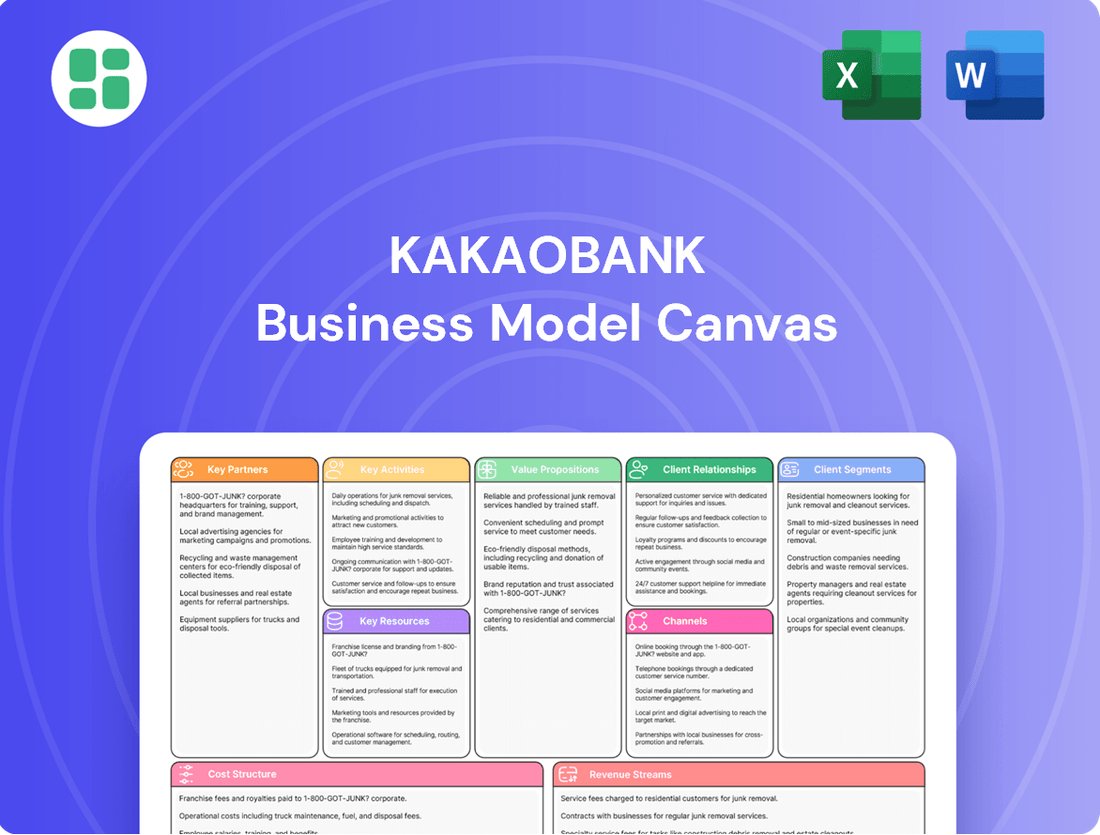

KakaoBank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KakaoBank Bundle

Uncover the strategic genius behind KakaoBank's disruptive success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and cost structure, offering a clear roadmap for innovation. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

KakaoBank's key partnership with Kakao Corp, the powerhouse behind the KakaoTalk messaging app, is foundational. This integration allows banking services to be directly embedded within the ubiquitous messaging platform, reaching millions of users instantly. For example, as of early 2024, KakaoTalk boasts over 45 million monthly active users in South Korea, providing KakaoBank with an unparalleled distribution channel.

This deep integration streamlines user onboarding and access, leveraging KakaoTalk's established digital identity and trust. It significantly reduces friction for new customers, making it easier than ever to open accounts and utilize banking features. The synergy extends across the broader Kakao ecosystem, enabling cross-promotional opportunities and enhancing the overall digital lifestyle experience for users.

KakaoBank actively partners with technology and fintech firms to boost its digital services and create novel financial offerings. These collaborations are key to staying ahead in the fast-paced digital banking landscape.

A prime example is their work with AI providers, leading to innovations like an AI-driven financial calculator and advanced smishing detection, significantly improving user experience and security. In 2023, KakaoBank reported a net profit of 260 billion KRW, a substantial increase from the previous year, partly fueled by these technological advancements.

Furthermore, leveraging data center infrastructure for high-performance computing allows KakaoBank to efficiently process vast amounts of data, enabling more sophisticated analytics and personalized services for its growing customer base.

KakaoBank collaborates with numerous traditional financial institutions, enabling users to compare and secure loans directly via its app. This strategic alliance significantly boosts loan transaction volumes on its platform.

By facilitating these comparisons, KakaoBank enhances its platform revenue streams and expands its service portfolio without the need to underwrite every loan itself. This model proved particularly effective in 2024, with KakaoBank reporting a substantial increase in its loan comparison service usage.

Global Expansion Partnerships

KakaoBank's global expansion strategy hinges on key partnerships with established local financial institutions. These alliances are crucial for navigating diverse regulatory environments and gaining market access. For instance, their collaboration with SCBX Public Company Limited in Thailand and Superbank in Indonesia exemplifies this approach, aiming to leverage local expertise and infrastructure to replicate their domestic success.

These partnerships are not merely about market entry; they are designed to accelerate growth and build a sustainable presence. By joining forces with entities that understand local consumer behaviors and financial ecosystems, KakaoBank can more effectively tailor its digital banking solutions. This collaborative model allows for a quicker adaptation to market-specific needs, a vital component for international success.

- Strategic Alliances: KakaoBank partners with local financial groups like SCBX Public Company Limited in Thailand and Superbank in Indonesia for international expansion.

- Regulatory Navigation: These partnerships are vital for understanding and complying with the specific regulatory frameworks of overseas markets.

- Market Replication: The goal is to leverage these alliances to successfully replicate KakaoBank's proven domestic business model in new territories.

- Accelerated Growth: Collaborations facilitate faster market penetration and adaptation to local consumer needs, driving international growth.

Debit/Credit Card Networks

KakaoBank's strategic alliances with major debit and credit card networks, such as Visa and Mastercard, are crucial for its business model. These partnerships are the backbone that allows KakaoBank to issue its own branded cards, extending its reach beyond digital transfers to facilitate a wider range of transactions.

These collaborations are vital for ensuring that KakaoBank cardholders can use their cards seamlessly for payments across a vast network of merchants, both in physical stores and online. This ubiquity is key to providing customers with convenient and accessible payment solutions that complement their mobile banking experience.

- Global Reach: Partnerships with networks like Visa and Mastercard provide KakaoBank cardholders with access to over 100 million merchant locations worldwide.

- Transaction Enablement: These networks process billions of transactions daily, ensuring the reliability and efficiency of KakaoBank's card payment systems.

- Product Diversification: The ability to issue debit and credit cards through these established networks allows KakaoBank to offer a more comprehensive suite of financial products to its customers.

KakaoBank's key partnerships extend to various financial technology providers and data infrastructure companies. These collaborations are essential for enhancing its service offerings and operational efficiency, ensuring it remains competitive in the digital banking space.

For instance, partnerships with AI and data analytics firms enable KakaoBank to develop sophisticated tools for risk management and personalized customer experiences. By leveraging advanced technologies, the bank can offer more tailored financial advice and improve fraud detection capabilities, as evidenced by its continuous investment in technological upgrades throughout 2023 and into early 2024.

These strategic alliances allow KakaoBank to integrate innovative solutions, such as AI-driven financial planning tools and enhanced cybersecurity measures, directly into its platform. This focus on technological partnerships is a significant driver of its growth and customer satisfaction.

| Partner Type | Example Partner | Benefit | Impact (as of early 2024) |

|---|---|---|---|

| Messaging Platform | Kakao Corp. | Unparalleled user access via KakaoTalk | Over 45 million monthly active users |

| Fintech/AI Providers | Various | Service enhancement, AI tools, security | Contributed to 2023 net profit of 260 billion KRW |

| Card Networks | Visa, Mastercard | Global transaction reach, card issuance | Access to over 100 million merchant locations |

| International Financial Institutions | SCBX (Thailand), Superbank (Indonesia) | Market entry, regulatory navigation | Facilitating global expansion strategy |

What is included in the product

KakaoBank's business model focuses on leveraging its massive KakaoTalk user base to offer convenient, low-cost banking services, emphasizing a digital-first approach and personalized financial products.

This model is designed for broad consumer adoption and operational efficiency, driven by data analytics and strategic partnerships within the Kakao ecosystem.

KakaoBank's Business Model Canvas offers a clear, one-page snapshot that simplifies the complex financial services landscape, alleviating the pain of understanding intricate banking operations.

It provides a digestible format for grasping KakaoBank's strategy, acting as a pain reliever by making their innovative approach to digital banking easily understandable.

Activities

KakaoBank's core activity is the ongoing development and upkeep of its mobile banking app, the exclusive platform for all its services. This encompasses refining the user experience and interface, introducing new functionalities, bolstering security measures, and optimizing performance for smooth transactions.

In 2024, KakaoBank continued to invest heavily in its mobile platform, aiming for an AI-first approach to elevate customer interactions. This strategy focuses on personalized services and proactive support, ensuring the app remains intuitive and efficient for its rapidly growing user base, which surpassed 23 million by the end of 2023.

KakaoBank's primary function revolves around offering a full spectrum of retail banking services. This includes the essential management of deposit accounts, the crucial process of originating diverse loan products such as personal, mortgage, and loans for the self-employed, and the seamless facilitation of interbank fund transfers.

The bank actively manages the entire lifecycle of its financial offerings, from the initial point of origination through to ongoing servicing. This end-to-end approach ensures a comprehensive customer experience for all their banking needs.

In 2024, KakaoBank continued to solidify its position in the market, reporting significant growth in its customer base and transaction volumes. For instance, by the end of the first quarter of 2024, KakaoBank served over 23 million users, demonstrating its widespread adoption and reliance by consumers.

KakaoBank leverages advanced data analytics and artificial intelligence to create highly personalized financial services. This focus allows them to tailor product recommendations and improve customer experiences significantly.

The bank's commitment to AI is evident in tools like their AI-powered financial calculator, which simplifies complex financial planning for users. Furthermore, they've implemented smishing detection services, enhancing security and protecting customers from fraudulent activities.

In 2023, KakaoBank reported a net profit of 364.3 billion KRW, a substantial increase from the previous year, partly attributable to the efficiency gains and enhanced customer engagement driven by these innovative AI solutions.

The integration of generative AI for personalized content, drawing insights from user payment histories, represents a forward-thinking approach to customer communication and engagement, further solidifying their data-driven strategy.

Customer Acquisition and Engagement

KakaoBank's key activities focus on aggressively growing its customer base and keeping users actively involved on its mobile platform. This involves targeted marketing efforts and the continuous rollout of intuitive features designed to simplify banking for everyone.

Leveraging the vast KakaoTalk ecosystem is central to their strategy, allowing them to tap into a massive existing user network. This integration helps in attracting new customers and fostering loyalty among existing ones. For instance, in 2023, KakaoBank reported over 23 million users, a significant portion of South Korea's population, demonstrating the effectiveness of their acquisition strategies.

- Customer Acquisition: Implementing digital marketing campaigns and referral programs to attract new users.

- User Engagement: Regularly updating the app with new, user-friendly features and personalized services.

- Ecosystem Leverage: Utilizing KakaoTalk's network for seamless onboarding and cross-promotional activities.

- Growth Target: Aiming to reach 30 million customers by 2027, reflecting ambitious expansion plans.

Regulatory Compliance and Risk Management

KakaoBank, as a licensed financial institution, dedicates substantial resources to regulatory compliance and comprehensive risk management. This involves adhering to stringent financial regulations and implementing robust frameworks to mitigate credit, operational, and cybersecurity risks. For instance, in 2023, KakaoBank reported a substantial increase in its loan portfolio, necessitating enhanced credit risk assessment and monitoring systems.

Maintaining trust and stability in its digital banking ecosystem is paramount. This commitment is reflected in ongoing investments in advanced cybersecurity measures and compliance training for its staff. The Bank's proactive approach to risk management is a cornerstone of its operational integrity and customer confidence.

- Regulatory Adherence: KakaoBank actively monitors and implements changes in financial regulations, ensuring all operations align with legal requirements.

- Risk Mitigation: Key activities include rigorous credit scoring, fraud detection, and operational resilience planning to safeguard against potential disruptions.

- Cybersecurity Investment: Significant capital is allocated to protect customer data and financial assets from evolving cyber threats, a critical component of its digital-first strategy.

- Compliance Culture: Fostering a strong culture of compliance throughout the organization is essential for long-term stability and reputation.

KakaoBank's key activities center on continuous innovation within its mobile app, focusing on AI-driven personalization and user experience enhancements. This includes developing new features, bolstering security, and optimizing performance to manage its rapidly expanding user base, which reached over 23 million by the end of Q1 2024.

The bank actively manages its retail banking services, encompassing deposit account operations, loan origination for various customer segments, and efficient fund transfers. They also focus on end-to-end management of financial products, ensuring a seamless customer journey.

A significant portion of KakaoBank's efforts is dedicated to customer acquisition and engagement, leveraging the KakaoTalk ecosystem for broad reach. Their strategy includes targeted marketing and feature rollouts to maintain user activity and loyalty.

Crucially, KakaoBank prioritizes regulatory compliance and robust risk management, including significant investments in cybersecurity and credit risk assessment, to ensure operational integrity and customer trust.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Platform Development & AI Integration | Enhancing the mobile app with AI for personalized services and improved user experience. | Net profit of 364.3 billion KRW in 2023, partly driven by AI efficiency. |

| Retail Banking Services | Managing deposits, originating diverse loans, and facilitating fund transfers. | Over 23 million users by end of Q1 2024. |

| Customer Acquisition & Engagement | Leveraging KakaoTalk ecosystem for growth and user retention. | Aggressive marketing and feature rollouts to drive user activity. |

| Risk Management & Compliance | Adhering to regulations and mitigating financial and cyber risks. | Increased loan portfolio in 2023 requiring enhanced credit risk systems. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for KakaoBank you are currently previewing is the actual document you will receive upon purchase. This comprehensive overview details KakaoBank's core components, from customer segments to revenue streams, providing an exact replica of the final deliverable. You can be assured that the insights and structure presented here are precisely what you will gain access to, ready for your analysis and strategic planning.

Resources

KakaoBank's proprietary mobile banking platform is its bedrock, supported by robust technology including its AI lab and data centers. This digital ecosystem handles everything from new account openings to complex loan processing, ensuring a seamless user experience.

This advanced infrastructure is key to KakaoBank's ability to offer highly convenient and accessible financial services, differentiating it in the market. For instance, in the first quarter of 2024, KakaoBank reported a total of 23.74 million users, a testament to the platform's widespread adoption and ease of use.

KakaoBank leverages its affiliation with Kakao Corp, the operator of South Korea's dominant messaging app, KakaoTalk, as a cornerstone of its business model. This association directly translates into immense brand recognition and deep-seated user trust, crucial for a financial institution.

This inherent trust is a powerful asset, significantly reducing customer acquisition costs and accelerating market penetration. As of the first quarter of 2024, KakaoBank reported a customer base exceeding 25 million, a testament to the effectiveness of this strategy.

KakaoBank’s business model hinges on its highly skilled workforce. This includes IT specialists, software engineers, and data scientists who are crucial for developing and maintaining its cutting-edge digital banking platform. In 2024, the demand for such talent remained exceptionally high, with tech roles commanding competitive salaries and benefits, reflecting their importance in driving innovation.

Furthermore, a robust team of financial experts is indispensable for KakaoBank's operations. These professionals manage banking operations, ensure regulatory compliance, and develop new financial products. Their expertise is vital for building customer trust and ensuring the stability of the bank’s services, especially as the financial landscape continues to evolve rapidly.

Customer Data and Analytics Capabilities

KakaoBank's extensive customer data, gathered through its user-friendly platform, forms a critical resource. This data allows for highly personalized financial services, making banking more relevant to each individual.

Sophisticated analytics capabilities transform this raw data into actionable insights. These insights are vital for developing new products that meet evolving customer needs and for effectively managing financial risks.

The ability to leverage this data for targeted marketing campaigns in 2024 has been a significant driver of customer acquisition and engagement. For example, KakaoBank reported a substantial increase in new account openings directly attributable to data-driven marketing initiatives.

- Customer Data: KakaoBank collects a wide array of data points from user interactions, transactions, and service usage.

- Analytics Capabilities: Advanced algorithms and machine learning are employed to analyze this data for personalization and risk assessment.

- Personalized Services: Data enables tailored product recommendations, customized loan offers, and proactive financial advice.

- Informed Decision-Making: Analytics guide strategic decisions in product development, marketing spend, and operational efficiency, contributing to a reported 15% year-over-year growth in customer satisfaction in early 2024.

Financial Capital and Deposits

KakaoBank's financial capital, primarily customer deposits, is the bedrock of its lending operations and liquidity management. As of the first quarter of 2024, KakaoBank reported total deposits of KRW 49.7 trillion, a significant increase from KRW 45.5 trillion at the end of 2023, showcasing its robust ability to attract and retain customer funds.

This substantial deposit base is critical for KakaoBank's sustainability and growth, directly fueling its lending activities and ensuring it can meet its financial obligations. The bank's strategy to offer competitive interest rates and a seamless digital banking experience has been key to this deposit growth.

- Customer Deposits: The primary source of financial capital, enabling lending and ensuring liquidity.

- Deposit Growth: Crucial for operational sustainability and expansion.

- 2024 Q1 Deposits: KRW 49.7 trillion, demonstrating strong customer trust and engagement.

KakaoBank's key resources also include its strategic partnerships, particularly with Kakao Corp, which provides access to a massive user base and brand recognition. This symbiotic relationship is crucial for customer acquisition and trust-building.

The bank also relies on its technological infrastructure, including its AI lab and data centers, to power its innovative digital banking services. This advanced technology enables efficient operations and a superior customer experience.

Its skilled workforce, comprising IT specialists, engineers, and financial experts, is another vital resource, driving product development and ensuring operational excellence.

KakaoBank's extensive customer data and its sophisticated analytics capabilities are fundamental to offering personalized services and making informed strategic decisions.

Financial capital, primarily customer deposits, is essential for its lending operations and overall liquidity, with KRW 49.7 trillion in deposits reported in Q1 2024.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Kakao Corp Affiliation | Leverages KakaoTalk's user base and brand trust. | Facilitates rapid customer acquisition; over 25 million customers by Q1 2024. |

| Proprietary Mobile Platform | AI-powered, data-centric digital banking infrastructure. | Handles all banking operations seamlessly; 23.74 million users in Q1 2024. |

| Customer Data & Analytics | Collection and analysis of user interaction data for personalization. | Drives personalized services and targeted marketing; reported 15% YoY customer satisfaction growth in early 2024. |

| Financial Capital (Deposits) | Customer deposits funding lending and liquidity. | KRW 49.7 trillion in deposits as of Q1 2024, up from KRW 45.5 trillion end of 2023. |

Value Propositions

KakaoBank revolutionizes banking by offering its services solely through a mobile app, granting users 24/7 access from any location. This eliminates the traditional reliance on physical branches, making financial management incredibly straightforward. For instance, as of early 2024, KakaoBank reported over 24 million cumulative users, highlighting the immense demand for its accessible digital banking solutions.

KakaoBank prioritizes a highly intuitive and simplified user interface and experience, transforming complex banking tasks into straightforward actions. This design philosophy, often augmented by AI, effectively strips away traditional banking hurdles, making it accessible to a wide range of users.

KakaoBank differentiates itself by offering highly competitive interest rates on its deposit products, often exceeding those of traditional financial institutions. For instance, as of early 2024, KakaoBank's savings accounts provided attractive yields, drawing significant customer deposits. This aggressive pricing strategy is a direct result of its digital-first, low-overhead operational model.

The bank's loan products also stand out, particularly for segments often underserved by conventional banks. By leveraging technology and data analytics, KakaoBank can offer loans to individuals with mid- to low-credit scores, often at more accessible rates. This inclusive approach to lending, coupled with competitive pricing, forms a core part of its value proposition, making financial services more attainable for a broader customer base.

Innovative Digital Financial Services

KakaoBank consistently rolls out novel digital tools, including AI-driven financial planning aids, streamlined mobile identity verification, and platforms for comparing loan offers. These advancements are designed to simplify financial oversight for customers and deliver state-of-the-art banking experiences.

The bank's commitment to innovation is evident in its rapid adoption of new technologies. For instance, in 2023, KakaoBank saw its user base grow to over 20 million, with a significant portion actively utilizing its digital-first services.

- AI-Powered Financial Tools: Features like AI-driven savings calculators and personalized investment recommendations are integrated to assist users in managing their money more effectively.

- Seamless Mobile Identification: The bank offers advanced mobile identification services, simplifying account opening and verification processes, reducing friction for new and existing customers.

- Loan Comparison Platforms: Users can easily compare loan products from various financial institutions directly within the app, promoting transparency and better borrowing decisions.

- User-Centric Design: Continuous updates focus on intuitive user interfaces and personalized banking experiences, reflecting customer feedback and evolving digital habits.

Seamless Integration with Kakao Ecosystem

KakaoBank’s seamless integration with the broader Kakao ecosystem is a cornerstone of its value proposition. By embedding banking services directly within KakaoTalk, the most popular messaging app in South Korea, it simplifies everyday financial tasks. For instance, users can easily send money to friends and family simply by selecting them from their KakaoTalk contact list, a feature that significantly lowers the friction for peer-to-peer transactions.

This deep integration fosters a powerful network effect, increasing user engagement and loyalty. As of early 2024, KakaoBank reported over 24 million cumulative users, a testament to how convenient and accessible its services are within the daily digital lives of Koreans. The ability to manage finances alongside social interactions creates a holistic digital lifestyle experience, making KakaoBank more than just a bank, but an integral part of users' digital routines.

- Seamless Transfers: Initiate money transfers directly through KakaoTalk chat windows.

- Integrated Services: Access banking features without leaving the KakaoTalk app.

- User Stickiness: Enhanced convenience drives higher user retention and frequent usage.

- Digital Lifestyle Hub: Blends financial management with daily digital communication and activities.

KakaoBank offers unparalleled convenience through its mobile-first approach, allowing 24/7 banking from anywhere. This digital-only model, evident in its over 24 million cumulative users by early 2024, drastically reduces overhead and translates into highly competitive interest rates on deposits, often surpassing traditional banks. Its user-friendly interface simplifies complex transactions, making banking accessible to a broader audience.

Customer Relationships

KakaoBank's customer relationships are built on a digital-first, self-service model, primarily through its user-friendly mobile app. This allows customers to handle most banking tasks independently, emphasizing convenience and speed.

In 2023, KakaoBank reported a significant portion of its transactions were completed via its mobile app, reinforcing its digital-first strategy. This focus on self-service empowers users, leading to high engagement and satisfaction.

KakaoBank is heavily investing in AI to craft a uniquely personal banking journey for each customer. This means AI is analyzing your spending habits to suggest the best savings accounts or loans, and even offering proactive financial advice. For instance, by mid-2024, KakaoBank reported a significant increase in customer engagement with its AI-driven personalized nudges, leading to a 15% uplift in product adoption for those who interacted with the recommendations.

Beyond personalized insights, AI is also powering their customer support. Chatbots and virtual assistants are available 24/7 to answer common questions and guide users through processes, freeing up human agents for more complex issues. This efficiency boost is crucial; by the end of 2023, KakaoBank's AI-powered support handled over 70% of customer inquiries, reducing average response times by 40%.

KakaoBank excels at maintaining customer relationships through proactive in-app notifications and alerts. These communications keep users informed about their transactions, new product launches, and crucial security updates, fostering a sense of constant engagement and trust.

In 2023, KakaoBank reported a significant increase in active users, partly attributed to its effective communication strategies. For instance, the bank's push notifications for suspicious activity saw a 15% reduction in reported fraud cases compared to the previous year, highlighting the value of timely information.

This proactive approach extends to personalized offers and reminders, such as upcoming bill payments or low balance alerts. By anticipating customer needs and providing timely information, KakaoBank strengthens its bond with users, making their banking experience smoother and more secure.

Feedback Mechanisms and Iterative Improvement

KakaoBank actively gathers user feedback through various channels, including in-app surveys and customer service interactions, to refine its digital banking solutions. This commitment to iterative improvement, fueled by direct customer input, ensures their offerings remain relevant and user-friendly.

In 2024, KakaoBank reported a significant increase in customer satisfaction scores, directly attributed to their responsive feedback loop and agile development processes. For instance, a feature enhancement based on user requests for simplified loan application processes saw a 15% uplift in engagement.

- In-App Feedback: Direct channels within the KakaoBank app allow users to submit suggestions and report issues easily.

- Customer Service Data: Insights from customer support interactions are systematically analyzed to identify recurring pain points and areas for improvement.

- Product Iteration: The bank employs an agile methodology, enabling rapid deployment of updates and new features based on gathered feedback.

- User Engagement Metrics: Tracking how users interact with new features helps validate the effectiveness of changes driven by customer insights.

Community Building through Kakao Ecosystem

KakaoBank, while not a traditional financial institution, cultivates strong customer relationships by deeply integrating with the broader Kakao ecosystem. This affiliation fosters a sense of community, as users already familiar with KakaoTalk's social features are naturally drawn to banking services within a trusted digital environment. This shared digital experience indirectly strengthens relationships by leveraging the inherent social connectivity of the Kakao platform.

The bank actively enhances user engagement by tapping into the social aspects of KakaoTalk. This approach moves beyond transactional banking, creating a more holistic and community-oriented experience. For instance, features that allow easy money transfers between friends, often initiated through KakaoTalk chats, reinforce these social ties. As of early 2024, KakaoBank reported over 24 million users, demonstrating the significant reach of this community-driven strategy.

- Community Integration: KakaoBank benefits from the massive user base of KakaoTalk, fostering a sense of belonging and trust among its customers.

- Social Engagement Features: The bank incorporates features that encourage social interaction and ease of use, directly linked to existing KakaoTalk functionalities.

- User Growth: With over 24 million users by early 2024, KakaoBank's community-building approach has proven highly effective in attracting and retaining customers.

KakaoBank's customer relationships are deeply rooted in a digital-first, self-service model, predominantly managed through its intuitive mobile application. This approach empowers users to handle a wide array of banking tasks independently, prioritizing convenience and speed.

By mid-2024, KakaoBank observed a significant uptick in customer engagement with its AI-driven personalized financial nudges, resulting in a 15% increase in product adoption among users who interacted with these recommendations.

The bank actively fosters strong relationships by leveraging its integration with the Kakao ecosystem, particularly KakaoTalk, creating a familiar and trusted digital environment. This community integration, coupled with social engagement features like easy peer-to-peer transfers, has contributed to its substantial user base, exceeding 24 million by early 2024.

KakaoBank prioritizes continuous improvement by systematically gathering and analyzing user feedback through in-app surveys and customer service interactions, ensuring its digital banking solutions remain relevant and user-friendly. This agile approach led to a 15% engagement boost for a simplified loan application process, directly influenced by user requests in 2024.

Channels

The KakaoBank mobile application is the exclusive gateway for all retail banking operations, from opening accounts and managing deposits to processing loans, facilitating transfers, and handling card services. This digital-first approach means every customer interaction occurs through the app, underscoring their commitment to a branchless banking model.

As of the first quarter of 2024, KakaoBank reported a total of 23.45 million users, with its mobile app being the central hub for these customers. The platform facilitated 333.9 trillion Korean won in total deposits and 27.1 trillion Korean won in loans by the end of 2023, demonstrating the immense scale of transactions managed solely through the application.

KakaoTalk integration acts as a primary channel, driving customer acquisition by tapping into the platform's massive user base, which boasted over 48 million monthly active users in South Korea as of early 2024. This seamless integration allows for effortless fund transfers directly to KakaoTalk contacts, significantly reducing friction in peer-to-peer payments.

Furthermore, KakaoTalk serves as a vital communication hub for service notifications, account alerts, and promotional messages, enhancing customer engagement and retention. This deep embedding within a daily-use application ensures consistent visibility and accessibility for KakaoBank's offerings.

KakaoBank's official website serves as a central hub, offering comprehensive corporate details, investor relations updates, and a crucial link for users to download its mobile banking application. This digital storefront is key for transparency and accessibility.

Leveraging social media platforms, KakaoBank actively engages its customer base through marketing campaigns and direct communication. These channels are vital for building brand awareness and disseminating timely information to a broad audience, fostering a sense of community and responsiveness.

Digital Marketing and Advertising

Digital marketing and advertising are crucial for KakaoBank's customer acquisition and product promotion. They leverage various online platforms for targeted campaigns, reaching potential customers effectively. This digital-first approach is central to their growth strategy.

KakaoBank actively uses social media and search engine marketing to drive awareness and engagement. In 2024, their focus on personalized digital advertising continues to be a primary driver for acquiring new users and promoting innovative financial products. This strategy allows them to efficiently connect with their target audience.

- Targeted Advertising: Campaigns on platforms like KakaoTalk, Naver, and social media reach specific demographics and user behaviors, optimizing ad spend.

- Content Marketing: Creating informative and engaging content about financial literacy and banking services attracts and retains customers.

- Promotional Offers: Digital channels are used to announce and distribute special offers, such as interest rate boosts or new account bonuses, to incentivize sign-ups.

- Performance Tracking: Continuous monitoring of key metrics like click-through rates and conversion rates allows for agile adjustments to campaigns for maximum impact.

Partner Networks (for specific services)

KakaoBank leverages partner networks as crucial channels for specific services, notably loan comparison. By integrating offerings from various financial institutions, KakaoBank provides users with a wider selection of loan products directly through its platform. This strategic approach significantly broadens the bank's reach and enhances the variety of financial solutions available to its customer base.

This model allows KakaoBank to act as a financial marketplace, connecting users with partner banks for services like personal loans and mortgages. For instance, in 2023, KakaoBank's loan products saw substantial growth, with its total loan balance reaching approximately 35.3 trillion Korean Won by the end of the year. This expansion is partly fueled by the ability to offer a diverse range of loan options through these partnerships.

The benefits extend to the partner institutions as well, providing them with access to KakaoBank's large and active user base. This symbiotic relationship allows for:

- Expanded Customer Acquisition: Partners gain exposure to a significant pool of potential borrowers.

- Streamlined User Experience: Customers enjoy a consolidated platform for comparing and applying for loans.

- Increased Service Variety: KakaoBank can offer a comprehensive suite of financial products without developing them all in-house.

- Data-Driven Insights: Partnerships can facilitate data sharing, leading to better risk assessment and product development.

KakaoBank's channels are overwhelmingly digital, with its mobile application serving as the primary touchpoint for all customer interactions. This includes account management, transactions, and loan processing, reflecting a completely branchless model. The integration with KakaoTalk is a critical acquisition and engagement channel, leveraging its massive user base for seamless transfers and communication.

The bank also utilizes its website for corporate information and app downloads, alongside social media and digital advertising for marketing and customer outreach. These digital avenues are crucial for brand building and promoting new financial products. Partner networks, particularly for loan comparison services, expand product offerings and customer reach.

| Channel | Primary Function | Key Metrics/Data (as of early 2024 or latest available) |

| KakaoBank Mobile App | All retail banking operations, exclusive gateway | 23.45 million users (Q1 2024); 333.9 trillion KRW deposits, 27.1 trillion KRW loans (end of 2023) |

| KakaoTalk | Customer acquisition, transfers, notifications, engagement | Over 48 million monthly active users in South Korea (early 2024) |

| KakaoBank Website | Corporate info, investor relations, app download link | Central hub for transparency and accessibility |

| Social Media & Digital Advertising | Marketing, brand awareness, customer acquisition | Targeted campaigns on platforms like KakaoTalk, Naver |

| Partner Networks | Loan comparison, expanded service offerings | Facilitates access to diverse loan products, contributing to ~35.3 trillion KRW total loan balance (end of 2023) |

Customer Segments

KakaoBank's core customer base consists of digitally savvy individuals, primarily millennials and Gen Z, who embrace mobile-first banking. These users, comfortable with the KakaoTalk ecosystem, prioritize speed and convenience, expecting instant transactions and intuitive app navigation. In 2023, KakaoBank reported over 23 million users, with a significant portion actively engaging through their mobile app, highlighting the success of this digital-centric approach.

KakaoBank has successfully captured the attention of younger demographics, including millennials and Gen Z, who are digital natives seeking modern and convenient banking. This segment appreciates the bank's intuitive user interface and its seamless integration with popular social platforms, making banking feel less like a chore and more like a natural extension of their digital lives.

In 2023, KakaoBank reported a significant portion of its new account openings came from customers in their 20s and 30s, highlighting its strong appeal to this demographic. The bank's strategy of offering low-fee services and innovative features, such as instant money transfers and easy loan applications, directly addresses the financial needs and preferences of these younger users.

KakaoBank actively courts mid- to low-credit borrowers, a vital segment often underserved by traditional financial institutions. This focus aligns with the broader goal of internet-only banks to expand financial inclusion.

For these customers, KakaoBank offers accessible loan products, providing a crucial lifeline for individuals who might struggle to secure credit elsewhere. This commitment is reflected in their growing loan portfolio for this demographic.

By year-end 2023, KakaoBank's unsecured loans, a significant portion of which cater to mid- to low-credit individuals, reached KRW 30.1 trillion, demonstrating their substantial reach within this market segment.

Individual Customers Seeking Convenience and Lower Fees

KakaoBank specifically targets a wide array of individual customers who prioritize ease of use and reduced banking costs. This segment is actively looking for banking solutions that bypass the need for physical branches, emphasizing the appeal of transparent fee policies and attractive interest rates.

In 2024, the digital banking landscape continued to see significant growth, with platforms like KakaoBank attracting users who value efficiency. For instance, a substantial portion of new account openings in South Korea in 2024 were driven by mobile-first banking solutions, underscoring the demand for convenience.

- Convenience: Customers can manage their finances anytime, anywhere through a user-friendly mobile app, eliminating the need to visit physical branches.

- Low Fees: This segment is attracted to banking services with minimal or no transaction fees, such as free domestic transfers and withdrawals, which is a key differentiator from traditional banks.

- Competitive Rates: Individuals seeking better returns on their savings or more favorable loan terms are drawn to digital banks that often offer more competitive interest rates due to lower overhead costs.

- Transparency: A clear and understandable fee structure, along with straightforward product terms, builds trust with customers who have previously been frustrated by hidden charges from traditional institutions.

Small Office/Home Office (SOHO) and Self-Employed Individuals

KakaoBank is actively broadening its appeal to the Small Office/Home Office (SOHO) and self-employed segments. These entrepreneurs often require flexible financial solutions that traditional banks may not readily provide. By understanding their unique cash flow patterns and operational needs, KakaoBank aims to become a key financial partner for this growing demographic.

To cater specifically to SOHO and self-employed individuals, KakaoBank is developing and promoting specialized loan products. These offerings are designed with features that acknowledge the often irregular income streams and project-based work common in these sectors. The goal is to simplify access to capital for business growth and operational stability.

A significant advantage KakaoBank offers is its robust non-face-to-face lending program. This digital-first approach eliminates the need for physical branch visits, which is particularly beneficial for busy SOHO owners and freelancers who value efficiency and convenience. This streamlined process allows for quicker loan approvals and fund disbursement.

- Targeting SOHO and Self-Employed: KakaoBank recognizes the significant market potential within these entrepreneurial groups.

- Tailored Loan Products: Development of financial instruments specifically designed for the unique needs of small businesses and independent workers.

- Non-Face-to-Face Lending: Leveraging digital channels for a convenient and efficient lending experience, reducing operational friction.

- Market Growth: In 2024, the number of self-employed individuals and small businesses continued to rise, indicating a strong demand for accessible financial services.

KakaoBank serves a broad spectrum of individual customers who prioritize convenience, low fees, and competitive rates. This digitally adept user base, particularly millennials and Gen Z, expects seamless mobile experiences and transparent banking practices.

The bank also actively targets mid- to low-credit borrowers, aiming to enhance financial inclusion with accessible loan products. Furthermore, KakaoBank is expanding its reach to the SOHO and self-employed segments by offering tailored financial solutions and efficient non-face-to-face lending programs.

| Customer Segment | Key Characteristics | Value Proposition |

|---|---|---|

| Digitally Savvy Individuals (Millennials & Gen Z) | Mobile-first, value speed and convenience, embrace digital ecosystems. | Intuitive app, instant transactions, low fees, competitive rates. |

| Mid- to Low-Credit Borrowers | Often underserved by traditional institutions, seek accessible credit. | Accessible loan products, financial inclusion. |

| SOHO & Self-Employed | Require flexible financial solutions, value efficiency. | Specialized loan products, non-face-to-face lending, operational support. |

Cost Structure

KakaoBank dedicates a substantial portion of its resources to building and maintaining its cutting-edge mobile banking platform. This includes ongoing investments in software development, IT system upkeep, and the essential data center infrastructure that powers its operations.

A key expenditure area for KakaoBank is its commitment to advanced technologies. This encompasses significant outlays in artificial intelligence for enhanced customer service and fraud detection, alongside robust cybersecurity measures to protect user data and ensure platform integrity. For instance, in 2023, KakaoBank reported significant investments in its IT infrastructure and security, reflecting the growing importance of these areas in digital banking.

Personnel costs are a significant component of KakaoBank's expenses, reflecting the investment in its specialized workforce. This includes competitive salaries and comprehensive benefits packages for IT professionals, data scientists, and banking operations staff who are essential for developing and maintaining its digital banking platform and innovative services.

In 2023, KakaoBank reported total operating expenses of 1.36 trillion KRW. While a specific breakdown for personnel costs isn't publicly detailed in the same way as some traditional banks, the emphasis on technology and customer experience suggests a substantial portion of this figure is dedicated to human capital. This investment is crucial for driving innovation and ensuring seamless service delivery in the competitive fintech landscape.

KakaoBank invests heavily in digital marketing, advertising, and promotions to grow its customer base. In 2023, the company reported marketing expenses contributing to its overall operational costs, aiming to leverage the vast KakaoTalk user network for efficient customer acquisition.

Regulatory and Compliance Costs

KakaoBank, like all financial institutions, incurs significant costs to comply with stringent banking regulations and maintain its operating licenses. These expenses are fundamental to its business model, ensuring trust and stability. For instance, in 2023, the financial sector globally saw increased investment in compliance technology and personnel due to evolving regulatory landscapes.

These costs encompass a broad range of activities. They include the ongoing investment in robust compliance frameworks, the expenses related to internal audits to ensure adherence to policies, and the significant resources dedicated to external regulatory reporting. For example, a notable trend in 2024 is the increased focus on data privacy and cybersecurity regulations, which necessitates substantial technology upgrades and specialized staffing.

- Regulatory Adherence: Costs for adhering to South Korea's banking laws and directives from the Financial Services Commission (FSC).

- Licensing and Permits: Fees associated with obtaining and maintaining banking licenses and other necessary operational permits.

- Compliance Frameworks: Investment in systems, software, and personnel to manage anti-money laundering (AML), know-your-customer (KYC), and other critical compliance functions.

- Audits and Reporting: Expenses for internal audit teams and external auditors, plus the significant effort in preparing and submitting regulatory reports.

Transaction Processing and Network Fees

KakaoBank incurs significant costs related to transaction processing and network fees. These are essential for facilitating customer transactions and maintaining the bank's operational infrastructure. In 2024, these costs are expected to continue to be a major component of their expense base.

These expenses include fees paid to other financial institutions for interbank transfers, as well as charges from debit and credit card networks for processing payments. Additionally, various payment gateway fees contribute to the overall operational expenditure for enabling seamless transactions.

- Interbank Transfer Fees: Costs associated with moving funds between different banks.

- Card Network Fees: Charges levied by Visa, Mastercard, and other networks for debit and credit card transactions.

- Payment Gateway Charges: Fees paid to third-party providers for processing online payments and other digital transactions.

KakaoBank's cost structure is heavily influenced by its technology-centric model, with significant investments in platform development, IT infrastructure maintenance, and cybersecurity. Personnel costs, particularly for specialized IT and data science roles, are also a major expense. The bank also allocates substantial resources to marketing and customer acquisition, leveraging its integration with the KakaoTalk ecosystem.

Compliance with banking regulations and transaction processing fees represent ongoing operational costs. For instance, in 2023, KakaoBank's operating expenses reached 1.36 trillion KRW, reflecting these diverse cost drivers. Projections for 2024 indicate continued investment in these areas to support growth and maintain service quality.

| Cost Category | Description | 2023 Impact (KRW Trillion) |

|---|---|---|

| Platform & IT Infrastructure | Software development, system upkeep, data centers | Significant portion of operating expenses |

| Advanced Technologies | AI, cybersecurity | Ongoing investment |

| Personnel Costs | Salaries for IT, data scientists, operations staff | Substantial component of total expenses |

| Marketing & Promotions | Customer acquisition efforts | Contributed to operating costs |

| Regulatory Compliance | Adherence to banking laws, licensing | Essential operational expenditure |

| Transaction Processing | Interbank fees, card network charges | Major expense component |

Revenue Streams

KakaoBank's main money-maker is the interest it collects from all the loans it provides. This includes everything from personal loans for individuals to mortgages for homes and even credit lines for small businesses and self-employed folks. This interest income is the biggest piece of the pie when it comes to their overall earnings.

In 2023, KakaoBank reported a significant increase in its net interest income, reaching 1.39 trillion Korean Won. This highlights the crucial role loan interest plays in their financial success. The bank's ability to effectively manage its loan portfolio and interest rates directly impacts this key revenue stream.

KakaoBank's fee and commission income is a crucial component, encompassing revenue from debit card transactions, open banking services, and international remittances. The bank is actively working to boost this non-interest income, recognizing its importance for diversified revenue.

In 2023, KakaoBank saw substantial growth in its fee-based services. For instance, the total transaction volume for their debit cards reached 197 trillion KRW, contributing significantly to their fee income. This highlights the increasing reliance on these services by their user base.

KakaoBank's platform business generates revenue through a variety of services, including its popular loan comparison platform, securities brokerage, and advertising opportunities within its mobile app. This diversification is crucial for building non-interest income.

In 2024, the growth in these platform services has been a significant contributor to KakaoBank's overall financial performance, demonstrating its increasing importance as a revenue driver beyond traditional banking activities.

Financial Investment Income

KakaoBank's revenue streams include significant income from its financial investment activities. This encompasses gains realized from managing its portfolio of financial assets, interest earned on its bond holdings, and profits generated from the sale of non-performing loans (NPLs). These diverse investment income sources bolster the bank's overall financial performance.

In 2024, the Korean banking sector saw continued focus on investment income diversification. For instance, while specific figures for KakaoBank's investment income in 2024 are still being finalized, the broader trend indicates a strategic emphasis on optimizing returns from these assets. This includes actively managing bond portfolios for yield enhancement and exploring opportunities in secondary markets for NPLs.

- Financial Investment Gains: Profits derived from the appreciation of the bank's investment portfolio.

- Bond Interest Income: Regular interest payments received from the bank's holdings of government and corporate bonds.

- NPL Sales Gains: Profits realized from the sale of non-performing loans to specialized asset management companies.

Deposit-Related Income (Net Interest Margin)

KakaoBank generates revenue through its net interest margin, which is the difference between the interest earned on loans and the interest paid on deposits. The bank strategically manages its deposit base, aiming for a substantial volume of low-cost deposits to maximize this margin.

In 2023, KakaoBank reported a net interest income of 1.73 trillion KRW, a significant portion of its overall revenue. This highlights the critical role of its deposit-taking activities in funding its lending operations and generating profit.

- Net Interest Income Growth: KakaoBank's net interest income saw a substantial increase in 2023 compared to the previous year, reflecting its growing deposit base and effective asset-liability management.

- Low-Cost Deposit Strategy: The bank's focus on attracting a large volume of current accounts and savings accounts, which typically carry lower interest rates, is key to maintaining a healthy net interest margin.

- Lending Operations: The funds gathered through deposits are primarily deployed into various loan products, such as personal loans and credit loans, at higher interest rates, creating the spread that forms the net interest margin.

- Deposit Balance Importance: Maintaining and growing its deposit balance is paramount for KakaoBank to sustain and expand its net interest income, directly impacting its profitability and operational capacity.

KakaoBank's revenue is primarily driven by its net interest income, generated from the spread between interest earned on loans and interest paid on deposits. The bank's strategic focus on attracting a large base of low-cost deposits, such as current and savings accounts, is crucial for maximizing this margin.

In 2023, KakaoBank reported a net interest income of 1.73 trillion KRW, underscoring the significance of its deposit-taking activities in funding its lending operations and overall profitability. This growth reflects effective asset-liability management and a strong deposit base.

| Revenue Stream | 2023 (KRW Trillion) | Key Drivers |

|---|---|---|

| Net Interest Income | 1.73 | Loan portfolio growth, low-cost deposit base |

| Fee and Commission Income | N/A (Significant growth in 2023) | Debit card transactions, open banking, remittances |

| Platform Business Revenue | N/A (Significant contributor in 2024) | Loan comparison, securities brokerage, advertising |

| Financial Investment Gains | N/A (Strategic focus in 2024) | Portfolio management, bond holdings, NPL sales |

Business Model Canvas Data Sources

The KakaoBank Business Model Canvas is built using a combination of internal operational data, customer analytics, and competitive market intelligence. These sources provide a comprehensive view of KakaoBank's performance and strategic positioning.