Itochu Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itochu Bundle

Uncover the strategic genius behind Itochu's diversified success with our comprehensive Business Model Canvas. This detailed breakdown reveals how Itochu leverages its vast network and market insights to create and capture value across multiple industries. Perfect for anyone seeking to understand the mechanics of a global trading powerhouse.

Dive into the core of Itochu's operational excellence with our full Business Model Canvas. This in-depth analysis maps out their key partners, customer relationships, revenue streams, and cost structures, offering a clear blueprint for their sustained growth. Download it now to gain a competitive edge.

Want to deconstruct Itochu's winning strategy? Our complete Business Model Canvas provides an editable, section-by-section view of their business. Gain actionable insights into their value propositions, channels, and key resources, empowering your own strategic planning.

Partnerships

Itochu's extensive network of global manufacturers and raw material suppliers forms the backbone of its operations across textiles, machinery, metals, and chemicals. These vital collaborations ensure a consistent flow of high-quality goods and essential resources, underpinning Itochu's ability to serve diverse markets effectively. For instance, in 2024, Itochu's involvement in the automotive sector, a key area for machinery and metals, saw significant activity driven by global demand for new vehicles, highlighting the reliance on these manufacturing partnerships.

Itochu actively cultivates strategic business alliances and joint ventures to fuel expansion into novel markets and foster technological innovation. These collaborations are crucial for bolstering specific business capabilities.

A prime illustration is Itochu's investment in Kawasaki Motors, Ltd., aimed at enhancing its financing operations. Furthermore, a joint acquisition of LeSportsac Japan Co., Ltd. underscores the strategy to broaden market reach.

These partnerships are designed to harness the distinct strengths of each collaborating entity, thereby propelling growth and generating fresh value streams. For instance, in 2023, Itochu's total investment in strategic alliances and joint ventures reached approximately ¥1.2 trillion, demonstrating a significant commitment to this growth driver.

Itochu's relationships with financial institutions and investors are crucial for securing the substantial capital needed for its diverse global operations. These partnerships, including those with major banks and investment funds, provide the necessary financing for large-scale projects and ongoing business investments.

In fiscal year 2023, Itochu reported total assets of ¥14,751 billion, underscoring the scale of financing required. The company actively engages with financial markets to maintain a strong capital structure and ensure ample liquidity, which directly supports its ambitious growth strategies.

Technology and Digital Solution Providers

Itochu actively collaborates with technology and digital solution providers to drive its digital transformation initiatives. These partnerships are crucial for optimizing operations and creating innovative digital business models.

A key focus is leveraging advanced analytics and emerging technologies like generative AI. For instance, Itochu has been exploring AI applications to uncover new business avenues and refine its strategic decision-making processes, aiming for enhanced business intelligence and operational agility.

- Technology Partnerships: Collaborations with IT service providers and software companies to integrate cutting-edge digital tools.

- AI Integration: Joint ventures to implement generative AI across various business units for efficiency and new opportunity identification.

- Digital Business Development: Working with tech firms to co-create and launch new digital platforms and services.

- Data Analytics Enhancement: Partnering for advanced data analytics capabilities to gain deeper market insights.

Government Bodies and Industry Associations

Itochu actively collaborates with government bodies and industry associations to shape sustainable business practices and policy. This engagement is crucial for navigating complex regulatory landscapes and fostering industry-wide improvements.

For instance, Itochu's participation in initiatives like the TCFD Consortium and the Japan Partnership for Circular Economy underscores its commitment to environmental stewardship and the development of circular economy models. These partnerships are vital for aligning business strategies with global sustainability goals and ensuring compliance.

Key partnerships in this area include:

- Government Agencies: Engaging with national and international bodies to influence policy related to trade, environment, and corporate social responsibility.

- Industry Associations: Collaborating with sector-specific groups to share best practices, address common challenges, and drive innovation.

- International Organizations: Partnering with global entities to promote sustainable development and international cooperation, such as those focused on climate action and resource management.

- Consortia and Alliances: Joining forces with other companies and organizations on specific projects, like those aimed at advancing circular economy principles or digital transformation within industries.

Itochu's key partnerships extend to a broad base of global manufacturers and raw material suppliers, ensuring a steady supply chain for its diverse business segments. The company also strategically forms alliances and joint ventures to enter new markets and develop innovative technologies, as seen in its investment in Kawasaki Motors. Financial institutions are critical partners, providing the substantial capital needed for Itochu's extensive global operations, with total assets reaching ¥14,751 billion in fiscal year 2023. Furthermore, collaborations with technology providers are vital for digital transformation, including the exploration of generative AI for business insights.

| Partner Type | Purpose | Example/Focus Area | 2023 Impact/Data |

| Manufacturers & Suppliers | Supply Chain Reliability | Textiles, Machinery, Metals, Chemicals | Underpinned diverse market service |

| Strategic Alliances & JVs | Market Expansion & Innovation | Kawasaki Motors (financing), LeSportsac Japan (market reach) | Total investment approx. ¥1.2 trillion |

| Financial Institutions | Capital Acquisition | Banks, Investment Funds | Supported ¥14,751 billion total assets |

| Technology Providers | Digital Transformation & AI | AI applications, Digital Platforms | Enhancing business intelligence |

What is included in the product

A strategic overview of Itochu's diverse operations, detailing its key customer segments, value propositions, and revenue streams across various industries.

This model breaks down Itochu's vast global network, illustrating how it leverages its trading company strengths to create value and manage costs.

Simplifies complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Provides a structured approach to understanding and communicating business value, reducing the frustration of unclear business objectives.

Activities

Itochu's global trade and distribution activities are central to its business, involving the import, export, and domestic movement of diverse products worldwide. This includes everything from textiles and food to advanced machinery and raw materials, showcasing the breadth of their operations.

The company excels at optimizing complex logistics and supply chains, ensuring efficient market access for a vast range of goods. In fiscal year 2023, Itochu reported total trading transactions of approximately ¥13.7 trillion, highlighting the sheer volume of goods they facilitate across the globe.

Itochu's core activities revolve around strategic investments and business development, both within Japan and internationally. This involves actively acquiring stakes in promising companies and nurturing their expansion through direct management. For instance, in fiscal year 2023, Itochu made significant investments across various sectors, aiming to bolster its long-term profit potential and market reach.

A key aspect of this is portfolio optimization, which includes divesting non-core assets to sharpen focus and improve overall financial performance. This strategic reallocation of resources ensures that capital is directed towards areas with the highest growth prospects and strategic alignment, contributing to Itochu's sustained competitive advantage.

Itochu's project management is central to its operations, especially in large infrastructure and energy ventures. They manage complex undertakings from initial planning through to operational phases, requiring coordination of diverse stakeholders and substantial capital. For example, Itochu's involvement in the Gorgon Project, a massive LNG development in Australia, showcases their capability in managing multi-billion dollar projects with significant technical and financial complexities.

Market Intelligence and Business Incubation

Itochu's global network is a powerful engine for market intelligence, allowing it to pinpoint emerging trends and promising opportunities. For instance, in 2024, the company continued to invest heavily in identifying sustainable growth sectors.

The company actively incubates new ventures, focusing on areas like sustainable aviation fuel (SAF) and digital transformation. This strategic incubation is designed to future-proof its business and capture new revenue streams.

- Global Market Scouting: Itochu leverages its extensive international presence to gather real-time data on market shifts, consumer behavior, and technological advancements, informing its strategic direction.

- Incubation of Future Growth Areas: The company actively nurtures new business initiatives, with a notable focus in 2024 on sustainable aviation fuel (SAF) and advanced digital solutions, aiming to diversify its revenue base.

- Strategic Diversification: By incubating businesses in high-potential sectors, Itochu aims to build a more resilient and diversified portfolio, reducing reliance on traditional markets and capitalizing on emerging economies.

Sustainability and ESG Initiatives

Itochu actively integrates sustainability into its core operations, focusing on climate change mitigation, circular economy principles, and upholding human rights across its diverse business segments. This commitment translates into tangible investments and strategic development of eco-friendly solutions and responsible supply chain management.

The company's dedication to sustainability is evidenced by its proactive engagement in social contribution activities, aiming to bolster corporate value while responding to evolving societal expectations. These initiatives are crucial for long-term resilience and stakeholder trust.

- Climate Action: Itochu is pursuing initiatives to reduce greenhouse gas emissions, aligning with global climate goals.

- Circular Economy: The company is exploring and investing in business models that promote resource efficiency and waste reduction.

- Human Rights: Itochu is committed to ensuring human rights are respected throughout its supply chains and business operations.

- Social Contribution: Engaging in activities that benefit society and enhance community well-being is a key aspect of their sustainability strategy.

Itochu's key activities center on its extensive global trading and distribution networks, facilitating the movement of a vast array of products. This includes strategic investments and business development, where the company actively acquires stakes in promising companies and manages their expansion to enhance long-term profit potential.

Project management, particularly for large infrastructure and energy ventures, is another core activity, demonstrating their capability to handle complex, multi-billion dollar undertakings. Furthermore, Itochu actively scouts global markets to identify emerging trends and incubates new ventures in high-potential sectors like sustainable aviation fuel.

Sustainability integration is fundamental, with a focus on climate action, circular economy principles, and human rights across operations. The company also engages in social contribution activities to bolster corporate value and societal well-being.

| Key Activity | Description | Fiscal Year 2023/2024 Data Point |

|---|---|---|

| Global Trading & Distribution | Import, export, and domestic movement of diverse products. | Total trading transactions of approx. ¥13.7 trillion (FY2023). |

| Strategic Investments & Business Development | Acquiring stakes in companies and nurturing their expansion. | Significant investments made across various sectors in FY2023. |

| Project Management | Managing complex infrastructure and energy ventures. | Involvement in large-scale projects like the Gorgon Project. |

| Market Scouting & Venture Incubation | Identifying trends and nurturing new business initiatives. | Focus on sustainable aviation fuel (SAF) and digital solutions in 2024. |

| Sustainability Integration | Focus on climate action, circular economy, and human rights. | Proactive engagement in social contribution activities. |

Full Document Unlocks After Purchase

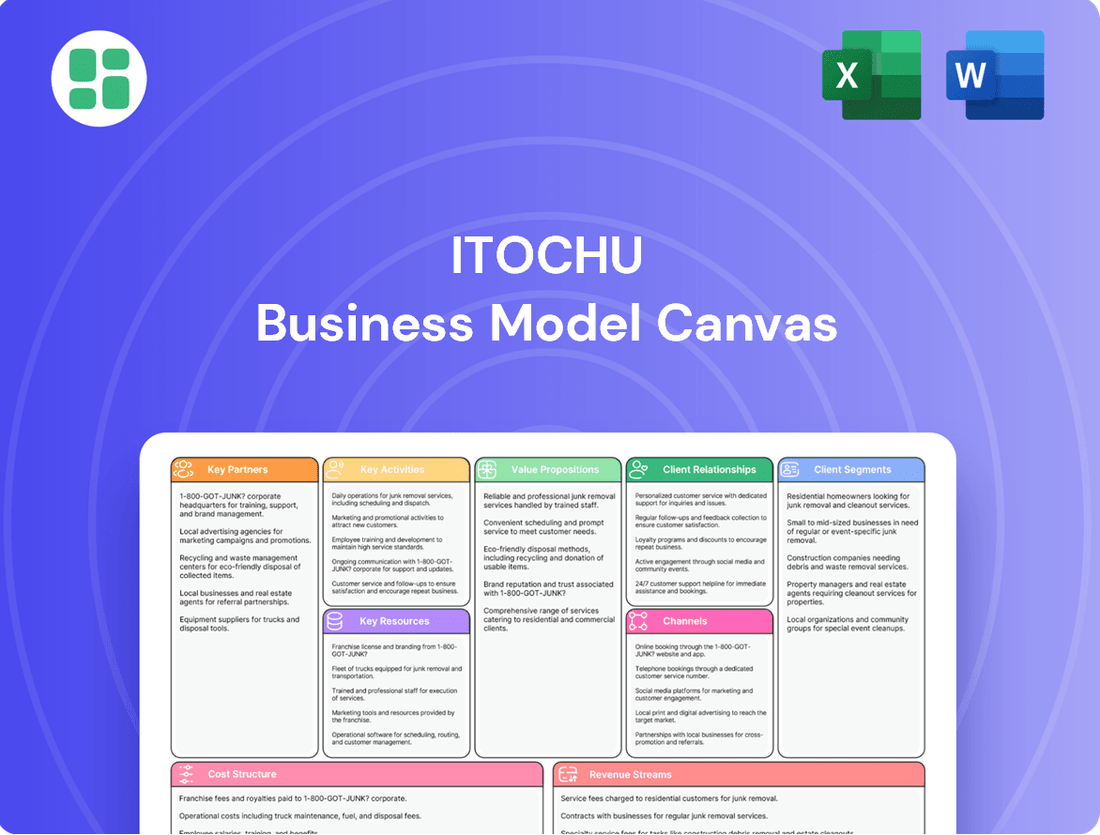

Business Model Canvas

The Itochu Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured file, ensuring no surprises in content or layout. Once your order is processed, you'll gain full access to this exact, ready-to-use Business Model Canvas.

Resources

Itochu's extensive global network, boasting operations in over 60 countries, is a cornerstone of its business model. This vast reach allows for unparalleled local market insights, crucial for navigating diverse economic landscapes. For instance, in 2024, Itochu's presence in emerging markets facilitated significant growth in its food and textile divisions, leveraging localized consumer trends.

This intricate web of offices and partners empowers Itochu to identify nascent opportunities and manage intricate global supply chains with remarkable efficiency. The company's ability to adapt to regional nuances, a direct benefit of this network, was evident in its successful expansion of renewable energy projects in Southeast Asia during 2024, responding swiftly to governmental incentives.

Itochu's diverse investment portfolio, spanning sectors like textiles, machinery, and food, generated significant returns, contributing to its stable earnings base. For the fiscal year ending March 2024, the company reported a net profit attributable to owners of the parent of ¥597.5 billion, showcasing the strength of its diversified holdings.

The company's robust financial capital, evidenced by strong operating cash flows and a healthy balance sheet, empowers strategic investments and acquisitions. As of March 31, 2024, Itochu held total assets of ¥15,968.3 billion, underscoring its substantial financial capacity to pursue global investment opportunities.

Itochu's workforce is a powerhouse of specialized talent, boasting deep expertise across diverse sectors like textiles, machinery, and food. These professionals are adept in international trade, complex finance, and intricate project management, forming the bedrock of Itochu's global operations.

The company actively invests in its people, focusing on continuous learning and skill diversification. This commitment to human capital development is vital for Itochu's strategy of uncovering novel business ventures and fostering innovation, as evidenced by its consistent focus on talent as a key differentiator.

Brand Reputation and Trust

Itochu's brand reputation and the trust it has cultivated are cornerstones of its business model, deeply rooted in its founding principle of Sampo-yoshi, which emphasizes mutual benefit for all parties involved. This commitment to integrity and long-term relationships globally is a powerful asset, enabling strong partnerships and customer loyalty.

This established trust is not just a qualitative advantage; it translates into tangible business benefits. For instance, Itochu's consistent financial performance, with reported operating income of ¥1.15 trillion for the fiscal year ending March 2024, underscores the reliability stakeholders associate with the brand. This financial strength further bolsters its reputation.

- Sampo-yoshi Philosophy: Ensures ethical business practices benefiting seller, buyer, and society, fostering deep trust.

- Global Recognition: Itochu is recognized worldwide for its reliability and integrity, facilitating international partnerships.

- Financial Stability: A strong financial track record, including ¥1.15 trillion in operating income for FY2024, reinforces stakeholder confidence.

- Stakeholder Relationships: The brand's trustworthiness is crucial for maintaining and expanding its network of partners and customers.

Information and Digital Infrastructure

Itochu's Information and Digital Infrastructure is a cornerstone of its operations, powered by advanced ICT. This includes robust data analytics and the burgeoning capabilities of generative AI, which are integral to their trading, investment, and overall management functions.

This digital backbone significantly boosts operational efficiency and provides invaluable insights for strategic decision-making. It also acts as a catalyst for creating innovative new digital business models, reflecting Itochu's forward-looking approach in the evolving market landscape.

- Data-Driven Decision Making: Itochu utilizes extensive data analytics to inform its investment and trading strategies, aiming for optimized outcomes.

- Generative AI Integration: The company is exploring and implementing generative AI to enhance its business processes and identify new opportunities.

- Enhanced Efficiency: Digital infrastructure streamlines operations, reducing costs and improving the speed of business transactions.

- New Digital Business Models: Leveraging digital capabilities allows Itochu to develop and scale novel digital services and platforms.

Itochu's key resources are its expansive global network, diverse investment portfolio, and skilled workforce. Its financial strength, coupled with a strong brand reputation built on the Sampo-yoshi philosophy, further underpins its operations. The company's investment in digital infrastructure, including advanced analytics and generative AI, is also a critical resource for future growth and efficiency.

The company's global reach, operating in over 60 countries, allows for deep market penetration and efficient supply chain management. In fiscal year 2024, Itochu reported a net profit of ¥597.5 billion, demonstrating the success of its diversified holdings and strategic investments across various sectors.

Itochu's commitment to its workforce and its trusted brand image are invaluable assets. The company's operating income reached ¥1.15 trillion in FY2024, reflecting the confidence stakeholders place in its reliable and ethical business practices.

| Key Resource | Description | FY2024 Impact/Data |

|---|---|---|

| Global Network | Operations in over 60 countries | Facilitated growth in food and textile divisions |

| Investment Portfolio | Diversified across textiles, machinery, food, etc. | Net Profit Attributable to Owners: ¥597.5 billion |

| Financial Capital | Strong operating cash flows, healthy balance sheet | Total Assets: ¥15,968.3 billion |

| Human Capital | Specialized talent across diverse sectors | Driving innovation and uncovering new ventures |

| Brand Reputation | Sampo-yoshi philosophy, trust and integrity | Operating Income: ¥1.15 trillion |

| Digital Infrastructure | Advanced ICT, data analytics, generative AI | Enhancing efficiency and enabling new digital models |

Value Propositions

Itochu's global market access is a cornerstone of its business model, facilitating efficient cross-border trade. In fiscal year 2023, Itochu's trading and investment segment reported a significant contribution to its overall revenue, underscoring the value of its international reach.

The company excels at optimizing supply chains, a critical function for partners seeking to navigate international logistics. This optimization translates into reduced costs and enhanced speed to market for a diverse range of products, from food to textiles.

By leveraging its vast network, Itochu effectively mitigates the inherent complexities and risks of global commerce. This allows businesses to focus on their core operations, assured of reliable procurement and distribution channels.

Itochu offers strategic capital and business development expertise, acting as a catalyst for growth in emerging ventures and established industries. This involves more than just funding; it's about actively guiding partners toward expansion and capability enhancement.

With a hands-on management style and a commitment to long-term vision, Itochu empowers its partners to navigate competitive landscapes effectively. For instance, in the fiscal year ending March 2024, Itochu's diverse portfolio saw significant contributions from strategic investments, with its total assets reaching approximately ¥12.3 trillion.

Itochu's diverse business portfolio, spanning sectors like textiles, machinery, and food, acts as a powerful risk mitigator. This broad diversification across various industries and geographies helps cushion the impact of downturns in any single sector or region, providing a more stable operational base. For example, in fiscal year 2023, Itochu reported a net income of ¥570.7 billion, demonstrating resilience despite global economic uncertainties.

The company's proactive approach to risk management is central to its stable operations. By carefully assessing and managing potential threats, such as volatile raw material prices or geopolitical shifts, Itochu ensures its business activities can continue smoothly. This robust framework allows Itochu to maintain consistent performance, even when facing challenging market conditions, safeguarding stakeholder interests.

Innovation and New Business Creation

Itochu actively fosters innovation, incubating new business models and technologies, with a significant focus on sustainable solutions and digital transformation. This proactive approach allows them to stay ahead of market shifts. For instance, in fiscal year 2023, Itochu invested heavily in areas like renewable energy and advanced materials, demonstrating their commitment to future-oriented growth.

By partnering with Itochu, businesses gain access to these cutting-edge projects, enabling them to adapt to evolving market demands. Itochu's incubation efforts create opportunities for collaboration in high-growth sectors, driving mutual expansion and resilience.

- Focus on Sustainable Solutions: Itochu's investments in eco-friendly technologies and circular economy initiatives are a key driver of new business creation.

- Digital Transformation Initiatives: The company is actively developing and integrating digital platforms and services across its diverse business segments.

- Partnership Opportunities: Itochu provides a collaborative environment for external partners to co-create and scale innovative ventures.

- Market Adaptability: Their strategy emphasizes identifying and capitalizing on emerging trends, ensuring continuous business evolution.

Commitment to Sustainability and Responsible Business

Itochu's dedication to sustainability, deeply embedded in its business model, translates into tangible value for stakeholders. By prioritizing Environmental, Social, and Governance (ESG) principles, the company fosters trust and attracts partners and customers who share its commitment to a better future.

This focus on responsible business practices isn't just about ethical conduct; it's a strategic advantage. Itochu's commitment to sustainable development and responsible sourcing resonates with a growing market segment that values environmental stewardship and social responsibility, thereby enhancing shared value creation.

For instance, Itochu's investments in renewable energy and its efforts to ensure ethical supply chains are key components of this value proposition. These initiatives not only mitigate risks but also open new avenues for growth and collaboration, aligning with global trends towards a greener economy.

- Commitment to ESG: Itochu actively integrates ESG principles across its diverse business segments.

- Sustainable Development: The company invests in and promotes businesses that contribute to sustainable growth and resource efficiency.

- Responsible Sourcing: Itochu works to ensure its supply chains are ethical, transparent, and environmentally sound.

- Ethical Business Practices: Upholding high standards of corporate governance and social responsibility is a cornerstone of Itochu's operations.

Itochu's value proposition centers on its extensive global network, enabling seamless cross-border trade and supply chain optimization for its partners. The company's strategic capital and business development expertise further empower ventures by providing crucial guidance and funding for expansion.

Its diversified business portfolio acts as a significant risk mitigator, offering stability through operations across various sectors and geographies. This broad reach, coupled with a proactive risk management approach, ensures consistent performance and safeguards stakeholder interests.

Itochu actively cultivates innovation, particularly in sustainable solutions and digital transformation, creating opportunities for partners to engage in high-growth sectors and adapt to evolving market demands.

The company's commitment to ESG principles and responsible sourcing is a core value, fostering trust and attracting partners aligned with sustainable growth and ethical business practices.

| Value Proposition Element | Description | Supporting Data (Fiscal Year Ending March 2024) |

|---|---|---|

| Global Market Access & Supply Chain Optimization | Facilitates efficient international trade and logistics, reducing costs and improving speed to market. | Total Assets: Approximately ¥12.3 trillion |

| Strategic Capital & Business Development | Offers funding and expert guidance to foster growth and capability enhancement in partner ventures. | Net Income: ¥570.7 billion (Fiscal Year 2023) |

| Diversified Portfolio & Risk Mitigation | Operates across multiple sectors, cushioning against sector-specific downturns and ensuring stable operations. | Diverse revenue streams contribute to overall financial resilience. |

| Innovation & Sustainability Focus | Incubates new business models and technologies, with emphasis on eco-friendly solutions and digital integration. | Significant investments in renewable energy and advanced materials (Fiscal Year 2023). |

Customer Relationships

Itochu prioritizes long-term strategic partnerships, fostering collaborative growth with its key customers and partners. This approach moves beyond simple transactions to joint business development, often cemented through mutual trust and shared objectives.

These deep relationships frequently manifest as joint ventures and co-investments, underscoring a commitment to sustained, mutual growth. For instance, in fiscal year 2024, Itochu's investments in strategic alliances played a significant role in its diversified revenue streams, contributing to its robust financial performance.

Itochu's customer relationships are built on dedicated account management and expert consultation. These teams work closely with clients to truly grasp their unique requirements, allowing Itochu to craft highly personalized solutions. This proactive engagement fosters strong partnerships and ensures clients receive strategic guidance across Itochu's broad portfolio.

This hands-on approach is crucial for navigating Itochu's diverse business segments, from textiles to machinery. For instance, in the fiscal year ending March 2024, Itochu reported significant growth in its ICT division, where understanding specific client technology needs is paramount for delivering effective solutions and maintaining high service levels.

Itochu actively partners with customers to jointly develop innovative products and services, especially in fast-growing sectors like sustainability and digital transformation. This collaborative approach allows them to quickly adapt to evolving market demands and craft future-oriented business strategies.

Transparent Communication and Reporting

Itochu prioritizes transparent communication and reporting to build trust with its stakeholders. This commitment is evident in their regular financial disclosures, which for the fiscal year ended March 2024, showed a record operating income of ¥790.1 billion. They also provide comprehensive sustainability reports, detailing their environmental, social, and governance (ESG) initiatives, which are crucial for long-term value creation and investor confidence.

These efforts foster mutual understanding and strengthen relationships. Investor briefings are a key component, offering direct engagement opportunities. For instance, during their FY2023 earnings call in May 2024, Itochu management provided detailed insights into their strategic direction and performance across various business segments.

Key aspects of Itochu's transparent communication include:

- Regular Financial Disclosures: Providing timely and accurate financial statements, such as the aforementioned record ¥790.1 billion operating income for FY2023, ensures stakeholders have a clear view of financial health.

- Comprehensive Sustainability Reports: Detailing ESG performance, including progress on climate change initiatives and social responsibility programs, demonstrates a commitment to sustainable business practices.

- Investor Briefings and Calls: Facilitating direct interaction and question-and-answer sessions with investors and analysts, as seen in their May 2024 earnings call, enhances understanding of their business strategy and outlook.

- Accessibility of Information: Making these reports and presentations readily available on their corporate website ensures broad access for all interested parties.

Global Relationship Management

Itochu's global relationship management is crucial, given its extensive international operations. The company navigates diverse cultural norms and regulatory environments, tailoring its engagement strategies to local customs and business practices to foster strong, effective connections worldwide. For instance, in fiscal year 2023, Itochu reported consolidated revenue of ¥11,556.4 billion, underscoring the scale of its global business and the importance of robust customer relationships across these varied markets.

The company's approach to customer relationships is multifaceted, aiming to build long-term partnerships. This involves:

- Localized Engagement: Adapting communication styles and business protocols to suit regional expectations.

- Value Co-creation: Collaborating with clients to develop mutually beneficial solutions and opportunities.

- Consistent Support: Providing reliable service and ongoing assistance across all operational regions.

- Strategic Partnerships: Cultivating deep relationships with key stakeholders to drive innovation and market penetration.

Itochu cultivates deep, collaborative relationships, moving beyond transactional interactions to foster long-term partnerships. This is achieved through dedicated account management, expert consultation, and a commitment to understanding unique client needs, as evidenced by their proactive engagement across diverse segments like ICT.

These relationships are solidified through joint ventures and co-investments, underscoring a shared vision for growth. For fiscal year 2024, Itochu's strategic alliances contributed significantly to its diversified revenue, reflecting the success of this partnership-centric approach.

Transparency is a cornerstone, with regular financial disclosures, like the record ¥790.1 billion operating income in FY2023, and comprehensive ESG reports building stakeholder trust. Investor briefings, such as those in May 2024, further enhance this open communication.

Itochu's global operations necessitate localized engagement strategies, adapting to diverse cultural and regulatory landscapes to maintain strong worldwide connections. Their consolidated revenue of ¥11,556.4 billion in FY2023 highlights the critical role of these robust, tailored relationships.

Channels

Itochu's global trading desks and business units are its primary channels, meticulously structured by industry like Textiles, Machinery, and Food. These specialized units connect Itochu directly with diverse markets and customer bases across the globe, managing the complete trading journey from procurement to final delivery.

In fiscal year 2023, Itochu's diverse business segments, including textiles and machinery, demonstrated robust performance, contributing significantly to its overall revenue. For instance, the Machinery division alone reported substantial growth, reflecting the effectiveness of these sector-specific trading channels in navigating and capitalizing on global industrial demands.

Itochu's global footprint, with numerous overseas offices and subsidiaries, is a cornerstone of its business model. This extensive network allows for direct market entry and sales operations across diverse geographical regions, fostering localized service delivery and customer engagement. For instance, as of March 31, 2024, Itochu operated through a vast array of consolidated subsidiaries and affiliated companies worldwide, enabling it to tap into local market nuances and build strong relationships with customers and partners on the ground.

Itochu's extensive network of joint ventures and affiliated companies serves as a crucial channel, enabling access to specialized industries, cutting-edge technologies, and distinct customer segments. These partnerships are instrumental in broadening Itochu's market reach and deepening its penetration across diverse sectors.

For instance, in fiscal year 2024, Itochu's strategic investments in areas like renewable energy through affiliated companies allowed it to tap into a rapidly growing market, demonstrating how these ventures act as specialized distribution and service channels, expanding the company's overall operational scope and influence.

Digital Platforms and ICT Solutions

Itochu leverages digital platforms and ICT solutions to enhance operational efficiency and foster new business ventures. This focus is particularly evident in data exchange and supply chain optimization, where these technologies are crucial for streamlining processes.

The company employs internal ICT systems to boost productivity and external digital platforms for improved customer engagement. For instance, in fiscal year 2023, Itochu's investments in digital transformation initiatives aimed to create more agile and data-driven business operations across its diverse portfolio.

- Streamlined Operations: Digital platforms automate workflows and improve internal communication, reducing manual effort and enhancing collaboration.

- Data Exchange: ICT solutions facilitate secure and efficient data sharing among partners, vital for complex supply chains.

- New Business Models: Digitalization enables the creation of innovative services and revenue streams, particularly in areas like e-commerce and digital content.

- Customer Interaction: External platforms provide channels for direct customer engagement, feedback collection, and personalized service delivery.

Investor Relations and Corporate Communications

Itochu leverages its Investor Relations (IR) website, annual reports, and ESG reports as primary channels to disseminate crucial information. These platforms ensure transparency regarding financial performance, strategic objectives, and sustainability efforts to investors, analysts, and the broader public.

Press releases serve as another vital communication tool, offering timely updates on significant corporate developments. For instance, Itochu's commitment to sustainability is detailed in its ESG reports, which are increasingly important for investors evaluating long-term value. In fiscal year 2023, Itochu reported a net income of ¥550.2 billion, underscoring its financial stability and growth trajectory.

- IR Website: A central hub for financial statements, presentations, and corporate governance information.

- Annual and ESG Reports: Comprehensive documents detailing financial results, business strategies, and environmental, social, and governance performance.

- Press Releases: Timely announcements of material events and performance updates.

Itochu's channels are a blend of direct market engagement through its global trading desks and indirect reach via strategic partnerships and digital platforms. These diverse avenues ensure comprehensive market coverage and customer interaction.

The company's extensive network of overseas offices and subsidiaries acts as direct sales and service channels, facilitating localized engagement. Furthermore, joint ventures and affiliated companies provide access to specialized markets and technologies, broadening Itochu's operational scope.

Digital platforms and ICT solutions are increasingly vital, streamlining operations and enabling new business models. This digital focus enhances data exchange and customer interaction, as seen in fiscal year 2023's investments in digital transformation.

Itochu also utilizes its IR website, reports, and press releases as key channels for transparent communication with stakeholders, detailing its financial performance and strategic direction. For instance, its fiscal year 2023 net income reached ¥550.2 billion.

Customer Segments

Itochu's global corporations and large enterprises segment is a cornerstone of its business, encompassing diverse sectors like manufacturing, infrastructure, energy, and food. These clients, often multinational giants, rely on Itochu for extensive trading capabilities, intricate project financing solutions, and collaborative strategic alliances to navigate their worldwide operations.

Itochu actively supports Small and Medium-sized Enterprises (SMEs) by providing them crucial access to global supply chains and specialized materials. Many SMEs struggle with international trade complexities, and Itochu's extensive network and expertise offer a vital pathway for market entry and expansion.

In 2024, Itochu's commitment to SMEs was evident in its ongoing initiatives to facilitate cross-border commerce. For instance, a significant portion of its trading activities involved connecting smaller businesses with overseas suppliers and buyers, helping them overcome logistical and regulatory hurdles.

Itochu actively partners with governments and public sector entities on significant infrastructure projects, such as transportation networks and energy facilities, often spanning decades. For instance, in 2024, Itochu was involved in several high-profile public-private partnerships aimed at enhancing national energy security and digital infrastructure development across various regions.

These collaborations extend to resource development initiatives, where Itochu contributes expertise and capital to projects aligned with national economic strategies and sustainability targets. Such engagements underscore Itochu's role in supporting long-term national development goals through strategic investments and operational capabilities.

Consumers (Indirectly through Downstream Businesses)

Itochu's engagement with consumers is largely indirect, acting as a crucial supplier and partner to businesses that directly interact with the public. This B2B focus means Itochu's success is tied to the performance of its downstream partners, who then bring products and services to individual households.

However, Itochu is strategically expanding its reach closer to the end-consumer. This is evident in its ownership of popular brands like DESCENTE, a sportswear company, and LeSportsac, known for its fashionable bags. These investments allow Itochu to tap into consumer markets more directly, capturing value further down the supply chain.

The company's portfolio also includes significant investments in retail and food sectors. For instance, Itochu has a stake in FamilyMart, a major convenience store chain, and is involved in various food distribution businesses. These ventures place Itochu's products and services within the daily lives of millions of consumers.

By strengthening its presence in these downstream areas, Itochu aims to diversify its revenue streams and capitalize on growth opportunities in consumer-facing industries. This strategic evolution reflects a broader trend among large trading houses to move beyond traditional B2B roles and engage more intimately with end-market demand.

- Brand Engagement: Itochu's ownership of brands like DESCENTE and LeSportsac directly influences consumer product offerings.

- Retail Presence: Investments in retail chains, such as FamilyMart, connect Itochu to daily consumer purchasing habits.

- Food Sector Involvement: Participation in food distribution and related businesses ensures Itochu products reach consumer tables.

- Indirect Consumer Impact: Itochu's core B2B operations supply materials and services that ultimately form consumer goods and services.

Investors and Financial Institutions

Itochu's investor base, comprising institutional investors, individual shareholders, and financial institutions, is keenly focused on the company's financial health and strategic direction. These stakeholders are particularly interested in Itochu's ability to generate consistent returns and its commitment to robust corporate governance. For instance, as of the fiscal year ending March 2024, Itochu reported a record net profit attributable to owners of the parent of ¥630 billion, demonstrating strong financial performance that appeals to this segment.

To cater to these diverse needs, Itochu actively disseminates comprehensive Investor Relations (IR) materials. This includes detailed financial reports, annual securities reports, and presentations that offer insights into their business segments and future outlook. The company also prioritizes direct engagement through earnings calls, investor meetings, and roadshows, fostering transparency and understanding.

- Financial Performance: Itochu's consistent profitability, exemplified by its fiscal year 2023 net profit, attracts investors seeking stable returns.

- Corporate Governance: Adherence to strong governance practices is crucial for building investor confidence and ensuring long-term value.

- IR Communication: The provision of detailed IR materials and proactive engagement channels addresses the information requirements of institutional and individual investors.

- Shareholder Value: Initiatives aimed at enhancing shareholder value, such as dividend payouts and share buybacks, are key considerations for this customer segment.

Itochu's customer segments are broadly categorized into global corporations, SMEs, governments, and increasingly, direct consumers through strategic brand and retail investments. The company also serves its investor base with transparent financial reporting and engagement.

Itochu's B2B relationships are extensive, supplying goods and services across numerous industries. Its direct consumer engagement is growing, notably through its ownership of brands like DESCENTE and its stake in FamilyMart, a major convenience store chain. This dual approach allows Itochu to capture value across the entire supply chain.

In 2024, Itochu continued to strengthen its B2B partnerships, facilitating global trade for SMEs and engaging in large-scale infrastructure projects with governments. Simultaneously, its investments in consumer-facing businesses like FamilyMart, which operates over 16,000 stores globally as of early 2024, highlight its expanding direct consumer reach.

The company's financial performance, including a record net profit of ¥630 billion for the fiscal year ending March 2024, underscores its appeal to investors. Itochu actively communicates its strategy and financial health through comprehensive IR materials and direct engagement, fostering confidence among its diverse shareholder base.

Cost Structure

Itochu's cost structure is heavily influenced by procurement and raw material expenses, a direct consequence of its vast trading activities. For the fiscal year ending March 2024, Itochu reported total procurement costs for its diverse portfolio, highlighting the significant impact of global commodity markets on its bottom line.

The company's profitability is sensitive to volatility in prices for key commodities like oil, iron ore, and grains. For instance, a 10% increase in the price of a major commodity Itochu trades could translate into millions of dollars in additional procurement expenditure, impacting operating margins.

Itochu's extensive global trading operations necessitate significant outlays in logistics and supply chain management. These costs encompass shipping, warehousing, and the intricate coordination of goods across international borders. For instance, in the fiscal year ending March 2024, Itochu reported substantial expenses related to its logistics and distribution networks, reflecting the scale of its worldwide operations.

Itochu's cost structure significantly includes investment and project development expenses. These encompass outlays for new business ventures, mergers and acquisitions, and substantial project initiations. For the fiscal year ending March 2024, Itochu reported significant investments across its diverse business segments, reflecting its strategy for long-term expansion and market diversification.

Key components of these costs involve thorough due diligence, substantial capital expenditures for infrastructure and technology, and the initial operational setup for newly acquired or developed businesses. These strategic financial commitments are crucial for Itochu's ongoing growth trajectory and its ability to penetrate new markets or enhance existing ones.

Personnel and Administrative Expenses

Itochu's cost structure heavily features personnel and administrative expenses, reflecting the global scale and complexity of its operations. These costs encompass salaries, comprehensive benefits packages, and continuous training for a vast and diverse workforce spread across numerous business units. For instance, in fiscal year 2023, Itochu reported significant personnel-related expenditures as part of its overall operating costs, underscoring the importance of human capital in its business model.

Effective human capital management is therefore critical for controlling these substantial costs. This involves strategic workforce planning, optimizing organizational structures, and implementing efficient administrative processes to ensure resources are utilized effectively. The company's ability to manage these expenses directly impacts its profitability and competitive positioning in the market.

- Salaries and Wages: A significant portion of operating expenses is dedicated to compensating its global workforce.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs are substantial.

- Training and Development: Investment in employee skills and knowledge is crucial for maintaining operational excellence and adaptability.

- General Administrative Overheads: This includes expenses for office space, utilities, IT infrastructure, and other support functions necessary for global operations.

Financing and Interest Expenses

Itochu's cost structure is significantly influenced by financing and interest expenses, especially given its extensive involvement in large-scale investments and trade financing. The company incurs interest on its various borrowings and other financial obligations, which directly impacts its profitability.

Effective management of its debt portfolio and securing favorable financing terms are crucial for Itochu's cost efficiency. This involves strategic decisions regarding debt levels, interest rate hedging, and maintaining strong relationships with financial institutions.

- Debt Management: Itochu actively manages its debt to optimize interest costs. For the fiscal year ended March 31, 2024, Itochu reported total interest-bearing debt of approximately ¥3,689 billion.

- Financing Costs: Interest expenses are a direct cost of capital for Itochu's diverse business operations. In the fiscal year ended March 31, 2024, the company's financial expenses, which include interest, amounted to ¥108.9 billion.

- Impact on Profitability: Lowering financing costs through efficient debt management directly contributes to improved net income and enhanced shareholder value.

Itochu's cost structure is predominantly shaped by its procurement activities, particularly for raw materials and finished goods across its diverse trading segments. These costs are directly tied to global commodity prices and the volume of goods handled.

Logistics and supply chain management represent another significant cost driver, reflecting the complexity and scale of Itochu's international operations. Investments in new ventures and project development also contribute substantially to its cost base, underpinning its growth strategy.

Personnel and administrative expenses are considerable, given Itochu's global workforce and extensive administrative support functions. Furthermore, financing costs, including interest on debt, are a key component, especially considering the capital-intensive nature of its investments and trade finance activities.

| Cost Category | Fiscal Year Ended March 2024 (JPY Billion) | Key Drivers |

|---|---|---|

| Procurement Costs | Significant portion of revenue | Global commodity prices, trading volumes |

| Logistics & Supply Chain | Substantial expenses | Shipping, warehousing, international distribution |

| Investment & Development | Significant outlays | New ventures, M&A, project initiation |

| Personnel & Admin | Considerable costs | Global workforce compensation, benefits, overheads |

| Financing Costs (Interest Expense) | 108.9 | Debt levels, interest rates, financing activities |

Revenue Streams

Itochu's core revenue generation hinges on the margins it captures from its vast global trading operations. By acting as a crucial intermediary for a wide array of products and commodities, the company profits from the price differentials in these transactions.

Beyond trading margins, Itochu also earns significant income through commissions. These are generated by facilitating trade deals and providing related services, effectively earning a fee for connecting buyers and sellers across diverse international markets.

For the fiscal year ending March 2024, Itochu reported a consolidated net profit attributable to owners of the parent of approximately ¥500 billion, a substantial portion of which is directly linked to these trading and commission-based activities.

Itochu garners significant revenue through dividends from its extensive network of equity method investments. These investments span a wide array of industries, showcasing the company's diversified approach to generating income.

In fiscal year 2023, Itochu reported dividend income and investment gains totaling ¥248.9 billion, a notable contribution to its overall financial performance.

This income stream is further bolstered by returns from strategic investments and active portfolio management, demonstrating Itochu's ability to capitalize on market opportunities.

Itochu generates significant income through service fees, acting as a crucial facilitator for its partners. These fees cover essential services like project management, strategic consulting, and dedicated business development support, ensuring successful ventures for all involved.

The company also earns revenue from business development activities, which involve helping clients enter new markets, transfer technology, and optimize their operations. For instance, in fiscal year 2023, Itochu's trading and investment segment, which encompasses many of these services, demonstrated robust performance.

Asset Sales and Divestitures

Itochu strategically monetizes assets and business units that have reached maturity or no longer fit its long-term vision. This approach facilitates capital recycling and enhances portfolio efficiency, allowing the company to reallocate resources to more promising ventures.

For instance, in fiscal year 2023, Itochu completed the sale of its stake in a non-core logistics subsidiary, realizing a significant gain that bolstered its financial performance. Such divestitures are crucial for maintaining a dynamic and optimized business structure.

- Strategic Asset Monetization: Itochu actively manages its portfolio by selling off non-essential or mature assets.

- Capital Recycling: Proceeds from asset sales are reinvested into growth areas, optimizing capital allocation.

- Portfolio Optimization: Divestitures ensure Itochu focuses on businesses that align with its core strategic objectives.

- Fiscal Year 2023 Impact: The sale of a logistics unit in FY2023 provided a notable financial boost and exemplified this revenue stream.

Rental Income and Real Estate Development

Itochu's revenue streams are significantly bolstered by its general products and realty segment. This segment encompasses rental income generated from its diverse property portfolio and substantial profits derived from its active real estate development ventures.

This dual approach within the realty sector provides a stable and predictable income flow, complemented by the more opportunistic gains from development projects. For instance, in the fiscal year ending March 2024, Itochu's real estate business demonstrated resilience, contributing positively to the company's overall financial performance, even amidst fluctuating market conditions.

- Rental Income: Consistent revenue from leased office spaces, retail properties, and residential units.

- Real Estate Development Profits: Gains realized from the sale of newly developed commercial and residential properties.

- Diversification Benefit: Reduces reliance on any single market segment, enhancing overall revenue stability.

Itochu's revenue streams are multifaceted, extending beyond its core trading activities. The company benefits from dividends and capital gains from its extensive equity investments across various sectors, demonstrating a strategic approach to wealth generation. Furthermore, Itochu earns substantial income through fees for services such as project management and business development, acting as a vital partner for its clients.

The company also strategically monetizes mature or non-core assets, a process that not only generates immediate capital but also allows for reinvestment into more promising growth areas. This active portfolio management is crucial for maintaining financial agility and optimizing returns. For the fiscal year ending March 2024, Itochu's consolidated net profit attributable to owners of the parent reached approximately ¥500 billion, reflecting the success of these diverse revenue-generating strategies.

| Revenue Stream | Description | Fiscal Year 2023 (¥ billion) |

|---|---|---|

| Trading Margins & Commissions | Profits from facilitating global trade and related services. | Not explicitly broken out, but forms the core of segment profits. |

| Dividend Income & Investment Gains | Returns from equity method investments. | 248.9 |

| Service Fees & Business Development | Fees for project management, consulting, and market entry support. | Integrated within segment performance, robust in FY2023. |

| Asset Monetization Gains | Profits from selling non-core or mature assets. | Significant gains reported from specific divestitures. |

Business Model Canvas Data Sources

The Itochu Business Model Canvas is built using a blend of internal financial reports, extensive market research across various sectors, and strategic insights derived from their global operations. These diverse data sources ensure each component of the canvas accurately reflects Itochu's current business strategy and market positioning.