KakaoBank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KakaoBank Bundle

KakaoBank's marketing success is built on a powerful 4Ps strategy, from its innovative digital product offerings to its accessible pricing and widespread app-based distribution. Their promotional efforts effectively leverage the KakaoTalk ecosystem to create a seamless and engaging customer experience.

Want to understand the deeper strategic thinking behind KakaoBank's impressive market penetration? Dive into our comprehensive 4Ps Marketing Mix Analysis, revealing the intricate interplay of their product, price, place, and promotion strategies.

Save hours of research and gain actionable insights. This pre-written Marketing Mix report provides a detailed breakdown of KakaoBank's approach, perfect for business professionals, students, and consultants seeking strategic advantage.

Product

KakaoBank's comprehensive digital banking services cover all essential retail needs. This includes a wide array of deposit accounts, diverse loan options like home and personal loans, seamless interbank fund transfers, and both debit and credit card issuance. As of Q1 2024, KakaoBank reported a total deposit balance of 134.4 trillion KRW, highlighting the trust and usage of its core banking products.

The bank is committed to continuous innovation, with plans to roll out new features. In 2025, customers can anticipate an AI-powered financial calculator and a mobile identification service, further enhancing the user experience and expanding the digital banking ecosystem. This forward-looking approach aims to solidify KakaoBank's position as a leading digital financial platform.

KakaoBank's commitment to financial inclusion is a cornerstone of its product strategy. In 2024, the bank demonstrated this by significantly increasing its loan offerings to mid- to low-credit borrowers, surpassing government-mandated targets. This focus ensures access to credit for a broader segment of the population.

The bank is actively innovating its loan products, with a particular emphasis on younger demographics and individuals new to the credit system. By developing tailored solutions for these groups, KakaoBank aims to foster financial literacy and build credit histories, thereby expanding financial inclusion.

Looking ahead, KakaoBank plans to further broaden its lending reach by expanding its portfolio for self-employed individuals. This strategic move in 2025 is designed to support a vital economic segment often underserved by traditional financial institutions, reinforcing its dedication to inclusive growth.

KakaoBank's integrated investment and platform services extend beyond basic banking, offering users a comprehensive financial hub. They can compare and open securities accounts directly within the app, streamlining the investment process. This move into platform services saw KakaoBank's total deposits reach 40.2 trillion KRW by the end of Q1 2024, indicating strong user engagement with its expanded offerings.

The bank is actively improving its fund services by broadening its product selection and introducing personalized recommendation features. Notably, the addition of Individual Retirement Pension (IRP) account opening services further solidifies its position as a one-stop shop for financial planning. By Q1 2024, KakaoBank's loan comparison service had facilitated over 1.4 million comparisons, demonstrating significant user adoption of its platform-based financial solutions.

Convenient Payment and Remittance Features

KakaoBank makes sending money incredibly simple, integrating directly with KakaoTalk. This means users can transfer funds to friends without needing their bank account details, streamlining peer-to-peer transactions. This convenience is a core part of their product offering.

The bank also boasts robust international remittance capabilities, serving over 200 countries. In 2024, KakaoBank's outbound international remittances surpassed $1 billion, highlighting its significant reach and competitive pricing in global money transfers.

- Seamless KakaoTalk Integration: Facilitates instant money transfers to contacts within the KakaoTalk app, eliminating the need for traditional account number sharing.

- Global Reach: Offers international wire transfer services to more than 200 countries worldwide.

- High Transaction Volume: Annual outbound remittances exceeded $1 billion in 2024, demonstrating substantial user adoption and trust in its remittance services.

Personalized User Experience and Card Offerings

KakaoBank prioritizes a user-centric approach, enabling customers to personalize their card designs. This focus on individual preference extends to unique product features, such as the engaging 26-week savings challenge enhanced by popular Kakao Friends characters, fostering a more relatable and enjoyable banking experience.

The bank is strategically expanding its card offerings through partnerships to launch private label credit cards (PLCC). These PLCCs are designed to deliver highly differentiated benefits, meticulously tailored to align with specific customer consumption habits and diverse lifestyle patterns, thereby enhancing customer loyalty and product relevance.

- Personalized Card Designs: Customers can customize the visual appearance of their KakaoBank cards to reflect personal tastes.

- Engaging Savings Features: The 26-week savings challenge, featuring Kakao Friends, adds an element of fun and motivation to saving.

- Strategic PLCC Partnerships: Collaborations are underway to introduce private label credit cards offering bespoke rewards.

- Lifestyle-Based Benefits: PLCC benefits are curated to match individual spending behaviors and lifestyle needs, providing greater value.

KakaoBank's product strategy centers on a user-friendly, integrated digital experience. This includes a broad suite of banking services, from deposits and loans to card issuance, all accessible through its intuitive app. The bank is also expanding into investment and platform services, aiming to be a comprehensive financial hub for its users.

Innovation is a key driver, with planned AI-powered tools and mobile ID services for 2025. Furthermore, KakaoBank is committed to financial inclusion, actively increasing loan offerings to underserved segments and tailoring products for younger demographics and the self-employed.

| Product Category | Key Features | 2024/2025 Data/Plans |

|---|---|---|

| Core Banking | Deposits, Loans (Home, Personal), Fund Transfers, Debit/Credit Cards | Total deposits: 134.4 trillion KRW (Q1 2024) |

| Innovation & Expansion | AI Financial Calculator, Mobile ID Service | Planned for 2025 |

| Financial Inclusion | Increased loans for mid- to low-credit borrowers, tailored products for youth/new credit users, expanded self-employed lending | Exceeded 2024 government targets for mid- to low-credit loans; Self-employed lending expansion planned for 2025 |

| Investment & Platform | Securities account opening, Fund services, IRP accounts, Loan comparison | Over 1.4 million loan comparisons facilitated (Q1 2024); Total deposits: 40.2 trillion KRW (Q1 2024) from expanded offerings |

| Remittances | KakaoTalk integration, International remittances | Outbound international remittances exceeded $1 billion (2024); Services over 200 countries |

| Card Services | Personalized designs, 26-week savings challenge, Private Label Credit Cards (PLCC) | PLCC partnerships underway to offer lifestyle-based benefits |

What is included in the product

This analysis provides a comprehensive breakdown of KakaoBank's marketing mix, examining its innovative product offerings, competitive pricing strategies, accessible digital distribution channels, and engaging promotional activities.

It offers a data-driven look at how KakaoBank leverages its unique digital ecosystem to redefine banking services for its target audience.

KakaoBank's 4P analysis highlights how its accessible product features and transparent pricing alleviate customer frustration with traditional banking.

This concise overview showcases how KakaoBank's strategic marketing mix effectively addresses common pain points in the financial sector.

Place

KakaoBank's exclusive mobile application platform is the cornerstone of its operations, as it is an internet-only bank. This means every banking service, from account opening to loan applications, is exclusively handled through its user-friendly app, ensuring 24/7 accessibility and eliminating the overhead of physical branches. As of Q1 2024, KakaoBank reported approximately 25 million total users, with a significant majority actively engaging through its mobile platform.

KakaoBank's mobile-only platform is a cornerstone of its distribution strategy, offering customers unparalleled 24/7 digital accessibility. This means banking services are available anytime, anywhere, directly from a smartphone, creating a highly convenient and efficient user experience.

This constant availability is crucial in today's fast-paced world. For instance, KakaoBank reported over 23.7 million users as of the end of 2023, highlighting the massive adoption of its accessible digital model. Such widespread use underscores the demand for financial services that fit seamlessly into customers' daily lives, without the constraints of traditional banking hours.

KakaoBank masterfully leverages its deep integration with KakaoTalk, the dominant messaging app in South Korea. This allows for banking functionalities, such as peer-to-peer fund transfers, to be embedded directly within chat conversations, making financial transactions as simple as sending a message. This seamless user experience was a key driver in KakaoBank's rapid growth, reaching over 24 million users by the end of 2023.

Strategic International Expansion

KakaoBank is actively pursuing strategic international expansion, focusing on replicating its successful digital-only banking model in high-growth Southeast Asian markets. This expansion is a key element of its long-term growth strategy, aiming to tap into underserved populations and leverage digital adoption trends.

Key partnerships are driving this global push. For instance, KakaoBank has partnered with Superbank in Indonesia, a digital bank backed by local conglomerates. Additionally, it's involved with an SCBX-led consortium in Thailand, further solidifying its presence in the region. These collaborations are designed to accelerate market entry and adaptation.

- Global Footprint Expansion: KakaoBank's strategy targets Southeast Asia, a region with significant digital banking potential.

- Key Partnerships: Collaborations with Superbank (Indonesia) and an SCBX-led consortium (Thailand) are central to this expansion.

- Model Replication: The aim is to successfully transfer its proven digital-only banking model to these new markets.

- Market Opportunity: This move capitalizes on the growing demand for convenient and accessible digital financial services in emerging economies.

ATM Network Access

KakaoBank, despite its digital-first approach and absence of physical branches, prioritizes cash accessibility for its customers. It achieves this through strategic alliances with a wide array of financial institutions and ATM operators throughout South Korea. This extensive network ensures that users can conduct transactions conveniently, mitigating the challenges posed by a branchless model.

This broad ATM network is a cornerstone of KakaoBank's accessibility strategy, enabling free deposits and withdrawals. For instance, as of early 2024, KakaoBank customers can access ATMs from major banks like KB Kookmin Bank, Shinhan Bank, and Woori Bank without incurring fees. This effectively bridges the gap created by not having its own physical branches, offering a tangible benefit to users who still require cash services.

The accessibility of cash through these partnerships is crucial for customer retention and acquisition. It addresses a fundamental banking need, ensuring that KakaoBank remains a viable option for a diverse customer base. The convenience of free access to a vast ATM network, estimated to cover over 100,000 locations nationwide by late 2023, directly supports the bank's value proposition.

- Extensive ATM Partnerships: KakaoBank collaborates with numerous financial institutions, providing access to a vast network of ATMs across South Korea.

- Fee-Free Transactions: Customers benefit from free cash deposits and withdrawals at partner ATMs, enhancing convenience and cost savings.

- Bridging the Digital Divide: This strategy compensates for the lack of physical branches, ensuring essential cash services are readily available.

- Customer Accessibility: The widespread ATM network is vital for meeting diverse customer needs, supporting KakaoBank's competitive positioning in the market.

KakaoBank's place strategy is defined by its digital-only presence, leveraging its mobile app as the primary channel for all services. This approach removes the need for physical branches, offering 24/7 accessibility and a streamlined user experience. By integrating seamlessly with KakaoTalk, it makes financial transactions as simple as sending a message, a key factor in its rapid user growth, reaching over 24 million users by the end of 2023.

The bank also ensures cash accessibility through extensive partnerships with financial institutions, providing free access to a vast ATM network across South Korea. This strategy, which included access to over 100,000 ATM locations nationwide by late 2023, bridges the gap created by its branchless model and caters to diverse customer needs.

Internationally, KakaoBank is replicating its digital-only model in Southeast Asia through strategic partnerships like Superbank in Indonesia and an SCBX-led consortium in Thailand, capitalizing on growing digital adoption. This expansion targets underserved populations and aims to transfer its successful digital banking framework to new markets.

What You See Is What You Get

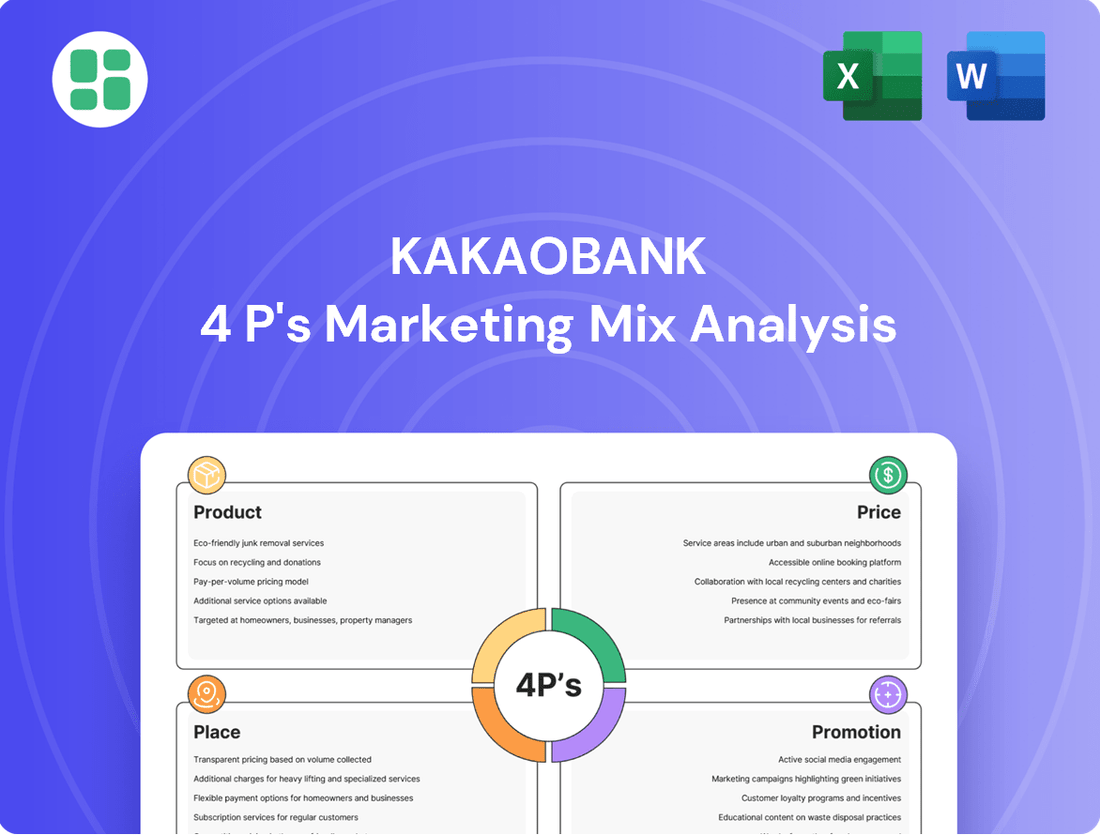

KakaoBank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive KakaoBank 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion, offering a complete picture of their strategy.

Promotion

KakaoBank's promotion strategy is deeply rooted in digital-first marketing. They effectively leverage the immense reach and brand equity of the Kakao ecosystem, especially KakaoTalk, which boasts over 50 million active users in South Korea. This integration enables highly cost-efficient customer acquisition and engagement, as promotions can be directly targeted within the familiar KakaoTalk interface.

KakaoBank leverages its user experience (UX) as a potent promotional tool within its marketing mix. The bank's commitment to a simple, intuitive, and even gamified interface actively draws in and retains customers.

This focus on user-friendliness translates directly into organic promotion. For instance, features like the popular 26-week savings challenge, enhanced with engaging Kakao Friends characters, foster high user participation and encourage natural word-of-mouth marketing.

By making banking tasks enjoyable and accessible, KakaoBank transforms its platform into a marketing asset. This strategy has been instrumental in its rapid growth, with KakaoBank reporting over 24 million users by the end of 2023, demonstrating the power of a well-executed user experience in driving customer acquisition and engagement.

KakaoBank strategically leverages partnerships to broaden its service portfolio and customer base. For instance, its collaboration with Shinhan Card on Private Label Credit Cards (PLCCs) directly targets specific consumer segments, enhancing customer loyalty and transaction volume. This approach is crucial in a competitive landscape where integrated financial solutions are increasingly valued.

Further extending its reach, KakaoBank integrates with fintech innovators like Naivy, offering seamless access to a wider array of financial and lifestyle services. These ecosystem plays not only add value for existing users but also attract new customers by positioning KakaoBank as a central hub for digital financial activities. In 2023, KakaoBank's total assets grew to approximately 60 trillion KRW, underscoring the impact of such strategic alliances on its overall growth and market presence.

Public Relations and Financial Inclusion Messaging

KakaoBank's dedication to financial inclusion, especially its focus on extending credit to individuals with mid- to low-credit scores, is a powerful public relations asset. This commitment not only bolsters its corporate image but also broadens its customer base by appealing to underserved segments of the population.

This strategy is backed by tangible results. For instance, as of the first quarter of 2024, KakaoBank reported that approximately 70% of its new loan customers were those with mid- to low-credit ratings, demonstrating a significant impact on financial accessibility.

The bank's efforts in this area create positive sentiment and can translate into increased customer loyalty and market share.

- Financial Inclusion Focus: KakaoBank actively targets mid- to low-credit borrowers, expanding access to financial services.

- Enhanced Corporate Image: This commitment builds a positive reputation and attracts a wider customer demographic.

- Customer Acquisition: By serving previously excluded groups, the bank gains new customers and strengthens its market position.

- Q1 2024 Data: Around 70% of new loan customers in Q1 2024 had mid- to low-credit ratings, showcasing the program's reach.

Targeted Digital Campaigns and Cashback Incentives

KakaoBank actively utilizes targeted digital campaigns to reach specific customer segments, enhancing its promotional efforts. These campaigns are often coupled with attractive cashback incentives, such as rewards for completing daily banking tasks or for utilizing their branded check cards.

These promotions are strategically crafted to boost user engagement and foster habitual interaction with KakaoBank's mobile banking platform. For instance, in early 2024, KakaoBank reported a significant increase in daily active users following targeted promotions for its savings products. The bank's focus on digital channels ensures efficient delivery and tracking of these incentives.

- Targeted Digital Campaigns: Utilizing data analytics to personalize marketing messages and offers across various digital platforms.

- Cashback Incentives: Rewarding users for engaging in specific behaviors like daily logins, fund transfers, or card usage.

- User Engagement: Promotions are designed to encourage frequent and consistent interaction with the KakaoBank app and its services.

- Data-Driven Approach: KakaoBank leverages user data to refine campaign effectiveness and optimize incentive structures for maximum impact.

KakaoBank's promotion strategy is a masterclass in digital engagement, heavily relying on the KakaoTalk ecosystem to reach its massive user base. They also excel at turning user experience into a promotional asset, with features like savings challenges encouraging organic word-of-mouth marketing.

Strategic partnerships and a commitment to financial inclusion further bolster their promotional efforts. By serving underserved segments, they build a positive brand image and attract new customers, as evidenced by around 70% of their new loan customers in Q1 2024 having mid- to low-credit ratings.

Targeted digital campaigns, often featuring cashback incentives, are key to driving user engagement and habitual interaction with their platform. This data-driven approach ensures promotions are effective, contributing to their substantial growth, with total assets reaching approximately 60 trillion KRW in 2023.

Price

KakaoBank consistently offers attractive interest rates, for instance, its high-yield savings accounts often surpass traditional bank offerings. In early 2024, their deposit rates for certain products reached up to 3.5% annually, making it a compelling option for savers. This aggressive pricing strategy is a core element of their market appeal.

The bank's fee structure is notably lean, frequently waiving fees for essential services like domestic interbank transfers and even international remittances, a significant differentiator. This cost advantage stems directly from their digital-first, internet-only operational model, which drastically reduces the overhead associated with physical branches.

KakaoBank's commitment to a transparent pricing model is a cornerstone of its customer-centric approach. They provide crystal-clear details on interest rates, fees, and credit terms directly within their mobile app. This straightforwardness empowers users, making financial decisions simpler compared to the often-opaque fee structures of traditional banks.

KakaoBank's loan offerings, encompassing personal, home, and self-employed loans, are strategically priced to be both competitive and accessible. This approach particularly benefits mid- to low-credit borrowers, reflecting a commitment to financial inclusion. For instance, in early 2024, KakaoBank's personal loan rates often started around 4.5%, a competitive figure in the market, demonstrating their value-driven strategy.

Non-Interest Income Generation

KakaoBank actively cultivates non-interest income, moving beyond traditional lending. This diversification is crucial for maintaining profitability and offering competitive rates on core banking products. For instance, their platform business, which includes loan comparison services and securities brokerage, generated significant revenue. In the first half of 2024, KakaoBank reported total revenue of 1.35 trillion KRW, with non-interest income playing a vital role in this performance.

This multi-faceted approach allows KakaoBank greater financial flexibility. By generating income from various sources, they can strategically price their interest-bearing products without solely relying on net interest margins. This is particularly important in a dynamic financial market where interest rate fluctuations can impact profitability.

- Loan Comparison Services: Facilitates user access to various loan products, earning commissions.

- Securities Brokerage: Offers investment services, tapping into the growing retail investment market.

- Advertising: Leverages its popular platform for targeted advertising opportunities.

- Partnerships: Collaborates with other businesses to offer integrated financial solutions.

Cost Efficiency Passed to Customers

KakaoBank's digital-first model, devoid of physical branches, translates directly into substantial savings on operational overhead. This lean structure allows the bank to pass these efficiencies onto its customers. For instance, in 2023, KakaoBank reported a significant portion of its cost savings being channeled into offering competitive interest rates and minimal transaction fees, enhancing its appeal in the market.

These cost advantages empower KakaoBank to provide more attractive financial products. Customers benefit from this model through:

- Lower loan interest rates compared to traditional banks.

- Reduced or eliminated fees for various banking services.

- Investment in superior digital platforms and user experiences.

By reinvesting operational savings, KakaoBank solidifies its value proposition, making banking more accessible and affordable. This strategy has contributed to its rapid customer acquisition, with user numbers consistently growing throughout 2024.

KakaoBank's pricing strategy is built on competitive interest rates and a minimal fee structure, directly enabled by its digital-only model. In early 2024, deposit rates reached up to 3.5%, while personal loan rates often started around 4.5%, significantly undercutting traditional banks. This aggressive pricing, coupled with waived fees for essential services like interbank transfers, underscores their commitment to customer value and financial accessibility.

| Product/Service | 2024 Pricing Example | Benefit to Customer |

|---|---|---|

| High-Yield Savings | Up to 3.5% annual interest (early 2024) | Higher returns on deposits compared to traditional banks. |

| Personal Loans | Starting around 4.5% annual interest (early 2024) | More affordable borrowing options. |

| Interbank Transfers | Free | Cost savings on everyday transactions. |

| International Remittances | Often waived fees | Reduced costs for sending money abroad. |

4P's Marketing Mix Analysis Data Sources

Our KakaoBank 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations, alongside analysis of their digital product offerings and customer-facing platforms. We also incorporate insights from reputable financial news outlets and industry-specific reports to capture their strategic positioning and market activities.