Itochu Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

Discover how Itochu leverages its diverse product portfolio, strategic pricing, extensive global distribution, and multi-faceted promotional activities to maintain its competitive edge.

Uncover the intricate details of Itochu's marketing strategy, from product innovation to pricing models, channel management, and communication campaigns.

Ready to gain a comprehensive understanding of Itochu's marketing success? Access the full, in-depth 4Ps analysis to unlock actionable insights and strategic frameworks.

Product

Itochu Corporation's diverse business portfolio is a cornerstone of its strategy, encompassing textiles, machinery, metals, energy, food, and ICT. This wide reach, as demonstrated by its FY2024 results showing revenue across these segments, allows it to weather industry-specific downturns and capitalize on varied global economic trends.

This extensive product and service range is not just about breadth; it's a market-oriented approach focused on meeting diverse customer needs. By operating across sectors like general products and finance alongside its core offerings, Itochu mitigates risk and enhances its ability to identify and pursue new growth avenues worldwide.

Itochu is strategically channeling resources into burgeoning sectors, with a keen eye on customer-centric, downstream operations and digital advancements. This focus is evident in their May 2024 establishment of WECARS Co., Ltd., a move designed to solidify their position in the used car sales and maintenance market.

Further demonstrating this commitment, Itochu is actively expanding its IT consulting services and integrating technology into its extensive FamilyMart convenience store network. These initiatives include leveraging IT for enhanced customer experiences and developing innovative product delivery methods.

Itochu is actively developing sustainability-aligned offerings, recognizing their importance in the modern market. This focus is evident in their commitment to a decarbonized society and sustainable development, directly integrating these goals into their core business operations.

A prime example is Itochu's involvement in projects promoting Sustainable Aviation Fuel (SAF) and advancing decarbonization within the aviation sector. They are also investing in sustainable agriculture, demonstrating a broad approach to environmental responsibility.

The company has set ambitious targets, aiming for 'offset zero' greenhouse gas emissions by 2040 and achieving net zero by 2050, underscoring a long-term strategic commitment to sustainability.

Value-added Services and Solutions

Itochu’s value-added services extend far beyond simple trading, encompassing crucial areas like business development, project financing, and sophisticated supply chain management. This holistic approach ensures they are deeply involved in the operational planning and execution of businesses, building a resilient value chain that spans from initial raw materials all the way to the end consumer.

Their strategy hinges on cultivating value through strategic alliances and a relentless pursuit of operational excellence. For instance, in the fiscal year ending March 2024, Itochu’s diverse business segments, including food, textiles, and machinery, demonstrated strong performance, with net sales reaching ¥11,369.8 billion, highlighting the success of their integrated service model.

- Business Development: Itochu actively partners with companies to identify growth opportunities and develop new ventures.

- Project Financing: They provide financial solutions and support for large-scale projects across various industries.

- Supply Chain Management: Itochu optimizes and manages complex supply chains, ensuring efficiency and reliability from sourcing to delivery.

- Operational Excellence: Their focus on improving operational processes across their portfolio enhances overall business performance.

Adaptability to Market Shifts

Itochu's adaptability is a cornerstone of its marketing strategy, allowing it to pivot effectively in response to global economic shifts and evolving consumer needs. Their management policy, 'The Brand-new Deal: Profit Opportunities Are Shifting Downstream,' effective April 2024, signals a deliberate move towards more consumer-centric businesses. This strategic reorientation aims to reduce exposure to the inherent volatility of commodity markets.

This agility is crucial for identifying and cultivating emerging business opportunities. For instance, Itochu's focus on areas like lifestyle and food services, which are less susceptible to raw material price fluctuations, demonstrates this adaptability. By actively seeking out and investing in these downstream sectors, Itochu is positioning itself for more stable and predictable revenue streams in the coming years.

Key aspects of Itochu's adaptability include:

- Strategic Realignment: The 'Brand-new Deal' policy, implemented in April 2024, prioritizes consumer-facing segments over traditional commodity trading.

- Diversification: Itochu actively expands its portfolio into sectors like retail, food, and healthcare, mitigating risks associated with single-industry dependence.

- Agile Investment: The company demonstrates a capacity to quickly identify and invest in nascent business trends, fostering innovation and new growth engines.

- Market Responsiveness: Itochu continuously monitors global economic indicators and consumer behavior to adjust its product and service offerings proactively.

Itochu’s product strategy is characterized by its vast diversification across multiple sectors, from textiles and food to machinery and energy. This broad offering, exemplified by their FY2024 revenue of ¥11,369.8 billion, allows them to cater to a wide array of consumer and industrial needs globally.

The company is increasingly focusing on downstream, customer-centric operations and digital integration, as seen in their May 2024 establishment of WECARS Co., Ltd. for used car sales. This strategic shift aims to enhance customer experience and develop innovative product delivery methods, including within their FamilyMart network.

Furthermore, Itochu is actively developing and promoting sustainability-aligned products and services, such as Sustainable Aviation Fuel (SAF) and sustainable agriculture initiatives. This commitment is underscored by their ambitious targets of 'offset zero' greenhouse gas emissions by 2040 and net zero by 2050.

Their product development is also driven by adaptability, with the April 2024 'Brand-new Deal' policy prioritizing consumer-facing segments to mitigate commodity market volatility and ensure more stable revenue streams.

| Product Segment | FY2024 Net Sales (¥ billion) | Key Focus Areas |

| Textiles | 1,412.7 | Sustainable materials, apparel innovation |

| Machinery | 1,090.5 | Industrial automation, eco-friendly equipment |

| Metals & Mineral Resources | 1,709.8 | Recycling, sustainable sourcing |

| Energy & Chemicals | 2,038.7 | Renewable energy, SAF, decarbonization |

| Food & Consumer Products | 3,064.3 | Downstream operations, convenience retail (FamilyMart), sustainable agriculture |

| ICT & General Products | 2,053.8 | Digital transformation, IT consulting, used car market (WECARS) |

What is included in the product

This analysis offers a comprehensive examination of Itochu's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It provides a deep dive into Itochu's marketing positioning, perfect for professionals seeking to understand their approach and benchmark against industry best practices.

Simplifies complex marketing strategies by clearly outlining Itochu's Product, Price, Place, and Promotion, alleviating the burden of deciphering dense reports.

Provides a clear, actionable framework for understanding Itochu's market approach, removing the confusion often associated with broad strategic overviews.

Place

Itochu leverages an extensive global network, boasting operations in roughly 80 countries and 86 overseas offices. This vast reach facilitates international trade, investment, and business development across numerous sectors, granting unparalleled market access.

Key regional hubs, such as ITOCHU International Inc. in North America and ITOCHU Europe PLC, strategically manage operations across their respective continents, ensuring localized expertise and efficient global coordination.

Itochu strategically utilizes a broad spectrum of distribution channels, adapting to the unique needs of each business segment. For commodities and industrial goods, this means established global trading networks, while consumer products benefit from extensive retail presence, exemplified by their ownership of FamilyMart, which boasted over 16,000 stores across Japan as of early 2024.

The company's mastery of intricate supply chain management is crucial, ensuring timely and cost-effective product delivery worldwide. This end-to-end capability, from sourcing raw materials to reaching the final consumer, underpins their global market reach and operational efficiency.

Itochu's localized market access strategy hinges on deep integration with regional economies, often utilizing subsidiaries and affiliates. This allows them to tailor products and services to specific local demands, a vital component of their global trade operations. For instance, their establishment of a China Food Safety Management Team underscores a commitment to understanding and navigating complex local regulations and consumer expectations.

Robust Supply Chain Management

Itochu's commitment to robust supply chain management is crucial given its vast global operations. This focus ensures resilience and ethical practices throughout its procurement and distribution networks. For instance, in fiscal year 2023, Itochu continued to strengthen its supplier engagement programs, with a particular emphasis on sustainability and human rights due diligence, reflecting a proactive approach to managing complex international relationships.

The company actively manages risks related to human rights, labor standards, and environmental impact across its entire supply chain. This proactive stance is demonstrated through rigorous supplier assessments and audits. In the food sector, Itochu conducts regular on-site visits and surveys of overseas suppliers to verify compliance and maintain high-quality standards, a practice that underpins its reputation for reliability.

Key aspects of Itochu's supply chain management include:

- Supplier Audits and Risk Assessments: Regular evaluations of suppliers to identify and mitigate potential risks, particularly concerning ethical and environmental standards.

- Human Rights Due Diligence: Implementing policies and procedures to ensure respect for human rights throughout the value chain, with a focus on labor conditions.

- Environmental Compliance: Monitoring and ensuring that suppliers adhere to environmental regulations and sustainability goals.

- Quality Assurance in Food Sector: Direct engagement with overseas food suppliers through visits and surveys to guarantee product quality and safety.

Digital Platform Integration for Distribution

Itochu is actively integrating digital platforms to streamline its distribution and trading operations. This strategic move is particularly evident in their engagement with emerging markets, such as environmental value trading.

Their involvement in platforms like the Sustainable Aviation Fuel (SAF) environmental value trading initiative highlights a commitment to leveraging digital solutions for improved market access and value exchange. This approach aims to foster more efficient transactions and broaden participation in these critical sectors.

- Digitalization of Trading: Itochu's push into digital platforms aims to modernize its trading infrastructure, making transactions faster and more transparent.

- Environmental Value Markets: The company is focusing on integrating digital tools for trading environmental assets, reflecting a growing global trend towards sustainability. For instance, the global voluntary carbon market was valued at approximately $2 billion in 2023 and is projected to grow substantially, underscoring the importance of digital solutions in this space.

- Enhanced Market Access: Digital integration facilitates broader reach, allowing Itochu to connect with a wider array of buyers and sellers, thereby optimizing its distribution network.

Itochu's place strategy is defined by its extensive global footprint and strategic use of diverse distribution channels. With operations in approximately 80 countries, Itochu ensures broad market access, supported by key regional hubs like ITOCHU International Inc. in North America. Their ownership of FamilyMart, a convenience store chain with over 16,000 locations in Japan as of early 2024, exemplifies their direct consumer product distribution capabilities.

What You Preview Is What You Download

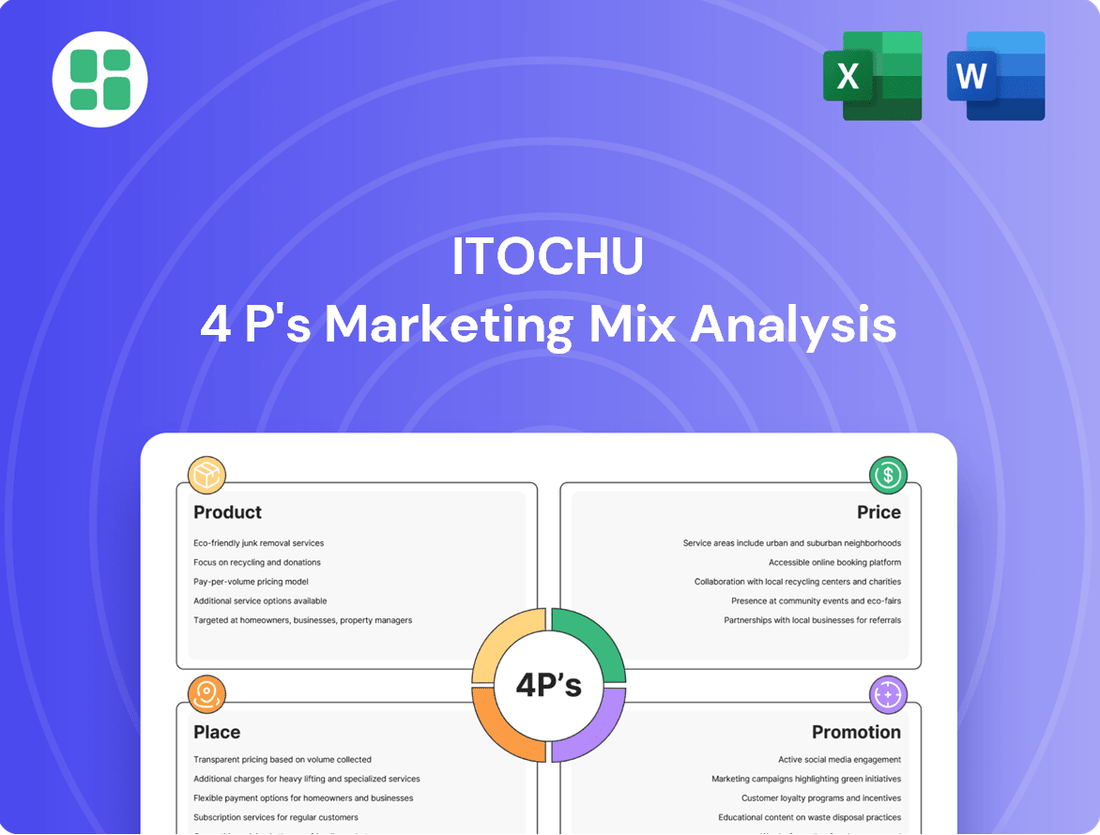

Itochu 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Itochu 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Itochu utilizes integrated corporate communications to effectively share its core mission, values, and strategic roadmap. This approach ensures a consistent message reaches diverse stakeholders, from investors to employees.

Key to this strategy are the Integrated Report 2024 and ESG Report 2024. These documents offer a comprehensive view of Itochu's business model, sustainable growth prospects, and how management strategies link financial and non-financial capital, with a strong emphasis on strategic direction and stakeholder engagement.

Itochu's promotional strategy is deeply rooted in its 'Sampo-yoshi' philosophy, a principle emphasizing benefits for the seller, buyer, and society. This commitment is consistently highlighted in their corporate communications, reinforcing their brand as one that prioritizes ethical conduct and social responsibility.

By actively communicating 'Sampo-yoshi,' Itochu aims to elevate its corporate brand value and showcase its dedication to contributing positively to society through its diverse business operations. This ethical framework underpins their public image and fosters trust among stakeholders.

Itochu actively engages with financial markets through proactive investor relations, detailing its performance, management strategies, and shareholder return plans. This communication is crucial for building investor confidence and ensuring market understanding of the company's direction.

The company utilizes regular financial reports, press releases, and investor events to disseminate information. A key example is the April 2024 announcement of their 'Brand-new Deal' management policy, which clearly outlined profit plans and key financial indicators, demonstrating a commitment to transparent disclosure.

Sustainability and ESG Reporting

Itochu actively promotes its commitment to sustainability and Environmental, Social, and Governance (ESG) performance. This promotion is primarily channeled through detailed reports and communications that highlight their progress and initiatives.

The company's ESG Report 2024, which includes data for the fiscal year ending March 31, 2024, underscores their efforts in critical areas. These include addressing climate change, upholding human rights, ensuring fair labor practices, and contributing to society. This strategic communication aims to align with societal expectations and bolster Itochu's reputation among stakeholders who prioritize environmental and social responsibility.

- Climate Action: Itochu is focused on reducing greenhouse gas emissions, with a target to achieve net-zero emissions by 2050.

- Human Rights and Labor: The company emphasizes fair labor practices and respect for human rights throughout its supply chain.

- Social Contributions: Itochu actively engages in initiatives that support local communities and promote social well-being.

- Governance: Strong corporate governance structures are in place to ensure ethical business conduct and transparency in ESG reporting.

Strategic Public Relations and Partnerships

Itochu leverages strategic public relations and key partnerships to bolster its brand and market position. By issuing regular news releases and actively participating in industry-wide initiatives, the company communicates its progress and vision. For instance, their involvement in the SAF trading pilot project with Japan Airlines and other major corporations, publicized widely, underscores their commitment to decarbonization and technological innovation, positioning them as leaders in sustainable aviation fuel development.

These collaborations are not merely operational; they are strategic communication tools. The SAF pilot, which began in 2023 and continued into 2024, aimed to establish a robust and transparent trading framework for sustainable aviation fuel. Itochu's public announcement of its role in this project, which saw the successful delivery of SAF for international flights, served to highlight their proactive approach to environmental, social, and governance (ESG) goals and their influence within the global aviation supply chain.

The company's PR efforts around such partnerships emphasize their dedication to innovation and broader societal impact. This strategy reinforces Itochu's image as a forward-thinking corporation committed to addressing global challenges like climate change. By showcasing their active participation and leadership in critical areas, Itochu aims to attract talent, investors, and further business opportunities, solidifying its competitive edge.

Key aspects of Itochu's strategic PR and partnerships include:

- News Releases: Regular dissemination of company updates and achievements to media outlets.

- Industry Initiatives: Active participation in sector-wide projects and collaborations.

- Partnership Showcasing: Publicizing joint ventures like the SAF trading pilot with Japan Airlines to demonstrate leadership.

- ESG Communication: Highlighting efforts in decarbonization and technological advancement to stakeholders.

Itochu's promotional activities are a direct reflection of its 'Sampo-yoshi' philosophy, emphasizing benefits for all parties involved. This principle is consistently communicated through integrated corporate communications, including their Integrated Report 2024 and ESG Report 2024, which detail their business model and commitment to sustainable growth.

The company actively engages financial markets through transparent investor relations, highlighting performance and shareholder return plans, as exemplified by the April 2024 announcement of their 'Brand-new Deal' management policy. This policy clearly outlined profit plans and key financial indicators, reinforcing investor confidence.

Itochu's commitment to ESG is promoted through detailed reports showcasing progress in areas like climate action, human rights, and social contributions, with a net-zero emissions target by 2050. Their ESG Report 2024, covering the fiscal year ending March 31, 2024, details these initiatives.

Strategic public relations and key partnerships, such as the SAF trading pilot project with Japan Airlines, further bolster Itochu's brand and market position, highlighting their leadership in decarbonization and technological innovation.

Price

Itochu's pricing across its vast trading operations inherently leans towards value-based strategies. This means they price based on the perceived worth of the goods and services they facilitate, which can fluctuate significantly given the complexity of global supply chains and the diverse industries they serve. For instance, in fiscal year 2024, Itochu reported strong performance in its specialized sectors, suggesting successful value capture.

As a sogo shosha, Itochu's pricing isn't just about the commodity itself but the comprehensive solutions offered, such as logistics, financing, and risk management. This integrated approach allows them to command prices that reflect the total value delivered to their clients, rather than just the transactional cost of goods. Their ability to provide these bundled services is a key differentiator.

The company strategically balances achieving robust financial results, as seen in their consistent profitability and dividend growth, with enhancing their corporate brand value. This dual objective means pricing decisions consider not only immediate profit but also long-term client relationships and the overall reputation of Itochu as a reliable and value-adding partner in global trade.

Itochu's pricing strategy is deeply intertwined with the ebb and flow of global markets. Fluctuations in commodity prices, currency exchange rates, and the general economic outlook significantly shape their pricing decisions.

For fiscal year ending March 2025, Itochu's financial projections explicitly factor in key variables such as the yen-dollar exchange rate and West Texas Intermediate (WTI) crude oil prices. These elements directly influence the pricing and profitability of their substantial energy and chemicals businesses, demonstrating a responsive approach to market volatility.

Itochu's approach to its own equity's price, as seen in its stock performance and overall valuation, is directly tied to how it manages its capital and rewards its shareholders. This is a key part of its marketing mix, influencing how investors perceive the company's worth.

A significant indicator of this strategy was Itochu's announcement in May 2025 of a ¥150 billion share buyback program. This move, alongside their target of a 50% total payout ratio for the fiscal year ending March 2026, demonstrates a strong belief in the company's intrinsic value and a commitment to returning capital to investors.

Investment-Driven Growth and Profit Targets

Itochu's pricing strategy is intrinsically linked to its substantial investment plans, with a significant ¥1 trillion earmarked for growth initiatives through fiscal year ending March 2026. This capital deployment, focusing on downstream and customer-centric ventures, is designed to fuel future profit expansion, thereby impacting the stock's intrinsic value and market perception. The overarching objective is to boost earnings and elevate the company's overall brand equity.

The company's pricing considerations are also informed by its commitment to enhancing corporate brand value and driving earnings growth through strategic investments. These investments are expected to yield higher returns, which in turn can support more favorable pricing and valuation metrics for Itochu's stock.

- Investment Allocation: ¥1 trillion planned for growth investments through FYE 2026.

- Strategic Focus: Downstream and customer-facing businesses are prioritized for investment.

- Growth Drivers: Investments aim to stimulate future profit growth and enhance brand value.

- Valuation Impact: Expected profit growth influences Itochu's stock's intrinsic value and perceived price.

Competitive Pricing in Diverse Sectors

Itochu's competitive pricing strategy is deeply embedded within its diverse business segments, allowing it to adapt to varied market demands. In its used car business, WECARS, the emphasis on customer trust and service indirectly underpins its pricing approach, aiming for value rather than just low cost.

This diversified approach is reflected in its financial performance. For the fiscal year ending March 2024, Itochu reported a consolidated net income attributable to owners of the parent of ¥577.3 billion. This consistent profitability, even amidst global economic fluctuations, highlights the effectiveness of its pricing and operational strategies across its many ventures.

The company's ability to maintain strong financial metrics, such as a high Return on Equity (ROE), further validates its competitive pricing. For the fiscal year ended March 2024, Itochu's ROE stood at an impressive 16.8%, demonstrating efficient capital utilization and profitable pricing structures across its extensive portfolio.

- Diversified Portfolio: Itochu's broad range of businesses allows it to absorb pricing pressures in one sector with strengths in others.

- Customer-Centric Pricing: In segments like WECARS, value and trust are key components of their pricing strategy, fostering customer loyalty.

- Operational Efficiency: Streamlined operations contribute to cost advantages, enabling more competitive pricing across the board.

- Financial Strength: A reported net income of ¥577.3 billion for FY2024 and an ROE of 16.8% underscore the success of its pricing strategies in generating robust returns.

Itochu's pricing strategy is dynamic, reflecting its role as a global trading company. They often employ value-based pricing, especially in complex supply chains where the total solution offered, including logistics and financing, justifies the price. For fiscal year 2024, Itochu's performance in specialized sectors indicates successful value capture through these integrated approaches.

The company's stock price itself is a key indicator of its perceived value, influenced by investment decisions and shareholder returns. Itochu's ¥150 billion share buyback in May 2025 and a target 50% payout ratio for FY2026 demonstrate confidence in its intrinsic value and commitment to investors, directly impacting its market valuation.

| Metric | FY2024 (ended March 2024) | FY2025 Projections (factors) |

|---|---|---|

| Consolidated Net Income (JPY billion) | 577.3 | N/A |

| Return on Equity (ROE) | 16.8% | N/A |

| Planned Investment for Growth (JPY trillion) | N/A | ¥1.0 (through FYE 2026) |

| Share Buyback Program (JPY billion) | N/A | ¥150 (announced May 2025) |

4P's Marketing Mix Analysis Data Sources

Our Itochu 4P's Marketing Mix Analysis is built upon a foundation of comprehensive data, including official company reports, investor relations materials, and detailed industry analyses. We meticulously examine product portfolios, pricing strategies, distribution networks, and promotional activities to provide a robust understanding of Itochu's market approach.