Inpex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

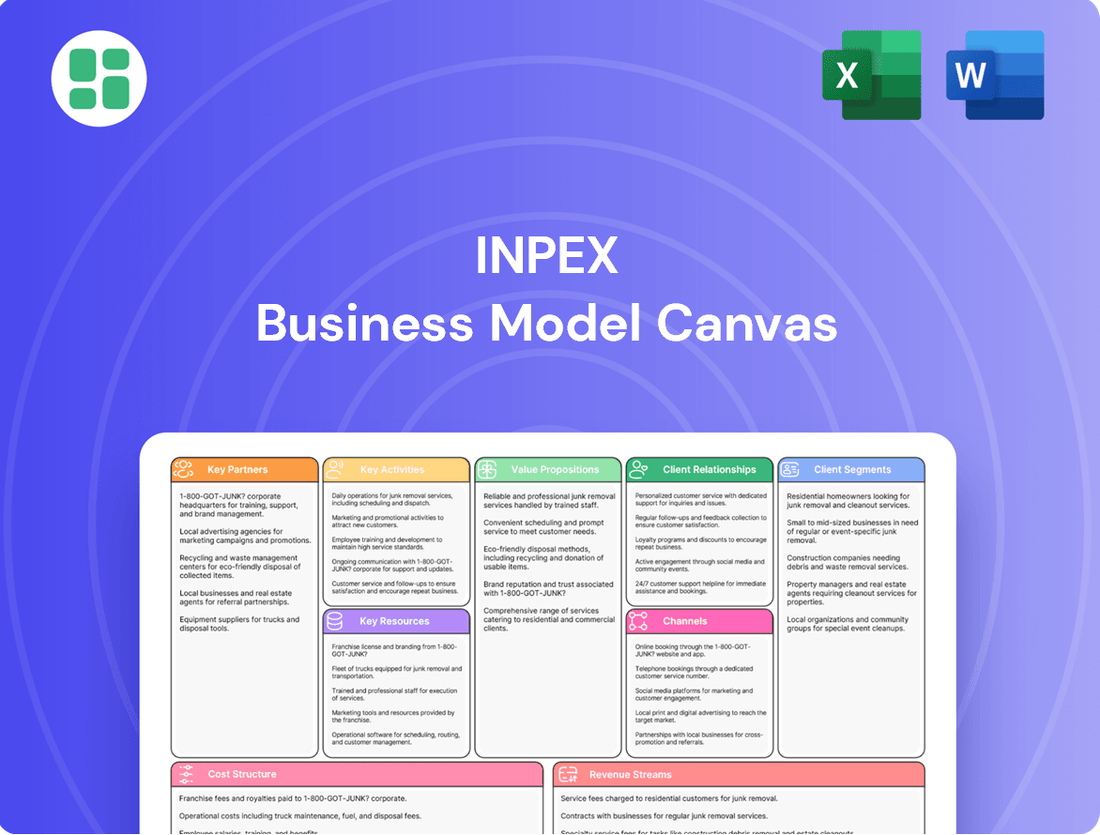

Curious about how Inpex navigates the complex energy sector? This Business Model Canvas breaks down their core operations, from key resources to revenue streams, offering a clear view of their strategic approach. Understand the drivers of their success and gain valuable insights for your own ventures.

Partnerships

INPEX strategically partners with other global energy leaders through joint ventures and consortiums to manage the substantial financial and operational demands of major energy projects. These collaborations are crucial for undertaking capital-intensive ventures that would be too risky or complex for a single entity. For instance, INPEX is involved with TotalEnergies and Woodside Energy in the Bonaparte CCS project, demonstrating a commitment to shared risk and expertise in carbon capture technology.

Further illustrating this strategy, INPEX collaborates with PT Pertamina Hulu Energi Masela and Petronas Masela Sdn. Bhd. on the significant Abadi LNG project in Indonesia. These alliances not only distribute the considerable financial burden but also pool diverse technical capabilities and facilitate entry into new geographical markets and access to cutting-edge technologies, enhancing project success rates.

Inpex actively partners with leading research institutions and technology firms to drive innovation, especially in critical areas like Carbon Capture, Utilization, and Storage (CCUS), hydrogen, and digital transformation. These collaborations are vital for staying at the forefront of sustainable energy development.

A prime example is their work with the Japan Organization for Metals and Energy Security (JOGMEC) to evaluate CCUS potential, a key step in decarbonizing operations. In 2024, such strategic alliances are foundational for Inpex’s ambition to achieve net zero by 2050.

Furthermore, Inpex engages in advanced engineering and design initiatives for CCUS projects with industrial leaders like Nippon Steel and Kanto Natural Gas Development. These partnerships underscore a commitment to developing practical, large-scale solutions for a lower-carbon future.

INPEX is actively building its renewable energy portfolio through strategic partnerships and joint ventures. A key development is its 50% acquisition in July 2023 of the Quorn Park Hybrid solar and battery project in Australia, a collaboration with Enel Green Power Australia.

These alliances are crucial for INPEX to speed up the creation and implementation of clean energy infrastructure. By teaming up with established players like Enel Green Power Australia, INPEX leverages expertise and resources to expand its presence in the growing renewable sector.

Local and Regional Energy Collaborations

INPEX actively cultivates partnerships with local utilities and regional bodies to bolster decarbonization initiatives and refine energy infrastructure within distinct geographical areas. For instance, an agreement with Hokuriku Electric Power Company is in place to advance decarbonization and energy systems. Furthermore, INPEX has entered into natural gas carbon neutralization agreements with Ashikaga Gas and Ashikaga City, showcasing a commitment to localized collaboration. These alliances are crucial for embedding INPEX's solutions into regional energy transition strategies.

These collaborations facilitate the integration of INPEX's low-carbon solutions and advanced energy technologies into the fabric of regional energy landscapes. By working with entities like Hokuriku Electric Power, INPEX gains access to established infrastructure and local market knowledge. The natural gas carbon neutralization agreements with Ashikaga Gas and Ashikaga City, for example, directly support the transition to cleaner energy sources at a community level.

- Hokuriku Electric Power Company Agreement: Focuses on decarbonization and the advancement of regional energy systems, aligning with Japan's broader energy transition goals.

- Ashikaga Gas and Ashikaga City Agreements: Specifically target natural gas carbon neutralization, demonstrating a commitment to reducing emissions at a local level.

- Geographic Focus: These partnerships are designed to integrate INPEX's offerings effectively within specific regional energy transition frameworks.

Supplier and Service Provider Networks

INPEX relies on a strong network of suppliers and service providers to manage its extensive global operations. This includes crucial partnerships for exploration, drilling, and the development of major energy infrastructure.

For example, in 2024, Worley secured significant contracts related to the Abadi LNG project, specifically for the gas export pipeline and subsea facilities. Such collaborations are vital for the safe and efficient completion of complex, large-scale projects across the globe.

- Key Partnerships: Supplier and Service Provider Networks

- Worley's Role: Awarded contracts for Abadi LNG's gas export pipeline and subsea facilities in 2024.

- Operational Necessity: Essential for exploration, drilling, and construction of energy infrastructure.

- Global Execution: Ensures efficient and safe project delivery worldwide.

INPEX's key partnerships are crucial for managing large-scale, capital-intensive projects and driving innovation in new energy sectors. These alliances distribute financial risk, pool technical expertise, and facilitate market entry, as seen in collaborations for the Abadi LNG project with PT Pertamina Hulu Energi Masela and Petronas Masela Sdn. Bhd. Their 2024 engagement with Worley for the Abadi LNG project's pipeline and subsea facilities highlights the reliance on specialized service providers for operational execution.

Strategic alliances with technology firms and research institutions are vital for INPEX's decarbonization efforts, particularly in CCUS and hydrogen. Partnerships with entities like JOGMEC for CCUS potential evaluation and industrial leaders such as Nippon Steel and Kanto Natural Gas Development for CCUS project engineering underscore this commitment to sustainable solutions. INPEX's 50% acquisition in the Quorn Park Hybrid solar and battery project in Australia in July 2023, in partnership with Enel Green Power Australia, demonstrates a proactive expansion into renewables.

| Partner | Project/Focus | Year/Status | Significance |

|---|---|---|---|

| PT Pertamina Hulu Energi Masela, Petronas Masela Sdn. Bhd. | Abadi LNG Project | Ongoing | Shared financial burden, pooled technical capabilities, market access |

| Worley | Abadi LNG (Pipeline & Subsea Facilities) | 2024 Contracts | Essential for safe and efficient project execution |

| Japan Organization for Metals and Energy Security (JOGMEC) | CCUS Potential Evaluation | Ongoing | Driving innovation in decarbonization technologies |

| Enel Green Power Australia | Quorn Park Hybrid Project (50% acquisition) | July 2023 | Accelerating renewable energy portfolio growth |

| Hokuriku Electric Power Company | Decarbonization & Energy Systems | Ongoing | Integrating solutions into regional energy transition |

What is included in the product

A strategic overview of Inpex's operations, detailing its key customer segments, value propositions, and revenue streams within the energy sector.

This model outlines Inpex's approach to resource development, partnerships, and market positioning to ensure sustainable energy production and supply.

The Inpex Business Model Canvas acts as a pain point reliever by providing a structured framework to quickly identify and address potential weaknesses in a company's operations.

It simplifies complex business strategies into a clear, actionable format, alleviating the pain of information overload and facilitating targeted improvements.

Activities

INPEX's core operations revolve around the exploration, development, and production of hydrocarbons, encompassing the entire lifecycle from identifying potential oil and gas reserves to their extraction. This crucial business segment spans diverse global geographies, including Asia, Oceania, the Middle East, Africa, and the Americas, ensuring a broad operational footprint.

The company actively pursues new exploration opportunities, demonstrating a commitment to future growth and resource security. For instance, INPEX has invested in the Serpang Working Area offshore Eastern Java, Indonesia, and secured licenses in Norway, highlighting its strategic approach to expanding its reserve base.

These activities are fundamental to maintaining INPEX's foundational revenue streams and ensuring a stable, long-term supply of energy to global markets. The continuous investment in exploration and development underpins the company's ability to sustain its core business and generate ongoing financial returns.

INPEX's core operational activities revolve around managing extensive liquefied natural gas (LNG) projects. This includes the intricate processes of extracting natural gas, transforming it into a liquid state through liquefaction, and then distributing it worldwide via specialized shipping. The Ichthys LNG facility in Australia stands as a prime example of their large-scale operational capabilities.

The company is actively working to enhance its existing infrastructure, with plans to expand the Ichthys LNG facility. Furthermore, INPEX is making significant strides in developing the Abadi LNG project located in Indonesia. Crucially, Front End Engineering and Design (FEED) for Abadi commenced in August 2025, with a target Final Investment Decision (FID) anticipated by 2027, underscoring its commitment to growing its natural gas and LNG portfolio.

INPEX is actively pursuing lower-carbon solutions, aligning with its Vision 2035 to achieve net-zero emissions. This involves significant investment in carbon capture, utilization, and storage (CCUS), as well as hydrogen and ammonia technologies.

A key initiative is the Niigata Blue Hydrogen/Ammonia project, which aims to establish a robust supply chain for these cleaner fuels. This project is central to Japan's decarbonization efforts.

Furthermore, INPEX is expanding its global footprint in CCUS by acquiring stakes in international projects, such as the Trudvang project in Norway. This diversification strategy is crucial for building a sustainable energy portfolio.

Investing in Renewable Energy Projects

INPEX is making significant strides in renewable energy, actively developing solar, wind, and geothermal projects. This strategic expansion aligns with their commitment to a sustainable energy future and achieving decarbonization targets. For instance, INPEX has made a final investment decision on the Quorn Park Hybrid solar and battery project located in Australia, demonstrating tangible progress in this sector.

Furthermore, the company has commenced exploratory drilling for geothermal energy in Japan, signaling a proactive approach to diversifying its renewable energy portfolio. These initiatives are crucial for INPEX's long-term vision, contributing to both environmental sustainability and business growth in emerging energy markets.

- Expansion into Renewables: Focusing on solar, wind, and geothermal energy sources.

- Key Projects: Final investment decision on Quorn Park Hybrid solar and battery project (Australia).

- Geothermal Exploration: Commenced exploratory drilling in Japan.

- Strategic Goals: Commitment to a sustainable energy future and decarbonization.

Digital Transformation and Technology Innovation

INPEX is actively pursuing digital transformation to boost efficiency, productivity, and safety across its operations. This includes developing specialized digital tools to streamline processes.

- Digital Tools for Field Operations: Development of solutions like 'Permit Plus' to enhance safety and efficiency in field activities.

- Cloud-Based Data Infrastructure: Establishment of 'AI-land', a cloud-based platform for managing exploration and development data, facilitating advanced analytics.

- Leveraging Advanced Technology: The company is focused on utilizing cutting-edge technology to ensure operational resilience and explore new value streams, particularly in decarbonization initiatives.

- 2024 Progress: While specific 2024 financial figures for these initiatives are still emerging, INPEX has consistently invested in technology, with capital expenditure on IT and digital solutions forming a significant portion of its overall investment strategy in recent years. For instance, in 2023, the company reported significant progress in its digital transformation roadmap, laying the groundwork for further advancements in 2024.

INPEX's key activities center on the exploration, development, and production of oil and natural gas, managing complex LNG projects, and actively investing in lower-carbon solutions like CCUS and hydrogen. The company is also expanding into renewable energy, including solar, wind, and geothermal projects, and is driving digital transformation to enhance operational efficiency and safety.

| Key Activity | Description | Examples/Progress |

| Hydrocarbon Exploration & Production | Global exploration, development, and extraction of oil and gas reserves. | Investments in Indonesia and Norway; broad operational footprint across continents. |

| LNG Project Management | Managing large-scale liquefaction, transportation, and distribution of LNG. | Ichthys LNG facility (Australia); development of Abadi LNG project (Indonesia) with FEED commencing August 2025. |

| Lower-Carbon Solutions | Investment in CCUS, hydrogen, and ammonia technologies for decarbonization. | Niigata Blue Hydrogen/Ammonia project (Japan); stake in Trudvang CCUS project (Norway). |

| Renewable Energy Development | Development of solar, wind, and geothermal energy projects. | Final investment decision on Quorn Park Hybrid solar/battery project (Australia); geothermal exploration in Japan. |

| Digital Transformation | Implementing digital tools and platforms to improve efficiency and safety. | Development of 'Permit Plus'; establishment of 'AI-land' data platform. |

Full Document Unlocks After Purchase

Business Model Canvas

The Inpex Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. You'll get full access to this exact document, allowing you to immediately begin refining your business strategy.

Resources

INPEX's extensive hydrocarbon reserves, including proven and probable oil and natural gas, are fundamental to its operations. These reserves are globally distributed, with significant holdings in Australia, the Middle East, and Southeast Asia.

Major projects like the Ichthys LNG project in Australia underscore the scale of these assets. INPEX's production activities are directly supported by these substantial physical reserves, which are crucial for generating ongoing revenue.

As of the first quarter of 2024, INPEX reported substantial production volumes, highlighting the active utilization of its reserve base. For instance, its oil and natural gas production in Q1 2024 contributed significantly to its overall financial performance.

Inpex heavily relies on advanced exploration and production technology to efficiently and safely extract energy resources. This includes sophisticated seismic imaging for better subsurface understanding and innovative drilling techniques. For instance, in 2024, Inpex continued to integrate digital solutions to enhance subsurface evaluation and optimize its operational efficiency across its projects.

The company's commitment to technological advancement is crucial for maximizing the recovery of oil and gas reserves while simultaneously minimizing environmental impact. This ongoing investment in innovation allows Inpex to maintain a competitive edge and ensure sustainable operations. In 2023, Inpex reported significant progress in adopting new digital technologies for production optimization, contributing to improved operational performance.

INPEX commands substantial financial resources, enabling it to undertake large-scale, multi-billion-dollar energy projects globally. For fiscal year 2023, INPEX reported total revenues of ¥2,134.4 billion, demonstrating significant financial strength to fund ambitious ventures.

Its robust financial performance, including a net profit of ¥204.3 billion in fiscal year 2023, provides the capital for both traditional oil and gas ventures and strategic investments in new energy sectors like renewables and carbon capture and storage (CCS).

Skilled Workforce and Technical Expertise

INPEX relies heavily on its highly experienced and specialized workforce, a core intellectual resource. This includes geoscientists, engineers, and project managers whose deep understanding of complex upstream and downstream operations is vital. Their expertise extends to emerging energy technologies, ensuring INPEX can successfully execute projects and drive innovation.

The company actively invests in human capital development to align with its strategic vision. For instance, in 2023, INPEX reported that approximately 80% of its workforce held tertiary qualifications, underscoring the emphasis on specialized knowledge. This commitment to training and development ensures their employees are equipped for the evolving energy landscape.

- Geoscientists and Engineers: Crucial for exploration, reservoir management, and production optimization.

- Project Managers: Essential for overseeing complex, large-scale energy projects from inception to completion.

- Technical Expertise: Covers both traditional oil and gas operations and new energy fields like hydrogen and CCS.

- Human Capital Investment: INPEX's focus on employee development supports its long-term strategic goals and operational excellence.

Global Operational Presence and Infrastructure

INPEX leverages its extensive global operational presence and infrastructure to access diverse energy markets and secure resources. This network spans Asia, Oceania, the Middle East, Africa, and the Americas, encompassing numerous offices, production sites, and crucial supply chain elements.

This widespread footprint is instrumental in INPEX's strategy to identify and capitalize on opportunities across different energy landscapes, fostering operational resilience. For instance, as of 2024, INPEX's project portfolio includes significant operations in Australia, Indonesia, and the UAE, demonstrating this global reach.

- Global Reach: Operations in Asia, Oceania, Middle East, Africa, and Americas.

- Infrastructure Network: Supported by offices, production facilities, and supply chains.

- Diversified Operations: Enables pursuit of opportunities in various energy markets.

- Resilience: A broad operational base contributes to business continuity and risk mitigation.

INPEX's key resources are its substantial hydrocarbon reserves, advanced exploration and production technology, significant financial strength, a highly skilled workforce, and its extensive global operational infrastructure.

These resources collectively enable the company to discover, develop, and produce energy resources efficiently, fund large-scale projects, and maintain a resilient and diversified business model in the global energy market.

The company's commitment to technological innovation, particularly in digital solutions for subsurface evaluation and production optimization, is a critical differentiator. Its financial performance, including substantial revenues and net profit in fiscal year 2023, provides the necessary capital for both existing operations and future energy transitions.

INPEX's workforce, with a high proportion holding tertiary qualifications, brings specialized expertise vital for navigating complex energy projects and emerging technologies like hydrogen and CCS.

| Resource Category | Key Components | Significance |

|---|---|---|

| Hydrocarbon Reserves | Proven and probable oil and natural gas globally distributed | Foundation for revenue generation and production activities |

| Technology | Advanced exploration and production tech, digital solutions | Maximizes recovery, optimizes operations, ensures competitive edge |

| Financial Resources | Substantial revenues and net profit (FY2023: ¥2,134.4B revenue, ¥204.3B net profit) | Funds large-scale projects and strategic investments |

| Human Capital | Experienced geoscientists, engineers, project managers (approx. 80% tertiary qualified in 2023) | Drives innovation, project execution, and operational excellence |

| Global Operations | Extensive network across Asia, Oceania, Middle East, Africa, Americas | Access to diverse markets, resource security, operational resilience |

Value Propositions

INPEX's core value proposition revolves around providing a stable and reliable energy supply, primarily oil and natural gas, to meet the critical needs of Japan and other Asian nations. This commitment underpins economic stability and energy security for these regions.

The company's diversified portfolio of production assets, spanning various geographies and resource types, is key to this reliability. INPEX actively manages these assets to ensure consistent output and mitigate supply chain risks.

Operational excellence is another pillar of this value proposition. INPEX invests in advanced technologies and stringent safety protocols to maintain high production levels and minimize disruptions, ensuring that energy flows dependably.

For instance, INPEX's projects like Ichthys LNG in Australia are designed for long-term, stable production, contributing significantly to Asia's energy security. In 2023, INPEX reported total production of 272 million barrels of oil equivalent, demonstrating its substantial contribution to global energy markets.

INPEX actively contributes to decarbonization by investing in lower-carbon solutions. This includes substantial commitments to Carbon Capture and Storage (CCS), hydrogen production, and renewable energy initiatives. These efforts directly align with global net-zero targets.

The company's strategic vision includes achieving net-zero greenhouse gas emissions from its own operations by 2050. Furthermore, INPEX is developing technologies aimed at reducing Scope 3 emissions, which are crucial for supporting the broader energy transition and appealing to environmentally conscious stakeholders.

INPEX actively integrates advanced technologies and digital transformation (DX) initiatives to boost operational efficiency, safety, and environmental stewardship. This focus on innovation is crucial for optimizing production, enhancing data analysis, and pioneering new carbon reduction strategies.

For instance, in 2024, INPEX continued to invest in digital solutions for its offshore projects, aiming to reduce downtime and improve resource allocation. Their commitment to technological advancement directly translates to value creation across both their established and emerging energy ventures.

Partnership and Investment Opportunities in Energy Transition

INPEX provides partners and investors with a unique chance to engage in a balanced energy portfolio, leveraging its established hydrocarbon business while expanding into sustainable energy. This dual approach allows for participation in both stable, cash-generating assets and future-oriented growth sectors.

The company actively seeks strategic alliances for its large-scale projects, offering shared growth and risk management benefits. Furthermore, INPEX's investments in renewable energy and lower-carbon initiatives present attractive opportunities for those looking to align with the energy transition.

- Diversified Portfolio: Access to both traditional hydrocarbon assets and emerging sustainable energy ventures.

- Strategic Alliances: Opportunities to co-invest in large-scale projects, sharing growth and mitigating risks.

- Lower-Carbon Investments: Participation in renewable energy and other decarbonization initiatives.

- Market Position: Aligning with a company actively shaping the future of the energy landscape.

Responsible and Sustainable Business Practices

INPEX places a strong emphasis on responsible and sustainable business practices, integrating them deeply into its operations. This commitment is demonstrated through adherence to high standards of corporate governance, environmental stewardship, and social responsibility, ensuring the company operates ethically and with long-term vision.

Prioritizing safety across all operations is a cornerstone of INPEX's approach. Furthermore, the company actively engages with indigenous communities, fostering positive relationships and mutual respect. Ethical conduct guides all decision-making processes, reinforcing the company's integrity.

- Safety First: INPEX reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.29 for the fiscal year ending March 31, 2024, highlighting their commitment to workplace safety.

- Community Engagement: The company invests in social programs and local development initiatives, aiming to create shared value with the communities in which it operates.

- Ethical Conduct: INPEX's Code of Conduct outlines clear expectations for all employees and business partners, promoting transparency and accountability.

- Sustainable Growth: These practices build trust with stakeholders, enhance INPEX's reputation, and are fundamental to achieving long-term, sustainable growth and resilience in the energy sector.

INPEX offers a unique blend of energy security through its stable oil and gas production, crucial for Japan and Asia. Its operational excellence, supported by significant investments in advanced technologies, ensures reliable energy delivery. For instance, the Ichthys LNG project continues to be a cornerstone of their supply chain, contributing substantially to regional energy needs.

The company is actively pursuing a lower-carbon future by investing in CCS, hydrogen, and renewables, aiming for net-zero emissions by 2050. This strategic pivot addresses growing environmental concerns and positions INPEX for sustainable growth. In 2024, INPEX continued its digital transformation initiatives to optimize operations and enhance environmental performance.

Partners and investors gain access to a balanced portfolio, combining established hydrocarbon assets with future-oriented sustainable energy ventures. This dual approach provides opportunities for stable returns and participation in the energy transition. INPEX's commitment to safety, with a TRIFR of 0.29 as of March 31, 2024, and strong community engagement further solidifies its value proposition as a responsible energy provider.

| Value Proposition | Key Aspects | Supporting Data/Examples |

|---|---|---|

| Energy Security & Reliability | Stable supply of oil and natural gas | Ichthys LNG project; 272 million boe production in 2023 |

| Lower-Carbon Solutions | Investment in CCS, hydrogen, renewables | Commitment to net-zero by 2050; Digitalization for environmental performance (2024) |

| Investment Opportunity | Balanced portfolio, strategic alliances | Participation in hydrocarbon and sustainable energy sectors; Shared growth and risk mitigation |

| Responsible Operations | Safety, community engagement, ethical conduct | TRIFR of 0.29 (FY2024); Social program investments |

Customer Relationships

INPEX cultivates enduring relationships with key customers, primarily utilities and industrial clients, through substantial long-term commercial contracts and offtake agreements for crude oil, natural gas, and liquefied natural gas (LNG). These agreements are foundational to revenue stability and foster robust commercial partnerships built on dependable supply chains.

The Ichthys LNG project exemplifies this strategy, securing long-term supply agreements that underpin its operational and financial viability. For example, as of early 2024, the Ichthys LNG project has significant offtake agreements in place with major Japanese buyers, ensuring a consistent demand for its produced LNG for decades.

INPEX cultivates robust relationships with its joint venture partners, crucial for navigating the complexities of major energy projects. This partnership model emphasizes shared decision-making, joint risk management, and synchronized operational execution, ensuring alignment across all stakeholders.

For instance, in the Ichthys LNG project, INPEX collaborates closely with partners like TotalEnergies and CPC Corporation, Taiwan. This collaboration is vital for coordinating the massive offshore and onshore facilities, reflecting the high degree of interdependence in such ventures.

Effective management of these joint ventures is paramount for INPEX to achieve its strategic objectives. By fostering trust and transparency, INPEX aims to ensure the successful and efficient delivery of its large-scale, multi-faceted energy developments, thereby maximizing value for all involved parties.

INPEX prioritizes robust investor relations, actively engaging with shareholders through detailed financial reports, dedicated investor days, and annual general meetings. This communication strategy ensures transparency regarding the company's operational performance and its forward-looking strategic initiatives.

The company demonstrates its commitment to shareholder value by consistently returning capital through dividends and share buyback programs. For instance, in the fiscal year ending March 31, 2024, INPEX announced a significant dividend payout, reinforcing its dedication to rewarding its investors and fostering confidence within the financial community.

Government and Regulatory Body Engagement

INPEX actively cultivates robust relationships with governments and regulatory bodies across the diverse nations where it operates. This engagement is crucial for navigating complex licensing frameworks, adhering to stringent environmental standards, and aligning with national energy policies, all of which are essential for project approvals and continued operations. For instance, in 2024, INPEX continued its dialogues with Japanese authorities regarding the Net Zero Carbon initiative, aiming to align its long-term strategy with national decarbonization goals.

Maintaining compliance with a multitude of regulations, from exploration permits to production safety standards, requires continuous and constructive interaction. This proactive approach helps to streamline approval processes and mitigate potential operational disruptions. INPEX's commitment to transparency and collaboration with regulatory agencies underpins its ability to secure and maintain the necessary permits for its global projects.

Key aspects of INPEX's government and regulatory body engagement include:

- License Acquisition and Renewal: Securing and maintaining exploration, development, and production licenses in various jurisdictions, ensuring all legal and regulatory requirements are met.

- Environmental Compliance: Adhering to and often exceeding environmental regulations for all project phases, from exploration to decommissioning, including emissions control and biodiversity protection.

- Policy Dialogue: Participating in consultations and discussions on energy policy, fiscal regimes, and climate change initiatives with national governments to ensure alignment and contribute to sustainable energy development.

- Permitting and Approvals: Facilitating the timely approval of project plans, environmental impact assessments, and operational procedures through consistent engagement with relevant authorities.

Community and Stakeholder Dialogue

INPEX actively cultivates relationships with local communities and stakeholders across its operational areas, prioritizing the resolution of social and environmental issues. This commitment is demonstrated through initiatives like Reconciliation Action Plans in Australia, designed to foster meaningful engagement and support Indigenous communities.

The company regularly conducts stakeholder meetings, creating platforms to gather valuable feedback on community concerns and to discuss sustainable operational practices. For instance, in 2023, INPEX reported engaging with over 1,000 stakeholders through various consultation processes, aiming to build trust and understanding.

- Community Engagement: INPEX's dedication to community dialogue is a cornerstone of its social license to operate.

- Reconciliation Action Plans: These plans in Australia are a tangible commitment to Indigenous partnerships and development.

- Stakeholder Feedback: Direct engagement ensures community concerns are addressed, influencing operational strategies.

- Sustainable Practices: Dialogue promotes shared understanding and collaboration on environmental stewardship and local development.

INPEX's customer relationships are primarily built on long-term contracts with major energy buyers, ensuring stable revenue streams. These agreements, particularly for LNG from projects like Ichthys, are crucial for financial predictability. The company also fosters strong partnerships with joint venture participants, essential for managing complex, capital-intensive projects.

Channels

INPEX leverages direct sales channels, securing long-term contracts with major industrial clients and national energy firms for its core energy products. This strategy, exemplified by the Ichthys LNG project, ensures predictable revenue and allows for tailored supply agreements, fostering strong customer relationships and market stability.

INPEX leverages a vast global network of chartered vessels and sophisticated logistics management to deliver crude oil and LNG to international markets. This ensures their energy products reach customers efficiently and on schedule, underpinning their worldwide operations.

The company's international reach is heavily dependent on these robust shipping and logistics channels. In 2024, INPEX continued to manage these complex supply chains, which are vital for maintaining its competitive edge in the global energy trade.

INPEX leverages extensive pipeline infrastructure within Japan to ensure the efficient and reliable delivery of natural gas to domestic utilities and industrial customers. This network is crucial for meeting energy demands in key markets, facilitating direct access to gas resources.

In 2023, Japan's natural gas consumption reached approximately 105.5 billion cubic meters, highlighting the significant role of pipeline networks in its energy supply chain. INPEX's infrastructure plays a vital part in this domestic distribution, supporting the nation's energy security and economic activities.

The company's pipeline assets are designed for safe and consistent transportation, enabling INPEX to serve a broad customer base, from power generation facilities to manufacturing plants. This commitment to robust infrastructure underpins its position as a key domestic gas supplier.

Digital Platforms for Operational Management and Data Sharing

Inpex increasingly utilizes digital platforms to streamline its internal operations and manage vast amounts of data. This is crucial for efficient decision-making and resource allocation across its diverse projects.

The company's investment in its 'AI-land' technical data infrastructure is a prime example of this focus. This platform is designed to boost efficiency and improve the flow of critical information, supporting everything from exploration to production.

While these digital platforms don't directly serve as channels for selling energy to end consumers, they are fundamental to the business model. They enable better management of assets and facilitate collaboration, ultimately supporting the company's core revenue-generating activities.

- AI-land Infrastructure: Enhances operational efficiency and data sharing within Inpex.

- Data Analytics: Supports informed decision-making across all business functions.

- Partner Engagement: Potential for improved collaboration and data exchange with strategic partners.

- Internal Efficiency: Drives productivity and cost savings through digital transformation.

Corporate Communications and Investor Relations Platforms

INPEX leverages its corporate website as a primary hub for disseminating crucial information. This includes detailed annual reports, comprehensive sustainability reports, and insightful investor presentations. These resources are vital for engaging with investors, media representatives, and the general public, offering transparency into the company's strategic direction, operational performance, and commitment to sustainability.

These communication channels are designed to foster trust and provide stakeholders with a clear understanding of INPEX’s business. For instance, the 2024 financial year saw INPEX reporting significant progress in its renewable energy initiatives, detailed on their investor relations portal. The company's commitment to ESG principles is prominently featured, demonstrating its long-term value creation strategy.

- Corporate Website: Central repository for all official announcements, financial statements, and corporate governance information.

- Annual Reports: Detailed review of the company's financial performance, operational highlights, and strategic outlook for the fiscal year.

- Sustainability Reports: Outlines INPEX's environmental, social, and governance (ESG) performance, including data on emissions reduction and community engagement.

- Investor Presentations: Provides concise overviews of recent performance, future plans, and market outlook, often presented at investor conferences and roadshows.

INPEX utilizes direct sales for its primary energy products, securing long-term agreements with industrial clients and national energy companies. This approach, evident in projects like Ichthys LNG, guarantees stable revenue and allows for customized supply, strengthening customer relationships and market stability.

The company's global reach relies heavily on chartered vessels and sophisticated logistics for delivering crude oil and LNG. In 2024, INPEX continued to manage these intricate supply chains, essential for maintaining its competitive edge in international energy markets.

Within Japan, INPEX employs an extensive pipeline network for efficient natural gas delivery to domestic utilities and industries. This infrastructure is critical for meeting energy needs in key regions, ensuring direct access to gas resources.

INPEX is also enhancing internal efficiency through digital platforms like its 'AI-land' data infrastructure. While not direct sales channels, these tools improve decision-making and resource management, supporting core revenue-generating activities.

The corporate website serves as a vital information hub, detailing annual reports, sustainability efforts, and investor relations. This transparency builds trust and keeps stakeholders informed about INPEX's strategic direction and performance, including its progress in renewable energy initiatives as highlighted in 2024 reports.

| Channel Type | Description | Key Function | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Long-term contracts with industrial clients and national energy firms | Guaranteed revenue, tailored supply | Core strategy for LNG and oil products |

| Global Logistics | Chartered vessels and supply chain management | Efficient product delivery worldwide | Maintaining competitive edge in global trade |

| Domestic Pipelines | Infrastructure within Japan for natural gas distribution | Reliable delivery to Japanese utilities and industries | Supporting Japan's energy security |

| Digital Platforms | Internal data infrastructure (e.g., AI-land) | Operational efficiency, informed decision-making | Enhancing resource allocation and productivity |

| Corporate Website | Official information hub for reports and presentations | Stakeholder engagement, transparency | Communicating ESG progress and strategic updates |

Customer Segments

National energy companies and state-owned enterprises are crucial customer segments for INPEX. These entities, often holding significant stakes in resource-rich nations, represent both partners and major buyers of INPEX's oil and gas products. For instance, INPEX's operations in Indonesia involve collaboration with Pertamina, the national oil and gas company, and in Abu Dhabi, it works with ADNOC, the state-owned entity.

These relationships are vital for INPEX's market access and operational stability, particularly in regions where national oil companies play a dominant role. In 2023, INPEX's net sales from Asia, which includes many of these key markets, contributed significantly to its overall revenue, underscoring the importance of these state-backed entities as foundational customers.

Major industrial sectors, including manufacturing, petrochemicals, and power generation utilities, are key customers for INPEX's natural gas and LNG. These industries rely on substantial, consistent, and frequently long-term energy provisions to sustain their extensive operations.

For instance, in 2024, global industrial energy consumption remained a dominant factor in natural gas demand. INPEX's ability to secure long-term supply agreements, such as those with major Asian industrial consumers, underpins its revenue stability and market position.

INPEX partners with international energy trading houses and distributors to efficiently market its crude oil and refined products. These crucial partners extend INPEX's market reach, ensuring its energy resources are available to a broader global customer base.

In 2023, global crude oil trade volumes reached approximately 50 million barrels per day, highlighting the scale of operations for entities like INPEX and its distribution partners. These trading houses play a vital role in managing price volatility and ensuring supply chain reliability for diverse energy consumers worldwide.

Joint Venture Partners and Consortia Members

Joint venture partners and consortia members represent a vital customer segment for INPEX, particularly for its large-scale, capital-intensive energy projects. These entities, including other international and domestic energy companies, are not just financial contributors but also critical sources of shared expertise and risk mitigation.

These partnerships are essential for INPEX to successfully execute complex projects such as the Ichthys LNG project and the Abadi LNG project. By co-investing, INPEX can leverage the strengths and resources of its partners, thereby enhancing operational efficiency and project viability. For instance, INPEX's stake in the Ichthys LNG project, a significant undertaking, was shared with partners like TotalEnergies and others, demonstrating the collaborative nature of such ventures.

- Shared Risk and Capital: Partners contribute capital, reducing the financial burden on INPEX and enabling the pursuit of larger, more ambitious projects.

- Expertise and Technology Transfer: Collaboration brings diverse technical knowledge and operational experience, improving project execution and problem-solving.

- Off-take Agreements: Partners often secure portions of the project's output, providing INPEX with guaranteed buyers and revenue streams.

- Strategic Alliances: These relationships foster long-term cooperation, potentially leading to future joint opportunities and market access.

Governments and Regulatory Bodies (as key stakeholders)

Governments and regulatory bodies are indispensable stakeholders for INPEX, influencing operational frameworks and market entry through policy and legislation. Their approval is vital for project licensing and ongoing business viability, making relationship management a strategic imperative.

These entities, while not direct purchasers of energy, set the rules of engagement. For instance, in 2024, INPEX, like other energy firms, navigates evolving environmental regulations and carbon pricing mechanisms that directly affect project economics and investment decisions in regions like Australia and Indonesia.

- Policy Influence: Governments shape INPEX's operating environment through energy policy, taxation, and environmental standards.

- Regulatory Approvals: Obtaining and maintaining permits for exploration, production, and infrastructure relies heavily on government and regulatory body compliance and cooperation.

- Market Access: Favorable government policies can unlock new markets and project opportunities, while restrictive ones can limit growth.

- Sustainability and Social License: Positive engagement with governments is crucial for maintaining a social license to operate, ensuring long-term business sustainability.

INPEX serves a diverse customer base, including national energy companies and state-owned enterprises, which are critical for market access and operational stability. Major industrial sectors like manufacturing and power generation rely on INPEX for consistent energy supply, with global industrial energy consumption remaining a dominant factor in 2024. Additionally, INPEX partners with international energy trading houses to broaden its market reach, facilitating the global distribution of its oil and gas products.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| National Energy Companies & State-Owned Enterprises | Major buyers, often partners in resource-rich nations. | Crucial for market access; Asia sales significant in 2023. |

| Industrial Sectors (Manufacturing, Petrochemicals, Power Generation) | Require substantial, consistent, long-term energy supply. | Global industrial energy consumption a key driver in 2024. |

| International Energy Trading Houses & Distributors | Facilitate global marketing and distribution of products. | Global crude oil trade ~50 million bpd in 2023, vital for reach. |

Cost Structure

INPEX allocates a significant portion of its expenses to capital expenditure for exploration and development. This involves substantial investments in drilling new wells and constructing essential infrastructure to support oil and gas production. For instance, in fiscal year 2023, INPEX's capital expenditures were ¥379.6 billion, with a significant portion dedicated to these activities.

Developing existing fields and creating new production facilities also represent major cost drivers. This includes building out the necessary infrastructure for extracting and processing hydrocarbons. These outlays are critical for maintaining and expanding INPEX's operational capacity and future revenue streams.

Furthermore, the development of new liquefied natural gas (LNG) facilities is a key component of INPEX's capital expenditure strategy. Projects like the Abadi LNG project, while not yet in production, require substantial upfront capital investment. These long-term investments are crucial for securing future growth and meeting global energy demand.

Operating expenses for production and processing are a significant component of INPEX's cost structure. These costs encompass the daily running of their oil and gas fields, LNG facilities, and other operational sites. This includes essential expenditures like employee salaries, keeping equipment in good repair, energy consumption, and the transportation of resources.

INPEX is actively pursuing strategies to lower these production costs, with a specific target of achieving below $5 per barrel. This focus on cost efficiency is crucial for maintaining competitiveness in the global energy market.

Inpex dedicates substantial resources to Research and Development, a cornerstone of its strategy to drive innovation and navigate the energy transition. This investment is critical for developing new technologies in areas such as enhanced oil recovery, which aims to maximize output from existing fields, and digitalization (DX) to improve operational efficiency and data analysis.

A significant portion of R&D is channeled into forward-looking energy solutions, including carbon capture utilization and storage (CCUS) technologies, the production of hydrogen, and the expansion of renewable energy sources. For instance, Inpex is actively involved in projects like the Ichthys LNG project, which incorporates advanced technologies, and is exploring opportunities in geothermal and offshore wind power, reflecting a commitment to a diversified and sustainable energy future.

Environmental Compliance and Decarbonization Investments

Inpex incurs significant costs to meet stringent environmental regulations and pursue its decarbonization strategy. These expenditures are crucial for maintaining operational licenses and demonstrating corporate responsibility.

Key cost drivers include investments in Carbon Capture, Utilization, and Storage (CCUS) technologies and the development of renewable energy sources. These initiatives are central to achieving the company's net-zero emission targets.

- Regulatory Adherence: Costs associated with monitoring, reporting, and complying with evolving environmental laws and standards.

- Decarbonization Initiatives: Capital and operational expenses for implementing carbon reduction projects, including CCUS and renewable energy development.

- Sustainable Solutions: Investments in research and development for innovative, sustainable energy solutions and technologies.

- Net-Zero Targets: Expenditures directly tied to achieving ambitious emission reduction goals, such as investing in green hydrogen and offshore wind projects.

For instance, in fiscal year 2023, Inpex reported substantial investments in its decarbonization roadmap, reflecting the growing financial commitment to environmental stewardship and future energy transition.

General, Administrative, and Marketing Expenses

General, Administrative, and Marketing Expenses (G&A&M) for Inpex, as part of its cost structure, include all the behind-the-scenes operations that keep the company running, from executive salaries and office rent to advertising campaigns and regulatory filings. In 2024, Inpex reported ¥239.8 billion in selling, general and administrative expenses, a notable increase from ¥189.2 billion in 2023, reflecting investments in growth and operational support.

These costs are crucial for maintaining the company's infrastructure and brand presence. For instance, marketing efforts are vital for securing new exploration blocks and attracting partners. Efficiently managing these overheads directly impacts Inpex's bottom line, as lower G&A&M costs translate to higher profitability on its energy production and development projects.

- Corporate Overheads: This includes costs associated with the company's headquarters, executive compensation, and support staff.

- Administrative Functions: Encompasses IT, human resources, legal, and finance departments essential for smooth operations.

- Marketing Activities: Covers branding, advertising, public relations, and business development efforts to secure new ventures and maintain market position.

- Legal and Compliance: Includes expenses related to regulatory adherence, contract management, and any legal proceedings.

INPEX's cost structure is heavily influenced by its substantial capital expenditures for exploration and development, as well as operating expenses for production and processing. The company also invests significantly in research and development to drive innovation and meet decarbonization targets, alongside general, administrative, and marketing expenses.

For fiscal year 2023, INPEX reported capital expenditures of ¥379.6 billion. Selling, general, and administrative expenses were ¥189.2 billion in 2023, increasing to ¥239.8 billion in 2024, indicating investments in growth and operational support.

The company aims to reduce production costs to below $5 per barrel, highlighting a strong focus on operational efficiency. Investments in CCUS and renewable energy are key to achieving its net-zero emission targets.

| Cost Category | Fiscal Year 2023 (¥ billion) | Fiscal Year 2024 (¥ billion) | Key Activities |

|---|---|---|---|

| Capital Expenditures | 379.6 | N/A | Exploration, development, new LNG facilities |

| Operating Expenses | N/A | N/A | Production, processing, maintenance, personnel |

| Research & Development | N/A | N/A | Enhanced oil recovery, digitalization, CCUS, hydrogen, renewables |

| Selling, General & Administrative | 189.2 | 239.8 | Corporate overheads, marketing, legal, compliance |

Revenue Streams

INPEX's core revenue generation stems from selling crude oil and condensate, sourced from its diverse international exploration and production assets. The fluctuating global oil market significantly impacts the financial performance of this segment, as do the actual volumes produced from its various fields.

Inpex primarily generates revenue through the sale of natural gas, both domestically through pipeline networks and internationally as Liquefied Natural Gas (LNG). A significant portion of this revenue comes from its flagship Ichthys LNG project.

The company is actively working to expand its LNG capacity, with projects like the Abadi LNG project in development, which is expected to substantially increase future revenue from LNG sales.

INPEX is actively growing its revenue from renewable energy projects, a key component of its diversification strategy. This includes income generated from electricity sales produced by solar, wind, and geothermal power facilities.

The company's investment in projects such as Quorn Park Hybrid, a significant renewable energy development, directly contributes to this burgeoning revenue stream. This expansion into renewables is crucial for INPEX's long-term growth and sustainability.

Carbon Capture, Utilization, and Storage (CCUS) Services/Credits

INPEX is exploring revenue generation through Carbon Capture, Utilization, and Storage (CCUS) services and credits. This initiative is a key part of its strategy to develop new businesses in the low-carbon sector, aiming to diversify its income sources beyond traditional oil and gas operations.

The company anticipates generating revenue by offering carbon storage solutions to other entities and potentially selling carbon credits earned from its CCUS projects. This aligns with global efforts to decarbonize industries and INPEX's commitment to contributing to a sustainable future.

- Carbon Credits: INPEX may generate revenue by selling carbon credits, which represent the reduction or removal of greenhouse gas emissions, in compliance with evolving regulatory frameworks.

- Storage Services: The company could offer its CCUS infrastructure and expertise to third parties, charging fees for the safe and secure storage of captured carbon dioxide.

- Low-Carbon Business Development: These CCUS-related activities are central to INPEX's strategic pivot towards new business ventures in the low-carbon economy, reflecting a forward-looking approach to energy transition.

Dividends and Profits from Equity Method Affiliates

INPEX frequently participates in joint ventures and affiliated companies, generating revenue through dividends and its proportionate share of profits. These equity investments represent a crucial element of its overall financial performance.

For the fiscal year ending March 31, 2024, INPEX reported income from equity in affiliated companies amounting to ¥108.2 billion. This figure underscores the material contribution of these strategic partnerships to the company's bottom line.

- Dividends Received: INPEX receives cash distributions from its equity stakes in various upstream and midstream projects.

- Share of Profits: The company recognizes its portion of net income generated by affiliated entities, reflecting its ownership interest.

- Strategic Value: These investments often align with INPEX's core business strategy, providing access to resources and markets.

INPEX's revenue streams are diverse, encompassing traditional oil and gas sales, liquefied natural gas (LNG), and increasingly, renewable energy and low-carbon initiatives. The company's financial performance is closely tied to global commodity prices and production volumes from its extensive portfolio.

A significant portion of INPEX's revenue comes from its substantial LNG operations, particularly from the Ichthys LNG project. The company is also actively expanding its renewable energy segment, investing in solar, wind, and geothermal power to diversify its income and contribute to decarbonization efforts.

Furthermore, INPEX is developing revenue opportunities in Carbon Capture, Utilization, and Storage (CCUS), offering storage services and potentially earning revenue from carbon credits. Income from joint ventures and affiliated companies also plays a crucial role in its overall financial results.

| Revenue Stream | Description | Key Projects/Activities | FY2024 Data (Approximate) |

| Crude Oil & Condensate Sales | Revenue from the sale of extracted oil and condensate. | Various exploration and production assets globally. | ¥766.5 billion (as of March 31, 2024, for Oil & Gas) |

| Natural Gas & LNG Sales | Revenue from domestic gas sales and international LNG exports. | Ichthys LNG, domestic gas fields. | ¥1,197.5 billion (as of March 31, 2024, for LNG) |

| Renewable Energy | Income from electricity sales from renewable sources. | Solar, wind, geothermal projects (e.g., Quorn Park Hybrid). | Growing contribution, specific FY24 figures not itemized separately from overall segment. |

| CCUS Services & Credits | Revenue from carbon storage and potential carbon credit sales. | Development of CCUS technologies and projects. | Emerging revenue stream, focus on future development. |

| Income from Affiliated Companies | Dividends and share of profits from joint ventures. | Equity investments in various energy projects. | ¥108.2 billion (Income from equity in affiliated companies for FYE March 31, 2024) |

Business Model Canvas Data Sources

The Inpex Business Model Canvas is informed by a blend of internal operational data, market intelligence reports, and financial performance metrics. This multi-faceted approach ensures a comprehensive and accurate representation of our strategic framework.