Itochu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

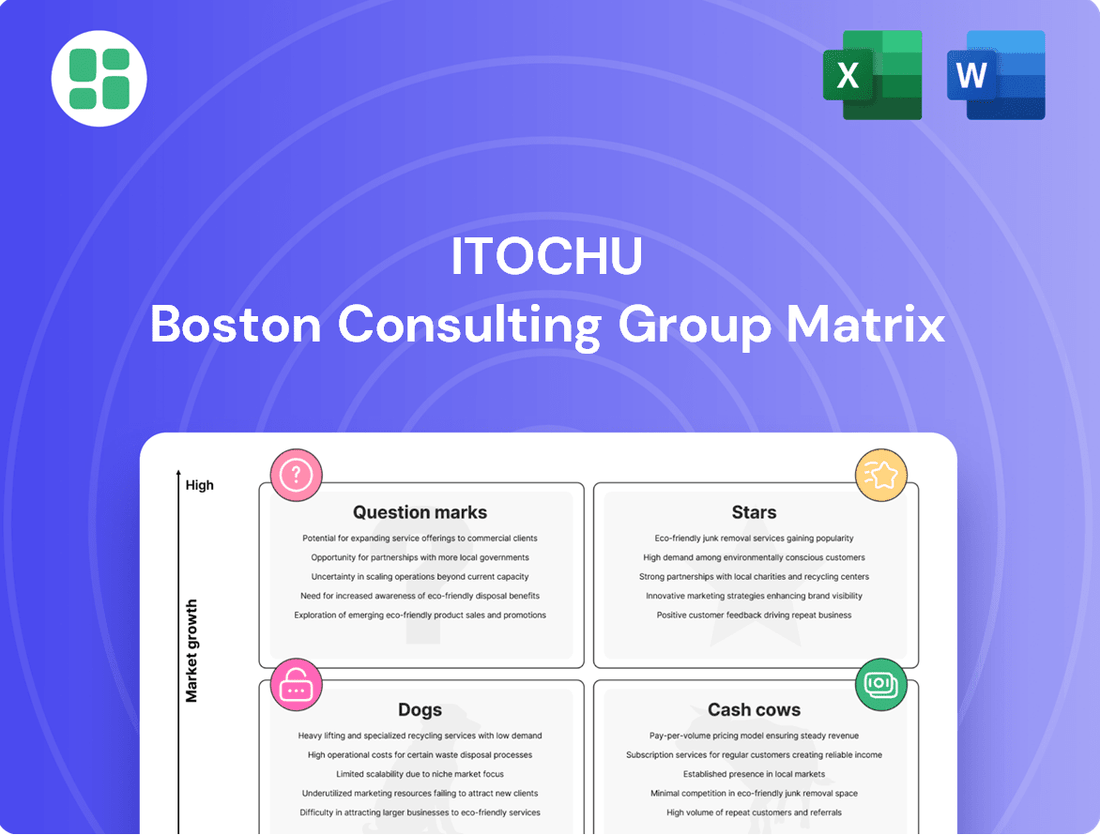

Uncover the strategic positioning of Itochu's diverse portfolio with our exclusive BCG Matrix analysis. See which of their businesses are market leaders and which require a closer look.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Itochu.

Stars

Itochu is making significant strides in renewable energy development, encompassing the creation, ownership, and operation of power generation facilities. This sector is experiencing robust global expansion, fueled by widespread decarbonization initiatives, and Itochu is strategically positioning itself to capture a leading market share.

The company's substantial investments in renewables are directly linked to its ambitious goal of achieving carbon neutrality by 2050. For instance, by the end of fiscal year 2023, Itochu had invested in renewable energy projects with a total capacity exceeding 10 gigawatts, demonstrating a clear commitment to this growth area. This focus makes renewable energy a pivotal driver for Itochu’s future performance and sustainability efforts.

Itochu is a key player in a groundbreaking project initiated in August 2024 focused on boosting Sustainable Aviation Fuel (SAF) adoption via Scope 3 environmental value trading. This strategic move places Itochu at the vanguard of the aviation industry's decarbonization efforts, a sector experiencing significant growth in its pursuit of sustainability.

Itochu's acquisition of full control of Descente in 2024 positions the sports apparel company as a cornerstone of its textile division, signaling a strategic push into the robust sports and activewear sectors. This move is underpinned by Descente's demonstrated growth trajectory, with the company reporting ¥176.7 billion in net sales for the fiscal year ending March 2024, indicating strong market demand.

The objective is to unlock Descente's full corporate value by enhancing its direct-to-consumer (DTC) engagement and refining marketing strategies. This focus on DTC is crucial as online apparel sales in Japan saw a notable increase, reflecting changing consumer habits and a greater reliance on digital platforms for purchasing sportswear.

Advanced ICT Solutions & Digital Transformation (DX)

Itochu is aggressively pursuing digital transformation (DX) across diverse sectors, employing advanced technologies like AI, IoT, and Fintech to pioneer new services and boost efficiency. This strategic push is evident in their establishment of a Silicon Valley venture capital fund and collaborations with autonomous driving innovators, signaling a strong commitment to a high-growth market. Itochu is actively cultivating its position through deliberate technological integration.

Key initiatives highlight Itochu's focus on this growth area:

- Investment in Silicon Valley VC: This move directly supports the acquisition and development of cutting-edge ICT solutions and DX capabilities.

- Partnerships with Autonomous Driving Startups: Collaborations with companies like May Mobility demonstrate a tangible investment in future mobility technologies, a rapidly expanding segment of the ICT market.

- Leveraging AI, IoT, and Fintech: Itochu is actively integrating these transformative technologies to create new business models and enhance existing operations, aiming to capture significant market share in the digital economy.

E-methane (e-NG) Deployment

E-methane (e-NG) deployment represents a significant growth opportunity for Itochu, likely positioning it as a Star in the BCG Matrix. Itochu's July 2025 entry into the e-NG Coalition underscores its strategic focus on this emerging decarbonization technology. This move leverages Itochu's extensive global network to build an early and robust market presence in a sector projected for substantial expansion as industries transition to climate-neutral energy.

The e-methane market is anticipated to grow rapidly, driven by global decarbonization efforts and the search for sustainable energy alternatives.

- Market Growth: The global e-methane market is projected to reach billions of dollars by the early 2030s, with significant CAGR forecasts.

- Strategic Investment: Itochu's coalition membership signifies a commitment to developing and scaling e-methane production and distribution infrastructure.

- Decarbonization Potential: E-methane offers a pathway to reduce greenhouse gas emissions in sectors like transportation and industry, aligning with global climate goals.

- Technological Advancement: Continued innovation in e-methane production methods, such as power-to-gas (PtG) technologies, will be crucial for its widespread adoption.

E-methane (e-NG) is positioned as a Star for Itochu, indicating high growth and high market share potential. Itochu's July 2025 entry into the e-NG Coalition highlights its strategic commitment to this burgeoning decarbonization technology. This move leverages Itochu's global network to establish a strong market presence in a sector poised for significant expansion as industries shift towards climate-neutral energy solutions.

The e-methane market is experiencing rapid growth, driven by global decarbonization targets and the demand for sustainable energy. Itochu's strategic investments and collaborations are designed to capitalize on this trend, aiming to secure a leading position in this emerging sector. Continued innovation in e-methane production, such as power-to-gas technologies, will be key to its widespread adoption and Itochu's success.

| Itochu's E-methane Initiatives | Description | Market Outlook |

|---|---|---|

| e-NG Coalition Membership (July 2025) | Strategic alliance to advance e-methane development and deployment. | High growth potential driven by decarbonization mandates. |

| Global Network Leverage | Utilizing Itochu's extensive network for market penetration. | Facilitates early and robust market presence. |

| Decarbonization Alignment | Addresses emissions reduction in key sectors like transportation and industry. | Supports global climate goals and creates demand. |

What is included in the product

Strategic allocation of resources for Itochu's diverse business units based on market growth and share.

The Itochu BCG Matrix offers a clear, visual snapshot of business unit performance, alleviating the pain of complex data analysis.

Cash Cows

Itochu's Metals & Minerals Company is a cornerstone of its operations, consistently acting as a cash cow. This division is deeply involved in investing, developing, and trading a wide array of resources, demonstrating its maturity and stability within the market.

Despite inherent commodity price volatility, the Metals & Minerals segment reliably generates significant profits. This consistent performance is a direct result of Itochu's well-established global supply chains and strong, long-standing international relationships.

In 2024, Itochu's Metals & Minerals business continued its role as a strong cash generator, benefiting from its high market share in a mature industry. The company reported robust trading volumes and stable margins in this sector, underscoring its dependable contribution to Itochu's overall profitability.

FamilyMart Convenience Store Operations represents a significant Cash Cow for Itochu. As a consolidated subsidiary, it consistently delivers stable, recurring revenue and profit. In 2023, Itochu's retail segment, which includes FamilyMart, reported operating income of ¥169.5 billion, showcasing the mature yet resilient nature of this business.

The Japanese convenience store market is highly developed, with deep consumer penetration and consistent demand, making FamilyMart a reliable generator of cash. Its strong brand recognition and vast store network, exceeding 16,000 locations in Japan as of early 2024, facilitate steady cash flow generation. This stability means that reinvestment needs are minimal, allowing profits to be easily funneled to other business units.

Itochu's Food Company is a significant revenue driver, boasting well-established businesses in distribution, processing, and merchandising. This segment consistently meets essential consumer demands, securing a substantial market share across numerous food categories.

These operations are characterized by robust profit margins and dependable cash flow, necessitating only moderate capital expenditures to sustain their market leadership. For fiscal year 2024, Itochu's Food segment reported strong performance, contributing significantly to the company's overall financial health and demonstrating its position as a stable cash cow.

General Products & Realty Management

The General Products & Realty segment within Itochu's portfolio represents a collection of stable, mature businesses that consistently generate strong cash flows. This segment includes real estate management, logistics services, and the trading of a broad spectrum of consumer and industrial products. Itochu's deep-rooted presence in these sectors allows for predictable revenue streams and reliable profit generation.

These operations are characterized by their steady contributions to Itochu's financial stability. For instance, in the fiscal year ending March 2024, Itochu reported a consolidated operating income of ¥1,177.5 billion. While specific segment breakdowns for cash cow status are not explicitly detailed in publicly available summaries, the nature of real estate and logistics typically ensures consistent rental income and distribution profits, acting as dependable cash generators for the conglomerate.

- Real Estate Management: Generates stable rental income from owned properties and management fees.

- Logistics Services: Leverages Itochu's extensive network for reliable distribution profits.

- General Trading: Benefits from established market positions in diverse consumer and industrial goods, ensuring consistent sales and margins.

- Financial Stability: These mature businesses provide a predictable and substantial cash flow, underpinning Itochu's overall financial health and ability to invest in growth areas.

Core Textile Business (Non-Apparel Segments)

Itochu's core textile business, excluding its high-growth apparel segments, stands as a classic cash cow. This mature division, dealing in raw materials, industrial textiles, and general apparel trading, benefits from Itochu's deep-rooted history and expansive global network, securing a substantial market share.

This segment consistently generates reliable profits with minimal need for aggressive investment in promotion or expansion, unlike its more dynamic counterparts. For fiscal year 2023, Itochu's textile segment reported operating income of ¥150.2 billion, demonstrating its stable profitability.

- Stable Profit Generation: The textile division consistently contributes to Itochu's overall earnings.

- Low Investment Requirements: Unlike growth-oriented businesses, this segment requires less capital for marketing and development.

- High Market Share: Itochu leverages its established infrastructure and relationships to maintain a dominant position.

- Historical Strength: This business area represents Itochu's foundational operations, built on decades of experience.

Itochu's Metals & Minerals Company consistently acts as a cash cow, generating significant profits through its mature operations in resource investment, development, and trading. Despite market volatility, its established global supply chains and strong international relationships ensure reliable cash flow. In 2024, this segment continued to benefit from a high market share in a mature industry, reporting robust trading volumes and stable margins.

FamilyMart Convenience Store Operations is a prime example of a cash cow, providing Itochu with stable, recurring revenue. With over 16,000 stores in Japan as of early 2024, its strong brand recognition and deep consumer penetration ensure consistent cash generation with minimal reinvestment needs. This stability allows profits to be channeled effectively to other business areas.

The Food Company is another significant cash cow, driven by Itochu's well-established businesses in distribution, processing, and merchandising. Its strong market share across numerous food categories, coupled with robust profit margins and dependable cash flow, necessitates only moderate capital expenditures to maintain leadership. The segment's strong performance in fiscal year 2024 underscores its role as a stable profit generator.

Itochu's core textile business, excluding high-growth apparel, functions as a classic cash cow. This mature division, involved in raw materials and industrial textiles, leverages Itochu's extensive network to maintain a substantial market share. It consistently generates reliable profits with minimal need for aggressive investment, as demonstrated by its ¥150.2 billion operating income in fiscal year 2023.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Metals & Minerals | Cash Cow | Mature, stable profits, high market share, established supply chains | Robust trading volumes and stable margins in 2024 |

| FamilyMart Convenience Stores | Cash Cow | Consistent recurring revenue, strong brand, extensive network | Over 16,000 stores in Japan (early 2024); ¥169.5 billion operating income (retail segment, 2023) |

| Food Company | Cash Cow | Established distribution/processing, strong market share, robust margins | Strong performance in fiscal year 2024 |

| Core Textiles | Cash Cow | Mature, minimal investment needs, high market share | ¥150.2 billion operating income (textile segment, FY2023) |

What You See Is What You Get

Itochu BCG Matrix

The Itochu BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive report, detailing Itochu's strategic positioning of its business units, is fully formatted and ready for immediate application in your business analysis.

Dogs

Itochu's fuel coal mine interests are firmly placed in the Dogs category of the BCG Matrix. The company has publicly stated its intention to completely divest from this sector, recognizing its declining demand and increasing environmental pressures.

This strategic withdrawal reflects the low growth prospects and diminishing importance of coal mining within Itochu's broader decarbonization goals. By exiting these assets, Itochu is actively reducing its exposure to an industry facing a sunset trajectory.

Itochu Corporation's decision in February 2024 to cease its partnership with Elbit Systems, an Israeli defense contractor, signals a strategic divestment from a sector deemed low-growth and non-strategic. This move, effective by the end of February 2024, suggests a recalibration of Itochu's portfolio, potentially driven by ethical concerns or a reassessment of the long-term viability of its defense-related ventures.

Within Itochu's extensive commodity trading operations, some older segments in heavily commoditized areas might show sluggish growth and a small market footprint. These are often overshadowed by Itochu's more dynamic and specialized business units.

These legacy operations frequently contend with fierce competition and unpredictable profit margins. For instance, in 2023, Itochu's overall trading segment saw revenue growth, but specific legacy commodity lines might have lagged significantly behind newer, higher-margin ventures.

Consequently, these underperforming areas are less appealing for substantial capital infusion. Itochu may consider optimizing these operations or even divesting them to redirect resources towards more promising, value-added activities that align with its strategic growth objectives.

Non-strategic Small Equity Holdings

Non-strategic small equity holdings within Itochu's vast portfolio can be categorized as 'dogs' if they are in industries experiencing stagnation or consistently yield minimal returns. These might represent legacy investments or smaller stakes that no longer align with the company's core strategic objectives.

Itochu's approach of 'asset replacements' actively addresses these positions. This strategy involves a proactive and ongoing evaluation of its diverse investment portfolio, identifying and divesting underperforming or non-essential assets to optimize capital allocation and improve overall portfolio performance.

- Portfolio Optimization: Itochu aims to streamline its investment holdings by divesting non-strategic small equity stakes, thereby freeing up capital for more promising ventures.

- Focus on Core Strengths: By shedding 'dog' assets, Itochu can concentrate resources and management attention on businesses that offer higher growth potential and strategic alignment.

- Enhanced Returns: The 'asset replacement' strategy is designed to improve the overall return on investment by replacing low-yield assets with those that contribute more significantly to profitability.

Outdated Logistic Services

Itochu's outdated logistic services, often characterized by a lack of digital integration and specialized solutions, represent its 'dogs' in the BCG matrix. These segments struggle with low efficiency and stunted growth prospects in today's fast-paced global supply chain environment.

These traditional, undifferentiated services are particularly vulnerable. For instance, while Itochu has invested in areas like e-commerce logistics, older, non-digitized warehousing or freight forwarding operations within its portfolio may be lagging. Companies in this category typically require minimal new investment, or worse, may face divestment or consolidation if they cannot adapt to evolving market demands and intense competition.

- Low Growth Potential: These services exhibit minimal revenue increases, reflecting a lack of innovation and market penetration.

- Low Market Share: They often hold a small or declining share in their respective logistics niches.

- Operational Inefficiencies: Manual processes and outdated technology contribute to higher operating costs and slower delivery times compared to competitors.

- Need for Restructuring: To avoid becoming a liability, these segments may need significant investment in modernization or strategic partnerships to enhance their competitiveness.

Itochu's legacy fuel coal mining operations are a clear example of 'dogs' in its BCG matrix. The company's stated intention to divest from coal by the end of fiscal year 2024 highlights its recognition of this sector's declining market share and increasing environmental scrutiny.

Similarly, certain older, less digitized logistics services within Itochu's portfolio also fall into the 'dogs' category. These segments face low growth and operational inefficiencies, often requiring minimal new investment and potentially leading to divestment if they cannot adapt.

Non-strategic small equity holdings that yield minimal returns are also categorized as 'dogs'. Itochu's 'asset replacement' strategy actively addresses these by divesting underperforming assets to reallocate capital towards more promising ventures, aiming to enhance overall portfolio performance.

| Business Segment | BCG Category | Rationale | Strategic Action |

|---|---|---|---|

| Fuel Coal Mining | Dogs | Declining demand, environmental pressures, low growth prospects. | Divestment planned by end of fiscal year 2024. |

| Outdated Logistic Services | Dogs | Lack of digital integration, low efficiency, stunted growth. | Potential restructuring, modernization investment, or divestment. |

| Non-Strategic Small Equity Holdings | Dogs | Stagnant industries, minimal returns, misalignment with core objectives. | Asset replacement strategy for portfolio optimization. |

Question Marks

Itochu's membership in the e-NG Coalition as of July 2025 places it in the vanguard of a burgeoning market for e-methane, a sector poised for substantial growth driven by decarbonization efforts. This strategic move signifies Itochu's commitment to a future where synthetic methane plays a crucial role in reducing greenhouse gas emissions, particularly in hard-to-abate sectors.

Given the nascent stage of e-methane technology and its associated value chain, Itochu's current market share is expected to be minimal. The company faces the challenge of significant capital investment to scale production and establish a competitive foothold in this emerging landscape.

Itochu's strategic investment in May Mobility, a US-based autonomous driving startup, announced in May 2025, signals a clear intent to expand its reach in the global remote autonomous vehicle support sector. This move positions Itochu to tap into a market projected to reach $2.5 trillion by 2030, according to some industry forecasts.

While the autonomous driving sector offers substantial growth potential fueled by rapid technological innovation, Itochu's current direct market footprint in this advanced technology remains nascent. This investment in May Mobility, which has been testing its driverless shuttle services in cities like Ann Arbor, Michigan, represents a high-risk, high-reward proposition.

Capturing significant market share in this competitive landscape will necessitate substantial and sustained future investment from Itochu. The company is essentially placing a bet on May Mobility's ability to scale its operations and technological capabilities effectively in the coming years.

Early-stage Digital Transformation (DX) ventures represent Itochu's 'Question Marks' in the BCG matrix. These are businesses in rapidly expanding digital markets, like AI-powered analytics or cloud infrastructure services, where Itochu is making initial investments. For instance, Itochu's Silicon Valley venture capital arm is actively scouting and funding such nascent technologies, aiming to capture future market leadership.

These ventures, while promising, often possess a low current market share and a high degree of uncertainty regarding their long-term success and profitability. They demand significant financial resources and strategic mentorship to navigate the competitive landscape and scale effectively. Itochu's approach is to nurture these early-stage players, providing the necessary capital and expertise to transform them into potential 'Stars' within its portfolio.

Strategic Investments in Emerging African Markets (Eswatini)

Itochu's strategic discussions regarding Eswatini in July 2025 place it in the "Question Marks" category of the BCG Matrix. These emerging markets, particularly in sectors like energy, chemicals, mining, ICT, and agriculture, present significant growth opportunities due to their developing economies.

However, Itochu's current market share in Eswatini for these nascent ventures is likely minimal, necessitating substantial investment to build a presence. This positions these investments as speculative, requiring careful consideration of future potential versus current low market share.

- High Growth Potential: Eswatini, as a developing economy, offers substantial growth prospects in key sectors.

- Low Market Share: Itochu's existing presence in these Eswatini sectors is expected to be limited, characteristic of Question Marks.

- Investment Requirement: Significant capital commitment is needed to establish and grow market share in these emerging areas.

- Speculative Nature: The success of these investments is uncertain, dependent on market development and Itochu's strategic execution.

New Health-Related Food Ingredients (e.g., Inulin)

Itochu's acquisition of domestic exclusive marketing rights for Inulin in June 2025 positions it within the burgeoning health-related food ingredient sector. This move into functional foods, a market projected to reach over $250 billion globally by 2027, signifies a strategic entry into a high-growth area.

- Market Entry: Itochu's venture into Inulin, a water-soluble dietary fiber, taps into the increasing consumer demand for health-promoting food components.

- Growth Potential: The functional food market is experiencing robust expansion, driven by greater health awareness and preventative healthcare trends.

- Market Share: While the overall market is large, Itochu's current share in the specific Inulin niche is likely nascent, requiring significant investment to build brand recognition and market penetration.

- Strategic Focus: Success will depend on intensive marketing and the development of a robust distribution network to effectively compete and capture market share in this dynamic segment.

Itochu's early-stage Digital Transformation (DX) ventures, including AI analytics and cloud services, are classified as Question Marks. These represent significant investments in rapidly expanding digital markets with high uncertainty but potential for future leadership.

These ventures typically have a low current market share and require substantial capital and strategic guidance to grow. Itochu aims to nurture these nascent technologies, hoping they will evolve into market-leading Stars.

The company's investment in May Mobility, an autonomous driving startup, also falls into this category. This high-risk, high-reward bet targets a market projected to reach $2.5 trillion by 2030, with Itochu seeking to capture future market share through this strategic partnership.

Similarly, Itochu's focus on emerging sectors in Eswatini, such as energy and agriculture, are Question Marks. Despite significant growth potential in these developing economies, Itochu's current market share is minimal, demanding considerable investment to build a presence.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each business unit.