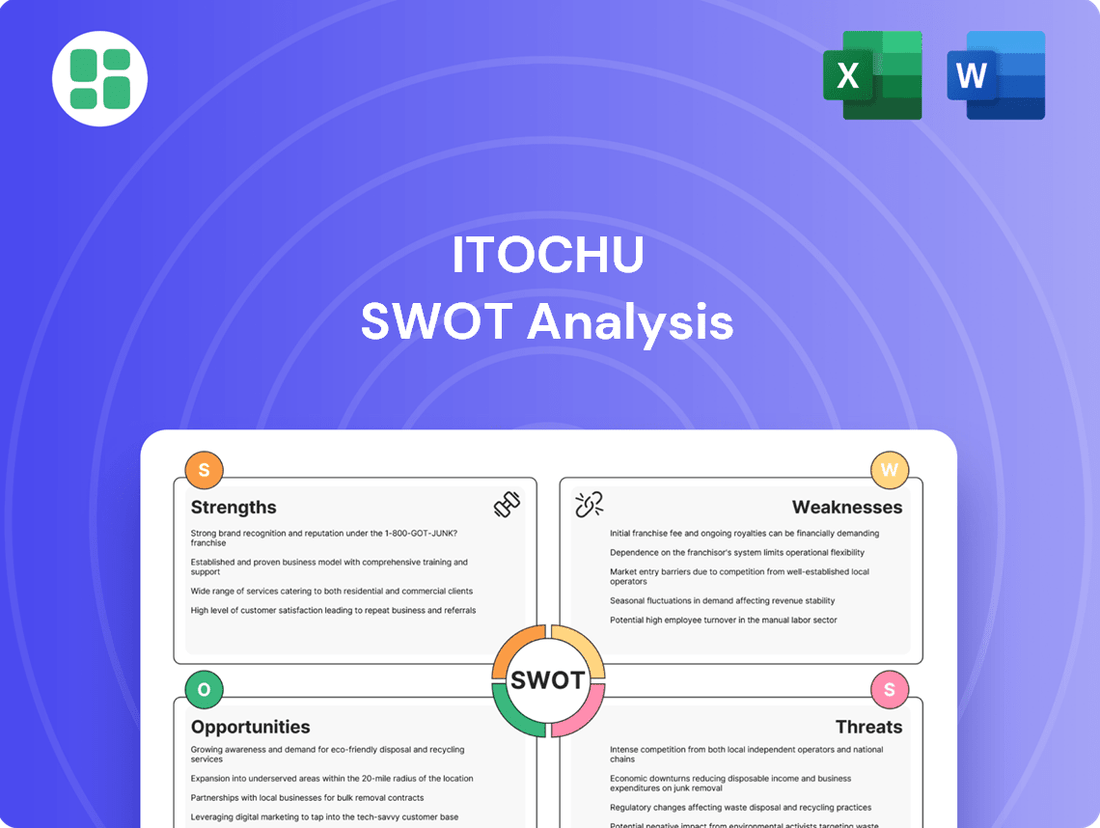

Itochu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

Itochu's diverse portfolio presents significant strengths in global reach and market diversification, yet its reliance on certain commodity markets poses a notable risk. Understanding these dynamics is crucial for any forward-thinking investor or strategist.

Want the full story behind Itochu's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Itochu Corporation's strength lies in its incredibly diversified business portfolio, spanning textiles, machinery, metals, energy, food, and ICT, among others. This broad engagement across multiple sectors significantly cushions the company against downturns in any single industry. For instance, in fiscal year 2023, Itochu reported a net income of ¥510.3 billion, showcasing its ability to generate consistent profits even amidst varied economic conditions.

Itochu's financial performance has been exceptionally robust, highlighted by a record-high consolidated net profit of ¥880.3 billion for the fiscal year ending March 2025. This strong showing is projected to continue, with forecasts indicating a ¥900.0 billion profit for the fiscal year ending March 2026, signifying a second consecutive year of record earnings.

The company's dedication to shareholder value is evident in its consistent total payout ratio of around 50%. This commitment is further demonstrated through a strategy of increasing dividend payouts and executing substantial share buybacks, directly rewarding its investors.

Itochu's strategic pivot towards downstream and consumer-facing sectors, including its significant stake in FamilyMart and expansion in IT consulting and building materials, is a key strength. This move aims to build a more resilient business model, less susceptible to the unpredictable swings of commodity markets.

The company's 'The Brand-new Deal' policy underpins this shift, with significant investment allocated to bolster these consumer-centric operations. For instance, Itochu has been actively investing in expanding its convenience store network and digital services, aiming for stable, recurring revenue streams.

Global Presence and Strategic Partnerships

Itochu's global presence is a significant strength, allowing it to operate across a diverse range of industries worldwide. This expansive network positions Itochu as a key facilitator for international trade, investment, and business development, connecting markets and opportunities on a global scale.

Strategic partnerships further amplify Itochu's global reach and influence. For example, its investment in Kawasaki Motors strengthens its position in the automotive and mobility sectors, while its involvement in sustainable aviation fuel (SAF) initiatives underscores its commitment to future-oriented industries and expands its environmental credentials.

- Global Operations: Itochu's business activities span numerous countries and industries, providing a broad base for revenue and growth.

- Strategic Investments: Key partnerships, such as the stake in Kawasaki Motors, enhance its competitive edge and market access.

- Future-Focused Alliances: Involvement in SAF projects demonstrates a forward-looking strategy and engagement with emerging sustainable markets.

Commitment to Sustainable Growth and ESG Initiatives

Itochu's commitment to sustainable growth is clearly articulated in its management policy, 'The Brand-new Deal,' which prioritizes increasing earnings, bolstering corporate brand value, and delivering shareholder returns. This strategy inherently links financial performance with long-term sustainability. For instance, in fiscal year 2023, Itochu reported a record operating income of ¥1.02 trillion, demonstrating the financial viability of their growth-oriented approach while integrating ESG principles.

The company is actively engaged in initiatives that support global decarbonization efforts. This includes a strong focus on promoting the use of Sustainable Aviation Fuel (SAF) and expanding its sustainability-related services. By investing in and facilitating these areas, Itochu is positioning itself to benefit from the growing demand for environmentally conscious solutions.

Key sustainability-focused actions and their implications include:

- Promotion of SAF: Itochu is actively involved in developing and distributing SAF, a critical component in reducing aviation's carbon footprint. This aligns with international targets for emission reductions in the transport sector.

- Expansion of Sustainability Services: The company is broadening its service offerings in areas like renewable energy and environmental consulting, catering to a market increasingly prioritizing ESG factors in business operations and investments.

- Alignment with Global Trends: By focusing on SAF and sustainability services, Itochu is directly addressing major global trends like decarbonization and the circular economy, creating new revenue streams and enhancing its long-term resilience.

Itochu's diverse business segments, including textiles, food, and ICT, provide significant resilience against sector-specific downturns. This diversification is a core strength, enabling consistent performance across varied economic conditions.

The company achieved a record consolidated net profit of ¥880.3 billion for the fiscal year ending March 2025, with projections for ¥900.0 billion in fiscal year ending March 2026, underscoring its financial prowess and growth trajectory.

Itochu maintains a shareholder-friendly approach with a consistent total payout ratio of approximately 50%, balancing increased dividends with substantial share buybacks to enhance investor returns.

Strategic investments in consumer-facing businesses like FamilyMart and expansion in IT consulting are key to building a more stable, recurring revenue model, reducing reliance on commodity market volatility.

Itochu's extensive global network facilitates international trade and business development, amplified by strategic partnerships such as its investment in Kawasaki Motors, strengthening its position in the mobility sector.

The company's commitment to sustainability, particularly its focus on Sustainable Aviation Fuel (SAF) and environmental services, aligns with global decarbonization trends and opens new avenues for growth and enhanced resilience.

| Financial Metric | FY Ending March 2025 (Actual) | FY Ending March 2026 (Projected) |

|---|---|---|

| Consolidated Net Profit | ¥880.3 billion | ¥900.0 billion |

| Total Payout Ratio | ~50% | ~50% |

What is included in the product

Delivers a strategic overview of Itochu’s internal and external business factors, highlighting its diverse portfolio and global reach while considering market volatility and competition.

It offers a clear framework to address the complexity of Itochu's diverse global operations, simplifying strategic decision-making by highlighting key internal capabilities and external market forces.

Weaknesses

Itochu's significant involvement in resource-related sectors, such as metals, minerals, and energy, exposes it to the inherent volatility of global commodity prices. For instance, during fiscal year 2023, fluctuations in these markets directly impacted the profitability of its resource divisions, requiring a strategic pivot towards non-resource income streams to offset these impacts.

This susceptibility means that downturns in commodity markets can directly affect Itochu's core earnings, as seen in certain fiscal periods where declining resource prices led to a noticeable dip in overall profit. Consequently, the company often needs to rely on growth from its other, less volatile business segments or even one-time gains to maintain its financial performance targets.

Itochu's extensive portfolio, spanning sectors from textiles to food and IT, presents a significant hurdle in operational management. This sheer diversity can strain resources and expertise, making it difficult to maintain uniform standards and responsiveness across all business units. For instance, the company's Food & Retail division and its ICT & General Products division operate under vastly different market pressures and require distinct strategic approaches, complicating centralized oversight.

Itochu's commitment to growth hinges on its investment strategy, with plans to deploy approximately ¥1 trillion in growth investments. This policy means the company's expansion is directly tied to the successful and timely execution of these capital deployments.

Any delays in these critical investments, or if new projects fail to deliver the anticipated profit contributions, can directly affect Itochu's projected earnings. For instance, the company's outlook for FYE 2025 acknowledges the potential impact of such timing issues on its financial performance.

Geopolitical and Economic Headwinds

Itochu navigates a landscape fraught with geopolitical and economic uncertainties. The potential for policy shifts, such as a hypothetical 'Trump 2.0' administration, could introduce rapid changes in trade agreements and tariffs, directly impacting Itochu's global operations. For instance, increased U.S. import tariffs could significantly raise costs for imported goods handled by the company.

Broader global economic slowdowns pose another significant threat. A contraction in economic activity in key markets, such as Asia or North America, could lead to reduced consumer spending and lower demand for the diverse range of products and services Itochu deals in. This directly affects trade volumes and overall market stability for the conglomerate.

- Policy Reversals: Risk of sudden policy changes impacting international trade.

- Trade Tariffs: Potential for increased import duties to affect cost structures.

- Economic Slowdowns: Reduced consumer spending and demand in global markets.

- Market Instability: Volatility in key operating regions due to macroeconomic factors.

Intense Competition in Trading and Investment Sectors

Itochu faces a formidable challenge from other major Japanese general trading companies, including Mitsui & Co., Marubeni Corp., and Sumitomo Corp., alongside a host of global rivals. This crowded marketplace exerts significant pressure on profit margins, necessitating constant innovation and strategic maneuvering to preserve market share and profitability.

The sheer intensity of competition means Itochu must continually invest in new ventures and adapt its business models to stay ahead. For instance, in the fiscal year ending March 2024, Itochu reported a net profit of ¥700 billion, a figure that reflects the ongoing efforts to navigate these competitive pressures and achieve growth.

- Intense Rivalry: Direct competition with established players like Mitsui & Co. and Marubeni Corp. limits pricing power.

- Global Competition: International trading houses also vie for market share across Itochu's diverse business segments.

- Margin Pressure: The need to offer competitive terms can compress profit margins, especially in commodity trading.

- Innovation Imperative: Continuous investment in new technologies and business development is crucial for differentiation.

Itochu's broad diversification, while a strength, also presents a weakness in terms of operational complexity. Managing such a wide array of businesses, from textiles to ICT, requires significant resources and expertise, potentially diluting focus and hindering uniform operational efficiency. For example, the differing market dynamics of its Food & Retail division versus its ICT & General Products division necessitate distinct management strategies, complicating centralized oversight and potentially slowing decision-making across the conglomerate.

Preview Before You Purchase

Itochu SWOT Analysis

The preview you see is the actual Itochu SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professional, in-depth analysis ready for your strategic planning.

Opportunities

The global push for sustainability, particularly in renewable energy and decarbonization, offers Itochu substantial growth opportunities. The company's strategic investments in areas like sustainable aviation fuel (SAF) development are well-aligned with escalating market demand for environmentally friendly solutions.

Itochu's engagement in developing and supplying SAF, for instance, taps into a sector projected for significant expansion. By 2025, the global SAF market is anticipated to reach billions of dollars, driven by airline commitments and regulatory pressures to reduce carbon emissions.

Itochu's strategic pivot towards downstream and consumer-facing sectors, notably its IT consulting arm and the ubiquitous FamilyMart convenience store chain, presents a significant avenue for expansion. These areas are ripe for leveraging digital technologies to streamline operations and broaden service portfolios.

The company's commitment to digital value chain integration is expected to yield substantial returns. For instance, FamilyMart, a key component of Itochu's consumer business, reported net sales of ¥1.3 trillion (approximately $8.7 billion USD based on an average 2024 exchange rate) for the fiscal year ending March 2024, highlighting the scale of its consumer reach.

By applying advanced IT solutions, Itochu can further optimize customer experiences and unlock new revenue streams within these consumer-centric businesses, reinforcing its growth trajectory in the dynamic digital economy.

Itochu's strategic mergers, acquisitions, and partnerships are a cornerstone of its growth, driven by a clear policy of 'no growth without investments.' This proactive approach fuels its expansion into new business areas and bolsters its existing operations.

Recent actions underscore this commitment. The privatization of DESCENTE, a sports apparel company, in 2023 for approximately ¥300 billion (around $2.1 billion USD at current rates) exemplifies its pursuit of strengthening core businesses. Furthermore, its collaboration with May Mobility, a leader in autonomous driving technology, signals a strategic push into future mobility solutions, aiming to capitalize on emerging market trends.

Leveraging Digital Transformation (DX)

Itochu has a substantial opportunity to accelerate its digital transformation (DX) across its varied business segments. By leveraging IT applications, the company can significantly boost operational efficiency and explore new avenues for digital service expansion. This strategic push is particularly promising for its consumer-facing and Information and Communications Technology (ICT) divisions, where enhanced digital capabilities can redefine customer experiences and unlock innovative business models.

The company's commitment to DX is already showing traction. For instance, Itochu's ICT segment, which includes businesses like Itochu Techno-Solutions Corporation, reported strong performance. In fiscal year 2023, Itochu Techno-Solutions saw its revenue grow, reflecting the increasing demand for digital solutions and services. This trend is expected to continue, with global IT spending projected to reach over $5 trillion in 2024, according to Gartner, highlighting the vast market potential for Itochu's digital initiatives.

- Enhanced Operational Efficiency: Implementing advanced IT solutions can streamline processes, reduce costs, and improve productivity across Itochu's diverse portfolio.

- New Digital Business Models: DX enables the creation of innovative digital services and platforms, opening up new revenue streams and market opportunities.

- Improved Customer Experience: Digitalization allows for more personalized interactions and seamless service delivery, particularly in consumer-oriented businesses.

- Growth in ICT Segment: Capitalizing on the expanding global IT market, Itochu can further strengthen its ICT businesses, such as Itochu Techno-Solutions, which are already experiencing robust demand.

Emerging Market Penetration and Regional Growth

Itochu can leverage its diversified business model to tap into growing consumer demand and infrastructure development in resilient emerging markets. For example, its investments in Southeast Asia, particularly in sectors like food and retail, align with the region's projected economic expansion.

The Japanese domestic market presents its own set of opportunities, with recent data indicating positive trends. In fiscal year 2023, Japan's GDP saw growth, supported by robust domestic demand and increased capital expenditures by corporations.

Specific regional growth trends, such as the increasing digitalization across Asia, offer avenues for Itochu’s trading and IT segments to expand their service offerings and market reach.

- Expansion in Southeast Asian markets: Capitalizing on the region's growing middle class and infrastructure needs.

- Domestic Japanese economic growth: Benefiting from wage increases and corporate capital expenditures.

- Digitalization trends in Asia: Offering opportunities for Itochu's IT and trading divisions.

Itochu's strategic alignment with global sustainability trends, particularly in renewable energy and decarbonization, presents a significant growth runway. The company's investments in areas like sustainable aviation fuel (SAF) are well-positioned to capitalize on escalating demand for eco-friendly solutions, with the SAF market projected for substantial expansion in the coming years.

The company can further leverage its strong presence in downstream and consumer-facing sectors, such as its IT consulting arm and the FamilyMart convenience store chain, by integrating digital technologies. This digital transformation (DX) across its diverse business segments is expected to enhance operational efficiency, create new digital business models, and improve customer experiences, particularly within its ICT division which is already seeing robust demand.

Itochu's proactive approach to mergers, acquisitions, and partnerships, exemplified by its privatization of DESCENTE and collaboration with May Mobility, fuels expansion into new and emerging markets. The company is also well-positioned to capitalize on growing consumer demand and infrastructure development in resilient emerging markets, particularly in Southeast Asia, and can benefit from positive economic trends within Japan.

Threats

Escalating geopolitical tensions and the growing trend of trade protectionism, exemplified by increased import tariffs in major economies, present a significant risk to Itochu's diverse global operations. These policies can directly impact the cost-effectiveness of international trade and investment, potentially disrupting established supply chains and increasing operational expenses.

For instance, the ongoing trade disputes and the imposition of tariffs on goods moving between major economic blocs can lead to reduced demand in affected markets, directly impacting Itochu's sales volumes across various sectors. In 2024, continued trade friction could see a rise in the cost of goods Itochu trades, potentially affecting profit margins.

Despite Itochu's diversification strategy, significant volatility in global energy and commodity markets, such as the fluctuations seen in oil prices throughout 2024, could still impact its resource-related businesses. For instance, a sharp decline in energy prices could directly affect the profitability of Itochu's investments in oil and gas exploration and production.

This market instability poses a threat to Itochu's core profits, potentially hindering its capacity to meet its projected financial goals for the 2024-2025 fiscal year. For example, if commodity prices fall significantly, the revenue generated from Itochu's trading and investment activities in these sectors would likely decrease, impacting overall earnings.

Itochu operates in a highly competitive general trading company landscape, facing pressure not only from established Japanese rivals but also from a growing number of global players. This intensifying rivalry, evident in the global trading market which saw significant growth in 2024, can lead to price wars and a squeeze on profit margins.

The need to maintain market share in this environment necessitates substantial and ongoing investment in new technologies and strategies to differentiate services. For instance, in 2024, many trading firms increased their R&D spending to develop more sustainable supply chains and digital platforms, a trend Itochu must actively counter to avoid losing ground.

Regulatory and Compliance Risks Across Jurisdictions

Itochu's global operations mean it must navigate a complex web of regulations, from environmental standards to labor laws and trade agreements. For instance, in 2024, the European Union continued to strengthen its ESG reporting requirements, impacting supply chain transparency for companies like Itochu. Failure to adapt to these evolving rules in key markets could lead to substantial penalties and operational disruptions.

Sudden shifts in governmental policies, such as changes to import/export tariffs or sanctions, pose a significant threat. For example, ongoing geopolitical tensions in 2024 have led to increased trade restrictions in various regions, directly affecting Itochu's diverse business segments. These regulatory shifts can quickly impact profitability and market access, requiring constant vigilance and strategic adaptation.

- Environmental Regulations: Increasing global focus on climate change and sustainability, with stricter emissions standards and waste management policies being implemented in major economies throughout 2024 and projected into 2025.

- Labor Laws: Varying labor protection laws across jurisdictions, including minimum wage, working conditions, and union rights, which can impact operational costs and employee relations.

- Trade Policies: Evolving trade agreements, tariffs, and sanctions, particularly those impacting key commodity flows and international business dealings, as seen with shifting trade dynamics in Asia and Europe during 2024.

- Financial Compliance: Adherence to diverse accounting standards, anti-corruption laws (like FCPA and UK Bribery Act), and data privacy regulations (e.g., GDPR, CCPA) across all operating territories.

Currency Fluctuations and Exchange Rate Volatility

Itochu's significant global footprint means it's vulnerable to currency fluctuations. For instance, a stronger yen can reduce the yen-denominated value of its foreign earnings. In 2023, the yen experienced considerable volatility, trading in a range that often made Japanese exports less competitive. This volatility directly impacts Itochu's reported profits and the purchasing power of its international revenue when converted back to yen.

The company's diverse business segments, from textiles to machinery, all face this exchange rate risk. For example, if Itochu imports raw materials or components, a weaker yen increases those costs. Conversely, if it exports finished goods, a stronger yen makes them more expensive for foreign buyers, potentially dampening demand. This dynamic was evident throughout 2024 as global economic uncertainties continued to influence currency markets.

- Impact on Translation: Adverse currency movements can significantly alter the reported value of Itochu's overseas assets and income when consolidated into its financial statements.

- Competitiveness of Exports: A strengthening yen makes Itochu's exported goods and services more expensive for international customers, potentially leading to reduced sales volumes.

- Cost of Imports: Conversely, a weakening yen increases the cost of imported raw materials and components, squeezing profit margins for segments reliant on foreign sourcing.

- 2024 Exchange Rate Trends: Throughout 2024, the Japanese yen saw fluctuations against major currencies like the US dollar and Euro, posing ongoing challenges for companies with substantial international trade.

Itochu faces significant threats from escalating geopolitical tensions and protectionist trade policies, which can disrupt its global supply chains and increase operational costs, as seen with ongoing trade disputes impacting major economies throughout 2024.

Market volatility, particularly in energy and commodities, poses a risk to Itochu's resource-related businesses, with price fluctuations potentially affecting profitability and the ability to meet financial targets for the 2024-2025 fiscal year.

Intensifying competition within the general trading company sector necessitates continuous investment in new technologies and strategies to maintain market share, as rival firms increased R&D spending in 2024 to develop digital platforms and sustainable supply chains.

Navigating a complex web of evolving regulations, including stricter environmental standards and data privacy laws, presents a challenge, with failure to adapt potentially leading to penalties and operational disruptions in key markets.

SWOT Analysis Data Sources

This Itochu SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and insightful expert commentary. These dependable data sources ensure a thorough and accurate assessment of the company's strategic position.