KakaoBank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KakaoBank Bundle

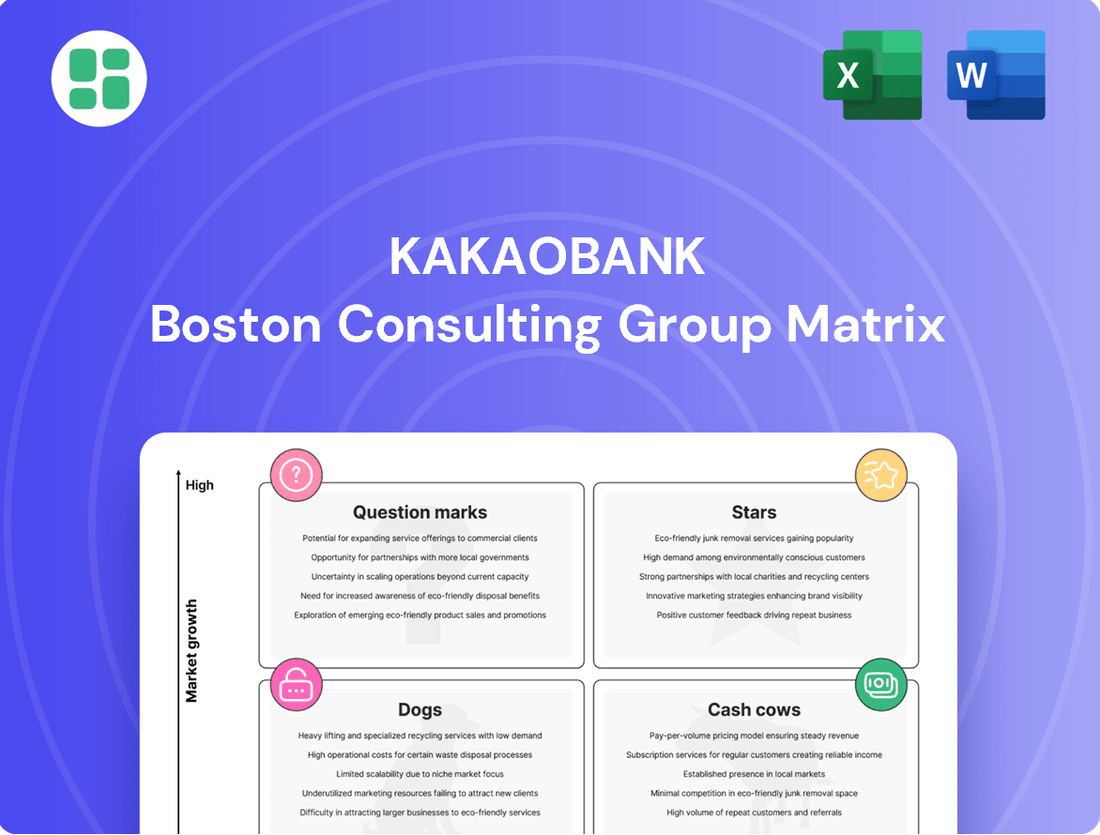

Curious about KakaoBank's strategic positioning? Our preview offers a glimpse into their product portfolio, hinting at which services are market leaders and which may need a closer look.

Unlock the full potential of this analysis by purchasing the complete KakaoBank BCG Matrix. Gain a crystal-clear understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about where to invest and innovate next.

Stars

KakaoBank's mobile application is the heart of its operations, offering essential banking services like effortless account opening, seamless interbank transfers, and convenient debit card issuance. These foundational offerings are its core strength, attracting and retaining a massive user base.

The bank's customer numbers are impressive, exceeding 25.45 million users by the first quarter of 2025, with a significant portion actively using the app monthly. This high engagement highlights the app's central role and its high market share within South Korea's rapidly growing digital banking sector.

KakaoBank's financial performance in 2024 further validates the success of these core services. The bank achieved record earnings, a direct result of increased customer acquisition and enhanced app usage, demonstrating the strong market position of its fundamental digital banking features.

KakaoBank's diverse digital lending portfolio, encompassing personal and credit loans, exhibits robust growth and a commanding presence in the online lending sector. By the close of March 2025, the bank's loan balance had surged to KRW 44.3 trillion, reflecting impressive expansion across its entire loan product range.

This strong performance is further bolstered by the projected significant expansion of the alternative lending market in South Korea. This upward trend signals a highly favorable and dynamic environment for KakaoBank's continued success in its digital lending offerings.

KakaoBank's platform business revenue, encompassing loan comparison, securities brokerage, and advertising, is a significant engine for growth. This segment experienced a robust 25.6% surge in non-interest income during 2024, reaching 889.1 billion won.

The momentum continued into the first quarter of 2025, demonstrating sustained strong performance. This diversified income stream effectively capitalizes on KakaoBank's substantial customer base and its strategic positioning within the rapidly expanding fintech sector.

Strategic Investments & Partnerships (e.g., Bank Jago)

KakaoBank's strategic equity investment in Indonesia's Bank Jago exemplifies its commitment to high-growth, high-potential markets, aligning with its global expansion ambitions.

Bank Jago, a key partner in KakaoBank's international strategy, achieved profitability within its first year of operation and is experiencing rapid customer acquisition in the burgeoning Southeast Asian digital banking sector. This venture is a direct effort to leverage KakaoBank's mobile banking proficiency in new territories, fostering future revenue streams and market share.

- Bank Jago's rapid ascent: Profitable within a year of launch, demonstrating strong market penetration.

- Strategic partnership with Grab: Enhances Bank Jago's reach and customer acquisition capabilities in Indonesia.

- Global expansion driver: Positions KakaoBank to replicate its domestic success in high-growth international markets.

- Future profitability potential: Taps into the expanding digital banking landscape across Southeast Asia.

AI-Powered Financial Services (Future)

KakaoBank's AI-powered financial services, including an AI financial calculator and AI Search, are being developed as future stars in its BCG matrix. These initiatives leverage advanced technology to cater to the dynamic digital finance landscape. By investing in AI, KakaoBank aims to significantly improve customer engagement, deliver tailored financial advice, and solidify its standing as a comprehensive financial solutions provider.

The bank's strategic focus on AI is expected to unlock substantial growth potential. For instance, in 2024, KakaoBank reported a net profit of 364.7 billion KRW, a 23.1% increase year-on-year, demonstrating its capacity for expansion. The introduction of AI-driven tools is designed to enhance user experience by offering more intuitive and personalized interactions, thereby attracting and retaining a larger customer base.

- AI Financial Calculator: Expected to offer sophisticated, user-friendly tools for financial planning and investment analysis, simplifying complex calculations for customers.

- AI Search: Designed to provide quick and accurate answers to financial queries, accessing and presenting information from KakaoBank's vast knowledge base.

- Personalized Content: AI will enable the delivery of customized financial product recommendations and educational materials based on individual customer behavior and needs.

- Market Growth: The global AI in fintech market is projected to reach USD 36.6 billion by 2028, growing at a CAGR of 23.1%, highlighting the significant opportunity for KakaoBank's AI ventures.

KakaoBank's AI-powered financial services, including an AI financial calculator and AI Search, are positioned as future stars. These innovations leverage advanced technology to enhance customer engagement and provide tailored financial advice. The bank's net profit in 2024 was KRW 364.7 billion, a 23.1% year-on-year increase, showcasing its growth potential as it integrates AI into its offerings.

| AI Financial Calculator | AI Search | Personalized Content | Market Growth Potential |

| User-friendly financial planning tools | Quick, accurate financial query answers | Customized product recommendations | Global AI in fintech market projected at $36.6B by 2028 |

| Simplifies complex calculations | Accesses vast knowledge base | Tailored educational materials | CAGR of 23.1% |

What is included in the product

KakaoBank's BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A KakaoBank BCG Matrix overview clarifies which business units are Stars, Cash Cows, Question Marks, or Dogs, easing strategic decision-making.

Cash Cows

KakaoBank's deposit accounts, encompassing both demand and time deposits, are firmly established as a mature product. Their impressive market share is a direct result of KakaoBank's vast customer base and highly competitive deposit rates.

By the first quarter of 2025, the total deposit balance had climbed to 60.4 trillion won. This steady increase underscores the reliability of these accounts as a foundational funding source for the bank's lending operations.

These deposit products are instrumental in generating substantial interest income for KakaoBank. Furthermore, they offer a cost-effective funding base, clearly positioning them as a quintessential cash cow within the bank's portfolio.

KakaoBank's debit and credit card issuance is a significant cash cow, benefiting from its vast user base within the popular KakaoTalk ecosystem. This integration drives consistent fee income, even in a mature market. By the end of 2023, KakaoBank reported over 23 million users, with a substantial portion actively using their card services.

The steady revenue stream from card issuance is further bolstered by KakaoBank's strategic moves. The planned launch of a private label credit card (PLCC) with Shinhan Card in 2024 is expected to tap into existing customer loyalty, ensuring continued and potentially increased transaction volumes and associated fees.

Interbank fund transfers are a foundational pillar for KakaoBank, functioning as a classic cash cow. This essential service, used by nearly 25 million customers for daily transactions, generates consistent revenue through transactional fees. Its integration within the widely used KakaoTalk platform drives high, recurring usage with minimal marketing spend.

Basic Payment & Remittance Services

KakaoBank's foundational payment and remittance services, including its foreign exchange (FX) remittance options, are a cornerstone of its offerings, boasting significant adoption among its vast customer base. These services, while not experiencing rapid expansion, generate steady fee income, bolstering the bank's non-interest revenue streams. The pervasive use of digital payment methods across South Korea ensures a consistent and reliable demand for these essential banking functions.

Key aspects of these services include:

- Market Dominance: KakaoBank's payment and remittance services have achieved widespread penetration, becoming a go-to solution for many South Korean consumers.

- Stable Revenue Generation: Despite being in a mature market, these services consistently contribute to KakaoBank's financial performance through predictable fee structures.

- Digital Ecosystem Integration: The services are deeply integrated into Kakao's broader digital ecosystem, enhancing user convenience and stickiness.

- Competitive FX Remittance: KakaoBank offers competitive rates and user-friendly interfaces for foreign exchange remittances, attracting a significant segment of users for international transactions. In 2023, KakaoBank reported a substantial increase in its overseas remittance volume, highlighting the growing demand for its FX services.

Traditional Interest Income from Loans

Traditional interest income from KakaoBank's extensive loan portfolio acts as a crucial cash cow. While some specific loan products might be considered stars due to their growth, the aggregate interest generated from its established lending operations remains a primary revenue engine.

In 2024, KakaoBank's loan interest income reached an impressive 2.56 trillion won. This substantial and consistent income stream is a direct result of a large and expanding loan balance, providing the financial foundation for the bank's ongoing investments and strategic initiatives.

- Revenue Driver: Interest income from the existing loan portfolio is a core revenue source.

- 2024 Performance: Loan interest income hit 2.56 trillion won in 2024.

- Capital Generation: This stable income fuels reinvestment and new business development.

- Portfolio Strength: A large and growing loan balance underpins this cash cow status.

KakaoBank's deposit accounts, including demand and time deposits, are firmly established as mature products. Their significant market share stems from KakaoBank's extensive customer base and highly competitive deposit rates. By the first quarter of 2025, the total deposit balance had reached 60.4 trillion won, underscoring their reliability as a funding source and a quintessential cash cow.

KakaoBank's debit and credit card issuance is a notable cash cow, leveraging its vast user base within the KakaoTalk ecosystem for consistent fee income. By the end of 2023, the bank reported over 23 million users, with a substantial portion actively using their card services. The planned launch of a private label credit card (PLCC) with Shinhan Card in 2024 is expected to further capitalize on customer loyalty and transaction volumes.

Interbank fund transfers serve as a foundational cash cow for KakaoBank, generating consistent revenue through transactional fees from its nearly 25 million customers. This essential service, deeply integrated into the KakaoTalk platform, drives high, recurring usage with minimal marketing expenditure.

Traditional interest income from KakaoBank's extensive loan portfolio acts as a crucial cash cow, with loan interest income reaching 2.56 trillion won in 2024. This substantial and consistent income stream, a result of a large and expanding loan balance, provides the financial foundation for the bank's ongoing investments.

| Product Category | BCG Status | Key Financial Metric (2024/Q1 2025) | Supporting Data |

| Deposit Accounts | Cash Cow | Total Deposit Balance: 60.4 trillion won (Q1 2025) | High market share due to large user base and competitive rates. |

| Card Issuance | Cash Cow | Over 23 million users (End of 2023) | Consistent fee income driven by ecosystem integration and planned PLCC launch. |

| Payment & Remittance Services | Cash Cow | Substantial increase in overseas remittance volume (2023) | Steady fee income from high, recurring usage within KakaoTalk. |

| Loan Interest Income | Cash Cow | Loan Interest Income: 2.56 trillion won (2024) | Primary revenue engine from a large and expanding loan portfolio. |

Delivered as Shown

KakaoBank BCG Matrix

The KakaoBank BCG Matrix preview you're examining is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no altered content, and no demo elements – just the complete, analysis-ready document designed for immediate strategic application.

Rest assured, the BCG Matrix for KakaoBank you are currently viewing is the exact file that will be delivered to you upon completing your purchase. It's a professionally designed, data-driven analysis ready for your immediate use in business planning and decision-making.

Dogs

Certain niche loan products within KakaoBank's portfolio, perhaps those targeting very specific demographics or industries with limited demand, could be classified as dogs. For instance, a specialized loan for artisanal cheese makers, while unique, might have seen very low uptake. As of the first quarter of 2024, KakaoBank reported a total loan portfolio of approximately 35.5 trillion KRW. If a niche product represents a minuscule fraction of this, say less than 0.1%, and shows negligible growth, it would fit this category.

Legacy or less adopted digital features within KakaoBank's ecosystem represent functionalities that, while perhaps innovative at their inception, now exhibit low user engagement. These could include older versions of loan application processes or less utilized investment tools that have been outpaced by more streamlined or feature-rich alternatives. For instance, if a particular savings account feature introduced in 2022 saw only a 5% adoption rate by the end of 2023 compared to newer products, it would fall into this category.

These functionalities often consume valuable maintenance resources, including development and server costs, without generating significant returns or contributing to user growth. While KakaoBank might maintain them for a niche user base or historical reasons, their impact on overall market share or revenue generation is minimal. In 2024, the focus would be on assessing whether the cost of maintaining these features outweighs their marginal benefit, potentially leading to their deprecation or integration into more popular offerings.

While KakaoBank generally boasts low delinquency, certain loan segments might show higher rates. These could include unsecured personal loans or credit facilities extended to individuals with lower credit scores. For instance, in 2023, while overall delinquency remained low, specific unsecured loan portfolios in the South Korean banking sector experienced delinquency rates that were notably higher than the average, sometimes reaching double digits.

Outdated Promotional Campaigns

KakaoBank's promotional campaigns that are no longer resonating with potential customers are a prime example of a Dog in the BCG Matrix. These efforts, which might have been successful in the past, now fail to attract new users or boost engagement for certain KakaoBank services. Continuing to pour resources into these outdated strategies would mean a low return on marketing investment.

In the fiercely competitive digital banking landscape, these ineffective campaigns are unable to capture new market share. For instance, a campaign heavily focused on a specific product feature that has since been surpassed by competitors would likely see diminishing returns. By 2024, digital marketing effectiveness is heavily reliant on data-driven personalization and innovative engagement tactics.

- Outdated marketing strategies yield low ROI in digital banking.

- Failure to attract new users or drive engagement for specific services.

- Inability to capture market share in a competitive digital environment.

- Example: Campaigns focusing on features now surpassed by competitors.

Unsuccessful Pilot Programs

KakaoBank's journey, like many innovative financial services, has likely included experimental ventures that didn't quite hit the mark. These pilot programs, while conceptually sound, may have struggled with user adoption or failed to generate the expected revenue streams. For instance, a hypothetical early attempt at a niche lending product for a specific demographic might have faced regulatory hurdles or insufficient market demand, leading to its discontinuation.

Such initiatives, if they consistently drain resources without a clear path to profitability or widespread acceptance, would fall into the "Dogs" category of the BCG Matrix. An example could be a pilot for cross-border remittance services that, despite technological investment, was outpaced by established competitors or failed to gain traction due to complex compliance requirements.

These underperforming projects represent investments that, while potentially innovative, did not translate into significant market share or financial success. For example, a pilot for a specialized investment advisory service targeting a very narrow segment of users might have incurred high operational costs without attracting a sufficient client base.

- Hypothetical Failed Pilot: A pilot for a peer-to-peer lending platform for small businesses that saw low participation rates and high default risks, leading to its termination in early 2024.

- Resource Drain: These programs often consume development, marketing, and operational resources without generating commensurate returns, impacting overall profitability.

- Lack of Market Viability: Initiatives that fail to demonstrate a clear market need or a sustainable business model are prime candidates for the Dogs quadrant.

- Strategic Reallocation: Identifying and discontinuing these "dog" projects allows KakaoBank to reallocate capital and focus on more promising growth areas.

Certain niche loan products within KakaoBank's portfolio, particularly those with limited demand or facing intense competition, can be classified as Dogs. For instance, a specialized loan for a very specific demographic that has seen minimal uptake, representing less than 0.1% of KakaoBank's total loan portfolio of 35.5 trillion KRW as of Q1 2024, would fit this description if it also shows negligible growth.

Legacy digital features or less adopted services that now exhibit low user engagement, such as older application processes or underutilized investment tools, also fall into this category. If a particular savings account feature introduced in 2022 had only a 5% adoption rate by the end of 2023, it would be considered a Dog, consuming resources without significant returns.

Underperforming pilot programs or experimental ventures that failed to gain traction or generate expected revenue streams are prime examples of Dogs. A hypothetical early attempt at a niche lending product that faced regulatory hurdles or insufficient market demand, or a pilot for cross-border remittance services outpaced by competitors, would represent investments that did not translate into market share or financial success.

Outdated marketing campaigns that no longer resonate with potential customers, failing to attract new users or boost engagement, also represent Dogs. Continuing to invest in these ineffective strategies, unable to capture market share in the competitive digital banking landscape, yields a low return on marketing investment.

| Category | Description | Example | Potential Impact | 2024 Focus |

|---|---|---|---|---|

| Niche Loans | Low demand, limited uptake | Specialized loans for very specific demographics | Minimal revenue, resource drain | Portfolio review, potential discontinuation |

| Legacy Features | Low user engagement, outdated | Older loan application processes | Maintenance costs, missed innovation | Streamlining, integration, or deprecation |

| Failed Pilots | Lack of market viability, low adoption | Hypothetical niche lending product with regulatory hurdles | Resource drain, opportunity cost | Analysis of learnings, reallocation of capital |

| Ineffective Campaigns | Low ROI, unable to capture market share | Marketing for features surpassed by competitors | Wasted marketing spend, stagnant growth | Data-driven personalization, innovative tactics |

Question Marks

KakaoBank is strategically expanding into the small business and self-employed loan market, a sector ripe for growth. While the bank holds a strong position in retail lending, its presence in this segment is less established, positioning it as a potential Star or Question Mark in the BCG matrix.

The planned introduction of secured and larger credit loans signifies a deliberate effort to capture a larger share of this high-potential market. This expansion leverages KakaoBank's digital capabilities to address the increasing demand for business financing in South Korea.

In 2024, the small and medium-sized enterprise (SME) loan market in South Korea continued to show robust activity, with total outstanding SME loans reaching approximately KRW 1,700 trillion by the end of the year. KakaoBank's entry and expansion in this space are aimed at capitalizing on this dynamic environment.

KakaoBank's international ambitions, exemplified by its collaboration with SCBX for a digital banking license in Thailand, represent significant question marks within its growth strategy. These ventures target high-potential emerging markets, demanding substantial upfront investment to establish a foothold and build brand recognition from scratch.

The success of these initiatives hinges on KakaoBank's ability to navigate new regulatory environments and secure robust market adoption in Thailand. While the potential for growth is considerable, the path to profitability and market leadership in these nascent digital banking landscapes remains uncertain, requiring careful execution and adaptation.

KakaoBank's planned 'Investment Box' and similar new products, slated for Q2 2025, are positioned as question marks within their BCG matrix. These offerings, leveraging MMFs, aim to enhance existing investment services, tapping into a digital investment market that saw significant growth, with fintech investment in South Korea reaching approximately $2.5 billion in 2023.

Despite the market's expansion, these new products begin with a low market share. Their success hinges on KakaoBank's ability to attract and retain customers, a challenge given the increasing competition from other digital platforms. For instance, the digital asset management sector in Korea is projected to grow, but differentiation will be key to carving out a significant presence.

Private Label Credit Card (PLCC) with Shinhan Card

KakaoBank's planned private label credit card (PLCC) with Shinhan Card, slated for a first-half 2025 launch, represents a strategic move into a new product category. This initiative aims to tap into a specific market segment by leveraging the combined strengths of both companies. As a new offering, its market share and long-term viability are currently uncertain, positioning it as a question mark within the BCG matrix. The success of this PLCC will hinge on its ability to attract and retain customers through compelling marketing campaigns and unique value propositions tailored to its target audience.

The partnership with Shinhan Card, a major player in the South Korean credit card market, is expected to provide a significant advantage. Shinhan Card reported total assets of approximately 115.5 trillion KRW (around $85 billion USD) as of the end of 2023, indicating a robust financial foundation and extensive operational experience. This collaboration allows KakaoBank to access a substantial existing customer base and benefit from Shinhan's established infrastructure and expertise in credit card operations. However, the PLCC itself is a novel product for KakaoBank, meaning its market reception and competitive positioning are yet to be fully determined.

- Market Entry Strategy: The PLCC is designed to capture a niche market, potentially appealing to existing KakaoBank users seeking integrated financial services.

- Partnership Strength: Leveraging Shinhan Card's extensive customer base and operational capabilities provides a strong foundation for the new product.

- Uncertainty Factor: As a new product, the PLCC's market share and profitability are unproven, classifying it as a question mark in the BCG matrix.

- Key Success Drivers: Differentiated benefits, competitive rewards, and targeted marketing efforts will be crucial for driving adoption and ensuring the PLCC's success.

AI-Powered Financial Calculator & Mobile ID Service

KakaoBank's AI-powered financial calculator and mobile ID service, slated for a 2025 launch, are positioned as innovative offerings with significant growth prospects. These ventures aim to disrupt the market by integrating advanced AI for personalized financial planning and a streamlined mobile identification process. Their current market share is negligible, reflecting their nascent stage, but their potential to redefine user engagement in finance and identity management is substantial.

The success of these initiatives will be largely determined by their ability to capture user interest and integrate smoothly within the already crowded digital landscape. For instance, the digital identity market is projected to grow significantly, with some estimates suggesting it could reach over $30 billion globally by 2027, indicating a ripe environment for such services. KakaoBank's challenge will be to differentiate its offerings and achieve widespread adoption against established players.

- High Growth Potential: Leveraging AI for financial calculators and mobile ID taps into rapidly expanding digital finance and identity verification markets.

- Low Current Market Share: As new offerings, they represent a strategic investment in future revenue streams with minimal existing market penetration.

- Competitive Landscape: Success depends on overcoming established digital ecosystems and attracting users with superior functionality and user experience.

- 2025 Launch Target: This timeline indicates a strategic move to capitalize on anticipated technological advancements and market readiness.

KakaoBank's foray into the small business loan market and international expansion into Thailand are key question marks. These ventures, while holding significant growth potential, require substantial investment and face considerable uncertainty in terms of market penetration and regulatory navigation.

The planned 'Investment Box' and private label credit card (PLCC) with Shinhan Card also fall into the question mark category. These initiatives aim to broaden KakaoBank's product portfolio and tap into new customer segments, but their market reception and competitive success are yet to be proven.

KakaoBank’s AI-powered financial calculator and mobile ID service, scheduled for a 2025 launch, represent further question marks. These innovative offerings aim to enhance user engagement and streamline financial management, but their ability to gain significant market share against established digital solutions remains a key question.

| Initiative | BCG Category | Rationale | Key Data Point |

| Small Business Loans | Question Mark | New market entry, high growth potential, but low initial market share. | South Korean SME loan market ~KRW 1,700 trillion (end of 2024). |

| International Expansion (Thailand) | Question Mark | Targeting emerging markets, demanding significant investment and facing regulatory hurdles. | Digital banking license acquisition process. |

| 'Investment Box' | Question Mark | New product offering in a growing digital investment market with low initial penetration. | Fintech investment in South Korea ~$2.5 billion (2023). |

| PLCC with Shinhan Card | Question Mark | Entry into a new product category with unproven market reception and competitive positioning. | Shinhan Card total assets ~115.5 trillion KRW (end of 2023). |

| AI Financial Calculator & Mobile ID | Question Mark | Innovative services with high growth potential but negligible current market share. | Global digital identity market projected to exceed $30 billion by 2027. |

BCG Matrix Data Sources

Our KakaoBank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.