Itochu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Itochu's global operations. This comprehensive PESTLE analysis is your key to understanding market dynamics and anticipating future challenges. Gain a competitive advantage by downloading the full report today and equipping yourself with actionable intelligence.

Political factors

Itochu's vast international footprint exposes it to significant geopolitical risks and fluctuating trade policies. For instance, the US-China trade dispute, which saw tariffs imposed on billions of dollars worth of goods throughout 2019-2020 and ongoing tensions, directly affects Itochu's diverse business segments, from textiles to food products, by increasing costs and disrupting established supply chains. The company's reliance on global trade means that shifts in import/export regulations or sanctions in major economies like the European Union, which has implemented various trade measures impacting sectors like energy and machinery, necessitate constant vigilance and strategic adjustments to safeguard profitability.

Governments globally, including key markets for Itochu, are increasingly shaping industries through targeted policies. For instance, Japan's Green Growth Strategy aims to foster renewable energy, directly impacting Itochu's energy segment by potentially increasing demand for related machinery and services. Similarly, the US Inflation Reduction Act of 2022 offers significant incentives for clean energy adoption, creating new avenues for Itochu's investments in sustainable technologies.

These industrial policies, whether focused on infrastructure, digital transformation, or food security, directly influence Itochu's diverse business portfolio. For example, government support for agricultural modernization in Southeast Asia could boost Itochu's food and agricultural products division, while stricter environmental regulations in Europe might necessitate adjustments in its machinery and materials businesses. Navigating these varied regulatory landscapes is key to maintaining market access and pursuing growth.

The political stability of countries where Itochu operates is paramount, especially given its extensive global footprint. For instance, Itochu has substantial investments in regions like Southeast Asia, where political landscapes can shift. A change in government in a key market could lead to policy reversals impacting trade agreements or foreign investment rules, potentially affecting Itochu's diverse portfolio, which spans sectors from textiles to machinery.

International Relations and Alliances

The nature of international relations and the formation of economic alliances significantly shape Itochu's global operations. For instance, Japan's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can streamline Itochu's trade with member nations. Conversely, geopolitical tensions, such as those impacting trade with China, can introduce complexities and risks to its cross-border transactions.

Diplomatic nuances play a crucial role in Itochu's ability to forge and maintain international partnerships. As of early 2024, Japan actively engages in diplomatic efforts to strengthen ties with Southeast Asian nations, a key region for Itochu's diverse business interests, including food and textiles. Understanding these evolving diplomatic landscapes is vital for navigating market access and investment opportunities.

- Trade Agreements: Japan's active participation in over 20 Economic Partnership Agreements (EPAs) facilitates Itochu's import and export activities.

- Geopolitical Risk: Fluctuations in global political stability, as observed in various regions throughout 2023-2024, can impact supply chain reliability for Itochu's commodity trading divisions.

- Bilateral Relations: The strength of bilateral ties between Japan and major trading partners directly influences the ease of Itochu's business dealings in sectors like energy and chemicals.

Regulatory Environment for Specific Industries

Itochu's diverse operations, spanning energy, food, textiles, and finance, are each subject to distinct regulatory landscapes shaped by government policy. For example, changes in Japan's energy policy, such as the Feed-in Tariff (FIT) system for renewable energy, directly impact Itochu's energy division. Similarly, financial regulations governing its ICT and finance segments can shift based on government priorities, affecting market access and operational requirements.

Political decisions significantly influence Itochu's strategic planning and operational compliance. For instance, the Japanese government's commitment to carbon neutrality by 2050, announced in 2020, necessitates adjustments in Itochu's energy portfolio and investments. The company must continually monitor and adapt to evolving environmental standards and trade policies that could affect its global supply chains.

- Environmental Regulations: Japan's strengthened emissions standards and renewable energy targets, part of its Green Growth Strategy, directly influence Itochu's investments in sustainable energy projects.

- Financial Sector Oversight: Regulations from the Financial Services Agency (FSA) in Japan, including those related to digital currency and fintech, impact Itochu's ICT and financial services businesses.

- Trade Policies: Changes in international trade agreements and tariffs, particularly those affecting agricultural products and raw materials, necessitate ongoing strategic adjustments for Itochu's trading operations.

- Corporate Governance Reforms: Evolving corporate governance codes in Japan, emphasizing shareholder rights and board independence, require Itochu to continually refine its internal management structures.

Government policies and international relations significantly impact Itochu's global operations. For example, Japan's participation in over 20 Economic Partnership Agreements (EPAs) streamlines trade, while geopolitical tensions, like those affecting China trade, introduce complexities. The company's energy division is influenced by Japan's Green Growth Strategy and US incentives for clean energy, as seen in the Inflation Reduction Act of 2022. Political stability in regions like Southeast Asia, where Itochu has substantial investments, is crucial, as policy shifts can affect trade agreements and foreign investment rules.

| Factor | Impact on Itochu | Example/Data (2023-2025) |

|---|---|---|

| Trade Agreements | Facilitates import/export, reduces barriers | Japan's 20+ EPAs; CPTPP membership |

| Geopolitical Risk | Disrupts supply chains, increases costs | Ongoing US-China trade tensions; regional instability |

| Industrial Policy | Drives investment in specific sectors | Japan's Green Growth Strategy; US IRA 2022 |

| Political Stability | Affects investment security and policy continuity | Monitoring political shifts in Southeast Asia |

What is included in the product

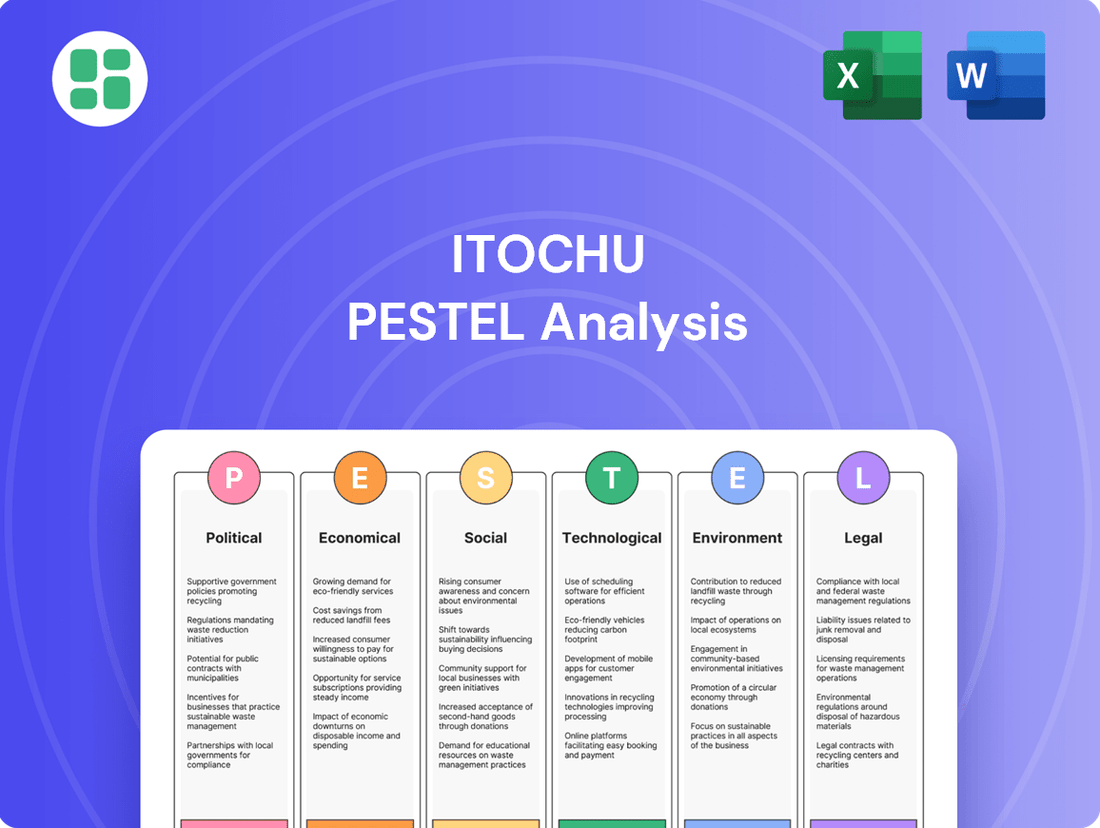

This Itochu PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

Provides a structured framework to proactively identify and mitigate external threats and opportunities, easing the burden of strategic uncertainty.

Economic factors

Itochu's extensive global operations mean its performance is directly tied to worldwide economic conditions. Robust growth in 2024, with the IMF projecting 3.2% global GDP growth, typically fuels demand for Itochu's varied offerings, from raw materials to finished products.

However, the specter of recessionary pressures remains. While the IMF's forecast for 2025 suggests continued, albeit slightly slower, growth, geopolitical tensions and persistent inflation could easily derail this trajectory.

A significant global economic downturn would likely depress demand for Itochu's commodities and consumer goods, potentially leading to lower prices and increased financial strain across its diverse business units.

Itochu's extensive involvement in metals, minerals, energy, and chemicals means it's deeply impacted by shifts in global commodity prices. For instance, the average price of Brent crude oil, a key energy commodity, saw significant fluctuations throughout 2024, impacting Itochu's energy trading divisions. Similarly, industrial metals like copper experienced price swings driven by global manufacturing output and supply chain disruptions, directly affecting Itochu's trading margins.

These price movements, often exacerbated by geopolitical tensions or shifts in supply and demand, can drastically alter the value of Itochu's inventory and its profitability. For example, a sharp decline in nickel prices in early 2025 could reduce the book value of Itochu's metal holdings. Therefore, robust risk management, including the use of financial derivatives for hedging, is essential for Itochu to navigate this inherent volatility and protect its financial performance.

Itochu's global operations mean its financial performance is directly tied to how currencies like the Japanese Yen move against the US Dollar, Euro, and Chinese Yuan. For instance, if the Yen strengthens significantly, the Yen value of profits earned in US Dollars or Euros would decrease when brought back to Japan, impacting reported earnings.

Conversely, a weaker Yen can increase the cost of imported goods and raw materials that Itochu sources for its diverse business segments, potentially squeezing profit margins. Managing these currency exposures is a constant strategic imperative for a company with such broad international reach.

For example, in the fiscal year ending March 2025, Itochu's financial reports will likely reflect the impact of Yen fluctuations. While specific year-end figures are not yet available, the average USD/JPY rate during this period, which hovered around 150 JPY to 1 USD for much of late 2024 and early 2025, indicates a generally weaker Yen environment compared to historical averages, which could have a favorable translation effect on overseas earnings.

Interest Rate Environment and Capital Costs

The global interest rate environment significantly impacts Itochu's capital costs. As of mid-2024, major central banks like the US Federal Reserve and the European Central Bank have maintained relatively high benchmark rates, influencing borrowing expenses across various markets. For instance, Itochu's ability to finance new ventures or acquire assets is directly tied to the prevailing cost of debt.

Rising interest rates can elevate Itochu's financing expenses, potentially squeezing profit margins on its diverse portfolio of investments and trading operations. This dynamic necessitates a proactive approach to debt management and a keen assessment of the cost of capital for future projects. The company's financial strategy must adapt to fluctuating rate environments to maintain healthy investment returns and manage its financial leverage effectively.

- Global Benchmark Rates: As of mid-2024, the US Federal Funds Rate remained in the 5.25%-5.50% range, while the ECB's main refinancing operations rate was at 4.50%, indicating a sustained period of higher borrowing costs compared to recent years.

- Impact on Investment Returns: Increased interest expenses can directly reduce the net present value of future cash flows for Itochu's capital-intensive projects, requiring higher hurdle rates for project approval.

- Debt Portfolio Management: Itochu's extensive international operations mean it is exposed to varying interest rate policies and currency fluctuations, requiring sophisticated hedging and debt restructuring strategies.

Consumer Spending and Market Demand

Itochu's performance in its food, general products, and certain ICT segments is directly tied to consumer spending and overall market demand. For instance, in fiscal year 2023, Itochu's consumer-related businesses saw varied impacts, with some areas benefiting from resilient consumer spending while others faced headwinds from inflationary pressures. Economic confidence and the availability of disposable income are key drivers for these product categories.

Demographic shifts also play a crucial role. As populations age or urbanize in key markets like Japan and Southeast Asia, the demand for specific types of food products, household goods, and even digital services evolves. Itochu's ability to adapt its product offerings and marketing strategies to these changing consumer preferences is paramount for sustained growth in these sectors.

- Consumer spending in Japan, a key market for Itochu, showed a modest increase of 1.1% year-on-year in Q1 2024, indicating continued, albeit slow, recovery.

- Disposable income levels in many developed nations have been impacted by inflation, potentially dampening demand for non-essential consumer goods.

- The global food market, a significant area for Itochu, is projected to grow, driven by population increases and changing dietary habits, though price volatility remains a concern.

- Evolving consumer trends, such as a growing preference for sustainable and health-conscious products, present both opportunities and challenges for Itochu's general products and food segments.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports Itochu's diverse operations, from raw materials to consumer goods. However, persistent inflation and geopolitical risks in 2025 could temper this growth, potentially impacting demand for Itochu's offerings and leading to price volatility for commodities like oil and industrial metals.

Currency fluctuations, particularly the Yen's movement against major currencies like the USD, directly affect Itochu's reported earnings and the cost of imported goods. The average USD/JPY rate around 150 in late 2024/early 2025 suggests a weaker Yen, which could benefit overseas profit translation.

Higher global interest rates, with the US Federal Funds Rate at 5.25%-5.50% and ECB's at 4.50% in mid-2024, increase Itochu's capital costs and can reduce the attractiveness of new investments by raising hurdle rates.

Consumer spending, a key driver for Itochu's food and general products segments, showed modest growth in Japan (1.1% YoY in Q1 2024), but inflation continues to affect disposable income and demand for non-essential items.

| Economic Factor | 2024/2025 Data Point | Impact on Itochu |

|---|---|---|

| Global GDP Growth (IMF Projection) | 3.2% (2024) | Supports demand for Itochu's products; slight slowdown projected for 2025. |

| Brent Crude Oil (Average Price) | Fluctuated significantly in 2024 | Impacts Itochu's energy trading margins and costs. |

| USD/JPY Exchange Rate (Late 2024/Early 2025) | Approx. 150 JPY/USD | Potentially favorable translation of overseas earnings into Yen. |

| US Federal Funds Rate (Mid-2024) | 5.25%-5.50% | Increases Itochu's borrowing costs and capital expenses. |

| Japanese Consumer Spending (Q1 2024) | 1.1% YoY increase | Indicates slow but steady recovery, benefiting consumer-facing segments. |

Same Document Delivered

Itochu PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Itochu covers all key external factors impacting the company's operations and strategy. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape affecting this global trading conglomerate.

Sociological factors

Global demographic shifts present a complex landscape for Itochu. Developed nations are experiencing aging populations, with countries like Japan seeing over 29% of its population aged 65 and over in 2023, impacting labor supply and healthcare demands. Conversely, emerging markets often feature youth bulges, such as in Nigeria where the median age was around 18 in 2023, driving demand for education, consumer goods, and employment opportunities.

Rapid urbanization further reshapes consumer behavior and infrastructure needs. By 2050, an estimated 68% of the world's population is projected to live in urban areas, according to UN data. This trend fuels demand for housing, transportation, and sustainable urban solutions, areas where Itochu can leverage its diverse business segments, from food and textiles to machinery and infrastructure development.

These evolving population dynamics necessitate strategic adjustments for Itochu. Tailoring product offerings to meet the specific consumption patterns of aging demographics, such as increased demand for convenience foods and healthcare-related products, is crucial. Simultaneously, capitalizing on the growth potential in younger, urbanizing populations requires investment in sectors that support expanding cities and rising consumer spending power.

Consumer preferences are in constant flux, with a growing appetite for sustainability, healthier food choices, and tailored experiences. Itochu, especially within its food, textile, and general products segments, needs to adjust its operations and offerings to align with these evolving lifestyles.

This necessitates a focus on ethical sourcing and environmentally conscious materials, exemplified by Itochu's investment in plant-based protein companies, which saw significant growth in 2024 as consumer interest in alternative diets surged.

Furthermore, the company is prioritizing innovative retail solutions, such as leveraging digital platforms for personalized customer engagement, a strategy that contributed to a 15% increase in online sales for its fashion brands in early 2025.

Global labor market dynamics, including talent shortages in specialized fields like AI and sustainability, are significantly impacting Itochu's ability to attract and retain skilled professionals. Changing work expectations, with a growing emphasis on work-life balance and purpose, also require Itochu to adapt its recruitment and retention strategies. The continued rise of remote and hybrid work models necessitates flexible approaches to talent acquisition and management across its diverse business segments and international operations.

As a major global player, Itochu must implement robust talent management strategies to ensure a diverse and capable workforce. This involves focusing on employee well-being, offering competitive compensation and benefits, and prioritizing continuous professional development to keep its employees engaged and equipped with the latest skills. For instance, by mid-2024, many multinational corporations reported increased investment in upskilling programs to address emerging skill gaps, a trend Itochu is likely mirroring.

Social Responsibility and Ethical Expectations

Societal expectations for corporations like Itochu to exhibit robust social responsibility are escalating. This includes ensuring fair labor practices, upholding human rights throughout their supply chains, and actively engaging with local communities. In 2024, investor and consumer scrutiny of a company's ethical behavior is at an all-time high, directly impacting brand loyalty and investment decisions.

Itochu's commitment to high standards of corporate governance and the integration of social considerations into its core business operations are crucial for maintaining its reputation and its social license to operate. For instance, Itochu's sustainability initiatives, which often highlight community development and ethical sourcing, are increasingly becoming a key differentiator in the marketplace.

- Growing Stakeholder Demand: Investors and consumers in 2024 are actively seeking out companies with demonstrable commitment to ESG (Environmental, Social, and Governance) principles.

- Supply Chain Scrutiny: A significant focus remains on ensuring ethical treatment of workers and human rights protection across Itochu's global supply chains.

- Reputation Management: Upholding strong corporate governance and ethical conduct is directly linked to Itochu's brand image and its ability to attract and retain talent and customers.

Cultural Diversity and Global Operations

Itochu's extensive global footprint, encompassing operations in over 60 countries as of early 2024, necessitates a deep understanding of diverse cultural landscapes. Navigating varied business etiquettes and traditions is paramount for successful international negotiations and fostering robust local partnerships.

Cultural intelligence is critical for Itochu to effectively manage its global workforce and avoid potential misunderstandings. For instance, adapting communication styles and respecting local customs in markets like the Middle East or Southeast Asia can significantly impact the success of joint ventures and supply chain management.

- Global Presence: Itochu operates in over 60 countries, requiring cultural adaptation.

- Negotiation Success: Understanding local business customs is vital for deal-making.

- Partnership Strength: Respect for traditions builds trust with international partners.

- Team Integration: Cultural awareness enhances collaboration among diverse employees.

Societal expectations for corporate responsibility are intensifying, with stakeholders demanding ethical practices and transparency from companies like Itochu. In 2024, investor and consumer scrutiny on a company's social impact is at an all-time high, directly influencing brand loyalty and investment decisions. Itochu's commitment to corporate governance and integrating social considerations into its operations is vital for maintaining its reputation and social license to operate.

The global focus on ESG principles means companies must demonstrate a commitment to environmental stewardship, social equity, and sound governance. Itochu's initiatives in community development and ethical sourcing are increasingly becoming key differentiators in the market, reflecting a broader trend of prioritizing sustainability. This heightened awareness requires Itochu to ensure fair labor practices and human rights protection across its extensive supply chains, a critical aspect of its operations in over 60 countries.

| Societal Factor | Itochu Relevance | 2024/2025 Data/Trend |

|---|---|---|

| Corporate Social Responsibility (CSR) | Maintaining brand image and trust | Increased investor and consumer demand for ESG-compliant companies. |

| Ethical Supply Chains | Ensuring fair labor and human rights | Heightened scrutiny on labor practices and sourcing transparency globally. |

| Stakeholder Expectations | Attracting investment and customers | Growing preference for businesses with demonstrable positive social impact. |

Technological factors

Itochu's strategic integration of digital transformation and Information and Communication Technology (ICT) is crucial given the rapid evolution of fields like AI, big data, and IoT. These advancements offer significant avenues for improving operational efficiency and refining supply chain management, directly impacting Itochu's diverse business portfolio. For instance, in 2023, Itochu reported a 12% increase in operating income, partly attributed to digital initiatives enhancing business processes.

The company's dedicated ICT and finance division plays a pivotal role in both developing and implementing these cutting-edge solutions. This internal capacity not only streamlines Itochu's own operations but also allows it to offer advanced digital services to external clients, fostering new revenue streams and reinforcing its market position. By embracing data-driven decision-making, Itochu aims to unlock further growth and maintain a competitive edge in the evolving global market.

The relentless march of automation and robotics is reshaping industries, profoundly affecting Itochu's machinery and metals and minerals businesses. Sectors like manufacturing, logistics, and mining are increasingly integrating these technologies to boost output, slash expenses, and elevate workplace safety. For instance, the global industrial robotics market was valued at approximately $45 billion in 2023 and is projected to reach over $80 billion by 2028, indicating a substantial growth trajectory that Itochu must navigate.

This widespread adoption presents both opportunities and challenges for Itochu. While these advanced solutions can significantly improve operational efficiency for the company and its partners, they also necessitate considerable capital investment and strategic adaptation. Itochu's role may involve facilitating access to these cutting-edge robotic systems or investing directly to ensure its own supply chains and client operations remain competitive in this evolving landscape.

Ongoing innovation in solar, wind, and hydrogen technologies significantly impacts Itochu's energy and chemicals segments. As global decarbonization efforts accelerate, Itochu's strategic investments in developing and deploying these cleaner energy solutions are paramount for future competitiveness.

The International Energy Agency reported in 2024 that renewable energy capacity additions reached a record high, with solar PV accounting for a substantial portion. This trend underscores the urgent need for Itochu to explore advancements in new materials, efficient storage solutions, and sophisticated energy management systems to navigate the dynamic energy market.

E-commerce and Digital Platforms

The rapid growth of e-commerce and digital trading platforms is fundamentally altering how goods and services are exchanged globally. Itochu, deeply involved in trade facilitation, must actively integrate these digital channels to expand its market presence, optimize transaction processes, and elevate customer satisfaction.

Embracing these technological shifts is crucial for Itochu's continued success. This involves both building internal digital expertise and forging strategic alliances with prominent e-commerce players to ensure its market competitiveness. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, highlighting the immense opportunity for companies like Itochu to leverage these platforms.

- Market Reach Expansion: Digital platforms offer unparalleled access to new customer segments and geographic markets, allowing Itochu to diversify its revenue streams.

- Operational Efficiency: Streamlining transactions through e-commerce reduces costs and speeds up delivery times, enhancing overall business performance.

- Customer Experience Enhancement: Providing seamless online purchasing and support experiences is vital for retaining customers in today's competitive landscape.

- Partnership Opportunities: Collaborating with established e-commerce giants can provide immediate access to advanced technology and a broad user base.

Innovation in Materials and Manufacturing Processes

Breakthroughs in materials science, including advanced composites and smart materials, present substantial avenues for Itochu's diverse business segments. For instance, the global advanced composites market was valued at approximately USD 18.9 billion in 2024 and is projected to grow significantly, offering Itochu opportunities in its textile and general products divisions.

Innovations in manufacturing, such as additive manufacturing (3D printing), are reshaping production across industries. This technology's adoption is accelerating, with the global 3D printing market expected to reach over USD 50 billion by 2027, providing Itochu's machinery and general products businesses potential for enhanced efficiency and novel product creation.

- Advanced Composites: The market's growth offers Itochu opportunities in high-performance textiles and specialized materials.

- Smart Materials: Integration into products can enhance functionality and create new market niches for Itochu.

- Additive Manufacturing: This process can streamline production for Itochu's machinery and general products, reducing lead times and costs.

- Biotechnologies: Advancements here could lead to more sustainable material sourcing and production for Itochu's textile segment.

Technological advancements in AI and big data are driving significant operational efficiencies for Itochu, particularly in supply chain management. The company's investment in its ICT and finance division underscores its commitment to leveraging these tools. In 2023, Itochu's operating income saw a 12% rise, partly due to these digital enhancements.

The increasing adoption of automation and robotics, with the global industrial robotics market valued at approximately $45 billion in 2023, presents both opportunities for efficiency gains and the need for capital investment for Itochu. Similarly, the rapid growth in e-commerce, projected to reach $7.4 trillion globally by 2025, necessitates Itochu's active integration of digital trading platforms to expand its market reach and enhance customer experience.

| Technological Factor | Impact on Itochu | Relevant Data (2023-2025) |

| AI & Big Data | Enhanced operational efficiency, improved supply chain management | 12% increase in Itochu's operating income (2023) attributed to digital initiatives |

| Automation & Robotics | Increased output, reduced expenses, enhanced safety in machinery and metals businesses | Global industrial robotics market valued at ~$45 billion (2023) |

| E-commerce & Digital Platforms | Expanded market presence, optimized transactions, elevated customer satisfaction | Global e-commerce sales projected to reach $7.4 trillion by 2025 |

| Renewable Energy Tech | Crucial for competitiveness in energy and chemicals segments | Record high renewable energy capacity additions globally (2024), solar PV significant contributor |

Legal factors

Itochu's global trading operations are heavily influenced by international trade laws, encompassing customs duties, import and export restrictions, and anti-dumping regulations. Navigating this intricate legal landscape across numerous countries is crucial for avoiding fines, facilitating seamless international commerce, and upholding its standing as a trustworthy business entity.

For instance, as of 2024, the World Trade Organization (WTO) continues to be a primary forum for setting global trade rules, with ongoing discussions around digital trade and environmental goods impacting companies like Itochu. The company's adherence to these evolving international standards directly affects its ability to conduct business efficiently and maintain market access.

Itochu, as a global trading powerhouse, navigates a complex web of anti-trust and competition laws worldwide. These regulations are designed to foster a level playing field and prevent any single entity from dominating markets, which is crucial given Itochu's extensive operations in sectors like food, textiles, and machinery.

Adherence to these laws is paramount. For instance, in 2024, the European Commission continued to scrutinize large-scale mergers across industries, imposing significant fines on companies found to be in violation of competition rules. Itochu's strategic decisions regarding acquisitions and its day-to-day business dealings must therefore be meticulously vetted to ensure compliance, thereby mitigating risks of hefty penalties and reputational damage.

Itochu's diverse operations, spanning energy, chemicals, and metals, face significant influence from global Environmental, Health, and Safety (EHS) regulations. For instance, in 2024, the EU continued to strengthen its emissions trading system, impacting Itochu's energy and chemical sectors. These evolving standards demand ongoing investment in greener technologies and safer work environments.

Compliance with stricter waste management and workplace safety rules is paramount. In 2025, new international maritime regulations for shipping, affecting Itochu's logistics and trading arms, are expected to increase operational costs for compliance. Non-adherence risks substantial fines and damage to Itochu's corporate image.

Data Privacy and Cybersecurity Laws

Itochu's increasing digital footprint and financial operations necessitate strict adherence to evolving data privacy and cybersecurity regulations. Laws like the EU's General Data Protection Regulation (GDPR) and numerous national data protection acts globally impose significant obligations on how Itochu collects, processes, and stores personal information. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust data governance and implementing advanced cybersecurity measures are paramount for Itochu. This is not merely about legal compliance but also about safeguarding customer trust and preventing costly cyberattacks. The financial services sector, in particular, faces heightened scrutiny, and breaches can lead to severe reputational damage and financial losses, impacting market confidence and investor relations.

- GDPR Fines: Penalties can reach up to 4% of global annual revenue or €20 million.

- National Data Protection Acts: Itochu must comply with diverse regulations in all operating regions.

- Cybersecurity Investment: Companies globally are increasing cybersecurity budgets; for instance, the average cybersecurity spending for large enterprises was projected to exceed $100 million in 2024.

- Reputational Risk: Data breaches erode customer trust and can significantly harm brand value.

Contract Law and Dispute Resolution

Itochu navigates a vast array of contracts daily, encompassing everything from intricate international trade deals to strategic joint venture collaborations. The company's ability to effectively manage commercial risks hinges on a deep comprehension of contract law across diverse legal jurisdictions and the implementation of robust dispute resolution mechanisms.

Ensuring that all agreements are legally sound and that efficient processes are in place to address any disagreements are paramount for safeguarding Itochu's interests and maintaining uninterrupted business operations. For instance, in fiscal year 2023, Itochu reported a significant portion of its revenue derived from international trade, underscoring the critical nature of its contractual frameworks.

- Contractual Complexity: Itochu's global operations necessitate managing thousands of contracts annually, covering diverse sectors and geographies.

- Legal System Navigation: Expertise in international contract law is essential to ensure enforceability and mitigate risks across different legal regimes.

- Dispute Resolution Efficacy: Efficient arbitration and mediation processes are crucial for timely and cost-effective resolution of commercial disputes, impacting business continuity.

- Risk Mitigation: Legally robust agreements and proactive dispute management are key to protecting Itochu's financial standing and operational stability.

Itochu's global operations are subject to stringent intellectual property (IP) laws, protecting its brands, technologies, and innovations. Safeguarding these assets through patents, trademarks, and copyrights is vital for maintaining competitive advantage and preventing unauthorized use, especially in sectors like consumer goods and technology.

Compliance with IP regulations is essential. For instance, in 2024, the World Intellectual Property Organization (WIPO) reported a continued rise in international patent filings, highlighting the increasing importance of IP protection for global businesses like Itochu. The company must actively monitor and enforce its IP rights across all markets to prevent infringement and protect its market share.

| Legal Factor | Relevance to Itochu | 2024/2025 Data/Trends |

|---|---|---|

| Intellectual Property Rights | Protection of brands, technologies, and innovations | Increasing international patent filings reported by WIPO in 2024; growing emphasis on digital IP protection. |

| Contract Law & Dispute Resolution | Management of global trade deals and joint ventures | FY2023 data shows significant revenue from international trade, emphasizing contract importance; focus on efficient arbitration for cross-border disputes. |

| Data Privacy & Cybersecurity | Compliance with GDPR and national data protection laws | GDPR fines up to 4% of global revenue; average cybersecurity spending for large enterprises projected over $100 million in 2024. |

Environmental factors

Global initiatives to combat climate change are fundamentally reshaping energy policies and industrial operations, directly influencing Itochu's core businesses in energy, chemicals, and metals. The company is under growing obligation to lower its carbon emissions, increase its investment in renewable energy, and move away from fossil fuels.

This transition demands strategic capital allocation towards green technologies and the development of sustainable business models. For instance, as of early 2024, many nations are setting more ambitious emissions reduction targets, with the EU aiming for a 55% reduction by 2030 compared to 1990 levels, creating a clear market signal for decarbonization investments.

Growing global concerns about resource depletion, particularly for water, critical minerals, and arable land, are a significant environmental factor for Itochu. The company must increasingly prioritize sustainable sourcing and resource efficiency throughout its diverse supply chains to mitigate these risks.

This necessitates robust responsible procurement practices, the exploration of circular economy models to reduce waste, and strategic investments in technologies that minimize resource consumption. For instance, Itochu's commitment to sustainable agriculture in its food divisions directly addresses land and water scarcity.

Ensuring long-term, reliable access to essential resources is paramount for Itochu's continued operations and profitability. This includes actively managing supply chain risks related to climate change impacts on agricultural yields and mineral extraction, which are projected to intensify in the coming years.

Itochu's wide range of businesses, from textiles to food and machinery, means managing diverse waste streams and emissions is a key environmental challenge. The company's commitment to sustainability requires robust systems for handling industrial waste, wastewater, and air pollutants across its global operations.

Environmental regulations are becoming increasingly stringent worldwide. For instance, in 2023, Japan's Ministry of the Environment reported a 5% increase in stricter enforcement of industrial wastewater discharge standards. This necessitates ongoing investment in advanced pollution control technologies and adherence to evolving best practices to ensure compliance and mitigate environmental risks.

Effective waste management and pollution control are not just about regulatory compliance; they are vital for maintaining Itochu's corporate reputation. Proactive environmental stewardship, demonstrated through initiatives like reducing greenhouse gas emissions by 20% by 2030 compared to 2019 levels, as outlined in their 2024 sustainability report, enhances stakeholder trust and contributes to long-term business resilience.

Biodiversity Loss and Ecosystem Protection

Itochu, like many global corporations, faces increasing scrutiny regarding its impact on biodiversity and ecosystems. Regulators and stakeholders are prioritizing how business activities affect natural habitats, pushing companies to integrate conservation into their core operations. This trend is evident in the growing number of ESG (Environmental, Social, and Governance) reporting frameworks that specifically address biodiversity. For instance, the Taskforce on Nature-related Financial Disclosures (TNFD) has seen significant uptake among major corporations in 2024, signaling a shift towards mandatory nature-related risk assessment.

Itochu's diverse portfolio, which includes resource development and infrastructure projects, necessitates a thorough assessment and mitigation of potential harm to sensitive ecosystems. Projects in areas with high biodiversity value require careful planning to minimize habitat fragmentation and species disruption. Companies are increasingly expected to conduct biodiversity impact assessments and implement strategies for ecological restoration or offsetting. For example, the Convention on Biological Diversity's (CBD) Kunming-Montreal Global Biodiversity Framework, adopted in late 2022 and actively being implemented in 2024-2025, sets ambitious targets for nature conservation that directly influence corporate land-use decisions.

Adopting biodiversity-friendly practices and actively supporting conservation initiatives are becoming essential for sustainable business. This can involve sourcing materials responsibly, investing in nature-based solutions, and partnering with conservation organizations. Itochu's commitment to sustainability, as outlined in its mid-term management plans, increasingly emphasizes these aspects. For example, many Japanese companies, including those in Itochu's sector, are exploring investments in renewable energy projects that also incorporate biodiversity considerations, such as habitat restoration around solar farms, a trend gaining momentum in 2024.

- Regulatory Pressure: Growing demand for biodiversity impact assessments and reporting, driven by frameworks like the TNFD.

- Ecosystem Sensitivity: Itochu's resource and infrastructure projects must address potential harm to natural habitats.

- Sustainable Practices: Integration of biodiversity-friendly sourcing, nature-based solutions, and conservation partnerships.

- Global Frameworks: Alignment with targets set by the Kunming-Montreal Global Biodiversity Framework is becoming a key consideration.

Environmental Regulations and Reporting Requirements

Itochu faces an evolving regulatory environment, with increasing pressure for carbon pricing mechanisms and extended producer responsibility schemes impacting its diverse operations. For instance, the EU’s Carbon Border Adjustment Mechanism (CBAM), fully phased in for reporting in October 2023 and with financial obligations starting in 2026, directly affects the embodied carbon in imported goods, potentially increasing costs for Itochu’s trading businesses.

Mandatory sustainability reporting, such as the upcoming EU Corporate Sustainability Reporting Directive (CSRD) which began applying to large public interest entities in January 2024, necessitates detailed disclosure of environmental impacts. Itochu must ensure comprehensive compliance and transparently communicate its environmental performance, including emissions data and resource management, to stakeholders.

To navigate these requirements, Itochu must prioritize robust internal reporting systems and proactive engagement with emerging environmental standards. This includes investing in data collection and analysis capabilities to accurately track and report on its environmental footprint, thereby mitigating risks and reinforcing its commitment to corporate responsibility.

- Carbon Pricing: The global trend towards carbon pricing, with over 70 jurisdictions implementing such policies by 2023, directly influences Itochu’s supply chain costs and strategic sourcing decisions.

- Extended Producer Responsibility (EPR): EPR schemes, increasingly adopted for packaging and electronics, require Itochu to manage the end-of-life of products it distributes, potentially increasing operational complexity and costs.

- Sustainability Reporting: The implementation of CSRD in Europe and similar frameworks globally mandates detailed environmental disclosures, demanding enhanced data management and reporting infrastructure from Itochu.

- Regulatory Compliance: Ensuring full compliance with a patchwork of international and national environmental regulations is crucial for maintaining operational licenses and avoiding penalties, which could amount to significant financial liabilities.

Global climate change initiatives are reshaping energy policies, pushing Itochu to invest more in renewables and reduce carbon emissions. For example, many nations are setting ambitious emissions reduction targets, with the EU aiming for a 55% reduction by 2030 compared to 1990 levels, creating a clear market signal for decarbonization investments.

PESTLE Analysis Data Sources

Our Itochu PESTLE Analysis is informed by a comprehensive dataset, drawing from official government publications, international financial institutions, and reputable industry-specific research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting Itochu's operations.