Inpex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

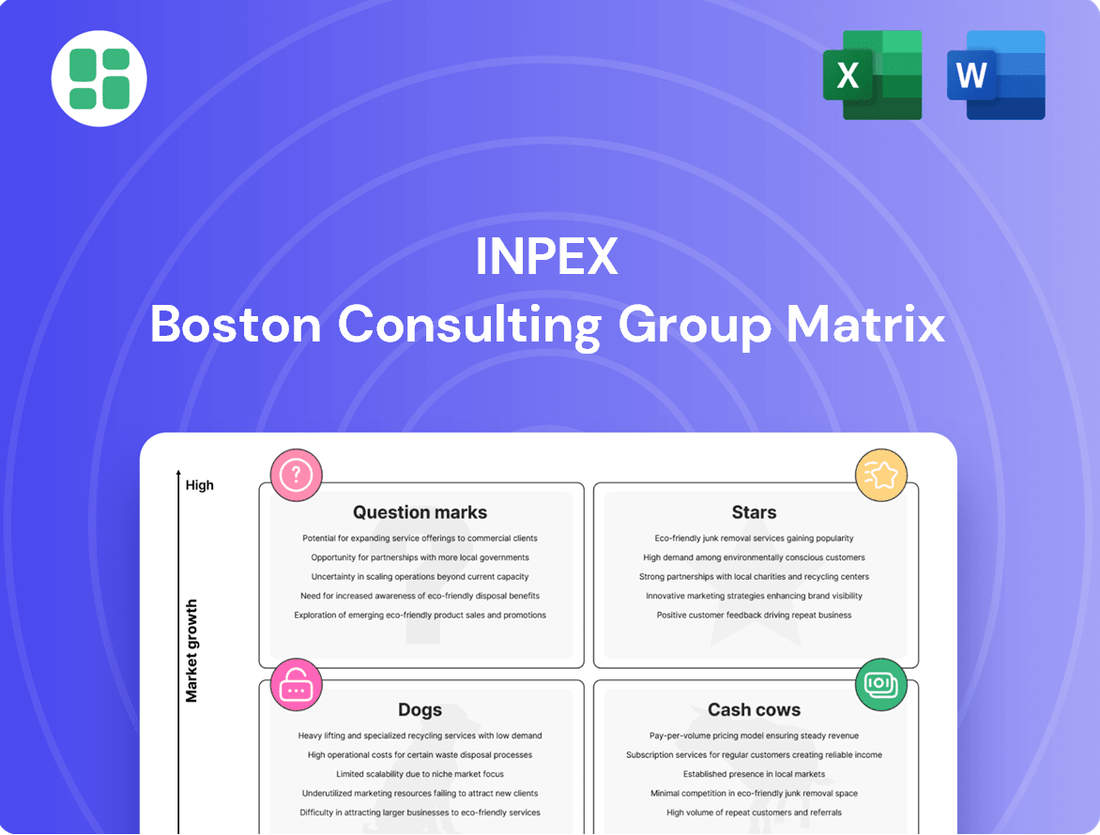

Uncover the strategic heartbeat of this company with a glimpse into its BCG Matrix. See which products are poised for growth and which might be holding back potential. Ready to transform this insight into action?

Purchase the full BCG Matrix for a comprehensive analysis, revealing the precise placement of each product in the Stars, Cash Cows, Dogs, and Question Marks quadrants. Gain the strategic clarity needed to optimize your portfolio and drive future success.

Stars

The Bonaparte CCS Project is a key growth driver for INPEX, recognized with Major Project Status by the Australian Government. This initiative is positioned in a high-growth sector for the company, focusing on carbon capture and storage.

With FEED starting in April 2025 and CO2 injection targeted for around 2030, Bonaparte CCS is poised to become a leading global commercial CCS project. It aims to significantly contribute to decarbonization across Australia and the Asia-Pacific region.

The global CCUS market is experiencing robust expansion, with projections indicating a compound annual growth rate between 16% and 24% from 2025 through 2034. This forecast underscores the substantial market potential for INPEX's Bonaparte CCS venture.

The Abadi LNG Project, a cornerstone of INPEX's portfolio, is poised for significant development. With Front-End Engineering Design (FEED) kicking off mid-2025 and a Final Investment Decision (FID) anticipated in 2027, the project targets early 2030s production. This massive undertaking is set to produce approximately 9.5 million tons of LNG annually, a vital supply for Japan's energy needs.

Crucially, the Abadi LNG Project integrates Carbon Capture and Storage (CCS) technology. This forward-thinking approach positions the project within the rapidly expanding decarbonization market, ensuring its strategic value and relevance in the evolving energy sector. The CCS component is a key differentiator, aligning INPEX with global sustainability goals and future-proofing this substantial asset.

INPEX's Kashiwazaki Clean Hydrogen/Ammonia project, set to commence operations in 2025, represents a significant move into the burgeoning clean energy sector. This initiative is positioned as a potential star within the BCG matrix due to its participation in the high-growth hydrogen market, which is projected to expand at a compound annual growth rate of 12.2% between 2025 and 2034. The project's focus on integrated blue hydrogen and ammonia production, coupled with CO2 capture, places INPEX at the vanguard of a critical decarbonization effort.

Strategic Renewable Energy Developments

INPEX is strategically positioning itself within the burgeoning renewable energy sector. The global renewable energy market is projected to experience robust growth, with an estimated compound annual growth rate (CAGR) of 9.47% between 2025 and 2033. This presents a significant opportunity for INPEX to establish a strong presence.

While INPEX's large-scale, market-leading renewable projects are still in their developmental stages, the company's Vision 2035 clearly articulates a focused strategy to capture substantial market share in this high-growth domain. This forward-looking approach underscores their commitment to diversifying their energy portfolio.

- Strategic Growth: INPEX is investing in renewable energy to capitalize on market expansion.

- Market Potential: The global renewable energy market is expected to grow significantly, with a CAGR of 9.47% from 2025 to 2033.

- Visionary Approach: INPEX's Vision 2035 outlines a clear plan to gain market share in renewables.

- Diversification: Investments in various renewable sources are key to expanding revenue and achieving net-zero objectives.

Ichthys LNG Capacity Expansion

The Ichthys LNG project is a significant growth driver for INPEX, positioning it as a star in the BCG matrix. The expansion to 9.3 million tonnes per annum by 2024 significantly bolsters its production capacity.

Further exploration for expansion around 2030 underscores INPEX's commitment to maintaining market leadership in the LNG sector. This strategic move capitalizes on natural gas's role as a transitional fuel, ensuring continued high market share and future growth potential.

- Ichthys LNG Capacity Target: 9.3 million tonnes per annum by 2024.

- Future Expansion Horizon: Exploration ongoing for around 2030.

- Strategic Importance: Reinforces market leadership and growth potential in LNG.

- Market Positioning: Leverages natural gas as a pragmatic transition fuel.

Stars represent business units with high market share in high-growth markets. INPEX's Kashiwazaki Clean Hydrogen/Ammonia project is a prime example, entering the burgeoning hydrogen market with a projected 12.2% CAGR from 2025-2034. Similarly, the Ichthys LNG project, with its expanded 9.3 million tonnes per annum capacity by 2024 and future expansion plans, holds a strong position in the growing LNG sector, leveraging natural gas's transitional fuel status.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Kashiwazaki Clean Hydrogen/Ammonia | High (Hydrogen: 12.2% CAGR 2025-2034) | Developing/Gaining | Star |

| Ichthys LNG | High (LNG: Ongoing growth) | High | Star |

| Bonaparte CCS Project | High (CCUS: 16-24% CAGR 2025-2034) | Developing/Gaining | Potential Star |

What is included in the product

The Inpex BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions.

The Inpex BCG Matrix provides clarity on business unit performance, alleviating the pain of uncertain resource allocation.

Cash Cows

The Ichthys LNG project in Australia is a significant contributor to INPEX's financial performance, accounting for roughly 20% of its total revenue. This established, large-scale operation boasts a current capacity of 8.9 million tonnes per year, ensuring consistent and substantial cash flow generation.

Even with the ongoing global energy transition, liquefied natural gas (LNG) continues to be a crucial energy source, underpinning stable demand within a mature market. This allows INPEX to leverage the considerable earnings from Ichthys LNG to fund future strategic investments and growth initiatives.

INPEX's oilfields in Abu Dhabi represent a significant portion of its business, contributing approximately 60% to the company's overall revenue. This strong market share within these producing assets firmly places them as a core component of INPEX's portfolio.

These mature Abu Dhabi concessions are characterized by their ability to generate stable and substantial cash flows. In a global oil market that is experiencing relatively low growth, these consistent earnings highlight their status as cash cows.

With established infrastructure and a long history of successful operations, these concessions require minimal new investment to maintain current production levels. This operational efficiency translates into consistent profitability for INPEX.

The Minami-Nagaoka Gas Field, located in Niigata Prefecture, Japan, is a cornerstone asset for INPEX, functioning as a mature Cash Cow. This field provides a stable and dependable domestic supply of natural gas, a critical resource for the nation's energy needs.

Its strategic importance is amplified by its role as the primary supplier for the Kashiwazaki Clean Hydrogen/Ammonia Project, demonstrating its ongoing relevance beyond simple gas extraction. This integration highlights the field's contribution to future energy solutions.

With production that is both steady and predictable, the Minami-Nagaoka Gas Field generates consistent cash flow for INPEX. The mature nature of the field means that significant new investments for growth are not typically required, allowing it to reliably contribute to the company's financial strength.

Established Global Oil & Gas Production Portfolio

INPEX's established global oil and gas production portfolio functions as a prime Cash Cow within its business structure. This diverse collection of mature assets, spread across key regions like Southeast Asia, Oceania, and the Americas, consistently delivers substantial and dependable cash flows. These operations, though in less rapidly expanding markets, are the bedrock of INPEX's financial stability, providing the necessary capital for other ventures.

The predictability of these mature assets is a significant advantage. Their consistent production levels and well-understood operational expenditures allow for reliable revenue generation. This stability is crucial for funding INPEX's growth initiatives and research into new energy technologies.

- Consistent Cash Generation: INPEX's established production assets are designed for steady output, ensuring a reliable stream of revenue.

- Geographic Diversity: Operations in Southeast Asia, Oceania, and the Americas mitigate risks associated with any single region.

- Financial Stability: The predictable nature of these Cash Cows underpins INPEX's overall financial health, enabling strategic investments.

- Support for Innovation: Cash flow from these mature assets is vital for funding INPEX's exploration and development of future energy solutions.

Existing Domestic Oil & Gas Operations

Beyond its significant Minami-Nagaoka operations, INPEX manages a portfolio of other domestic oil and gas assets within Japan. These mature fields generally exhibit stable production levels with limited growth prospects, serving as reliable generators of consistent cash flow for the company.

These operations are crucial for Japan's energy security, providing a steady domestic supply. Their established nature means that capital expenditure needs are primarily focused on maintenance rather than expansion, allowing for efficient cash generation from existing infrastructure and market positions.

- Stable Cash Flow: These assets contribute a predictable income stream, supporting INPEX's overall financial stability.

- Low Growth, Low Capex: Mature fields require less investment for growth, enhancing their cash-generating efficiency.

- Energy Security Contribution: INPEX's domestic production plays a vital role in bolstering Japan's energy independence.

- Operational Efficiency: Focus on maintaining existing production allows for optimized operational costs.

Cash Cows within INPEX's portfolio are its mature, established oil and gas assets that consistently generate strong, predictable cash flows with minimal need for further investment. These operations are the bedrock of the company's financial stability, providing the capital necessary to fund more speculative growth ventures or research into new energy technologies. Their low-risk, high-return profile makes them indispensable for maintaining INPEX's overall financial health and strategic flexibility.

| Asset Category | Primary Contribution | Key Characteristics | Financial Impact |

|---|---|---|---|

| Ichthys LNG Project (Australia) | Significant Revenue Generator | Established, large-scale operation (8.9 MTPA capacity) | Accounts for ~20% of total revenue, stable cash flow |

| Abu Dhabi Oilfields | Major Revenue Driver | Mature concessions, stable production | Contributes ~60% of overall revenue, consistent earnings |

| Minami-Nagaoka Gas Field (Japan) | Domestic Gas Supply | Mature field, steady output | Reliable cash flow, supports Kashiwazaki project |

| Other Domestic Japan Assets | Domestic Energy Security | Mature fields, stable production | Consistent cash flow, low capital expenditure needs |

| Global Mature Portfolio | Broad Cash Flow Base | Diverse assets in SE Asia, Oceania, Americas | Substantial and dependable cash flows, financial stability |

Preview = Final Product

Inpex BCG Matrix

The Inpex BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, professionally designed strategic tool ready for your immediate use.

Dogs

Marginal or high-cost oil and gas fields within INPEX's portfolio are typically older or smaller assets experiencing declining production and elevated operating expenses per barrel. These fields often struggle to compete in a market characterized by mature growth and fluctuating commodity prices.

With a low market share and in a slowing hydrocarbon market, these fields generate minimal net cash flow. For instance, INPEX's 2023 financial report indicated that while overall production remained robust, certain mature fields required significant investment to maintain output, impacting their profitability on a per-barrel basis.

These marginal assets are prime candidates for strategic review, including potential divestiture or a carefully managed decommissioning process. Such actions would allow INPEX to reallocate capital towards more promising exploration or development projects, thereby optimizing its overall portfolio performance.

Underperforming exploration blocks are those where initial surveys or drilling have shown commercially unviable reserves, or development is on hold due to poor economic outlook. These ventures are capital drains, offering no returns and holding minimal market share in the competitive exploration sector.

In 2023, the global oil and gas exploration sector saw significant investment, but many projects struggled to deliver. For instance, several deepwater exploration blocks, despite substantial initial capital outlay, failed to meet commercial thresholds, leading to write-downs by major energy firms. These represent past investments that haven't translated into profitable assets.

Non-Strategic Legacy Ventures represent INPEX's smaller, peripheral investments that have drifted from the company's core objectives, particularly its Vision 2035 which emphasizes a responsible energy transition. These ventures typically possess a minimal market footprint and offer little to no prospect for significant growth or integration with INPEX's evolving portfolio.

As of fiscal year 2024, INPEX has been actively reviewing its asset base to identify such non-core holdings. While specific figures for these legacy ventures are not granularly disclosed, the company's strategic divestments in recent years, such as the sale of certain mature oil and gas assets, reflect this ongoing rationalization process. The aim is to reallocate capital towards areas with higher strategic alignment and future potential.

Divested or Fully Depleted Assets

Divested or fully depleted assets represent areas where INPEX has strategically exited or where operations have naturally concluded. These are assets that, while perhaps once significant revenue generators, now contribute very little to the company’s overall income. In fact, they might even represent a cost due to ongoing decommissioning expenses. For example, INPEX has been actively managing its portfolio, and in 2024, the company continued its focus on optimizing its asset base. This often involves selling off mature fields or those with limited future potential to free up capital for more promising ventures.

These assets, often categorized as Divested or Fully Depleted, are essentially in the "question mark" or even "dog" quadrant of a strategic matrix. Their contribution to revenue is minimal, and the primary financial consideration becomes the cost of their eventual closure and site restoration. For instance, the decommissioning of offshore platforms can run into millions of dollars. INPEX’s financial reports for 2024 would likely detail any such asset disposals or provisions made for future decommissioning liabilities, reflecting a proactive approach to managing the entire asset lifecycle.

- Portfolio Optimization: INPEX’s divestment of mature or non-core assets in 2024 is a deliberate strategy to streamline operations and focus resources on higher-growth areas.

- Decommissioning Costs: Fully depleted fields necessitate significant expenditure for safe and environmentally sound decommissioning, impacting the company’s financial outlays.

- Capital Reallocation: Proceeds from divestitures are often reinvested into new exploration, development projects, or acquisitions that offer better long-term returns.

- Reduced Revenue Contribution: These assets, by definition, no longer contribute substantially to INPEX's revenue streams, reflecting their terminal stage of production.

Stalled Renewable Pilot Projects

Stalled renewable pilot projects often find themselves in the question mark category of the BCG matrix, especially if they represent early-stage ventures with uncertain futures. These are initiatives that, despite initial investment, haven't shown enough promise to warrant further expansion. For instance, a small-scale solar thermal pilot in a niche industrial application might have consumed millions in development capital but failed to attract commercial interest due to high operational costs or lower-than-expected energy output. By mid-2024, many such projects across the globe have been re-evaluated, with a significant number being shelved rather than scaled.

These projects are characterized by low market share and low growth prospects, making them prime candidates for a re-evaluation of their strategic position. Consider a wave of small-scale offshore wind turbine prototypes tested in the early 2020s. While the broader offshore wind market is booming, many of these specific pilots, perhaps due to unforeseen engineering challenges or higher manufacturing costs than anticipated, failed to achieve the necessary efficiency benchmarks. Data from the International Renewable Energy Agency (IRENA) in late 2023 indicated that a notable percentage of pilot-scale renewable technologies struggle to transition to commercial deployment, highlighting the inherent risks.

The failure of these pilots to gain traction means they are not generating substantial revenue, nor do they appear poised to capture a significant portion of the growing renewable energy market. This stagnation is a critical indicator for strategic decision-making.

- Low Market Share: These projects have failed to capture a meaningful percentage of their target market.

- Uncertain Growth Prospects: Technical or economic hurdles prevent them from scaling up and achieving significant future growth.

- Capital Intensive: They have already consumed initial investment without demonstrating a clear path to profitability or market leadership.

- Strategic Re-evaluation: Their current state necessitates a decision on whether to divest, harvest, or attempt a turnaround, often leaning towards divestment if viability remains unproven.

Dogs in INPEX's portfolio represent assets with low market share and low growth potential. These are often older, marginal oil and gas fields or stalled renewable energy pilot projects that consume resources without generating significant returns. For instance, INPEX's 2023 financial review highlighted that certain mature fields, while still producing, had high operating costs per barrel, diminishing their profitability. These ventures are prime candidates for divestment or managed closure to free up capital.

The company's strategic focus, as outlined in its Vision 2035, is shifting towards more sustainable and growth-oriented projects. Assets categorized as Dogs do not align with this vision. By mid-2024, INPEX continued its portfolio rationalization, a process that involves identifying and exiting such underperforming ventures. The aim is to reallocate capital towards areas with higher strategic alignment and future potential, optimizing overall portfolio performance.

These assets, whether legacy oil fields or unproven renewable pilots, are characterized by their minimal contribution to revenue and limited prospects for future growth. For example, INPEX's 2024 efforts to optimize its asset base included assessing the viability of all its holdings, with the clear objective of divesting or decommissioning those that no longer offer a competitive return on investment. The costs associated with maintaining these Dog assets, including potential decommissioning liabilities, often outweigh their current or future economic benefits.

The strategic imperative is to transition away from these low-return ventures. INPEX's 2023 and 2024 financial disclosures would likely reflect ongoing efforts to manage these assets, possibly through sales or by making provisions for their eventual decommissioning. This proactive approach ensures that capital is not tied up in ventures with little to no strategic or financial upside, allowing for investment in more promising opportunities.

Question Marks

INPEX is actively pursuing early-stage global hydrogen projects, extending beyond its Kashiwazaki initiatives. A prime example is the exploration of clean ammonia production in the United States, tapping into a market projected for substantial growth, with hydrogen CAGR estimates ranging from 12.2% to 38.5% as of 2024.

These ventures, while positioned in a high-growth sector, represent a very low market share for INPEX currently. They necessitate considerable capital investment to achieve scalability and ascertain commercial viability, presenting a classic high-risk, high-reward profile characteristic of question mark entities.

INPEX's acquisition of a 30% stake in Norway's Trudvang CCS Project in December 2024 positions it within the burgeoning Carbon Capture, Utilization, and Storage (CCUS) sector. This market is projected for significant growth, with estimates suggesting a compound annual growth rate (CAGR) between 16% and 24%.

This move marks INPEX's initial significant step into the European CCS landscape, where its current market presence is minimal. The project requires substantial cash investment for development and evaluation, with its eventual profitability contingent upon successful implementation and market adoption.

INPEX has recently secured new exploration blocks, including those in Malaysia and offshore Eastern Java, Indonesia, representing classic 'Question Marks' in the BCG matrix.

These ventures are characterized by high risk and high potential reward within the upstream oil and gas industry. In 2023, INPEX's upstream segment saw revenue of ¥570.2 billion, with exploration and appraisal expenditures being a significant component.

Currently, these new blocks possess no market share and necessitate substantial capital outlay for exploration and appraisal activities. The commercial viability and future production potential remain uncertain, mirroring the inherent characteristics of question mark assets.

Pilot Carbon Recycling & New Business Ventures

INPEX is actively exploring advanced carbon recycling and other novel business ventures as a core component of its long-term strategy to achieve net-zero emissions by 2050. These initiatives are currently in their nascent stages, often represented by research and development or pilot projects, meaning they possess minimal to no existing market share.

These ventures target potentially disruptive, high-growth future markets, but their ultimate commercial viability and scalability remain highly uncertain. Consequently, they necessitate substantial capital investment to navigate the inherent risks and development challenges.

- Pilot Carbon Recycling: INPEX is investing in technologies that capture and convert CO2 into valuable products, aiming to create new revenue streams and reduce emissions. For instance, in 2024, INPEX continued its involvement in projects exploring the use of captured CO2 for chemical synthesis or material production.

- New Business Ventures: Beyond carbon recycling, INPEX is diversifying into areas such as renewable energy development, hydrogen production, and digital solutions, reflecting a broader strategic shift. Their commitment to these areas underscores a long-term vision for growth in non-traditional energy sectors.

- R&D and Pilot Phase Characteristics: These new ventures are characterized by significant upfront investment and a long development timeline, typical of early-stage technological innovation. Success hinges on overcoming technical hurdles and establishing market demand in emerging sectors.

- Strategic Importance: These investments are crucial for INPEX's transformation into a broader energy company, moving beyond traditional oil and gas to secure future competitiveness and sustainability in a decarbonizing world.

Early-Stage Geothermal and Offshore Wind Projects

INPEX is likely exploring early-stage geothermal and offshore wind projects as part of its renewable energy expansion. These ventures fall into the high-growth renewable sector but represent new territories for INPEX, where its current market presence and expertise are limited.

These nascent projects demand significant initial capital outlays and involve inherent risks tied to technological advancements and market acceptance. For instance, the global offshore wind market is projected to see substantial growth, with capacity expected to reach over 300 GW by 2030, according to some industry forecasts, highlighting the potential but also the scale of investment required.

- High Growth Potential: Geothermal and offshore wind are key growth areas within the renewable energy landscape.

- New Market Entry: INPEX is venturing into segments where it has less established experience.

- Significant Investment: These projects require substantial upfront capital for development and infrastructure.

- Technological and Market Risks: Challenges include the maturity of the technology and the pace of market adoption.

Question Marks represent new ventures with low market share but high growth potential, requiring significant investment. INPEX's hydrogen and clean ammonia projects in the US, with a projected CAGR of 12.2% to 38.5% in 2024, exemplify this category. Similarly, its recent acquisition in the CCUS sector, a market with a projected CAGR of 16% to 24%, also fits this profile due to its minimal current market presence.

| Venture Area | Market Growth Projection (CAGR) | INPEX Market Share (Current) | Investment Requirement | Risk Profile |

|---|---|---|---|---|

| Hydrogen/Ammonia (US) | 12.2% - 38.5% (2024) | Low | High | High |

| Carbon Capture (Europe) | 16% - 24% | Minimal | Substantial | High |

| New Exploration Blocks (Malaysia/Indonesia) | N/A (Upstream Oil & Gas) | None | High | High |

| Carbon Recycling/New Ventures | Emerging/High Potential | Negligible | Significant | High |

| Geothermal/Offshore Wind | High (Renewable Sector) | Limited | Substantial | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.