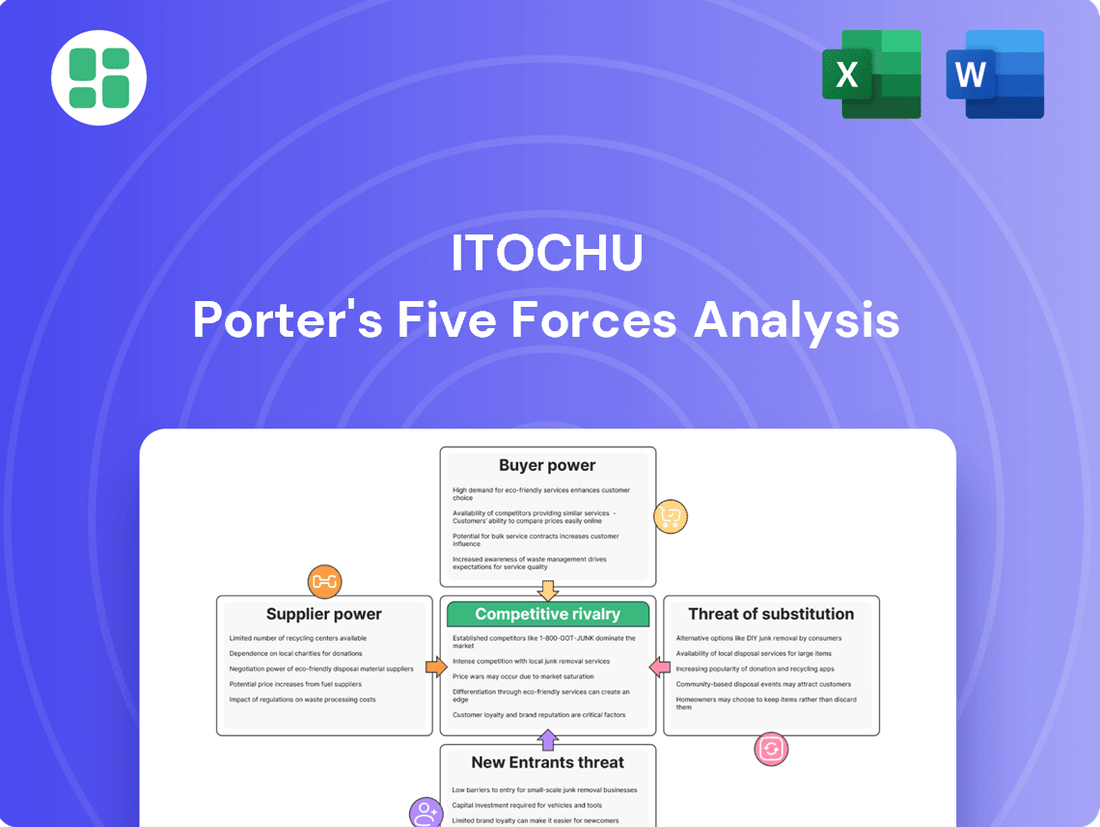

Itochu Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

Itochu navigates a complex global landscape, facing intense competition and evolving customer demands. Understanding the underlying forces that shape its industry is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Itochu’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Itochu's expansive operations across sectors like textiles, machinery, metals, energy, food, and ICT mean it works with an incredibly diverse range of suppliers. This wide net significantly reduces the company's reliance on any single supplier, thereby diffusing their individual bargaining power.

By sourcing from a vast and varied supplier ecosystem, Itochu effectively dilutes the leverage any one supplier might hold. This broad engagement is a key strategy in managing supplier relationships and costs.

The company's global footprint further strengthens its position by providing access to a wider selection of potential suppliers. In fiscal year 2023, Itochu's consolidated revenue reached ¥11.1 trillion, underscoring the scale of its sourcing operations and its ability to leverage this scale to its advantage.

Itochu's strategic investments in upstream resources, like iron ore and coking coal, bolster its position against suppliers. For example, its November 2024 investment in CSN Mineração S.A. in Brazil aims to secure long-term supply chains. This move towards partial vertical integration lessens reliance on external suppliers for critical raw materials, thereby reducing their bargaining power.

Itochu's sheer scale as one of Japan's largest general trading companies, handling vast volumes of goods, grants it significant leverage in procurement. This substantial purchasing power enables Itochu to negotiate highly favorable terms, including competitive pricing and optimized delivery schedules, with its extensive supplier network.

Suppliers recognize the immense value of consistent, large-volume orders from a global entity like Itochu, making them more amenable to accommodating the company's demands. For instance, Itochu's diverse business segments, from food and textiles to machinery and metals, collectively represent a massive demand that suppliers are eager to meet.

Long-term relationships and partnerships foster stability

Itochu's commitment to long-term relationships and strategic partnerships with its suppliers is a cornerstone of its operational stability. By cultivating these deep ties, especially within intricate supply chains, Itochu can secure more consistent access to essential resources and materials.

This collaborative strategy not only fosters a more reliable supply but also allows for the sharing of risks and joint ventures for business growth. While these alliances solidify supplier loyalty, they also subtly diminish the suppliers' leverage to impose unfavorable price hikes or stringent contract terms on Itochu.

For instance, in fiscal year 2023, Itochu reported that its raw materials segment, which heavily relies on supplier relationships, maintained robust performance, indicating the success of these long-term partnerships in navigating market volatility.

Key aspects of Itochu's supplier relationship management include:

- Strategic Sourcing: Identifying and partnering with suppliers who align with Itochu's long-term vision and operational needs.

- Joint Business Development: Collaborating on new product development or market expansion initiatives with key suppliers.

- Risk Mitigation: Working with suppliers to build resilience into the supply chain, reducing vulnerability to disruptions.

- Performance Incentives: Establishing performance metrics and incentives that reward reliability and quality from suppliers.

Focus on sustainability and ethical sourcing influences supplier selection

Itochu's dedication to sustainability, evident in its 2024 ESG report, means it actively seeks suppliers adhering to strict ethical and environmental criteria. This focus on responsible sourcing can limit the number of available suppliers, but it also fosters stronger, more collaborative relationships built on shared values.

By prioritizing suppliers with robust sustainability practices, Itochu aims to secure long-term supply chain stability. This approach can influence supplier behavior, encouraging them to adopt more responsible operational methods to maintain their partnership with Itochu.

- Supplier Selection Criteria: Itochu’s 2024 ESG report details a strong emphasis on environmental stewardship and ethical labor practices when choosing partners.

- Impact on Supplier Pool: While this rigorous selection process may reduce the immediate number of eligible suppliers, it aims to build a more resilient and values-aligned supply chain.

- Collaborative Dynamics: Itochu's strategy shifts from purely transactional supplier relationships to fostering long-term partnerships that encourage mutual growth in sustainability efforts.

- Influence on Supplier Behavior: The company's commitment to sustainability incentivizes suppliers to proactively improve their environmental and social performance to meet Itochu's evolving standards.

Itochu's vast supplier base, spanning diverse industries and geographies, significantly dilutes the bargaining power of individual suppliers. The company's scale, demonstrated by its ¥11.1 trillion consolidated revenue in fiscal year 2023, allows it to negotiate favorable terms, leveraging its substantial purchasing volume.

Strategic investments, such as the November 2024 acquisition of a stake in CSN Mineração S.A., further reduce reliance on external suppliers for critical materials, thereby diminishing their leverage.

Long-term partnerships and collaborative development initiatives with suppliers foster loyalty and stability, subtly limiting their ability to impose unfavorable terms, as evidenced by the robust performance in its raw materials segment during fiscal year 2023.

| Factor | Itochu's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Supplier Concentration | Highly diversified, low concentration | Low |

| Purchasing Volume | Massive, due to global scale and diverse segments | Low |

| Switching Costs for Itochu | Relatively low due to broad supplier network | Low |

| Supplier Differentiation | Low for many commodity inputs | Low |

| Threat of Forward Integration | Moderate, through strategic investments in upstream resources | Low |

What is included in the product

This analysis delves into the competitive forces shaping Itochu's operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse business sectors.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model that visually highlights areas of intense pressure.

Customers Bargaining Power

Itochu's strategic push into downstream, consumer-facing operations, exemplified by its significant stake in FamilyMart and expansion into car dealerships, has fundamentally reshaped its customer landscape. This diversification means Itochu now interacts with a vast array of individual consumers and numerous small to medium-sized businesses.

This broad customer base, characterized by its sheer volume and individual insignificance, naturally fragments the bargaining power of its customers. For instance, while FamilyMart operates thousands of convenience stores, each store's purchasing volume is relatively small compared to Itochu's overall operations, limiting their individual leverage.

The collective bargaining power of these dispersed customers is therefore diminished. In 2024, Itochu's diverse portfolio, including its substantial retail and automotive segments, means that no single customer or small group of customers can dictate terms, thereby strengthening Itochu's position.

Itochu's extensive reach across diverse business segments, including textiles, machinery, metals, energy, food, general products, ICT, and finance, significantly dilutes the bargaining power of individual customers. This broad operational scope means the company isn't overly dependent on any single industry or customer group for its revenue. For instance, in fiscal year 2024, Itochu reported total revenue of ¥12,010.6 billion, with its diverse portfolio contributing to this figure, preventing any one segment from dominating its financial performance and thus limiting customer leverage.

Itochu's strategic advantage lies in its ability to offer a comprehensive suite of value-added services beyond mere trading. These include sophisticated logistics management, tailored financing solutions, and proactive business development support, all integrated across its diverse business segments. This multifaceted approach significantly enhances customer loyalty, making it challenging for clients to disengage from Itochu's ecosystem.

For instance, a client relying on Itochu for end-to-end supply chain solutions, from sourcing raw materials to managing distribution and providing working capital, would face considerable disruption and cost if they sought to replicate these services elsewhere. In 2024, Itochu reported a robust performance in its logistics and financial services divisions, contributing significantly to its overall profitability and underscoring the value customers derive from these integrated offerings, thus solidifying their commitment.

Global network and market access provide customer solutions

Itochu's vast global network, spanning numerous countries and industries, significantly enhances its ability to source and supply a wide array of products and services. This extensive reach means customers can often find exactly what they need through Itochu, reducing their reliance on alternative suppliers and thus diminishing their bargaining power.

The company's deep market knowledge and established relationships allow it to identify and fulfill niche demands, making it a preferred partner for businesses seeking specialized solutions. For instance, Itochu's involvement in sectors like food, textiles, and machinery provides a consolidated platform for diverse customer needs, limiting the incentive for customers to seek out multiple, smaller suppliers.

- Global Network: Itochu operates in over 60 countries, facilitating access to diverse markets and products.

- Market Access: The company provides solutions across various sectors, including food, textiles, machinery, and ICT.

- Customer Solutions: By offering a broad spectrum of goods and services, Itochu acts as a one-stop shop for many clients.

- Reduced Customer Power: This comprehensive offering makes it harder for individual customers to exert significant price pressure or demand preferential terms.

'Sampo-yoshi' philosophy promotes mutual benefit

Itochu's core philosophy, Sampo-yoshi, meaning good for the seller, good for the buyer, and good for society, directly influences its bargaining power with customers. This principle guides Itochu to cultivate long-term, symbiotic relationships rather than engaging in short-term, exploitative transactions. By prioritizing mutual benefit, Itochu aims to create a stable customer base, thereby mitigating the risk of customers leveraging their power to demand significantly lower prices or more favorable terms.

This approach fosters customer loyalty, which can translate into reduced price sensitivity and a willingness to engage in more collaborative partnerships. For instance, Itochu's diverse business segments, from textiles to food and IT, allow for cross-selling opportunities and integrated solutions that add value beyond mere product provision. In 2024, Itochu reported consolidated revenue of approximately ¥11.5 trillion, showcasing the scale of its operations and the breadth of its customer relationships.

- Sampo-yoshi Philosophy: Fosters long-term partnerships, reducing adversarial bargaining.

- Customer Loyalty: Cultivated through mutual benefit, leading to lower price sensitivity.

- Diversified Business: Enables integrated solutions and cross-selling, enhancing customer value.

- Financial Scale: ¥11.5 trillion in consolidated revenue (2024) demonstrates significant customer engagement.

Itochu's diverse customer base, ranging from individual consumers to numerous small and medium-sized businesses across its many segments, naturally fragments their collective bargaining power. This broad reach means no single customer or small group can exert significant leverage over Itochu. For example, Itochu's fiscal year 2024 revenue of ¥12,010.6 billion was spread across numerous operations, preventing undue reliance on any specific customer segment.

The company's strategy of offering integrated, value-added services, such as logistics and financing, across its global network further solidifies customer relationships. This makes it difficult and costly for clients to switch suppliers, thereby reducing their bargaining power. Itochu's operations in over 60 countries and its presence in sectors like food, textiles, and ICT provide a comprehensive solution, acting as a one-stop shop and limiting customers' ability to negotiate better terms.

Itochu's Sampo-yoshi philosophy, emphasizing mutual benefit, cultivates customer loyalty and reduces price sensitivity. This approach, combined with the company's substantial scale, as evidenced by its ¥11.5 trillion consolidated revenue in 2024, creates stable, long-term partnerships that mitigate aggressive customer demands.

| Customer Characteristic | Impact on Bargaining Power | Itochu's Mitigation Strategy |

|---|---|---|

| Fragmented Base | Low individual leverage | Diversified portfolio across multiple industries and geographies |

| Value-Added Services | Reduced switching incentive | Integrated logistics, financing, and business development support |

| Global Network & Market Access | Limited reliance on single suppliers | One-stop-shop for diverse needs across sectors like Food, ICT, and Machinery |

| Sampo-yoshi Philosophy | Lower price sensitivity | Cultivating long-term, mutually beneficial relationships |

Preview the Actual Deliverable

Itochu Porter's Five Forces Analysis

This preview showcases the complete Itochu Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You are viewing the final deliverable, ready for immediate use and application to your strategic planning needs.

Rivalry Among Competitors

Competition from other major Japanese sogo shosha is intense. Itochu operates in a highly competitive landscape with other large Japanese general trading companies such as Mitsubishi Corporation, Mitsui & Co., Sumitomo Corporation, and Marubeni Corporation.

These rivals are also highly diversified conglomerates, vying for similar investment opportunities and market shares across various industries globally. For instance, in fiscal year 2023, Mitsubishi Corporation reported total revenue of approximately ¥21.7 trillion, demonstrating the scale of its operations and its direct competition with Itochu.

Itochu's strategic pivot towards consumer-facing and non-resource sectors, a move initiated earlier than many competitors, significantly alters its competitive landscape. This proactive shift, prioritizing high-margin services over commodity-dependent businesses, aims to mitigate the inherent earnings volatility tied to fluctuating resource prices.

By focusing on value and specialized services, Itochu positions itself to compete on differentiation rather than solely on price. This strategy is seen by some analysts as strengthening its economic moat, allowing for more stable and predictable revenue streams in a dynamic market.

For fiscal year 2024, Itochu reported a substantial increase in its non-resource segments' contribution to operating income, underscoring the success of this strategic direction. This focus on consumer goods and services, for instance, saw a notable uptick in performance, reflecting robust consumer demand.

Itochu's extensive operations span numerous industries, leading to a complex web of competitors. In fiscal year 2023, Itochu reported total revenue of ¥11,699.8 billion, showcasing its significant presence across diverse sectors. This broad diversification means Itochu contends with specialized trading houses, original equipment manufacturers, and various service providers, each with unique competitive pressures.

This wide operational scope necessitates constant adaptation. For instance, in its textiles segment, Itochu competes with global apparel brands and manufacturers, while its food division faces off against major food conglomerates and retailers. Maintaining a competitive edge across such varied landscapes demands agile strategies and a deep understanding of each market's specific dynamics.

Global economic volatility and geopolitical tensions impact rivalry

The global economic landscape, characterized by geopolitical tensions and inflationary pressures, is intensifying competitive rivalry as companies like Itochu seek stable revenue. These uncertainties force continuous strategic adjustments among industry players as they adapt to shifting trade dynamics.

Itochu's diversified portfolio and proactive risk management are key to navigating this volatile environment. However, competitors are also employing similar strategies, meaning the pressure to innovate and adapt remains high across the sector.

- Global economic volatility: Persistent inflation and supply chain disruptions continue to challenge businesses.

- Geopolitical tensions: Ongoing conflicts and trade disputes create unpredictable market conditions.

- Itochu's strategy: Diversification and risk mitigation are central to its competitive approach.

- Rival adaptation: Competitors are also enhancing their resilience and strategic flexibility.

Focus on digital transformation and sustainability shapes new competitive fronts

Itochu's strategic focus on digital transformation and sustainability is actively reshaping the competitive landscape. The company's significant investments, for instance, in sustainable aviation fuel (SAF) and broader renewable energy development, are creating entirely new arenas for competition. This means companies are now vying not just on price or product features, but increasingly on their technological prowess and their commitment to Environmental, Social, and Governance (ESG) principles.

These new competitive fronts demand different capabilities. Companies that can effectively leverage digital technologies for efficiency and innovation, while also demonstrating a genuine commitment to sustainable practices, are likely to gain a significant advantage. For example, Itochu's involvement in SAF production directly addresses the growing demand for greener travel options, a market segment that traditional oil and gas companies are also targeting, albeit with varying degrees of success.

- Digital Transformation Investments: Itochu's commitment to digital initiatives aims to streamline operations and unlock new revenue streams in areas like data analytics and e-commerce platforms.

- Sustainability Initiatives: The company's push into SAF and renewable energy development positions it to capture growth in environmentally conscious markets.

- New Competitive Metrics: Success is increasingly measured by innovation in green technologies and strong ESG performance, alongside traditional financial metrics.

- Industry Convergence: These trends are blurring lines between traditional sectors, forcing companies to adapt to a more integrated and purpose-driven competitive environment.

Itochu faces intense rivalry from other major Japanese sogo shosha like Mitsubishi Corporation, Mitsui & Co., Sumitomo Corporation, and Marubeni Corporation, all large, diversified conglomerates competing for global investment opportunities and market share.

In fiscal year 2023, Mitsubishi Corporation reported revenues of approximately ¥21.7 trillion, highlighting the scale of competition Itochu encounters. Itochu itself posted ¥11,699.8 billion in total revenue for the same period, demonstrating its significant, yet comparable, market presence across diverse sectors.

Itochu's strategic shift towards consumer-facing and non-resource sectors, a move that began earlier than many rivals, significantly alters the competitive dynamics. This focus on higher-margin services aims to reduce earnings volatility tied to commodity prices, with the non-resource segments showing a notable performance increase in fiscal year 2024.

The competitive landscape is further shaped by Itochu's broad operational scope, which means it contends with specialized trading houses, original equipment manufacturers, and various service providers across industries like textiles and food, each presenting unique competitive pressures and demanding agile, market-specific strategies.

| Competitor | Fiscal Year 2023 Revenue (Approx.) | Key Competitive Areas |

|---|---|---|

| Mitsubishi Corporation | ¥21.7 trillion | Global investments, diverse sectors |

| Mitsui & Co. | ¥16.2 trillion | Energy, machinery, infrastructure |

| Sumitomo Corporation | ¥5.3 trillion | Metals, machinery, chemicals |

| Marubeni Corporation | ¥8.1 trillion | Food, energy, industrial goods |

SSubstitutes Threaten

The rise of sophisticated digital platforms presents a threat by enabling direct buyer-seller connections, potentially disintermediating traditional trading companies. For instance, B2B e-commerce platforms are projected to reach $35.3 trillion globally by 2027, up from $23.9 trillion in 2023, indicating a growing trend of bypassing intermediaries.

However, Itochu's value proposition transcends mere transaction facilitation. The company provides intricate logistics, crucial financing solutions, and robust risk management services, capabilities that are challenging for nascent digital platforms to fully replicate for complex international trade.

For certain Itochu services, like trade compliance or financial advisory, clients may choose to build these functions internally or hire niche consulting firms. This poses a threat because businesses often desire highly customized solutions, a demand that specialized providers can meet directly.

However, Itochu's strength lies in its ability to offer integrated, cross-service solutions, providing a broader value proposition than many specialized alternatives. For instance, in 2024, the global trade compliance consulting market was valued at approximately $10 billion, indicating a substantial demand for such specialized services.

Technological advancements, particularly in materials science and manufacturing, pose a significant threat of substitution for Itochu. Innovations like biodegradable plastics or advanced composites could displace traditional materials Itochu trades, impacting demand for commodities like lumber or petrochemicals. For instance, the growing adoption of electric vehicles, enabled by battery technology, directly impacts the demand for traditional internal combustion engine components and related fuels.

Itochu actively addresses this threat by strategically investing in and partnering with companies at the forefront of emerging technologies. Their focus on high-growth sectors such as renewable energy, including solar and wind power, and advanced mobility solutions helps them pivot and capture value in evolving markets. This proactive approach ensures they are not merely trading existing goods but are also positioned to benefit from the technologies that might otherwise threaten their traditional business lines.

Shift in consumer preferences towards localized or direct-to-consumer models

The increasing consumer demand for locally sourced products and direct-to-consumer (DTC) channels presents a significant threat of substitutes for traditional trading companies like Itochu. This shift means consumers might bypass intermediaries, opting for goods produced closer to home or bought directly from manufacturers, potentially diminishing the volume of international trade Itochu facilitates.

Itochu is actively mitigating this threat by strategically investing in and strengthening its localized consumer-facing businesses. For instance, its significant stake in FamilyMart, a convenience store chain with a strong presence in Japan and other Asian markets, allows it to tap into local consumer preferences and distribution networks directly. This diversification helps capture value even as global supply chains evolve.

The company is also adapting its extensive distribution networks to better serve these localized and DTC models. By optimizing logistics for smaller, more frequent deliveries and integrating digital platforms, Itochu aims to remain relevant by providing essential services to these growing market segments. This proactive approach is crucial in a landscape where consumer behavior is rapidly changing.

In 2023, Itochu's retail and consumer-related segments, including its investments in convenience stores and food services, contributed substantially to its overall performance, underscoring the success of its strategy to counter the threat of substitutes by embracing localized models. The company's continued focus on these areas indicates a commitment to adapting its business model to meet evolving consumer demands.

Policy changes promoting domestic production or specific alternative industries

Government policies that champion domestic production or bolster particular alternative sectors, like renewable energy or sustainable agriculture, can introduce viable substitutes for imported products or established energy sources. For instance, in 2024, many nations continued to implement incentives for green hydrogen production, directly impacting demand for traditional fossil fuels.

Itochu strategically navigates this by investing in these very sectors, effectively transforming potential threats into avenues for growth. Their commitment to areas such as Sustainable Aviation Fuel (SAF) and expansion in North American energy markets, including natural gas, demonstrates a proactive approach to these evolving market dynamics.

- Government Incentives: Policies favoring domestic manufacturing and alternative industries are on the rise globally in 2024, aiming to reduce reliance on imports and foster innovation.

- Itochu's SAF Investments: Itochu's involvement in SAF development is a direct response, creating a substitute for conventional jet fuel.

- North American Energy Expansion: This move by Itochu addresses energy security concerns, potentially offering alternatives to other global energy supplies.

The threat of substitutes for Itochu arises from alternative products, services, or business models that can fulfill similar customer needs. This includes digital platforms bypassing intermediaries, specialized firms offering niche services, and technological advancements creating new materials or energy sources. Consumer shifts towards localized products and government policies favoring domestic production also contribute to this threat.

Itochu counters these threats by leveraging its integrated service offerings, investing in emerging technologies, and adapting its distribution networks to local and direct-to-consumer models. Its strategic diversification into areas like convenience stores and renewable energy aims to capture value in evolving markets and mitigate the impact of substitutes on its traditional trading businesses.

The company's proactive investment in sectors like renewable energy and advanced mobility, alongside its strong presence in localized consumer businesses, demonstrates a strategic pivot. These efforts are designed to ensure Itochu remains competitive by offering comprehensive solutions and capitalizing on new market opportunities, rather than being solely reliant on traditional commodity trading.

In 2024, the global market for sustainable aviation fuel (SAF) saw significant growth, with projections indicating continued expansion driven by government mandates and corporate sustainability goals. Itochu's strategic investments in this area directly address the substitution threat posed by cleaner alternatives to traditional aviation fuels.

| Threat of Substitute | Itochu's Response/Mitigation | Supporting Data/Trend |

|---|---|---|

| Digital Platforms (B2B E-commerce) | Focus on complex logistics, financing, and risk management | Global B2B e-commerce projected to reach $35.3 trillion by 2027 |

| Niche Consulting Firms | Offering integrated, cross-service solutions | Global trade compliance consulting market valued at ~$10 billion in 2024 |

| New Materials/Technologies (e.g., EVs) | Investing in renewable energy and advanced mobility | Growth in EV adoption impacts demand for traditional automotive components |

| Direct-to-Consumer (DTC) & Local Sourcing | Investing in localized businesses (e.g., FamilyMart) | Retail and consumer segments contributed substantially to Itochu's performance in 2023 |

| Government Policies (e.g., Green Hydrogen) | Investing in targeted sectors like SAF and North American energy | Nations implementing incentives for green hydrogen production in 2024 |

Entrants Threaten

Establishing a general trading company akin to Itochu demands substantial capital. This investment is necessary for ventures across various sectors, building a worldwide infrastructure, and securing ample working capital for trade financing. For instance, Itochu's diverse portfolio, spanning everything from food and textiles to machinery and metals, requires continuous capital allocation to maintain and expand its operations.

Furthermore, developing a global network of offices, sophisticated logistics, and robust relationships is a process that spans decades. This long-term commitment creates a formidable hurdle for any new player attempting to enter the market. Itochu, with its presence in approximately 60 countries and regions as of early 2024, exemplifies the extensive reach and established connections that new entrants would struggle to replicate quickly.

Itochu's extensive history, dating back to 1858, and its vast, diversified business portfolio have allowed it to build an unparalleled depth of industry-specific knowledge and specialized expertise. This accumulated intellectual capital, which includes intricate supply chain management, sophisticated market intelligence gathering, and robust risk management frameworks, presents a formidable barrier for any potential new entrant aiming to compete effectively.

For instance, in fiscal year 2024, Itochu reported consolidated net sales of ¥11.5 trillion, demonstrating the sheer scale and complexity of its operations. Newcomers would find it exceptionally challenging to quickly develop the nuanced understanding of diverse markets and the intricate operational efficiencies that Itochu has honed over decades, making immediate replication of its competitive advantages a significant hurdle.

Established relationships and long-term trust with partners present a significant barrier to new entrants for sogo shosha like Itochu. These companies have cultivated deep connections with suppliers, customers, and collaborators across the globe over decades. For instance, Itochu's extensive network, built through consistent performance and reliability, makes it difficult for newcomers to replicate the established trust and access to resources that Itochu enjoys.

Regulatory complexities and compliance in international trade

The threat of new entrants for Itochu, particularly concerning regulatory complexities in international trade, is significantly mitigated by its established global presence and deep expertise. Navigating the intricate web of international trade regulations, tariffs, and compliance requirements across numerous countries and product categories poses a substantial hurdle for any newcomer. Itochu’s extensive experience and dedicated resources in managing these complexities across its diverse business segments act as a powerful barrier to entry.

For instance, in 2024, the World Trade Organization (WTO) reported ongoing efforts to streamline trade procedures, yet the sheer volume and evolving nature of national regulations, including import/export licensing and product-specific standards, remain a significant challenge. A new entrant would need to invest heavily in legal, compliance, and logistical infrastructure to match Itochu's capabilities, a daunting task when considering the breadth of sectors Itochu operates within, such as food, textiles, machinery, and energy.

- Regulatory Expertise: Itochu's long-standing engagement in global trade has cultivated profound knowledge of diverse customs, tax, and product safety regulations.

- Compliance Infrastructure: The company maintains robust internal systems and personnel dedicated to ensuring adherence to international trade laws, a costly setup for new firms.

- Tariff Navigation: Understanding and managing the impact of fluctuating tariffs and trade agreements across multiple jurisdictions requires specialized, hard-won experience.

- Market Access: Itochu’s established relationships and understanding of market access protocols in various countries further erects a barrier for potential new competitors.

Itochu's continuous growth investments and strategic acquisitions solidify market position

Itochu's commitment to growth investments and strategic acquisitions in promising sectors like sustainable aviation fuel and renewable energy significantly bolsters its market standing. For instance, in fiscal year 2023, Itochu announced investments totaling billions of yen into various growth initiatives, demonstrating a clear strategy to expand its reach.

This consistent expansion into new and emerging markets makes it exceptionally challenging for potential new entrants. They face the hurdle of competing against Itochu's established scale, diversified portfolio, and significant capital resources, which are vital for achieving competitive parity.

- Diversified Investments: Itochu's strategic focus on sectors like autonomous driving and sustainable aviation fuel creates a broad competitive moat.

- Capital Strength: The company's substantial investment capacity, evidenced by its fiscal year 2023 growth investments, deters smaller, less capitalized new players.

- Economies of Scale: By consolidating market share through acquisitions, Itochu leverages economies of scale that new entrants struggle to replicate quickly.

The threat of new entrants for Itochu is considerably low due to the immense capital requirements needed to establish a global trading infrastructure and secure working capital for trade financing. Itochu's operations, spanning diverse sectors and requiring extensive worldwide networks, necessitate significant upfront investment that deters potential newcomers.

Building a global network, sophisticated logistics, and strong relationships takes decades, presenting a formidable hurdle. Itochu’s presence in approximately 60 countries as of early 2024 highlights the extensive reach and established connections that new entrants would find incredibly difficult to replicate swiftly.

Itochu's deep industry knowledge, accumulated over its long history since 1858, and its vast, diversified business portfolio create a significant barrier. This intellectual capital, encompassing supply chain management, market intelligence, and risk management, is hard for new entrants to match.

| Factor | Itochu's Advantage | Implication for New Entrants |

|---|---|---|

| Capital Requirements | Massive capital for global infrastructure and trade finance. | High barrier to entry due to significant upfront investment needs. |

| Global Network & Relationships | Decades of cultivation across ~60 countries. | Extremely difficult and time-consuming for new players to build comparable reach and trust. |

| Industry Expertise | Accumulated knowledge from diverse sectors since 1858. | New entrants lack the nuanced understanding of markets and operations Itochu possesses. |

| Regulatory Navigation | Profound knowledge of diverse international trade laws and compliance. | New entrants face substantial costs and complexity in matching Itochu's compliance infrastructure. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Itochu is built upon a foundation of publicly available financial reports, including annual and quarterly filings, alongside industry-specific market research from reputable firms. We also incorporate insights from trade publications and news archives to capture current competitive dynamics and emerging trends.