Inpex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

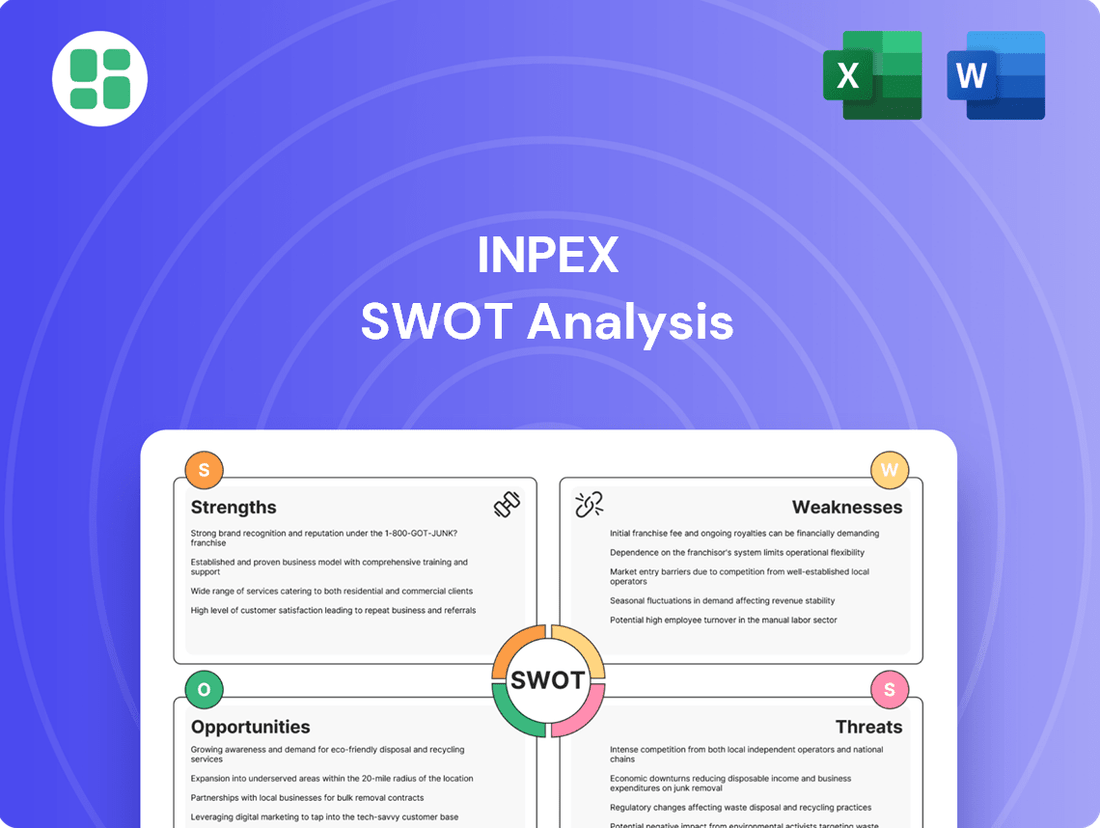

INPEX leverages its strong operational expertise and significant project pipeline to capitalize on global energy demand, but faces challenges from volatile commodity prices and increasing environmental regulations. Our analysis reveals how these factors shape its market position.

Want the full story behind INPEX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

INPEX's global diversified operations, spanning Asia, Oceania, the Middle East, Africa, and the Americas, are a key strength. This wide geographical spread significantly reduces the risk tied to any single market or region. For example, in 2023, INPEX reported that its production was spread across multiple continents, with significant contributions from projects in Australia and Indonesia, demonstrating this diversification in action.

This extensive operational reach allows INPEX to tap into diverse energy demands and navigate varying regulatory landscapes globally. Such a strategy enhances the company's overall resilience and market stability, enabling it to adapt to regional economic fluctuations and capitalize on growth opportunities wherever they arise.

INPEX's integrated exploration and production capabilities are a significant strength, covering the entire upstream oil and gas value chain. This end-to-end control allows for enhanced cost management and operational optimization. For instance, in 2023, INPEX reported a net profit of ¥282.5 billion, reflecting the efficiency of their integrated operations in a volatile market.

INPEX is making significant strides in its commitment to the energy transition, actively investing in renewable energy sources, carbon capture, utilization, and storage (CCUS) technologies, and the burgeoning hydrogen sector. This strategic diversification is crucial for navigating the evolving global energy landscape and aligning with increasing demands for sustainability.

By expanding into these future-oriented areas, INPEX is not only addressing environmental concerns but also positioning itself to capitalize on new growth opportunities. For instance, the company is involved in projects like the Ichthys LNG project's CCUS component, aiming to reduce CO2 emissions. This forward-thinking approach signals a potential for new, sustainable revenue streams that complement its traditional oil and gas operations.

Strong Financial Position and Investment Capacity

INPEX benefits from a robust financial position, allowing it to fund its extensive, capital-intensive projects. This financial muscle is crucial for ongoing exploration, development, and investment in emerging energy solutions. The company's solid balance sheet underpins its long-term growth strategies and potential for strategic acquisitions, ensuring continued operational strength and market competitiveness.

- Financial Strength: INPEX reported total assets of approximately ¥3,649.8 billion as of March 31, 2024, highlighting its substantial resource base.

- Investment Capability: The company's consistent profitability and access to capital markets enable significant investment in exploration and production activities, as well as diversification into new energy sectors.

- Strategic Flexibility: A strong financial footing grants INPEX the flexibility to pursue strategic partnerships, joint ventures, and acquisitions that align with its long-term vision, particularly in the evolving energy landscape.

Established Partnerships and Infrastructure

INPEX leverages its established partnerships with major international energy firms and host governments, crucial for navigating complex project development and securing market access. For instance, its participation in the Ichthys LNG project involves key partners like TotalEnergies and CPC Corporation, demonstrating the strength of these collaborations.

The company's existing infrastructure, including production facilities and transportation networks, provides a solid foundation for current operations and future growth initiatives. This robust asset base, valued in the billions, underpins its production capacity and operational efficiency, contributing to a stable revenue stream.

These deep-rooted relationships and substantial existing assets significantly mitigate the execution risks associated with new projects. By reducing uncertainties in areas like regulatory approvals and logistical challenges, INPEX can more effectively pursue and deliver on its expansion strategies.

- Established Partnerships: Collaborations with international energy majors and host governments streamline project execution and market entry.

- Robust Infrastructure: Existing operational assets and networks provide a stable base for production and future expansion.

- Risk Mitigation: Long-standing relationships and assets reduce the inherent risks in developing new energy ventures.

INPEX's diversified global operations across Asia, Oceania, the Middle East, Africa, and the Americas significantly de-risk its business by reducing reliance on any single market. This geographical spread was evident in its 2023 production, which included substantial contributions from Australia and Indonesia, showcasing its resilience against regional economic shifts.

The company's integrated upstream capabilities, from exploration to production, enhance cost management and operational efficiency, as reflected in its ¥282.5 billion net profit in 2023. This end-to-end control allows INPEX to optimize its value chain and maintain profitability even in volatile market conditions.

INPEX's strategic investments in the energy transition, including renewables, CCUS, and hydrogen, position it for future growth and sustainability. Projects like the Ichthys LNG's CCUS component demonstrate this commitment, aiming to reduce emissions and unlock new revenue streams.

A robust financial position, with total assets of ¥3,649.8 billion as of March 31, 2024, empowers INPEX to fund capital-intensive projects and pursue strategic diversification. This financial strength provides the flexibility for partnerships and acquisitions, crucial for navigating the evolving energy landscape.

Established partnerships with major energy firms and host governments, such as those in the Ichthys LNG project with TotalEnergies, mitigate project execution risks and secure market access. Coupled with its substantial existing infrastructure, these relationships provide a stable foundation for current operations and future expansion.

What is included in the product

Delivers a strategic overview of Inpex’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Inpex's strategic challenges and opportunities.

Weaknesses

Despite INPEX's strategic moves towards energy transition, a significant portion of its revenue, around 85% in recent fiscal years, still originates from oil and natural gas. This heavy reliance makes the company particularly vulnerable to the sharp swings in global crude oil and natural gas prices. For instance, a 10% drop in oil prices could directly impact revenue streams, as seen in past market downturns.

This dependence on fossil fuels also exposes INPEX to regulatory risks and changing market sentiment favoring cleaner energy sources. As the world pushes for decarbonization, the long-term demand for oil and gas could face headwinds, affecting INPEX's core business model and future growth prospects.

Inpex faces significant challenges due to the inherently high capital expenditure requirements of the energy sector, especially in exploration and production. Developing large-scale projects demands substantial upfront investment, which can strain the company's financial resources and potentially limit its capacity for other strategic investments or distributions to shareholders.

The long lead times associated with these energy projects mean that capital remains tied up for extended periods. For instance, major offshore developments can take many years from discovery to production, impacting cash flow and requiring robust financial planning to manage these long-term commitments effectively.

Operating across numerous international territories exposes INPEX to a spectrum of geopolitical uncertainties, such as political instability, nationalization threats, and fluctuating regulatory landscapes. These external forces can impede operations, inflate expenses, or even trigger project postponements or outright cancellations.

For instance, the company's significant presence in regions like Indonesia and Australia means navigating distinct political climates and legal frameworks. In 2023, INPEX's net profit after tax was ¥277.1 billion, but such figures are always subject to the volatility that geopolitical shifts can introduce, potentially impacting future earnings and project viability.

Furthermore, adherence to increasingly stringent environmental regulations across these varied jurisdictions presents ongoing challenges. The need to adapt to evolving climate policies and sustainability mandates adds layers of complexity and potential cost to INPEX's global operations.

Environmental and Social Scrutiny

As a major oil and gas producer, INPEX is under intense pressure from environmental advocates, investors, and the public concerning its carbon emissions and overall environmental impact. This heightened scrutiny presents significant reputational risks and can escalate operational expenses as INPEX navigates more stringent environmental regulations.

The company may face difficulties in obtaining funding for its conventional projects due to these environmental concerns. Furthermore, public sentiment can directly influence regulatory outcomes and impact INPEX's ability to access key markets.

- Reputational Damage: Negative perception regarding environmental performance can deter customers and partners.

- Increased Compliance Costs: Adhering to stricter environmental standards, such as those likely to be enforced in 2024-2025, can significantly raise operational expenditures.

- Financing Challenges: Accessing capital for new oil and gas projects may become more restricted as financial institutions prioritize ESG (Environmental, Social, and Governance) factors.

- Regulatory Hurdles: Public and governmental pressure could lead to more restrictive policies and permitting processes for INPEX's operations.

Aging Infrastructure and Decommissioning Costs

Inpex, like many established players in the oil and gas sector, faces the challenge of aging infrastructure. This can translate into increased operational expenses for maintenance and upgrades. For instance, the company's long operational history means some of its facilities may be nearing the end of their economically viable life, necessitating capital allocation for refurbishment or replacement.

The costs associated with decommissioning older assets are also a significant consideration. By 2025, the industry anticipates substantial spending on plugging wells and dismantling platforms. These environmental liabilities and the physical removal of legacy infrastructure can represent a considerable financial burden, potentially diverting funds from investments in newer, more sustainable energy technologies or exploration activities.

These legacy costs can directly impact Inpex's financial flexibility. As of its latest reporting periods in 2024, the company has allocated significant capital towards asset integrity and maintenance programs. The ongoing need to manage and eventually retire older assets means a portion of its budget is committed to these end-of-life activities, rather than solely focusing on growth initiatives.

- Increased Maintenance Expenditure: Aging facilities often require more frequent and extensive repairs, driving up operational costs.

- Decommissioning Liabilities: The eventual dismantling and environmental remediation of offshore platforms and onshore facilities represent substantial future financial commitments.

- Capital Diversion: Funds earmarked for maintaining or decommissioning older assets could otherwise be invested in new projects or research and development for cleaner energy solutions.

- Operational Risks: Older infrastructure may carry higher risks of equipment failure or environmental incidents, potentially leading to unplanned downtime and remediation costs.

INPEX's substantial reliance on oil and gas, representing approximately 85% of its revenue in recent fiscal years, leaves it highly susceptible to price volatility. A downturn in crude oil prices, for example, directly impacts its earnings. This dependence also poses long-term risks as the global shift towards cleaner energy sources could diminish demand for fossil fuels, affecting INPEX's core business model.

The company faces significant financial strain from the high capital expenditure required for exploration and production projects. These large-scale ventures demand considerable upfront investment, potentially limiting funds available for other strategic initiatives or shareholder returns. Furthermore, the extended timelines for project development, often spanning many years from discovery to production, mean capital remains tied up, impacting cash flow and necessitating robust financial management.

Operating globally exposes INPEX to geopolitical uncertainties and varying regulatory environments. Political instability, nationalization risks, and evolving climate policies can disrupt operations, increase costs, or lead to project delays or cancellations. For instance, navigating the distinct political climates in Indonesia and Australia requires constant adaptation to local legal frameworks. The company's 2023 net profit after tax was ¥277.1 billion, but future earnings are subject to these geopolitical and regulatory shifts.

INPEX faces reputational risks due to its carbon emissions and environmental impact. Increased scrutiny from environmental advocates and investors can lead to higher operational expenses as the company adapts to stricter environmental regulations. This pressure may also hinder access to funding for conventional projects and influence public sentiment, potentially impacting market access.

| Weakness | Description | Impact | Example/Data |

| Fossil Fuel Dependence | High revenue concentration from oil and gas. | Vulnerability to price swings and long-term demand decline. | ~85% of revenue from oil and gas. |

| High Capital Expenditure | Significant upfront investment for E&P projects. | Financial strain, limited strategic flexibility. | Long lead times tie up capital for years. |

| Geopolitical & Regulatory Exposure | Operations in diverse, potentially unstable regions. | Risk of operational disruption, increased costs, project cancellations. | Presence in Indonesia and Australia necessitates navigating varied legal frameworks. |

| Environmental Scrutiny | Intense focus on carbon emissions and impact. | Reputational damage, increased compliance costs, financing challenges. | Potential difficulty securing funding for new oil/gas projects due to ESG concerns. |

What You See Is What You Get

Inpex SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Inpex. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

The global push towards decarbonization is a major opportunity for INPEX to grow in areas like renewable energy, hydrogen, and carbon capture, utilization, and storage (CCUS). For instance, by 2023, the company had already committed to projects aimed at reducing its carbon emissions, signaling a strategic move into these cleaner energy sectors.

Expanding into these new energy markets allows INPEX to tap into growing demand and diversify its income sources beyond traditional oil and gas. This aligns with global energy transition goals, potentially attracting investment and partnerships focused on sustainable development.

By investing in and developing expertise in renewable energy, hydrogen, and CCUS, INPEX can position itself as a key player in the future energy landscape. This strategic focus is crucial for maintaining long-term viability and competitiveness in an evolving market, especially as many nations are setting ambitious net-zero targets by 2050.

INPEX can harness AI and big data analytics to boost operational efficiency, cutting costs and enhancing safety. For instance, in 2024, the energy sector saw significant investment in digital twin technology, which promises to improve reservoir management and production optimization, potentially leading to a 15-20% increase in output efficiency for pilot projects.

Digitalization offers a clear path to improving exploration success rates and streamlining production. By implementing advanced seismic data processing and AI-driven geological modeling, INPEX could reduce exploration risks. The adoption of predictive maintenance powered by IoT sensors, a trend gaining traction in 2025, can minimize downtime and associated revenue losses.

Embracing these technological innovations provides a crucial competitive advantage. Companies that effectively integrate automation and digital solutions in 2024-2025 are better positioned to navigate market volatility and capitalize on new opportunities, as evidenced by the projected 10% cost reduction for early adopters of advanced automation in upstream operations.

INPEX can significantly boost its expansion into new energy arenas by forming strategic alliances with technology innovators, renewable energy firms, or other key industry participants. These collaborations offer direct pathways to specialized knowledge, proprietary technologies, and established market access, crucial for navigating evolving energy landscapes.

For instance, INPEX's 2023 financial reports show a continued investment in research and development, signaling a readiness to integrate external innovations. Acquiring companies with proven track records in areas like carbon capture or hydrogen production could rapidly bolster INPEX's portfolio and market presence, ensuring it remains competitive in the energy transition.

Growing Global Energy Demand

Global energy demand is expected to rise, especially in developing nations, creating ongoing opportunities for both traditional and emerging energy sectors. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global energy demand will increase by 1.3% in 2024, driven by economic growth. INPEX is well-positioned to benefit from this trend by maintaining efficient oil and gas operations while expanding its renewable energy portfolio.

This strategy allows INPEX to generate revenue from its established assets while investing in future growth areas. The company's focus on projects like the Ichthys LNG (Liquefied Natural Gas) facility in Australia, which commenced operations in 2018 and continues to be a significant contributor, exemplifies its capability in meeting large-scale energy needs. In 2023, INPEX reported total production of 263 million barrels of oil equivalent, underscoring its capacity to serve existing demand.

INPEX's commitment to new energy initiatives, such as carbon capture, utilization, and storage (CCUS) and hydrogen projects, aligns with the evolving energy landscape. The company is actively involved in CCUS development, including the Kashiwazaki-Kariwa Nuclear Power Station CCS demonstration project. This diversification strategy is crucial for capitalizing on the projected growth in global energy consumption, which the IEA anticipates will reach over 300 million barrels of oil equivalent per day by 2030.

The dual approach of optimizing existing hydrocarbon production and scaling up new energy ventures provides INPEX with a robust financial foundation. This enables continued profitability, supporting investments in sustainable energy solutions that will cater to future demand. The company's strategic investments in areas like offshore wind power further demonstrate its proactive stance in capturing opportunities within the expanding global energy market.

Carbon Market and Emission Trading Schemes

INPEX can capitalize on the growing global carbon markets and emission trading schemes (ETS). As of early 2024, the voluntary carbon market is projected to reach $50 billion by 2030, offering significant potential for companies actively reducing emissions.

Participation allows INPEX to potentially generate revenue from its carbon capture initiatives or by selling emission reduction credits. For instance, the EU ETS, the world's largest carbon market, saw an average carbon price of €93.46 per tonne of CO2 in 2023, demonstrating the financial viability of emission reduction strategies.

- Monetize Carbon Capture: INPEX can explore opportunities to sell carbon credits generated from its carbon capture, utilization, and storage (CCUS) projects.

- New Revenue Streams: Developing projects that demonstrably reduce greenhouse gas emissions can create valuable new income sources.

- Enhanced ESG Profile: Engaging in carbon markets aligns INPEX with global climate objectives and can attract investment from environmentally, socially, and governance (ESG) focused funds, which saw inflows of over $200 billion in 2023.

INPEX can leverage the global shift towards decarbonization by expanding into renewable energy, hydrogen, and CCUS, sectors with significant growth potential. The company's strategic investments in cleaner energy, evident in its 2023 emission reduction commitments, position it to meet increasing demand and diversify revenue.

Digitalization and AI adoption offer substantial improvements in operational efficiency, cost reduction, and safety. For instance, the energy sector's 2024 investment in digital twins promises enhanced reservoir management, potentially boosting production efficiency by 15-20% in pilot programs.

Strategic partnerships and acquisitions can accelerate INPEX's entry into new energy markets, providing access to specialized knowledge and technology. The company's R&D investments in 2023 underscore its readiness to integrate external innovations, crucial for navigating the evolving energy landscape.

Rising global energy demand, particularly in developing nations, presents an opportunity for INPEX to capitalize on both traditional and emerging energy sources. The IEA projected a 1.3% increase in global energy demand for 2024, highlighting INPEX's well-balanced strategy.

INPEX can also benefit from growing carbon markets and emission trading schemes, potentially generating revenue from CCUS projects. The EU ETS, for example, saw an average carbon price of €93.46 per tonne of CO2 in 2023, illustrating the financial viability of emission reduction initiatives.

Threats

Volatile global commodity prices represent a significant threat to INPEX's financial stability. Fluctuations in international oil and natural gas prices directly impact the company's revenue streams and profitability. For instance, a sharp decline in crude oil prices, such as the period in early 2020 when Brent crude briefly traded below $20 per barrel, can severely reduce earnings and hinder capital expenditure plans for new developments.

Geopolitical instability, shifts in global supply and demand dynamics, and broader economic downturns are key drivers of this price volatility. These factors can lead to unpredictable revenue streams, making long-term financial planning and investment decisions more challenging for INPEX. Sustained periods of low commodity prices, as seen intermittently throughout the 2010s and potentially resurfacing, can even jeopardize the economic viability of planned projects, impacting future growth prospects.

The global drive towards decarbonization is intensifying environmental regulations, including carbon taxes and more rigorous licensing for oil and gas ventures. For INPEX, this translates to potentially higher operating expenses and a more challenging environment for securing new project approvals and expanding exploration activities.

Policy shifts, such as the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023 and will fully apply from 2026, could impact the cost competitiveness of energy exports. In 2024, many nations are expected to continue reviewing and potentially strengthening their emissions reduction targets, further pressuring companies like INPEX to adapt their strategies and investments.

As INPEX diversifies into burgeoning areas like renewable energy, hydrogen, and carbon capture, utilization, and storage (CCUS), it's encountering intense rivalry. This competition stems not only from established energy giants also pivoting to these sectors but also from nimble, specialized newcomers who focus exclusively on these new technologies. For instance, in the burgeoning green hydrogen market, numerous startups and mid-sized firms are emerging with highly specific technological advantages and potentially leaner operational models, posing a significant challenge to INPEX’s market entry and growth.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including ongoing tensions in regions like the Middle East and Eastern Europe, poses a significant threat to INPEX's global operations. These conflicts can directly impact INPEX's asset locations, potentially leading to operational disruptions and increased security expenses. For instance, the ongoing conflict in Ukraine has already demonstrated the far-reaching effects on energy markets and supply chains, impacting companies across the sector.

Regional conflicts and trade disputes can create substantial supply chain vulnerabilities for INPEX. This instability can hinder the timely delivery of essential equipment and materials, causing project delays and escalating costs. The company's reliance on international logistics makes it particularly susceptible to these external shocks, potentially affecting its ability to maintain production levels and meet contractual obligations.

- Project Delays: Geopolitical events can stall exploration, development, and production activities, pushing back INPEX's timelines and revenue generation.

- Cost Overruns: Increased security measures, rerouting of logistics, and potential asset impairments due to conflict can significantly inflate project budgets.

- Supply Chain Bottlenecks: Disruptions in shipping, manufacturing, or raw material sourcing due to political tensions can cripple operational efficiency.

- Reduced Production Capacity: In extreme cases, geopolitical instability might force temporary or permanent shutdowns of operations in affected regions.

Shifting Investor Sentiment and Divestment Pressure

Institutional investors are increasingly divesting from fossil fuel companies, with a significant portion of global ESG (Environmental, Social, and Governance) assets, estimated to be over $3.7 trillion as of 2023, now avoiding such investments. This trend puts pressure on INPEX to demonstrate a robust transition strategy, as a negative shift in investor sentiment could hinder its ability to secure capital, raise borrowing costs, and negatively affect its market valuation.

For INPEX, this evolving landscape means that maintaining investor confidence hinges on transparently communicating its decarbonization roadmap and its commitment to sustainable practices. Failure to do so could lead to a decline in its stock price, as seen with other energy companies facing similar pressures, potentially impacting its ability to fund future projects.

- Growing ESG Investment: Global ESG assets surpassed $3.7 trillion in 2023, indicating a strong preference for sustainable investments among institutional players.

- Capital Access Risk: Divestment pressure can limit INPEX's access to capital and increase its cost of financing.

- Valuation Impact: Negative investor sentiment towards fossil fuels could depress INPEX's stock valuation.

- Strategic Communication: Clear and credible communication of INPEX's sustainability strategy is crucial for retaining investor support.

The increasing global focus on decarbonization presents a significant challenge for INPEX, potentially increasing operational costs through carbon taxes and stricter licensing. For example, the EU's Carbon Border Adjustment Mechanism, fully effective from 2026, could impact export competitiveness. Many nations in 2024 are expected to reinforce emission reduction targets, further pressuring companies like INPEX to adapt.

SWOT Analysis Data Sources

This Inpex SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence from leading industry analysts, and insights from seasoned energy sector experts. These sources ensure a robust and accurate assessment of Inpex's strategic position.