secure the value of its diverse brand portfolio. In 2023, companies globally spent an estimated $200 billion on patent filings, highlighting the importance of this legal protection for competitive advantage.

Labor Laws and Workplace Safety

Middleby's manufacturing operations, particularly those involving heavy machinery and food preparation equipment, are significantly impacted by labor laws and workplace safety regulations. Compliance with these mandates, such as those outlined by the Occupational Safety and Health Administration (OSHA) in the United States, is crucial. For instance, OSHA's general industry standards require employers to provide a safe working environment, with specific rules for machine guarding and hazard communication. In 2023, there were 2.8 workplace fatalities per 100,000 full-time workers in the private sector, highlighting the ongoing importance of robust safety protocols.

Adherence to labor laws, including minimum wage requirements and working conditions, directly influences Middleby's operational costs and its ability to attract and retain a skilled workforce. As of January 2024, the U.S. federal minimum wage remains $7.25 per hour, but many states and cities have enacted significantly higher rates, impacting labor expenses for companies with diverse operational footprints. Failure to comply can result in substantial fines and legal challenges, jeopardizing the company's financial stability and reputation.

- OSHA fines can range from thousands to hundreds of thousands of dollars for serious or willful violations.

- Minimum wage increases in various U.S. states and cities can directly affect Middleby's labor costs in those regions.

- Workplace safety training and equipment are essential investments to mitigate risks and ensure compliance.

- Non-compliance with labor laws can lead to costly lawsuits and damage to Middleby's brand image.

Antitrust and Competition Laws

Middleby's growth strategy, particularly through strategic acquisitions like those in its Food Processing segment, is inherently subject to antitrust and competition laws across its global operating regions. These regulations are designed to prevent the formation of monopolies and ensure a level playing field for all market participants. For instance, in 2023, the Federal Trade Commission (FTC) in the US continued its robust enforcement of merger guidelines, scrutinizing transactions that could substantially lessen competition. Middleby must navigate these legal frameworks, which often involve detailed reviews of market share and potential impacts on consumer choice and pricing.

The company's compliance efforts are critical, as violations can lead to significant penalties, divestitures, or even the blocking of proposed mergers. This legal landscape requires Middleby to proactively assess the competitive implications of its M&A activities. For example, a significant acquisition in the commercial kitchen equipment sector in Europe might trigger review by the European Commission, which has a history of blocking deals deemed anti-competitive. Staying abreast of evolving regulatory interpretations and enforcement trends is therefore a key operational imperative for Middleby.

- Antitrust Scrutiny: Middleby's acquisition strategy, especially in consolidating sectors like food processing equipment, faces rigorous antitrust reviews globally.

- Market Dominance Prevention: Laws aim to prevent any single company from gaining excessive market power, ensuring fair competition and consumer benefits.

- Regulatory Compliance Costs: Navigating these regulations involves legal counsel, due diligence, and potentially significant compliance investments to ensure adherence.

- Global Enforcement Trends: Regulatory bodies like the FTC and European Commission are actively monitoring and enforcing competition laws, impacting merger approvals.

Middleby's global operations are shaped by a complex web of legal and regulatory frameworks. Product safety and certification, such as UL and NSF standards, are crucial for market access in 2024, with evolving energy efficiency mandates in Europe impacting CE marking. Intellectual property laws, including patents for smart kitchen technologies and trademarks for its brands, are vital for maintaining competitive advantage, with global patent filings estimated at $200 billion in 2023.

Environmental factors

Growing environmental awareness and escalating energy expenses are fueling a significant demand for commercial and residential kitchen appliances that are highly energy-efficient. This trend directly impacts manufacturers like Middleby, pushing them to innovate in ways that reduce operational costs for their customers.

Middleby is actively responding to this market pressure by prioritizing the development and promotion of ENERGY STAR certified appliances. Their investment in induction cooking technology, which is demonstrably more energy-efficient than traditional methods, directly targets this growing customer need. For instance, ENERGY STAR certified commercial cooking equipment can reduce energy consumption by up to 50% compared to standard models, translating to substantial savings for businesses.

The growing global focus on sustainability is significantly impacting the food service industry, with waste reduction, especially food waste, at the forefront. This trend directly influences demand for equipment and systems designed to minimize waste at its source and manage unavoidable waste effectively. For instance, the UN Environment Programme reported in 2024 that an estimated 1 billion meals are wasted daily worldwide, highlighting the urgency for solutions.

Companies like Middleby are seeing increased interest in technologies that address this challenge. Biodigesters, which convert organic waste into biogas and fertilizer, are gaining traction in commercial kitchens. Furthermore, advanced inventory management software and smart kitchen appliances that optimize ingredient usage are becoming essential tools for businesses aiming to cut down on spoilage and disposal costs.

The growing demand for environmental responsibility is pushing manufacturers like Middleby to adopt sustainable materials and embrace circular economy principles. This means re-evaluating everything from the sourcing of raw components to how products are designed for longevity and eventual recycling. For instance, the global market for sustainable building materials, a sector that often influences appliance manufacturing, was projected to reach $375 billion by 2027, indicating a significant shift in industry expectations.

Middleby faces the challenge of integrating these practices by exploring eco-friendly materials, designing equipment for extended use, and ensuring their products can be easily taken apart and recycled at the end of their operational life. This not only addresses regulatory pressures but also appeals to a growing consumer base that prioritizes environmental impact in their purchasing decisions. By 2025, it's estimated that over 70% of consumers will consider sustainability when making purchasing choices, a trend that directly impacts B2B relationships in the food service equipment sector.

Carbon Emissions and Climate Change Initiatives

Regulations targeting carbon emissions are increasingly influencing manufacturing operations and the energy efficiency of equipment. For instance, by 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began imposing costs on carbon-intensive imports, pushing industries towards lower-emission production methods. This regulatory shift directly impacts companies like Middleby, which must adapt their manufacturing processes and product designs to meet evolving environmental standards and customer demands for reduced carbon footprints.

Middleby actively addresses these environmental factors by focusing on developing products that contribute to lower greenhouse gas emissions. Their innovation in energy-efficient commercial kitchen equipment, for example, helps their customers reduce their operational carbon output. This proactive approach aligns with both customer sustainability goals and Middleby's own corporate responsibility initiatives, potentially leading to competitive advantages in a market increasingly prioritizing eco-friendly solutions.

- Regulatory Pressure: Growing global regulations, such as the EU's CBAM, are creating financial incentives for industries to decarbonize, impacting manufacturing costs and supply chains.

- Customer Demand: End-users are increasingly seeking equipment that lowers their operational carbon emissions, driving demand for energy-efficient and sustainable product offerings.

- Middleby's Response: The company is investing in R&D for products that reduce greenhouse gas emissions, aiming to support both customer sustainability targets and its own environmental objectives.

Water Conservation Requirements

Increasing concerns about water scarcity are leading to stricter regulations and a growing preference for water-saving appliances. Middleby's focus on developing innovative kitchen systems that significantly reduce water consumption empowers its customers to conserve vital resources and meet evolving environmental mandates.

For instance, the commercial food service industry, a key market for Middleby, is facing increasing pressure to adopt sustainable practices. Reports from 2024 indicate that water costs for businesses have risen, making water efficiency a direct cost-saving measure. Middleby's advanced dishwashers and warewashing systems, designed for optimal water and energy usage, directly address these operational challenges.

- Water Efficiency as a Competitive Advantage: Middleby's commitment to water conservation in product design provides a distinct advantage in a market increasingly prioritizing sustainability.

- Regulatory Compliance: Products designed with reduced water footprints help Middleby's clients adhere to local and international environmental regulations, avoiding potential penalties.

- Cost Savings for Customers: By minimizing water usage, Middleby's appliances contribute to lower utility bills for food service operators, enhancing their profitability.

- Market Demand for Green Solutions: Consumer and corporate demand for environmentally responsible products drives the need for appliances that offer both performance and ecological benefits.

Environmental factors are increasingly shaping the commercial kitchen appliance market, pushing companies like Middleby towards greater energy and water efficiency. Growing consumer and regulatory demand for sustainable operations means that eco-friendly product design is no longer optional but a key differentiator. By 2025, over 70% of consumers are expected to consider sustainability in their purchasing decisions, a trend that extends to business procurement.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Middleby is built on a robust foundation of data from leading global economic institutions, government regulatory bodies, and reputable industry-specific market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.