Inpex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

Inpex operates in a dynamic energy sector, facing significant pressures from powerful buyers and intense rivalry. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Inpex’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

INPEX's reliance on highly specialized equipment and technology for its complex oil and gas operations, from exploration to processing, grants significant bargaining power to its suppliers. This is particularly true for advanced solutions required in challenging offshore and deepwater environments where the pool of qualified providers is inherently limited.

The scarcity of suppliers capable of delivering these sophisticated technologies means INPEX often faces higher costs and reduced negotiation leverage. For instance, the global market for Floating Production, Storage and Offloading (FPSO) vessels is highly concentrated, with only a handful of major players capable of undertaking large-scale projects, a situation that persists into 2025.

Supply chain disruptions, a persistent issue through 2024 and expected to continue into 2025, exacerbate this power imbalance. Bottlenecks in the availability of critical components like subsea kits and drilling rigs, coupled with lead times for FPSOs, directly contribute to inflated project costs and potential delays for INPEX's capital-intensive ventures.

The oil and gas sector, including companies like INPEX, relies heavily on a specialized workforce. Think geologists, petroleum engineers, and highly trained technicians. A scarcity of these experienced individuals, especially in areas like supply chain and data analytics, can drive up labor expenses. This directly impacts INPEX's ability to negotiate favorable terms, as skilled labor becomes a more valuable commodity.

For instance, in 2024, the global demand for experienced petroleum engineers remained robust, with reports indicating a persistent shortage in specialized fields. Companies are increasingly investing in continuous training and development programs to ensure their workforce stays current with technological advancements and operational demands. This focus on upskilling and fostering an innovative environment is crucial for attracting and retaining the talent necessary to maintain a competitive edge.

Governments and regulatory bodies wield significant influence over INPEX, acting as powerful suppliers by controlling access to crucial exploration and production licenses. Their ability to set environmental standards and impose taxes and royalties directly shapes project viability and profitability. For instance, in 2024, governments globally continued to implement stricter environmental regulations, impacting the operational costs and strategic planning for oil and gas companies like INPEX.

The bargaining power of these governmental entities is exceptionally high. They can dramatically alter a company's financial outlook through policy shifts, such as new carbon emission targets or mandates for local content in projects. As INPEX diversifies into emerging energy sectors, navigating these evolving regulatory landscapes becomes even more critical, underscoring the substantial influence governments have on the company's strategic direction and operational success.

Land and Infrastructure Access Providers

Access to essential land and infrastructure, such as pipelines and processing facilities, grants significant bargaining power to providers in the oil and gas sector. This is particularly true for INPEX, as these resources are critical for its operations. In many regions, a concentrated ownership of such infrastructure, often by a limited number of companies or state-owned entities, restricts INPEX's choices and can result in elevated access fees or operational delays.

The limited availability of alternative routes or processing options further amplifies the suppliers' leverage. For instance, in 2024, the average cost of securing pipeline access for new oil projects in certain developed markets saw an increase of up to 15% compared to the previous year, reflecting this concentrated power. Geopolitical factors also play a crucial role; disruptions in global energy supply chains due to international tensions can exacerbate access issues and drive up costs for companies like INPEX.

- Limited Infrastructure Options: INPEX often faces a situation where only a few entities control the necessary land and infrastructure for its operations.

- Increased Access Costs: This limited competition can lead to higher fees for using pipelines, terminals, and processing facilities.

- Logistical Constraints: Dependence on a few providers can introduce logistical challenges and potential bottlenecks in the supply chain.

- Geopolitical Impact: Global events can disrupt energy flows, making infrastructure access more unpredictable and costly for INPEX.

Service Companies for Low-Carbon Solutions

As INPEX expands into low-carbon sectors like renewable energy, carbon capture, utilization, and storage (CCUS), and hydrogen, it faces a growing dependence on specialized suppliers for these emerging technologies and services. This shift introduces a new dynamic to its supplier relationships.

The early stages of many of these low-carbon markets, especially for advanced CCUS and green hydrogen, mean there are fewer established providers. This scarcity can give these specialized suppliers increased bargaining power, particularly in the short to medium term, as INPEX seeks critical components and expertise.

- Limited Supplier Pool: The nascent nature of advanced CCUS and green hydrogen technologies means fewer companies offer these specialized services, potentially concentrating power among a small number of providers.

- Technological Expertise: Suppliers with proprietary or highly sought-after low-carbon technologies possess significant leverage due to the difficulty and cost of replicating their expertise.

- Project Timelines and Scale: Large-scale energy transition projects often require significant upfront investment and have strict timelines, making reliable and capable suppliers indispensable, thus enhancing their bargaining position.

INPEX's reliance on specialized equipment and limited infrastructure providers, coupled with government regulations, significantly enhances supplier bargaining power. This is evident in the concentrated markets for FPSOs and the increasing demand for skilled petroleum engineers, as seen in 2024, which drives up costs and limits INPEX's negotiation leverage.

The scarcity of suppliers for emerging low-carbon technologies like CCUS and green hydrogen further amplifies their influence, particularly as INPEX diversifies its operations. This concentration of power means INPEX faces higher costs and potential project delays, impacting its overall profitability and strategic execution.

| Factor | Impact on INPEX | Example Data (2024/2025 Trends) |

|---|---|---|

| Specialized Technology (e.g., FPSOs) | Limited supplier options lead to higher costs and reduced negotiation leverage. | Global FPSO market dominated by a few key players, maintaining high project costs. |

| Skilled Labor (e.g., Petroleum Engineers) | Shortage of experienced personnel drives up labor expenses. | Robust demand for petroleum engineers in 2024, with persistent shortages in specialized fields. |

| Government Regulations & Licenses | Governments act as powerful suppliers by controlling access and setting operational terms. | Stricter environmental regulations globally increased operational costs for oil and gas firms. |

| Infrastructure Access (Pipelines, Terminals) | Concentrated ownership of infrastructure results in increased access fees and logistical constraints. | Pipeline access costs for new oil projects rose by up to 15% in certain markets in 2024. |

| Emerging Low-Carbon Technologies | Nascent markets for CCUS and hydrogen have few providers, granting them significant leverage. | Early-stage development of advanced CCUS and green hydrogen technologies limits the supplier pool. |

What is included in the product

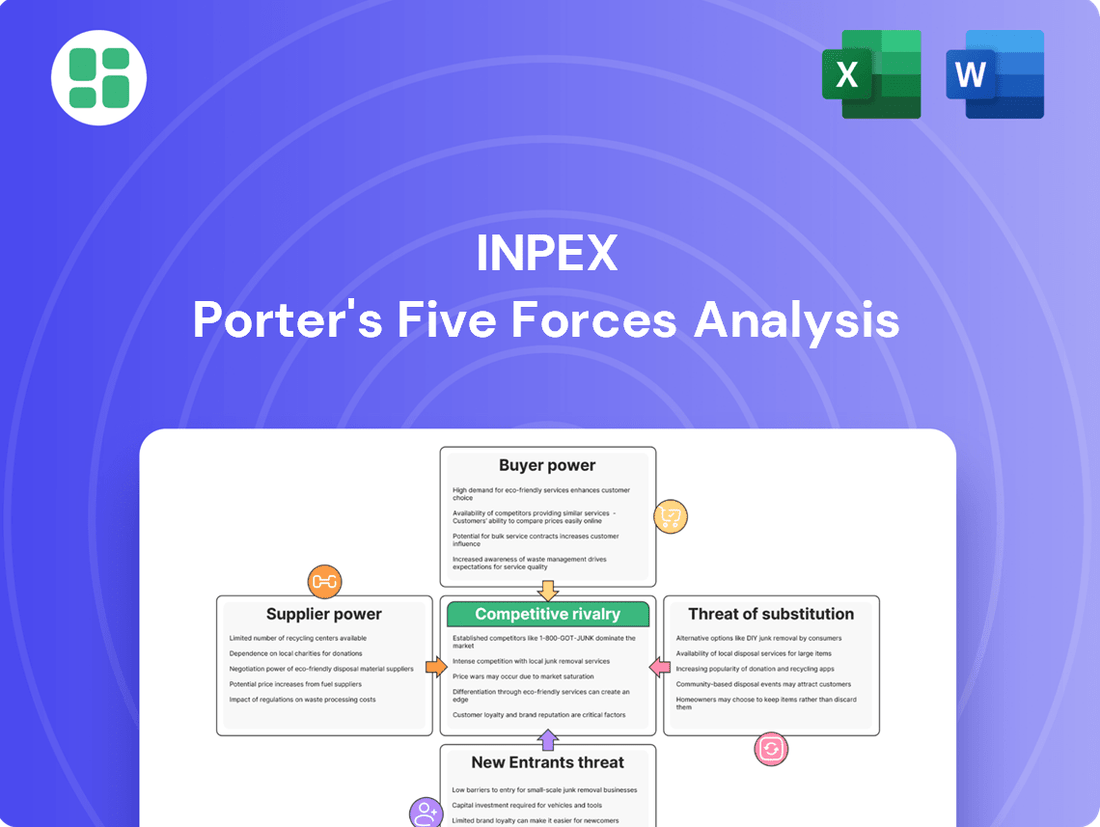

Tailored exclusively for Inpex, analyzing its position within its competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Quickly identify and address competitive pressures by visualizing the five forces with an intuitive, interactive diagram.

Customers Bargaining Power

INPEX's core clientele comprises major industrial entities, refineries, and utility providers who are significant consumers of oil and natural gas. These substantial purchasers, by virtue of their immense order volumes, inherently possess considerable bargaining power, particularly when multiple suppliers are vying for their business in a dynamic market. For instance, in 2024, the global demand for refined oil products remained robust, driven by industrial activity, yet the capacity of these large buyers to negotiate pricing based on volume was a consistent factor.

The commodity nature of oil and natural gas significantly strengthens customer bargaining power for INPEX. Because these resources are largely undifferentiated, customers can easily switch between suppliers based on price, limiting INPEX's ability to set premium rates, particularly when supply is abundant or markets are stable.

This fungibility means INPEX's revenue is directly tied to market volatility. For instance, in 2024, crude oil prices experienced significant fluctuations, with Brent crude averaging around $83 per barrel for the year, impacting the revenue potential for companies like INPEX that rely on these commodity markets.

The global energy transition, marked by a growing embrace of renewables and efficiency, is poised to moderate demand for traditional fossil fuels. This shift could gradually empower customers, leading them to seek more diverse and sustainable energy options, potentially increasing their leverage over time.

Diversified Customer Base and Geographic Reach

INPEX's extensive global footprint, spanning Asia, Oceania, the Middle East, Africa, and the Americas, significantly dilutes the bargaining power of individual customers. This broad geographic reach means that a downturn or increased demand in one region is often balanced by performance in others, preventing any single customer or market segment from exerting undue influence over INPEX's pricing or terms.

While this diversification acts as a buffer, it's important to note that widespread regional economic weaknesses could still collectively impact overall demand. For instance, a slowdown in major Asian economies, a key market for INPEX, could present challenges despite strength in other areas.

- Global Operations: INPEX serves customers across Asia, Oceania, the Middle East, Africa, and the Americas, reducing reliance on any single market.

- Mitigated Customer Power: Geographic diversification lessens the ability of any one customer or regional market to dictate terms.

- Economic Sensitivity: Despite diversification, regional economic downturns can still collectively affect overall demand for INPEX's products.

Long-Term Contracts and Strategic Partnerships

For its large liquefied natural gas (LNG) projects, INPEX frequently secures long-term supply contracts. These agreements can temper short-term shifts in customer bargaining power by locking in volumes and pricing. For instance, INPEX's Ichthys LNG project in Australia has secured long-term offtake agreements with major buyers in Japan and China, providing a stable revenue base.

These strategic partnerships offer INPEX significant stability and predictability in its revenue streams. This predictability helps to balance the inherent volatility and commodity risk associated with the global energy market. By entering into these multi-year arrangements, INPEX mitigates the immediate impact of fluctuating spot prices and strengthens its financial planning capabilities.

- Long-Term Contracts: INPEX's commitment to long-term supply agreements for projects like Ichthys LNG reduces customer bargaining power by establishing fixed terms.

- Revenue Stability: These contracts provide predictable revenue streams, crucial for managing the capital-intensive nature of LNG development.

- Commodity Risk Mitigation: Strategic partnerships help offset the inherent price volatility of the global LNG market.

- Customer Lock-in: Customers are tied to specific volumes and pricing mechanisms, limiting their ability to switch suppliers easily in the short term.

INPEX's customers, primarily large industrial buyers, wield significant bargaining power due to the commodity nature of oil and gas and their substantial order volumes. This allows them to negotiate pricing, especially when supply is plentiful, as seen with Brent crude averaging around $83 per barrel in 2024. While INPEX's global operations and long-term LNG contracts help mitigate this power by diversifying markets and locking in terms, the inherent fungibility of energy commodities means customers can still exert pressure by switching suppliers if prices are unfavorable.

| Factor | Impact on INPEX | 2024 Relevance |

|---|---|---|

| Customer Volume | High | Large industrial buyers' significant order volumes grant them leverage. |

| Product Differentiation | Low | Oil and gas are largely undifferentiated, enabling easy supplier switching based on price. |

| Market Conditions | Variable | Abundant supply or stable markets increase customer bargaining power. |

| Long-Term Contracts | Mitigates Power | LNG contracts (e.g., Ichthys) secure volumes and pricing, reducing short-term leverage. |

| Global Diversification | Mitigates Power | Operations across multiple continents reduce reliance on any single customer's influence. |

Same Document Delivered

Inpex Porter's Five Forces Analysis

This preview shows the exact Inpex Porter's Five Forces Analysis document you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use, ensuring no surprises and full usability upon acquisition.

Rivalry Among Competitors

INPEX faces formidable competition from global oil majors and national oil companies (NOCs). Giants like Saudi Aramco, with an estimated 274 billion barrels of proven oil reserves as of 2023, and PetroChina, which reported over 10 billion barrels of oil equivalent reserves, command significant advantages. These competitors often boast integrated value chains, extensive financial muscle, and established market access, intensifying the battle for exploration opportunities and market share.

The oil and gas sector, including companies like Inpex, operates with substantial fixed costs for exploration, drilling, and maintaining extensive infrastructure. For instance, a single offshore oil platform can cost billions of dollars to construct and operate, creating a significant financial commitment.

These immense upfront investments translate into high exit barriers. Companies are often compelled to continue production even when oil prices are low, simply to recoup their capital expenditures and avoid substantial write-offs. This pressure intensifies competition as firms strive to cover their costs and retain market share, leading to a more aggressive competitive landscape.

Inpex operates in a market characterized by significant volatility in crude oil and natural gas prices. These fluctuations, often driven by global supply-demand imbalances and geopolitical events, directly impact the company's profitability and the intensity of competition. For instance, in early 2024, Brent crude oil prices experienced considerable swings, trading between $75 and $90 per barrel, reflecting ongoing Middle East tensions and OPEC+ production decisions.

This price volatility forces companies like Inpex to maintain a strong focus on capital discipline and operational efficiency. By carefully managing expenditures and optimizing production processes, Inpex aims to preserve its profit margins even amidst unpredictable market conditions. This strategic approach is crucial for navigating the competitive landscape where agility and cost control are paramount for survival and success.

Diversification into New Energy Sectors

INPEX and its rivals are increasingly venturing into new energy domains like renewable power, carbon capture, utilization, and storage (CCUS), and hydrogen. This strategic shift means competition is no longer confined to traditional oil and gas. Companies are now vying for crucial investment capital, skilled personnel, and market dominance in these nascent low-carbon technologies, fundamentally altering the competitive arena.

This diversification intensifies rivalry as companies like INPEX, Shell, and TotalEnergies compete for limited government incentives and project development opportunities in areas such as offshore wind and green hydrogen production. For instance, in 2024, global investment in clean energy reached record highs, creating a more crowded and competitive landscape for all players seeking to establish a foothold.

- Renewable Energy Investments: INPEX is actively pursuing renewable energy projects, mirroring competitors' strategies to capture market share in a growing sector.

- CCUS and Hydrogen Competition: The race to develop and commercialize CCUS and hydrogen technologies is a key battleground, attracting significant R&D spending from major energy firms.

- Talent Acquisition: Securing specialized talent in areas like renewable engineering and carbon management is becoming a critical differentiator, intensifying competition for human capital.

- Market Share in Low-Carbon: Establishing early market leadership in emerging low-carbon sectors is a primary objective, driving aggressive investment and strategic partnerships among competitors.

Strategic Partnerships and M&A Activity

The energy sector, including companies like Inpex, is experiencing a significant uptick in strategic partnerships and mergers and acquisitions (M&A). This trend is driven by a desire to consolidate valuable assets, improve operational efficiencies, and build more robust business portfolios. For instance, in 2024, the global M&A market saw substantial activity in the energy sector, with several multi-billion dollar deals announced as companies sought to gain scale and competitive advantage.

This wave of consolidation means the industry landscape is shifting, with fewer, but considerably larger and more influential, competitors emerging. This can intensify the competitive rivalry, particularly for smaller companies or those that are not actively involved in these strategic consolidations. As larger entities gain greater market share and operational leverage, they can exert more pressure on pricing and resource acquisition, creating a more challenging environment for independent players.

- Increased M&A Activity: Global energy M&A deal values reached hundreds of billions of dollars in early 2024, reflecting a strong trend towards consolidation.

- Portfolio Strengthening: Companies are using M&A to acquire complementary assets, expand into new geographic regions, or secure critical technologies.

- Impact on Rivalry: Consolidation can lead to a more concentrated market, potentially increasing price competition and reducing opportunities for smaller, unaligned firms.

- Efficiency Gains: Mergers often aim to achieve economies of scale and scope, allowing larger entities to operate more cost-effectively than their smaller counterparts.

INPEX faces intense competition from global oil majors and national oil companies like Saudi Aramco, which held approximately 274 billion barrels of proven oil reserves in 2023. These larger entities possess significant financial resources and integrated operations, creating a challenging environment for INPEX. The high fixed costs associated with exploration and infrastructure, often running into billions for projects like offshore platforms, mean companies must continue production to recoup investments, fueling aggressive competition.

Price volatility in crude oil and natural gas, with Brent crude trading between $75 and $90 per barrel in early 2024, forces companies like INPEX to prioritize capital discipline and operational efficiency. Furthermore, the energy transition is intensifying rivalry as companies diversify into renewables, CCUS, and hydrogen, competing for investment and talent in these new sectors. This diversification is reflected in record global clean energy investments in 2024, creating a more crowded competitive landscape.

The energy sector is also experiencing a surge in M&A activity, with hundreds of billions of dollars in deals in early 2024. This consolidation leads to fewer, larger competitors who can leverage economies of scale, potentially increasing price competition and reducing opportunities for smaller, independent firms like INPEX if it doesn't participate strategically.

| Competitor Type | Key Advantage | 2023 Reserve Estimates (Approx.) | 2024 Price Environment Example |

|---|---|---|---|

| Global Oil Majors (e.g., ExxonMobil, Shell) | Integrated value chains, financial muscle | Varies greatly, significant reserves | Brent Crude: $75-$90/barrel |

| National Oil Companies (e.g., Saudi Aramco) | Vast reserves, state backing | Saudi Aramco: 274 billion barrels | Brent Crude: $75-$90/barrel |

| Emerging Energy Players (Renewables, Hydrogen) | Focus on new technologies, government incentives | N/A (asset-based) | Record clean energy investment |

SSubstitutes Threaten

The most significant threat to traditional energy companies like Inpex comes from the rapid advancement and increasing cost-competitiveness of renewable energy sources. Solar, wind, and hydropower are becoming increasingly viable alternatives.

Global investments in renewables are surging, bolstered by supportive policies. For instance, the Inflation Reduction Act in the US is a major driver, accelerating the deployment of these cleaner technologies. Renewables are projected to surpass coal as the world's primary power source in 2025, underscoring the magnitude of this substitution threat.

Improvements in energy efficiency and conservation are a significant threat to Inpex. For instance, advancements in building insulation and smart home technology are reducing electricity consumption, a trend that is expected to continue. In 2024, global energy intensity improvements are projected to reach around 2.5%, meaning less energy is needed to produce each unit of economic output.

The accelerating adoption of electric vehicles (EVs) and the development of alternative transportation fuels present a significant threat to traditional oil demand. By the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, directly impacting the market for refined petroleum products.

This growing reliance on clean power for transportation means a reduced need for gasoline and diesel, which are core to the oil industry's revenue streams. Projections indicate that EVs could displace over 15 million barrels of oil per day by 2040, fundamentally altering the energy landscape.

Hydrogen and Ammonia as Energy Carriers

Hydrogen, especially green and blue varieties, alongside ammonia, are rapidly developing as low-carbon alternatives for energy. These are particularly important for sectors that are difficult to decarbonize, such as heavy industry and shipping. INPEX's strategic investments in these burgeoning markets highlight their understanding of the potential these substitutes pose to traditional energy sources.

The global hydrogen market is projected to reach $270.5 billion by 2027, with significant growth driven by government support and technological advancements. For instance, the European Union's Hydrogen Strategy aims to produce 10 million tons of renewable hydrogen by 2030. This expansion directly challenges the market share of fossil fuels.

- Growing Demand: The International Energy Agency reported that global hydrogen production reached 95 million metric tons in 2023, with a significant portion aimed at industrial applications.

- Investment Trends: By the end of 2023, over $500 billion in global hydrogen investments were announced, signaling a strong commitment to scaling up production and infrastructure.

- Policy Support: Governments worldwide are implementing policies and incentives, like tax credits for green hydrogen production, to accelerate its adoption and reduce reliance on conventional fuels.

- Sectoral Adoption: Major shipping companies are exploring ammonia as a fuel, with several new ammonia-fueled vessel orders placed in 2023, indicating a tangible shift away from traditional bunker fuels.

Carbon Capture, Utilization, and Storage (CCUS)

Carbon Capture, Utilization, and Storage (CCUS) technologies act as a significant threat of substitutes for traditional hydrocarbon consumption by Inpex. While CCUS aims to mitigate the environmental impact of fossil fuels, it fundamentally alters how these resources are perceived and utilized, offering an alternative to outright cessation of use.

The CCUS market is experiencing robust expansion, with projections indicating substantial growth. For instance, the global CCUS market size was valued at approximately USD 3.5 billion in 2023 and is anticipated to reach over USD 12 billion by 2030, growing at a compound annual growth rate (CAGR) of around 19%. This growth is fueled by stringent climate regulations and increasing demand from industries, including the oil and gas sector itself, seeking to decarbonize operations.

- Market Growth: The CCUS market is expected to grow significantly, driven by climate change mitigation efforts.

- Demand Drivers: Key drivers include government incentives, industrial decarbonization targets, and the oil and gas industry's own need to reduce emissions.

- Substitution Effect: CCUS offers a pathway to continue hydrocarbon use with reduced environmental impact, acting as a substitute for a complete transition to renewables.

- Investment Trends: Major energy companies, including those in the oil and gas sector, are investing heavily in CCUS projects, signaling its increasing importance.

The threat of substitutes for Inpex is multifaceted, primarily stemming from the accelerating transition to cleaner energy sources and increased energy efficiency. Renewables like solar and wind are becoming more cost-competitive, with global investments surging due to supportive policies such as the US Inflation Reduction Act. Energy efficiency improvements, projected at around 2.5% in 2024, also reduce overall energy demand.

The rise of electric vehicles (EVs) directly impacts demand for refined petroleum products, with global EV sales exceeding 13 million units by the end of 2023. Furthermore, emerging low-carbon fuels like hydrogen and ammonia, supported by substantial global investments and government strategies, offer viable alternatives, especially in hard-to-decarbonize sectors.

| Substitute Category | Key Developments/Data (as of mid-2025) | Impact on Inpex |

|---|---|---|

| Renewable Energy | Projected to surpass coal as primary power source in 2025. | Reduces demand for fossil fuels in power generation. |

| Energy Efficiency | Global energy intensity improvements around 2.5% in 2024. | Decreases overall energy consumption, impacting demand. |

| Electric Vehicles (EVs) | Over 13 million global EV sales by end of 2023. | Shrinks market for gasoline and diesel. |

| Hydrogen & Ammonia | Global hydrogen market projected at $270.5B by 2027. Over $500B in global hydrogen investments announced by end of 2023. | Offers low-carbon alternatives for transportation and industry. |

Entrants Threaten

The oil and gas sector, especially exploration and production, demands enormous capital for infrastructure, technology, and project execution. This high financial threshold significantly deters new companies from entering the market, as only a select few can match the investment capacity of established entities like INPEX.

Upstream oil and gas investments are expected to see substantial growth, with projections indicating an increase through 2030. For instance, global upstream investment was estimated to reach approximately $570 billion in 2023 and is anticipated to continue its upward trend, reinforcing the significant capital barrier for potential new entrants.

New entrants into the oil and gas sector, like Inpex, confront a formidable wall of regulatory challenges. Obtaining exploration and production licenses, adhering to stringent environmental protection standards, and meeting rigorous safety protocols are all critical, time-consuming steps. For instance, in 2024, the average time to secure permits for new oil and gas projects in many developed nations has extended significantly due to increased environmental scrutiny and public consultation requirements, often spanning several years and demanding substantial legal and technical resources.

Established players in the oil and gas sector, like INPEX, possess significant advantages through their control of vast proven reserves and extensive existing infrastructure, including pipelines and processing facilities. For instance, as of December 31, 2023, INPEX reported proven and probable reserves of 2,340 million barrels of oil equivalent.

New entrants face a formidable barrier in securing access to commercially viable reserves, often requiring substantial upfront investment and years of exploration. Furthermore, the cost and time involved in replicating INPEX's established infrastructure, estimated in the billions of dollars for new projects, present a significant deterrent.

Technological Complexity and Expertise

The oil and gas industry, particularly in demanding areas like deepwater or unconventional resource extraction, requires cutting-edge technology and highly specialized skills. New companies entering this space face a significant hurdle in acquiring or developing the necessary technological prowess and expertise. For instance, the capital expenditure for a single deepwater project can easily run into billions of dollars, a substantial barrier for potential entrants.

This technological intensity creates a formidable entry barrier. Companies must invest heavily in research and development, or alternatively, acquire existing firms with established technological capabilities. The sheer cost and time involved in building this expertise mean that only well-capitalized and technically adept players can realistically consider entering the market.

- High R&D Investment: Companies like ExxonMobil and Shell consistently invest billions annually in R&D to maintain their technological edge in areas like enhanced oil recovery and carbon capture.

- Specialized Workforce: The industry relies on a finite pool of geoscientists, petroleum engineers, and drilling specialists, making talent acquisition a critical challenge for new entrants.

- Complex Infrastructure: Developing and maintaining sophisticated drilling rigs, subsea equipment, and processing facilities demands immense capital and technical know-how.

Emerging Energy Transition Barriers

The energy transition, while fostering new avenues, erects significant barriers for new entrants, especially within nascent low-carbon sectors like Carbon Capture, Utilization, and Storage (CCUS) and hydrogen. These segments demand substantial upfront capital investment, often running into billions of dollars for large-scale projects. For instance, the estimated cost for a single large CCUS facility can exceed $1 billion, creating a formidable entry hurdle.

Furthermore, the technological landscape in these emerging areas is still maturing, presenting risks and requiring extensive research and development. Companies looking to enter need to navigate evolving technical standards and operational complexities. The development of new infrastructure, such as specialized pipelines for CO2 transport or hydrogen refueling stations, alongside the establishment of entirely new supply chains, adds further layers of difficulty and cost for potential new competitors.

- High Capital Requirements: CCUS and hydrogen projects often require initial investments in the billions of dollars.

- Technological Uncertainty: Evolving technologies in low-carbon sectors increase R&D costs and operational risks for new entrants.

- Infrastructure Needs: Significant investment is needed to build new infrastructure like pipelines and refueling networks.

- Supply Chain Development: Establishing reliable and cost-effective supply chains for new energy carriers is a major challenge.

The threat of new entrants for INPEX is significantly low due to the immense capital required for exploration and production, with global upstream investment projected to remain robust. For example, in 2024, significant investments continue to be made in developing new oil and gas fields, reinforcing the high financial barrier.

New companies also face substantial regulatory hurdles and the challenge of acquiring proven reserves, often necessitating billions in upfront costs and years of exploration. INPEX's established infrastructure, including pipelines and processing facilities, represents another considerable deterrent, as replicating such assets is prohibitively expensive for potential new entrants.

The industry's reliance on advanced technology and specialized expertise further limits new competition. Acquiring or developing the necessary technological capabilities and a skilled workforce, particularly in complex areas like deepwater exploration, demands massive investment and time, effectively barring less-resourced entities.

Even in emerging low-carbon sectors like CCUS and hydrogen, new entrants face high capital demands and technological uncertainties, with large-scale projects often exceeding $1 billion in initial investment. The need to build entirely new infrastructure and supply chains adds further complexity and cost.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | Enormous upfront investment for infrastructure and exploration. | Upstream investment expected to remain in the hundreds of billions globally. |

| Regulatory Hurdles | Complex licensing, environmental, and safety compliance. | Extended permit times for new projects due to increased scrutiny. |

| Access to Reserves | Difficulty in securing commercially viable reserves. | Years of exploration and substantial upfront costs required. |

| Infrastructure & Technology | High cost of replicating established infrastructure and acquiring advanced technology. | Deepwater projects costing billions; specialized workforce scarcity. |

| Energy Transition Sectors | High capital for CCUS/hydrogen; technological uncertainty. | CCUS facilities costing over $1 billion; new infrastructure needs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Inpex leverages data from Inpex's annual reports, sustainability reports, and investor relations website. We also incorporate industry insights from reputable sources like Wood Mackenzie, Rystad Energy, and IEA reports, alongside government regulatory filings and macroeconomic data.