KakaoBank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KakaoBank Bundle

KakaoBank's strengths lie in its innovative digital platform and strong brand recognition, while its weaknesses include reliance on KakaoTalk integration. Opportunities abound in expanding financial services, but threats from intensifying competition and evolving regulations demand careful navigation.

Want the full story behind KakaoBank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

KakaoBank's digital-first approach, entirely mobile-based, offers unparalleled convenience for users. Its intuitive interface, enhanced by AI features, directly appeals to South Korea's digitally native population, fostering strong customer engagement. This seamless user experience, further amplified by its integration with KakaoTalk, has been a key driver of its rapid growth and market penetration.

KakaoBank's ability to attract and retain customers is a significant strength. By Q1 2025, the bank had amassed over 25.45 million users, showcasing remarkable customer acquisition. This large and expanding user base is crucial for introducing new financial products and services, driving future revenue streams.

The bank's success isn't just in numbers; it's also in how actively users engage. With notable increases in both monthly and weekly active users, KakaoBank demonstrates strong customer loyalty and consistent interaction. This high engagement across various age demographics highlights its broad market appeal and deep penetration.

KakaoBank demonstrated exceptional financial strength in 2024, reporting a record net profit of 440.1 billion won, a significant 24% increase from the previous year. This upward trend continued into the first quarter of 2025, with operating profit surging by 23%, underscoring the bank's sustained profitability and efficient operations.

Diversified Revenue Streams (Non-Interest Income)

KakaoBank's diversification into non-interest income is a significant strength, reducing reliance on traditional lending. This segment, encompassing fees, platform services, and financial investments, experienced a robust 25.6% growth in 2024. It now represents a substantial 30% of the bank's total operating revenue, fueled by the success of offerings like loan comparison and investment platforms.

The bank's strategic focus is to elevate this non-interest income contribution to over 40% in the coming years. This ambitious target underscores a commitment to building a more resilient and diversified financial model, moving beyond the volatility often associated with interest-rate sensitive businesses.

- Growing Non-Interest Income: A key strength is the increasing revenue from fees, platform businesses, and financial investment assets.

- 2024 Performance: This segment grew by 25.6% in 2024, contributing 30% to total operating revenue.

- Drivers of Growth: Services like loan comparison and investment platforms are key contributors to this non-interest income.

- Future Strategy: KakaoBank aims to increase non-interest income to over 40% of total revenue through further diversification.

Commitment to Financial Inclusion

KakaoBank's dedication to financial inclusion is a significant strength, actively serving mid-to-low credit borrowers. In 2024, a notable 32.4% of its loan portfolio was allocated to these segments, surpassing government targets and demonstrating a commitment to broader market access. This focus not only fulfills regulatory expectations for internet-only banks but also broadens KakaoBank's customer reach and enhances its social impact.

KakaoBank's digital-first, mobile-only platform offers exceptional convenience and a user-friendly experience, resonating strongly with South Korea's tech-savvy population. Its integration with KakaoTalk further enhances engagement and accessibility. By Q1 2025, the bank had secured over 25.45 million users, a testament to its rapid growth and market penetration. This expanding user base is a critical asset for introducing new financial products and driving future revenue.

The bank's financial performance in 2024 was robust, with net profit reaching 440.1 billion won, a 24% year-over-year increase. This momentum carried into Q1 2025, where operating profit saw a 23% surge, highlighting operational efficiency and sustained profitability. Diversification into non-interest income, including fees and platform services, grew by 25.6% in 2024, now accounting for 30% of total operating revenue, with a strategic aim to exceed 40% in the coming years.

| Metric | 2024 (or latest available) | Significance |

| Total Users | 25.45 million (Q1 2025) | Large customer base for cross-selling and growth |

| Net Profit | 440.1 billion won (2024) | Demonstrates strong profitability and financial health |

| Non-Interest Income Growth | 25.6% (2024) | Reduces reliance on interest income, enhances revenue stability |

| Non-Interest Income Contribution | 30% of total operating revenue (2024) | Shows successful diversification strategy |

| Loan Portfolio to Mid-Low Credit Borrowers | 32.4% (2024) | Commitment to financial inclusion and broader market reach |

What is included in the product

Delivers a strategic overview of KakaoBank’s internal and external business factors, analyzing its strengths like brand recognition and market share against weaknesses such as reliance on KakaoTalk and opportunities in expanding financial services, while also considering threats from competition and regulatory changes.

Provides a clear, actionable framework for addressing KakaoBank's competitive challenges and leveraging its digital strengths.

Weaknesses

KakaoBank's significant concentration within South Korea, while fostering a strong local foothold, presents a notable weakness. This deep reliance on a single market exposes the company to substantial risks stemming from localized economic fluctuations, evolving domestic regulations, and fierce competition within its primary operating region.

This lack of geographic diversification inherently curtails KakaoBank's potential for broader long-term expansion when contrasted with international financial entities. For instance, as of Q1 2024, KakaoBank reported that over 99% of its customer base and loan portfolio remained within South Korea, highlighting this concentrated risk.

KakaoBank's delinquency rate, a key indicator of loan health, saw a slight increase, reaching 0.52% by the fourth quarter of 2024. While this figure remains comparatively low, the upward trend in non-performing loans signals a potential vulnerability.

This rise is particularly concerning given the prevailing economic uncertainties and the growing burden of household debt within South Korea. Such conditions could negatively impact the bank's asset quality and, consequently, its profitability.

To counter this emerging weakness, KakaoBank must maintain vigilant oversight and implement strong risk management practices. Proactive measures are essential to effectively mitigate the potential risks associated with an increasing delinquency rate.

KakaoBank, despite its strong market presence, navigates a fiercely competitive environment. Traditional banks like KB Kookmin and Shinhan are aggressively bolstering their digital capabilities, directly challenging KakaoBank's online dominance. Furthermore, fellow internet-only banks, such as K Bank and Toss Bank, are also vying for market share, intensifying the pressure.

Regulatory Scrutiny on Parent Company

The broader Kakao ecosystem, including its parent company, has faced heightened regulatory scrutiny. This has resulted in investigations and fines for various subsidiaries, creating a potential ripple effect. While KakaoBank's core banking operations might remain insulated, these broader group issues could tarnish the overall reputation and investor confidence in the Kakao brand. This could translate into more cautious public perception and potentially lead to more stringent oversight for KakaoBank itself.

Limited Physical Presence

KakaoBank's primary weakness stems from its nature as an internet-only bank, meaning it has no physical branches. This digital-first approach, while cost-effective, can alienate customers who value face-to-face interactions, especially older demographics or those dealing with intricate financial matters or requiring assistance with disputes. In 2023, while KakaoBank's user base continued to grow, reports indicated that a segment of the population, particularly those less comfortable with digital platforms, still preferred traditional banking channels for certain services.

This lack of a physical presence could limit its market penetration among segments that prioritize in-person banking services. For instance, while KakaoBank saw its total customer accounts reach 23.4 million by the end of 2023, a portion of these users might still rely on other institutions for services requiring branch access. This limitation could hinder its ability to capture the entire market, particularly for complex wealth management or specialized lending products where direct consultation is often preferred.

KakaoBank's significant concentration within South Korea, while fostering a strong local foothold, presents a notable weakness. This deep reliance on a single market exposes the company to substantial risks stemming from localized economic fluctuations, evolving domestic regulations, and fierce competition within its primary operating region.

This lack of geographic diversification inherently curtails KakaoBank's potential for broader long-term expansion when contrasted with international financial entities. For instance, as of Q1 2024, KakaoBank reported that over 99% of its customer base and loan portfolio remained within South Korea, highlighting this concentrated risk.

KakaoBank's delinquency rate, a key indicator of loan health, saw a slight increase, reaching 0.52% by the fourth quarter of 2024. While this figure remains comparatively low, the upward trend in non-performing loans signals a potential vulnerability, especially given the growing burden of household debt in South Korea.

The absence of physical branches, a hallmark of its digital-first model, can alienate customers who prefer in-person interactions, particularly older demographics or those with complex financial needs. This limitation could hinder its ability to capture the entire market, especially for services where direct consultation is preferred.

| Weakness | Description | Relevant Data |

|---|---|---|

| Geographic Concentration | Over-reliance on the South Korean market. | Over 99% of customers and loans in South Korea (Q1 2024). |

| Rising Delinquency Rate | Increasing non-performing loans. | Delinquency rate reached 0.52% in Q4 2024. |

| Lack of Physical Branches | Potential alienation of customers preferring in-person banking. | While user base grew, some segments still prefer traditional channels. |

| Intense Competition | Competition from traditional banks and other internet-only banks. | KB Kookmin, Shinhan, K Bank, and Toss Bank are active competitors. |

Preview Before You Purchase

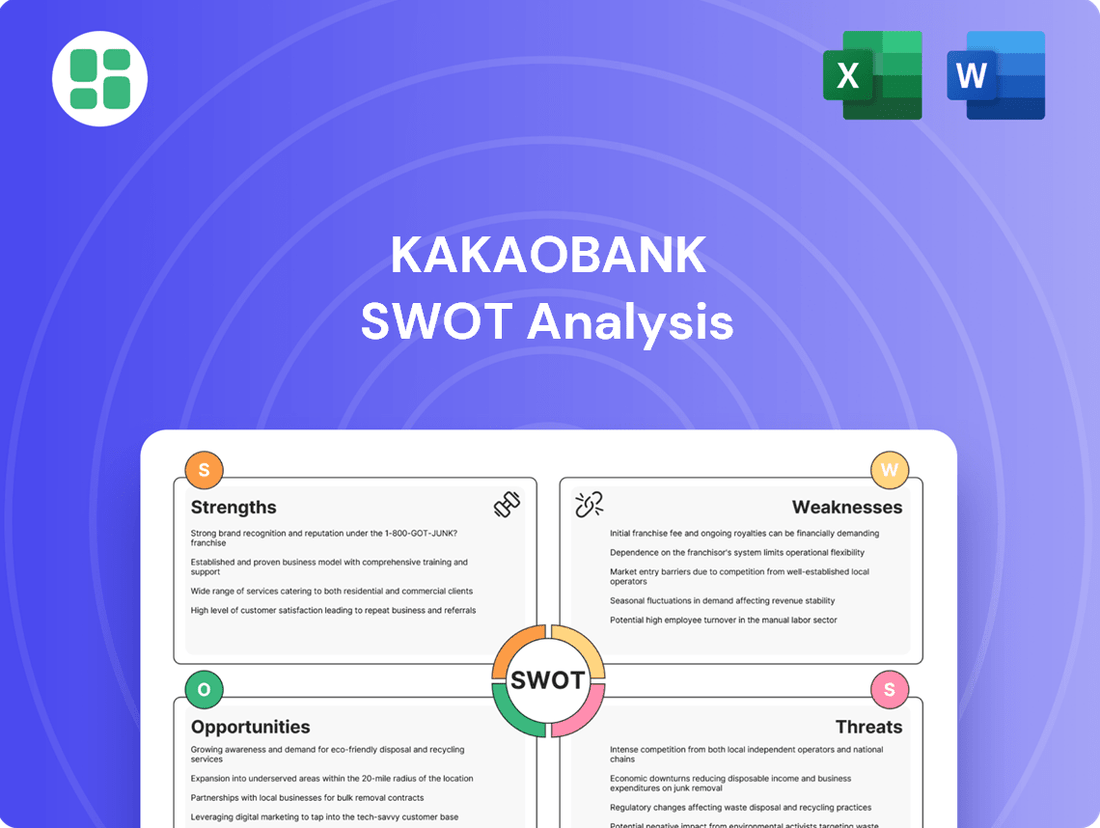

KakaoBank SWOT Analysis

This is the actual KakaoBank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of KakaoBank's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full KakaoBank SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic insights for this leading digital bank.

Opportunities

KakaoBank is well-positioned to expand its offerings beyond core banking. The company has signaled intentions to introduce an AI-driven financial calculator, a private label credit card tailored for business owners, and mobile identification services. These moves align with a broader strategy to diversify revenue and enhance customer engagement.

Further opportunities lie in venturing into wealth management and integrated investment platforms. By embedding financial services directly into other platforms, KakaoBank can tap into new markets and solidify existing customer loyalty. For instance, as of Q1 2024, KakaoBank's total assets reached 57.6 trillion KRW, demonstrating a strong foundation for such expansions.

KakaoBank is strategically expanding its reach into international markets. A significant move is its investment in Indonesia's Superbank, signaling a commitment to emerging digital banking landscapes. Furthermore, the bank is pursuing virtual bank licenses in Thailand, indicating a focused approach to establishing a presence in key Asian economies.

The bank's ambition to become a global leader in AI-powered banking presents a major growth avenue. By leveraging its proven digital expertise and customer-focused approach, KakaoBank aims to replicate its success in new geographical regions, potentially setting a new standard for digital financial services worldwide.

KakaoBank is making significant strides by investing in AI labs, aiming to refine its services and create a more personalized user journey. This strategic focus allows them to analyze extensive customer data, paving the way for bespoke financial products and predictive credit scoring.

By harnessing big data, KakaoBank can anticipate customer needs, offering tailored solutions that boost satisfaction and loyalty. For instance, their AI-driven credit assessment tools, continuously refined through data analysis, are expected to improve loan approval efficiency and risk management, a key differentiator in the competitive digital banking landscape.

Strategic Partnerships

Strategic partnerships offer significant growth potential for KakaoBank. Collaborating with other financial institutions and tech companies allows for the expansion of service offerings and customer reach. For instance, the planned partnership with Shinhan Card in 2025 for a Private Label Credit Card exemplifies this strategy.

These alliances enable KakaoBank to leverage complementary strengths, share valuable data insights, and expedite market penetration into new customer segments or product categories. Such collaborations are crucial for staying competitive in the rapidly evolving digital finance landscape.

- Expanded Service Portfolio: Partnerships can introduce new financial products and services, such as co-branded credit cards or integrated investment platforms.

- Enhanced Customer Acquisition: By tapping into the customer bases of partners, KakaoBank can significantly broaden its reach and acquire new users more efficiently.

- Technological Synergies: Collaborations with tech firms can accelerate the development and integration of cutting-edge technologies, improving user experience and operational efficiency.

- Data-Driven Insights: Sharing anonymized data with partners can unlock deeper customer understanding, leading to more personalized product offerings and targeted marketing campaigns.

Targeting Underserved Customer Segments

KakaoBank can continue to grow by focusing on financial inclusion, specifically by serving customers with mid-to-low credit scores. This approach taps into a significant market segment that traditional banks may overlook, fostering loyalty and expanding its reach.

The bank's 'value-up' plan also highlights an opportunity in attracting foreign customers. By developing and offering deposit products and services specifically designed for this demographic, KakaoBank can access a growing international user base in South Korea.

For instance, as of early 2024, South Korea's foreign resident population has been steadily increasing, presenting a fertile ground for tailored financial services. KakaoBank's commitment to innovation in product development for these segments is a key strategic advantage.

- Financial Inclusion: Continued focus on mid-to-low credit borrowers offers a stable growth avenue.

- Foreign Customer Focus: Tailored deposit products can attract a growing demographic.

- Market Expansion: Serving underserved segments diversifies revenue and customer base.

KakaoBank's strategic expansion into wealth management and integrated investment platforms presents a significant growth opportunity. By embedding financial services directly into other platforms, the bank can tap into new markets and solidify existing customer loyalty. As of Q1 2024, KakaoBank's total assets reached 57.6 trillion KRW, providing a robust foundation for these ventures.

The bank's international expansion, particularly its investment in Indonesia's Superbank and pursuit of virtual bank licenses in Thailand, signals a clear strategy to penetrate emerging digital banking landscapes. This global ambition is further supported by its aim to become a leader in AI-powered banking, leveraging its digital expertise to replicate success in new regions.

KakaoBank's focus on financial inclusion, by serving customers with mid-to-low credit scores, taps into a substantial market segment. Additionally, tailoring deposit products for the growing foreign resident population in South Korea, which has seen a steady increase as of early 2024, offers another avenue for market expansion and revenue diversification.

Threats

The South Korean banking landscape is fiercely competitive. Traditional banks are aggressively enhancing their digital offerings, while agile fintech rivals like Toss Bank and K Bank are actively gaining traction and customer share.

The entry of major tech giants into financial services presents a significant challenge. These players possess vast customer bases and advanced technological capabilities, potentially impacting KakaoBank's market position and customer loyalty.

As of early 2024, Toss Bank reported over 10 million cumulative users, highlighting the rapid growth of digital-first competitors. This underscores the need for KakaoBank to continuously innovate to maintain its competitive edge.

Digital banks like KakaoBank navigate a constantly shifting regulatory terrain. New rules concerning data privacy, cybersecurity, and overall financial stability are always a possibility. For instance, in late 2024, several jurisdictions were actively discussing enhanced data protection laws that could impact how digital banks handle customer information, potentially increasing compliance burdens.

Increased government mandates for robust cybersecurity or adjustments to financial inclusion goals could lead to higher operational costs or necessitate changes to existing business models. For example, a hypothetical mandate in 2025 requiring all digital financial institutions to adopt a new, more stringent multi-factor authentication protocol could add significant development and implementation expenses.

Furthermore, any regulatory challenges encountered by Kakao Corporation, KakaoBank's parent company, could indirectly affect the digital bank's operations and reputation. This interconnectedness means that broader corporate governance or compliance issues within the parent entity can create ripple effects, impacting investor confidence and operational flexibility for KakaoBank itself.

A general economic slowdown in South Korea presents a considerable threat to KakaoBank. This is exacerbated by rising household debt levels, which reached approximately 105.3% of GDP in Q1 2024, according to Bank for International Settlements data. Tighter lending standards, a natural consequence of economic uncertainty, could directly impact KakaoBank's ability to grow its loan portfolio.

The broader banking sector is experiencing an increase in at-risk loans, and KakaoBank is not immune. Its delinquency rate, while still manageable, has shown an upward trend, mirroring this industry-wide concern. This suggests a heightened potential for credit losses, which could significantly dent profitability, especially if economic conditions worsen through 2024 and into 2025.

Cybersecurity Risks & Data Privacy Concerns

KakaoBank, as an internet-only bank, faces significant cybersecurity risks due to its handling of extensive sensitive financial data. A major security breach could erode customer confidence, result in considerable financial damages, and incur substantial regulatory penalties, directly challenging its digital-centric operational model.

The threat landscape is constantly evolving, with cybercriminals employing increasingly sophisticated methods. For instance, in 2023, global financial institutions reported a significant uptick in ransomware attacks, with average recovery costs soaring. KakaoBank's reliance on digital infrastructure makes it a prime target.

- Data Breach Impact: A breach could lead to identity theft and financial fraud for millions of customers.

- Reputational Damage: Loss of trust is a critical threat, as customers may migrate to more secure alternatives.

- Regulatory Fines: South Korean financial regulators impose strict penalties for data privacy violations, potentially impacting profitability.

- Operational Disruption: Cyberattacks can halt essential banking services, leading to immediate financial losses and customer dissatisfaction.

Rapid Technological Disruptions

The fintech landscape is evolving at an unprecedented speed, posing a significant threat. New technologies, innovative business models, or agile startups can quickly emerge, potentially making KakaoBank's current offerings or technological infrastructure outdated. For instance, the rise of embedded finance, allowing financial services to be integrated directly into non-financial platforms, could shift customer interaction away from traditional banking apps.

To counter this, KakaoBank needs sustained investment in research and development to stay ahead. The global fintech market was projected to reach over $300 billion in 2024, highlighting the intense competition and rapid innovation. Staying at the forefront of digital banking requires constant adaptation and foresight.

Key areas of concern include:

- Emergence of new disruptive technologies: Advancements in AI, blockchain, and quantum computing could fundamentally alter banking operations and customer expectations.

- Agile fintech startups: Smaller, more nimble competitors can often adopt new technologies and business models faster, capturing market share.

- Shifting customer preferences: As technology advances, customer demand for seamless, personalized, and integrated digital financial experiences will continue to grow, pressuring existing providers to keep pace.

The intense competition from both traditional banks upgrading their digital services and rapidly growing fintech rivals like Toss Bank, which surpassed 10 million users by early 2024, poses a significant threat. Furthermore, the potential for new regulatory mandates concerning cybersecurity or data privacy, which could increase compliance costs, adds to operational challenges. KakaoBank also faces the risk of its technological infrastructure becoming obsolete due to the swift evolution of fintech, as evidenced by the growing trend of embedded finance.

SWOT Analysis Data Sources

This KakaoBank SWOT analysis is built upon a robust foundation of reliable data, including KakaoBank's official financial statements, comprehensive market research reports, and insights from industry experts. These sources ensure a thorough understanding of the company's current standing and future potential.