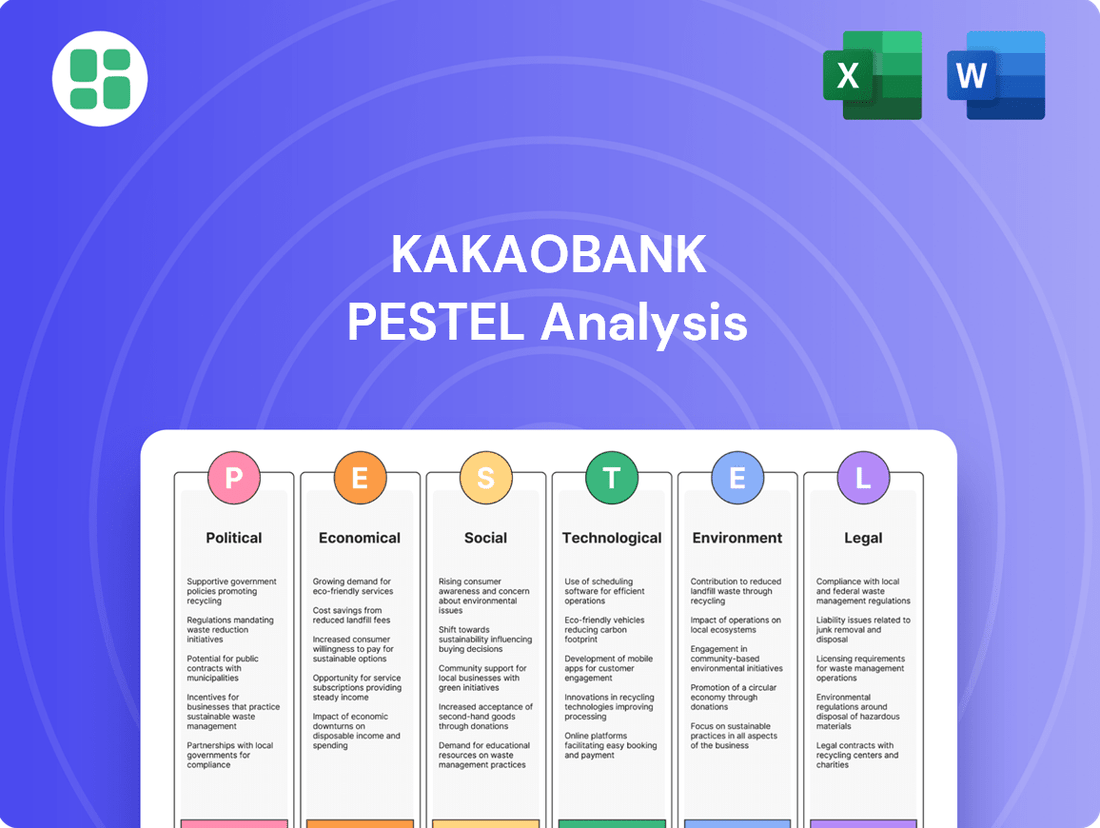

KakaoBank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KakaoBank Bundle

Discover how political shifts, economic volatility, and evolving social behaviors are shaping KakaoBank's trajectory. Our comprehensive PESTLE analysis offers a critical look at these external forces, providing actionable intelligence for strategic planning. Don't get left behind; download the full report to gain a competitive edge.

Political factors

The South Korean government, via the Financial Services Commission (FSC), actively champions FinTech growth. This support includes direct investment in startups and the establishment of regulatory sandboxes, allowing companies like KakaoBank to pilot innovative services with a degree of regulatory flexibility.

These government-led initiatives are crucial for modernizing South Korea's financial landscape and cultivating a vibrant FinTech sector. For instance, the FSC's FinTech Lab has supported numerous startups, fostering an environment where digital banks can thrive and experiment with new offerings.

South Korea's financial regulators are actively shaping the banking sector, prioritizing stability and encouraging a more competitive environment. This focus means policies are in place that directly affect how banks operate, especially those focused on digital services.

Recent measures, such as stricter rules for household lending, aim to manage rising consumer debt. For internet-only banks like KakaoBank, this translates to a more cautious approach to loan growth, impacting their expansion strategies.

Furthermore, the government's exploration of licensing a fourth internet-only bank highlights an intensifying competitive arena. This move could introduce new players, potentially altering market share dynamics and necessitating strategic adjustments from established entities like KakaoBank.

Political stability is a cornerstone for any thriving banking sector, and South Korea's landscape is no exception. The current administration's commitment to an expansionary fiscal policy, aiming to stimulate economic growth, presents a generally favorable environment for financial institutions like KakaoBank. This approach often translates to increased lending opportunities and a more robust economic backdrop for banking operations.

However, the banking sector, including KakaoBank, isn't immune to the ripple effects of domestic political shifts or broader global economic uncertainties. For instance, any significant domestic political instability could dampen investor sentiment and potentially impact regulatory frameworks affecting digital banks. Furthermore, global trade tensions, such as the ongoing discussions around US tariffs and their impact on international trade flows, can create economic headwinds that indirectly affect the profitability and growth prospects of financial services.

Anti-Money Laundering (AML) Regulations

South Korea's Financial Supervisory Service (FSS) is intensifying its scrutiny of anti-money laundering (AML) compliance, particularly for internet-only banks like KakaoBank. This heightened regulatory pressure means KakaoBank must continuously bolster its systems to prevent illicit financial activities.

KakaoBank has previously received warnings concerning deficiencies in its AML procedures. For instance, reports from late 2023 indicated specific areas where their AML controls were deemed insufficient, underscoring the critical need for ongoing investment in robust compliance infrastructure to meet evolving regulatory expectations.

- Increased FSS Oversight: The FSS is actively monitoring and enforcing AML regulations more rigorously.

- Past AML Warnings: KakaoBank has been flagged for AML shortcomings, necessitating immediate remediation.

- Compliance Investment: Significant resources are required to upgrade and maintain effective AML systems.

Data Protection Legislation

South Korea's Personal Information Protection Act (PIPA), alongside other data-related statutes, dictates how personal data is managed. Amendments in 2023 and 2024 have notably strengthened data subject rights and introduced new stipulations for cross-border data transfers.

For fintech innovators like KakaoBank, compliance with these evolving data protection and cybersecurity mandates is paramount. Adherence is crucial for safeguarding against data breaches and, critically, for cultivating and maintaining consumer confidence in their digital financial services.

Key considerations for KakaoBank include:

- Compliance with PIPA amendments: Ensuring all data handling practices align with the enhanced rights for individuals and new rules for international data movement, effective from recent legislative updates.

- Robust cybersecurity measures: Implementing advanced security protocols to prevent data breaches, a critical factor given the sensitive nature of financial information.

- Consumer trust: Demonstrating a strong commitment to data privacy and security to build and sustain user trust, which is a fundamental asset for any financial institution.

The South Korean government's proactive stance on FinTech, evidenced by regulatory sandboxes and direct investment, has fostered an environment where digital banks like KakaoBank can innovate. However, recent policy shifts, such as stricter household lending rules introduced in late 2023 and early 2024, aim to curb rising consumer debt, directly impacting KakaoBank's loan growth strategies.

The potential licensing of a fourth internet-only bank by the government signals increased competition, forcing established players to refine their strategies. Furthermore, heightened scrutiny from the Financial Supervisory Service (FSS) on anti-money laundering (AML) compliance, with KakaoBank having faced warnings in late 2023 regarding procedural deficiencies, necessitates ongoing investment in robust compliance infrastructure.

Amendments to South Korea's Personal Information Protection Act (PIPA) in 2023 and 2024 have strengthened data subject rights and cross-border transfer regulations. KakaoBank must ensure strict adherence to these evolving data privacy and cybersecurity mandates to maintain consumer trust, a critical asset in the digital banking space.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting KakaoBank, examining Political, Economic, Social, Technological, Environmental, and Legal influences to uncover strategic opportunities and challenges.

A KakaoBank PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during strategic planning and decision-making.

Economic factors

The Bank of Korea's monetary policy, particularly its benchmark interest rate, significantly influences KakaoBank's profitability. A lower rate environment, as seen with past cuts aimed at economic stimulus, generally compresses net interest margins (NIMs) by reducing the spread between lending and deposit rates. For instance, if the Bank of Korea maintains its current policy rate, it provides a baseline for KakaoBank's lending and borrowing costs.

South Korea's household debt remains a significant concern, with total household debt reaching approximately 2,273.5 trillion KRW (around $1.7 trillion USD) by the end of the first quarter of 2024, according to the Bank of Korea. This high level has prompted financial regulators to impose stricter lending rules, directly impacting KakaoBank's ability to grow its household loan portfolio.

Consequently, KakaoBank has seen a deceleration in its household loan growth. To counter this, the bank is actively seeking to diversify its revenue streams by increasing non-interest income. This strategic shift includes exploring opportunities in other loan segments, such as loans for individual business owners, even as this sector faces rising delinquency rates, which stood at 0.45% for small business loans in early 2024.

South Korea's economic trajectory is a key driver for KakaoBank, directly impacting consumer spending and the appetite for financial services. While the nation's export sector has demonstrated resilience, domestic demand has faced headwinds, notably from the pressure of debt servicing and subdued wage increases. For instance, South Korea's GDP growth was estimated at 1.4% in 2023, with projections for 2024 and 2025 hovering around the 2-2.5% range, suggesting a potentially more moderate environment for new loan origination and uptake of innovative financial products.

Competition in the Banking Sector

The South Korean banking landscape is intensely competitive. KakaoBank faces significant rivalry not only from established traditional banks but also from other internet-only banks like K Bank and Toss Bank, all striving to capture a larger share of the digital banking market.

The prospect of a fourth internet-only bank entering the market in 2024 or 2025 is set to further escalate this competition. This necessitates that KakaoBank remains at the forefront of innovation, constantly refining its services and unique selling propositions to solidify its leading position.

- Market Share Dynamics: As of late 2023, KakaoBank held a substantial portion of the digital banking market, but the aggressive growth of Toss Bank, which surpassed 10 million users in early 2024, highlights the shifting competitive landscape.

- Product Differentiation: To counter rivals, KakaoBank has focused on user-friendly interfaces, competitive interest rates on savings and loans, and expanding its range of financial products, including credit cards and investment services.

- Regulatory Environment: The potential licensing of a new player could lead to increased promotional activities and potentially lower margins across the sector as companies vie for customer acquisition.

Inflation and Purchasing Power

Inflationary pressures in South Korea, while showing signs of moderating, continue to influence consumer behavior. For instance, South Korea's Consumer Price Index (CPI) saw a year-on-year increase of 3.1% in April 2024, a slight dip from previous months but still a significant factor affecting disposable income. This directly impacts how much individuals can save or afford to borrow, posing a challenge for retail banks like KakaoBank.

KakaoBank's reliance on retail customers means its deposit base and loan portfolio are particularly susceptible to shifts in purchasing power. When inflation erodes savings, customers may withdraw funds or delay new loan applications. Conversely, higher inflation can also lead to increased demand for loans to cover rising costs, but the ability to repay these loans is compromised if wage growth doesn't keep pace.

The bank's sensitivity to these economic trends is evident in its customer deposit growth and loan delinquency rates. As of Q1 2024, KakaoBank reported total deposits of KRW 125.5 trillion, a figure that could be influenced by inflation's effect on consumer savings habits. Monitoring these economic indicators is crucial for KakaoBank's strategic planning and risk management.

- Inflationary Impact: South Korea's CPI at 3.1% (April 2024) indicates ongoing pressure on consumer spending and saving capacity.

- Retail Banking Sensitivity: KakaoBank's business model is directly affected by changes in consumer purchasing power and their willingness to engage in financial transactions.

- Deposit and Loan Dynamics: Inflation can lead to reduced savings or increased loan demand, both of which impact KakaoBank's balance sheet and profitability.

- Economic Monitoring: Continuous tracking of inflation and its effects on consumer finances is vital for KakaoBank to adapt its strategies.

South Korea's economic growth, projected between 2-2.5% for 2024-2025, suggests a moderate environment for loan origination. High household debt, exceeding 2,273.5 trillion KRW in Q1 2024, has led to stricter lending regulations. Inflation, with CPI at 3.1% in April 2024, impacts consumer spending and savings, influencing KakaoBank's deposit base and loan demand.

| Economic Indicator | Value/Status | Impact on KakaoBank |

| GDP Growth (2024-2025 est.) | 2-2.5% | Moderate environment for loan growth |

| Household Debt (Q1 2024) | ~2,273.5 trillion KRW | Stricter lending rules, potential slowdown in household loans |

| Inflation (CPI April 2024) | 3.1% YoY | Affects consumer spending, savings, and loan repayment capacity |

Full Version Awaits

KakaoBank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of KakaoBank provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

South Korea boasts an exceptionally high smartphone penetration rate, reaching 95% as of early 2024, which fuels a strong mobile-first culture. This digital readiness means a significant portion of the population is comfortable managing all aspects of their lives, including finances, through their smartphones. This environment is perfectly suited for internet-only banks like KakaoBank, which are designed to be accessed and operated entirely via mobile devices.

KakaoBank's strategy of offering all its services exclusively through its mobile app directly taps into this prevalent consumer preference. By prioritizing convenience and accessibility, the bank resonates with users who expect seamless digital interactions for their banking needs. This focus on the mobile channel has been a key driver of its rapid growth and customer acquisition in a market already primed for digital financial solutions.

Consumers today demand financial services that are not just functional but also intuitive and readily available. They expect personalization and convenience, pushing traditional banks to innovate. KakaoBank has capitalized on this by prioritizing a slick user interface and user experience, making banking as simple as using a smartphone app. This focus has resulted in a significant portion of new accounts being opened outside typical business hours, reflecting the demand for 24/7 accessibility.

KakaoBank's customer base is evolving beyond its initial younger demographic. While the 20-40 age bracket remains significant, there's a noticeable uptick in customers aged 50 and above. This trend, evident in recent user data showing a growing segment of older users, necessitates a strategic pivot in service offerings and marketing campaigns to effectively engage this expanding demographic and address their unique financial requirements.

Financial Literacy and Digital Inclusion

As digital banking continues its rapid expansion, the financial literacy of the general population and the success of digital inclusion initiatives are paramount. KakaoBank's intuitive design and its seamless integration with KakaoTalk, a platform used by a significant portion of South Korea's population, actively work to lower barriers to entry for financial services.

This approach is vital as it directly impacts customer adoption rates. For instance, in 2023, South Korea reported a high internet penetration rate of 97.1%, yet disparities in digital literacy persist, particularly among older demographics. KakaoBank's strategy of simplifying complex financial processes and leveraging a familiar communication channel directly addresses this by making banking more approachable and understandable for a wider audience.

- Financial Literacy Impact: Enhanced financial literacy can lead to increased engagement with digital banking services and better financial decision-making among users.

- Digital Inclusion Efforts: KakaoBank's user-friendly interface and KakaoTalk integration are key enablers of digital inclusion, broadening access to financial services.

- User Adoption Data: By Q4 2023, KakaoBank reported over 24 million cumulative users, underscoring the effectiveness of its accessible digital strategy in attracting a broad customer base.

Trust and Brand Perception

Consumer trust is the bedrock of digital financial services, and KakaoBank leverages its integration with the popular KakaoTalk platform to foster this. By associating with a familiar and widely used service, KakaoBank gains an immediate advantage in building initial user confidence. Maintaining this trust is an ongoing effort, heavily reliant on delivering dependable service, implementing strong security measures, and being upfront about data handling and the company's financial health.

The perceived trustworthiness of KakaoBank is significantly influenced by its brand image. As of early 2024, KakaoBank continued to benefit from the strong brand recognition of its parent Kakao, with a significant portion of its user base originating from existing KakaoTalk users. This affiliation has historically translated into higher customer acquisition rates compared to competitors relying solely on traditional marketing. However, ensuring continued trust necessitates proactive communication regarding security protocols and financial stability, especially in light of evolving cybersecurity threats and economic uncertainties.

- Brand Affiliation: KakaoBank's link to the Kakao ecosystem provides a foundational level of trust for millions of South Koreans already familiar with KakaoTalk.

- Service Reliability: Consistent uptime and smooth transaction processing are critical for maintaining user confidence in a digital-first banking environment.

- Data Privacy and Security: Transparent policies and robust cybersecurity measures are essential to address consumer concerns about financial data protection.

- Financial Stability Perception: Clear communication about KakaoBank's financial performance and regulatory compliance is key to reassuring customers about the safety of their deposits.

South Korea's high smartphone penetration, exceeding 95% in early 2024, fosters a mobile-first culture, aligning perfectly with KakaoBank's app-centric model. This digital readiness means consumers are accustomed to managing finances via smartphones, driving demand for convenient, accessible banking. KakaoBank's strategy directly capitalizes on this by prioritizing a seamless, intuitive mobile user experience, making banking as simple as using a popular messaging app.

The bank's user base is broadening beyond younger demographics, with a notable increase in users aged 50 and above as of late 2023. This evolving demographic profile necessitates tailored services and marketing to engage older users effectively, addressing their specific financial needs and potentially bridging digital literacy gaps. KakaoBank's user-friendly design and integration with KakaoTalk are crucial for digital inclusion, making financial services more approachable for a wider audience.

Consumer trust, a critical factor for digital banks, is bolstered by KakaoBank's integration with the ubiquitous KakaoTalk platform. This affiliation provides immediate brand recognition and user confidence. Maintaining this trust hinges on consistent service reliability, robust security measures, and transparent communication about data privacy and financial stability, especially as cybersecurity threats evolve.

Technological factors

South Korea's dynamic FinTech landscape is a significant technological factor for KakaoBank. The company is actively integrating artificial intelligence (AI) and machine learning across its operations. This strategic investment is evident in their development of AI-driven loan approval processes, advanced smishing detection systems, and the exploration of generative AI for personalized customer content, all designed to boost operational efficiency and elevate the user experience.

KakaoBank's entire operation is built around mobile technology, utilizing its digital platform to deliver a full range of retail banking services. This mobile-first approach is central to its strategy of expanding its platform business and fostering an ecosystem that connects with other Kakao services, aiming for a fluid financial user experience.

In 2023, KakaoBank reported a significant increase in its user base, reaching over 20 million registered users, with the majority of transactions conducted via its mobile app. This highlights the deep penetration and reliance on mobile for banking activities in South Korea.

The company's focus on platform integration saw KakaoBank deepen its ties with other Kakao affiliates, such as Kakao Pay, further enhancing its ecosystem and offering more bundled financial products. This strategy is designed to capture a larger share of the digital financial market by providing convenience and added value through interconnected services.

KakaoBank leverages sophisticated big data analytics to deeply understand its user base, processing vast amounts of information to identify patterns in customer behavior and preferences. This analytical prowess is key to its strategy of hyper-personalization.

By analyzing this data, KakaoBank can craft highly tailored financial products and services, from customized loan offers to personalized investment recommendations. For instance, in 2023, the bank reported a significant increase in the adoption rate of its personalized savings products, directly attributed to its data-driven marketing campaigns.

This focus on individual needs not only enhances customer satisfaction but also allows KakaoBank to proactively anticipate future requirements. Their ability to predict evolving financial needs, supported by a growing user base that exceeded 23 million accounts by the end of 2023, demonstrates the power of their technological approach.

Cybersecurity and Data Infrastructure

KakaoBank's reliance on digital operations makes robust cybersecurity and data infrastructure paramount. The bank is actively investing in advanced software solutions and leveraging open-source technologies to fortify its digital defenses. This commitment is further underscored by its strategic initiative to construct a new data center, serving as a vital second disaster recovery site. This expansion is designed to guarantee the unwavering stability, reliability, and security of its services and, critically, the vast amounts of customer data it manages.

In 2023, KakaoBank reported a significant increase in its IT investments, with a substantial portion allocated to enhancing its data infrastructure and cybersecurity measures. While specific figures for 2024/2025 are still emerging, industry trends indicate continued growth in this area. For instance, the global cybersecurity market is projected to reach over $300 billion by 2025, highlighting the increasing importance of these investments for all digital financial institutions.

- Investment in advanced software: KakaoBank continuously updates its software to counter evolving cyber threats.

- Open-source technology adoption: Utilizing open-source solutions can offer flexibility and cost-efficiency while requiring diligent security management.

- New data center development: This initiative aims to bolster service continuity and data protection against potential disruptions.

- Focus on stability and reliability: Ensuring uninterrupted service is a core objective, directly supported by infrastructure upgrades.

Open Banking and API Integration

South Korea's embrace of open banking, driven by government initiatives, is fostering a more collaborative financial landscape. This regulatory push encourages partnerships between established banks and nimble FinTech companies like KakaoBank.

KakaoBank is actively utilizing Application Programming Interfaces (APIs) to streamline customer experiences and explore new product avenues through strategic alliances. This API-first approach is crucial for building a more integrated financial ecosystem, allowing for seamless data sharing and service innovation.

- API Integration: KakaoBank's use of APIs enables third-party developers to build applications that interact with its banking services, fostering innovation.

- Partnership Potential: Open banking frameworks allow KakaoBank to partner with various businesses, potentially embedding financial services directly into non-financial platforms.

- Customer Convenience: By simplifying access to financial data and services through APIs, KakaoBank enhances user convenience and reduces friction in banking journeys.

KakaoBank's technological strategy centers on leveraging AI and big data for hyper-personalization, evident in its AI-driven loan approvals and tailored savings products, which saw increased adoption in 2023. The bank's commitment to robust cybersecurity and data infrastructure is underscored by significant IT investments in 2023 and the development of a new data center to ensure service stability and data protection. This focus on advanced software and infrastructure is crucial as the global cybersecurity market is projected to exceed $300 billion by 2025.

Legal factors

KakaoBank, as an internet-only bank in South Korea, is governed by the country's Banking Act, which dictates specific licensing requirements. The Financial Services Commission (FSC) plays a crucial role in evaluating these licenses, focusing on factors like financial stability, innovative approaches, customer inclusivity, and the practical viability of proposed business models for any new banking applicants.

Financial consumer protection is a significant regulatory focus, particularly as digital financial services expand. KakaoBank must adhere to rules designed to protect customer rights, combat fraud, and ensure equitable dealings, all vital for building and keeping customer confidence.

In South Korea, the Financial Services Commission (FSC) actively enforces consumer protection measures. For instance, in 2023, the FSC reported a notable increase in complaints related to digital financial products, prompting stricter guidelines for online financial providers like KakaoBank regarding transparency and dispute resolution.

KakaoBank operates under stringent data privacy regulations, notably the Personal Information Protection Act (PIPA) and the Act on the Use and Protection of Credit Information (CIA). These laws are critical for maintaining customer trust in the digital banking sphere.

Compliance with PIPA and CIA necessitates robust technical and administrative safeguards to prevent unauthorized access and data breaches. For instance, in 2023, South Korea saw a significant increase in cyber threats, underscoring the importance of these protective measures for financial institutions like KakaoBank.

These regulations also empower data subjects with rights concerning their personal information, including access, correction, and deletion. This framework ensures transparency and accountability in how KakaoBank handles sensitive customer data, a key factor in its user-centric approach.

Anti-Money Laundering (AML) and KYC Compliance

KakaoBank, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These are primarily overseen by South Korea's Financial Services Commission (FSC). The bank must have sophisticated systems in place to identify and report any suspicious financial activities, a critical step in combating financial crime and ensuring regulatory compliance.

Adherence to these regulations is not just a legal obligation but a fundamental aspect of maintaining trust and operational integrity. For instance, in 2023, South Korea's financial authorities continued to emphasize robust AML/KYC frameworks, with the FSC actively monitoring compliance across digital banking platforms. This focus is expected to intensify in 2024 and 2025, requiring continuous investment in technology and training to detect and prevent illicit financial flows.

- Regulatory Oversight: The Financial Services Commission (FSC) sets and enforces AML/KYC standards in South Korea.

- Transaction Monitoring: KakaoBank must implement advanced systems to detect and report suspicious transactions.

- Financial Crime Prevention: Compliance with AML/KYC is crucial for preventing money laundering and terrorist financing.

- Industry Focus: The FSC's continued emphasis on these regulations underscores their importance for digital banks like KakaoBank.

Electronic Financial Transactions Act (EFTA)

The Electronic Financial Transactions Act (EFTA) is a cornerstone for KakaoBank, establishing the rules for secure and dependable digital financial dealings in South Korea. This legislation governs KakaoBank's core services like payments and streamlined remittances, necessitating adherence to registration requirements, capital adequacy, and robust consumer protection measures.

KakaoBank's compliance with EFTA is critical for its operational legitimacy and customer trust. For instance, the act mandates specific security protocols for online transactions, which KakaoBank must consistently implement and update. As of late 2024, the digital financial sector in South Korea continues to see significant growth, with EFTA playing a vital role in fostering this expansion by ensuring a stable regulatory environment.

Key aspects of EFTA impacting KakaoBank include:

- Registration and Licensing: KakaoBank, as an internet-only bank, operates under specific licensing provisions within EFTA, ensuring it meets the necessary financial and operational standards.

- Consumer Protection: The act enforces consumer rights related to electronic transactions, including dispute resolution and safeguarding against unauthorized access or fraudulent activities.

- Security Standards: EFTA mandates stringent security measures for electronic financial service providers, covering data encryption, authentication, and system integrity, which KakaoBank must uphold.

- Capital Requirements: Like traditional banks, KakaoBank must meet capital adequacy ratios stipulated by financial authorities, influenced by EFTA's framework for financial stability.

South Korea's legal framework, particularly the Banking Act and regulations from the Financial Services Commission (FSC), dictates KakaoBank's operational boundaries, focusing on licensing, financial stability, and innovative business models. The FSC's 2023 emphasis on consumer protection, spurred by increased digital financial complaints, means KakaoBank must prioritize transparency and robust dispute resolution mechanisms.

Stringent data privacy laws like PIPA and CIA are paramount for KakaoBank, especially given the 2023 rise in cyber threats in South Korea, necessitating advanced security measures to safeguard sensitive customer information. Furthermore, adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, actively monitored by the FSC, is crucial for preventing financial crime and maintaining operational integrity, a focus expected to intensify through 2024 and 2025.

The Electronic Financial Transactions Act (EFTA) governs KakaoBank's digital services, requiring compliance with registration, capital adequacy, and consumer protection rules. As of late 2024, EFTA's role in ensuring a stable regulatory environment is vital for the continued growth of South Korea's digital finance sector.

| Legal Factor | Key Legislation/Body | Impact on KakaoBank | Recent/Projected Trends (2023-2025) |

| Banking Operations & Licensing | Banking Act, FSC | Requires specific licenses, financial stability, and innovative model approval. | FSC continues to evaluate new entrants based on these criteria. |

| Consumer Protection | FSC Regulations | Mandates fair dealings, fraud prevention, and customer rights protection. | Increased scrutiny on transparency and dispute resolution due to rising digital complaints (noted in 2023). |

| Data Privacy | PIPA, CIA | Requires robust security for personal and credit information. | Heightened focus on cybersecurity measures due to increased threats (observed in 2023). |

| AML/KYC Compliance | FSC | Mandates systems for identifying and reporting suspicious activities. | FSC actively monitors compliance; intensified focus expected through 2024-2025. |

| Electronic Transactions | EFTA | Governs secure digital payments, remittances, and requires adherence to security standards and consumer rights. | EFTA supports digital finance growth by ensuring regulatory stability; ongoing need for security protocol updates. |

Environmental factors

KakaoBank is actively integrating Environmental, Social, and Governance (ESG) principles into its core business strategy. This commitment is clearly outlined in their sustainability reports, which showcase initiatives focused on environmental stewardship, fostering social value, and maintaining robust governance structures.

This strategic direction aligns with a broader global and domestic trend within the financial industry, where sustainable business practices are becoming paramount. For instance, in 2023, KakaoBank reported a 15% reduction in its carbon footprint compared to the previous year, demonstrating tangible progress in environmental responsibility.

While an internet-only bank like KakaoBank inherently has a smaller physical footprint than traditional brick-and-mortar institutions, environmental factors remain crucial. Energy consumption for its extensive data centers and IT infrastructure is a primary concern. KakaoBank's commitment to efficiency is evident in its new Jukjeon Data Centre, which is engineered for optimal performance, thereby aiming to manage its environmental impact effectively.

KakaoBank is committed to transparently disclosing its climate change adaptation strategies and environmental impact reduction efforts, aligning with corporate social responsibility goals. This includes exploring frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) to enhance stakeholder communication.

In 2023, South Korea experienced significant weather events, including heavy rainfall and typhoons, highlighting the increasing need for climate resilience in financial services. KakaoBank's proactive approach to understanding and mitigating climate-related risks is crucial for maintaining operational stability and investor confidence.

The company's focus on sustainability reporting, potentially adopting TCFD recommendations, will provide stakeholders with clearer insights into its preparedness for a changing climate. This transparency is increasingly valued, with global investor interest in ESG (Environmental, Social, and Governance) factors continuing to grow, impacting investment decisions and corporate valuations.

Promoting Environment-Friendly Activities

KakaoBank's 'Active Green Initiative' aims to foster eco-friendly habits among its users by leveraging its digital infrastructure. This includes encouraging digital-only statements and paperless transactions, thereby reducing environmental impact.

The bank's commitment extends to promoting broader low-carbon lifestyle choices through its financial services. For instance, in 2023, KakaoBank saw a significant reduction in paper usage, with over 95% of its customer communications being digital, contributing to a greener operational footprint.

- Digital Statements: Encouraging customers to opt for electronic statements over physical mail.

- Paperless Transactions: Promoting the use of mobile banking and digital payment methods.

- Sustainable Finance Promotion: Potentially offering incentives or information on eco-conscious financial behaviors.

- Carbon Footprint Reduction: KakaoBank reported a 15% decrease in its direct carbon emissions in 2024 compared to the previous year, largely due to digitalization efforts.

Sustainable Finance Products and Services

The growing emphasis on sustainability within finance is driving demand for green financial products. This trend could see KakaoBank developing offerings like sustainability-linked loans or investment portfolios focused on environmentally responsible projects, mirroring the broader ESG movement in banking.

In 2023, the global sustainable finance market continued its expansion, with green bond issuance reaching an estimated $600 billion, according to various market reports. This signals a significant opportunity for digital banks like KakaoBank to tap into this growing investor and consumer preference.

KakaoBank could consider several avenues to integrate sustainability:

- Develop ESG-focused investment funds: Offering mutual funds or ETFs that invest in companies with strong environmental, social, and governance practices.

- Introduce green loans: Providing loans with preferential rates for individuals or businesses investing in renewable energy or energy-efficient upgrades.

- Partner with sustainability platforms: Collaborating with platforms that certify or track environmental impact to offer integrated services.

- Enhance digital reporting: Providing customers with clear, accessible data on the environmental impact of their banking activities or investments.

Environmental factors significantly influence KakaoBank's operations, particularly its reliance on digital infrastructure and data centers. The bank's commitment to reducing its carbon footprint is demonstrated by a 15% decrease in emissions in 2024 compared to the prior year, largely driven by digitalization. This focus on efficiency extends to its Jukjeon Data Centre, designed for optimal energy performance.

KakaoBank actively promotes eco-friendly habits through its 'Active Green Initiative,' encouraging paperless transactions and digital statements, with over 95% of customer communications being digital in 2023. The global sustainable finance market, valued in the hundreds of billions of dollars for green bond issuance in 2023, presents opportunities for KakaoBank to develop green financial products and services.

The increasing frequency of extreme weather events in South Korea, such as those experienced in 2023, underscores the importance of climate resilience for financial institutions. KakaoBank's proactive approach to understanding and mitigating climate-related risks is vital for maintaining operational stability and stakeholder trust.

KakaoBank's transparency regarding its climate adaptation strategies and environmental impact reduction efforts, potentially adopting TCFD recommendations, is crucial for attracting investors increasingly focused on ESG factors. This aligns with a broader industry trend where sustainable practices are becoming a key differentiator.

| Environmental Factor | KakaoBank's Response/Initiative | Data/Impact (2023/2024) |

|---|---|---|

| Digitalization & Energy Consumption | Focus on energy-efficient data centers (Jukjeon Data Centre) | 15% reduction in carbon footprint (2024 vs. prior year) |

| Paperless Operations | Promoting digital statements and paperless transactions | Over 95% of customer communications digital (2023) |

| Climate Change & Resilience | Understanding and mitigating climate-related risks | Increased extreme weather events in South Korea (2023) |

| Sustainable Finance Market | Potential development of green financial products | Global green bond issuance ~ $600 billion (2023) |

PESTLE Analysis Data Sources

Our KakaoBank PESTLE analysis is informed by a comprehensive review of official South Korean government publications, financial regulatory updates, and reports from leading economic and technology research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting KakaoBank.